Navigating Market Lingo In 2021

Authored by Lance Roberts via RealInvestmentAdvice.com,

In February, Institutional Investor published a brilliant piece entitled “Asset Manager B.S. Decoded.” As we approach the year-end of 2020, succeeding in 2021 may come down to navigating the “market lingo” successfully.

“A handy translation guide to the sales jargon and IR excuses that one family office chief is sick of hearing.” – Institutional Investor

What They Say Versus Mean

-

Now is a good entry point = Sorry, we are in a drawdown.

-

We have a high Sharpe ratio = We don’t make much money.

-

We have never lost money = We have never made money.

-

We have a great backtest = We are going to lose money after we take your money.

-

We have a proprietary sourcing approach = We invest in whatever our hedge fund friends do

-

We are not in crowded positions = We missed all the best-performing stocks.

-

We are not correlated = We are underperforming while the market keeps going up.

-

We invest in unique uncorrelated assets = We have an illiquid portfolio that can’t be valued.

-

We are soft-closing the fund = We want to raise as much money as we can right now.

-

We are hard-closing the fund = We are definitely open for you.

-

We are not responsible for the bad track record at our prior firm = We lost money but are blaming all our ex-colleagues

-

We have a bottom-up approach = We have no idea what markets are going to do.

-

We have a top-down process = We think we know what markets will do but really, who does?

-

The markets had a temporary mark-to-market loss = Our fundamental analysis was wrong, and we don’t know why we lost money.

-

We don’t believe in stop-loss limits = We have no risk management.

There is a lot of truth to the list and many more examples from IPO’s to SPAC’s. To successfully navigate the markets in 2021, we need to understand what we are dealing with.

Wall Street Is A Business.

The “business” of any business is to make a profit. Wall Street makes profits by building products to sell you, whether it is the latest “fad investment,” an ETF, or bringing a company public. While Wall Street tells you they are “here to help you grow your money,” three decades of Wall Street shenanigans should tell you differently.

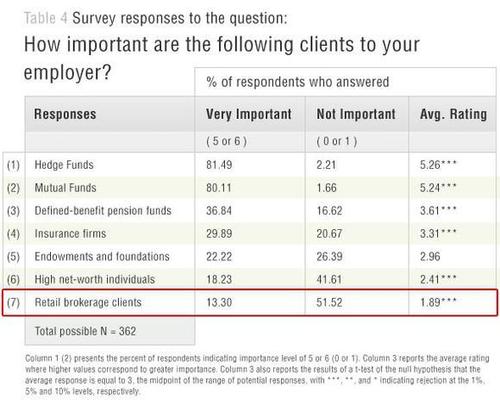

I know you probably don’t believe that, however, but take a look at a survey of Wall Street analysts. It is worth noting where “you” rank in terms of their concern and compensation.

Not surprisingly, you are at the bottom of the list.

While the translation is satirical, it is also more than truthful. Investors often only hear what they “want” to hear. However, actions are often quite different, along with the eventual outcomes.

So, what can you do about it?

The 2021 Investing Guidelines.

You can take actions to curb those emotional biases, which lead to eventual impairments of capital. The following activities are the most common mistakes investors repeatedly make, mostly by watching the financial media, and what you can do instead.

1) Refusing To Take A Loss – Until The Loss Takes You.

When you buy a stock, it should be with the expectation that it will go up – otherwise, why would you buy it?. If it goes down instead, you’ve made a mistake in your analysis. Either you’re early or just plain wrong. It amounts to the same thing.

There is no shame in being wrong, only in STAYING wrong.

Such goes to the heart of the familiar adage: “let winners run, cut losers short.”

Nothing will eat into your performance more than carrying a bunch of dogs and their attendant fleas, both in terms of actual losses and in dead, or underperforming, money.

2) The Unrealized Loss

From whence came the idiotic notion that a loss “on paper” isn’t a “real” loss until you actually sell the stock? Or that a profit isn’t a profit until you sell the stock? Nonsense!

Your portfolio is worth whatever you can sell it for, at the market, right at this moment. No more. No less.

People are reluctant to sell a loser for a variety of reasons. For some, it’s an ego/pride thing, an inability to admit they’ve made a mistake. That is false pride, and it’s faulty thinking. Your refusal to acknowledge a loss doesn’t make it any less real. Hoping and waiting for a loser to come back and save your fragile pride is just plain stupid.

Realize that your loser may NOT come back. And even if it does, an investment down 50% has to regain 100% to get back to even. Losses are a cost of doing business, a part of the game. If you never have losses, then you are not trading correctly.

Take your losses ruthlessly, put them out of mind and don’t look back, and turn your attention to your next trade.

3) More Risk

It is often touted the more risk you take, the more money you will make. While that is true, it also means the losses are more severe when the tide turns against you.

In portfolio management, the preservation of capital is paramount to long-term success. If you run out of chips, the game is over. Most professionals will allocate no more than 2-5% of their total investment capital to any one position. Money management also pertains to your total investment posture. Even when your analysis is overwhelmingly bullish, it never hurts to have at least some cash on hand, even if it earns nothing in a “ZIRP” world.

Such actions give you liquid cash to buy opportunities and keep you from having to liquidate a position at an inopportune time to raise cash for the “Murphy Emergency:”

This is the emergency that always occurs when you have the least amount of cash available – (Murphy’s Law #73)

4) Bottom Feeding Knife Catchers

Unless you are adept at technical analysis and understand market cycles, it’s almost always better to let the stock find its bottom on its own and then start to nibble. Just because a stock is down a lot doesn’t mean it can’t go down further. A significant multi-point drop is often just the beginning of a more considerable decline. It’s always satisfying to catch the low tick, but it’s usually by accident when it happens. Let stocks and markets bottom and top on their own and limit your efforts to recognizing the fact “soon enough.”

Nobody, and I mean nobody, can consistently nail the bottom or top ticks.

5) Averaging Down

Please don’t do it. For one thing, you shouldn’t have the opportunity as a losing investment should have already gotten stopped out.

The only time you should average into any investment is when it is working. If you enter a position on a fundamental or technical thesis that proves correct, it is generally safer to increase your stake in that position on the way up.

6) Don’t Fight The Trend

Yes, some stocks will go up in bear markets and stocks that will go down in bull markets, but it’s usually not worth the effort to hunt for them. The vast majority of stocks, some 80+%, will go with the market flow. And so should you.

It doesn’t make sense to counter trade the prevailing market trend. Don’t try and short stocks in a strong uptrend and don’t own stocks that are in a strong downtrend. Remember, investors don’t speculate – “The Trend Is Your Friend”

7) A Good Company Is Not Necessarily A Good Stock

Some great companies are mediocre investments, while some poor quality companies have been great stocks over a short time frame. Try not to confuse the two.

While fundamental analysis will identify great companies, it doesn’t take into account market and investor sentiment. Analyzing price trends, a view of the “herd mentality,” can help determine the “when” to buy a great company that is also an outstanding stock.

8) Technically Trapped

Amateur technicians regularly fall into periods where they tend to favor one or two indicators over all others. No harm in that, so long as the favored indicators are working, and keep on working.

But always be aware of the fact that as market conditions change, so will the efficacy of indicators. Indicators that work well in one type of market may lead you badly astray in another. You have to be aware of what’s working now and what’s not, and be ready to shift when conditions change.

There is no “Holy Grail” indicator that works all the time and in all markets. If you think you’ve found it, get ready to lose money. Instead, take your trading signals from the “accumulation of evidence” among ALL of your indicators, not just one.

9) The Tale Of The Tape

I get a kick out of people who insist that they’re long-term investors, buy a stock, then anxiously ask whether they should bail the first time the stock drop a point or two. More likely than not, the panic was induced by listening to financial television.

Watching “the tape” can be dangerous. It leads to emotionalism and hasty decisions. Try not to make trading decisions when the market is in session. Do your analysis and make your plan when the market is closed. Turn off the television, get to a quiet place, and then calmly and logically execute your plan.

10) Worried About Taxes

Don’t let tax considerations dictate your decision on whether to sell a stock. Pay capital gains tax willingly, even joyfully. The only way to avoid paying taxes on a stock trade is not to make any money.

“If you are paying taxes – you are making money…it’s better than the alternative”

The Law Of Change

Don’t confuse genius with a bull market.

It’s hard not to make money in a roaring bull market. Keeping your gains when the bear comes prowling is the hard part. The market whips all our butts now and then, and that whipping usually comes just when we think we’ve got it all figured out.

Managing risk is the key to survival in the market and ultimately in making money. Focus on managing risk, market cycles, and exposure.

The law of change states: Change will occur, and the elements in the environment will adapt or become extinct, and that extinction in and of itself is a consequence of change.

Therefore, even if you are a long-term investor, you have to modify and adapt to an ever-changing environment; otherwise, you will become extinct.

To navigate through this complex world, we suggest investors need to be open-minded, avoid concentrated risks, be sensitive to early warning signs, constantly adapt and always prepare for the worst.”

– Tim Hodgson, Thinking Ahead Institute

Investing is not a competition.

It is a game of long-term survival.

Start by turning off the mainstream financial media. You will be a better investor for it.

I wish you a prosperous and happy 2021.

Tyler Durden

Tue, 12/29/2020 – 08:14

via ZeroHedge News https://ift.tt/34PIKpC Tyler Durden