Last year, cities across the country suffered from what I will call the Great 2020 Homicide Spike. Homicide rates were 30% higher than in 2019—an historic increase representing more than 1,268 additional murders (in a sample of 34 cities), according to an important new report released today by Professor Richard Rosenfeld and two colleagues. The new Rosenfeld report explains that this is a “large and troubling increase that has no modern precedent.” The previous largest single-year increase in the United States was 12.7%, back in 1968.

After presenting data on the homicide spike, the Rosenfeld report briefly attempts to explain what might have caused it. The report discusses two potential causes: first, the COVID-19 pandemic; and, second, anti-police protests following the death of George Floyd during his arrest by Minneapolis police. But after carefully laying out these two possibilities, the report declines to take a position on which one is the more significant contributor to the homicide spikes. And then, in a concluding section on recommendations, it focuses on need for subduing the COVID-19 pandemic and downplays the need to consider whether the anti-police protests—and consequent police pullbacks—have played a major role in the deaths of more than a thousand homicide victims.

In my view, the best explanation for the Great 2020 Homicide Spike is a decline in proactive policing–and, accordingly, public policy responses to the spike should specifically address that decline. This post builds on a lengthy paper I published last month in the Federal Sentencing Reporter (which also included responses from Larry Rosenthal and Richard Rosenfeld). My paper relied on data through the summer of 2020, but my position can now be supported with data ending through the end of 2020 based on the new Rosenfeld report.

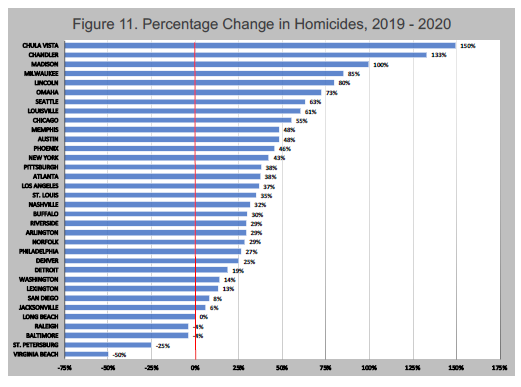

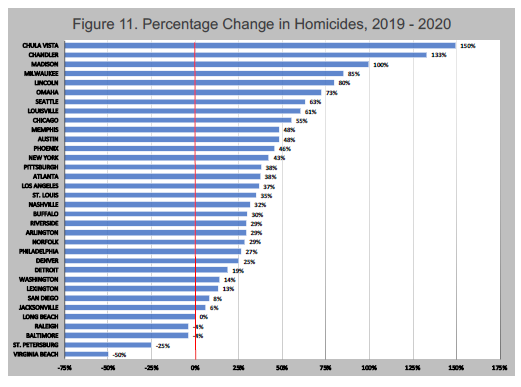

Let’s start first with 2020 homicide data, as no real dispute exists about the fact that last year homicides increased dramatically in most major cities. The report looked at homicide rates in 2020 compared to 2019 in sample of 34 cities. In 29 of the 34 cities, homicides increased–and, in many cities, increased substantially–as shown in Figure 11 from the new Rosenfeld report:

As can be seen, there were significant increases in almost all cities. Because these figures are percentages, however, they can perhaps be misleading for smaller cities. As the report explains, Chula Vista, California, experienced the largest percentage homicide increase in the sample (150%), but that percentage is based on a difference of just six homicides (ten in 2020 compared with four in 2019).

As can be seen, there were significant increases in almost all cities. Because these figures are percentages, however, they can perhaps be misleading for smaller cities. As the report explains, Chula Vista, California, experienced the largest percentage homicide increase in the sample (150%), but that percentage is based on a difference of just six homicides (ten in 2020 compared with four in 2019).

But staggeringly large homicide increases were observed in many of the country’s most populous cities. New York suffered 131 homicides, representing a 43% increase. Chicago suffered 278 homicides compared to its 2019 total of 502, for an increase of 55%. Los Angeles’ homicides were up 37%, Phoenix’s up 46%, Philadelphia’s up 27%, Milwaukee’s up 85%, and Seattle’s up 63%. Unsurprisingly, given their size, large cities with appreciable homicide increases contributed disproportionately to the overall increase in murder victims. The nation’s three largest cities (New York, Los Angeles, and Chicago) accounted for 40% of the 1,268 additional people murdered in 2020.

While variation exists among the cities, what is most notable is that homicides rose substantially in the vast majority of them. As the Rosenfeld report appropriately concludes: “[L]ocal variations in social and demographic conditions, while important, do not appear to be the primary driving force behind rising homicide rates. National factors must be explored to better understand the increase.”

The report then turns to two national factors that might have caused the Great 2020 Homicide Spike: (1) the pandemic; and (2) protests against police violence. Turning first to the pandemic, the report argues that the pandemic may have initially suppressed some homicides by limiting the opportunities for offenders and victims to interact due government-ordered restrictions. Then, as pandemic-related restrictions were relaxed during the last spring and summer of 2020 (or compliance with them diminished), homicide rates increased. The report suggests that this increase in social mobility was a major factor in the homicide surge, although the report does not include precise data or findings on social mobility.

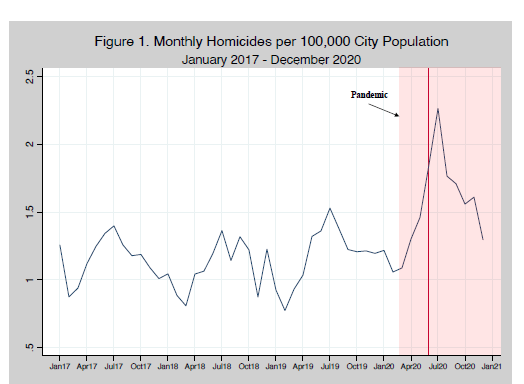

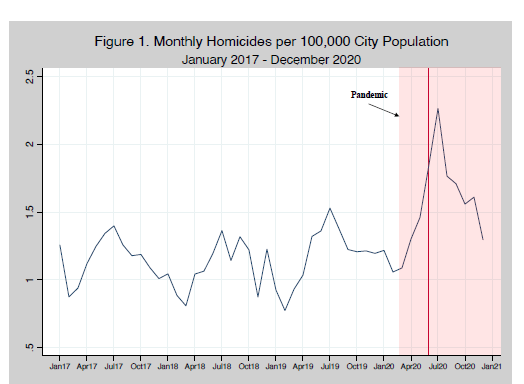

A major problem with attempting to link the homicide spike to the pandemic itself, however, is the spike’s timing. Let’s first look at the homicide trend line that needs to be explained. The new Rosenfeld report provides this graph of homicide trends from 2017 through 2020:

This graph depicts a structural break in homicide trends (the vertical red line) occurring in June 2020 that might appear to correspond somewhat to the onset of the pandemic and related social mobility trends. But this graph–which depicts monthly data–does not allow much precision in identifying when the spike in homicides began. To be sure, homicides increased in the spring of 2020. But given the “seasonality” of homicide (more homicides in summer, fewer in the winter), some general upward trend would be expected.

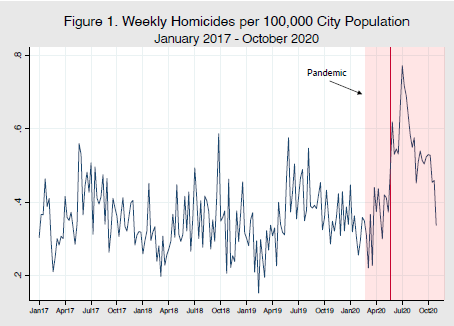

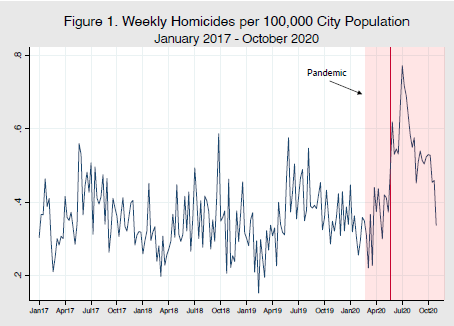

More informative on the issue of the homicide spike’s precise timing are weekly homicide data, reported though October 2020 by Rosenfeld in an earlier report, as depicted below:

This graph depicts the structural break (the vertical red line) in homicide trends–i.e., a statistically significant change in the times series occurring in the last week of May. This graph would seem to identify the increase in homicides igniting at that time–not earlier.

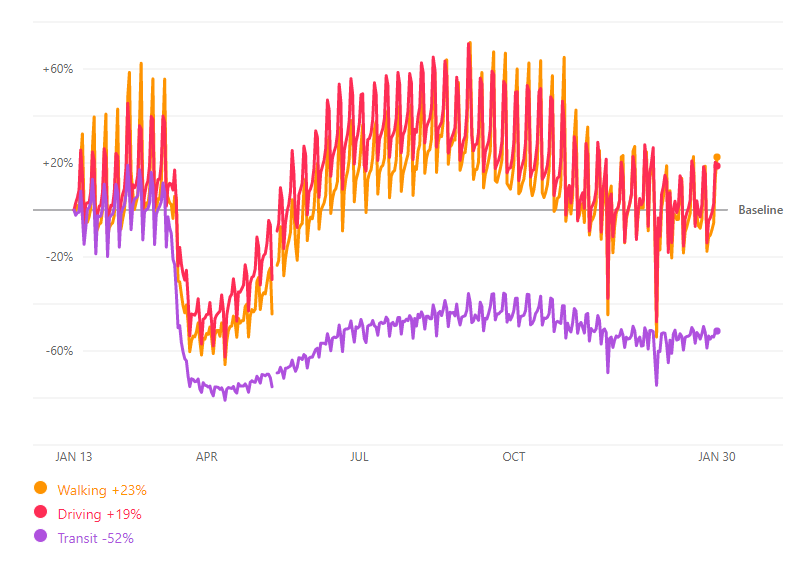

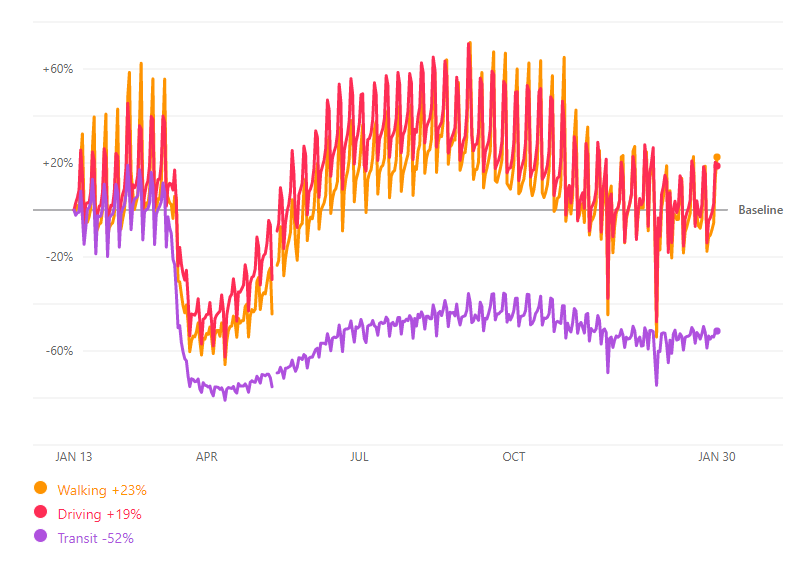

Now let’s compare the weekly homicide trends with social mobility data. Social mobility in the U.S. plummeted in mid-March as the pandemic struck, but then moved back to normal levels at a steady pace from early April through the late summer. Depicted below, for example, is national social mobility data from the last year from Apple, based on iPhone routing requests:

As readily apparent, from a nadir in early April, social mobility rebounded fairly smoothly through the summer of 2020. Given that the pandemic struck in mid-March and social mobility began returning normal levels in early April, the timing of the homicide spike does not appear to coincide with the pandemic. Indeed, the new Rosenfeld report acknowledges that homicide rates increased “significantly” in June, “well after the pandemic began, coinciding with the death of George Floyd and the mass protests that followed.”

Other analysis of national homicide trends confirms the conclusion that homicides (and shootings) were largely unaffected by the pandemic’s onset. For example, Professor David Abrams has published a detailed analysis of crime data from 25 large U.S. cities for January through May 2020. Abrams concluded that, as of the end of May, “[s]ome types of serious violent crime seemed unaffected by the pandemic onset, notably homicide and shootings.”

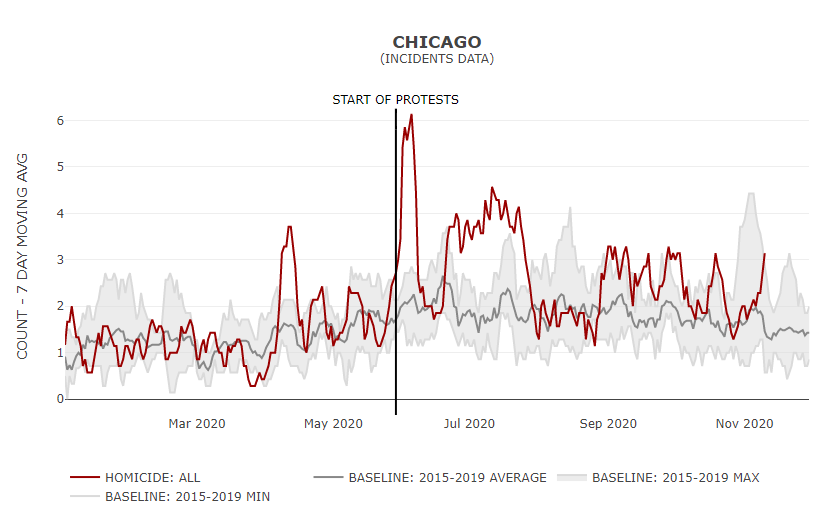

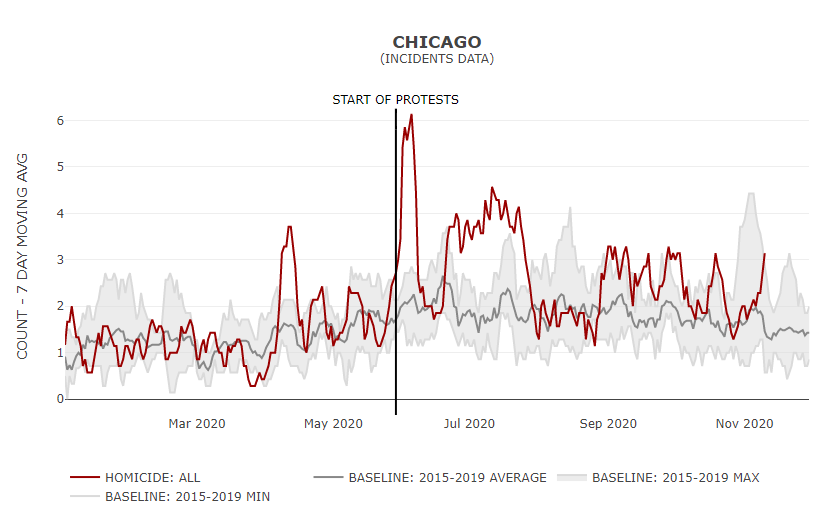

The Rosenfeld report (and the Abrams analysis just discussed) rely on aggregate data from a number of cities. But it is useful to drill down into particular cities to see if any patterns emerge. I have previously researched homicide issues in Chicago, the nation’s third largest city. Here is Chicago’s homicide data for 2020:

This graph (taken from the excellent website https://ift.tt/3anfusa) shows the five-year average for homicides in grey and then the 2020 homicide data in red. Between January 1 and May 28, 2020, Chicago suffered 191 homicides. During the same time frame in 2019, it had an almost identical number of homicides: 192.

Then, as with other major cities, Chicago witnessed substantial antipolice protests a few days after George Floyd’s death on May 25, 2020. Four days after Floyd’s death, on May 29, demonstrators shut down several downtown Chicago streets. The next day, Chicago protests escalated; one person died and six others were shot. A dozen police officers were injured. These protests “evolved into criminal conduct” (as Chicago Mayor Lori Lightfoot put it) and protesters and looters extensively damaged businesses on Michigan Avenue. The next day, Mayor Lightfoot asked the Illinois Governor to summon the National Guard to Chicago for the first time in fifty-two years. (The last time was during the 1968 riots.) The economic costs of the protests and looting in Chicago through June 1 were estimated at around $66 million.

And a homicide spike ignited. On May 31, eighteen people were murdered and dozens more were shot in Chicago, making it the single most violent day in six decades. Chicago’s 9-1-1 emergency center received 65,000 calls for all types of service–50,000 more than on a usual day. The homicide explosion in Chicago does not appear to follow the more gradual trends, such as modestly changing social mobility patterns linked to the pandemic.

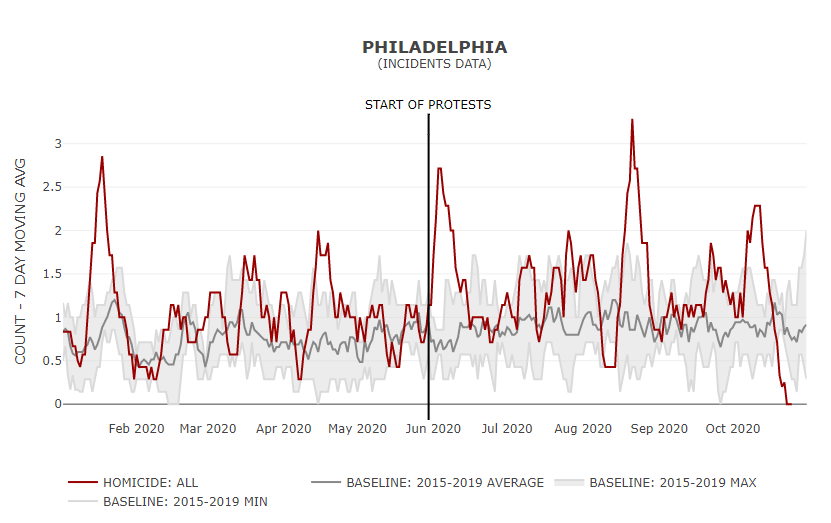

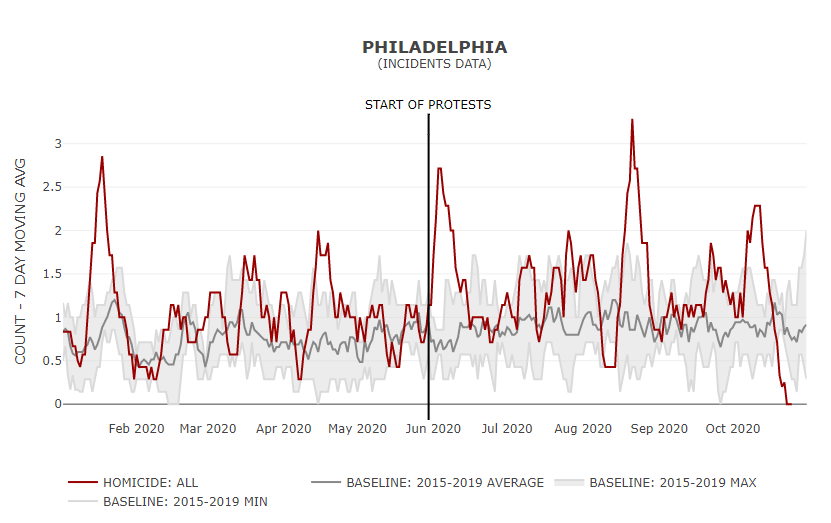

This explosive spike in homicides is also evident in other cities. Depicted below is Philadelphia’s homicide data for 2020:

Here again, an explosive spike at the end of May 2020 is evident, although there are also other increases visible in the Philadelphia data (which is the proverbial “noise” in data that always attends research of this type).

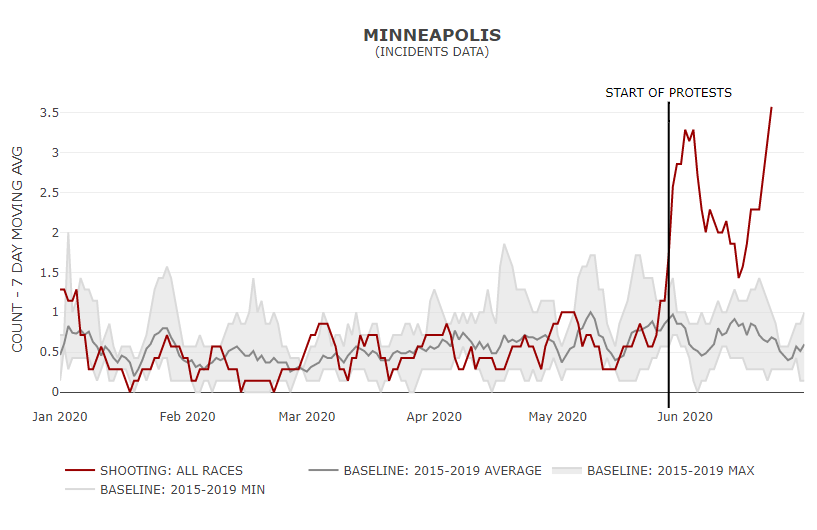

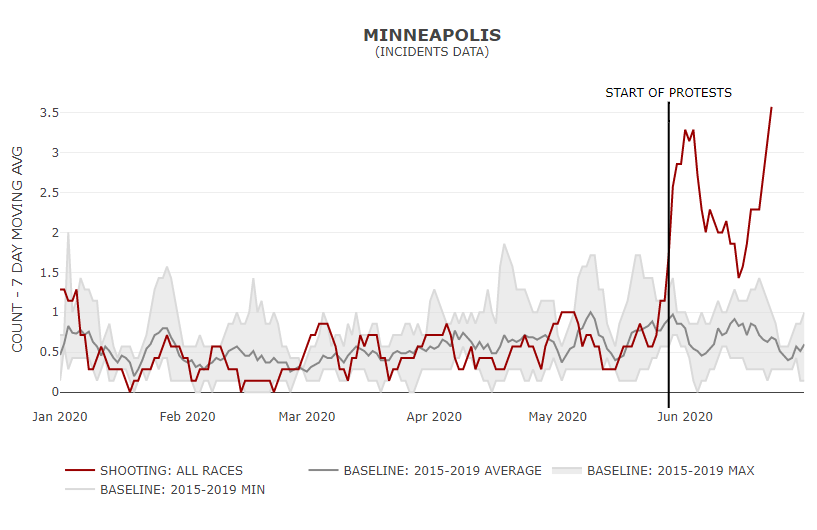

Similar patterns can be observed in data for the first cousin to homicides–shootings. Here is Minneapolis shooting data for the relevant period:

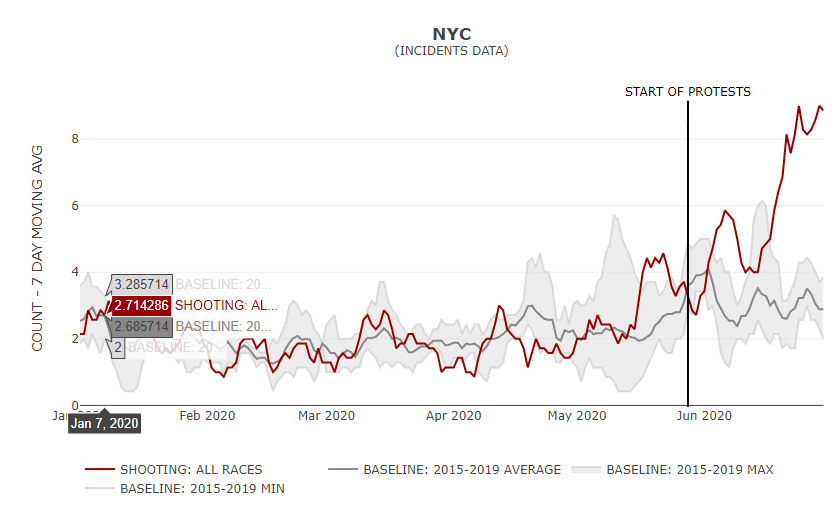

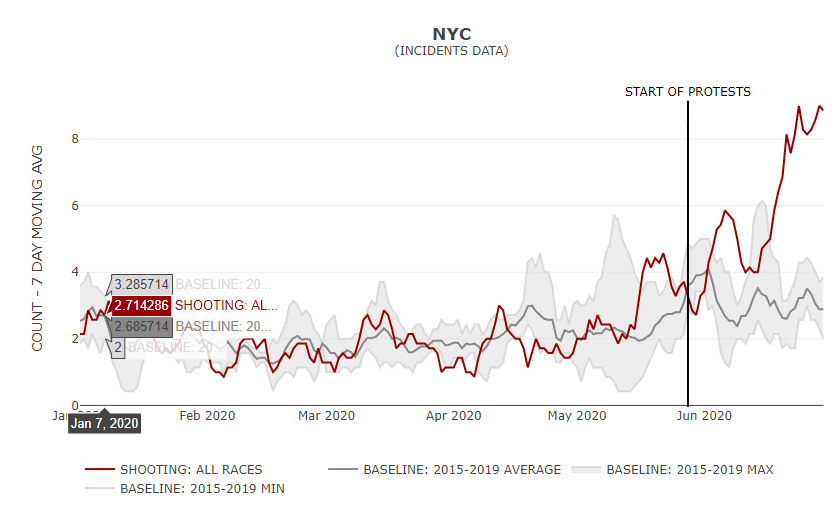

And here is New York City’s shooting data:

These are obviously sudden changes in trends, not gradual ones.

If changes due to the pandemic do not explain the nation’s explosive homicide spike, what does? The Rosenfeld report readily acknowledges the other leading hypothesis: That following George Floyd’s death at the hands of Minneapolis police on May 25, 2020, anti-police protests led to a decline in policing. This hypothesis is what I (and others) have called a “Minneapolis Effect”—that is, as police protests spread around the country, police had to be redeployed from their normal duties to help manage the protests. And, more expansively, even following the protests, “proactive policing” declined.

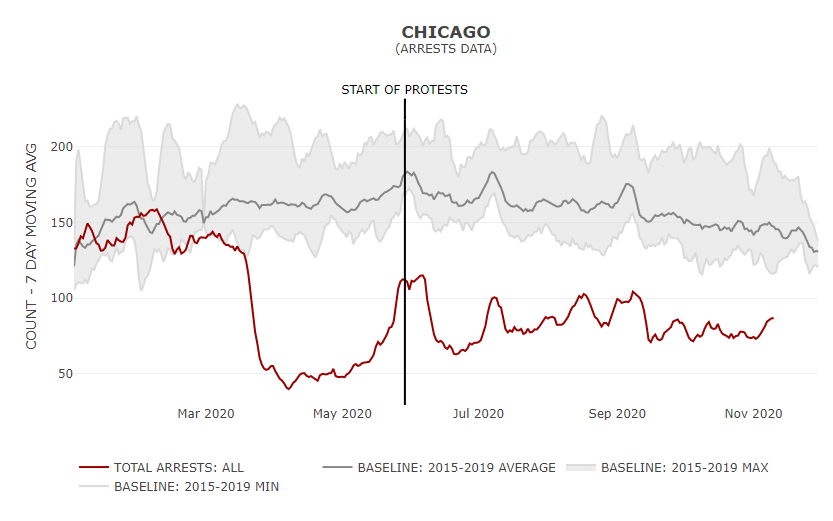

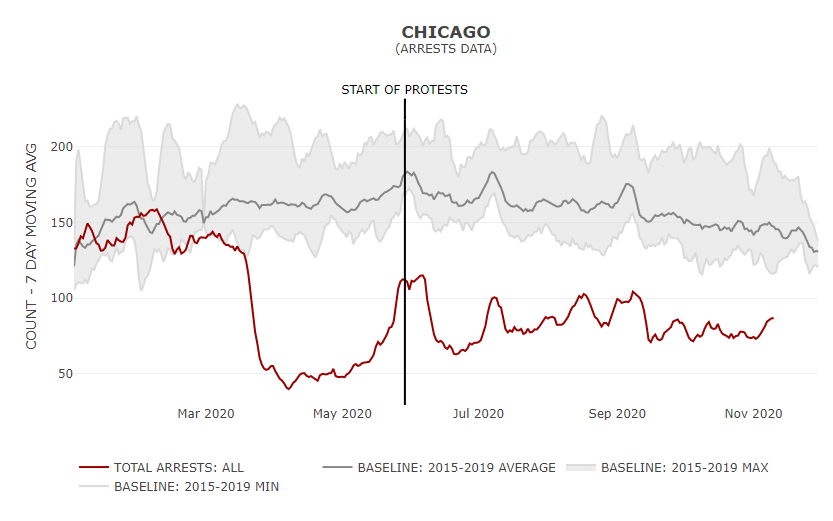

Measuring a decline in proactive policing is difficult. Not all police agencies report good data on policing. And there isn’t a single measure of proactive policing that captures all varieties of police work. But it is possible to get some general sense of changes in policing in 2020. Important measures of proactive policing generally show a post-protest decline. For example, the chart below depicts total arrests by the Chicago Police Department.

As can be seen, in mid-March the pandemic’s onset triggered a sharp decline in arrests. Then, beginning in April, arrests climbed toward pre-pandemic levels. But at the end of May, that return to normalcy was interrupted and arrests plummeted, never to again regain traditional levels.

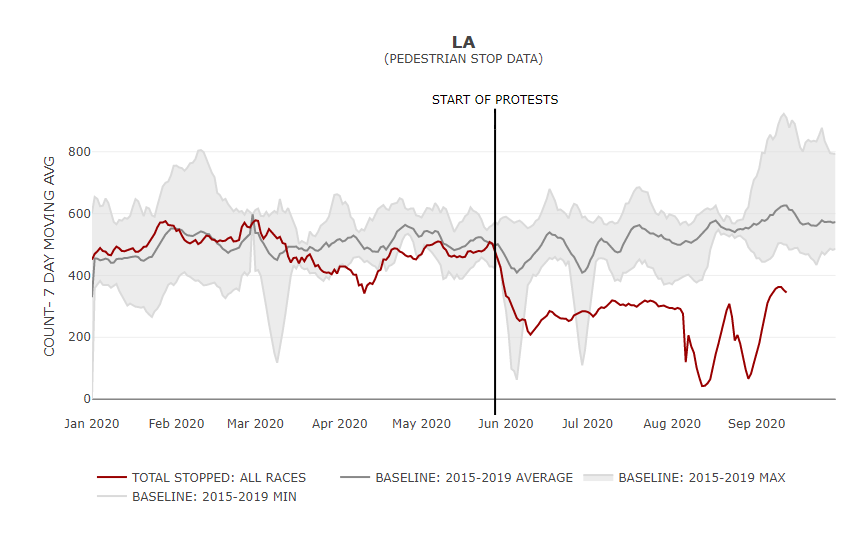

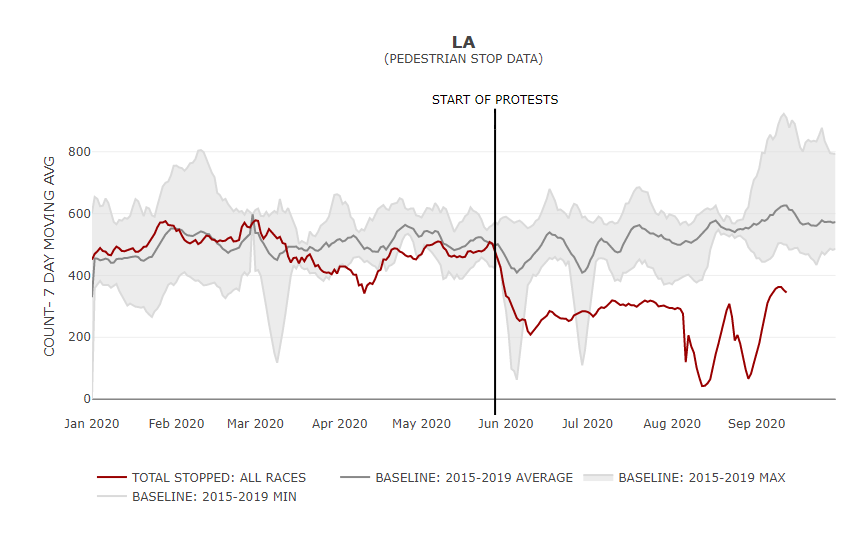

Here’s another similar trend line showing sharp reductions in policing at the end of May, this one depicting street stops by the Los Angeles Police Department:

Here again, LAPD activity (as measured by total persons stopped) dropped below normal levels (depicted in the grey line) beginning around mid-March. During April stops returned to expected levels, equaling normal levels just before the last week in May. But then, suddenly, pedestrian stops declined well below normal levels, where they have remained ever since.

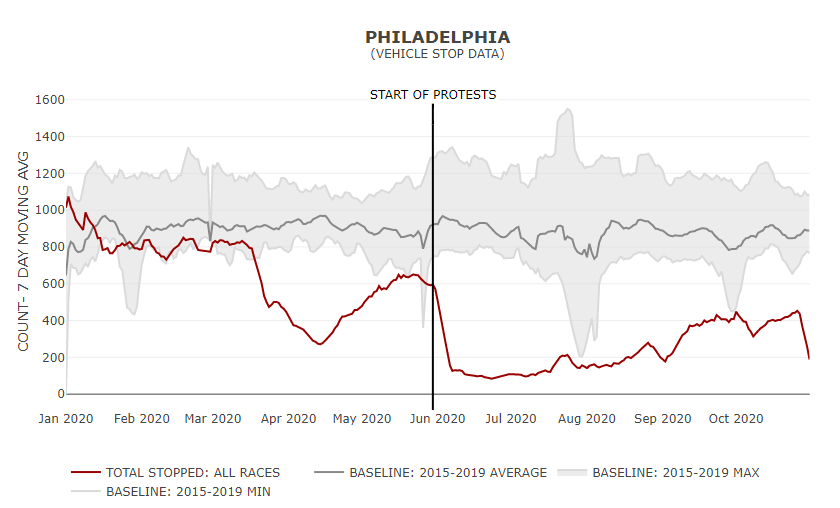

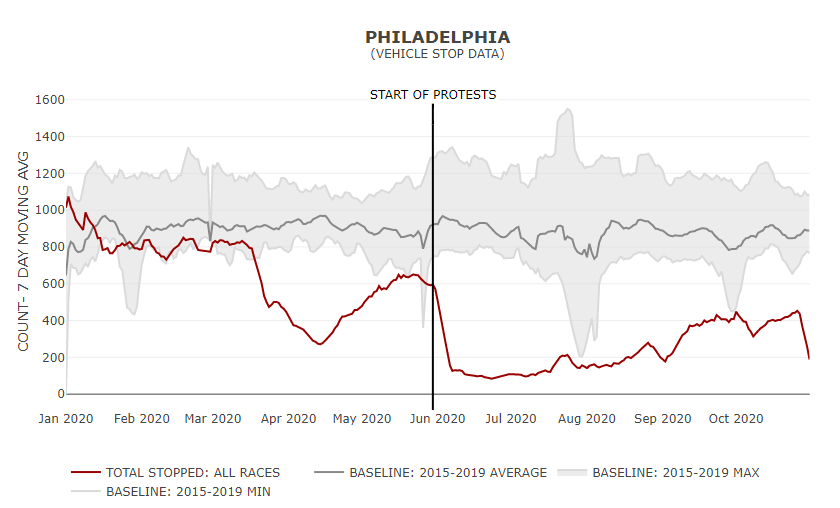

Once last graph will show a similar trend line–this one for traffic stops in Philadelphia:

Here again, the pandemic-induced decline in stops appears in mid-March, followed by a return toward normal levels in April and most of May—only to see a steep drop to well below normal levels after the start of anti-police protests. And this drop coincides exactly with the onset of the Great 2020 Homicide Spike.

Against this backdrop, a “de-policing” explanation readily emerges as the triggering event for the sudden increase in homicides in late May. In the wake of the antipolice protests following George Floyd’s death in late May, less proactive policing occurred. For example, police had to be redeployed to manage the protests, diverting them from antigun patrols and other activities that deter the carrying of illegal firearms. And even after the protests began to wane, police pulled back from proactive policing—that is, from self-initiated policing methods designed to reduce crime by using preventive strategies, such as street stops or antigun patrols. In addition, beginning at the same time, law enforcement capabilities were diminished by reduced funding and other setbacks (such as increased retirements due to demoralization), again due to the anti-police protests. The consequence of reducing law enforcement activity directed against gun violence has been, perhaps unsurprisingly, an increase in gun violence.

Since I articulated my “Minneapolis Effect” theory several months ago, an important new paper had been published supporting my conclusions. As a companion piece to my article in the Federal Sentencing Reporter, Professor Lawrence Rosenthal published an article entitled “The Law and Economics of De-Policing.” In his article, he points to “mounting evidence for what some have dubbed ‘De-Policing’—police retreat in the face of hostile public scrutiny, often in the wake of a highly publicized incident of police misconduct.” He also concludes that the law and economics of policing suggest the most likely mechanism for the decline in law enforcement activity: “Because police officers internalize few, if any, of the benefits of effective policing, when they perceive a risk that they will be made to internalize its costs, over-deterrence is the likely outcome.”

Also supporting the de-policing theory is the seemingly puzzling pattern of crime trends in 2020, developed in today’s Rosenfeld report. During 2020, homicides dramatically increased (up 30%), as did the somewhat related crime categories of gun assaults (up 8%) and aggravated assaults (up 6%). On the other hand, declines occurred in many other crime categories, including robbery (down 9%), residential burglary (down 24%), non-residential burglary (down 7%), larceny (down 16%), and drug offenses (down 30%).

The Great 2020 Homicide Spike looks eerily similar to the pattern of crime increases during the 2016 Chicago homicide spike. As Professor Fowles and I explained in an earlier paper about Chicago crime trends, in 2016 stop-and-frisks fell dramatically in the Windy City following an agreement between Chicago Police and the ACLU. And, as a consequence of that agreement, homicides and shootings dramatically increased, while most other crimes did not. The 2016 Chicago pattern may thus provide a key for unlocking an answer to why rates for some crimes spiked in the U.S. last year while others did not. As the 2016 Chicago homicide spike demonstrates, proactive policing (e.g., stop-and-frisks) plays a uniquely important role in deterring the carrying of illegal guns and thus preventing firearm crimes. When stop-and-frisks plummeted in Chicago in 2016, gun violence spiked (but not other crime categories). So, too, in the summer of 2020, as proactive policing declined across the country, gun violence spiked (but not other crime categories).

Today’s new report about 2020 crime trends acknowledges the possibility of de-policing–as does an earlier paper by Rosenfeld. But today’s report seemingly discounts the issue, noting that “the connection between police violence, protects and social unrest, and heightened community violence remains uncertain.” (p. 16). At some level, this point is true. Social science research is often unable to reach definitive conclusions. But the issue for policy makers today is how to respond to the dramatic homicide spike–and policymakers do not have the luxury of waiting until perfect knowledge exists.

To my mind, the major flaw in today’s Rosenfeld report is its concluding section, which makes policy recommendations. The section calls for “bold action” to respond to rising homicide rates, But rather than presenting a bold response, the reports offers three anodyne recommendations–recommendations that unfortunately seem to steer clear of directly addressing de-policing issues.

The first recommendation calls for “subduing the coronavirus pandemic.” No one will disagree with that proposal. But for reasons explained above, the pandemic does not appear to be the main cause of the homicide spike and thus subduing it will not address most of the problem.

The Rosenfeld report’s second recommendation is “improving the fairness and legitimacy of the justice system in general, and policing in particular.” This is a good idea, to be sure. Indeed, I doubt anyone would disagree with improving the “legitimacy” of our criminal justice system in general. But, again, this proposal does not provide helpful guidance to policymakers seeking to respond immediately to the sharp increase in homicides that has manifested over the last seven months. Issues surrounding “legitimacy” of the system ebb and flow in long term cycles that seem unrelated to the current spike.

The final recommendation is that “responses to record-breaking increases in homicide must not wait. Policymakers can and should address the pandemic, police legitimacy, and violent crime simultaneously. A large body of rigorous empirical evidence demonstrates that violent crime can be addressed using strategies that are available now and do not require significant budgetary outlays, new legislation, or deep systemic reforms.” This recommendation is apparently based on a footnote to one of the co-authors on the Rosenfeld report–Thomas Abt, who has written an informative book, Bleeding Out. But that book, written in 2019 before the pandemic, offers a series of proposals designed to reduce homicides generally, such as by expanding social services and anti-violence programs. To be sure, preventing homicides is obviously a good thing. But general approaches obviously are not targeted to a specific problem that sudden arose during the last half of 2020. The Rosenfeld report fails to explain clearly what countermeasures would be effective in specifically combating the nation’s recent homicide spike.

Indeed, one interesting point is that Abt’s book discusses the importance of “hot spot” policing, explaining that “[w]hether a hot person carries a hot gun in a hot spot depends on, among other things, supply and demand. To reduce the demand for illegal firearms among dangerous people in dangerous places, the risk of apprehension must be high.” This suggests that if recent anti-police protests have reduced the risk of apprehension for carrying illegal firearms or for committing gun crimes, the likely result is an increase in gun crimes. Thus, the Rosenfeld report seems to be suggesting (sub silencio) that we need more “hot spot” policing–although that point is not specifically mentioned. I wish the Rosenfeld report had more pointedly called for expanded proactive policing, as that seems to be the clear and immediate need in this country.

While today’s report is unduly limited in its recommendations, I hope that the report will lead to further research on last year’s homicide spike. Given the wealth of data that are available, time series regression analysis should be able to shed further light on what caused such a dramatic increase in homicides over such a short period of time. To be sure, time series analysis of events in 2020 will be difficult, given that COVID-19 has disrupted so many aspects of American society–including criminal justice. But difficult does not mean impossible. Research should be able to disentangle the competing effects of the various events in 2020, allowing policymakers to have a better understanding of why homicides sharply increased last year.

While highlighting these points of possible disagreement with today’s report, I want to conclude by emphasizing a point of strong agreement between me and the Rosenfeld et al. The new report concludes that the Great 2020 Homicide Spike led to 1,268 more deaths in the sample of 34 cities than in the year before. In its last sentence, the report finishes with the plea that “[w]ith so many lives at stake, the time to act is now.”

I wholeheartedly agree–and have argued in my earlier paper for immediate responses to spiking homicide rates. It is time to act now, as many lives are, indeed, at stake–disproportionately the lives of victims who are of color, residents of inner cities, and impoverished. But that immediate action must be clear-eyed about why so many additional victims were murdered last year. The best, currently available evidence strongly supports the conclusion that the Great 2020 Homicide Spike resulted from the widespread anti-police protests, which in turn lead to a reduction in policing activity directed at fighting gun crimes. To save lives in 2021, we need urgent action to restore proactive policing to its pre-protest levels.

from Latest – Reason.com https://ift.tt/3cyXsWu

via IFTTT

Oklahoma County, Oklahoma, District Attorney David Prater has charged two former detention officers and their supervisor with cruelty to a prisoner and conspiracy. Prater says the three forced inmates to listen to the children’s song “Baby Shark” for extended periods of time.

Oklahoma County, Oklahoma, District Attorney David Prater has charged two former detention officers and their supervisor with cruelty to a prisoner and conspiracy. Prater says the three forced inmates to listen to the children’s song “Baby Shark” for extended periods of time.

As can be seen, there were significant increases in almost all cities. Because these figures are percentages, however, they can perhaps be misleading for smaller cities. As the report explains, Chula Vista, California, experienced the largest percentage homicide increase in the sample (150%), but that percentage is based on a difference of just six homicides (ten in 2020 compared with four in 2019).

As can be seen, there were significant increases in almost all cities. Because these figures are percentages, however, they can perhaps be misleading for smaller cities. As the report explains, Chula Vista, California, experienced the largest percentage homicide increase in the sample (150%), but that percentage is based on a difference of just six homicides (ten in 2020 compared with four in 2019).