Now that the quarter-end rebalance malarkey is behind us, it’s full steam ahead into the new quarter and S&P futures hit a new all time high overnight rising as high as 3,984 before stabilizing up 0.3%, breaching Wednesday’s best levels as signs of faster job creation in the US fueled optimism about the global recovery (although all that will change tomorrow if the NFP whisper of 1.8MM jobs is remotely accurate). Oil climbed above $60 per barrel before a meeting of OPEC+ on extending production cuts.

At 7:30 a.m. ET, Dow E-minis were up 12 points, or 0.04%, S&P 500 E-minis were up 12 points, or 0.30%. Nasdaq futures rose as much as 1.1%, as “high flying” FAAMG stocks added between 0.6% and 1.1% after underperforming last month on concerns over elevated valuations. Some notable premarket movers:

- Micron rose 4.3% after the chipmaker forecast fiscal third-quarter revenue above Wall Street estimates due to higher demand for memory chips, thanks to 5G smartphones and artificial intelligence software.

- Western Digital Corp. gained 1.1% after a report it and Micron were exploring a potential deal for Japan’s Kioxia Holdings Corp.

- US-listed shares of rival Taiwan Semiconductor also added 2.3% on its plan to invest $100 billion over the next three years to meet the rising chip demand.

- Uber Technologies Inc rose nearly 2% after Jefferies began coverage on the ride-hailing company’s shares with “buy” and said the company could be profitable soon.

- Johnson & Johnson slipped 1.1% premarket after the drugmaker said it had found a problem with a batch of the drug substance for its COVID-19 vaccine being produced by Emergent Biosolutions.

- Microsoft Corp. climbed 1.2% in premarket as the company’s multibillion-dollar deal to build customized versions of its HoloLens goggles for the U.S. Army moved forward.

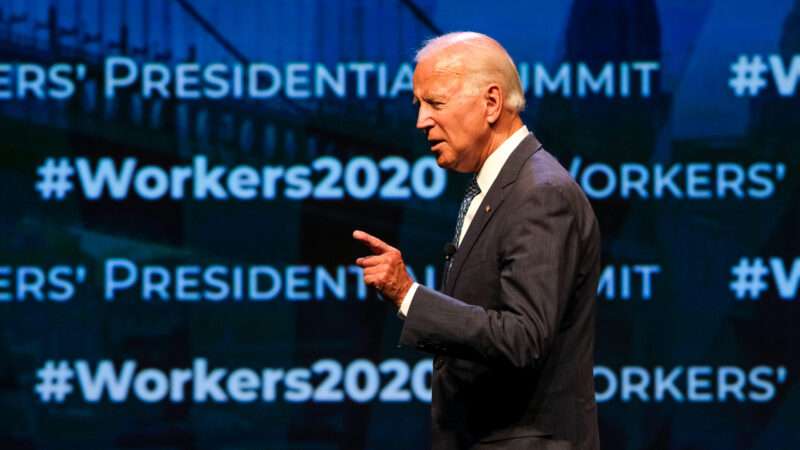

On Wednesday, the S&P 500 hit a new intraday high, but stopped just shy of touching 4,000 points for the first time after President Joe Biden’s unveiled a $2.25 trillion plan to rebuild the world’s largest economy. Biden’s “American Jobs Plan” would put corporate America on the hook for the tab as the government creates millions of jobs building infrastructure, such as roads, tackles climate change and boosts human services like care for the elderly.

“There is still some room for recovery in stocks that will benefit from the economic recovery and the reopening trade,” Ania Aldrich, investment principal at Cambiar Investors LLC, said on Bloomberg TV. “There’s still a lot of growth that has to come and that’s not necessarily reflected in earnings yet.”

With the Archegos fiasco behind us, investors remain focused on inflation risk as central banks reassert their commitment to low interest rates. Traders for now are looking past worsening virus trends, such as lockdowns in France and Canada’s Ontario province.

European equities also traded near session highs, with the Euro Stoxx 600 rising 0.4%, and although it traded higher earlier in the session, it was headed for the longest streak of weekly gains this year; the FTSE outperformed at the margin. Real estate, tech and retailers lead gains; autos are the sole sector in the red. European airline stocks rose (IAG +4.3%, TUI +3.5%, Ryanair +2.6%, Lufthansa +2.5%), lifting the Stoxx 600 travel and leisure subgroup higher, amid positive newsflow around prospects for a travel recovery this year. Goodbody analysts note an interview with Ryanair CEO Michael O’Leary on Good Morning Britain on Wednesday, with O’Leary predicting restrictions being removed on flights to Spain, Portugal and Greece this year given the rising vaccination rates. Countries such as Malta, Turkey and Thailand are keen to welcome British tourists, analysts including Mark Simpson write in a note Thursday.

On the Stoxx 600, 447 members were up, 103 down and 50 unchanged. Here are some of the biggest European movers today:

- Prosus shares jump as much as 5.8% after Tencent closed higher. Additionally, the Stoxx Europe 600 Technology Index gains as much as 1.7% after chip stocks rallied, boosted by Micron’s bullish forecast and by TSMC’s spending plans.

- Quilter shares rise as much as 4.4% after the U.K. wealth manager sold its international unit to Utmost for GBP483m. RBC said the deal price is “fair,” yet also at a discount to the rest of the group.

- Delivery Hero shares advance as much as 4.9% as stocks that benefited from the pandemic rose, with makers of home- office equipment, food-delivery firms and e-commerce stocks gaining as France and Italy prepare to extend curbs to contain the virus.

- Vinci shares jump as much as 3.2% after signing agreement to buy ACS’s energy business for about EU4.9 billion in cash, according to statement. The acquisition will be financed through Vinci’s available cash and credit lines.

- Atos shares plunge as much as 22%, the biggest one-day drop since Oct. 2018, after the IT services firm said

Earlier in the session, an index of Asia-Pacific shares rose for the first time in three days, with Hong Kong leading gains, after data signaled a pick-up in regional manufacturing. The emerging-market equity benchmark rebounded from Wednesday’s losses. Asian stocks climbed after Joe Biden announced a $2.25 trillion infrastructure plan and amid several big news items in the semiconductor industry. Tech stocks were the biggest boost to the MSCI Asia Pacific Index as chip giant TSMC announced plans to spend $100 billion over the next three years to expand capacity. Another lift came from a Dow Jones report that Micron and Western Digital are each exploring potential deals for Kioxia that could value the Japanese memory maker at around $30 billion. Japanese shares gained after the Tankan survey showed the nation’s large manufacturers have turned optimistic for the first time since the fall of 2019. South Korean stocks climbed following a report that the nation’s exports rose the most in more than two years on strong global demand. Hong Kong stocks advanced even as trading in more than 50 companies was halted as a number of firms failed to report earnings in time. Vietnam’s benchmark notched the region’s biggest advance Thursday, hitting a record high. The Philippine market was closed for a holiday, and a number of markets will be shut on Friday

The closely watching Chinese market – where fears of policy tightening has kept a lid on stock gains – advanced on Thursday, starting the month in the green after posting the first quarterly slump in a year. The CSI 300 Index closed 1.2% higher, the most this week, with consumer discretionary and health care firms leading gains. The gauge’s 10-day historical volatility fell to the lowest in six weeks, which coincides with the starting point for the recent selloff. Various benchmarks on the mainland also advanced, though moves remained largely range bound. Turnover in Shanghai and Shenzhen dropped to nearly 628 billion yuan, the lowest in five months. Meanwhile, trading in more than 50 Hong Kong-listed companies was suspended after a number of firms failed to report earnings ahead of the March 31 deadline. The Hang Seng Index was up 1.5% as of 3:09 p.m. local time. The Shanghai Composite advanced 0.7% while the tech-heavy ChiNext rose 2.1%

Back in the US and its holiday-shortened week, Bloomberg notes that traders were jockeying for position before the Easter weekend – US stock markets are closed on Good Friday – after ADP’s March data showed U.S. private employers hired the most workers in six months, leaving a risk that tomorrow’s NFP print will be a blowout number that could spike reflation fears again. Biden’s ambitious plan to rebuild U.S. infrastructure has added to the growth outlook, even though Republican opposition to the plan raises questions about how much can actually be delivered.

In rates, Treasuries were mixed with the curve flatter as long end holds most of its Asia-session gains, which were led by a broader advance in regional debt markets. 10Y bonds ground higher with longer-dated Treasury yields falling as investors weighed the prospects of President Joe Biden winning approval for his $2.25 trillion stimulus plan. Gilts led a modest bull flattening move, richening ~3.5bps at the long end. Peripheral spreads tighten to core slightly.

In FX, the Bloomberg Dollar Spot Index gave up an Asia-session gain and the dollar traded unchanged versus G10 peers, with most moves contained in tight ranges; the euro and Scandinavian currencies erased Asia-session losses in early European hours. AUD was the worst performer in G-10, extending Asia’s losses in early London trade before finding support near 0.7532. EUR/USD and cable fade a small pop higher to trade flat. The Turkish lira jumped for a second day, paring some of its world-leading losses since a shuffle in the central bank’s leadership. In China, the yuan slumped to a four-month low after a gauge of manufacturing activity in March fell.

In commodities, crude futures pared earlier gains in London and New York ahead of the OPEC+ meeting set to begin shortly. Brent was up just 0.1% having earlier climbed 2.4%, while WTI traded up 0.2% after earlier climbing as much as 2.5%. Spot gold drifted through Wednesday’s best levels trading near $1,715/oz. Most base metals are on the back foot: LME zinc and copper underperform, aluminum holds in the green

Official data is likely to show that the number of Americans filing new claims for jobless benefits slipped last week. It comes ahead of the closely-watched monthly jobs report on Friday that could show U.S. economy added 647,000 jobs last month after February’s 379,000 rise.

Market Snapshot

- S&P 500 futures up 0.3% to 3,981.00

- SXXP Index up 0.5% to 431.89

- German 10Y yield little changed at -0.30%

- Euro little changed at $1.1741

- MXAP up 0.9% to 205.34

- MXAPJ up 1.2% to 686.01

- Nikkei up 0.7% to 29,388.87

- Topix up 0.2% to 1,957.64

- Hang Seng Index up 2.0% to 28,938.74

- Shanghai Composite up 0.7% to 3,466.33

- Sensex up 0.7% to 49,872.78

- Australia S&P/ASX 200 up 0.6% to 6,828.69

- Kospi up 0.8% to 3,087.40

- Brent futures up 1.7% to $63.84/bbl

- Gold spot up 0.7% to $1,719.06

- U.S. Dollar Index little changed at 93.15

Top Overnight News from Bloomberg

- Chinese sovereign debt is due to face a number of challenges in the second quarter. On top of a longer phase-in period for FTSE Russell’s World Government Bond Index, a surge in supply of local government securities and the narrowing yield premium over U.S. Treasuries are also threatening to reduce China’s appeal

- The Scottish government is exploring raising funds on capital markets for the first time, ahead of elections that could trigger a renewed standoff with the U.K. over independence

- The U.K.’s efforts to disentangle itself from sterling Libor by year-end just went up a gear. Starting Thursday, firms should stop issuing new loans, bonds and securitizations tied to the discredited benchmark, according to the Bank of England. It’s ramped up the pressure in recent days, warning bankers that continued use is a risk for business and could cost them their bonuses

- The ECB will still have more work to do to boost inflation after the pandemic as increased price pressures this year will not be sustained, chief economist Philip Lane wrote in a blog post

- A bonanza of European debt sales so far this year may be as good as it gets for the market as recovery from the pandemic starts to put the brakes on issuance

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded positively as participants reflected on the busy slate of data releases and US President Biden’s announcement of his two-part spending proposal consisting of the American Jobs Plan and American Family Plan whereby he only provided details of the former which will modernize, repair and upgrade the transportation network, boost the US edge on chips and which will create millions of jobs. Furthermore, President Biden stated that they will make sure to buy American with contracts only to be awarded to US firms and that the capital investment is to be around USD 2tln with spending spread over 8 years, while he also suggested increasing the corporate tax rate to 28% and that they will dramatically raise IRS tax compliance. ASX 200 (+0.6%) was kept afloat with gold miners underpinned after the recent rebound in the precious metal and with tech inspired by outperformance of the sector stateside, although financials were indecisive with CBA and Macquarie pressured from disciplinary actions by regulatory agencies and AMP was boosted after it named ANZ Bank’s Deputy CEO as its next chief. Nikkei 225 (+0.7%) and KOSPI (+0.9%) benefitted from encouraging data including a strong BoJ Tankan report which showed large manufacturers sentiment index at its highest since September 2019 and large non-manufacturers sentiment at its best levels in a year, while South Korea cheered a continued surge in exports. Hang Seng (+2.0%) and Shanghai Comp. (+0.7%) conformed to the upbeat mood following reports that China’s cabinet is to further cut taxes for smaller companies and after China approved the long-planned mega-merger between state-owned SinoChem and ChemChina, although gains were capped following a miss on Chinese Caixin Manufacturing PMI data. Finally, 10yr JGBs were lower after the fluctuations in USTs and the BoJ announcement of its purchase intentions for April in which it upped the amount but lowered the frequency which would effectively result to a decline of total purchases from March, although improved results from the 10yr JGB auction helped pare some of the losses.

Top Asian News

- Masayoshi Son’s ‘Money Guy’ Greensill Went From Hero to Zero

- Vietnam Stocks Shoot Past Toughest Key Level to Hit Record High

- Mizuho May Have $90 Million Exposure to Archegos, Nikkei Reports

- Barclays Plans to Hire Several Private Bankers in Singapore

European equities (Eurostoxx 50 +0.2%) have seen a steady grind higher since the open as markets head towards the end of the holiday-shortened week. In terms of broader macro impulses, a bulk of the news cycle has centred around President Biden’s two-part spending proposal, consisting of the American Jobs Plan and American Family Plan. That said, little follow-through has been observed in Europe as many of the specifics of the release were announced during yesterday’s session. Closer to home, the narrative is somewhat less upbeat after French President Macron announced new measures, including a national lockdown, which will take place from Saturday and last for at least one month. Nonetheless, the CAC 40 (+0.3%) has still managed to eke out mild gains throughout trade, in-fitting with broader sentiment in the region. From a sectoral standpoint, they are broadly firmer with Technology names leading the charge higher. This can also be observed in the US with the e-mini Nasdaq outperforming US peers with gains of 0.9% as the US 10yr yield continues to retreat. Elsewhere, outperformers include Financial Services, Basic Resources and Retail with the latter aided by gains in Next (+2.3%) post-FY earnings. To the downside, Autos is the only sector in the red with Daimler (-2.1%) and Volkswagen (-1.3%) at the bottom of the DAX with market participants still bemused over the latter’s Voltswagen “April fools joke”. Atos (-14.2%) sit firmly at the foot of the Stoxx 600 after announcing that auditors found issues that prompted accounting errors at two of its US subsidiaries.

Top European News

- U.K. Manufacturing Growth Reaches Decade High as Lockdown Eases

- Atos Shares Drop the Most in Over Two Years on Accounting Errors

- Commerzbank Loses Three More Board Members as Upheaval Deepens

- Vinci Seals $5.8 Billion Deal to Bolster Renewable Construction

In FX, the Aussie is still underperforming, but some way off overnight lows vs the Greenback within a 0.7601-0.7532 range in wake of trade data revealing a 1% fall in exports due mainly to iron ore, though the partial recovery to 0.7550+ is mainly down to another pull-back in its US counterpart rather than anything else. However, retail sales were not quite as weak as forecast and some are touting a hawkish shift from the RBA next week given tangible evidence of a rapid recovery in the domestic economy via the labour market and booming building permits.

- CHF/NZD/CAD – Also weaker vs their US adversary despite the DXY stalling ahead of yesterday’s high and recoiling into a tighter band between 93.338-122 compared to Wednesday’s 93.437-92.082 extremes. Moreover, the Franc is straddling 0.9450 even though the Swiss manufacturing PMI was considerably firmer than forecast in March to offset mixed CPI and weak retail sales for the prior month, while the Kiwi has not been able to take advantage of Aud/Nzd tailwinds to retest 0.7000. Elsewhere, the Loonie has lost post-Canadian GDP momentum ahead of building permits and the Markit PMI, albeit holding above 1.2600 with the aid of firmer oil prices, as BoC Governor Macklem expresses concern about an unsustainable house price bubble and resultant rising levels of household debt. Nevertheless, Usd/Cad may be capped by decent option expiry interest extending from 1.2600-10 (1.5 bn) through 1.2630-45 (1.2 bn) to 1.2600-75 (1.3 bn) in the event of a bullish reaction to any of the Canadian or US releases that also include Challenger layoffs, jobless claims, Markit’s final manufacturing PMI, construction spending and the ISM before Fed speakers in the form of Harker and Kaplan.

- GBP/EUR/JPY – The Pound remains propped near 1.3800 vs the Dollar and 0.8500 against the Euro, but unable to breach either psychological barrier on the back of an upgrade in UK manufacturing PMI, and aside from the obvious swathe of bids in Eur/Gbp just under the current 2021 low, Eur/Usd resilience on the 1.1700 handle is also keeping Sterling at bay. Similarly, the Yen continues to repel offers into 111.00 and an upbeat Japanese Tankan survey may be helping alongside a strong 10 year JGB auction and some bull re-flattening across the US Treasury curve.

- SCANDI/EM – Momentum and the pendulum is still swinging away from the Sek towards the Nok, as evident by Eur/Sek remaining elevated around 10.2500 following a considerably better than anticipated Swedish manufacturing PMI in contrast to Eur/Nok continuing to hover over 10.0000. Meanwhile, the Cnh has been ruffled by China’s Caixin manufacturing PMI falling short of expectations and slowing from the previous month, but the Try is paring more losses after a firmer Turkish manufacturing PMI and an extension of the reduction to withholding taxes for bank deposits through the end of May.

In commodities, WTI and Brent front month futures have opened the session on a firmer footing, but off initial highs, following on from Asia’s positive lead. Fundamental support for price action resides around the OPEC+ meeting, where expectations remain that OPEC+ will maintain its output cuts. Following the JMMC, alleged not to be very upbeat, Eurasia Group reported “the most likely outcome is no significant changes in production and any decisions on tapering will likely be delayed to the May meeting.” Moreover, this decision would come amid growing COVID infection rates, in some regions, hindering demand. As such, OPEC+ continuing the supply cuts has had less of an impact on the complexes’ price as usual, due to the growing concerns surrounding the economic outlook and the global recovery. The May WTI contract trades on a mid USD 60.00/bbl handle (vs low USD 59.26/bbl) whilst its Brent counterpart trades marginally north of USD 64.00/bbl (vs low USD 62.81/bbl). Spot gold and spot silver have both benefitted modestly from a pause in USD strength, with the former seeing more pronounced gains on the day and rebounding from its 3-week low while silver is more contained in comparison. At the time of writing, spot gold trades at USD 1,715/oz (vs low USD 1,706/oz) and silver trades just shy of USD 24.40/oz (vs low USD 24.26/oz). Onto base metals, LME copper is softer on the session and nearing 1-month lows after Caixin Manufacturing PMI fell short of expectations.

US Event Calendar

- 7:30am: March Challenger Job Cuts YoY, prior -39.1%

- 8:30am: March Initial Jobless Claims, est. 675,000, prior 684,000; Continuing Claims, est. 3.75m, prior 3.87m

- 9:45am: March Markit US Manufacturing PMI, est. 59.2, prior 59.0

- 10am: March ISM New Orders, prior 64.8;

- ISM Employment, prior 54.4;

- ISM Prices Paid, est. 83.5, prior 86.0;

- ISM Manufacturing, est. 61.5, prior 60.8

- 10am: Feb. Construction Spending MoM, est. -1.0%, prior 1.7%

DB’s Henry Allen concludes the overnight wrap

Yesterday marked a pretty eventful end to the first quarter, as not only did we get the announcement of Biden’s infrastructure package, but multiple European countries moved to toughen up restrictions as the continent has been forced to grapple with a rising 3rd wave of the virus. This led to a pretty divergent performance for equities on either side of the Atlantic, with the S&P 500 (+0.36%) climbing to just short of an all-time high and at one point hitting its highest ever intraday level of 3994, just shy of breaching the 4,000 mark for the first time. Over in Europe however, the STOXX 600 (-0.24%) fell back from its post-pandemic high the previous day, as the prospect of fresh restrictions risked dampening economic activity further. A large rally in technology shares drove much of the divergence as the NASDAQ rose +1.54% and the NYFANG index gained +1.65%, while US banks stocks (-1.00%) and their European counterparts (-1.22%) fell back even as rates rose.

Before we go into what happened yesterday, the start of the month means that we’ll shortly be releasing our latest performance review of financial assets for March and Q1. Risk assets were the winners in Q1, with equities, oil and HY credit mostly recording a positive performance. Conversely, safe havens had a less good time, with gold ending a run of 9 successive quarterly advances, and sovereign bonds also losing ground on the back of optimism over the economic recovery, as markets brought forward their expected timing for future rate hikes. See the full report out soon for more info.

Of course, one of the biggest stories of the quarter happened right at the beginning, as the Democrats won both of the Georgia Senate races that gave their party overall control of the chamber thanks to Vice President Harris’ casting vote. In turn, this paved the way for much bigger stimulus, and yesterday we heard the administration’s latest plans from President Biden, who outlined his “American Jobs Plan” that would see $2.25 trillion invested over the next eight years. The overall price tag breaks down into $620 billion for transportation and $650 billion for measures including clean water and high-speed broadband. The bill would earmark $580 billion for American manufacturing, including $180 billion in the biggest non-defence R&D program on record. Lastly there is an expected $400 billion toward care for the elderly and disabled. Unsurprisingly there was also emphasis on sustainability and the green economy, with money for modernising the electric grid, as well as building, preserving and retrofitting homes and commercial buildings.

In his speech, President Biden said the plan would “bring everybody along” and would “build our economy from the middle out.” And there was also a nod to foreign policy objectives, with the administration’s fact sheet noting how China was “investing aggressively in R&D” as it called for further investment by the United States, while President Biden said the “rest of the world is closing in and closing in fast.” This comes following reports that both Democratic and Republican Senators said they were discussing proposals to fund semiconductor research and better compete, though worries about overall costs remain. It is uncertain what parts would get tied into the “American Jobs Plan”, but Majority Leader Schumer plans to incorporate many China-related bills into one package that would go through a bipartisan committee later this month, according to Bloomberg reports. That would include $50 billion for semiconductor manufacturing and $50 billion for the National Science Foundation.

In terms of how it’s all being paid for, the plan included a number of changes to the corporate tax code, including an increase in the corporate tax rate to 28%, and a global minimum tax of 21%. The administration said that this would “be fully paid for within the next 15 years and reduce deficits in the years after.” President Biden said he would meet with Congressional Republicans on the proposal and would engage in “good faith negotiations” with lawmakers on a path forward. However, it’s still expected that there’ll be strong Republican opposition thanks to the tax increases, and Senate Minority Leader McConnell has already responded negatively, saying that “It’s called infrastructure, but inside the Trojan horse it’s going to be more borrowed money, and massive tax increases on all the productive parts of our economy.” In terms of timelines, multiple outlets said that House Speaker Pelosi told her caucus that her aim was to have the bill voted on in the House by July 4, which would allow it to be taken up by the Senate prior to the chamber’s month-long recess in August.

Overnight in Asia, markets have followed Wall Street’s lead with the Nikkei (+0.69%), Hang Seng (+1.13%), Shanghai Comp (+0.25%) and Kospi (+0.59%) all seeing gains, as a number of positive data releases were reported in the region this morning. Firstly, the BoJ’s Tankan survey showed that large Japanese manufacturers have turned optimistic for the first time in six quarters with businesses of all kinds saying that they plan to boost investment by the most in decades. Additionally, we have already seen the March manufacturing PMIs in Asia which mostly printed in expansionary territory. Japan’s final PMI came in at 52.7 (vs. 52.0 in flash) while the numbers from South Korea (at 55.3 vs. 55.3 last month) , Vietnam (53.6 vs. 51.6) and Indonesia (53.2 vs. 50.9) all remained in expansionary territory. China’s Caixin manufacturing PMI was relatively weaker however at 50.6 (vs. 50.9 last month and 51.4 expected). Outside of Asia, futures on the S&P 500 (+0.02%) are trading broadly flat but those on the Nasdaq (+0.26%) are pointing higher.

Back to yesterday now, and US Treasury yields rose against the backdrop of Biden’s announcement, with 10yr yields up +3.8bps at 1.740%, to their highest closing level in over a year, albeit still beneath the intraday high of 1.774% reached on Wednesday. Inflation expectations were responsible for the rise, and 10yr breakevens climbed +2.7bps to 2.37%, their highest level since 2013, whereas real yields saw a slight rise of +0.8bps. As with equities however, it was a different story for sovereign bonds in Europe, where yields on 10yr bunds (-0.5bps), OATs (-0.3bps) and BTPs (-1.2bps) all saw modest declines.

There were some pretty major developments regarding the pandemic yesterday, as governments across Europe moved to respond to a third wave of the virus. In France, President Macron announced a four-week nationwide lockdown of schools and businesses, while warning that “the virus is more contagious and deadlier” during the current wave. He called on residents to take extra effort, even as restrictions will be somewhat flexible over the holiday weekend. Meanwhile in Italy, the government extended their own national restrictions on movement and businesses, while also being one of the first countries to make the vaccine mandatory for healthcare workers. Finally it’s been reported by Canada’s CBC News that the Canadian province of Ontario would go into a 28-day lockdown from Saturday. On the topic of the vaccine, there was some bad news out of the US, where a manufacturing error affected 15 million doses of the one-shot Johnson & Johnson vaccine. This is not expected to meaningfully affect US vaccination efforts according to reports, with the majority of the country still relying on Moderna’s and Pfizer’s jabs. Both of those companies met their first quarter targets of 100mn and 120mn shots respectively.

In more positive news though, a final-stage trial of the Pfizer vaccine in 12-15 year olds in the US found that it was 100% effective and saw robust antibody responses. The trial enrolled 2,260 children, and while there were 18 Covid cases among the placebo group, there were no cases in the vaccinated group. At the moment, the vaccine is only authorised among those 16 and older in the US and the EU, but Pfizer said they planned to submit the data to the FDA and EMA for authorisation as soon as possible.

Looking at yesterday’s data, the Euro Area flash CPI reading for March came in at +1.3% (vs. +1.4% expected), which is its highest rate in over a year. Core inflation unexpectedly fell back however, declining to +0.9% (vs. +1.1% expected). Meanwhile in the US ahead of tomorrow’s jobs report, the ADP’s report of private payrolls said that the US added +517k jobs in March (vs. +550k expected), which is the fastest pace since September. Other releases included German unemployment for March, which fell by -8k (vs. -3k expected), while data revisions in the UK showed the economy grew by +1.3% in Q4 (vs. +1.0% at previous estimate), and the overall 2020 contraction was revised to -9.8% (vs. -9.9% previously).

To the day ahead now, and the main highlight will be the manufacturing PMIs from around the world, as well as the ISM manufacturing reading from the US. Other data releases include German retail sales for February, and the US will be releasing their weekly initial jobless claims and February’s construction spending. From central banks, Philadelphia Fed President Harker will be speaking, while the OPEC+ group will be discussing oil production.