Authored by Alasdair Macleod via GoldMoney.com,

There is an established theoretical relationship between bonds and equities which provides a framework for the future performance of financial assets. It would be a mistake to ignore it, ahead of the forthcoming rise in global interest rates.

Price inflation is roaring, and so far, central banks are in denial. But it is increasingly difficult to see how monetary policy planners can extend the suppression of interest rates for much longer. There can only be one outcome: markets, that is to say prices determined by non-state actors, will force central banks to capitulate on interest rates in the summer.

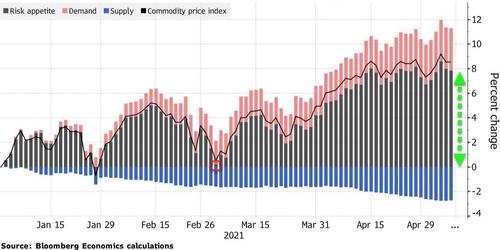

Hardly noticed, China is deliberately putting the brakes on its economy, which will cause an inflationary dollar to collapse, unless the US defends it by putting up interest rates.

Deliberate?

Almost certainly, as part of its strategy, China is taking the financial war with the US into the foreign exchanges.

Bond yields will rise, with the US Treasury 10-year bond leaving a 2% yield far behind.

Equity markets will sense the danger, and it might turn out that the month of May marks a peak in financial asset values — following cryptocurrencies into substantial bear markets.

Introduction

There is an old stock market adage that you should sell in May and go away. It has already proved its worth in the case of cryptocurrencies, with Bitcoin more than halving at one point, and Ethereum losing 57% between 10—19 May. A sea-change in cryptocurrencies’ market sentiment has taken place.

As for equities, it could also turn out that 10 May, which so far has marked the S&P 500 Index’s high point, will mark the beginning of their decline. But it’s too soon to tell. However, we do know that following the unprecedented dilution of the major currencies’ purchasing power since March 2020 commodity prices have increased substantially, global logistics are fouled up and consumer prices are rapidly rising everywhere, a combination of events which is bound to lead to higher interest rates. But as is usually the case in times like these, central bankers and market bulls are wishing this reality away.

Only last week, the Federal Reserve Board told us that:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.”

Two per cent, two per cent, two percent and two per cent. Clearly, the world’s most powerful monetary policy planners are wilfully blind to reality. In an interview with Greg Hunter of USAWatchdog.com this week, John Williams of Shadowstats.com, who calculates US CPI on an unadjusted basis, put current price inflation at over 11%. If his numbers are closer to reality, a huge interest rate shock is being stored up, likely to hit markets without much warning.

Central banks are always reluctant to raise interest rates and consequently are horribly wrong-footed. Not mentioned in the Fed’s statement quoted above is the $120bn monthly QE stimulus still inflating financial bubbles and which are feeding yet more inflation into the system. Furthermore, the Fed cannot stop inflating. Unless interest rate suppression and QE are abandoned the certain outcome will be hyperinflation. Arguably, the dollar is on that path already and its purchasing power is early in the process of collapsing.

The notion that maintaining the QE stimulus and interest rates at zero is to help the economy is poppycock. The Fed has two unwritten objectives that override the economy: to fund a free-spending government as cheaply as possible, and to keep the bubble in financial assets inflated. Therefore, it cannot afford to consider the horrors of raising interest rates and to reduce the monthly money-pumping, the objective of which is to keep blowing financial bubbles. In these circumstances, markets themselves, being the collective pricing of everything by non-government actors, will eventually force control over financial asset prices away from government agencies.

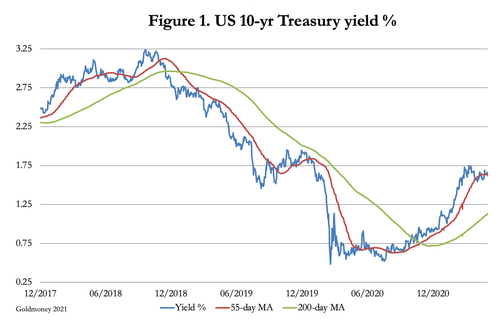

Non-government actors include both foreign and domestic investors, and they need to be considered separately because their motivations in important respects are different. According to the US Treasury’s TIC statistics, foreign ownership of dollar-denominated financial assets and bank deposits total $30 trillion and are one and a half times America’s GDP. The private sector element alone is $22 trillion. If the dollar’s trade weighted index is any guide, it may be just beginning to dawn on this class of investor that the dollar is losing purchasing power, not only measured against industrial commodities and raw materials, but against rival currencies as well. An over-owned dollar has been falling for over a year and will slide lower when foreign interests start to liquidate dollar financial assets in earnest — and that includes equities.

So far, other than commodities they may not see another currency which offers clear benefits over the dollar, but that will change with an inflation-driven outlook. It is also changing with China’s policy of restricting credit creation, a monetary policy starkly at odds with those of reflationist Western governments.

It was William Shakespeare who came up with the phrase “sea-change” as a substitute for the turn of the tide in The Tempest. The line that followed was “Into something rich and strange”. Bitcoin hodlers will identify with strange. But as for riches, their fortunes have changed substantially for the worse. In its reluctance to protect the dollar, the Fed’s rejection of the consequences of its ongoing monetary inflation is teeing up more conventional markets for a similar price outcome to that currently being suffered by cryptocurrencies.

The fallacy of money-printing to preserve wealth

The empirical precedent about to how to destroy a fiat currency by pursuing monetary policies to inflate asset values was given to us by John Law, the proto-Keynesian who, in 1720, tried to sustain his Mississippi bubble by printing money. Thanks to the dominance of the US dollar, the Fed is repeating Law’s policy on a global scale, seemingly oblivious to the consequences. In 1720, Law’s company survived, though the Mississippi venture’s share price collapsed from a high of 12,000 livres to about 3,000. What did not survive was the currency, the French livre which in about six months from the bubble top became completely worthless. It would seem the Fed and other central banks are now locked into a modern, global version of the John Law experience.

Those who have yet to understand why markets and the dollar are set to fall together should consider how things will develop from here. Without doubt, financial markets have become wildly over-valued, and their future is becoming binary but with both outcomes being negative. Let us assume the optimists are correct about a post-lockdown sustainable spending recovery. In that case, interest rates will “normalise”, bond yields will rise, and equity valuations will be undermined. Every bear market in a normal credit cycle evolves out of these conditions.

Alternatively, let us assume that the post-lockdown recovery is hampered by rising prices, the consequence of lack of production to satisfy spending inflated by monetary means, and the inability for this imbalance to be rectified by just-in-time manufacturing policies at the mercy of the greatest global logistic foul-up ever recorded. Add to that a shortage of bank credit to finance production, because banks have run out of balance sheet capacity.

Both outcomes will see financial values undermined, because in common they lead to higher price inflation and inevitably to higher interest rates. But the Fed and its confrères at the ECB, the BoJ and the BoE are all committed to keeping their bond and equity bubbles continually inflated. The first sign of an inflation crisis can result in only one response: inject yet more money into financial markets to keep them afloat and to compensate for a reluctant rise in interest rates. If the central banks fail to increase the pace of monetary inflation targeted at financial assets, bond yields and market interest rates will continue to rise, and the equity bubble will burst. With no option but to continue to support markets and their wealth effect, a rise in the natural rate of interest simply leads to an acceleration of monetary inflation. A vision of the 1929-32 Wall Street crash will haunt policymakers if they don’t act quickly enough to supply the extra currency.

For the fact of the matter is that using monetary inflation to rig markets requires accelerating debasement to keep the illusion going. But at best, the sacrifice of the currency only delays matters temporarily. This is what Richard Cantillon, the Irish-French banker contemporary with John Law worked out in 1719: the most certain way to profit from a bubble’s implosion was not to short it, but the unbacked currency, which he did in London and Amsterdam for specie-backed alternatives.

Today, there are no specie-backed alternative currencies, the backing for all of them being the US dollar, which faces the same fate as Law’s livre. Another important lesson from the fallacy of money-printing to preserve wealth by inflating financial assets is that it does not take an incremental and accelerating loss of purchasing power through a policy of continual debasement to undermine the currency on a formulaic basis as monetarists would suppose. Instead of initially being driven by rising prices for goods and services the collapse of currencies is linked initially to that of financial assets, less so than to the prices of goods. Instead of an evolutionary process it has the potential to be much more sudden, tied into an overwhelming stock market collapse.

While events run concurrently, it is after a financial crisis that the principal users of a collapsed currency, its domestic actors for their daily purchases, suffer the full effects. Not only do they see prices of essentials rising, which they might mistakenly attribute to the preceding financial crisis, but interest rates rise as well. Mainstream economists will tell everyone that higher interest rates are reducing demand, and without more stimulus businesses will fail in even greater numbers. Inflation, by which they mean increasing prices, will only be temporary due to falling demand and they urge the authorities to maintain and even increase the rate of money creation to boost the economy and stop it from entering a slump.

What economists, investors and the ordinary person fail to understand until too late in the process is that the problem is of a collapse in the purchasing power of an unbacked state currency, which requires a completely different solution. That oft-quoted phrase about fiat money reflecting faith and credit in the government means something after all.

After the foreign holders have sold out, it is the actual users of a currency, who pay for their consumption with it, that are last to realise the currency is set to collapse entirely, and that they should get rid of it for anything they can buy. This eventual outcome is certain, so long as the central bank continues with its inflationary policies.

It is at this endpoint that the economy experiences a crack-up boom. When and if they can afford it, people even buy equities and property, simply to get out of fiat currency. But both these classes of asset will have fallen substantially measured in a rapidly depreciating currency before this condition has arrived.

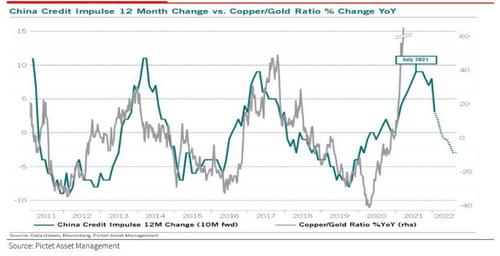

Interest rates are already rising

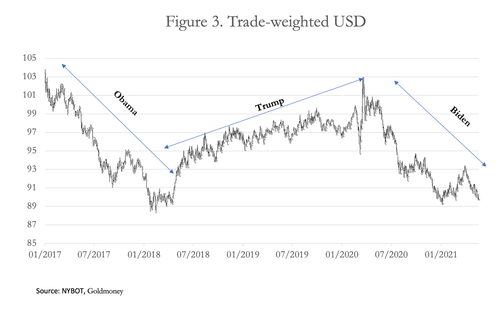

In our analysis we have identified higher interest rates as the trigger that will burst the financial asset bubble. While Western central banks continue to suppress very short-term interest rates, insofar as they reflect the cost of borrowing they are already rising as the chart of the US Treasury 10-year bond in Figure 1 shows.

The initial rise in yield from 0.48% in March 2020 has not yet curbed enthusiasm for equity markets. This is normal cyclical behaviour, because bond yields usually rise during the last leg of an equity bull market. And the current and likely final leg for rising US equities — and most others — commenced only days after the lowest yield seen on 9 March 2020.

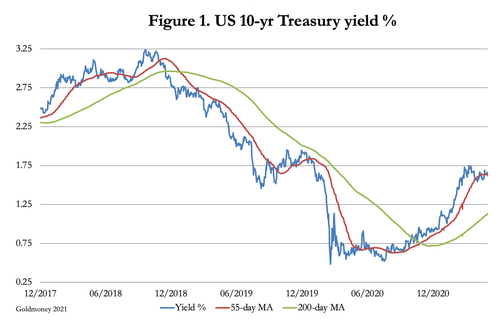

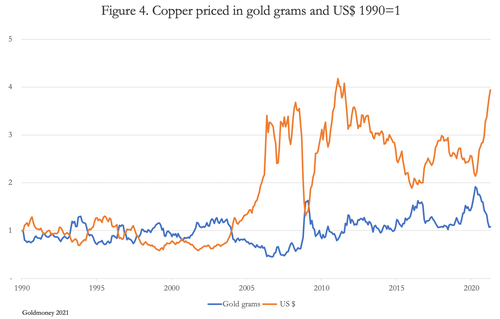

Investment psychology for equities turns positive at these times. A moderate rise in bond yields is taken to be evidence of improving economic prospects, and not a danger signal. A backward-looking investment establishment does not yet fear inflation, which it naively takes to be rising prices. Public participation increases, in the sure knowledge that the market is going up. This is reflected in borrowing to leverage bullish returns, the current position of which is shown in Figure 2.

Figure 2 is an alarming reflection of investors’ bullish mentality, but very few participants are paying attention to it. Furthermore, the Fed’s monthly QE injection of $120bn into financial markets gives everyone enormous confidence it will continue.

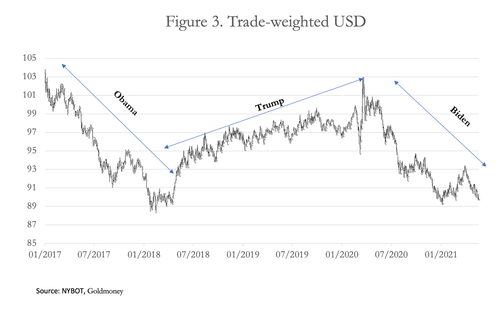

It is the unwinding of this madness of crowds that always feeds into a subsequent bear market. The cause is in plain sight. A second rise in bond yields, driven by rising prices for goods being so assiduously ignored by the investing establishment and public alike, is in the making. And it is almost always the second rise in bond yields that triggers cyclical bear markets. But the US stock market does not operate in a global vacuum: out of their $30 trillion total in dollars, foreigners have $10.7 trillion invested in US stocks.[ii] Bearing in mind the messages from Figures 1 and 2, they are also deeply affected by the message from Figure 3 below, of the dollar’s trade weighted index.

Since late-March 2020, when the dollar’s TWI turned south, gains of 90% on the S&P 500 have been offset by a 12.6% decline in the TWI. And in the light of President Biden’s high-spending policies, the chart suggests foreign investors will be faced with an important break lower in the TWI, and that the cyclical rise in bond yields that inevitably follows will lead to a double loss for them on holdings of US equities. Unless they move quickly, foreign-owned financial interests could simply evaporate into losses.

The dollar’s TWI is very heavily weighted in favour of the euro, so the outlook for the latter is also important. In the Eurozone, consumer demand is now surging at the fastest pace since before the great financial crisis, without enough production to supply it. Consequently, the prospects for price inflation are at least as dangerous as for the dollar. The difference is the ECB still maintains a negative deposit rate, so bond yields and interest rates have a lower base from which to rise. It is that prospect which is sure to make an over-owned dollar vulnerable to a relatively under-owned euro. A similar situation pertains for the Japanese yen.

But perhaps the most important currency rate will be that of China’s yuan. Last September, China began a progressive clampdown on excess credit which continues today. The few western analysts who are aware of it attribute this policy to cyclical factors, an attempt to prevent China’s economy overheating after earlier stimulus. They are also aware that tighter money in China will be reflected in a stronger yuan, potentially destabilising foreign exchange rates.

Furthermore, it also makes sense for China to attract investment flows currently overexposed to the dollar, by sending a clear signal that the yuan is the stronger currency. It would be China’s response to America’s attempted destruction of the Hong Kong—Shanghai Connect route for inward investment by deliberately destabilising Hong Kong. And it would also strip US capital markets of foreign funds, forcing an early increase in dollar interest rates in the US’s authorities attempt to prevent a dollar collapse.

The conclusion can only be that the sea-change about to hit capital markets will be both widely unexpected and sudden. Its degree of financial violence will reflect the accumulated difference between increasing government manipulation of markets along with the illusions created, and economic and monetary reality. Interest rates will not stop rising at a few per cent. Taking John Williams’s estimate of 11% price inflation as a starting point, markets will drive interest rates towards related levels. Swathes of indebted businesses will be threatened with failure before then, which is bound to be reflected in equity market valuations. The longstanding myth that the equity class offers protection against inflation will be debunked.

The property/equity relationship

Another class of asset that is commonly believed to offer protection against a collapsing currency is property. At a personal level, both productive agricultural land and residential property are commonly cited. But owning them requires additional resources to ensure their continued possession through an inflationary crisis. And the resources required will in turn depend on the characteristics and duration of the disruption to economic activity.

During a normal credit cycle, in the early stages of increasing price inflation equities prove more sensitive to the threat of rising interest rates than residential property. Individual investors tend to more immediately see that declining share prices offer little or no protection against an inflation threat, because the increases in interest rates sparked by it are deemed to be bad for the business outlook, but not enough to undermine the values of non-financial assets. There are some exceptions, such as mining shares, but otherwise generally this statement holds true.

Consequently, people turn to non-financial assets for protection against inflation, and the most prominent of these is property: principally residential and farmland. Furthermore, there are usually encouraging benefits such as the absence of capital gains taxes owner-occupiers of residential property. And first-time buyers are often subsidised by governments.

Residential property has already been booming on the back of very low interest rates and a widespread desire to move out of major conurbations, triggered by pandemic lockdowns. In many jurisdictions, home working for at least part of the working week is seen to be the future, increasing time spent in and therefore the relative importance of one’s home. For the middle classes, unspent funds have been accumulating. And behind it all has been enthusiastic mortgage lending fuelled by the Fed’s interest rate suppression and QE targeted at agency debt.

Prospects for residential property markets normally change when mortgage rates are forced significantly higher, in line with rising interest rates. The erosion of a currency’s purchasing power, which feeds into rising consumer prices, pushes interest rates higher than the majority of mortgagees can afford to pay. Those who have fixed interest mortgages obtain some relief, but new buyers are deterred. Furthermore, inflation sets in train a destructive transfer of wealth from the productive economy, impoverishing its economic actors for the benefit of the state. Inevitably, production suffers, and unemployment rises. Many homeowners with mortgages are driven into negative equity, and they can no longer afford their mortgage payments. Repossession rates rise.

This cycle is different in that the rush into residential property has occurred before the inflation threat has materialised sufficiently to undermine both financial and non-financial asset values. It is therefore probable that the rise in interest rates and borrowing costs we can expect in the next few months will undermine residential property prices at the same time as the ending of the equity bull market.

But so long as homeowners maintain their mortgage payments, they can probably see the inflationary crisis through. If they can hang on, their situation could be rescued by a near-total collapse in the purchasing power of their government’s currency, eliminating much or all of their mortgage liabilities in real terms. The mortgagees who have the resources to keep payments going will avoid the crisis. Instead, it will be borne by the mortgage providers and their savers.

Only then does residential property come into its own by offering a degree of protection against a currency collapse.

The role of precious metals

Earlier, we referred to the wisdom of Richard Cantillon when he sold John Law’s unbacked currency in London and Amsterdam for alternatives readily convertible into specie —principally sterling and guilders.

Incidentally, when the Mississippi venture collapsed, taking the livre down with it, Britain’s South Sea Bubble suffered the same fate; but the silver shilling survived. Today, there are no currencies backed by precious metals; instead, they are almost all on a dollar standard, and the dollar is at the heart of our problem. Where the dollar goes, we should assume all other currencies will follow.

We must also dismiss cryptocurrencies as being impractical. Central banks are planning their own versions and the intention is to use them to accelerate their failing monetary policies even faster. Fortunately for their long-suffering subjects, central bank digital currencies are unlikely to see the light of day, given the imminency and potential scale of a financial and monetary crisis.

Initially acting as a reserve of purchasing power, that leaves precious metals emerging to form the basis of a future money, as they always have done throughout history. Gold is the one monetary asset possessed by the majority of central banks that is not fiat — only 24 out of 130 central banks have reported they hold no gold or failed to report a holding to the IMF at the end of last year. After fiat fails, the only way a central banker and his political masters can get paid in a form of money with any purchasing power will be for the state to back its currency with gold. And even then, unless this is done correctly, it will probably be little more than a temporary fix.

One mistake frequently paraded is that gold has no interest rate. Therefore, the logic goes, rising fiat interest rates penalise holders of gold. But this is to misunderstand the role of interest rates. Interest rates compensate a lender for parting with possession of his money, compensates for any expected change in purchasing power over the duration of the loan, and compensates for the risk of being a creditor of the borrower. With a fiat currency whose debasement is obvious to a lender, the combination of these factors can be expected to lead to a high rate of interest, which, as is argued in this article, will lead to higher dollar interest rates to prevent foreign selling of the dollar.

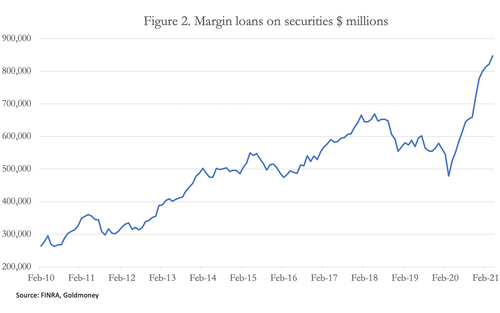

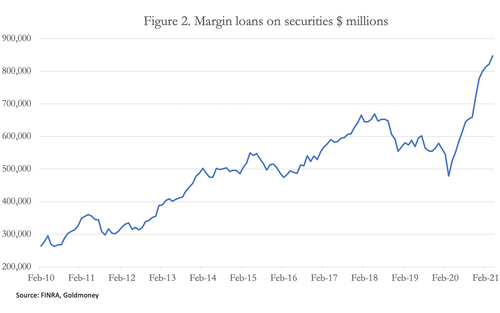

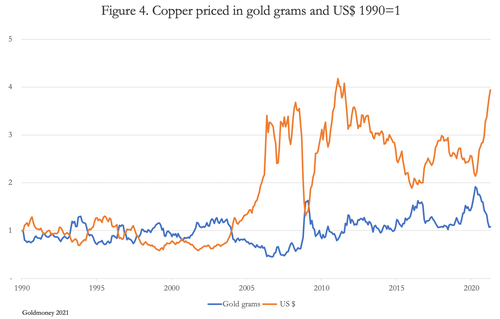

Like folding fiat notes, physical gold in possession has no interest rate, but as money it is routinely loaned, leased and swapped for fiat. This would not happen if gold was not money. Because of its innate stability, gold’s interest rate is low. Figure 4 illustrates why.

The chart shows the monthly price of copper measured in dollars and gold since 1990. Copper is regarded by commodity analysts as a reference for industrial demand for metals, and therefore as a reflection of global economic demand.

Over the last three decades the dollar price of copper has varied between a low of 58% of the price in January 1990, and a high of 418% in 2011, a level which it is approaching again today. The average value over the whole 31 years was 186% of the 1990 price.

Copper priced in gold varied between 45% and 192%, ending up 8% today compared with the start of the period. Its average price over the whole 31 years was up 0.8% on the 1990 price — pretty much unchanged.

Not only has gold been a far more stable form of money over the last thirty years for users of copper, but it has proved to be stable over far longer periods for everything from common commodities to low-tech finished goods. Price stability was an important driver behind the industrial revolution, because it permitted entrepreneurs to calculate production costs and investment returns. Investment in production also tended to reduce consumer prices, increasing standards of living. Not only did consumers have access toimproved products, but their gold-backed currencies went further.

Therefore, we can say unequivocally and, without having to delve into monetary theory, proclaim that only gold can be the basis of the future non-fiat monetary system. The successes and failures of future gold-backed currencies do not concern us yet — those are bridges to be crossed later. Our present interest is to seek protection from the accumulating folies of central banks and their inflationary policies. In that sense, ownership of gold remains our principal link with a post-crisis future.

It has to be physical metal, because anything else imparts counterparty risk, and that’s the last thing you will want in a financial crisis. When the importance of gold is realised again, there is a significant risk of government confiscation, which is where silver comes into the picture. Central banks own none, or at least none that we are aware of, so in the event of governments doubling down against gold ownership silver would become much more precious.