Authored by Jeff Thomas via InternationalMan.com,

The concept of government is that the people grant to a small group of individuals the ability to establish and maintain controls over them. The inherent flaw in such a concept is that any government will invariably and continually expand upon its controls, resulting in the ever-diminishing freedom of those who granted them the power.

When I was a schoolboy, I was taught that the feudal system of the Middle Ages consisted of serfs tilling small plots of land that belonged to a king or lord.

The serfs lived a meagre life of bare subsistence and were subject to the tyranny of the king or lord whose men would ride into their village periodically and take most of the few coins the serfs had earned by their toil.

The lesson I was meant to learn from this was that I should be grateful that, in the modern world, I live in a state of freedom from tyranny, and as an adult, I would pay only that level of tax that could be described as “fair”.

Later in life, I was to learn that, in the actual feudal system, some land was owned by noblemen, some by common men. The commoners typically farmed their own land, whilst the noblemen parcelled out their land to farmers, in trade for a portion of the product of their labours.

As a part of that bargain, the nobleman would pay for an army of professional soldiers to protect both the farms and the farmers. Significantly, unlike today, no farmer was required to defend the land himself, as it was not his.

There was no exact standard as to what the noblemen would charge a farmer under this agreement, but the general standard was “one day’s labour in ten”.

This was not an amount imposed or regulated by any government. The nobleman could charge as much as he wished; however, if he raised his rate significantly, he would find that the farmers would leave and move to another nobleman’s farm. The 10% was, in essence, a rate that evolved over time through a free market.

Modern Serfdom

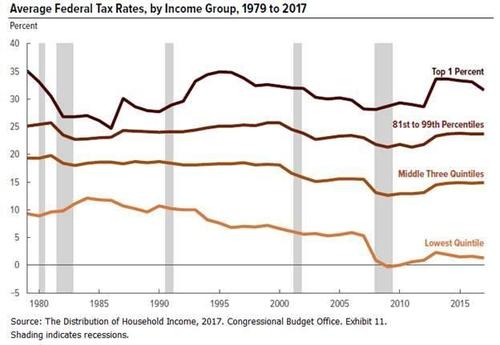

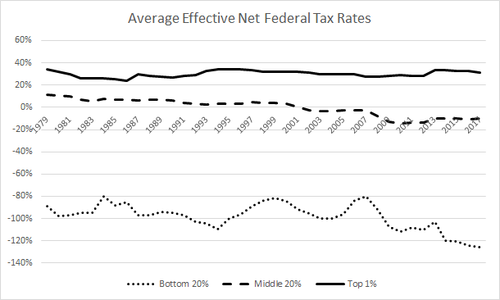

Today, of course, if most countries levied an income tax of a mere 10%, there would be dancing in the streets. And the days of one simple straightforward tax are long gone.

Today, the average person may expect to pay property tax (even if he is a renter), sales tax, capital gains tax, value added tax, inheritance tax, and so on. The laundry list of taxes is so long and complex that it is no longer possible to compute what the total tax level actually is for anyone.

And to this, we add the hidden tax of inflation. In the US, for example, the Federal Reserve has, over the last hundred years, devalued the dollar by 98%, a hefty tax indeed. And the US is not alone in this.

Only 50 years ago, the average man might work a 40-hour week to support a wife who remained at home raising the children. He often had a mortgage on his home but might have it paid off in ten years. He paid cash for nearly everything else that he and his family owned or consumed.

Today, both husband and wife generally must be employed full time. In spite of this, they can’t afford as many children as their parents could, and they generally remain in debt their entire lives, even after retirement. This is significant inflation by any measure.

In contrast, in the Middle Ages, the cost of goods might remain the same throughout the entire lifetime of an individual.

In light of the above, the 10% that was paid by the serfs is beginning to look very good indeed.

However, the great majority of people in the First World are likely to say, “What can you do; it’s the same all over the world. You might as well get used to it.”

Well, no, actually, it’s not.

There are many governmental and economic systems out there and many are quite a bit more “serf friendly” than those in the major countries.

Countries such as the British Virgin Islands, the Cayman Islands, Bermuda and the Bahamas have no income tax. Further, some have no property tax, sales tax, capital gains tax, value added tax, inheritance tax, and so on.

So how is this possible?

The OECD countries state that it is largely accomplished through money laundering, but this is not the case. In fact, low-tax jurisdictions are known to have some of the most stringent banking laws in the world.

The success of these jurisdictions is actually quite simple. Most of them are small. They have small populations and therefore need only a small government. Yet each jurisdiction can accommodate large numbers of investors from overseas. This results in a very high level of income per capita.

But unlike large countries, the money that is deposited or invested there is overseas money, so it is not captive. Investors can transfer it out overnight if need be.

So, even if the politicians are no better than those in larger countries (generally, they are of the same ilk), they’re aware that, like the noblemen of old, if they attempt to impose taxation, the business will dry up quickly.

In fact, such a free market dictates that the jurisdictions keep on their toes and keep trying to outdo their competitors by being more investment friendly.

Therefore, the politicians in these countries, who might be only too happy to promise entitlements to their constituents, then tax them to the hilt in order to pay for the entitlements, are kept restrained by their own system.

Are there downsides to living in a low-tax jurisdiction? Yes.

As most of them are small but require a very high standard of living in order to attract investors, they must import virtually all goods needed by residents. This means a higher cost of all goods, as compared to the cost in a country that produces such goods. However, the wage level is also higher, which tends to balance out the equation.

But there are also upsides.

Those who move to such a jurisdiction find that after the first year there (when the basics such as cars, televisions, etc., have been paid for), all further income that has been saved from taxation is beginning to get deposited in the bank.

At some point, the deposit level becomes great enough that investment becomes advisable. And as low-tax jurisdictions tend to be naturally prosperous, there is generally no limit to the opportunities for investment within the jurisdiction.

There is a further benefit to living in a low-tax jurisdiction that tends to become apparent over time. Any government that depends on major investments from overseas parties must, of necessity, be non-intrusive and non-invasive. Such a government stays out of people’s business, eschews electronic monitoring and most certainly is not given to SWAT teams crashing down doors for imagined wrongdoing.

Benjamin Franklin famously said, “Nothing can be said to be certain, except death and taxes.”

He was correct, but the level of tax can vary greatly from one country to the next. And just as important, the level of government intervention into the affairs of its citizenry varies considerably. In a country where the level of tax is low, the quality of life is generally correspondingly high.

A thousand years ago, noblemen, from time to time, became overly confident in their ability to keep the serfs on the farmland and demanded taxes beyond the customary “one day’s labour in ten”. When they did, the serfs of old often voted with their feet and simply moved. Today, this is still possible.

If the reader presently contributes more than one day’s labour in ten to his government, he may wish to consider voting with his feet.

* * *

The political and economic climate is constantly changing… and not always for the better. Obtaining the political diversification benefits of a second passport is crucial to ensuring you won’t fall victim to a desperate government. That’s why Doug Casey and his team just released a new complementary report, “The Easiest Way to a Second Passport.” It contains all the details about one of the easiest countries to obtain a second passport from. Click here to download it now.