WeWork Pays Another $245M To Former CEO Adam Neumann To Clear Last Obstacle To SPAC Deal

WeWork co-founder and former CEO Adam Neumann may well be remembered as the worst CEO ever. But that hasn’t stopped him from collecting billions of dollars in payouts on his way out the door at WeWork, as SoftBank’s Masayoshi Son was forced to effectively bribe Neumann to relinquish control of the flailing office rental company.

A legal fight erupted when SoftBank tried to renege on some $3 billion it owed to Neumann and other early investors, but it appears this issue was settled out of court.

But according to the latest documents released by the company, Neumann has just received even more goodies from the firm, including a final “enhanced” package worth roughly one quarter of a billion dollars that was paid out to Neumann in February after he renegotiated the details of his departure with SoftBank as part of a settlement over another payout that SoftBank tried to get out of making.

SoftBank was supposed to pay out $3 billion to various early-stage WeWork shareholders including Neumann, but it tried to get out of paying, claiming WeWork had violated the terms of the agreement.

According to the details, reported by WSJ for the first time, Neumann’s final exit package gave him $200MM in cash, while letting him refinance $432MM in debt on favorable terms and allowing an entity controlled by Neumann to sell $578 million in WeWork stock.

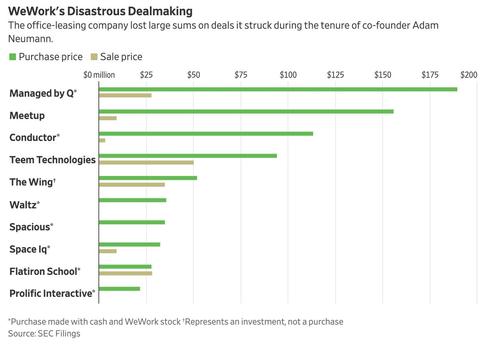

But while the payout to Neumann is just one more slap in the face to WeWork employees who were left with nothing when the IPO was scrapped and their shares in the company were rendered pretty much worthless, other information disclosed to the SEC included the staggering losses booked by the company when it sold off most of Neumann’s acquisitions.

After Neumann’s exit in the fall of 2019, WeWork booked big losses as it sold off a number of companies acquired during his tenure. It managed to recover just $164MM on 10 investments that were initially purchased for $759MM in cash and WeWork stock.

Experts in executive severance said the package received by Neumann was particularly generous.

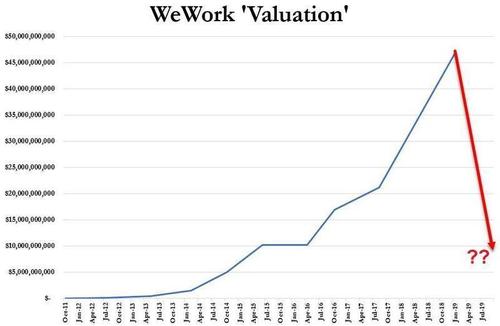

Executive-severance experts said the package stands out not only for its enormous size, but also given Mr. Neumann’s record. The valuation of WeWork, which he co-founded in 2010, fell to around $8 billion when he left from $47 billion in early 2019. In all, WeWork has raised more than $11 billion to build a company worth $7.9 billion, not including debt.

“Generous would be an understatement,” said Conor Callahan, a management professor at the University of Illinois at Chicago who studies severance packages. “It’s going to be something people are going to be very upset about.”

But Callahan added that Neumann’s 10-to-1 voting rights enjoyed by his shares gave him a level of control enjoyed by few others. WeWork also signed deals to cancel leases in buildings partly owned by Neumann.

As we noted above, Neumann’s $245 million stock award was part of a renegotiated version of an early 2019 agreement initially meant to encourage Neumann to boost the company’s valuation. This type of an award, called a profits interest, is similar to a stock option and gives Neumann gains above a certain minimum share price. As of his late 2019 deal, the package gave him any gains above $19 a share.

But as part of his renegotiation, Neumann managed to change that minimum share level to $0, which means he will get the full amount so long as BowX’s shares remain above their current level. But if the share price falls below $10, Neumann will become ineligible for any reward.

Neumann isn’t the only one walking away from the talks with a massive nut: His lawyers are reportedly entitled to $50M of his profits in accordance with their fee.

Tyler Durden

Thu, 05/27/2021 – 18:20

via ZeroHedge News https://ift.tt/3p1kA47 Tyler Durden