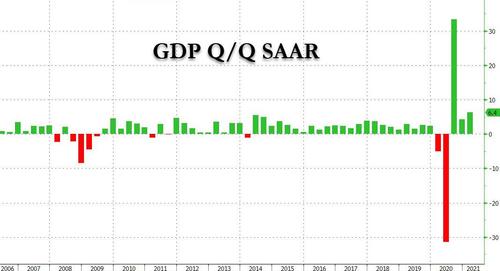

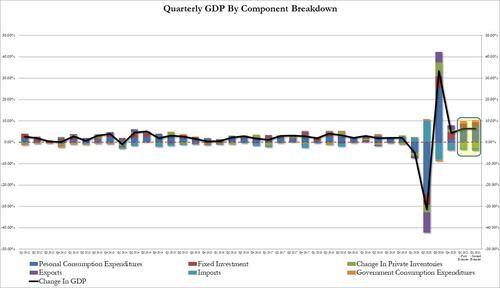

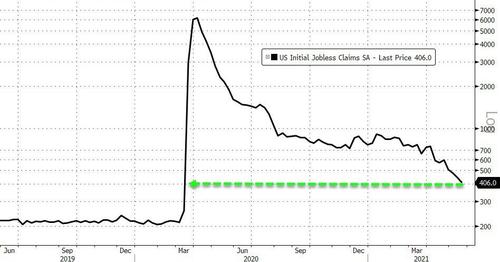

U.S. stock index futures ticked lower ahead of an economic data dump that will reveal the latest durable goods, cap goods orders, jobless claims, GDP, PCE, and Personal Consumption data, amid fears that signs of an improving economy would lead the Federal Reserve to start tapering following comments on Wednesday that the Fed’s Quarles is open to talk about adjusting the Fed’s bond purchases. At 7:15 a.m. ET, Dow e-minis were up 3points, or 0.01%, and S&P 500 e-minis were down 6.50 points, or 0.16%. Nasdaq 100 e-minis were down 45.5 points, or 0.33%, as tech giants Apple, Amazon.and Tesla slipped between 0.2% and 0.7%.

Meme favorites GameStop and AMC dipped in premarket trading after soaring for the past three days. Here are today’s notable premarket movers:

- Bitcoin mining company Bit Digital (BTBT) jumps 26% premarket, indicating an extension of Wednesday’s rally after the appointment of Brock Pierce, chairman of the Bitcoin Foundation, to its advisory board and leadership team.

-

- Snowflake (SNOW) drops 4.4% in premarket trading after the software provider’s earnings report. Guidance for the year undershot expectations set by a 1Q revenue beat, according to Barclays analysts.

- Vir Biotechnology (VIR) shares extend gains in premarket trading after the FDA approved an emergency use authorization for sotrovimab to treat mild-to-moderate Covid-19.

- Vertex Energy (VTNR) doubles in premarket trading after it agreed to buy an Alabama refinery from Shell for $75 million in cash plus the value of the hydrocarbon inventory.

- Zosano Pharma (ZSAN) surges in U.S. premarket trading after announcing clinical data which supported evidence that its drug Qtrypta has potential for being a long-term option for patients with migraines if approved.

Futures were down after closing modestly in the green on Wednesday after the Fed’s vice chair for supervision, Randal Quarles, said at a Brookings Institution event that he was ready to open talks on reducing some of the Fed’s emergency support for the economy, even if only to clarify the Fed’s plans as the economy roars ahead and prices rise. He noted he did not expect a round of 1970s-style breakout inflation, and that he was “fully committed” to a new Fed strategy that aims to keep monetary policy running full-throttle while jobs recover. But he also laid out the case for why the “upside” risks of higher inflation may be mounting, and how the Fed may need to begin smoothing the way for a policy shift.

Though “we need to remain patient” in any policy shift, Quarles said, “if my expectations about economic growth, employment and inflation over the coming months are borne out … and especially if they come in strong … it will become important for the (Federal Open Market Committee) to begin discussing our plans to adjust the pace of asset purchases at upcoming meetings.”

Quarles comments come at the end of a month when global stocks have pushed higher as investors swung from worries that higher inflation poses a threat to loose monetary policy to optimism about the economic recovery. Federal Reserve officials have hinted that they may start discussions on reducing bond purchases in upcoming meetings if the economy powers ahead, a move that could push yields higher and damp demand for riskier assets. “It will be the inflation prints that will be dominating markets,” Janet Mui, investment director at Brewin Dolphin, said on Bloomberg Television. “This year we are at a junction when market participants are thinking about a potential withdrawal of stimulus.”

In Europe, the Stoxx 600 Index hovered around a record as gains in miners offset losses in health-care and food-and-beverage stocks. The Stoxx Europe 600 Basic Resources Index (SXPP) rose for a second day, up as much as 2.2%, as iron ore bounces from a 5-week low after slumping into a bear market. Shares in Rio Tinto, BHP, Glencore and Anglo American all climbed. Planemaker Airbus SE climbed after telling suppliers it plans to raise output, while Bayer AG dropped after a U.S. judge rejected its plan to resolve claims related to its Roundup weedkiller. Here are some of the biggest European movers today:

- Airbus shares gained as much as 6.8%, the most intraday since Feb. 2, after announcing new production goals. Jefferies notes the European plane-maker unveiled “punchy” plans and told suppliers to prepare for “markedly higher” production rates.

- Suppliers and other aircraft and part manufacturers also gained, with Rolls-Royce +3.8%, Safran +3.5%, Meggitt +3.1%, MTU Aero Engines +2.4%, Leonardo +1.7%, Thales +1.2%

- CD Projekt rose as much as 7.4% after one of its founders Michal Kicinski increased his stake in the company to 10.36% from 9.99%.

- Evolution added as much as 5.1% after the company signed an agreement with Scientific Games to make its live online Lightning Roulette game available as a physical game in land- based casinos worldwide.

- Bayer dropped as much as 5.3% before a temporary suspension in Frankfurt after a U.S. judge rejected the company’s proposal to resolve future claims related to its Roundup weed killer, bringing “prolonged uncertainty” and risk, according to Liberum.

- Royal Dutch Shell declined as much as 2.1%, weighing on a gauge of European energy shares, after a Dutch court ordered the company to slash its emissions harder and faster than planned. RBC said doesn’t “put much weight to this ruling given it is likely to be appealed.”

- Tate & Lyle fell as much as 5.7% after forecasting growth in FY22 adj. operating profit before commodities in the mid-single digit range at constant FX. The outlook is cautious, according to Jefferies.

- Puma slid as much as 3% after French luxury conglomerate Kering cut its stake. Kering sold about a 5.9% holding at EU90.30 apiece, leaving it with a 4% stake. Analysts at Jefferies and RBC said the funds gained by Kering may be used for M&A.

Asian stocks fell, with the regional benchmark heading to end its longest winning streak in more than a month, as sentiment was sapped by inflation concerns and restrictions to combat a resurgence in Covid-19 cases. Among industry groups, communication stocks were the biggest losers with China’s internet giant Tencent contributing most to the decline. A rebound in U.S. benchmark Treasury yields indicated investors continued to weigh the threat of prices gains, a negative for growth stocks. Vietnam and New Zealand were the worst performing markets on Thursday, with VN Index falling 1.2% after reports that Ho Chi Minh City’s mayor ordered the temporary closure of restaurants, hotels and religious establishments to curb the virus’ spread in the nation’s commercial hub. Fisher & Paykel Healthcare weighed most on New Zealand’s equity gauge as the shares plunged 5.4% after an earnings miss. “Some of the week’s froth has come out of the markets in Asia today,” said Jeffrey Halley, an analyst at Oanda Asia Pacific Pte Ltd. “Inflation is a story that just won’t go away, especially when the markets are positioned heavily against it.”

Philippine stocks staged their biggest gain in more than six months after expectations of pandemic-linked restrictions easing spurred a late-day buying spree. A resurgence in Covid-19 infections remains a lingering risk to Asia’s equities. Melbourne, the Australian city that’s already endured one of the world’s longest and most arduous lockdowns, is heading back into enforced isolation, while Japan may extend its third state of emergency due to the contagion.

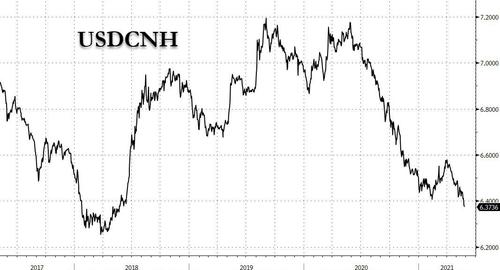

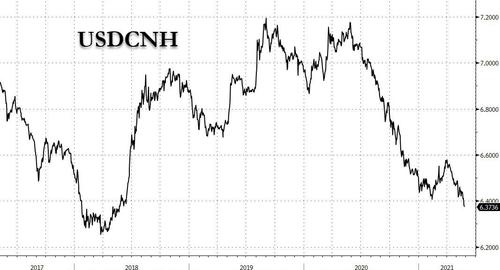

China’s CSI 300 Index bucked the trend to close higher for the fourth day in a row, as foreign investors continued to pile in after the yuan hit a five-year high against a basket of foreign currencies after mainland officials met with the top U.S. trade negotiators for their first talks since President Joe Biden was elected. While the talks were described as “candid,” tensions remain — the White House’s top official for Asia said Wednesday the U.S. is entering a period of intense competition with China. The CSI 300 Index closed up 0.3% Thursday, after rising 3.6% in the past three sessions. The benchmark rose as much as 1.1% earlier in the day, led by telecommunications and technology stocks, following initial optimism about resumed trade talks between Beijing and Washington. The Hang Seng Index shed 0.2%, dragged by Tencent after local media reported that regulators asked the tech giant to put its finance-related business into a new financial holding company for better supervision. The gains in Shanghai and Shenzhen came as foreigners bought a net 14.6 billion yuan of mainland shares via trading links with Hong Kong. Also driving the purchases was a robust yuan that climbed to its strongest level since March 2016 against a basket of trading partners. While news that the U.S. and China held their first trade talks since the election of President Joe Biden initially improved sentiment, the market’s weaker momentum later signaled caution among investors about the pace of progress, analysts said. “The gains today were still driven by foreigners as global hot money piled in with expectations of the strengthening yuan. But I doubt whether it will persist because at this rate valuations won’t look attractive and for now I just view this as a rebound rather than a rally,” said Wang Zhuo, a fund manager at Shanghai Zhuozhu Investment Management

Japanese stocks fell, halting a five-day gain, as the possibility that pandemic restrictions will be extended deepened concerns over the nation’s ability to host the Olympics and quicken an economic recovery. Chemical-related companies and banks were the biggest drags on the Topix, as some investors took advantage of a lull in the market’s longest rally in almost 10 weeks to reduce positions. SoftBank Group Corp. and Shin-Etsu Chemical Co. helped pull down the Nikkei 225 Stock Average. The Tokyo Metropolitan Government is considering asking the central government to extend a coronavirus state of emergency in the capital that’s due to expire May 31, public broadcaster NHK reported Wednesday. The Asahi newspaper urged Prime Minister Yoshihide Suga in an editorial to call off the Tokyo Olympics, which are scheduled to start July 23. Mamoru Shimode, the chief strategist at Resona Asset Management, said headlines on the state of emergency probably triggered some program selling. “I do anticipate buying to kick in for Japanese equities once the pace of vaccinations pick up in either June or July, spurring reopen trades,” Shimode said. “The question is how much progress is being made on vaccinations at home, while globally the economic recovery is kind of at a standstill.”

Australia’s S&P/ASX 200 index fluctuated throughout the day to end little changed at 7,094.90. Gains in technology stocks were offset by losses in utilities. The index climbed as much as 0.4% but trimmed gains after Melbourne announced its fourth lockdown as the number of community cases doubled. AMP was the best performing stock, jumping the most since Nov. 2. Costa Group was the biggest decliner, tumbling after issuing an “underwhelming” trading update, according to Wilsons Advisory analysts. In New Zealand, the S&P/NZX 50 index fell 0.8% to 12,243.34

In FX, the Bloomberg Dollar Spot Index was down 0.1% after Fed Vice Chairman for Supervision Randal Quarles said it’s important to begin discussing plans to reduce bond purchases in the coming months as the economy recovers. The pound drifted, trading little changed after an earlier decline, as a more cautious tone seeped into markets and concerns grew over the U.K. government’s ability to reopen the economy. New Zealand dollar led G-10 gains, rising as much as 0.3% to $0.7305.

China’s yuan advanced to its highest since March 2016 against a basket of trading partners’ exchange rates, supporting other emerging Asian currencies. A gauge of regional equities edged lower as investors weighed potential policy shifts from developed market central banks and trade talks between the U.S. and China. “Both the USD-CNY and USD-CNH have detached further away from the 6.4000 resistance,” and this RMB strength will likely lead the Asian complex higher against the USD, says Terence Wu, FX strategist at Oversea-Chinese Banking Corp. in Singapore. “There appears to be some underlying confidence that any pandemic- related concerns in parts of Asia will be effectively managed. This implies that global market sentiment can focus on the reopening positives in Europe and the U.S.”

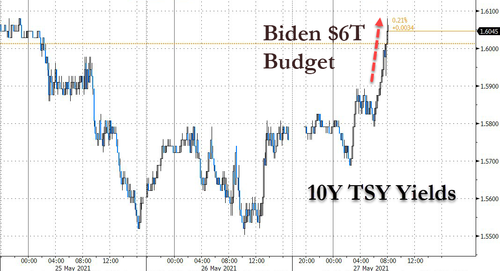

In rates, treasuries were narrowly mixed inside weekly yield ranges, with yields beyond the 2-year higher ahead of today’s $62BN 7-year note auction at 1pm ET, last of three Treasury coupon auctions this week. 5- to 30-year yields are higher by 1bp-2bp near session highs, 10-year by 1.5bp at ~1.59%; yields across the curve remain inside weekly ranges and below 50-DMAs. Demand was robust for Wednesday’s 5-year and Tuesday’s 2-year auctions; both drew yields lower than the WI yield at the bidding deadline, with strong bidder-participation metrics. In Europe, Italian bonds slide across the curve and underperform euro-area peers after large selling is seen on screens. Gilts lead developed bond markets lower after BOE’s Vlieghe said an early rate increase was possible under certain circumstances. U.K. 10-year yield rose as much as 4bp to 0.792%, approaching its 50-DMA

In commodities, oil weakened as familiar concerns returned that there will be a glut of Iranian supply if sanctions on the Persian Gulf producer are lifted (something which Goldman explicitly said is not the case earlier this week). Bitcoin held below $40,000. Gold steadied near the highest level in more than four months.

To the day ahead now, we get the preliminary durable goods orders for April, the second estimate of Q1 GDP, weekly initial jobless claims, April pending home sales, and the Kansas City Fed’s manufacturing index for May. Over in Europe, there’s also the German GfK consumer confidence reading for June and Italy’s consumer confidence index for May. Central bank speakers include the ECB’s Vice President de Guindos, Weidmann, Schnabel and Hernandez de Cos, as well as the BoE’s Vlieghe. Finally, earnings releases include Salesforce, Medtronic, Costco, HP, Royal Bank of Canada and Dell Technologies.

Market Snapshot

- S&P 500 futures down 0.2% to 4,186.25

- STOXX Europe 600 up 0.11% to 445.7

- MXAP down 0.1% to 206.94

- MXAPJ little changed at 695.54

- Nikkei down 0.3% to 28,549.01

- Topix down 0.5% to 1,911.02

- Hang Seng Index down 0.2% to 29,113.20

- Shanghai Composite up 0.4% to 3,608.85

- Sensex up 0.2% to 51,135.67

- Australia S&P/ASX 200 little changed at 7,094.87

- Kospi little changed at 3,165.51

- Brent Futures down 0.9% to $68.28/bbl

- Gold spot up 0.1% to $1,898.39

- U.S. Dollar Index down 0.12% to 89.93

- German 10Y yield rose 0.4 bps to -.202%

- Euro up 0.2% to $1.2211

Top Overnight News from Bloomberg

- The Department of Justice is investigating the market-rattling meltdown of Bill Hwang’s Archegos Capital Management in March

- U.K. Prime Minister Boris Johnson is battling a major attack on his authority after the controversial strategist who masterminded his rise to power declared he is unfit to hold the job

- The yuan’s rally gathered pace on Thursday, with the Chinese currency climbing to its strongest level since March 2016 against a basket of trading partners

- The U.S. is entering a period of intense competition with China as the government running the world’s second-biggest economy becomes ever more tightly controlled, the White House’s top official for Asia said

- HSBC Holdings Plc exited its U.S. domestic mass market retail banking business, as Europe’s biggest lender looks to focus on wealthy clients and steer billions of dollars in capital towards Asia

A quick look at global markets courtesy of Newsquawk

Asia-Pac bourses were choppy as markets continued to waver heading into month-end and after the mildly positive bias from the US wore thin overnight, which saw US equity futures also pare back their marginal gains. ASX 200 (+0.4%) swung between gains and losses with strength in the broader commodity-related sectors offset by underperformance in gold miners after the precious metal recently retreated below the USD 1900/oz level, while the confirmation of a 7-day snap lockdown for Victoria state, which impacts Australia’s second most populated city of Melbourne, added to the sombre mood. Nikkei 225 (-0.3%) was constrained by an indecisive currency, lingering COVID concerns, and with telecom stocks cautious on reports that the government is mulling eliminating 2-year internet contracts. The KOSPI (-0.1%) meanwhile languished despite the upgrades to growth forecasts at the BoK policy meeting where the central maintained its base rate at 0.50%, before Governor Lee eventually flagged the potential for a rate hike this year – contingent on the pace of growth. Hang Seng (-0.2%) and Shanghai Comp. (+0.4%) were mixed with Tencent among the laggards in Hong Kong after it was told by regulators to put its finance-related business into a new financial holding company where they can be better supervised. However, a resumption of the strength in biopharmaceuticals and improved earnings from Xiaomi has stemmed the downside for the broader market, with the mainland also kept afloat after China pledged to boost support for smaller business and following recent constructive dialogue between the US and China’s top trade envoys whereby the sides agreed that bilateral trade was important and to maintain communication. Finally, 10yr JGBs are flat with price action indecisive after the recent whipsawing in T-notes and mixed results at the 40yr JGB auction which showed the b/c remained inline with the previous 40yr offering in March.

Top Asian News

- JD Logistics Jumps 29% in Hong Kong Gray Market Trading

- Paytm Is Said to Target $3 Billion IPO, Largest Ever for India

- China Said to Ease Offshore Funding Limit for Foreign Banks

- JD Logistics Advances 28% in Hong Kong Gray Market Trading

European cash bourses and futures have seen choppy and directionless but rangebound trade throughout the morning (Euro Stoxx 50 Unch), potentially due to month-end related flows in the absence of news flow and heading into the long weekend over in the UK and US. State-side futures see a marginally more pronounced downside bias vs Europe, but in the grand scheme, the contracts are within recent ranges with some mild underperformance in the tech-laden NQ. Back to Europe, cash markets are mixed with no real standout performers. Sectors are similarly mixed with Basic Resources the outperformer following its recent string of underperformance. Travel & Leisure again resides as the best performer on the back of its Leisure subsector – with Evolution Gaming (+4.7%) cheering the signing of an exclusive agreement with Scientific Games. The downside sees some of yesterday’s better performers including Food & Beverages and Healthcare, with Oil & Gas also reacting to recent losses crude prices and Shell’s (-1.4%) court order to cut carbon emissions by 45% by 2030 also adds to the glum mood in the sector. Thus, the FTSE 100 (+0.1%) fails to glean full benefit from the miners’ and banks’ rebound as losses in oil and healthcare counter the upside. Overall, no clear theme can be derived from the sectors. In terms of individual movers, Bayer (-4%) resides as the laggard in the DAX (-0.3%) after a US judge has rejected Bayer’s class action proposal to resolve future lawsuits alleging roundup causes cancer. Airbus (+6%) meanwhile flies highs amid a constructive production update, with the stock likely lifting Industrials amid potential tailwinds from the Travel & Leisure sector as airliners maintain an upbeat view of the upcoming summer period.

Top European News

- Johnson Faces Challenge to Authority After Cummings Salvo

- UniCredit Defies Coupon Furor With Popular $2 Billion Debt Sale

- Italian Bonds Slump Across Curve After Large Screen Selling Seen

- Mafia Claims Expose Erdogan’s Political Vulnerability

In FX, the Dollar has lost some of its midweek recovery momentum, broadly, if not right across the board, in similar vein to last week and the week before that when ‘hawkish’ Fed minutes and strong CPI prompted only brief periods of respite. However, the DXY is trying to stay within touching distance of the 90.000 handle that has become pivotal after a minor extension beyond the round number to top yesterday’s 90.113 recovery high, at 91.179 and retreat to 89.909. Moreover, the Buck may benefit from further month end rebalancing demand over today’s fixes, albeit only a weak buy signal vs major counterparts bar the Yen, according to Citibank’s model, and especially the 4 pm London round as today is spot May 31. Nevertheless, there is also data to consider, including the latest jobless claims tallies, often erratic durable goods and 2nd look at Q1 GDP before pending home sales and the 7 year note offering that normally goes down well with foreign buyers and could impact US Treasury yields alongside the Greenback either directly or indirectly. For the record, Fed’s Kaplan is also due to speak on business TV, but he has been very vocal of late and his hawkish leanings and desire to talk taper soon are well known.

- NZD/AUD – No extension through Wednesday’s 0.7300+ post-RBNZ peak vs its US peer, but equally only a relatively shallow Kiwi pull-back overnight when Governor added another caveat to policy guidance to keep the option of further easing in the locker, if the situation warrants. In fact, Nzd/Usd has already regrouped to hover in the high 0.7200 echelons and Aud/Nzd has reversed a tad closer to 1.0600 as the Aussie lags mostly under 0.7750 against its US rival irrespective of very encouraging Q1 Capex data (came in over 3 times consensus). Note also, Aud/Usd has not inversely tracked Usd/Cny or Usd/Cnh following the latest PBoC midpoint fix that edged nearer 6.4000, or subsequent steeper inclines to fresh 3 year pinnacles for both the onshore and offshore Yuan, and perhaps lockdown for 7 days in the state of Victoria is keeping the pair capped.

- CAD/GBP/JPY/EUR/CHF – All narrowly mixed and rangebound vs the US dollar, in keeping with the index, as the Loonie meanders between 1.2142-02, Sterling regains poise after a dip below 1.4100, and the Yen attempts to fend off more of the aforementioned negative portfolio hedging flows and increasingly bearish technical price formation having failed to stay above 109.00 or chart supports close by (109.20 low vs 21 and 50 DMAs that come in at 109.05 and 109.10 respectively today). Elsewhere, the Euro is fading further from 1.2250+ highs and looking vulnerable again amidst more dovish ECB rhetoric, while the Franc has retreated towards 0.9000 following Swiss trade and jobs updates showing a narrower surplus and slowdown in payrolls growth.

- SCANDI/EM – Sweden has dominated an otherwise sparse am agenda in terms of data and events, with a string of mostly positive releases, like a clean sweep of upbeat sentiment readings and a sharp rise in NIER 1 year inflation expectations to more than offset a smaller trade surplus that would have almost halved without a downward revision, but the Sek has not been able to take much advantage against the backdrop of fragile risk sentiment. Conversely, the Zar is continuing its marked rally to the extent that 13.7500 vs the Usd has now been breached with little regard to slightly softer than forecast SA PPI prints or latest power supply warnings from Eskom.

In commodities, WTI and Brent front month futures have been pressured throughout APAC and early European hours with WTI July now trundling closer to USD 65.50/bbl (vs high 66.18/bbl) while its Brent counterpart eyes USD 68/bbl to the downside (vs high 68.72/bbl). News flow for the complex has remained on the lighter side, thus crude prices may take heed of the overall sentiment across markets as Iranian nuclear discussions continue in the background. Sources via Politico suggested that an Iranian nuclear deal is attainable but cautioned that critical questions remain only partially answered. Elsewhere, spot gold and silver remain within recent ranges and the precious metals continue to track the Dollar and yield developments – with the yellow metal in a tight band on either side of USD 1,9000/oz. Turning to base metals, Dalian and Singapore iron ore futures rebounded overnight after hitting six- and five-week lows respectively after China announced its crackdown on soaring prices. Copper meanwhile retains an underlying bid, with LME back above USD 10,000/t after BHP confirmed that Chile control central workers will begin their strike on Thursday and noted that it will take contingency measures, while other workers at the Spence and Escondida mines will continue working during the remote operation guild’s strike.

US Event Calendar

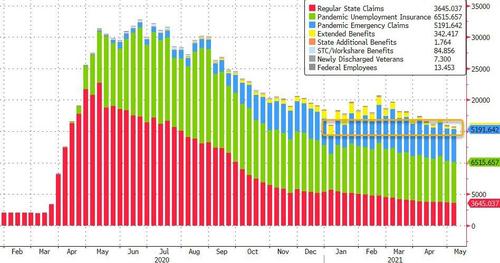

- 8:30am: 8:30am: May Initial Jobless Claims, est. 425,000, prior 444,000; Continuing Claims, est. 3.68m, prior 3.75m

- 8:30am: 1Q GDP Annualized QoQ, est. 6.5%, prior 6.4%

- 8:30am: 1Q Personal Consumption, est. 10.9%, prior 10.7%

- 8:30am: 1Q GDP Price Index, est. 4.1%, prior 4.1%

- 8:30am: 1Q PCE Core QoQ, est. 2.3%, prior 2.3%

- 8:30am: April Durable Goods Orders, est. 0.8%, prior 0.8%, revised 1.0%

- 8:30am: April Cap Goods Orders Nondef Ex Air, est. 1.0%, prior 1.2%, revised 1.0%

- 8:30am: April Cap Goods Ship Nondef Ex Air, est. 0.8%, prior 1.6%, revised 1.3%

- 10am: April Pending Home Sales YoY, prior 25.3%;April Pending Home Sales (MoM), est. 0.5%, prior 1.9%

- 11am: May Kansas City Fed Manf. Activity, est. 30, prior 31

DB’s Jim Reid concludes the overnight wrap

US equities and other risk assets made a modest recovery yesterday, with the S&P 500 up +0.19% as investor fears over inflation continued to subside and the global picture on the pandemic showed further signs of improvement. The move put the S&P back within 1% of its all-time high from earlier in the month, though the index and other key markets still appear to be in a holding pattern as they await the next big round of US data releases over the next couple of weeks, with the previous 7 weeks having seen the S&P close repeatedly within just a 4% band. Meanwhile the VIX volatility index fell -1.5pts to its lowest closing level (17.4) since the S&P closed at its all-time high on May 7.

In light of the improving macro picture, small-cap companies outperformed, with the Russell 2000 gaining +1.97%, while rate-sensitive big tech companies had another decent session as investors maintained their caution on the likelihood of higher interest rates. This helped the NASDAQ (+0.59%) and the FANG+ (+0.61%) indices to make decent gains, though in Europe the STOXX 600 was up by less than a basis point (+0.00%) thanks to a marked decline among banks (-1.04%) in the index as a result of the further moves lower in sovereign bond yields. Much of the S&P’s gains came in cyclical industries that are tied to the global reopening trade including autos (+2.76%), transportation (+1.01%) and consumer services (+0.72%), which includes travels and recreation stocks. There was a somewhat similar sector twist in Europe, where the travel & leisure sector (+1.19%) led the index, followed by retail (+0.92%) and energy (+0.70%) stocks.

Speaking of sovereign bonds, the waning inflation fears failed to pull down yields on 10yr Treasuries, which broke a streak of 4 daily declines yesterday. Yields were up +1.7bps to 1.576%, after rising real yields (+3.7bps) overcame lower inflation expectations, with the 10yr breakeven declining another -1.9bps to a 3-week low of 2.43%. In turn, this has coincided with a pushing back of market expectations of future Fed hikes, with investors having become more cautious on the prospects of a first hike in 2022 relative to a month ago.

On the other hand, sovereign debt in Europe saw declines in yields, with those on 10yr bunds (-3.9bps), OATs (-4.2bps) and gilts (-3.4bps) all moving lower. In fact, that leaves 10yr bund yields down by more than -7bps since the start of the week, which would be the biggest weekly decline so far this year before we’ve even got to Thursday and Friday’s session. Peripheral spreads continued to come down as well, and the spread of 10yr Greek debt over bunds fell to just 106.5bps yesterday, which is its tightest level since 2008. We actually looked at the Greek spread in Jim’s Chart of the Day yesterday (link here), pointing out that it’s fallen to fresh lows in spite of the fact that their government debt has continued to climb since the sovereign debt crisis, and now stands at more than 200% of GDP. To be fair, much of this is held by the “official” sector and is concessional, which in turn makes the traditional debt-to-GDP metrics less relevant. But it’s still striking how the narrative has turned over the last decade from being very worried about sovereign default risk coming out of the GFC, to today’s much more relaxed stance on the negative effects of debts and deficits.

Overnight there’ve been some fresh US-China headlines, with a phone call between US Trade Representative Katherine Tai and Chinese Vice Premier Liu He taking place. The initial soundbites were positive, with China’s Ministry of Commerce saying in a statement that they’d “conducted candid, pragmatic and constructive exchanges in an attitude of equality and mutual respect.” Meanwhile the USTR said that “Ambassador Tai discussed the guiding principles of the Biden-Harris administration’s worker-centered trade policy and her ongoing review of the U.S.-China trade relationship, while also raising issues of concern.” Separately, the US’ coordinator for Indo-Pacific affairs on the National Security Council, Kurt Campbell, said that the US was entering a period where “the dominant paradigm is going to be competition” with China, and that it was Chinese policies that bore a large part of the responsibility for this.

Turning to Asian markets now, a quick refresh of our screen shows that markets are mostly trading lower with the Nikkei (-0.67%), Kospi (-0.35%) and Hang Seng (-0.24%) all down. An exception to this pattern are Chinese markets however, with the Shanghai Comp up +0.18% on the above mentioned trade talks with the US. We also got the latest policy decision from the Bank of Korea overnight, who kept their key rate at 0.5%, in line with expectations. Outside of Asia, futures on the S&P 500 are down -0.11% pointing to a weaker open for the index later on, and Bitcoin prices are down -3.09% this morning to trade at $37,576 as we type.

Looking at other markets yesterday, haven assets had a solid performance, with the dollar index up +0.47%, and gold prices traded above $1910/oz for the first time since early January before ending the day slightly lower (-0.14%) on the whole. Meanwhile some of the Reddit-fuelled favourites from earlier in the year are surging again, with Gamestop advancing +15.8% yesterday, along with AMC Entertainment Holdings (+19.2%). And crypto-assets were another to recover ground, as Bitcoin (+3.0%) and Ethereum (+9.6%) both rose.

In terms of the latest on the pandemic, there was continued discussion in the US on the origins of Covid-19, with the White House releasing a statement from President Biden saying that he’d asked intelligence officials “to redouble their efforts to collect and analyse information” that would help discover the origins of the pandemic, reporting back to him within 90 days. Meanwhile in Singapore, border restrictions are being toughened up further this weekend, with all travellers entering or transiting through the country (unless they’ve stayed in lower-risk countries for the last 3 weeks), now having to present a negative test before departure. And in Australia, the state of Victoria will go into a 7-day lockdown as a cluster of cases is continuing to grow. We also got some positive news on therapeutics overnight with GlaxoSmithKline’s antibody treatment called sotrovimab receiving an emergency use authorization from the US FDA to treat mild-to-moderate Covid-19 in people 12 and older.

Staying on Covid, there was quite a bit of news out of the UK yesterday, with the number of reported cases in the country coming in at 3,180. That’s the first day above 3,000 cases in more than 6 weeks, and as mentioned yesterday the government has advised people to minimise travel in and out of 8 local areas where the Indian variant is spreading fastest. The concern is having an impact elsewhere, with France announcing fresh restrictions on UK passengers that will apply from May 31, requiring that non-French citizens or residents have an overwhelming reason to travel to the country, in addition to the existing requirement to produce a negative test and self-isolate for a week after arrival. That said, one piece of brighter news is that unlike with the previous waves of the virus, the increase in the worst-affected areas of the UK has so far been concentrated among the under-40s, who are relatively less likely to be hospitalised or die. Domestically however, the news yesterday was primarily focused on the former chief advisor to PM Johnson, Dominic Cummings, who testified before a committee of MPs with a series of explosive claims yesterday. Among others, he said that he regarded Johnson as “unfit” for office, the Health Secretary Matt Hancock should have been sacked, and that “tens of thousands of people died, who didn’t need to die”.

There was little data to speak of yesterday, though in France, the INSEE’s consumer confidence measure rose to 97 in May as expected. That’s its highest level since March last year, but still below its long-term average of 100.

To the day ahead now, and data highlights from the US include the preliminary durable goods orders for April, the second estimate of Q1 GDP, weekly initial jobless claims, April pending home sales, and the Kansas City Fed’s manufacturing index for May. Over in Europe, there’s also the German GfK consumer confidence reading for June and Italy’s consumer confidence index for May. Central bank speakers include the ECB’s Vice President de Guindos, Weidmann, Schnabel and Hernandez de Cos, as well as the BoE’s Vlieghe. Finally, earnings releases include Salesforce, Medtronic, Costco, HP, Royal Bank of Canada and Dell Technologies.