“What The Hell Is Going On – 2020 Edition” – Chamath’s Annual Letter Warns That “People Have Stopped Thinking For Themselves”

While many of the SPACs he has sponsored have seen less than stellar returns, Chamath Palihapitiya and his VC firm, Social Capital, are doing just fine. Palihapitiya has been a player in Silicon Valley for years, but thanks to the SPAC boom, 2020 was a breakout year for the former Facebook employee. Not only did he rake in profits for his firm and his investors, but SPACs have changed the nature of the IPO process

Somewhat lost in all the excitement of the SPAC boom is the fact that Social Capital is a VC firm that has invested in more than 70 companies during the past decade, which has been a lucrative one for Silicon Valley. Social Capital has backed many a winner, including Slack, SurveyMonkey, Wave (acquired by H&R Block) and Yammer (which was acquired by Microsoft). Its entire portfolio is listed here.

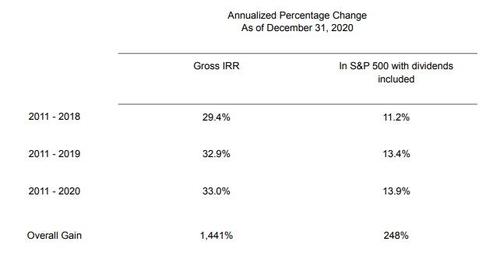

Between 2011 and 2020, Social Capital has achieved a Gross Internal Rate of Return equivalent to 1,441%, compared with just 248% for the S&P 500. But as Warren Buffett, Jamie Dimon and Jeff Bezos have shown, annual investor letters aren’t so much about sharing returns, but are about allowing the CEO to pontificate about issues near and dear to their hearts.

And Palihapitiya, whose interviews and tweets draw a large audience, didn’t disappoint. In a section entitled “What the hell is going on – 2020 edition”, Palihapitiya opened with one of the most quoted lines penned by Charles Dickens – “it was the best of times, it was the worst of times…” before progressing to other topics from BLM, to obesity to the fact that “people have stopped thinking for themselves.”

We have reproduced the entire section below (emphasis ours):

What the hell is going on – 2020 edition

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way…”

Most of us recognize this as the famous beginning of Charles Dickens’ 1859 novel A Tale of Two Cities. Dickens wrote about the years leading up to the French Revolution and is about two men who are, in some ways the same, but in others completely different. In hindsight, 2020 can be described in equivalent terms.

On the one hand, 2020 was a witness to the ongoing compounding of prosperity, health, life expectancy and wealth that has symbolized the post World War II 20th and 21st centuries thus far. But at the same time, through the lens of COVID-19, 2020 introduced us to the fragility of our lungs, our borders, our institutions and our compassion with many lives lost and many mistakes made.

In no world was the coronavirus pandemic a blessing but it was instructive. What was laid bare in the cloud of 2020 was, if taken positively, a roadmap for us to follow if we want to rebuild that “shining city upon a hill” again.

Globalization as we know it is over

This, in our opinion, is the largest macro force at play coming out of the pandemic, but it is still poorly understood. First, some history. When historians describe the period from 1980 to 2020, they may initially focus on Paul Volcker’s fight to rein in runaway inflation but it will quickly move to 1994. In 1994, Deng Xiaoping’s “socialism with Chinese characteristics” faced a reckoning with the devaluation of the RMB to the US Dollar. While a currency devaluation may not mean much to most people, the implications of this one were immense. Overnight, China’s currency became almost 40% more competitive and the West was flooded with an amazing production surplus. We were able to buy things made in China at a huge discount, so we bought more and more, building an insatiable demand of retail consumption.

This currency devaluation also had several advantages for China. With a large demographic bulge of young people, the government was able to put these hard working and ambitious people to work in all manner of factories. In turn, these factories were increasingly running 24 hours per day feeding the West’s insatiable appetite for consumption – and a virtuous cycle was born. China was then able to take the proceeds of this activity and invest heavily in its own infrastructure, running massive yearly GDP gains and eventually becoming the 2nd most important economy in the world.

Other Asian countries, not willing to stand on the sidelines, joined the devaluation fun and by the turn of the century, we had seen an entire block of countries devalue their currency relative to the US Dollar further exacerbating the trade deficit/surplus between the West and Asia.

Then in 2001, the other shoe fell.

With President Bush increasingly pushing for a war in Iraq, he also advocated for China to become a member of the World Trade Organization. By December of 2001 China was admitted to the WTO and in November of 2002, China supported the UN Security Council resolution that created the pretext for the US invasion of Iraq. Within the course of a few months, the US became distracted by fighting a protracted and oddball war in the Middle East while China was able to focus on scaling their economy and building wealth. The US was spending money needlessly while China was saving and investing.

Then, because of China’s admission to the WTO and the normalized trade relations that came with it, globalization was supercharged. Companies in the West were not just incentivized to buy cheap Chinese goods, they also had a mechanism to export jobs to, and invest heavily in, China. All of this, as we know now, ultimately hollowed out the American middle class, created the Rust Belt, lit the fuse on the opioid crisis and enabled a resurgence of both left and right populism. The kill shot to globalization came in 2016 with the election of President Trump – it was the disenchanted protest vote heard around the world.

“Just in time” was a feature and is now a bug

We should note that despite all of the issues with globalization noted above, we were not allowed to be anything but positive about globalization until the pandemic.

During the pandemic, facing critical shortages of goods like PPE, it became clear that globalization had created a fragile ecosystem which was optimized for “just in time” instead of “under all circumstances”. The former is cheaper and faster while the latter manages corner cases and reliability despite being inefficient and costly.

Now it’s easy to be anti-globalization and advocate a hyper balkanized world view. But the problem is that if each country was forced to be self-sufficient, it is akin to advocating for the Dark Ages. Instead, a more reasonable middle ground is a world where we value a handful of trading partners for critical resources, metals and supply chains versus just one. While no one country will get rich quickly under this model, and while it will likely be more inefficient and cause prices to rise, it will also allow many countries to create lots of middle class jobs for their populations (ie the circa 2000 China playbook but for everyone).

Based on this, we see many new investment opportunities in all things “resiliency”. In rebuilding supply chains for rare earths, battery metals, semiconductors, additive manufacturing and many other end markets, we believe we will see a resurgence of the American middle class and our manufacturing prowess. This will also have a secular, positive impact on commodity prices, as well as creating a new generation of technology companies who view “under all circumstances” as a feature and “just in time” as a historical artifact.

Basically, by the end of 2020, we essentially learned that the original manifestation of globalization was like sugar. In the right quantities, it’s hard to beat, but if there is too much of it, it will lead to cavities and disease.

We have an epidemic of obesity

Speaking of disease, simply put, the pandemic told us an ugly truth: we are a nation of overweight and obese people and it’s getting worse. At the end of 2020, 42.4% of all Americans were obese. If being obese wasn’t psychologically and physiologically hard enough, the pandemic made clear that it was also an acute killer. Of all hospitalized patients with COVID-19, 78% were overweight or obese. Further, the mortality rate for this cohort was 20%. Chained probabilities mean that if you are overweight/obese and you are hospitalized with the next variant of covid you have a (78% * 20%) = 15.6% chance of dying. And each new year, and with every new variant, you have a new 15.6% chance of dying. At some point, it’s impossible to outrun these odds.

We have a responsibility to recognize this as the epidemic that it is and start to address it in scaleable ways. The most difficult thing to fix, but where tremendous value will come from, is improvements to our domestic food supply. American’s have become addicted to cheap food high in sugar, preservatives and other additives. It’s not clear that there is a sustainable food supply that can be created at the same price point but this is where we need to invest engineering, science and government resources. It is possible to imagine a domestic food supply that is rich in nutrients, free of pesticides and engineered to taste good that can satiate the American palate. If we don’t, and the next pandemic doesn’t kill us, then over the next few decades, the chronic care of America’s obese population will.

People have stopped thinking for themselves

Part of what led to our obesity epidemic were lies about fats versus sugars. The issue of truth has only become more exacerbated. In fact, the most pernicious issue with the pandemic was how rife it was with a lack of information, disinformation and misinformation. The often conflicting and inconclusive statements from our institutions: CDC, WHO, POTUS, FDA disappointed many. Wear a mask. Don’t wear a mask. Clean surfaces regularly. Surfaces don’t pass COVID-19. Ingest bleach. Don’t ingest bleach. Don’t take this vaccine because it causes clots. Actually, that’s not true, take it.

As all of this conflicting information was put into the world on the same level playing field, average people were left to scratch their heads in confusion, paralyzed with fear or invent their own conspiracy theories to explain it to themselves.

In fact, all of this mis/disinformation had a very sinister result. Instead of making the issue simpler to understand, we started a dangerous new trend of making science about interpretation vs facts. Every day of the pandemic, we saw various ways of interpreting data, facts, cohorts and theories to maximize clicks and confusion and minimize rational decision making. Even worse, we stopped iterating, we stopped changing our minds through data and instead we allowed bad decisions to fester because saving face became more important than good decisions. This is a dangerous trend which will undoubtedly spill into many other organizations we rely on unless we do something.

In a world of social media where everyone has a megaphone, we need to increasingly rely on institutions for the truth, not the opposite. But the pandemic has further eroded this expectation and has drawn opinion lines around science. The implications of this for future pandemics, natural disasters or broad public agreement on big issues is concerning – especially as we leave the pandemic, survey the damage and try to return to normal.

Inequality and climate change are getting worse

If we entered 2020 precariously trying to manage the growing inequality we have in America, we left with even fewer answers and new levels of anger and discontent. The trillions of dollars printed by the Federal Reserve in 2020 were critical to ensuring well functioning capital markets, but it also exacerbated the asset inflation that separates average Americans from the wealthiest ones. Despite a raging pandemic, large unemployment and negative GDP, the S&P 500 returned 17.88% in 2020 (with dividends reinvested). It’s likely that most Americans didn’t feel 17.88% richer or more secure by the end of 2020 but financial assets seemed to not listen.

At the same time, despite an entire world in a lockdown, the effects of climate change continued unchallenged. In fact, per NASA, despite much less economic activity, 2020 was not only the warmest year on record, it added to a trend where now the last seven years have been the warmest seven years on record. At this rate, the impacts to the Earth’s biodiversity and resource scarcity (food, water) are unavoidable.

BLM

Finally, as we look back on 2020, we need to talk about Black Lives Matter. While we all want to live in a world where stating the obvious isn’t necessary, this is what millions of people were forced to do throughout America in 2020. The overwhelming majority of BLM protests were just that – peaceful statements of disapproval about the status quo. The reason is that over decades, we have allowed systemic racism and unconscious bias to affect how an entire class of people are treated – by the justice system, by the penal system, by the social welfare system, by the education system and the list goes on – because of the color of their skin. In no reasonable, moral worldview is this acceptable. Even in the most reductionist worldview, if it could happen to them, then why not to you? The point is that equality is a pillar of the US democracy…not an expendable feature that can come and go.

To wit, we can’t fix what we don’t acknowledge and we need to acknowledge that this has happened and begin the hard work of finding solutions. Again, as in other areas, the immediate reflexive reaction is to swing the pendulum wildly to the other side which is what politicizes the issue and stops progress. Is the solution to BLM and improving policing of black and brown lives to wildly decarcerate? No. It’s a more nuanced middle ground where you can logically support BLM, training and accountability for police and law and order all at the same time. I think we will find that this kind of nuance has broad support across America for the politician willing to take this middle ground.

Insiders vs Outsiders

In all of these issues – inequality, climate change and BLM among many others, lies an important emerging truth about how, in 2021, solutions can be found and coalitions built. In order to truly address the root causes of inequality, climate change or systemic racism we need to acknowledge what brought us here.

Again, some history. The modern media landscape before social media was about a few, trusted outlets that became the tastemakers for the broad majority of people. If you didn’t like the opinion of CBS News, you could always switch to ABC or NBC. Through the social media lens of 2020, having a choice between ABC News, NBC News and CBS News is akin to the famous Henry Ford quote that:

“Any customer can have a car painted any colour that he wants so long as it is black.”

The implications of this monocultural interpretation of facts and truth were vast and, in hindsight, somewhat predictable. There were a few outlets (NBC, CBS, ABC) that catalyzed opinions and views – and as long as they stayed relatively centered, not much could go wrong. At the same time, it also turned out that systemic injustices would continue to compound with no obvious way to shine a light on and fix them unless these three outlets decided to do so.

This hasn’t just been a problem of broadcast TV. In fact, many of the most important issues of our time were the byproduct of business model decisions within the media landscape that were poorly thought through, if at all.

Take for example, the rampant inflation in the price of US private universities.

What does this have to do with the media? The prices of US private universities were relatively stable until they exploded in 1983. As it turns out, 1983 was also the year that US News & World Report started their Best Colleges Ranking issue. In it, they amplified artificial markers of admissions exclusivity including selection rate and cost. This fed the university administrators and parents with a new kind of insecurity that was masterfully, and perhaps inadvertently, exploited to create the higher education system we now have. As they sold more ads and sold more copies, entire admissions criteria were changed in order to rank highly. Heretofore normal parents became “helicopter parents” all fed by keeping up with the Jones’ who sent their kid to Stanford. Perhaps the team at US News & World Report were simply trying to sell ads in their magazine and deserve no blame, but the result is still the same.

The point is that many of our institutions, our biases and status quos have been shaped by a select group of media insiders who tell us what to know or think. While this isn’t inherently wrong, in and of itself, it’s a system that is under attack. Social media now allows outsiders to sit on the same level playing field as insiders with insiders scrambling to find new solutions. If you aren’t convinced, just see what your kids browse on YouTube.

You can now find your own news, your own tribe, your own calling and feel validated in a way that wasn’t possible before. We have all become multi-faceted and diverse in our opinions with room and opportunity to explore the edge cases and think in nuanced ways. This has also meant that centralized tastemaking and narrative control are the least valuable it has ever been.

For most people, the solution is in getting the facts, finding the middle ground, de-escalating the rhetoric, being open minded and listening to one another. The implications of all of this are vast and we are focused on how all of this may play out, particularly in the financial markets.

On Markets

If 1980-2020 was about rampant globalization, then 2020-2060 will be a moderation of this dynamic. In part because of demographics. As we start 2021, there has been a meaningful shift in the demographics of the West vs Asia. Every two years, the median age in China increases by ~1 year. In America, we are roughly staying the same. As this has played out over time, the median ages of China and America have now become equal. But China will continue to age while America remains relatively young over the next few decades. The scale of this demographic shift means fewer young workers in China, increased domestic consumption by older Chinese citizens and the attendant infrastructure needs to deal with an aging population. As China lowers growth to deal with this trend, the impact on prices should see a reverse of the 1990s and 2000s. In other words, prices, in general, are more likely to go up than down for traditional commodities and goods.

Now as we face rising prices, the existential risk in the market is related to inflation. As inflation goes up so will interest rates which has negative implications to future cash flows (this disproportionately negatively affects tech companies). That said, an eternal truth about interest rates, inflation and the like, is that the only way to be immune is to grow really fast. While it’s true that there are cyclical companies to own at certain times over others during a rising inflationary period, the surest way to survive is to keep growing faster than the rate of rising costs. To that end, while we are cautious believers in the case for moderate inflation we remain ardent believers in the case for technology and growth stocks.

The no man’s land, however, is the slow growing company – whose leadership has eroded. These are the new quicksands of the public markets and while tantalizingly offering cheap cash flows, unless that cash can create a new arc of growth for that company or be invested by that CEO at superior rates of return, it is literally the last puff of a used cigar that one is best advised to avoid.

On Performance

We had a very strong 2020.

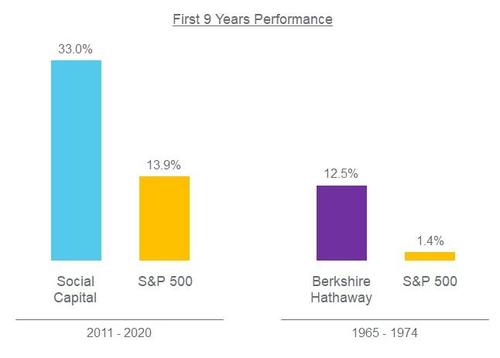

Palihapitiya compared Social Capital’s returns to both the S&P 500…

…while also comparing the firm to Buffett’s Berkshire Hathaway.

Readers can find the full letter below:

Tyler Durden

Wed, 05/26/2021 – 18:40

via ZeroHedge News https://ift.tt/3wAtc4j Tyler Durden