US equity futures rose on Wednesday, rebounding from a modest dip the day before as more central-bank officials joined the chorus predicting that inflationary pressures are transitory, while a recent dip in bond yields supported Nasdaq futures climb for a third straight session. At 7:15 a.m. ET, Dow e-minis were up 82 points, or 0.24%, S&P 500 e-minis were up 14 points, or 0.33%, and Nasdaq 100 e-minis were up 51.25 points, or 0.38%. Treasuries and the dollar were roughly flat, recovering from an earlier drop. BItcoin soared back over $40,000, rising as much as 8.6%, before paring gains.

Among the notable premarket moves were retail trader favorites GameStop and AMC which surged in U.S. premarket trading, adding to Tuesday’s rally as investors touted the stocks on social media platforms including Twitter, Stocktwits and trader WallStreetBets. The gains will add to losses for short-sellers of the stocks who have already seen $6.8 billion in mark-to-market losses this year, according to S3 Partners. GameStop climbed 4.3% to $218.40, while AMC added 3.8% to $17.04 at 7:10am in New York.

Here are some other notable premarket movers:

- Larimar Therapeutics slumps in premarket trading after the U.S. Food and Drug Administration placed a clinical hold on its CTI-1601 drug.

- Nabriva Therapeutics jumps after the company, alongside Sinovant Sciences, said Tuesday that lefamulin was shown to be non-inferior to moxifloxacin.

- Urban Outfitters jumped 9.3% after reporting 1Q results after market Tuesday that beat profit and sales estimates. Analysts see the apparel maker as a retail recovery play, with Jefferies saying the strong results will “bring bulls back,” while JPMorgan upgraded the retailer to neutral from underweight.

- Oil heavyweight Exxon Mobil Corp gained 0.7% ahead of its first major boardroom contest where climate change is a central issue.

- Crypto- exposed stocks like Riot Blockchain, Marathon Patent Group and Coinbase Global rose between 2% and 4.6% in premarket trading as bitcoin climbed back above $40,000 for the first time this week with other cryptocurrencies recovering some of the ground lost this month.

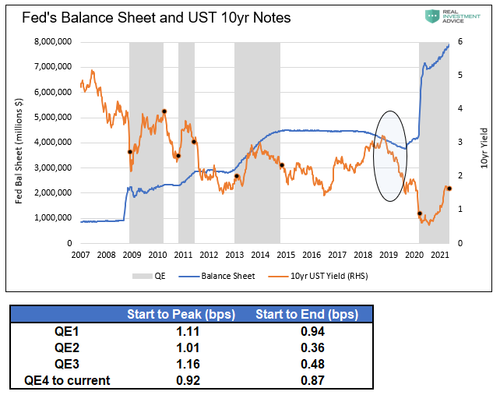

- Nordstrom dropped 6% in thin trading after reporting a bigger-than-expected quarterly loss, hurt by price markdowns.

Futures rose after a downbeat Tuesday, where the S&P closed down 8 points, despite Fed vice chair Richard Clarida downplaying the effects of higher price pressures, voicing faith in the central bank’s ability to engineer a “soft landing” if prices continue to escalate beyond what is expected. All the same, Clarida’s comments reflect a shifting tone at the Fed. A month ago, Fed Chair Jerome Powell said it was “not yet” time to even contemplate discussion of policy tapering, but more recently policymakers have acknowledged they are closer to debating when to pull back some of their crisis support for the U.S. economy. This is why, as we noted overnight, the narrative on Wall Street is starting to shift, portraying the taper as a positive or bullish catalyst.

“The messages were not necessarily new but they reinforced the prevailing consensus still that the bulk of the surprise in April (CPI) can be traced to transitory elements,” said Stefan Hofer, chief investment strategist at LGT in Hong Kong. “The proof is in the pudding so to speak over the coming months, how much of the CPI increase is structural and how much of it is transitory. And the jury is I would say still out on that, but the Fed is sticking to its guns and markets seem to be by and large still comfortable with that.”

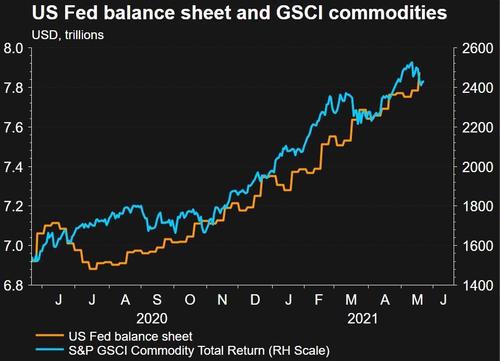

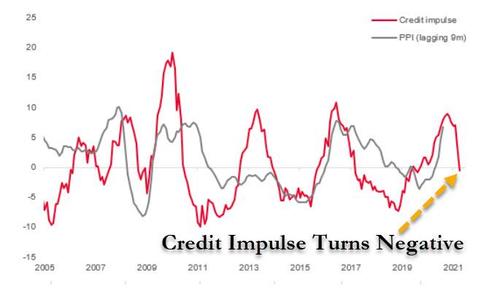

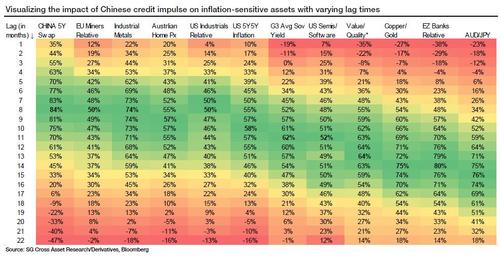

Fears of soaring inflation have weighed on Wall Street’s main indexes this month, with most analysts expecting a jump in borrowing costs in the short term as the economy reopens, even though a recent Chinese crackdown on commodity prices coupled with a plunge in China’s credit impulse suggests a deflationary wave is coming. Furthermore, central bankers around the globe are playing down the risk of rising prices. The question, as Bloomberg notes, is how long the Fed and other central banks can keep stimulative monetary policy in place if economic data continue to show price pressures.

“What we keep hearing from the Fed is that they’re going to take a very different approach to inflation this time around,” Kristina Hooper, Invesco chief global market strategist, said on Bloomberg TV. “The Fed is likely to let the punchbowl stay out a lot longer. The big fear about inflation is that the Fed would act.”

Europe’s Stoxx 600 Index erased earlier gains of as much as 0.4% as the rally lost steam after the region’s stocks approached record levels. Banks pulled the index lower with the banks subgroup index down 1.5%, after a report on Sweden’s lenders facing new tax. The travel & leisure subgroup index trim gains to 0.9%. Here are some of the biggest European movers today:

- Marks & Spencer shares rose as much as 6.3% to highest intraday since March 2020. The U.K. retailer’s FY results showed continued improvement in its balance sheet as well as “constructive” comments for the year ahead, according to Morgan Stanley.

- Softcat shares jumped as much as 6%, the most since March 24, after the IT services firm says it sees its full-year earnings ahead of expectations.

- Norwegian Air shares rose as much as 31% as a restructuring proposal is expected to take effect after close of trading on the Oslo Stock Exchange on May 26.

- Vectura Group shares gained as much as 34% to a price above the level of an agreed offer from Carlyle Group that values the U.K. drug maker at GBP958m. Stifel said the offer represents a fair premium to their price target.

- Solutions 30 shares jumped as much as 26%, rebounding from a slump in the previous two sessions, after CEO Gianbeppi Fortis sought to reassure investors worried about pressures from short sellers and its auditor’s decision not to certify the company’s 2020 accounts.

- Spire Healthcare shares rose as much as 29% after agreeing to a takeover by Ramsay Health Care. RBC said “it may not have taken much for Spire’s share price to reach this” without a bid, “given the pent-up demand in the market”

- De La Rue shares fell as much as 8.3% before trimming the decline after the banknote and authentication document-maker’s full-year results. Company has been speculated upon as a potential producer of Covid-19 “vaccine passports.”

Similar to Clarida, Bank of France Governor Francois Villeroy de Galhau talked down stimulus adjustments anytime soon, while European Central Bank Executive Board member Fabio Panetta said he sees no signs of sustained inflation that would allow for a reduction in bond purchases.

In Asia, stocks rose for a fifth day as the soothing Fed comments helped boost sentiment with MSCI’s broadest index of Asia-Pacific shares outside Japan rising 0.28% near more than two-week highs, while Tokyo’s Nikkei added 0.27%. The MSCI Asia Pacific Index climbed above its 50-day moving average on Wednesday, a sign that the region’s stocks have steadily recovered from a slump in early May.

“The weaker U.S. dollar has helped non-USD assets,” said Linus Yip, a strategist at First Shanghai Securities in Hong Kong. However, the sustainability of market gains remains uncertain as “we haven’t seen a significant change in Asia economies. And the pandemic hasn’t been controlled in India and Taiwan,” he said. The Bloomberg Dollar Spot Index fell as much as 0.2% in its third day of declines before paring some losses. The gauge is hovering near its year-to-date low. A weaker greenback tends to be beneficial for Asian shares if it signals higher risk appetite and is seen as a positive for growth in the region’s emerging economies, many of which rely on imports priced in dollars. Stocks in India were on track for a record close. Chinese equities ended little changed after the CSI 300 Index jumped 3.2% on Tuesday, the most since July. Hong Kong stocks rose to the highest level in almost a month. Communication services and industrial shares led the gains in Asia, while materials stocks posted declines. China’s internet giant Tencent and Taiwan’s TSMC contributed the most to the regional benchmark’s advance. Markets in Singapore, Indonesia, Thailand and Malaysia were shut for holidays.

Japanese equities overcame early turbulence to post their fifth-straight day of gains, as investors were encouraged by signs of calm in external financial markets. Electronics makers were the biggest boost to the Topix, which has eked out a gain of 1.3% over the past five sessions, helped also by optimism over a ramp-up of Japan’s coronavirus vaccination program. Fast Retailing and Recruit contributed most to gains in the Nikkei 225. A measure of volatility on the blue-chip gauge fell to its lowest since May 10. Stocks fluctuated in early Tokyo trading after U.S. shares fell overnight. “U.S. long-term yields have retreated quite a bit, and that is probably quite a big factor leading to the calm in markets,” along with smaller moves in Bitcoin, said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank. “We have U.S. jobs data coming up next week, but for now, we’re in an environment that’s extremely good for equity markets, with U.S. economic conditions being good while inflation is contained.”

Analysts at Jefferies said Asian regional equity markets could benefit, especially given a weak dollar could help boost global trade and emerging markets by lowering global prices of goods and services. “A weak dollar should underwrite emerging market performance despite very mixed vaccine roll-outs to date,” they said in a note. “Until the U.S. government declares the pandemic is over and job growth is running at one million plus per month, tapering is unlikely to happen…In the meantime, real rates will be heavily negative. Moreover, based on the dollar’s Real Effective Exchange Rate, the greenback cannot be described as being ‘cheap’.”

In rates, Treasuries little changed across the curve after paring losses amid bund rally. US Treasuries fell to multi-week lows on Tuesday on easing inflation concerns and a strong auction of 2-year notes. The yield on the benchmark 10-year Treasury note stood at 1.5638 after scaling a more than one-month high earlier in May. Higher yields pressured valuations for tech and other growth stocks, whose future cash flows are discounted at higher rates after the ECB’s Panetta said only sustained inflation could warrant slowing PEPP. European price action dominated the rates market, with German 10-year almost 4bp richer vs U.S. as markets pare taper expectations. Treasury auction cycle continues with 5-year note sale, following strong demand for Tuesday’s 2-year.

In FX, the Bloomberg Dollar Spot Index fell a third day and the greenback traded mixed versus its Group-of-10 peers, with Antipodean currencies leading gains; The euro fluctuated at around $1.2250; the euro erased a modest gain at the beginning of the European session, and the region’s government bonds advanced, as ECB Executive Board member Fabio Panetta said he sees no signs of sustained inflation pressures that would allow for a reduction in bond purchases yet. On the other end of the spectrum, New Zealand’s dollar led G-10 gains to touch a three-month high and swap rates surged after RBNZ published official cash rate forecasts for the first time in more than a year that show the rate beginning to rise in mid-2022.

The onshore yuan rose for a fourth day to its highest in three years after the PBOC set the yuan’s daily midpoint fixing at its strongest level since June 2018, signaling its comfort with a recent rally after the currency tested a key level against the dollar a day earlier, prompting state banks to step into curb the rally.

In commodities, oil was little changed as traders weighed expectations of improving demand in the U.S. against the possibility of new supply from Iran. Global benchmark Brent crude was up 3 cents at $68.68 and U.S. crude fell 7 cents to $66 per barrel. Bitcoin traded around $40,000, earlier crossing above the key barrier, despite China’s northern region of Inner Mongolia escalating a campaign against cryptocurrency mining on Tuesday, days after Beijing vowed to crack down on bitcoin mining and trading. Gold extended its advance after Federal Reserve official Clarida talked down prospects for inflation, piling pressure on Treasury yields.

It’s a fairly quiet day ahead now on the calendar, with the data highlights including French consumer confidence for May, and central bank speakers including Fed Vice Chair Quarles and the ECB’s Villeroy. Earnings releases include Nvidia, and the CEOs of a number of Wall Street firms will be testifying before the Senate Banking Committee.

Market Snapshot

- S&P 500 futures up 0.3% to 4,197.50

- STOXX Europe 600 rose 0.23% to 446.25

- MXAP up 0.3% to 207.32

- MXAPJ up 0.4% to 695.72

- Nikkei up 0.3% to 28,642.19

- Topix little changed at 1,920.67

- Hang Seng Index up 0.9% to 29,166.01

- Shanghai Composite up 0.3% to 3,593.36

- Sensex up 0.6% to 50,965.37

- Australia S&P/ASX 200 down 0.3% to 7,092.53

- Kospi little changed at 3,168.43

- Brent Futures up 0.2% to $68.78/bbl

- Gold spot up 0.5% to $1,907.81

- U.S. Dollar Index little changed at 89.73

- German 10Y yield fell 2.2 bps to -0.189%

- Euro little changed at $1.2245

Top Overnight News from Bloomberg

- U.S. three-month 10-year implied swaption volatility — a closely watched gauge of how much prices may move over the period — has been steadily declining, and hit the lowest levels since early March, as officials repeat the line that inflation will be transitory

- Bitcoin rallied back above the $40,000 level as cryptocurrencies recover some of the ground lost in this month’s volatile rout. Bitcoin’s explosive moves are stoking the volatility of U.S. stock futures in haywire trading days, according to Singapore’s DBS Group Holdings Ltd

- The U.K. government was forced to backtrack over its attempt to restrict travel to coronavirus hotspots in England where the so-called Indian variant is spreading. The U-turn came after ministers were accused of introducing “local lockdowns by the back door” with the new guidance against travel to eight areas in England, which was published without fanfare online late last week but didn’t reach the attention of local leaders for several days

- China’s banking regulator has asked lenders to stop selling investment products linked to commodities futures to retail buyers, Reuters reports, citing three unidentified people

- Europe’s labor market may recover more slowly from the pandemic than its economy, according to a study by Accenture. The region lost 3.5 million jobs in 2020 that will take until 2023 to be recreated, the consultancy said, citing a survey of 700 company executives. That’s as much as one year after the last European Union economy will have seen output returning to pre-crisis levels

A quick look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly positive in what was a modest improvement from the subdued performance on Wall Street where most major indices posted marginal losses following mixed data releases, although the Nasdaq 100 bucked the trend amid resilience in tech and as softer yields helped stem downside in duration sensitive stocks. ASX 200 (-0.3%) was kept afloat for most of the session amid notable strength in tech and outperformance in gold miners after the precious metal reclaimed the USD 1900/oz level. Furthermore, the top-weighted financials were also higher as shares in big-4 leader CBA briefly topped AUD 100 for the first time, although gains in the broader marker were limited amid snap lockdown concerns in Victoria state which reported 10 new locally transmitted cases and after a COVID-positive person was confirmed to have attended a match at the Melbourne Cricket Ground. Nikkei 225 (+0.9%) traded positively amid reports that Japan’s government is considering another cash handout program of up to JPY 100k for households in need, but with upside restricted amid expectations of state of emergency extensions and further calls for the cancellation of the Olympics, this time coming from an editorial by Asahi Shimbun press, which is an official partner of the Tokyo Olympics. Hang Seng (+0.6%) and Shanghai Comp. (+0.3%) held on to the spoils from the prior day’s outperformance where northbound flows into the Chinese mainland through the stock connect reached record levels. Focus was also on Xiaomi after it received the final US District Court ruling which removed its designation as a Communist Chinese Military Company and lifted all restrictions on the Co.’s shares, although this failed to boost its share price with participants awaiting its earnings results. Finally, 10yr JGBs were rangebound with upside restricted amid the mild positive risk tone and with the BoJ only in the market for treasury bills, while New Zealand 10yr yields gained around 8bps following the RBNZ rate hike projections.

Top Asian News

- Two Million Evacuated as Cyclone Hits India Amid Virus Woes

- Japan Ministry Says UBS No Longer Primary Dealer for JGBs

- Nine-Day Wait for Covid Test Results Leaves Taiwan in Limbo

- Triumphant Assad Eyes Return to Arab Fold as Syrians Vote

Major bourses in Europe kicked off the day with mild gains but have since drifted off best levels (Euro Stoxx 50 -0.2%) with the region now seeing a mild downside bias amid a light European morning in terms of data and news flow, and as month-end looms. US equity futures meanwhile hold onto modest gains, but the breadth of the price action remains narrow with no clear stand-out performers. Analysts at Barclays note that fatigue and inflation woes have seen investors trimming bullish bets over the last month. “Cyclical exposure has moderated, but Value has recovered its 2020 outflows, with buying of Financials, Energy and Materials outpacing Tech. Value is thus more consensus and prone to profit-taking but can still benefit from higher rates and momentum rebalancing, in our view.”, the bank says. Barclays also suggests that the correlations between the broader equity market vs cryptos and SPACs have been relatively lower, meaning little contagion in the bank’s view. “Overall, less complacency reduces correction risk, and investors have dry powder to keep buying on dips, which should support a further grind higher in equities.”, the analysts note. Back to Europe, cash bourses are trading either side of neutral while sectors have been tilting more towards a defensive bias as Personal Household Goods, Food & Beverages and Healthcare reside among the better performers. Travel & Leisure is the clear outperformer as sector heavyweight Flutter Entertainment (+2%) is underpinned by an upgrade at HSBC – note, Flutter accounts for over 1/5th of the sector. Banks and Basic resources meanwhile reside at the bottom of the pile amid the recent pullback in yields and as some base metal prices in Asia slumped. Tech also resides as laggards following its recent outperformance. In terms of individual movers, Marks & Spencer (+4.8%) is among the top gainers post-earnings as the group notes that its balance sheet has emerged stronger than expected and online sales doubled in the period. Meanwhile, Spire Healthcare (+24%) was bolstered as Ramsay Healthcare offered to purchase 100% of Spire for GBP 2.40/shr in a deal valued at around GBP 2bln. On the downside, Nordea (-0.6%) sees losses as its largest shareholder Sampo (-1.0%) offloaded 162mln shares to institutional investors.

Top European News

- U.K. Could Block Some London Listings on Security Grounds

- Ireland Needs Credible Fiscal Strategy, Watchdog Warns

- Czech Central Bank Is Deciding Between June and August Rate Hike

- Swedish Banks Face New Tax to Cover ‘Enormous’ Crisis Costs

In FX, the Kiwi was already taxiing in preparation for the RBNZ policy meeting, but took off in wake of the Bank signalling lift-off for the OCR at the end of Q3 next year and flagging the end of the LSAP remit by June 2022. Indeed, Nzd/Usd scaled the 0.7300 handle and Aud/Nzd cross retreated through 1.0650 even though the Aussie is holding gains vs the Greenback following firmer than forecast Q1 construction work completed that offset a dip in Westpac’s leading index for April. However, Aud/Usd ran into resistance just ahead of 0.7800 and will now be looking towards Q1 Capex and the breakdown for further impetus, while observing decent option expiry interest for the NY cut in the interim given 1.2 bn rolling off between 0.7750-40 and 1.1 bn from 0.7770-85.

- USD/GBP/CHF/CAD/EUR/JPY – There may be an element of intraday or short term jobbing rather than strictly technical impulses behind the latest Buck bounce as the DXY managed to hold above 89.500 again and pare losses off a slightly higher low compared to Tuesday, but other factors have contributed, including the latest dovish interjection from the ECB. Indeed, GC member Panetta went further than his peers in a speech containing rationale for delaying any decision about unwinding the pace of QE in Q3 when he noted a non-negligible appreciation of the Euro exchange rate to knock the single currency back down below 1.2250. Predictably, the ensuing Dollar rebound that lifted the index to 89.794 at one stage, rippled across to the remaining basket constituents, with Cable off peaks circa 1.4172, Usd/Chf firmer around a 0.8950 axis post-more dovish remarks from SNB head Jordan, Usd/Cad towards the upper end of a 1.2043-82 range and Usd/Jpy in the high 108.00 area again as the Japanese Government downgrades its official view of the economy amidst further contagion from COVID-19.

- SCANDI/EM/PM – Some payback for the Sek vs the Nok and Eur after an uptick in Sweden’s sa jobless rate and the Riksbank’s latest FSR revealing a brighter outlook, but risks to stability still deemed to be elevated. Conversely, the Nok may be deriving some underlying support from a mild bid in Brent and Q2 Norwegian oil investment forecasts showing increases in the current year and 2022, while the Cnh and Cny are going from strength to strength, partly on the back of a higher onshore fixing from the PBoC overnight (in fact the loftiest midpoint in almost 3 years) and the CSJ highlighting analyst predictions for more Yuan upside based on Usd weakness, China’s trade surplus and economic recovery. Elsewhere, the Try has regained a bit of composure after sliding to a fresh all time low near 8.4850 on Tuesday and the Zar continues to glow in the shadow of Gold that has topped Usd 1900/oz.

- RBNZ maintained policy settings as expected with the OCR kept at 0.25% and both LSAP and Funding for Lending Programme were also left unchanged, although it provided rate forecasts which pointed to a 25bps hike in September 2022 and to 1.75% by June 2024. RBNZ stated that it will maintain stimulatory monetary settings until it is confident inflation and employment targets are achieved, while it added that domestic economic activity has returned to near pre-pandemic levels and that the medium-term outlook is similar to scenario presented in February, but they remain cautious due to ongoing virus-related restrictions to activity. In terms of forecasts, the RBNZ sees the OCR at 0.25% in September 2021, 0.31% in June 2022, 0.49% in September 2022 and 1.78% in June 2024, while Governor Orr stated at the press conference that he feels comfortable using the OCR projection as a guidance but noted that the projection will only occur if the economy pans out as expected and Deputy Governor Hawkesby also suggested the important message is that OCR is not forward guidance. (Newswires)

In commodities, WTI and Brent front month futures have been choppy within relatively narrow bands with the former on either side of USD 66/bbl (65.81-66.43 range) and the latter around USD 69/bbl (68.44-69.17 range). Crude markets have been somewhat uneventful throughout the European morning after a relatively mixed Private Inventory report (Crude -0.44mln vs exp. -1.1mln), and ahead of the DoEs where the headline is forecast to draw 1.05mln bbls. Elsewhere, eyes remain on Iranian nuclear talks with the Iranian president recently noting that a common understanding has been found on some key points, but the US must take the first step – several officials hope for this to be the final round of talks. On this, Russian Deputy PM Novak hit the wires ahead of the June 1st JMMC/OPEC+ meeting, stating that the group will have to keep Iranian output growth in mind. Iran is currently exempt from the OPEC+ quotas amid US sanctions. Elsewhere, spot gold and silver remain buoyed by the recent Dollar, and yield declines. Spot gold reclaimed USD 1,900/oz status overnight (vs low 1,897/oz) before encountering a barrier at USD 1,910/oz in early European hours. Spot silver meanwhile surpassed USD 28/oz. Over to base metals, LME copper trades on a firmer footing and eclipsed USD 10,000/t to the upside, underpinned by reports that unions at BHP’s Escondida mine rejected the labour offer, thus paving the way for strikes. The Escondida copper mine is currently the world’s largest copper mine by reserve. Overnight, steel rebar futures in Shanghai extended on losses, whilst Singapore and Dalian iron ore futures fell over 5% apiece after China’s NDRC held a meeting with key enterprises in the steel industry.

US Event Calendar

- 7am: May MBA Mortgage Applications, prior 1.2%

- 10am: Fed’s Quarles Discusses Insurance Regulation

- 3pm: Fed’s Quarles Discusses the Economic Outlook

DB’s Jim Reid concludes the overnight wrap

It’s fair to say that we’re in a holding pattern for now. The inflationists have undoubtedly won the first round of the data war but central banks, and in particular the Fed, have won the early PR skirmishes. To expand on this you only have to see my CoTD yesterday (link here) to appreciate that US inflation surprises are almost off the charts and higher than ever before. Whether or not it’s transitory, economists have completely underestimated its strength so far. Markets though have for now preferred to be calmed by what has been a seemingly coordinated dovish response from the Fed. Their messaging has been excellent for calming markets. If inflation is transitory they have done a phenomenally good job. However here’s where round 2 will get interesting. If it isn’t transitory they have really boxed themselves in and they’ll need to make a disruptive big step change to the messaging. So an awful lot is at stake here.

This bigger theme played out on a very small scale yesterday as investors weighed up competing pressures to the economic outlook. On the one hand, weaker-than-expected economic data served to dampen sentiment following a recent run of very strong growth. But on the other, the reports raised the prospect that inflationary pressures were more likely to be subdued, helping to reduce a key concern of investors lately, whilst also raising the likelihood that monetary stimulus from the Fed would be maintained for longer. By the close of trade the negatives had marginally outweighed the positives, in turn sending the S&P 500 down to a small -0.21% loss, with the Dow Jones (-0.24%) and the NASDAQ (-0.03%) also experiencing modest declines.

Nearly 75% of all S&P 500 members saw their shares decline though in a broad selloff that was particularly hard on cyclical industries that have outperformed this year. Energy (-2.04%), Banks (-1.18%) and Material (-0.88%) stocks were among the worst performers as commodity prices and yields declined. European equities saw a similar dynamic with Basic resources (-1.73%) and Energy (-1.43%) shares the largest laggards as Technology (+1.29%) caught up to the US tech rally the day earlier after German markets came back from their Monday holiday. The STOXX 600 overall was basically unchanged (+0.03%) after registering its smallest daily move in nearly a month.

In terms of those releases, there were a number of data points that surprised to the downside out of the US. Firstly, the Conference Board’s consumer confidence index for May fell to 117.2 (vs. 118.8 expected), marking the first decline in the measure this calendar year. Furthermore, the previous month’s figure was revised down -4.2 points to 117.5, so a slightly less rosy picture of what went before, whilst the expectations gauge hit a 3-month low of 99.1. Separately, new home sales fell to an annualised rate of 863k (vs. 950k expected) amidst a big surge in prices, with the prior month similarly revised down -104k to 917k. And speaking of that price surge in housing, the Case-Shiller 20-city composite city home price index was up +13.3% year-on-year, the fastest annual increase since December 2013.

These data points were supplemented by comments from Fed Vice Chair Clarida reiterating much of what was said in last week’s release of the April Fed meeting minutes. He said that it’s possible that “in upcoming meetings, we’ll be at the point where we can begin to discuss scaling back the pace of asset purchases.” Clarida believes that pricing pressures will eventually “prove to be largely transitory”. The Vice Chair also noted that the macro data is likely to continue to be volatile, citing the most recent employment report, which “really highlights a fair amount of near-term uncertainty about the labor market.”

Though equities struggled for traction given the data, the reports were much better news for sovereign bond markets, which gained further ground as investors again moved to downgrade the pace of rate hikes over the next couple of years. Yields on 10yr US Treasuries fell -4.2bps to 1.559% in their 4th consecutive move lower, which is the benchmark’s lowest closing levels since April 23. European countries saw an even larger decline in yields, with those on 10yr bunds (-2.7bps), OATs (-3.8bps) and gilts (-2.5bps) all falling back. Once again, Greek debt was a relative outperformer, with the spread of their 10-year yields over bunds falling to a 12-year low of 1.07%.

Overnight in Asia, equities have posted gains for the most part, with the Nikkei (+0.29%), the Shanghai Comp (+0.29%) and the Hang Seng (+0.76%) all advancing. The exception to this pattern is the Kospi however, which has fallen -0.22%. Elsewhere, the New Zealand dollar surged against other major currencies (+1.12% vs USD) after the RBNZ brought back their projection of the Official Cash Rate, which pointed to a rate hike in the second half of 2022. In turn, this also led to a surge in yields, with those on the country’s 10yr debt seeing a +8.2bps increase this morning. US equity futures are pointing higher this morning, with those on the S&P up +0.29%.

Back to yesterday, and on the political front we got confirmation from the White House that President Biden would be meeting Russian President Putin in Geneva on June 16. This is their first in-person meeting since Biden’s inauguration and comes amidst tensions between the two sides over a range of issues, with the US having recently imposed fresh sanctions on Russian officials over the poisoning of Alexei Navalny. The meeting between the two will come directly after Biden’s attendance at the G7 summit in the UK from June 11-13, followed by a meeting of the NATO heads of State and Government in Brussels on June 14.

Staying on the political sphere, today also marks exactly 4 months until the German election in September, and the polls have recently begun to indicate that the Green Party’s surge in the polls has shown signs of stalling. That big increase followed the selection of Annalena Baerbock as the party’s chancellor candidate, but her popularity has shown signs of ebbing, which is probably to do with news stories from last week that she failed to report bonus payments that she’d received from her party. This isn’t necessarily a turning point, and the overall polling average from Bloomberg still puts the Greens on 23.6%, which is just shy of the CDU/CSU bloc on 24.4%. But that’s still a reversal from just 3 weeks earlier, when the same average put the Greens ahead on 24.8%, compared to the CDU/CSU’s 24.1%. As a reminder, our German economists’ baseline call is that there’ll be a CDU/CSU-Green government.

On the pandemic, we got the news yesterday that the Moderna vaccine was between 93% and 100% effective at preventing symptomatic Covid among 12-17 year olds, depending on whether you included very mild cases. In turn, this opens the prospect that the vaccine will soon join the Pfizer vaccine in being cleared by the US for younger age groups. Separately, the White House has announced that half of all American adults are now fully vaccinated. Elsewhere, the UK government also issued some revisions to their own guidance for 8 council areas where the Indian variant is spreading the fastest. They’re recommending that people should meet outside rather than inside where possible, and avoid travelling into or out of those areas unless essential. The new advice was actually published online on Friday, but was done without an announcement and only came to the attention of the wider media over the last couple of days. France is considering imposing travel restrictions on those coming and going to Britain following reports of the Indian variant. Elsewhere parts of Southeast Asia continue to struggle under the current wave of infections with Malaysia now seeing more per capita daily cases than India.

Looking at yesterday’s data, the Ifo’s business climate indicator from Germany for May rose to 99.2 (vs. 98.0 expected), which is its strongest level in 2 years. The expectations (102.9) hit its highest since April 2017, while the current assessment reading (95.7) reached its highest since February 2020.

It’s a fairly quiet day ahead now on the calendar, with the data highlights including French consumer confidence for May, and central bank speakers including Fed Vice Chair Quarles and the ECB’s Villeroy. Earnings releases include Nvidia, and the CEOs of a number of Wall Street firms will be testifying before the Senate Banking Committee.