Rabo: Is Someone Trying To Delay The Global COVID Recovery To Ram Through Even More Stimulus

By Michael Every of Rabobank

Yesterday’s Daily concluded with the question: “Is this a piece of your brain?” Sadly, I feel the need to start today’s with the same question. What else can one ask when our financial press are filling pages telling us Jeff Bezos is going into space? “Multi-billionaire does something expensive and irrelevant” might as well be the headline; or, I would settle for a Muppets-like “Bezos in Spaaaaaace”, which at least has the appropriate lack of gravity.

Meanwhile, we need to be talking more about uncomfortable “I” words:

“Inflation”, obviously. There is a lot of market discussion about it, and if it is really back or not; and some even address formerly-taboo issues like labor vs. capital. However, those who have been brave enough to take that big leap have only landed on a narrow pillar sticking up from a deep intellectual divide, not the other side. The next, more difficult jump is to admit one cannot address the labor issue without also addressing the free movement of goods, services, and capital (let alone people) – and the global supply chains built on their back. Until then, you are intellectually stuck between the solid ground of neoliberal “because markets” –with low inflation, high inequality, and “Bezos in Spaaaaaace!”– and Bretton Woods / national- conservatism / mercantilism / or international Marxism on the other side – which means higher inflation, lower inequality, less globalization, and very different supply chains. And that pillar in the middle is wobbly and won’t hold for long. (For our own take on an inflation framework, not model, and which tries to encompass these factors and more, please see here.)

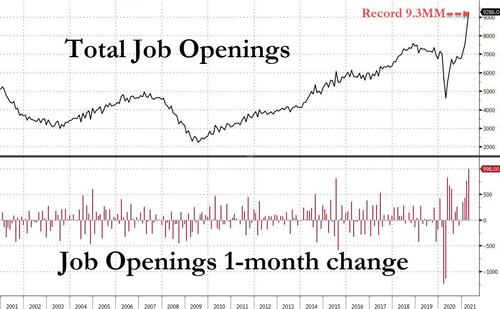

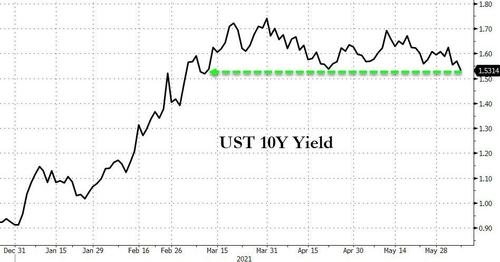

“Interest rates”, just as obviously. US Treasury Secretary Yellen says she backs slightly higher rates, which would apparently be healthy for the US economy. How many times has she forgotten this is not her job anymore? Could Mr Powell say he prefers a slightly lower fiscal stimulus, for example? The media seem indulgent of these repeated snafus removing the clear red line between Fed and fiscal. Meanwhile, market chatter is that Jackson Hole in late summer is too soon for the Fed to flag any tapering. Given the extended unemployment checkes won’t have run out at that point, US jobs growth will still be below expectations, so requiring said stimulus: there is some logic if you think about it. And months more of $120bn QE a pop for markets.

“Invermectin”, which is a cheap, safe, effective medicine for treating parasitic infections and inflammation. Repeated on-the-ground medical studies claim the drug is an equally cheap, safe, and effective part of a cocktail Covid-19 treatment that could help ensure a far faster global recovery from this pandemic. The fact that none of you have probably heard of it; that academics at the UK’s leading virus-research universities aren’t looking at it; that Twitter has frozen the accounts of some advocating for it; and that India just dropped it as a recommended treatment, all suggests either the data from the studies are flawed, or how we make decisions about such important matters is. (I am no doctor or scientist: but Bret Weinstein has firm views on which of the two is more likely.)

Of course, a faster *global* recovery from Covid would mean we wouldn’t need as much fiscal and monetary stimulus in the first place. Yet even so, perhaps we aren’t having the well-rounded “have we tried this?” discussions about the realities of the best ways to treat either inflation or inflammation.

“’International’ law”, which reflects China’s first of its kind anti-foreign sanctions draft law being proposed yesterday, with a vote expected soon. According to an expert quoted by the Global Times, the law “will deter foreign governments, notably the US and the EU, from resorting to long-arm jurisdiction,…if Chinese entities are hit with unjustified sanctions, the proposed law is supposed to crystallize actionable countermeasures against the foreign governments and institutions…expecting the legal effort to make up for losses that Chinese entities would suffer.”

The example of the Australian government’s decision to tear up Victoria’s Belt and Road agreements with China is given as a “wake-up call” for China to “broaden the extraterritorial reach of its own legislation.” In other words, the proposed law would have allowed China to impose countermeasures on Australia, or demand compensation, for Canberra following Australian federal law within its own territory – because it harmed Chinese interests. Of course, the US, and now EU and UK –and Hong Kong– extend their legal remits outside their geographical territory. Now China is going to join in – and in the opposite direction to the West’s legal moves. This potentially leaves Western firms damned-if-they-do and damned-if-they-don’t, which is a wake-up call for those who haven’t heard any of the alarm bells so far. It’s also another factor likely to play into supply-chains and inflation over time, even if mentioning it is as popular as Invermectin.

“Industrial policy”, given the US senate is expected to pass “The US Innovation and Competition Act of 2021” today, which includes $52bn for US-based semiconductor manufacturing; $80bn over five years for the National Science Foundation; a new office to oversee the development of technologies such as AI, semiconductors, quantum computing and biotech; to limit Chinese state funds flowing to US universities; to create a new State Department position to monitor and counter Chinese influence in international organizations; steps to strengthen US military alliances in the Pacific; to create a working group with the legislatures of nations in the Quad – Japan, Australia, and India; a ban on US officials attending the 2022 Beijing Winter Olympics; a declaration that China’s policies in the Xinjiang are genocide; and requiring the US to impose sanctions on anyone in China (not Russia) engaging in intellectual property theft or cyberattacks against the US. There is also more in it – and much still subject to last-minute change. Meanwhile, the US is also pushing ahead with the Blue Dot Network

Critics of the legislation point out that it has huge security holes in its proposals for a new 5G technology platform; and others that this is yet another big government boondoggle. However, it’s the clearest bipartisan signal yet that the US is serious about “extreme competition” with China – and it also looks likely to breach the terms of the proposed new Chinese law to prevent its interests being targeted. Hold on to your hats – and perhaps not your supply chains.

“Inverse?”, given 68 Republican members of the House of Representatives are sending a letter to the White House ahead of the US-Russia summit slamming President Biden for waiving sanctions on Russia’s Nord Stream 2 Pipeline; and Ukrainian President Zelenskiy claims US President Biden that he is opposed to Russia’s Nord-Stream 2 project; and US Secretary of State Blinken states that the recent sanctions waiver over the project “can be rescinded”, language that sounded like the US is OK with the pipeline being completed given it is a fait accompli,…but still perhaps doesn’t want it to actually be turned on(?)

But let’s forget about all this and return to “Bezos in Spaaaaaace”, where Bezos, his brother, a lucky lottery winner, Captain Link Hogthrob, First Mate Piggy, and Dr. Julius Strangepork are….

Tyler Durden

Tue, 06/08/2021 – 10:51

via ZeroHedge News https://ift.tt/3pvKXQ7 Tyler Durden