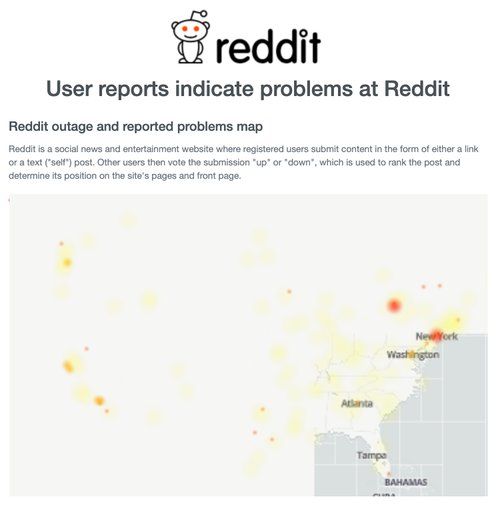

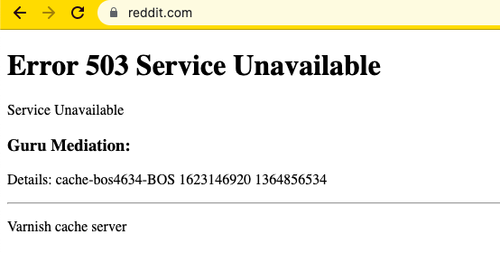

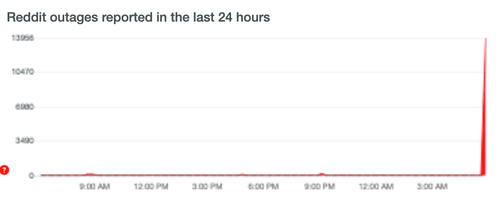

US equity futures suffered a violent airpocket shortly after 6am, sliding 20 points in minutes after news that a Fastly outage had sent many media and government websites offline in a repeat of last year’s Cloudflare fiasco, pushing traders to buy safe assets, but then rebounded just as quickly rising to session highs even as the dollar and Treasuries also rose. Nasdaq 100 contracts rebounded. The 10-year yield fell back to 1.55% area with focus turning toward Thursday’s blistering CPI report that may offer clues on how far the Fed can postpone a tapering of stimulus.

Fastly shares fall as much as 5.5% Tuesday morning in pre-market trading after its services went down, impacting websites across the internet including the New York Times, Reddit, and the U.K. government. It has since pared its losses to about 2.7%, after the software company said the issues that were impacting some of its services earlier had been identified and a fix is being implemented. Cyberstocks which moved on the news were FEYE +0.6%, CRWD +0.6%, SWI -0.4%, while other stocks also moving were AMZN -0.3%, CLDR -0.6%. Amusingly, NYT shares were up about 0.5% after the NYT website went down. Here are some of the other notable pre-market movers today:

- Apple (AAPL) gains 0.3% as analysts praised its Worldwide Developer Conference for small software changes that would improve the user experience, though some said these wouldn’t have a direct impact on sales and noted that the tech giant didn’t release any new hardware products.

- AMC Entertainment (AMC) climbs 4%, pointing to an extension of Monday’s 15% rally.

- Biogen (BIIB) slips 0.3% in premarket trading amid concerns on the pricing of its Alzheimer’s drug. At least five analysts upgraded the stock.

- Cyclerion Therapeutics (CYCN) soars 16% after company insiders, including its own chief executive officer, bought shares.

- Cryptocurrency-exposed companies like Marathon Digital (MARA) and Coinbase (COIN) slide in premarket trading Tuesday with Bitcoin and other digital tokens falling.

- Tesla (TSLA) rises 3% in premarket trading after the electric-vehicle maker reported a surge in May deliveries in China.

- Wendy’s (WEN) shares gain 8.3%, following a tout for the fast-food restaurant operator on Reddit. Other so-called meme stocks also higher.

- Stitch Fix jumped 16% after the clothing company projected revenue that topped analyst expectations.

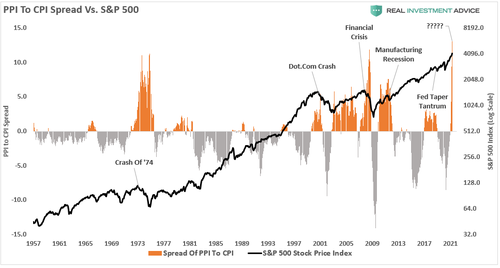

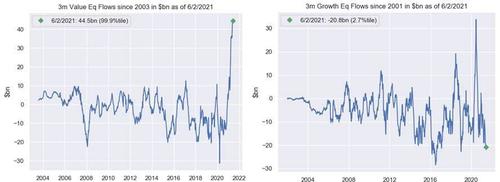

Fastly fiasco aside, US futures and global equities hovered near record highs, and Treasury yields have eased for three successive weeks. That suggests the Fed’s assurances are calming fears of a so-called taper tantrum for now. Yet on Tuesday, traders were exercising caution before the inflation data, helping the dollar post its first gain in three days. The upward momentum in markets came as the G7 nations reached a landmark deal on Saturday to back a minimum global corporate tax rate of at least 15%, lifting shares of technology giants such as Microsoft and Facebook as their future tax obligations become more predictable. At the same time, expectations that data on Thursday will show another jump in U.S. inflation could weigh on tech stocks this week, according to Ipek Ozkardeskaya an analyst at Swissquote.

“The market is mostly willing to believe the Fed in this theory of nothing but a transitory rise in inflation,” she said. “But with Biden’s huge spending plans, positive pressure on commodity prices, slow global logistics and worldwide shortages due to the pandemic, there is a chance that we see a more-persistent-than-what-the-Fed-expects inflation in the short run.”

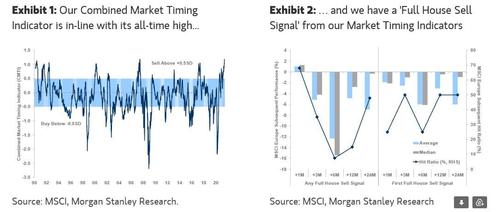

Stocks globally have mainly treaded water over the past two months. Investors are trying to gauge the downsides from potentially higher inflation and interest rates against the upsides of economic reopenings and continued massive government stimulus. “The next leg higher is likely upon us … with cyclicals expected to do better again versus defensives,” JPMorgan strategists led by Marko Kolanovic wrote in a report. “Despite peaking in some activity indicators, the market is likely to get comfortable that growth will remain significantly above trend in the second half, supported by both consumer and capex.”

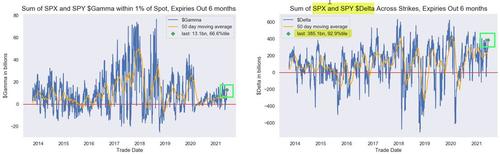

While Kolanovic being permabullish is hardly news, it is the case that the recovery in the world’s largest economy and the Fed’s continued dovish stance are supporting a risk-on environment, even as gains are punctuated by worries over inflation, high valuations and disparities in global vaccine rollouts. Forecasts for deepening price pressures have underpinned volatility this week as traders await clues to when the U.S. central bank will begin discussions on a tighter policy. “We advocate looking through near term market volatility and remain pro-risk, predicated on our belief that the Fed faces a very high bar to change its easy monetary policy stance,” BlackRock Investment Institute strategists led by Elga Bartsch wrote in a note.

The Stoxx Europe 600 Index rose for a third day, up 0.3%, led by travel and leisure companies. British insurance company Aviva advanced 3.5% to the highest in more than a year after Swedish activist investor Cevian Capital AB revealed it had bought almost 5% of the stock and planned to use its stake to target greater cost cuts and shareholder returns. Dutch telecommunications provider KPN dropped 2.9%.

European stocks ground higher after an uninspiring start with the majority of indexes eventually breaching Monday’s best levels. Eurostoxx 50 and FTSE 100 were up 0.3% with travel, tech and mining stocks outperform. Vol measures drifted lower with the V2X dropping toward May’s lows. Here are some of the biggest European movers today:

- Aviva shares rise as much as 3.8%, touching the highest since January 2020, after Swedish activist investor Cevian Capital AB revealed it had bought almost 5% of the company.

- Intermediate Capital gains as much as 7.6%, hitting a record high. The investment firm’s 2H performance was a beat across the board and its outlook is positive, Citi (buy) writes in a note.

- Nexi rises as much as 3.3% to the highest since Oct. 6 after Jefferies raises its price target on the Italian payments firm, citing its post-M&A organic growth potential.

- Windeln.de jumps as much as 104%, following a 133% jump on Monday, amid discussions on Reddit about the German online retailer for baby and toddler products.

- GEA Group falls as much as 5.2%, the most since Nov. 5, after Goldman Sachs downgraded the stock to sell, arguing long- term growth is being overestimated and the short-term outlook is clouded by cost concerns.

- Lufthansa falls as much as 4.4% after Goldman Sachs downgraded the stock to sell due to factors including corporate travel exposure (45%) and limited progress on structural cost cuts.

Earlier in the session, Asian equities dipped as losses in China and the technology sector held sway in a market searching for fresh clues. MSCI’s gauge of Asia Pacific stocks outside Japan rose 0.11%, following the path taken by its All-Country World Index which advance 0.1% on Monday, hitting its sixth record close in seven days. The regional benchmark was on track for its fifth straight daily move of 0.2% or less. Australia’s S&P/ASX 200 was up 0.32% while Japan’s Nikkei 225 edged up 0.35%, as the country revised first-quarter data showing the economy shrank at a slower pace than initially reported. Alibaba and TSMC were the biggest drags on the MSCI Asia Pacific Index, while Japanese drugmakers Eisai and Daiichi Sankyo cushioned the downside. Chinese stocks slid as Kweichow Moutai and other baijiu distillers declined amid concern about valuations and the prospect of local governments imposing consumption taxes. Vietnam’s main equity benchmark dropped nearly 3% while Indonesia’s fell more than 1%.

In rates, price action was muted with curves bull flattening mildly. Treasuries held gains after retreating from session highs reached in a burst of risk-off trading as multiple internet outages briefly spooked investors. A calm Asia session gave way to firming in bunds following data-packed European morning. BTPs widen to core with more than EU60 billion orders at Italy’s 10y syndication. The Treasury auction cycle kicks off with $58b 3-year note sale at 1pm ET. Ahead of the 3-year note auction, WI yield ~0.33% compares with 0.329% stop in May, a 0.2bp tail; cycle comprises 10-year note and 30-year bond reopenings Wednesday and Thursday.

In FX, the Bloomberg dollar index was little changed in a quiet morning for FX. GBP is the worst performer in the G-10 space with cable off 0.3%, finding support near 1.4129. The pound led declines and fell the most since Thursday on concerns the country’s exit from lockdown could be delayed and rising tensions between Britain and the EU. Norway’s krone led G-10 peers, reversing a loss versus the euro and rising above parity against the Swedish krona after Norges Bank’s regional network survey raised prospects for a central bank hike in September. Brussels is ready to consider tougher retaliatory measures if the U.K. government fails to implement post-Brexit obligations over Northern Ireland, according to an EU official. An announcement on the final step out of lockdown is due on June 14. The Australian dollar declined for the first day in three after a gauge of business confidence eased from a record high; bond yields slid for a second day. The yen fell from a more than one- week high versus the dollar after a government report showed Japan’s economy shrank less in the first quarter than earlier reported.

In commodities, oil prices lost more ground on Tuesday as concerns about the fragile state of the global recovery in demand for crude and fuels were heightened by data showing China’s oil imports fell in May. As a result, crude futures were in the red but off worst levels: WTI dropped is 0.5% lower near $68.89 having dropped as much as 1%. Spot gold edges lower, down ~$6 near $1,892/oz. Base metals are mostly in the green with LME tin up as much as 2.5%, outperforming peers. Bitcoin rebounded after dropping as low as $32,000 overnight, slumping to a two-week low, with some analysts pointing to the recovery of Colonial Pipeline Co.’s ransom as evidence that crypto isn’t beyond government control

Looking ahead, the ECB is due for its monetary policy meeting on Thursday, the same day U.S. consumer price index number will be released, potentially fuelling talks of tapering by the Federal Reserve. In Asia, China inflation data is due on Wednesday. “The start of a new week has not seen much by way of price action across all asset classes,” said Ray Attrill, head of FX Strategy at National Australia Bank.”It’s hard to avoid the sense the global markets are for the most part now simply lurching from one big event risk to the next with not a lot to see in-between,” he said.

To the day ahead now, and data releases include German industrial production and Italian retail sales for April, along with Germany’s ZEW survey for June. Meanwhile in the US, we’ll get the trade balance and job openings for April, as well as the NFIB small business optimism index for May. Finally, central bank speakers include BoE Chief Economist Haldane.

Market Snapshot

- S&P 500 futures little changed at 4,229.25

- STOXX Europe 600 up 0.3% to 454.90

- MXAP down 0.2% to 209.80

- MXAPJ down 0.2% to 702.90

- Nikkei down 0.2% to 28,963.56

- Topix little changed at 1,962.65

- Hang Seng Index little changed at 28,781.38

- Shanghai Composite down 0.5% to 3,580.11

- Sensex down 0.2% to 52,237.61

- Australia S&P/ASX 200 up 0.1% to 7,292.59

- Kospi down 0.1% to 3,247.83

- Brent Futures down 0.71% to $70.98/bbl

- Gold spot down 0.34% to $1,892.81

- U.S. Dollar Index up 0.18% to 90.11

- German 10Y yield fell 0.8 bps to -0.205%

- Euro down 0.14% to $1.2173

Top Overnight News from Bloomberg

- The EU will conduct three syndicated bond sales before the August summer break under the NextGenerationEU plan designed to help it finance a recovery program, according to a call the bloc held with investors

- The G-7’s tax deal raises the prospects of the G20 reaching a similar agreement in coming talks, according to Japanese Finance Minister Taro Aso

- ECB policy makers have all the evidence they need to keep in place their ultra-loose monetary stimulus when they meet on Thursday, thanks in part to their opposite numbers at the Federal Reserve

- Yields on government bonds might be agreeing with the Federal Reserve that price pressures are transitory, but they could also just be artificially low thanks to a constellation of arcane money market rates

- China’s sovereign bonds have defied expectations for a selloff all year but their day of reckoning may be getting closer. The amount of cash in the banking system has been shrinking, while local government debt sales are set to double this week, hoovering up more funds

- As the global economic recovery from the coronavirus gathers momentum, Japan looks to be standing still, while its currency goes backward

- European businesses are increasing investment in China and moving supply chains onshore after the quick recovery from the pandemic last year made China an even more important source of growth and profits

Quick look at global markets courtesy of Newsquawk

Asian equity markets lacked direction following a similar indecisive performance on Wall Street where the major indices closed mixed as the absence of any significant catalyst, had participants looking ahead to the key events later in the week including the ECB meeting and US CPI data. ASX 200 (+0.2%) was choppy after stalling at fresh record highs and with early advances in the index pared by weakness in mining names and financials, while mixed NAB Business Survey data also added to the non-committal tone. Nikkei 225 (+0.1%) was initially lifted following the revised Q1 GDP figures which showed a narrower than expected contraction to Japan’s economy, although the gains were then briefly wiped out with the index not helped by the recent currency moves and amid concerns of stealth tapering by the BoJ which refrained from ETF purchases throughout the whole of last month for the first time since Governor Kuroda began QQE in 2013. There was plenty of focus on Eisai which remained untraded but set to hit limit up amid a glut of buy orders after the FDA approved the ADUHELM drug for Alzheimer’s disease which earlier boosted shares in development partner Biogen. Hang Seng (-0.3%) and Shanghai Comp. (-0.5%) were choppy with initial upside limited by the continued China-related tensions with the G-7 expected to reference the Taiwan Strait into its summit statement and express concerns about human rights abuses against Uyghur Muslims, as well as the pro-democracy crackdown in Hong Kong. Furthermore, China was said to be making progress on legislation to counter US sanctions and reports citing Secretary of State Blinken also suggested the US is planning trade talks with Taiwan which is likely to add to the tensions with China. Finally, 10yr JGBs were rangebound amid the indecisive mood across the region and with some concerns of stealth tapering by the BoJ after it refrained from ETF purchases throughout the entire of last month, although there was some mild support following the mixed results of the 30yr JGB auction which showed a slightly higher b/c.

Top Asian News

- Li’s Bridgetown 2 SPAC Said in Talks to Merge With PropertyGuru

- Huarong Trading Dwindles in Onshore Bond Market as Bids Vanish

- China Bond-Selloff Fears Grow as Liquidity Begins to Tighten

- China Vows to Prevent Coal Fatalities and Blames Higher Prices

Major bourses in Europe experienced another lacklustre cash open with sideways action persisting throughout the early European hours and following on from a mostly downbeat APAC handover. The region thereafter adopted a mild but fleeting upside bias in conjunction with upward revisions to Q1 EZ GDP and a sub-par German ZEW – which was accompanied by constructive forward-looking commentary. US equity futures have also been drifting off throughout the morning but came under pressure with some pointing to the mass outages seen across several news vendors including the FT, Guardian, CNN, Reddit and New York Times among others are currently unavailable – which seemingly dented sentiment – but the breadth of the price action remains narrow. Sectors in Europe are mostly firmer with no stand-out bias nor theme. Banks continue to be pressured by the pullback in yields. Oil & Gas also lags amid sluggish crude prices. The upside meanwhile sees Travel & Leisure amid a surge in summer demand, whilst healthcare coat-tails on the State-side sectoral performance yesterday after Biogen shares soared on the FDA green-lighting its Alzheimer’s drug. In terms of individual movers, Aviva (+3.5%) is supported by Cevian Capital announcing a 5% stake in the group, suggesting that it should have a value of over GBP 8/shr within three years and more than double its dividend to GBP 0.45. British American Tobacco (+1.8%) rose after the Co. upped its revenue growth guidance to “above 5%” from the prior of “3-5%”. Meanwhile, Volkswagen shares (-1.1%) shares opened lower by around 3% with potential catalysts for the move including a Business Insider article about work councils getting more hands-on with bonus payments, alongside perhaps read-across from the earlier Apple EV battery source reports. However, the exact catalyst behind the move remains unclear.

Top European News

- Euro-Area Economy Shrinks Less Than Reported in First Quarter

- Aviva Gets New Activist Owner as Cevian Reveals 4.95% Stake

- BAT Lifts 2021 Sales Outlook on Growing Alternatives Demand

- EU, U.K. Head for Fresh Brexit Collision Over Northern Ireland

In FX, the Sterling and Yen remain the main G10 laggards with the former drifting lower in light of reports that the UK June 21st reopening could be delayed by a fortnight, as well as ongoing tensions with the EU over the Northern Ireland protocol. Technicals are also keeping the Pound under pressure – EUR/GBP tested and failed to breach 0.8600 to the downside in early hours in a move that coincided with touted stopped being tripped in GBP/USD at its 21 DMA around 1.4144, according to market contacts. In terms of nearby levels, the pair sees yesterday’s low at 1.4110 ahead of the psychological 1.4100 and with 1.4080 touted as major support. Up next, BoE’s outgoing Chief Economist Haldane is poised to speak at 14:00BST albeit at an Inequality workshop. Elsewhere, the JPY experienced weakness heading into the Tokyo fix overnight with some also noting of investment demand and speculative bargain-hunting. USD/JPY rebounded from its 50 DMA (109.17) and rose above its 21 DMA (109.30) to reside around the 109.50 mark which sees around USD 1bln in OpEx ahead of the NY cut.

- DXY – The broader Dollar and index remain on firmer footings with the aid of some overnight inflows as risk sentiment deteriorated, whilst losses in the JPY and GBP offer further tailwinds. The index clambered off its 89.953 low and again mounted its 21 DMA (90.093) to a current high of 90.181 ahead of yesterday’s 90.302 high. Looking ahead, the State-side docket remains light with US CPI (Thursday) the main highlight and as Fed officials continue to observe its blackout period.

- EUR, AUD, NZD – All relatively flat and mirroring Dollar action. EUR/USD came under gentle pressure just before the 1.2200 mark with some also citing sell orders at the psychological level – with the pair later dipping below its 21 DMA at 1.2177 to a current low at 1.2171. The Single Currency saw was unfazed by the upward EZ GDP revisions and below-forecast German ZEW print which was accompanied by some hopeful economic commentary. The Aussie and Kiwi remain contained by a barrage of nearby DMAs, with AUD/USD meandering around its 21 DMA at 0.7747 whilst its 50 and 100 DMAs overlap at 0.7727. NZD/USD is back under its respective 21 DMA (0.72222) whilst the 50 and 100 reside at 0.7182 and 0.7175 respectively.

- NOK – The NOK gained impetus on an overall optimistic Norges Bank Regional Network survey – which suggested that contacts expect substantial output growth ahead as the measures ease through summer. All-in-all, the report indicates that the Norges Bank’s policy normalization plans (which look for a rate increase around the end of this year) are on track as things stand. EUR/NOK dipped from its 10.08 high, through its 50 DMA (10.0688) to a current low of 10.5021.

In commodities, WTI and Brent front month futures remain subdued as the benchmarks largely moved in tandem to risk amid the absence of catalysts, and with the complex looking ahead to this week’s tri of oil market reports. WTI and Brent hit session lows of USD 68.50/bbl and USD 70.70/bbl respectively as APAC sentiment sourced, before trimming losses to trade around USD 69/bbl and 71.25/bbl at the time of writing as equities edge higher – . Aside from the sentiment-driven moves, news flow for crude has been light. Next up, the EIA STEO scheduled for later today will be eyed for commentary on demand heading into the Summer, whilst the agency’s Iran-related risks will also be interesting as JCPOA talks are poised to restart this Thursday. Elsewhere, spot gold and silver have been trundling lower as precious metals continue to tackle the lower yield environment with a perkier Dollar intraday. Spot gold trades sub-1,900/oz (vs 1,903/oz high) but still above its 21 DMA at 1,877/oz, whilst spot silver inches closer towards UDS 27.50/oz from its 27.97/oz peak. Elsewhere, LME copper has trimmed losses as overall market sentiment improves, but prices remain below USD 10,000/t as the upside is capped by US-Sino tensions. Dalian iron ore futures fell for a third straight session overnight, with some citing the decline in China’s inventory of construction steel rebar – which slowed sharply last week – indicating easing demand.

DB’s Jim Reid concludes the overnight wrap

Since we went to Legoland last week there are now hundreds of bits of small Lego pieces strewn around various parts of the house and from my home office I keep on hearing yelps and cursing from downstairs as my wife treads barefooted on yet another piece. It kept me very entertained on a dull market day yesterday even if marketing the inflation piece kept me busy.

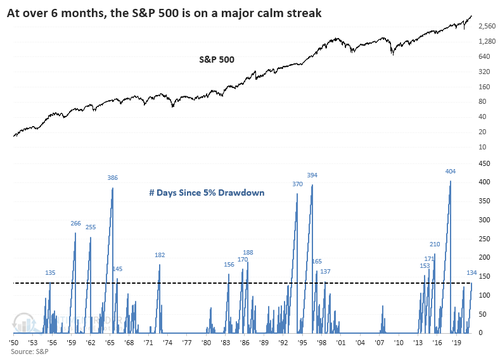

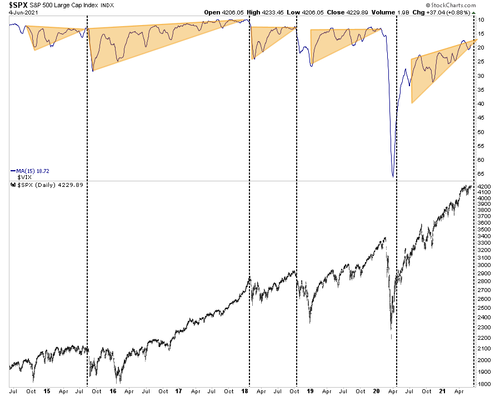

Indeed markets have felt a bit like August over the last 24 hours. If they feel the same way after Thursday’s US CPI then the Fed will surely be able to crack open the champagne ahead of next week’s FOMC. In terms of the specific moves, Europe’s STOXX 600 (+0.22%) edged to another new record whilst the S&P 500 fell back -0.08%, though that still left the S&P less than quarter of a per cent away from its all-time closing high a month ago. It’s now kept within a 4% band for the last two months now. The last time the S&P 500 traded within such a 4% range for two months was early-October 2018.

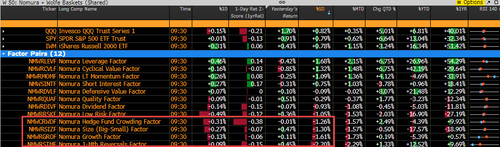

Cyclical sectors underperformed, with materials (-1.23%), financials (-0.63%) and industrials (-0.69%) weighing on the S&P, whereas the NASDAQ gained +0.49% on the back of biotech (+1.13%) and media (+0.62%) stocks. The former was driven primarily by a record +38.34% rise in Biogen Inc., which received FDA approval for the company’s new therapy to treat Alzheimer’s disease. Lower commodity prices weighed on European stocks with basic resources (-1.61%) and energy (-0.25%) companies among the largest laggards, while the day’s gainer were led by autos (+0.88%) and consumer products (+0.79%)

There was marginally more action in sovereign bond markets, where yields moved higher on both sides of the Atlantic. US Treasuries lost ground following Treasury Secretary Yellen’s Sunday comments that a higher interest rate environment would “actually be a plus for society’s point of view”, and 10yr Treasury yields were up +1.5bps to 1.569%. But it was noticeable that the rise was entirely driven by higher real yields (+3.6bps) rather than inflation expectations (-2.2bps). Indeed, US10yr breakevens closed at a five-week low yesterday of 2.40%, which is over 16bps beneath their 8-year high a few weeks ago and just shows that investor concern over the inflation issue has become much less acute as the month has gone on since that last CPI release. Separately in Europe, yields on 10yr bunds (+1.5bps), OATs (+1.9bps) and BTPs (+4.1bps) all moved higher.

We’ll have to see if that more relaxed attitude on inflation lasts past Thursday, but one of the drivers of inflationary pressures lately has been higher commodity prices, with Bloomberg’s Commodity Spot Index closing at its highest level in nearly a decade on Friday. Nevertheless, the index fell back slightly yesterday with a -0.55% decline, as both WTI (-0.56%) and Brent crude (-0.56%) oil prices lost ground, whilst the industrial bellwether of copper (-0.06%) fell back as well. Commodities broadly lost ground even as the dollar index fell -0.21% on the day.

Overnight, Asian markets have erased early gains to trade mostly flat to lower. The Nikkei (-0.16%), Hang Seng (-0.35%), Shanghai Comp (-0.51%) and Kospi (-0.04%) are all lower. In general, commodity related sectors like materials and energy are leading the underperformance. Futures on the S&P 500 (+0.05%) and the Stoxx 50 (-0.02%) are fairly flat. Elsewhere, Bitcoin is trading down -4.58% and sub $33k this morning after yesterday’s -4.23% move lower. In terms of overnight data, Japan’s final Q1 2021 annualised GDP printed at -3.9% qoq (vs.-5.0% qoq) and April labour cash earnings came in at +1.6% yoy (vs. +0.8% yoy expected) with previous month’s reading revised up to +0.6%yoy from +0.2% yoy.

Turning to the pandemic, the news has continued to brighten at the global level, with the growth rate of weekly cases now at its slowest since mid-March, whilst cases in the US are rising at their slowest pace since March 2020. In Asia, the tide is also turning for India with the country reporting sub 100k daily cases for the first time in over two months. Most states in India have now laid out a plan to embark on a graded reopening. In the UK however, there have been continued signs of rising cases, with the numbers having risen by +53% compared with last week (albeit from low levels). The all-important question will be how this translates into hospitalisations and deaths now that 53% of the adult population are fully vaccinated, and there’ll be intense focus on those numbers given that the government are expected to outline on Monday what they’re going to do about the potential full easing of restrictions on June 21. The Times is reporting that a two week delay is being considered by the government.

Separately in India, it was announced by Prime Minister Modi that all adults would be vaccinated for free from June 21. In Italy, the government announced a goal of vaccinating 80% of the country’s population by September. This plan was helped by news that Moderna applied for authorisation to make their vaccine eligible for 12-17 years olds in the EU, after having already started the approval process in the US and Canada.

There wasn’t much data to speak of yesterday, though German factory orders in April fell by -0.2% (vs. +0.5% expected). Lower domestic demand drove the decline, having fallen by -4.3%, whereas foreign orders were up +2.7% on the month.

To the day ahead now, and data releases include German industrial production and Italian retail sales for April, along with Germany’s ZEW survey for June. Meanwhile in the US, we’ll get the trade balance and job openings for April, as well as the NFIB small business optimism index for May. Finally, central bank speakers include BoE Chief Economist Haldane.