Authored by Alasdair Macleod via GoldMoney.com,

A number of events are coming together which are set to push gold prices higher. Besides a combination of continuing inflationary policies and massive future budget deficits undermining the dollar, by closing down derivative market activities new Basel 3 regulations appear set to deflect some demand into physical metals. Furthermore, liquidity in gold markets will contract, potentially making prices more volatile

This article looks at how these developments will affect the undeclared but very real financial and propaganda war being waged by America against China.

China is moving on, enlarging its own middle class which will benefit from a stronger yuan, much as the German and Japanese economies did between 1970—2000. Having dominated economic developments until now, the export trade is becoming less important. With this dependency lessening, the argument in favour of a coup de grace against the dollar by China revealing its true gold position is increasing.

In this article, China’s undeclared gold reserves are quantified, and we can be confident that China has at least 20,000 tonnes “off balance sheet”. For China to openly declare her gold position always was her final, almost nuclear option in the financial war waged against her by America. Unwittingly, by diverting demand from paper gold to physical bullion, Basel 3 may have brought forward that day by default.

Introduction

The imminent introduction of Basel 3’s net stable funding ratio is going to have a major impact on the global banking system, and it is a reasonable assumption that government agencies concerned with geopolitical implications will be considering it from that point of view. And nowhere is this more important than for gold, and by implication the dollar’s unrivalled hegemony.

With China having restricted credit expansion for about a year, its economy is in a different position from that of the major Western economies. The US, the EU, Japan and the UK have continued to give credit free rein with zero and negative interest rates. With China at a different stage of its credit cycle, strains are bound to surface across the foreign exchanges. China’s yuan is strong, having risen by 10% against the US dollar over the last year, and it is likely to continue to rise.

It is hardly surprising that the Chinese are warning the West about financial market bubbles. While there may be an element of crowing by China’s monetary authorities about how wrongfooted their Western counterparties have become while they themselves acted against price inflation early, they are correct. I devoted last week’s article to the consequences of ignoring the threat of rising prices, primarily the outcome of ultra-loose monetary policies.

It is worth noting that statements by the Chinese about the US and vice-versa are in the context of an on-going financial conflict. So far, China has survived all US attempts to destabilise it, having successfully deployed the Sun Tzu tactic of bending with the wind. But Sun Tzu also warned that there is no instance of a country having benefited from prolonged warfare. At some point and when the time is right, China must be prepared to take the initiative and inflict a final financial defeat on its aggressors. Perhaps the Basel 3 move will trigger the event for her by driving the dollar price of gold higher, destabilising the dollar.

Furthermore, China has always understood that relying on export surpluses to America to drive her economy was a transitory phase because of the likely kickback, which is what happened under President Trump.

As long-term thinkers and with their regular five-year plans the Chinese have consistently shown an objective of self-reliance. Following a transitory period based on the manufacture of cheap exports, the vision has been to develop a large non-agricultural middle class acting as a consumer base with her own infrastructure and technological development. And rather than depending on trade with a belligerent America, China’s natural trade partners are the nations of the Eurasian land mass.

It is to be expected that a growing middle class will reduce the nation’s overall propensity to save, and all else being equal China’s trade surplus would then diminish. Admittedly, a reducing trade balance is also dependent on the governments of China’s export markets keeping control over their budget deficits — a discipline sadly lacking in China’s largest trade counterparties.

Other than the trade position, the long-term vision is in sight, which means that the loose monetary policies that were central to getting to this point in China’s evolution are no longer necessary and are now being reined in.

When the Chinese observed the Fed going all-in on inflationary financing with zero interest rates and record QE last March, it did not take them long to respond. Their analysis would most probably have been that the dollar would rapidly lose purchasing power, undermining its credibility as the world’s reserve currency. It was something the Chinese have long wanted, seeking to replace the dollar for its own trade with the yuan. But the more immediate consideration is that China’s trade surplus with America will increase significantly, mirroring the US budget deficit as so-called savings are unwound, potentially leading to yet more trade friction.

March 2020, when the US stepped out on the road to hyperinflation, was therefore time for a change in China’s economic strategy. She has graduated towards an economy which, despite intended greater consumer spending, will remain savings-driven and characterised by a strong currency, like Germany and Japan were in the seventies and into the late nineties. A stronger yuan offsets some of the commodity price rises due to dollar weakness. A stronger yuan increases the standard of living and personal wealth of the blue-collar worker, and that will be vital if the Communist Party is to retain its customary control. Marginal export producers will suffer, but they can be encouraged to redeploy their capital resources towards serving domestic markets.

Western analysts in thrall to neo-Keynesian inflationism fail to understand what China is doing and have missed the point entirely. But as the US with its weakening dollar drifts further behind China, the geopolitical tensions will increase. And it is here that China must be considering how to play her trump card: the implementation of sound money policies so that the yuan becomes the trading currency of choice for all Asia, the Middle East and Africa. In the process, with respect to the ultimate sound money, gold, we will obtain answers (which we know in advance anyway) to the following questions:

-

Why did China delegate to the Peoples bank of China a free run between 1983 and 2002 to acquire gold and silver on behalf of the state before permitting the people to buy any?

-

Why did the state then run an advertising campaign on TV and elsewhere encouraging the population to buy gold?

-

Why did the state invest heavily in gold mining to the extent that China has become the largest gold mining nation by a country mile?

-

Why has the state retained a firm monopoly on all gold and silver refining?

-

Why does the state retain strict control over the vaulting system for bullion?

-

Why does the state retain control over the Shanghai Gold Exchange monopoly through the PBOC and not permit the establishment of rival exchanges?

-

Why does the state permit the import of gold and gold doré but bans all gold exports? (Chinese refined bars are hardly ever seen outside China — the only permitted exception is limited supplies to Hong Kong, most of which is turned into jewellery for sales-tax-evading day-tripping mainlanders) And,

-

Why has the state appeared to have set out to take control of the global market for physical bullion?

There is every indication that there has been stockpiling of gold, off balance sheet, and not part of China’s official reserves. Sooner or later, China must lift the curtain on why it has placed such importance on gold, because the imminent demise of paper gold will hand her enormous power. We cannot know how much she has actually stashed. But by judging gold and money flows since 1983 we can estimate its scale.

Estimates of monetary gold in 1983 and China’s strategy to 2002

In order to gain an approximation of the quantities of gold China is likely to have acquired, we need to recognise her position in 1983, when the PBOC was appointed with the sole authority for acquiring and managing the state’s bullion. The year before, China had adopted a new post-Mao constitution, and Deng Xiaoping formalised his emergence as the new dominant executive leader.

Following Mao’s death in 1978, Deng presided over the country’s recovery from the former’s disastrous economic policies. The path he chose was to embrace economic liberalisation on American lines, instead of remodelling Chinese communism on that of the Soviets, which finally collapsed six years later. Initially, America welcomed this development, and her corporations led the way with inward investment into designated free trade zones. By 1983, the direction of economic liberation was well established, and the leadership under Deng began to consider the time when growing exports, coupled with inward investment flows would lead to permanent balance of payments surpluses. What was needed was a comprehensive foreign exchange policy.

In accordance with Marxist philosophy, economic professors at China’s universities at that time unilaterally condemned capitalism and predicted the fall of capitalistic economies and the collapse of their currencies. Coupled with longstanding Chinese monetary tradition, that sound money was only gold and silver, the new foreign exchange policy included the sensible precaution of accumulating bullion, paid for out of growing foreign currency balances. In this, the Chinese trod a well-worn path. Post-war Germany had invested some of her surplus foreign exchange earnings in gold. In the seventies and early eighties, Arab nations similarly hoarded some of their oil revenues in bullion. Consequently, “Regulations of the PRC on the control gold and silver”, appointed the Peoples Bank of China with sole responsibility for the state’s gold and silver accumulation, and were promulgated on 15 June 1983.

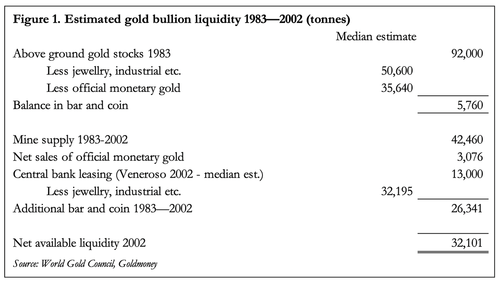

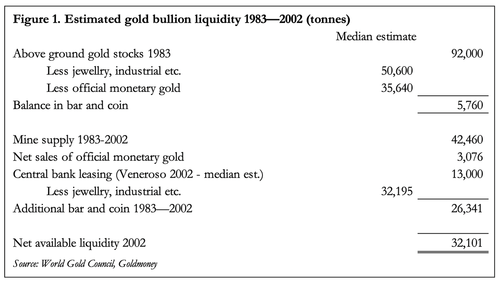

At that time, total above-ground global gold stocks were reckoned to be 92,000 tonnes, of which between 50%—60% was believed to have been non-monetary, mainly jewellery but with growing industrial usage. The balance can be deemed to include official monetary reserves, which totalled 35,640 tonnes. That left “liquidity” in bars and coin held privately at between 1,160 and 10,360 tonnes. So, on the most optimistic assumptions, in 1983 there was a pool of about 10,000 tonnes available for patient buyers. A median figure of 5,760 tonnes (45% of 92,000 less official gold reserves) is more likely than either extreme and will form the basis of our calculations. We will then consider a period of gold acquisition by the Chinese state over nineteen years to 2002 following the introduction of the regulations.

So as to not drive prices up against itself, China would have to acquire its gold secretly. Furthermore, in discussions with the Americans, if the subject was raised, we can be sure that Deng and his team would have been discouraged from accumulating gold, because of the threat to dollar hegemony. Clearly, secretly acquiring sufficient gold as part of its overall reserves in such a tight market was not going to be easy, and it would have to be stored outside the capitalistic dollar-based monetary system.

The Chinese were fortunate in their timing. Having peaked in 1980/81, gold had entered a deep and prolonged bear market which endured for all that time, making the acquisition of bullion easier. Mine supply was added to above-ground stocks, and by 2002, central bank leasing had supplied additionally anything between 10,000 and 16,000 tonnes, according to Frank Veneroso, an analyst who did valuable work uncovering this activity. Using median estimates of the ranges for other uses, we can therefore derive the table in Figure 1.

At first glance it comes as no surprise that there were substantial quantities of gold accumulating during a bear market, which ran from 1981 to 2002. This was mainly due to accelerated mine supply. But given that was the case, why was it that demand was so great that between 10,000 and 16,000 tonnes of leased central bank gold was absorbed by the market, and that supplies continued to be tight? Clearly, there was a very large buyer of bullion in the market absorbing all this gold and central bank leasing.

There is further evidence that that buyer was the Chinese state acting secretly, in China’s other gold-related activities. Having liberated its economy, Deng maintained a firm grip on gold, and his successor, Jiang Zemin, only permitted citizens to acquire gold in 2002, when the Shanghai Gold Exchange was set up for the purpose under the aegis of the PBOC. Clearly, the state had reached its gold ownership target.

At contemporary prices and taking into account an approximate ten per cent allocation to gold from foreign exchange inflows between 1983—2002, we get a ballpark estimate that the state probably accumulated 20,000 to 25,000 tonnes. In India, the Gold Control Act of 1968 had been repealed in June 1990, allowing Indians to import gold legally, which would have reduced gold liquidity in the West. By 2002 India had imported a total of 8,467 tonnes. Subtracting that from the total liquidity recorded in Figure 1 above of 32,101 tonnes, and we get 23,634 tonnes, remarkably close to our estimate of China’s state accumulation of between 20—25,000 tonnes. Of course, this is predicated on physical liquidity in Western markets remaining tight, which given the requirement for central bank leasing to provide extra liquidity we can confirm was the case.

Beyond some informed sleuthing, we have no information as to how much gold the Chinese state actually accumulated by 2002, other than to conclude that by then she must have accumulated a sufficient quantity of bullion relative to her prospective national wealth. The fact that she then encouraged her citizens to accumulate gold for themselves is further circumstantial evidence that this must have been the case.

Since 2002 and up to 2020, Chinese mine output is estimated to have been 6,200 tonnes. Based on delivery withdrawals from SGE vaults, over the same period the Chinese public took possession of over 18,000 tonnes. Therefore, gold was migrating from Western vaults into China in huge quantities, despite a sharp bear market between September 2011 and December 2015, when the price fell 45%. Anecdotal evidence of old LBMA bars of less than the current .995 standard being delivered to Swiss refiners for recasting into .9999 1 kilo bars confirms. Between just 2012 and end-2015, the duration of the bear market when the gold price fell from $1925 to $1048, 8,033 tonnes were delivered out of SGE vaults into public ownership while China’s mine output totalled just 1,723 tonnes. So, despite the dramatic fall in prices, Chinese public demand for imported gold continued uninterrupted.

Again, China took advantage of Western liquidation to accumulate large quantities of gold. This time, the addition was primarily an allocation to jewellery rather than monetary hoarding.

The American stance on gold

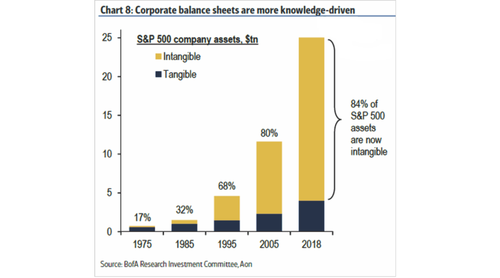

Since the end of the Bretton Woods agreement in 1971, the US has promoted a policy of dollar hegemony, suppressing any monetary rivalry from gold. Either deliberately or accidently, it has encouraged the expansion of synthetic supply in the form of futures markets and has not objected to London’s role in developing a remarkable forward OTC derivative market. Regulated and unregulated balances of paper gold have grown to the equivalent of over 11,000 tonnes, according to the Bank for International Settlements OTC statistics and the Commodity Futures Trading Commission’s figures for the gold swap category of trader.

The effect of gold’s paper supply has been to soak up demand which otherwise would have only been satisfied by buying physical bullion. It has also kept other commodity prices suppressed, benefiting consumers at the ultimate expense of producers. Like all other commodities, gold is priced primarily in dollars, and the dollar itself has benefited from foreign demand because it is central to expanding foreign trade, as well as having its reserve status. Indeed, the dollar’s Triffin dilemma has meant that inflationary US policies have supplied the world’s demand for dollars, to the extent that foreign governments and private sector entities now possess dollar-denominated financial assets and bank deposits totalling some $30 trillion — 150% of US GDP.

The dollar’s hegemonic status has served the US government well since 1971. But the world moves on. Central to the post-Bretton Woods policy was that oil-producing Saudis would always accept dollars for their oil. Today, Saudi Arabia no longer sells oil to America. Including gas, Russia is now the world’s largest energy exporter — another financial enemy. The EU, collectively now a rival to the US, is creating its own diplomatic identity. And China and Russia cooperate with each other in the Shanghai Cooperation Organisation to bring under a collective roof 40% of the world’s population.

The downside to Triffin is rarely mentioned, but clearly, the US with its dollar hegemony is now vulnerable to accidents. Yet the politicians are blithely debasing the dollar at a frightening pace, while the world watches, with $30 trillion riding on the outcome. And it appears that an accident is about to happen in the form of bank regulations brought in by the new Basel 3 regulations. Under these regulations all banks will adopt a new method of calculating lending risk. They will apply a Net Stable Funding Ratio, with the objective of ensuring counterparty risk is contained by banks being forced to match their liabilities to their asset maturities.

Briefly, a consequence of the NSFR is that any bank operating in commodities or running an uneven derivative position bears a funding disadvantage, making these lines of business uneconomic. With respect to gold, they will effectively close down the London bullion market, virtually admitted in writing by the LBMA, and because the Comex gold contract Swap category is populated with the same LBMA bullion banks, that will be similarly affected.

The effect of defusing demand for gold, silver and other commodities by the expansion of paper markets is coming to an end. People with unallocated gold accounts will find they have lost their exposure to the gold price, and some of them are likely to seek physical exposure instead. The only problem is there is very little physical available — China and Russia are back in the market — and therefore the prices of gold, silver and even copper and energy are likely to rise as a consequence of the Basel 3 regulatory changes.

The dollar is set for a mighty fall

The other side of a rising gold price is a falling purchasing power for the dollar. And it is unlikely to be restricted to gold. The signal from a strong gold price to foreigners holding $30 trillion of dollar denominated financial assets and deposits will become clear: the sucker is going down. Foreign liquidation will undermine financial values and dollar interest rates will have to rise, undermining them further. What price the gold-dollar exchange rate then?

The balance of power in the financial war between America and China will have shifted significantly. The assessment the Chinese will make includes their view on President Biden and how his administration will react. They probably think of his administration as more predictable than that of his predecessor. But the Democrats subscribing to woke agendas are a signal of fundamental weakness and a lack of firm political direction. And as long as the war remains financial, the US military complex will remain on the side-lines.

There is little doubt that the demise of gold and silver paper markets is set to push dollar prices higher. It could be that China takes the view it is better to watch the Western financial system disintegrate while it learns to love gold again. Alternatively, it could take the view there is no better time to kick its opponent when it is down. It will probably depend on how far China’s plans are developed with respect to its own self-sufficiency.