Dollar & Bond Yields Plunge To End Meme-orable Week

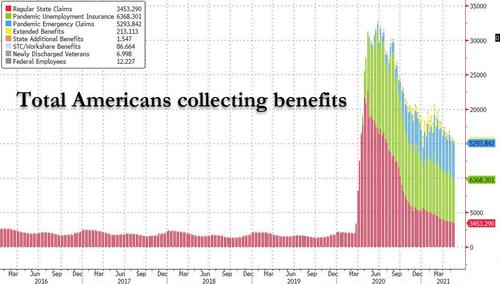

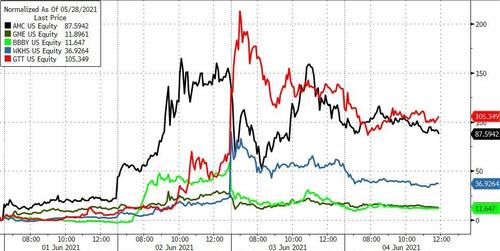

The headline grabber for the week was the return of the meme-stock-mania from January with Reddit Rebels sending heavily-shorted stonks “to the moon”. This was the biggest weekly gain since the last week of January for the Reddit shorts…

Source: Bloomberg

While GME sadly did nothing, the attention shifted to AMC and GTT this week…

Source: Bloomberg

Was this the vinegar strokes of the exuberance?

Today saw Nasdaq panic bid higher relative to the majors…

Which lifted big-tech stocks back in line with the rest of the majors on the week with a 0.5%-ish gain…

Today’s shift reverted the Russell 2000 / Nasdaq 100 ratio…

Energy stocks dominated the week’s performance with Healthcare and Consumer Discretionary the odd couple at the bottom of the barrel…

Source: Bloomberg

Thanks to a huge short position…

Don’t sell them size until you can see their eyeballs bulging out from their heads.

Because now, uous can’t leave. https://t.co/WM1Suw95DT

— ZeroHedge⚙️ (@govttrader) June 4, 2021

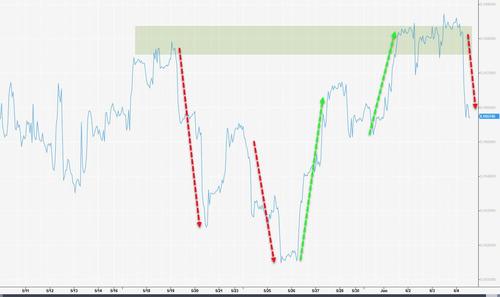

Treasury yields plunged today across the curve and ended lower on the week (despite stocks being higher also)…

Source: Bloomberg

With 10Y Tumbling back below 1.60%…

Source: Bloomberg

That is the second lowest yield close since early March…

Source: Bloomberg

The dollar was clubbed like a baby seal today after its biggest daily gain in 9 months yesterday. That reversal – at key levels from May – shifted the dollar back to unchanged on the week…

Source: Bloomberg

After an ugly weekend, cryptos rallied back to end the week higher with Ether up around 12% and Bitcoin up around 5%…

Source: Bloomberg

Commodities were mixed this week with PMs suffering a small loss and crude and copper notably divergent…

Source: Bloomberg

Gold resurged today but was unable to get back up to $1900…

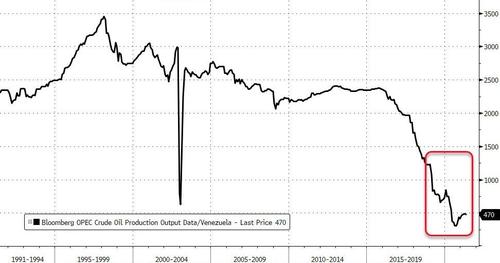

WTI soared this week to close above $69 for the first time sinece Oct 2018…

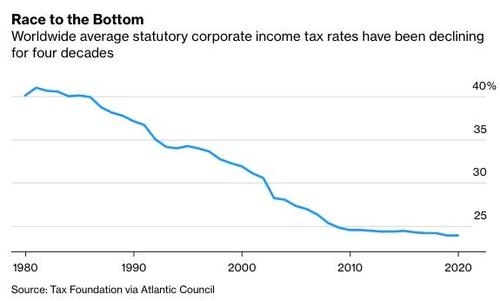

Finally, we are going old school with a look at what Ed Yardeni’s infamous ‘Stock Market Indicator’ says about the current state of stonks right now. The indicator – based on consumer confidence. commodities, and jobless claims – had been correlation-almost-1 to the moves in the broad equity market until around Q1 2018, signaling downside decoupling… then again towards the end of 2019… and now, the fundamentals-based indicator is entirely decoupled from the ‘reality’ of stocks…

Source: Bloomberg

And given the huge stagflationary impulse, we wonder which way the jaws will snap shut…

Source: Bloomberg

Tyler Durden

Fri, 06/04/2021 – 16:00

via ZeroHedge News https://ift.tt/3clMClI Tyler Durden

Removed tweet

Removed tweet