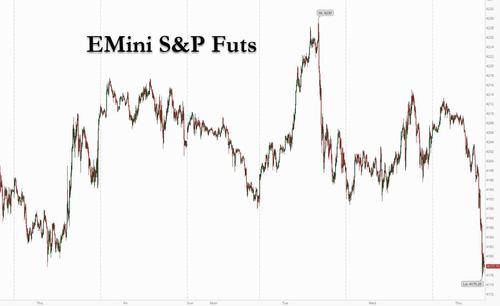

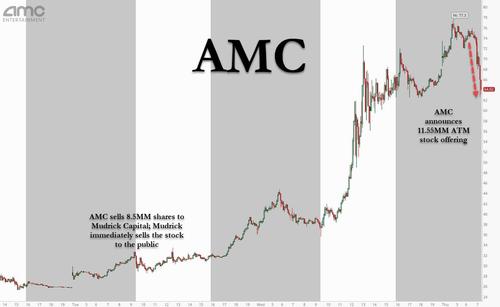

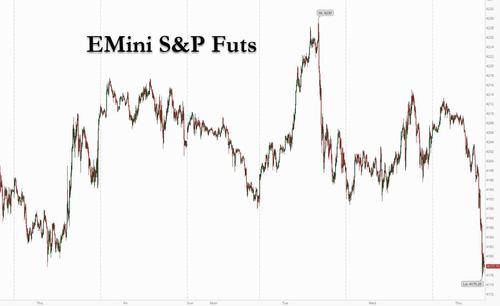

Futures were already looking a shaky when they took a hit lower after news that Russia would cut the dollar from its sovereign wealth fund, shifting to euros, yuan and gold instead in an attempt to reduce exposure to U.S. assets amid threats of sanctions. . They then slumped even more on the perfectly predictable news that AMC would offer 11.55mm shares in an At The Market offering, with the Emini sliding 0.6% to 4,175 after trading around 4,210 for much of the overnight session. Nasdaq futures were hit even harder, dropping 1% even though the broader risk-off mood did not help TSY yields which rose modestly, while the dollar barely dipped from its upward trajectory even as Bitcoin rose again, approaching $40,000.

Despite the hit to AMC following news of the equity offering, the stock still remains green on the day after soaring 95% the previous day, and although we saw a tremendous meme stock rally, it is now fading fast.

After our post that Workhorse was the most shorted Russell 2000 name, the company soared earlier in premarket trading, rising as much as 30%, the gain has now been cut to just 10%; another meme favorite stock BlackBerry was up 6.2%. Other meme stocks including Express -0.2%, Koss -12%, Bed Bath & Beyond -13% and PetMed Express -11% fell in premarket after climbing Wednesday. Some pot stocks also rise, including Tilray +6.8%, Sundial Growers +13% and Canopy Growth +0.8%.

“Frothiness it seems is there, particularly on the retail side, which may be part of the caution being seen in the wider stock market ahead of Non-farm Payrolls on Friday,” said Tapas Strickland, economist at National Australia Bank.

Here are all the notable premarket movers:

- AMC Entertainment Holdings Inc. (AMC) erases its premarket rally and falls after the company said it plans to sell up to 11.55 million of its common stock to repay debt and finance future acquisitions.

- C3.ai shares (AI) fall 10% in premarket trading on Thursday, after the artificial-intelligence software company reported fiscal fourth-quarter results and gave an outlook that failed to reassure analysts about its growth prospects.

- Conn’s shares (CONN) climb in premarket trading after the specialty retailer reported adjusted earnings per share and net sales for the first quarter that beat the average analyst estimate.

- GTT (GTT) soars in U.S. premarket trading, extending Wednesday’s 57% leap.

- Medtronic (MDT) to Stop Distribution and Sale of HVAD System, according to a press release. Shares decline in early New York trading.

- Splunk (SPLK) analysts remain largely cautious on the infrastructure software company after it gave an outlook for fiscal second-quarter annual recurring revenue that was below expectations. Several firms are lowering their price targets, and shares are down 5.1% in premarket trading.

- Tilray (TLRY) rises in U.S. premarket trading after Cantor Fitzgerald upgraded the pot stock to overweight from neutral.

European stocks dipped 0.6%, and were trading at session lows. Here are the biggest movers:

- Hiscox shares gain as much as 4.3% as the firm announces a reinsurance agreement with Enstar. The pact should be supportive of earnings stability, Morgan Stanley said in a note.

- Saint- Gobain jumps as much 4% to the highest since January 2008 in Paris trading, after the building materials maker said operating margin in 1H 2021 should reach a record.

- Nokia extends its winning streak to a third day, gaining as much as 3.9% to a four-month high, as good 1Q results plus signs of contract momentum imply the network equipment maker is at an inflection point, Liberum said, highlighting mobile networks in particular.

- Pennon rises as much as 5.1%, hitting the highest since July 3, after the U.K. water-services firm announced a special dividend and the acquisition of Bristol Water.

- SThree gains as much as 8.4% to the highest since July 2007 after the specialist staffer said it expects profit before tax for the year to be “materially above” market consensus. Liberum upgrades its estimates and PT, while keeping SThree as its top pick in the sector.

- Remy Cointreau falls as much as 5.7%, after initially rising 4% to a record high, after the French distiller reported FY21 earnings that beat expectations, with analysts turning their attention to the likely negative FX impact in the current fiscal year.

- B&M drops as much as 4.4% after the U.K. retailer reported FY results and said it is “well positioned to execute its strategic priorities for FY22.” The lack of clear guidance for FY22 suggests “weaker trading more recently,” according to Jefferies.

- BT falls as much as 3.5%, biggest decliner in the Stoxx 600 Telecom Index, after Deutsche Bank downgrades to sell from hold, saying the stock’s reversal of fortunes has perhaps become “over-cooked.”

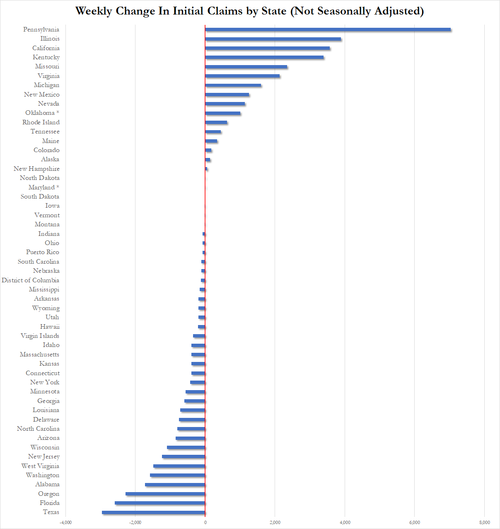

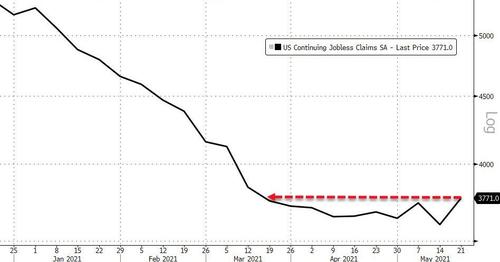

Asian shares traded mixed after President Joe Biden unveiled plans to amend a U.S. ban on investments in companies linked to the Chinese military, which may expand scrutiny to a wider set of enterprises. The MSCI Asia Pacific Index closed up 0.2% led by rallies in South Korea and Japan, but pared an advance of as much as 0.7% as Europe-based traders came online. Japanese shares extended recent gains, boosted by optimism over the nation’s vaccine rollout, while stocks in Vietnam also rallied. Korea’s equity benchmark closed shy of a record high amid buying by foreign investors. Gains have been driven by expectations that the country’s race to accelerate inoculations may lead to an easing of social-distancing rules in the fall, Huh Jae-Hwan, strategist at Eugene Investment & Securities said by phone. Chinese shares fell on President Joe Biden’s plans to amend a U.S. ban on investments in companies linked to China’s military. The broad Asia gains came as traders absorbed remarks from Philadelphia Fed President Patrick Harker, who said the U.S. central bank should begin discussing the time frame for paring back its bond-buying program. Investors are looking ahead to U.S. jobs data for cues on economic growth and price gains. BlackRock Inc. Chief Executive Officer Larry Fink said the potential for a spike in inflation may be underestimated. “A further tapering of initial jobless claims to another new pandemic-low may potentially drive sentiments toward the economic recovery theme,” continuing the trend over the past few weeks, Jun Rong Yeap, market strategist at IG Asia, said in a note. Thailand was closed for a holiday.

With global stocks trading in a tight range for the past month, investors have been looking for any signs that central banks may start to withdraw emergency support. While Fed officials have mainly stuck to the message that stimulus will remain in place, inflation is perking up, with global food prices surging to the highest in almost a decade. Friday’s payrolls data could add another twist to the debate in the wake of Harker’s remarks.

The various comments from officials help “the Fed to communicate early and communicate often so that the public gets so comfortable with the idea of tapering,” Kristina Hooper, Invesco chief global market strategist, said on Bloomberg Television.

In rates, Treasury futures were near bottom of daily range into early U.S. session with losses led by long-end of the curve, following a more aggressive bear-steepening move across gilts. Treasury 10-year yields around 1.60% are cheaper by 1.5bp vs Wednesday close while weakness in long end steepens 2s10s by more than 1bp, 5s30s by ~0.5bp; gilts lag, with U.K. 10-year cheaper by 1.2bp vs Treasuries and U.K. 30-year 3.2bp higher on the day. Cash volumes were robust during Asia session amid two-way regional flow. U.S. session features next week’s Treasury auction sizes at 11am ET as well as several Fed speakers and economic data releases.

In FX, moves in currency markets have been limited with the dollar index and other major pairs staying in tight ranges. The dollar index , which measures the greenback against a basket of major currencies, was flat at 89.899, not far from a five month trough of 89.535 touched last week. The Japanese yen was barely changed at 109.65 per dollar. The Canadian dollar and the Norwegian krona have outperformed over the past 24 hours on the back of higher oil prices. At the other end of the ladder, the New Zealand dollar was a laggard, down 0.2%. The Aussie was little changed at $0.7749.

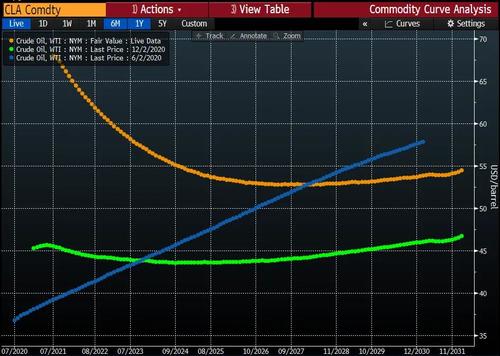

In commodities, Brent rose 24 cents to settle at $71.59 a barrel, its highest since January 2020. U.S. West Texas Intermediate (WTI) crude rose 25 cents to $69.08 a barrel, its highest since October 2018. Elsewhere, Bitcoin traded at about $39,000, holding its advance this week after May’s cryptocurrency rout.

Looking at the day ahead, the main data highlight will be the release of the ISM services index for May, the weekly initial jobless claims, and the ADP’s report of private payrolls for May. Otherwise, central bank speakers include the Fed’s Quarles, Bostic, Kaplan and Harker, along with BoE Governor Bailey.

Market Snapshot

- S&P 500 futures down 0.17% to 4,199.25

- STOXX Europe 600 down 0.16% to 450.58

- MXAP up 0.1% to 210.55

- MXAPJ down 0.1% to 707.47

- Nikkei up 0.4% to 29,058.11

- Topix up 0.8% to 1,958.70

- Hang Seng Index down 1.1% to 28,966.03

- Shanghai Composite down 0.4% to 3,584.21

- Sensex up 0.5% to 52,113.28

- Australia S&P/ASX 200 up 0.6% to 7,260.15

- Kospi up 0.7% to 3,247.43

- Brent Futures up 0.25% to $71.53/bbl

- Gold spot down 0.74% to $1,894.30

- U.S. Dollar Index up 0.17% to 90.066

- German 10Y yield rose 1.3bps to -0.185%

- Euro down 0.16% to $1.2191

Top Overnight News from Bloomberg

- Economists, blindsided by a major miss in April’s U.S. employment report, are now ready for any number of surprises. Estimates for May payrolls growth are wide-ranging — from 335,000 to 1 million, according to a Bloomberg survey

- The EU passed 250 million vaccinations and is on track to reach its target of inoculating 70% of adults in July, according to European Commission President Ursula von der Leyen

- President Joe Biden plans to amend a U.S. ban on investments in companies linked to China’s military this week, after the Trump-era policy was challenged in court and left investors confused about the extent of its reach to subsidiary firms, people familiar with the matter said

- A United Nations gauge of world food costs climbed for a 12th straight month in May, its longest stretch in a decade. Higher food costs can accelerate broader inflation, complicating central banks efforts to provide more stimulus

- The U.K. markets regulator says significant numbers of crypto firms are withdrawing applications to register with the watchdog after struggling to meet its anti-money laundering standards

- Turkey’s consumer inflation rate snapped seven months of increases in May, slowing to 16.6% and making it harder for the central bank governor to keep resisting President Recep Tayyip Erdogan’s pressure to begin cutting interest rates

- The yield on European CoCos has fallen to a record low, amid increased demand for the riskiest type of bank debt from investors seeking to beef up returns

- Israeli opposition leader Yair Lapid succeeded in forming a coalition that is now set to end Prime Minister Benjamin Netanyahu’s record-long grip on power

Quick look at global markets courtesy of Newsquawk

Top Asian News

- Singapore Finds 35 New Cases of Locally Transmitted Covid-19

- India Orders 300 Million Doses of Vaccines After Court Rebuke

- HSBC Hiring Fitch Asia Chairman Ginsburg as Top Asia Dealmaker

- Biggest India Bank Torn Between BlackRock and Funding Coal

Europe sees another uninspiring session after picking up a mixed lead from the APAC region overnight, with a tentative tone felt across the market ahead of US ADP, IJC and ISM Services PMI and on the eve of NFP – with US equity futures also lacklustre in early European trade. Sectors are mixed with no overarching theme and with the breadth of the market also narrow. Basic resources narrowly underperform whilst Autos and Oil & Gas are among the better performers. Today’s action is primarily seen across individual stocks: Saint Gobain (+3.5%) is firmer after announcing that sales in April and May continued to show good trends, and operating income in H1 2021 exceeded the previous record set in H2 2020. Nokia (+3.2%) is coat-tailing on the meme stock frenzy which sees AMC Entertainment +20% premarket after closing higher by 95% yesterday. BMW (+1.7%) provides the Auto sector with some support amid reports to build 360k EV charging sites in China. Meanwhile, Orange (-0.70%) is pressured following an outage yesterday that left emergency services in limbo. BT (-2.8%) saw a broker downgrade at Deutsche Bank. BASF (-0.2%) failed to garner much traction from source reports that the Co. and its private equity partner CD&R are said to be mulling a USD 5bln sale or an IPO of their water treatment venture.

Top European News

- EU Eyes First-of-a-Kind Border Levy in Climate Fight

- EU Poised To Hit Belarus With Initial Sanctions This Week

- Germany Failed to Slash City Pollution, EU Top Court Rules

- Johnson’s U.K. Education Czar Quits Over Covid Catch-Up Plan

In FX, the more fundamentally based traders and analysts may put it down to pure coincidence, but those with heads in the charts will be aware that the DXY recently probed the 21 DMA (at 91.128 today) on return from another retreat through 90.000, while the Euro and Sterling also rebounded off the same support levels vs the Dollar on Wednesday when Eur/Usd and Cable hit lows of around 1.2164 and 1.4112 respectively. However, trade in the currency markets remains rather aimless and directionless overall, with a few notable exceptions, and others have also highlighted seasonal factors beyond the obvious tendency to keep positions relatively tight ahead of the monthly US jobs data tomorrow. One long standing client and well respected contact notes that a new moon arrives in the UK next Thursday and this has been known to align with a firm break outside of ranges that can be confined over mid-Summer in the Northern Hemisphere and Solstice on June 21. Only time will tell of course, but for now the techs, jobbers and short term proponents appear to be influencing price action as the index fades having failed to breach the aforementioned marker convincingly or yesterday’s intraday peak (90.247) within a 90.138-89.885 range, while Eur/Usd is straddling 1.2200 again and Cable is nudging up towards 1.4200 from just shy of 1.4150 at one stage. Ahead, a barrage of US releases and yet more Fed officials are slated to speak following in line or better than forecast Eurozone services and composite PMIs before decent upgrades to the final UK headline readings.

- NZD/CAD/AUD – All on the back foot against their US counterpart, but keeping heads afloat of round and psychological numbers at 0.7200, 1.2100 and 0.7700 respectively, as the Kiwi extracts some underlying support from a considerably narrower than forecast 10 month rolling budget deficit, Loonie continues the be cushioned by firm crude prices and Aussie weighs up somewhat mixed trade internals, unrevised final retail sales and PM Morrison’s pledge to provide more COVID-19 fiscal aid.

- CHF/JPY – The Franc and Yen are still tracking the Buck and fluctuations in bond yield differentials rather than the general tone of risk sentiment or Swiss and Japanese specifics, with the former anchored around 0.9000 and latter meandering between 109.85-52 having held above 110.00 and waning after multiple attempts to maintain 109.50+ momentum.

In commodities, WTI and Brent front month futures have given up the mild gains seen overnight to ultimately trade near the unchanged mark intraday, with the former under USD 69/bbl (vs high 69.40/bbl) and the latter dipping closer towards USD 71/bbl to the downside (vs high 71.99/bbl). News flow has been quiet throughout the European morning, albeit there were reports that the 220k BPD refinery in Tehran that caught on fire yesterday should resume operations later today, whilst other news vendors suggested that another tank exploded – with details still on the light side. Elsewhere, Russia’s Lukoil CEO said the Co. is interested in returning to Iran – comments that addressed analysts’ concerns about whether Iranian appetite remains among oil firms following the sanctions imposed by the former US President. On that note, US sources yesterday poured some cold water over the optimism expressed by the Iranian President – noting that “core differences still remain on important questions and that real gaps on all three main areas — nuclear, sanctions and above all sequencing — still need to be closed.” (via WSJ), as opposed to Rouhani’s remarks that critical issues with the US have been resolved. Nonetheless, talks resume on June 10th. Note, Russia’s Deputy PM Novak also hit the wires, but provided no fresh commentary on OPEC+ policy or the near-term oil outlook. Looking ahead, the oil complex will be eyeing overall sentiment amid a raft of Tier 1 US data whilst the weekly DoEs will be released later at 16:00BST/11:00EST – with headline crude seen drawing down by 2.4mln bbls following yesterday’s larger-than-expected Private inventory draw (-5.36mln vs exp -2.4mln). Elsewhere, precious metals remain pressured as the Dollar index briefly reclaims 90.00 and yields clamber off yesterday’s lows, with spot gold back under USD 1,900/oz (vs high 1,909/oz) and spot silver sub-28/oz (vs high 28.23/oz). Although spot gold saw some upside on reports that Russia will be dropping USD assets, but the yellow metal failed to reclaim USD 1,900/oz status. Meanwhile, LME copper holding onto its modest gains despite the cautious risk tone and firmer Buck, with some citing the red metal’s demand outlook as Automakers announce further entries into the EV and battery markets, whilst BHP’s Escondida strikes also provide some underlying support. Overnight, Dalian coke futures notched a three-week high amid dwindling supply and robust demand from mills.

US Event Calendar

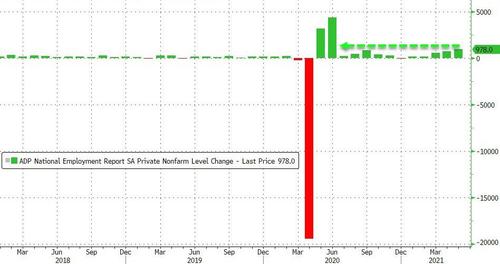

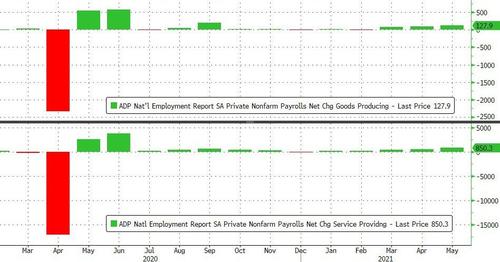

- 8:15am: May ADP Employment Change, est. 650,000, prior 742,000

- 8:30am: May Initial Jobless Claims, est. 386,000, prior 406,000;

- Continuing Claims, est. 3.61m, prior 3.64m

- 8:30am: 1Q Unit Labor Costs, est. -0.4%, prior -0.3%;

- 1Q Nonfarm Productivity, est. 5.5%, prior 5.4%

- 9:45am: May Markit US Services PMI, est. 70.1, prior 70.1

- 10am: May ISM Services Index, est. 63.2, prior 62.7

DB’s Jim Reid concludes the overnight wrap

Given it’s half-term in many places and markets have been in a tight range for a number of days, it doesn’t feel we are going to get much excitement until the all important payrolls release tomorrow. Don’t forget next week’s US CPI too. After last month that will be one of the most watched data prints of all time. So enjoy the next 30 hours of relative calm. While we wait, markets continue to eke out small gains though and by the close of trade yesterday, the MSCI World Index (+0.13%) and the STOXX 600 (+0.28%) had both inched up to new all-time highs, and the S&P 500 saw a modest +0.14% gain of its own. To reinforce the point about holding patterns, the S&P 500 has now moved by less than 0.25% either way for 6 successive sessions, which is the longest such run since December 2017. The index is hovering -0.67% away from its all time high and has been trading between 0 and -2% of that record closing level for the last 2 weeks. A remarkable stable range.

As we await payrolls and US CPI we do have some interesting data today, as we get the release of the services and composite PMIs from around the world, along with the ISM services index in the US. The flash numbers were pretty strong in both the US and Europe, with the US composite PMI at a record high of 68.1, while the Euro Area reading was at a 3-year high of 56.9. Overnight in Asia, we’ve already had some of the numbers, which showed improvements in Japan versus the flash readings with the services PMI printing at 46.5 (vs. 45.7 in flash) and the composite at 48.8 (vs. 48.1 in flash). China’s Caixin services PMI printed a touch softer than expectations though at 55.1 (vs. 56.2 expected) bringing the composite to 53.8 (vs. 54.7 last month).

Staying on the data theme, we’ll also get a couple of clues later on about the state of the US labour market. Firstly there’s the ADP’s report of private payrolls, where our US economists are expecting a +750k increase in May. Although the last ADP survey overestimated private payrolls by 524k, they think that it will likely anchor expectations going into tomorrow’s report, so worth keeping an eye on. Meanwhile there’s also the weekly initial jobless claims for the week through May 29, where our economists are expecting an increase to 435k after the previous week’s post-pandemic low of 406k, and there’ll also be focus on the employment components within the services ISM, after the manufacturing employment reading came in softer than expected.

Elsewhere in markets, sovereign bonds made gains yesterday on both sides of the Atlantic as immediate inflation concerns were becalmed even with higher commodity prices as we’ll see below. Yields on 10yr US Treasuries were down -1.9bps to 1.588%, with the bulk of the move driven by falling inflation expectations, and 10yr breakevens fell -1.8bps. Meanwhile in Europe, yields on bunds (-2.0bps), OATs (-1.8bps) and BTPs (-2.3bps) similarly moved lower. Nevertheless, an exception to this pattern of lower inflation expectations was in the UK, where 10yr breakevens were up +3.5bps to 3.63%, their highest level since 2008. And finally on the inflation theme, there were fresh moves higher for oil prices yesterday, with both Brent Crude (+1.57%) and WTI (1.64%) closing at new post-pandemic highs of $71.35/bbl and $68.83/bbl respectively. This led to energy stocks being among the best performers in equity markets on either side of the Atlantic as the pro-cyclical trade continues. As a lingering curiosity, some past Reddit favourites are again coming back in the spotlight with AMC Entertainment rising by +95% yesterday (+127% at the highs) to close at a record high of $62.55. I would never have guessed this story would have lasted as long as this when it broke several months ago.

Asian markets are mostly trading higher this morning outside of the Hang Seng (-0.40%) which is down. The Nikkei (+0.41%), Shanghai Comp (+0.38%) and Kospi (+0.96%) are all up. Futures on the S&P 500 are also up +0.08% while those on the Stoxx 50 are up +0.15%. Elsewhere, commodity prices are continuing to rise with oil prices up c. +0.60% this morning while DCE iron ore futures are up +3.16% and SHF steel rebar futures are up +1.52%.

Overnight, we have received some interesting US-China news with Bloomberg reporting that President Biden will amend a US ban on investments in companies linked to China’s military this week. Under the new amended order, the Treasury Department, instead of a congressionally-mandated Defense Department report, will create a list of companies that could face financial penalties for their connection to China’s defense and surveillance technology sectors.

Last night after US markets closed, the Federal Reserve announced it plans to sunset its pandemic corporate credit facility. The Fed will begin selling off its portfolio of corporate debt and ETFs over the next 6 months, beginning with ETFs and then progressing to bond holdings later on this summer. The Fed, through a spokesperson, made sure to note that this was not a signal of monetary policy and also highlighted that the facility has not made a purchase since the end of 2020. The New York Fed also said that additional details will be provided to market participants prior to any sales beginning.

Before that the Federal Reserve’s Beige Book showed the US economy growing at a “moderate pace” during the observation period of early-April to late-May. While this was the same wording from the previous 2-month assessment, the Fed added that the economic expansion was at “a somewhat faster rate than the prior reporting period.” The report showed that “overall price pressures increased further since the last report. Selling prices increased moderately, while input costs rose more briskly.” This matches what has been seen in commodity prices, other surveys, and what corporates were saying during this past earnings season. The report also indicated that final goods prices may increase in the coming months as it cited “strengthening demand…allowed some businesses, particularly manufacturers, builders, and transportation companies, to pass through much of the cost increases to their customers.” On the other side, the Fed also found contacts increasing wages in some industries, with wage growth increasing moderately as “a growing number of firms offered signing bonuses and increased starting wages to attract and retain workers.” Markets were largely unchanged following the release as much of this was known from various sources. It does highlight the issues the Fed will face going forward though.

On that front, Philadelphia Fed President Harker said that it “may be time to at least think about thinking about tapering our $120 billion in monthly Treasury bond and mortgage-backed securities purchases.” Though he emphasised it would be a gradual process, reiterating previous comments from Fed Chair Powell that the aftermath of the Financial Crisis would be the blueprint. Ahead of tomorrow’s payrolls, Governor Harker noted that he anticipates, “ the labor force returning to its prepandemic trend sometime next summer — it will be a while, in other words.” Despite some of the anecdotal evidence in the beige book, Federal Reserve Bank of Richmond President Barkin said yesterday, that the “data don’t yet show much rebound in overall wage growth.” He did say that he will be paying attention to whether wage pressures seen at the lower end of the pay scale start to appear higher.

In terms of the latest on the pandemic, there were a number of positive milestones reached in Europe, as 75% of the adult population in the UK have now received a first vaccine dose, while EU Commission President von der Leyen tweeted that they had passed the 250m vaccination mark, with the bloc on track to reach their goal of vaccinating 70% of the adult population in July. Furthermore, UK Prime Minister Johnson said that he could “see nothing in the data at the moment that means we cannot go ahead” with the planned “final” easing of restrictions on June 21. Having said that, reputable reports suggest the recent trend of new cases in England is indicating a case doubling time of 13 days as the Indian variant takes over. So it’s going to be a big battle in the next couple of weeks to see if all restrictions are lifted on June 21 in England. Across the other side of Atlantic, there were more signs of a return to normality as Apple’s CEO Tim Cook said that employees should begin returning to offices in early September for at least three days a week.

With 63% of the US adult population now having received at least one shot (52% fully vaccinated), President Biden has redoubled efforts to increase vaccination rates to reach 70% of all adults by the July 4th holiday. Measures to increase turnout include free child care during vaccination visits, extended pharmacy hours, and working with private industries on promotions. With the country’s domestic production outstripping demand, President Biden again affirmed his promise to export 80 million doses by the end of June on top of the doses that US-based pharmaceutical companies have already begun shipping.

There were a few data releases out of Europe yesterday, including Germany’s retail sales for April, which fell by a stronger-than-expected -5.5% (vs. -2.5% expected), and the UK’s mortgage approvals for April, which came in at 86.9k (vs. 81.0k expected). Finally, producer price inflation in the Euro Area for April rose to +7.6% as expected, its highest level since 2008.

To the day ahead now, and the main data highlight will be the release of the services and composite PMIs for May from around the world. Meanwhile from the US, there’s also the ISM services index for May, the weekly initial jobless claims, and the ADP’s report of private payrolls for May. Otherwise, central bank speakers include the Fed’s Quarles, Bostic, Kaplan and Harker, along with BoE Governor Bailey.