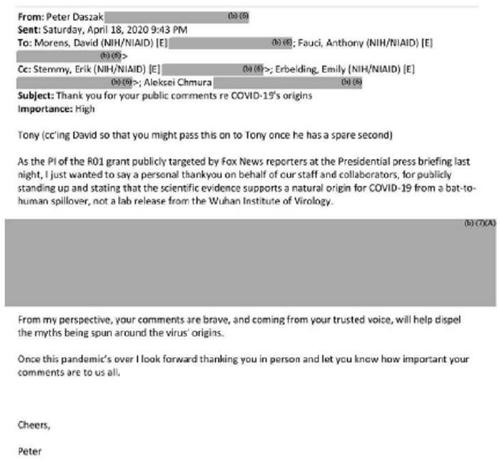

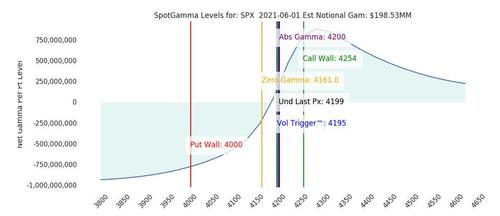

One day after a concurrent ramp (then reversal) in stocks and the VIX prompted some confusion on trading desks, on Wednesday e-mini futs were stuck at the 4200 gamma pin…

… while European stocks rose and Asian markets fell as the tussle between economic optimism and inflation concern continues to play out in markets. Bitcoin and the dollar ticked up, oil and treasuries were mostly flat.

The S&P 500 slipped fractionally after three straight days of gains on Tuesday as losses in healthcare and technology stocks overshadowed gains in economically sensitive financials and energy after upbeat U.S. factory activity data. While futures were little changed – with Dow e-minis up 36 points, or 0.10%, S&P 500 e-minis up 0.75 points, or 0.02%, and Nasdaq 100 e-minis flat – ahead of key economic data due later this week, it was the latest leg of the surge in “meme stocks” that stood out in early moves on Wall Street on Wednesday. Here are some of the biggest U.S. movers today:

- AMC Entertainment (AMC) extends rally in premarket trading, rising 31% to $44 after raising $230.5 million in a stock sale to Mudrick Capital Management. The stock has since faded much of its gains.

- Cannabis stocks like Tilray (TLRY) and Aurora Cannabis (ACB) climb in premarket trading after Amazon.com (AMZN) said it will actively support proposed U.S. legislation that would legalize marijuana at the federal level.

- Etsy Inc rose 1% after the company said it would acquire Depop, a privately held fashion marketplace, for $1.63 billion, as the online seller looks to attract Gen-Z consumers.

- IRhythm Technologies (IRTC) drops 13% after saying Chief Executive Officer Mike Coyle plans to resign due to personal matters.

- Orbital Energy Group (OEG) drops 4.5%, reversing some of Tuesday’s 115% rally after its unit Gibson Technical Services reached an agreement with telecom service provider TEC for a project in central Mississippi.

- Zoom Video Communications (ZM) gains 2.8% after analysts said its quarterly results signaled a good start to the year.

While broader stock markets remain close to record highs, the momentum of earlier in the year has ebbed as investors begin to worry a stronger-than-expected rebound from COVID-19 means higher inflation and sooner-than-expected monetary policy tightening.

Fed Governor Lael Brainard said on Tuesday there are risks on both sides of monetary policy as the U.S. economy surges ahead while millions of people are unemployed. “Investors would see a surge in payrolls growth as a sign that the Fed is more likely to move,” said Lauren Goodwin, portfolio strategist at New York Life Investments.

The MSCI world equity index bounced in and out of positive territory for the day and below Tuesday’s record high. In Europe, the Stoxx 600 Index climbed 0.1%, trading near all time highs, with energy shares getting a boost from rising oil prices. British shares’ initial gains fizzled with the FTSE 100 last up 0.1%, while Germany’s DAX and the French CAC 40 gained 0.2%. Here are some of the biggest European movers today:

- Interpump Group shares rise as much as 7.6% to a record high after the company said it is acquiring White Drive Motors & Steering, in a transaction expected to close in 4Q.

- Beiersdorf gains as much as 3.3%, hitting the highest since Nov. 17. The personal-care products maker is well-positioned for a strong recovery and is trading at an “undemanding” valuation, Berenberg said, upgrading the stock to buy and raising its price target.

- Volvo adds as much as 3.8% after the company proposed a distribution of proceeds from the sale of UD Trucks. Handelsbanken sees the plan as a “clear indication” of a solid outlook.

- U-Blox rises as much as 10% after the Swiss electronic components maker raised its sales growth guidance; analysts at ZKB and Vontobel highlight strong order intake and see upside to consensus.

- Solutions 30 climbs as much as 12%, continuing its roller-coaster ride since last week’s slump.

- Wizz Air falls as much as 3.4%, the most since May 11, after the Eastern Europe- focused budget carrier cut its fleet guidance.

- Eurofins Scientific drops as much as 4.1%, falling with stocks of other lab-testing companies, after Abbott Laboratories issued a profit warning on declining demand

Earlier in the session, Asian stocks slipped snapping a three-day winning streak, as inflation concerns offset a positive outlook for earnings growth. The MSCI Asia Pacific Index fell 0.1% paring an advance of as much 0.4%, as tech stocks declined. China’s CSI 300 Index slid 1%, after the state-run Securities Times reported that regulators are against analysts’ practice of setting specific targets for market gauges. China’s IT sector pulled back from a near-three-month peak. Meanwhile, Philippine stocks were the biggest gainers, with the benchmark closing at its highest since March 5, after a media report said the government increased allowable capacity for restaurants and personal care shops, while allowing venues for conferences and exhibits to open. Japanese shares were also among the top performers. The Topix gained for a second day with investors assessing the nation’s vaccine rollout and upcoming U.S. employment data this week. Korea’s Kospi ended the day 0.1% higher — pulling back from an initial climb — after the country announced that inflation rose at its highest pace since 2012 in May as the economy’s rebound gathered momentum. “The fears around inflation likely won’t be proved or disproved for a few months yet – although the lack of excitement around last week’s high-ish PCE readings perhaps suggests that in this area, too, a lot is in the price with break-evens around 2.5%,” Patrik Schowitz, globalmulti-asset strategist at JPMorgan Asset Management wrote in a note.

There was more good news on the data front, where economies are recovering much faster than anticipated — the latest data showed Australia’s economy racing ahead last quarter as consumers and businesses spent with abandon, lifting output back above where it was last year before the pandemic.

That helped the Australian stock market to its latest record but the Aussie dollar succumbed to selling to remain with its recent range as the central bank has been stubbornly sticking to its dovish tone. The S&P/ASX 200 index rose 1.1% to close at 7,217.80, a new record. Energy stocks led sector gains as oil extended advances after closing at the highest since October 2018. Worley was among the top performers after saying it was poised to deliver an improved 2H. Regis Resources was among the worst, snapping a three-day winning streak. In New Zealand, the S&P/NZX 50 index fell 0.2% to 12,440.05

In rates, Treasury 10-year yields slipped 1 basis point on Wednesday to 1.6028%, after choppy price action in Asia and European morning in which gilts and bunds advanced. 10-year yield, lower by about half a basis point at ~1.60%, lagging bunds and gilts despite Euro zone yields largely shrugged off Tuesday’s data showing euro zone inflation rose to 2% in May — a sign that markets were confident the European Central Bank would not decide to slow the pace of its bond buys when it meets on June 10. Germany’s 5-year bond sale receiving a bid/cover ratio of 1.21x, the lowest since April 2020.

“As the major developed economies continue to reopen from COVID lockdowns, the focus on central bank meetings is going to intensify,” MUFG analysts said in a monthly outlook note. They expect the ECB to avoid signaling a slowdown in bond purchases, but think the Fed might confirm that “very initial” discussions on tapering its bond buying have begun.

In FX, the Bloomberg dollar index was heading for its best two-day run in almost three weeks, with the ongoing shift in tone from Federal Reserve policy makers offering support. The Bloomberg Dollar Spot Index rose 0.3%, with the greenback gaining against all of its major peers. The pound declined as worries over a third wave of coronavirus and a delay in economic reopening intensified. The onshore yuan edged lower to 6.3871 per dollar after retreating from three-year highs as policymakers took steps to cool its advance including raising banks’ FX reserve requirements.

The yen declined against most of its major peers amid expectations that a slower recovery in Japan’s economy will keep the central bank from tapering stimulus. USD/JPY rose for the first time this week as Bank of Japan board member Seiji Adachi said “a long battle” must be anticipated toward achieving 2% inflation. The pound edged lower on concern over a possible third U.K. coronavirus wave and a delay to economic reopening; GBP/USD was down as much as 0.2% to 1.4129, the lowest in a week. Australia’s dollar was lower even as its economy expanded faster than economists forecast in the first three months of the year, driven by the private sector as firms boosted investment and households tapped their pandemic savings war chest. The Reserve Bank of Australia left policy unchanged on Tuesday and reiterated that inflation and wage gains are unlikely to be at the point where an interest-rate hike is needed until 2024.

The Turkish lira fell to a record low against the greenback after President Recep Tayyip Erdogan renewed calls for lower interest rates.

In commodities, crude oil prices rallied again after closing above $70 a barrel for the first time in two years, aided by investors wagering that the economic recovery would lift energy demand and that supply would fall behind. Brent futures added 1.3% to $71.16 per barrel and U.S. West Texas Intermediate crude added 1.11% to $68.47, despite the OPEC+ alliance agreeing to hike output in July.

Mark Haefele, chief investment officer at UBS, Global Wealth Management, said vaccination rollouts would spur “a return to normal patterns of mobility, supporting energy demand”, while support for prices also came from an OPEC showing discipline about production increases. “We see energy firms as among the main beneficiaries of the broader global reflation trend, along with financials,” he said.

Cryptocurrency prices rose, with Bitcoin up 1.2% to $37,175 . Gold was flat at $1,900 having traded slightly lower for much of the session.

To the day ahead now, and data releases include the April numbers for German retail sales, UK mortgage approvals and Euro Area PPI. Meanwhile from central banks, we’ll hear from the Fed’s Evans, Bostic, Kaplan and Harker, along with the ECB’s Villeroy. Furthermore, the Federal Reserve will be releasing their Beige Book. Looking at the rest of the week, we get the weekly unemployment claims report and May’s private payrolls data on Thursday will be followed by the crucial monthly jobs numbers on Friday. Investors are closely tracking the labor market’s recovery after an unexpected slowdown in jobs growth in April fanned inflation worries.

Market Snapshot

- S&P 500 futures little changed at 4,197.50

- MXAP little changed at 210.20

- MXAPJ down 0.3% to 708.54

- Nikkei up 0.5% to 28,946.14

- Topix up 0.8% to 1,942.33

- Hang Seng Index down 0.6% to 29,297.62

- Shanghai Composite down 0.8% to 3,597.14

- Sensex down 0.7% to 51,583.79

- Australia S&P/ASX 200 up 1.1% to 7,217.80

- Kospi little changed at 3,224.23

- Brent Futures up 0.78% to $70.80/bbl

- Gold spot down 0.22% to $1,896.28

- U.S. Dollar Index up 0.28% to 90.08

- STOXX Europe 600 +0.2% to 450.99

- German 10Y yield fell 5 bps to -0.184%

- Euro down 0.27% to $1.2180

Top Overnight News from Bloomberg

- Turkey’s President Recep Tayyip Erdogan renewed calls for lower interest rates, pushing the lira to a fresh low against the dollar and piling pressure on his central bank governor to ease policy despite high inflation

- A selloff in China Huarong Asset Management Co.’s bonds is broadening to the nation’s other major bad-debt managers

- Federal Reserve Governor Lael Brainard said there are risks on both sides of monetary policy right now as the U.S. economy surges ahead in a post-pandemic boom while millions of people remain unemployed

- Europeans are in for a costly summer that will test central bankers’ resolve on stimulus as the region’s delayed economic recovery unleashes surging demand

- South Korea’s inflation rose to its highest since 2012 in May as the economy’s rebound gathered pace, adding support to views that the central bank could be among the first in the region to start normalizing policy

Quick look at global markets courtesy of Newsquawk

Asian equity markets traded mixed following a similar indecisive performance in the US where the mood was kept tentative on return from the extended weekend alongside mixed data releases and as this week’s key event remained on the horizon with the NFP jobs data on Friday. ASX 200 (+1.1%) was led higher by outperformance in the energy sector after recent upside in oil prices and with better-than-expected GDP data for Q1 contributing to the tailwinds, although participants also digested confirmation of the one-week lockdown extension to Australia’s second most populated city of Melbourne. Nikkei 225 (+0.5%) briefly reclaimed the 29k level, helped by favourable currency flows and after recent comments by BoJ board member Adachi who stuck to the dovish message in which he suggested to be ready for a long battle to reach the 2% price goal and that the BoJ must ease further without hesitation if an external shock places large downward pressure on the economy. Elsewhere, Hang Seng (-0.6%) and Shanghai Comp. (-0.8%) were lacklustre amid mixed US-China headlines including a call between US Treasury Secretary Yellen and Chinese Vice Premier Liu He where they agreed bilateral ties between the two countries are very important and expressed a willingness to maintain communication, although there was also a recent US congressional advisory report that alleged the US Commerce Department is failing to do its part to protect national security and keep sensitive technology out of the hands of China’s military. Finally, 10yr JGBs were flat as price action was contained by resistance at the 151.50 level and with demand sapped due to the positive mood in Japanese stocks, although downside was also limited with the BoJ present in the market for over JPY 1.1tln of JGBs ranging from 1yr-5yr and 10yr-25yr maturities.

Top Asian News

- China Stocks Drop as Technology Shares Come Off Three-Month High

- Singapore’s Local Virus Cases Rise to More Than One-Week High

- Musk Says Tesla’s Biggest Challenge Is Supply Chain

- Bank of Korea Moves to Dispel Concerns on 9-Year High Inflation

European bourses thus far have been inspired, with flat and caged trade seen across the board (Euro Stoxx 50 Unch), with the European calendar on the light side and news flow also quiet. US equity futures have also been trading horizontally ahead of a slew of Fed speakers later today, and Friday’s looming US jobs report also likely prompting trader to keep some dry powder. Back to Europe, sectors are mostly firmer but do not portray a particular theme nor bias, whilst the breadth of the market also remains narrow. Oil & Gas modestly outperform following the post-OPEC+ gains across the crude complex, whilst there is little to report regarding the other sectors. In terms of individual movers, Volvo (+3.4%) resides near the top of the pack after Co’s board has proposed a SEK 9.5/shr share distribution of the proceeds, corresponding to around SEK 19bln, from the sale of UD Trucks. Lufthansa (+2.2%) is firmer alongside source reports that Germany is said to be taking part in a Lufthansa capital raise. Alstom shares (Unch) gave up gains seen at the open as shareholder Bouygues (+0.3%) offloaded 11ml Alstom shares at EUR 45.35/shr.

Top European News

- U.K. Mortgage Approvals Rise to 86,921 in April Vs. Est. 81,000

- U.K. to Begin Process to Join Trans-Pacific Trade Partnership

- EU to Force Multinationals to Report Revenue in Each Country

- Wizz Air Holds Hope for Busier Summer Even As Outlook Cloudy

In FX, the Greenback continues to grind higher having formed a base or at least finding underlying bids on Tuesday to bounce off post-Memorial Day lows, and has now probed 90.000 to the upside in DXY terms amidst a broad if not all round recovery vs major counterparts. The Buck appears to have overcome initial disappointment with elements of the manufacturing ISM, while also taking comfort from the failure of other currencies to maintain momentum and breach key resistance or psychological levels when it was floundering. Moreover, the Dollar may be benefiting from some short covering ahead of another raft of Fed speakers flanking the Beige Book for June’s FOMC meeting as the index hovers between 90.193-89.856 parameters vs yesterday’s 89.941-662 session range.

- TRY – Scant respite for the Lira, though it has clambered off extreme and fresh all time lows circa 8.7775 hit on the back of latest attempts by Turkish President Erdogan to steer CBRT monetary policy towards lower rates. In short, he met with the Governor and reiterated that the country needs to ease in order to bring down inflation in typically unorthodox fashion, and Usd/Try is now trying to regain composure, but failing to get near 8.5000 again.

- AUD/JPY/NZD/CHF – The high betas and low yielders are conceding most ground to the Greenback as the pendulum changes direction and Aussie loses traction around 0.7750, Kiwi retreats through 0.7250, Yen succumbs to stop-sales beyond 109.70 and Franc slips back below 0.9000. Note, Aud/Usd was only briefly uplifted by firmer than forecast Q1 GDP data as the good news was countered by a week long extension to lockdown in Melbourne, while upbeat comments from the RBA’s Head of Economic Analysis, jones were tinged with caution, but the headline pair may still be drawn to decent option expiry interest between 0.7740-50 (1.3 bn) even though RBA Deputy Governor Debelle is adamant that wage growth will not be strong enough to boost overall inflation until 2024. Meanwhile, NZ Q1 terms of trade were mixed and Head of Financial Markets at the RBNZ, Raynor, stated that the balance sheet is likely to be enlarged for a long time, and BoJ Board member Adachi chimed with the usual dovish script that further easing must be implanted without hesitation if an external shock puts large downside pressure on the economy.

- EUR/GBP/CAD – Stops also contributed to the Euro’s downfall with market contacts noting sell orders at 1.2200, but the headline pair has held around recent lows in the 1.2170-80 region with ongoing support from the Eur/Gbp cross that remains elevated on the 0.8600 handle, as Sterling slips further from yesterday’s new multi-year highs vs the Buck around 1.4250 to pivot 1.4150 and hover mostly below. Conversely, the Loonie continues to outperform above 1.2100 against the backdrop of lofty crude and awaiting Canadian building permits for further direction before Friday’s face-off with the US on employment.

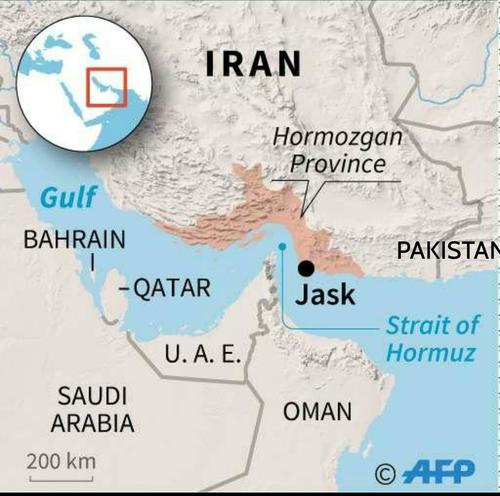

In commodities, WTI and Brent front month futures see modest gains, but the benchmarks have eclipsed overnight ranges – with the former just north of USD 68/bbl (67.78-68.48 range) and the latter testing USD 71/bbl (vs 70.35 low) at the time of writing. OPEC+ saw a swift meeting yesterday with quotas through to July maintained as expected, whilst the producers also reiterated a proactive stance against the backdrop of the Iranian JCPOA talks, which are poised to resume next week after a wrap-up meeting later today – with the Iranian President also noting that talks are progressing well. OPEC+ refrained from giving guidance past July, given the fluidity of the supply/demand situation. Analysts at ING have maintained the view that ICE Brent will average USD 70/bbl over the second half of this year. As a reminder, the weekly Private Inventory data will be released later today due to the US Memorial Day holiday on Monday. Meanwhile on the geopolitical front, Iran’s largest warship caught on fire and sunk in the Gulf of Oman, with the circumstances currently unclear. This situation is one to keep on the radar, given that the Gulf of Oman is the mouth of the Strait of Hormuz chokepoint. Elsewhere, precious metals are mildly pressured by the recent Dollar strength, although some losses are cushioned as yields remain stable following a modest pullback from yesterday’s best levels. Spot gold and silver trade within narrow parameters under USD 1,900/oz and USD 28/oz respectively. Over to base metals, LME copper is subdued but holds onto its USD 10,000/t status, with the red metal facing headwinds from the firmer Buck alongside continuing operations at BHP’s Chilean copper mines despite strike action. Meanwhile, Dalian iron ore and coking coal futures saw another session of gains as traders continue to cheer the relaxation of restrictions at the top steelmaking Chinese city of Tangshan.

US Event Calendar

- 7am: May MBA Mortgage Applications -4.0%, prior -4.2%

- 2pm: U.S. Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

Since we last spoke I’ve played 5 tournament rounds of golf over three days and been to Legoland. 4 rounds were decent. One very bad which for golf is not bad going. A very busy Legoland was enough to try the patience of a saint and I must confess I lost it towards the end of a long day when someone jumped what was an hour long queue with his whole family to join a friend. Steam came out of my ears and I went up to him and told him he was bang out of order. A row ensued but they didn’t relent. I came up with the immortal line “where would the world be if everyone acted like you”. He shrugged his shoulders and carried on. My wife had to tell me to calm down.

I’m contrast there seemed to be an orderly queue of buyers and sellers yesterday as most risk assets pressed on to fresh highs after strong data releases helped bolster investor sentiment. By the close of trade, the MSCI World Index (+0.21%) and the STOXX 600 (+0.75%) had both climbed to all-time records, while the S&P 500 (-0.05%) fell back ever so slightly as it reopened following Monday’s holiday. Even though the S&P was largely unchanged, US equities saw large moves under the surface as the cyclical over growth trade continued with energy (+3.93%), materials (+1.39%) and banks (+0.97%) outperforming higher growth industries like biotech (-1.41%) and software (-0.61%). The worst performing industry in the S&P 500 was healthcare equipment (-1.88%), on the back of Abbott Laboratories (-9.3%) warning investors of lower-than-expected profits this year as demand for Covid-19 testing kits is drying up. Good news in general however.

The Euro Area flash CPI reading coming in at 2.0% for the first time since 2018 was interesting, but it didn’t stop a broad-based rally in Europe with 19 of 20 sectors higher with cyclicals leading the way – particularly inflation-sensitive basic resources (+2.85%).

Looking at those economic reports in depth now and the main highlight were the various manufacturing PMIs from throughout the world, which added to the positive tone set by the flash readings. The Euro Area manufacturing PMI was revised up from the flash reading to 63.1 (vs. flash 62.8), with both France and Germany seeing positive revisions too. And in the US, the final PMI was revised up to 62.1 (vs. flash 61.5), while the ISM manufacturing print also came in at an above-expected 61.2 (vs. 61.0 expected).

So far so good, but the breakdowns pointed to what could be some issues down the line, as the ISM employment measure was fairly soft at 50.9 (vs. 54.6 expected). Looking through the press release where it quoted various respondents, it was noticeable how many referred to supply-side issues, such as difficulties in obtaining components or hiring qualified candidates, so it’ll be interesting to see how this translates to the nonfarm payrolls number on Friday. The measure of average lead time for production materials has risen nearly 20 days over the last 3 months and is now at 85 days – the longest length of time recorded since the data started being kept in 1987. Meanwhile although the prices paid measure did slip back slightly to 88.0 (vs. 89.5 expected), it’s worth bearing in mind that this is still the 2nd highest reading for the measure since the GFC.

One factor helping to bolster the inflationary case recently has been the rise in a number of key commodity prices, and yesterday saw them extend their gains from last week as the Bloomberg Commodity Spot Index rose +1.42%. Oil prices were one of the big movers, with Brent crude (+1.34%) and WTI (+2.11%) closing at their highest level in over 2 years, which came even as OPEC+ agreed that they’d maintain their plans to increase production in July. OPEC+ gave little indication on exactly how much production will increase by with forecasts clouded by the US-Iran nuclear talks and the uncertain global demand picture. Elsewhere agricultural prices moved higher too, with corn (+4.87%) and wheat (+4.52%) futures both rebounding following recent declines.

Asian markets are trading mixed overnight with the Nikkei (+0.50%) and Kospi (+0.14%) up while the Hang Seng (-0.50%) and Shanghai Comp (-0.65%) are both down. Futures on the S&P 500 (-0.01%) are pointing to a flat open while, those on the Stoxx 50 are up +0.10%. In Fx, the Turkish lira is down -1.13% as we type, after being down as much as -3.08% at one point overnight, weighed down by remarks from President Recep Tayyip Erdogan calling for lower interest rates. Elsewhere, the US Treasury Secretary Janet Yellen and China’s Vice Premier Liu He held an “introductory virtual meeting,” overnight where the two sides discussed how to “support a continued strong economic recovery and the importance of cooperating on areas that are in U.S. interests, while at the same time frankly tackling issues of concern,” according to a statement from the US Treasury.

Back to data and as mentioned earlier, yesterday saw the release of the Euro Area flash CPI data, which rose to +2.0% in May (vs. +1.9% expected), which was the highest reading since November 2018. Energy prices drove the move higher with a +13.1% year-on-year increase, as core CPI came in at just +0.9%, in line with expectations. As a result, it’s unlikely to weigh heavily on the ECB Governing Council ahead of next week’s meeting, in contrast to the US where core CPI stood at +3.0% in April, its highest level so far this century.

Against this backdrop, sovereign bond markets had a weaker performance yesterday, with yields on 10yr Treasuries (+1.2bps) and gilts (+3.1bps) seeing the largest rises as they caught up from the previous day’s holiday. Nevertheless, yields on the European continent were also higher for the most part, with those on 10yr bunds (+0.9bps) and OATs (+1.0bps) rising too. And there was a further reduction in the spread of Greek 10yr yields over bunds, falling to a fresh post-2008 low of 101bps yesterday.

In terms of the latest on the pandemic, there was some good news out of the UK yesterday as the country recorded 0 Covid-19 deaths within 28 days of a positive test. Even if this may have been distorted a bit by reporting over the longer holiday weekend, the fact it’s capable of happening is still a positive sign of movement in the right direction, as the government faces calls from some to delay its planned easing for England on June 21. Elsewhere, Germany announced it has downgraded its risk level for the pandemic to “high” from “very high”, which means loosening restrictions may soon be coming to Europe’s largest economy. The threat level has been at “very high” since December. And staying on the positives, New York City saw their positivity rate fall to its lowest level since the pandemic began yesterday, at 0.83%. Separately, it was reported by Axios that the White House would invite all employees back to work in person in July.

Looking at yesterday’s other data, unemployment in Germany fell by -15k in May (vs. -9k expected), while the wider Euro Area saw unemployment fall a tenth to 8.0% in April (vs. 8.1% expected), marking its lowest level since last June. Finally in Italy, growth in Q1 was revised up to show +0.1% growth (vs. -0.4% contraction before).

To the day ahead now, and data releases include the April numbers for German retail sales, UK mortgage approvals and Euro Area PPI. Meanwhile from central banks, we’ll hear from the Fed’s Evans, Bostic, Kaplan and Harker, along with the ECB’s Villeroy. Furthermore, the Federal Reserve will be releasing their Beige Book.