US equity futures stumbled – if trading off session lows – and global shares tracked Asia lower on Friday as investors were worried by a jarring cut to Amazon’s guidance, China’s ongoing regulatory crackdown and rising Delta variant cases, but still remained on course for their sixth straight month of gains as overall solid corporate earnings and central bank largesse kept sentiment intact, while the dollar held near a one-month low and Treasuries rose. Nasdaq futures fell 1% after Amazon tumbled in premarket trading after its sales outlook missed expectations, adding to this week’s cautious forecasts from Facebook and Apple. At 7:15 a.m. ET, S&P 500 e-minis were down 25 points, or 0.56%, while Dow e-minis were down 79 points, or 0.23%.

The top overnight story was Amazon’s 6% plunge after the company said sales growth would slow in the next few quarters as customers ventured more outside the home. Shares of other tech giants including Netflix, Alphabet, and Facebook which benefited last year from people staying indoors due to COVID-19 restrictions, fell between 0.6% and 1.2%. Other notable premarket movers include:

- Caterpillar also fell 2.5% despite reporting a rise in second-quarter adjusted profit on the back of a recovery in global economic activity that has boosted demand for heavy machinery and construction equipment.

- Didi Global (DIDI) shares fall 6.7% after China said it plans to deepen anti-monopoly supervision of ride- hailing companies.

- Pinterest Inc sank 20.9% after saying U.S. user growth was decelerating as people who used the platform for crafts and DIY projects during the height of the pandemic were stepping out more.

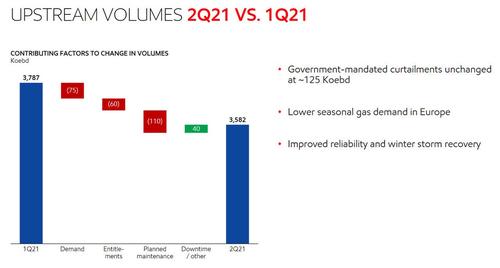

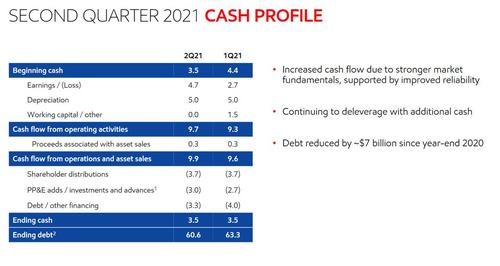

- Chevron Corp rose 2% as it reported its highest profit in six quarters and joined an oil industry stampede to reward investors with share buybacks.

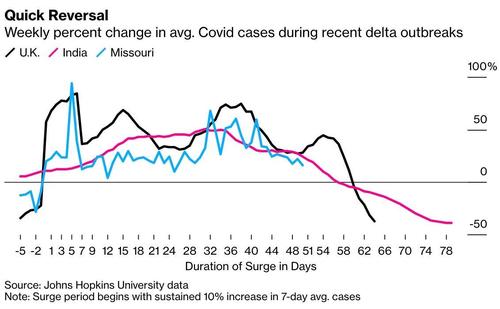

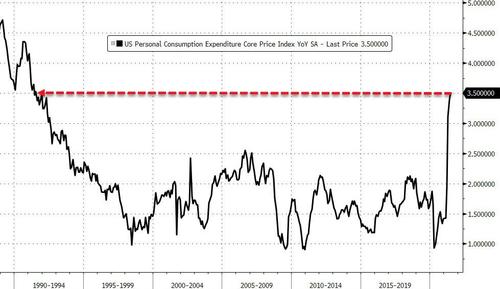

Data on Thursday showed the economy recovered to pre-pandemic levels in the second quarter, but the pace of GDP growth was slower than expected. Meanwhile, a report cited the CDC as describing the Delta variant to be as contagious as Chickenpox. After the Federal Reserve this week reiterated its view that higher inflation would be transient, focus on Friday will be on the June reading of the personal consumption expenditures price index. Elsewhere, with second-quarter results coming in from about half of the S&P 500 companies, nearly 91% have beaten profit estimates, according to Refinitiv data. That hasn’t helped push their stock price higher however as markets remain priced to perfection.

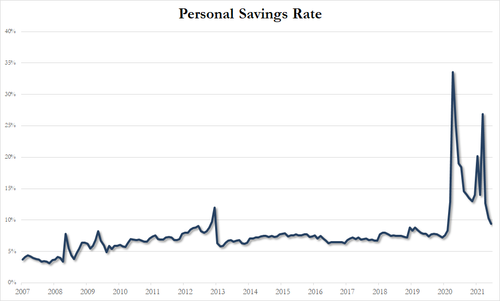

“The earnings season has delivered strong results so far, however some investors are concerned that earnings growth will slow from here,” said Lewis Grant, senior global equities portfolio manager at the international business of Federated Hermes. “It was a case of better to travel than arrive for the FAANG stocks. On the other hand, the economy is opening up as we move past the peak infections and consumer balance sheets are strong, and that should support the cyclical end of the market.”

Investors piled into cash and equities in the past week, according to a Bank of America Corp. note citing EPFR Global data. BofA strategists recommended owning defensive and quality names in the second half of the year, as “policy flip-flops will end in market correction.”

MSCI’s World index was last down 0.3%, leaving it broadly flat on the week, but up 1.1% for the month, just shy of a record high. Markets remain in a tussle, though, as a Chinese crackdown on its technology sector and rising cases of the Delta coronavirus variant range against still-Dovish monetary policy and punchy earnings from a range of companies.

In Europe, one day after hitting an all time high, the Stoxx 600 Europe Index slid 0.6%, with declines led by travel and mining companies. UniCredit jumped 5% after the Italian bank reported profit that topped the highest analyst estimate as provisions for loan losses fell.

“We have a bit of day-to-day volatility, but the overall market is quite strong,” said Hans Stoter, global head of core investments at AXA Investment Managers. French billionaire Xavier Niel is joining rival Patrick Drahi in taking his phone company private after customer losses and heavy spending sent its shares into a steady decline. Iliad SA jumped as much as 62% to Niel’s offer price. Here are some of the biggest European movers today:

- UniCredit shares gain as much as 6.3% in Milan trading after the Italian lender beat analyst estimates and announced it’s starting talks to take over Banca Monte dei Paschi.

- Umicore shares rise as much as 3.3%; 1H results beat both consensus and in-house expectations, KBC (accumulate) says in a note.

- Proximus shares rise as much as 4.1%, the most intraday since Jan. 27, with KBC (hold) saying the 2Q results from the Belgian telecoms firm are better than expected.

- Pearson shares rise as much as 2.7%, reversing earlier declines and hitting the highest since June 17, after results that topped expectations and with Shore Capital (hold) saying it sees potential for growth for the education company.

- Intertek shares drop as much as 9.4%, hitting their lowest level since May 2020, with RBC (underperform) saying 1H results missed expectations on weak margins in the Trade unit.

- IAG shares decline as much as 6.4%, falling with other travel stocks, following the British Airways owner’s 2Q results, which struck a more cautious tone than its peers.

“We have a bit of day-to-day volatility, but the overall market is quite strong,” said Hans Stoter, global head of core investments at AXA Investment Managers. “It’s largely still a function of limited alternatives available, with a still attractive pick up in return versus the more risk-free alternatives.”

Bank of America analysts, however, said they had turned “neutral” on European equities after a 60% rally year-to-date, saying they expected the STOXX Europe 600 to remain close to current levels of 460 until early in the fourth quarter.

Earlier in the session, Asian stocks fell as investors remained wary over China’s tightening regulatory grip, while concerns about rising Covid-19 cases sent shares lower in Japan and the Philippines. The MSCI Asia Pacific Index fell as much as 1.3% on Friday a day after capping its biggest one-day gain since mid-May. Chinese tech giants Alibaba, Tencent and Meituan were the biggest drags on the gauge. Benchmarks in Japan and the Philippines were among the worst performers as their governments added measures to contain the spread of the virus. China’s CSI 300 index fell, reversing Thursday’s gain. Chinese stocks are rounding off a volatile week during which investors grappled with an uncertain regulatory landscape after a rout pushed the nation’s key equity index to the brink of a bear market.

“It looks like investors are taking risk off the table in China and also in the Nasdaq ahead of the weekend as no one wants to be caught out if China comes out with some new regulatory surprises or some bad headlines emerge from China’s credit market,” Jeffrey Halley, senior market analyst at Oanda Asia Pacific Pte., said in an email. Asia’s stock benchmark is headed for its second-straight weekly decline, dragged by a combination of virus worries and continued weakness in Chinese shares amid crackdowns on tech and online-education companies. In Hong Kong, the Hang Seng Index, which earlier this week posted its biggest two-day loss since 2008, dropped as much as 2.6%

In rates, after rising on Thursday on the economic data, U.S. Treasury yields pulled back, particularly towards the long end of the yield curve. Benchmark 10-year notes last yielded 1.2506%, down from 1.269% late on Thursday, and the 30-year yield stood at 1.9077%, down from 1.916% on Thursday. The 10-year yield was 3bp lower on the week, its fifth straight weekly drop, supported by favorable supply dynamics and potential for month-end flows; the Bloomberg Barclays Treasury Index was headed for a monthly gain of ~1.2%. The spread between the U.S. 10-year and 2-year yield narrowed to 105.30 basis points. But following Fed Chairman Jerome Powell’s remarks this week that rate increases are “a ways away” and the job market still had “some ground to cover”, the dollar wallowed near one-month lows on Friday and was set for its worst week since May.

In FX, the Bloomberg Dollar Spot Index was flat on the day; sterling eyed its best week since December, advancing 1.7% and up 0.1% on the day. It was buoyed by optimism the spread of the virus in the U.K. may be coming under control, with attention turning to next week’s Bank of England meeting. “Data has been sending encouraging signals that vaccines are helping the U.K. to win the fight against Covid,” said Lee Hardman, a strategist at MUFG. “It reinforces our confidence in a stronger, more sustained economic recovery.” Elsewhere, trading was mixed with month-end in focus. The Japanese yen eased after rising to one-week high earlier in the session amid Gotobi day flows.

“We expect the Fed to remain flexible, edging toward tightening only when justified by consistently strong economic data. Powell was a Fed board member in 2013 when taper talk unsettled markets, so he looks set to remain cautious in his communications,” said Mark Haefele, Chief Investment Officer, UBS Global Wealth Management.

In commodities markets, oil prices fell back after global benchmark Brent on Thursday topped $76 a barrel on tight U.S. supplies. Brent was down 0.24% at $75.87 per barrel and U.S. West Texas Intermediate crude traded down 0.29% at $73.41. Brent crude is still up nearly 2% for the week. Spot gold was unchanged at $1,827.9 an ounce, on course for its best week in more than two months on the prospect of delayed Fed tapering.

Bitcoin continued to trade near $40,000, maintaining its recent rebound.

Looking at the day ahead, there are a number of data highlights from around the world. In Europe, there’s the first look at Q2’s GDP for the Euro Area, Germany, France and Italy, along with the flash CPI print for the Euro Area in July, and preliminary CPI readings from France and Italy. In the US, there’ll be the personal income and personal spending data for June, the final University of Michigan consumer sentiment index for July, and the MNI Chicago PMI for July. Otherwise, central bank speakers include the Fed’s Bullard, and earnings releases include Procter & Gamble, Exxon Mobil, AbbVie, Chevron, Charter Communications, Linde, Caterpillar and Natwest Group.

Market Snapshot

- S&P 500 futures down 0.6% to 4,385.25

- STOXX Europe 600 down 0.4% to 462.01

- MXAP down 1.0% to 197.79

- MXAPJ down 0.9% to 654.41

- Nikkei down 1.8% to 27,283.59

- Topix down 1.4% to 1,901.08

- Hang Seng Index down 1.3% to 25,961.03

- Shanghai Composite down 0.4% to 3,397.36

- Sensex up 0.4% to 52,867.11

- Australia S&P/ASX 200 down 0.3% to 7,392.62

- Kospi down 1.2% to 3,202.32

- German 10Y yield rose 0.1 bps to -0.449%

- Euro up 0.1% to $1.1900

- Brent Futures down 0.1% to $75.96/bbl

- Brent Futures down 0.1% to $75.96/bbl

- Gold spot up 0.1% to $1,829.92

- U.S. Dollar Index little changed at 91.82

Top Overnight News from Bloomberg

- The U.S. expressed concern over harassment and intimidation of foreign correspondents in China, marking an escalation of the two nations’ dispute over the work of journalists

- The euro-area economy rebounded sharply in the second quarter as businesses reopened following the lifting of lockdowns

- China blamed European demands to meet jailed Uyghur scholar Ilham Tohti for preventing diplomatic visits to Xinjiang, suggesting little chance of a breakthrough in a stalemate at the center of tensions between the two sides

- Beijing pledged more effective fiscal support for the world’s second-largest economy and tighter supervision of overseas share listings as policy makers highlighted economic risks in the second half of the year.

- China ordered 12 Internet giants including Alibaba Group Holding Ltd. and Tencent Holdings Ltd. to step up data security protections, including the exporting of key information

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks mostly weakened at month-end with the region occupied by a slew of earnings and data releases, while US equity futures also pulled back after the prior day’s fresh record levels on Wall St. following earnings from Amazon which disappointed on revenue and guidance. ASX 200 (-0.3%) was subdued by underperformance in the defensive sectors and with Origin Energy the worst performer after it flagged significant impairments, although the losses for the index were cushioned by resilience in mining names after further production updates. Nikkei 225 (-1.8%) retreated to its lowest level since early January with the government likely to add four prefectures to the state of emergency and extend the emergency status in Tokyo and Okinawa to August 31st. In addition, the list of worst-performing stocks was heavily dominated by Co.s that recently announced earnings despite some actually reporting improved results, while the mostly better than expected data from Japan including the fastest pace of growth in Industrial Production since July last year, failed to spur risk appetite. Hang Seng (-1.4%) and Shanghai Comp. (-0.4%) were negative as the recent aggressive tech-rebound lost steam which saw yesterday’s best performers in Hong Kong languish at the other end of the spectrum and as Chinese money market rates increase heading into month-end with the PBoC opting again for another tepid increase in its liquidity operations. Notable weakness was also seen in the likes of Sinochem and Sinofert after reports China’s state planner summoned key fertilizers firms and warned them regarding hoarding and speculation. Finally, 10yr JGBs failed to benefit from the weakness in stocks and traded flat with demand sapped amid the recent indecisive mood in T-notes and firm Japanese data, as well as the lack of BoJ purchases in the market today.

Top Asian News

- NetEase’s Music App Is Said to Get HKEX Nod for Hong Kong IPO

- China Holds Seminar With Alibaba, Tencent, Meituan

- Fire Erupts at Tesla Big Battery in Australia During Testing

- Iron Ore Tumbles as China’s Steel Sector Revamp Curbs Demand

The downside pressure across European bourses and futures has lessened in intensity, albeit the region remains largely in the red (Stoxx 500 -0.5%) as the negative APAC sentiment seeped into Europe as traders tee up for month-end. The mood was also hit by Amazon (-6% pre-market) slumping some 7.5% after earnings as the behemoth (accounting for around 5% and 10% of the SPX and NDX respectively) warned of headwinds as COVID restrictions are lifted. US equity futures trade with varying degrees of losses, with the YM (-0.3%) performing better than its ES (-0.7%), RTY (-0.5%) and NQ (-1.1%) peers. Back to Europe, earnings have remained in focus, with varying degrees of losses are seen across the bourses, with the CAC 40 (-0.4%) losses cushioned by earnings-related gains in EssilorLuxottica (+3%), L’Oreal (+0.4%) and BNP Paribas (+0.3%). Sectors are predominantly in the red, although Banks outperform as UniCredit (+5.1%) and BBVA (-0.1%) reported alongside BNP, with the former also entering exclusive talks to purchase some parts of BMPS (+7.5%) with the two sides have agreed on a framework for a potential deal. However, terms have not been agreed. Elsewhere, Deutsche Telekom (-0.7%) gave up the opening gains seen on the back of T-Mobile’s metrics, with Deutsch Telekom a 43% stakeholder of the latter. For full details of the pre-market earnings, please refer to the European Equity Opening News and Additional Equity Stories. Finally, Iliad (+60%) shares spiked higher at the open and held onto gains as Xavier Niel, the controlling shareholder with a stake of 70.65%, is launching a simplified public tender offer for the Co. at EUR 182/shr, representing a 61% premium from Thursday’s close. The offer has been unanimously favourably received by the board.

Top European News

- Iliad Soars 62% After Buyout Offer From French Billionaire Niel

- Polish Inflation Rebounds to 5%, Highest Level in a Decade

- German Economy Expands 1.5% Q/q in 2Q; Est. +2% Q/q

- Italian Economy Expanded 2.7% Q/q in 2Q; Est. +1.3%

In FX, USD – Aside from mild selling for month end via Citi’s rebalancing model, the signs are looking more and more ominous for the Greenback, technically if not fundamentally beyond the dovish leanings of this week’s FOMC relative to market expectations. Indeed, after a pretty tame bounce to barely above the 92.000 mark, the DXY has retreated even further to register a new low for the week and July, at 91.775, and bears will now be eyeing 91.699 from June 29 ahead of 91.500. However, the Dollar may yet get a late reprieve via PCE data as the Fed’s preferred measure of inflation, comments from known hawk Bullard and/or the Chicago PMI as a proxy for the manufacturing ISM.

- GBP/EUR/NZD/AUD/CAD – Sterling is among those setting the pace in the race to extract most from the Buck’s demise, but could remain capped into 1.4000 having stalled just shy of the 50 DMA not far under the round number yesterday, while the Euro has now absorbed offers standing in the way of 1.1900, though could be hampered by multi-billion option expiries stretching from 1.1850 to 1.1920. Elsewhere, the Kiwi and Aussie are back above 0.7000 and around 0.7400 respectively after reversing overnight amidst broader risk aversion, with the former drawing encouragement from a solid recovery in NZ building consents and latter piggy-backing the Yuan’s ongoing revival to best levels seen since late last month. Similarly, the Loonie has rebounded through 1.2450 alongside WTI recouping losses from sub-Usd 73/brl, and is now looking towards Canadian GDP, PPI and budget balances for some independent impetus.

- CHF/JPY – The Franc is probing 0.9050 and poised to gather more momentum if sentiment really deteriorates, while the Yen has breached 100 DMA resistance at 109.60 in wake of mostly better than expected Japanese data in the form of ip, retail sales and unemployment, but is holding beneath 109.50 following Japanese PM Suga declaring a state of emergency for four additional prefectures, in line with earlier reports.

- SCANDI/EM – No change in Norges Bank daily currency purchases planned for August, but the Nok has come unstuck regardless of Brent’s bounce on the back of a surprise rise in Norway’s registered jobless rate. Conversely, the Try has been bolstered by a narrower Turkish trade deficit and the Zar is firmer against the backdrop of Gold forming a base above the 200 DMA and staying on track to record its best week in over two months.

In commodities, WTI and Brent front month futures are choppy, after earlier trimming their APAC losses and briefly breached USD 73.50/bbl and USD 75/bbl respectively to the upside from overnight bases of USD 72.93/bbl and USD 74.39/bbl. New flow for the complex has remained light heading into month-end and with most of the risk events out of the way barring today’s PCE. On the geopolitical front, it’s worth keeping on the radar reports of an oil tanker linked to an Israeli billionaire reportedly coming under attack off the coast of Oman – although details remain light and motives unknown. Alongside sentiment, participants will likely home in on demand-side developments in the absence of notable supply-side events until around the second week of August. Iranian nuclear talks are expected to resume after Raisi is sworn in as Iran’s President on August 5th, whilst OPEC+ will keep an eye on the macro environment in the run-up to its September 1st decision-making meeting – with the JTC. Next week’s focus will fall on the inventory data for expected drawdowns ahead of the US labour market report. Elsewhere, spot gold and silver trade sideways as traders keep some powder dry for today’s US PCE metrics – with the former meandering around its 50 DMA around 1,828/oz. LME copper meanwhile remains subdued amid the sullied risk tone, albeit the red metal trades north of USD 9,750/oz.

US Event Calendar

- 8:30am: June Personal Income, est. -0.3%, prior -2.0%

- 8:30am: June Personal Spending, est. 0.7%, prior 0%

- 8:30am: June PCE Core Deflator YoY, est. 3.7%, prior 3.4%; Core Deflator MoM, est. 0.6%, prior 0.5%

- 8:30am: June PCE Deflator YoY, est. 4.0%, prior 3.9%; Deflator MoM, est. 0.6%, prior 0.4%

- 8:30am: June Real Personal Spending, est. 0.3%, prior -0.4%

- 9:45am: July MNI Chicago PMI, est. 64.1, prior 66.1

- 10am: July U. of Mich. 1 Yr Inflation, est. 4.8%, prior 4.8%; 5-10 Yr Inflation, prior 2.9%

- 10am: July U. of Mich. Sentiment, est. 80.8, prior 80.8; Expectations, est. 78.4, prior 78.4; Current Conditions, est. 84.5, prior 84.5

DB’s Jim Reid concludes the overnight wrap

Since we last spoke two days ago yet more stuff has been sold from our house clear out via Facebook marketplace. A piece of artificial indoor topiary had around 50 people enquire over it. I’m beginning to think it’s like the used car market at the moment. It’s been eye opening. My wife has sold so much stuff online over the last couple of weeks that I’m expecting someone to come round and say they’ve now purchased me. As long as I achieve a higher price than the topiary I’ll be happy.

Higher prices seems to be where we are closing out July as we hit the last business day of the month. Global equities were once again at all-time highs yesterday, with the MSCI World index (+0.66%) and Europe’s STOXX 600 (+0.46%) both climbing to fresh records, whilst the S&P 500 (+0.42%) closed less than 0.1% away. On one level, this is ignoring the fact that global Covid-19 cases are on track for a 6th successive weekly increase, with cases currently rising in every G7 economy apart from the UK. However, strong corporate earnings releases and further dovishness from Fed Chair Powell this week have helped to outweigh that, and if anything, the impact of more cases on markets has been cushioned by expectations that this will in turn see central banks become more cautious about withdrawing monetary stimulus over the coming months. Financial conditions remain at or around record levels of looseness.

That “slightly bad news is good” interpretation was offered further reinforcement by weaker-than-expected US data yesterday. On the bright side, we found out that real GDP has now exceeded its pre-Covid peak in the US, thanks to growth at an annualised rate of +6.5% in Q2 (vs. +8.4% expected). This means that in spite of seeing the largest contraction since quarterly records began in the late-1940s, the time taken to get back to the pre-recession level of GDP has been broadly in line with the post-war average, and much quicker than after the GFC (see my CoTD here for more on this). However, that still underwhelmed expectations that we’d see growth at a stronger pace, and the prior quarter’s reading was also revised down a tenth to show growth of +6.3%. The price index/deflator was up an annualised 6% (vs. 5.4% expected) as inflation concerns are bubbling quietly back up in the background again. See news on breakevens, commodities and German inflation below.

On top of the GDP data, the weekly initial jobless claims for the week through July 24 fell by less-than-expected to 400k (vs. 385k expected) and the prior week’s number was revised up by +5k as well.

In spite of this however, risk appetite remained strong as mentioned, with equity indices rising to fresh records across multiple regions. It was a broad-based advance on both sides of the Atlantic with cyclical industries leading the way, along with energy stocks on the back of a continued recovery in oil prices. The S&P 500 saw over 77% of the index’s constituents increase yesterday with 19 of the 24 GICS Level 2 industry groups gaining. Media (-1.12%) was the worst performing industry yesterday – and the only one to lose more than 0.25% – dragged down by the previous day’s earnings release from Facebook (-4.01%). After the close yesterday, we got further earnings news from Amazon, with the company seeing its shares fall over -7% in after-hours trading due to a lower earnings forecast than expected and missing on analysts’ revenue expectations. There were also signs that consumers, especially in the US, were shifting back to in-store shopping at higher rates than expected.

Overnight in Asia, sentiment has weakened with most indices trading lower along with futures on the S&P 500 (-0.77%) as weak earnings from Amazon act as an overhang. The Nikkei (-1.34%), Hang Seng (-2.10%), Shanghai Comp (-0.53%) and Kospi (-1.10%) have all lost ground, capping off what’s been a relatively poor performance over the month as a whole for equities in the region. Separately, yields on 10y US treasuries are also down -1.9bps. On the data side, there’ve been a number of releases from Japan, with retail sales for June coming in at +3.1% month-on-month (vs. +2.7% expected), whilst the jobless rate ticked down to 2.9% (vs. 3.0% expected).

Today, attention could well turn to the inflation theme again, with the release of the Euro Area flash CPI reading for July at 10:00 London time. That follows the German inflation reading yesterday, which came in at a stronger-than-expected +3.1% (vs. +2.9% expected) on the EU-harmonised measure, and marks the highest that inflation has been in Germany since August 2008. As with the US readings lately, we can’t help thinking that if this is solely due to factors such as base effects, then why weren’t economists predicting them in advance, which begs the question as to whether these pressures are becoming more entrenched. As a reminder, we released the second publication in our “What’s in the tails?” series last week that specifically looked at the prospect for heightened inflation in Germany, which you can read here.

Speaking of inflationary pressures, yesterday saw continued strength across commodities as a whole, with Bloomberg’s Commodity Spot index (+1.38%) hitting its highest levels in over a decade. Precious metals were among the biggest winners yesterday amidst continued concern over inflation and low real yields, with gold (+1.17%) and silver (+2.21%) both seeing decent advances. Energy prices have also recovered after their recent wobble, with Brent Crude up +1.75% to close above $76/bbl again, whilst WTI was also up +1.70%. The gain in oil prices was partly driven by strong demand, which saw US stockpiles decline more than expected. So although various people (including Fed Chair Powell) have cited isolated examples of commodity declines like lumber for why inflation will prove transitory, it’s clear across the asset class as a whole that we’re yet to see broader declines just yet.

Over in sovereign bond markets, there was a more divergent performance across countries. Yields on 10yr US Treasuries rose +3.7bps to 1.269%, as real yields (+0.8bps) hovered around their recent lows. The main driver of the rates move was higher inflation breakevens (+2.8bps), which at 2.42% are now the highest they’ve been since early June. Rates were far tamer in Europe with yields on 10yr bunds closing unchanged, and those on OATs (-0.8bps) and gilts (-0.2bps) moving lower.

Turning to the latest on the pandemic, the UK numbers continued to move in the right direction, with cases over the entire last week now down -37% on the previous week’s total. For reference, there’s only been one other day this calendar year where the weekly decline over the previous 7 days has been as rapid as this. On the flipside, the Japanese government’s expert panel has approved a plan to expand a state of emergency to areas surrounding Tokyo like Osaka and extend it to the end of August to control the spread of the virus. Prime Minister Yoshihide Suga is likely to make it official at a task force meeting beginning at 5 pm and give a news conference on the situation at 7 pm (Tokyo time). Over in the US there was news that some restaurants in New York City would be independently requiring proof of vaccinations in order for patrons to dine indoors. While Mayor de Blasio has not instituted any such rule, he commended the owners and said “This is the shape of things to come.” Staying in the US, President Biden wants the rest of the US to follow NYC’s lead and called on state and local governments to use part of the $350bn in federal funding the administration appropriated to them in the latest stimulus package to offer residents $100 to get vaccinated. On vaccinations, President Biden announced that he would require federal workers to prove their vaccination status or wear masks while at work and be submitted to frequent testing. Meanwhile, Israel will be the first country to widely disperse booster shots of the Covid-19 vaccine, with the country giving third Pfizer shots to those over the age of 60.

Running through yesterday’s other data, German unemployment fell by a stronger-than-expected -91k in July (vs. -29k expected), which pushed the unemployment rate down to a post-pandemic low of 5.7%. Separately, the European Commission’s economic sentiment indicator for the Euro Area rose to 119.0 (vs. 118.2 expected), which is its highest on record going back to 1985. Finally, UK mortgage approvals came in at 81.3k in June (vs. 84.5k expected).

To the day ahead now, and there are a number of data highlights from around the world. In Europe, there’s the first look at Q2’s GDP for the Euro Area, Germany, France and Italy, along with the flash CPI print for the Euro Area in July, and preliminary CPI readings from France and Italy. Over in the US, there’ll be the personal income and personal spending data for June, the final University of Michigan consumer sentiment index for July, and the MNI Chicago PMI for July. Otherwise, central bank speakers include the Fed’s Bullard, and earnings releases include Procter & Gamble, Exxon Mobil, AbbVie, Chevron, Charter Communications, Linde, Caterpillar and Natwest Group.