There was a lot of chatter in the pre-market about Goldman having issues getting the deal fully allocated but nothing, obviously, was confirmed; and as a reminder, for Robinhood’s own IPO, the company has stated that it plans to sell its users between 20% and 35% of its IPO shares through the app’s IPO Access feature.

Robinhood CEO Vlad Tenev concluded a pre-open interview with CNBC this morning by pronouncing that:

…or at a minimum, still in business.

I don’t follow Robinhood other than reporting the numerous problems it has had with account theft and customer service.

-

For those that haven’t read Robinhood’s 360-page S-1 and subsequent registration amendment, some brief observations follow on some of the most egregious aspects of one of the most one-sided, enrich the insider casino offerings I’ve ever seen, and there have been some doozies.

-

If Robin Hood robbed the rich to give to the poor, the modern-day version is now in the business of gutting the sheep and pocketing the wealth of the retail speculator for himself. Fleecing at least. “Robinhood is democratizing finance for all,” reads the prospectus. Sure.

-

Robinhood, who in December paid a $65 million fine (without admitting or denying guilt, wink) for best execution and payment for order flow alleged violations, will raise on the order of $2.3 billion from new shareholders in its upcoming IPO. What does The IPO investor get?

-

The expected $2.3B brought to the party by new shareholders represents almost 30% of all of capital raised since 2013, including proceeds raised in the offering. For their money these new “investors” will only own 7% of the company and far less voting rights. Dilution, baby.

-

Including proceeds from the IPO, the VAST MAJORITY of capital will have been raised just in the past two years, mostly 2021. Reread the breakdown of how much capital the IPO buyers are investing and what percent of the company they will own. This makes SPACs look non-dilutive.

-

From its founding in ’13, $HOOD raised $5.6B in a series of $2.2B convertible preferreds and 2 tranches of $4.7B in converts (the converts sold just this year). Additional paid in capital totals $149m. The balance sheet has $4.8B cash with shareholder equity a negative $1.5B.

-

Most of the negative equity value reflects “losses” on the degree to which converts issued in February are already “in the money.” They were money good at issue! More on this in a bit. The IPO will sell 55 million shares, with the founders & CFO selling 2.6 million of those.

-

An over-allotment option for another 5.5m could bring the total to 60.5m shares sold at an expected range of $38-$42 per share. Using the midpoint, the company may raise $2.3B, bringing cumulative capital raised to $7.9B. At $40, Robinhood will have a market value of ~$33.6B.

-

Remember, this is against $7.9B in cumulative capital raised, including proceeds from the IPO. In their generous hearts of hearts, 25% to 30% of the shares offered in the IPO are “reserved” for Robinhood “customers.” That’s 13 to 16 million shares at a midrange $40 per share.

-

That’s $500 million to more than $600 million. Rob from the fools, give to the poor insiders. What a deal. But it’s a brokerage firm. With capital requirements. Growing revenues will require new capital, either retained profit or new capital. Regardless, let’s talk dilution.

-

What’s missing from outstanding shares at 3/31? Hold on to your wallets. There are $2.55B in tranche 1 converts outstanding which will be exercised at the LOWER of 70% of the IPO price or $38.29. Assume at $28, which at an IPO price of $40 yields a quick 42.9% gain or $1.1B.

-

The converts were sold in February 2021, not bad for 5 months of ownership. If the IPO is wildly oversubscribed and prices north of $55 per share, the option holders get in at no higher than $38.29. The only way the converts were anything but free money was if no IPO ensued.

-

There are $1.03B in tranche 2 converts outstanding which will be likewise exercised at the LOWER of 70% of the IPO price or $42.12. Again assume at $28, which at an IPO price of $40 yields the same quick 42.9% gain or a gain of $441m. Same deal as above. Quick. Free. Money.

-

These converts were also sold in February 2021, again not bad in 5 months of ownership. Who wouldn’t invest at 70 cents on the dollar if an IPO was coming tomorrow? On both tranches of converts, buyers were further rewarded with 6% interest in the interim. Payable in shares!

-

These converts were also sold in February 2021, again not bad in 5 months of ownership. Who wouldn’t invest at 70 cents on the dollar if an IPO was coming tomorrow? On both tranches of converts, buyers were further rewarded with 6% interest in the interim. Payable in shares!

-

There are 39.1m “time-based” RSUs outstanding. At a $40 price these have $1.6B of pre-tax value. Not bad. The company will withhold the tax liability. There are 27.7m (I think that’s the #) 2019-class “market based” RSUs out that vest at the IPO. Graduated hurdle is an IPO!

-

There are 35,520,000 2021-class “market based” RSU shares outstanding that vest at the IPO. These will have $1.42B of value at a $40 IPO price. Not bad for a few months of ownership. These were granted in MAY – TWO MONTHS AGO. Brilliant timing. What luck.

-

There are 27.8m shares set aside for future SBC. This is a $1.1B set-aside for insiders. In total, an additional 14% dilution is authorized. There are additional shares set-aside for an Employee Stock Purchase Plan, offering new shares at a discount to market value. Why not.

-

Any A-share RSUs vested and exercised by the founders can be converted to uber-voting B shares upon exercise. There were 230.7m shares outstanding (vested and held by insiders/private owners) at 3/31 (before the IPO). After the IPO, the share count stands to be ~840 million.

-

New shareholders will bring $2.3B to the party, over 29% of all of the capital raised since 2103. For their money they will own 7% of the company. Did I already mention dilution? Wait until you see the dilution in book value and evisceration of per share book value.

-

Cash in the firm will total about $7 billion with the addition of proceeds from the IPO. So how do you get to a ~$34B valuation? On fundamentals, 2020 REVENUES totaled $959m. 3/31 quarterly revs were $522m & 6/30 are estimated by the company at a range of $546 and $574m.

-

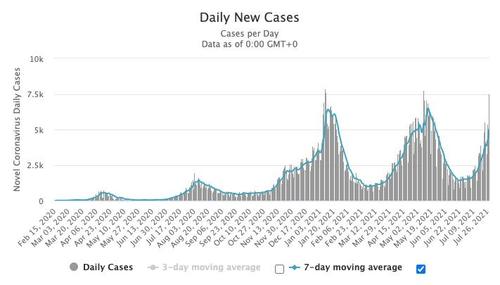

At the midpoint, sequential revenues were up 7.3%, growing fast but decelerating in a hurry…In fact, monthly revenues in March of this year actually declined from February. The company reports $81 billion in assets under custody at March 31 and 18 million accounts.

-

That works out to a whopping $4,444 per account (the median must be even WAY lower). The company further reports annual revenue per user of $137. No doubt some averaging is involved, but what they don’t report is that $137 in revenues from a $4,444 account is 3% per year.

-

On those 18 million $4,444 accounts, total assets under custody break down as: $65 billion in equities (AMC, GME & TSLA for sure) $2B options $11.6B crypto (up from $3.5B at 12/31 & $481m a year ago) $7.6B cash ($5.4B) margin Total assets under custody total $81B.

-

14% of customer assets are crypto! You don’t see any bonds. You don’t see any mutual funds. Half of transaction revenue, which are 81% of firm revenues, come from OPTION rebates, while options at market value account for only $2B of customer assets. Tell me it’s not a casino.

-

Option trading should definitely be allowed for the inexperienced, small, retail “investor.” This is how you get experience, and initiated. On assets held as crypto, these “assets” can neither be transferred in our ACAT’d out. They must be transacted while in the hood.

-

The company naturally collects transaction fees from its trading partners and “can not guarantee the risk of a hack or theft.” Most crypto is stored in “cold pockets” but, of course, no SIPC protection exists on crypto. I can’t imagine anything untoward or going wrong here.

-

17% of firm revenues were earned in Q1 from crypto transaction “rebates,” up from 4% in the prior quarter. While $HOOD supports 7 cryptos for trading, no less than 34% of crypto revenues were from DOGECOIN! Hilarious reading this. I’m probably wrong about this being a casino.

-

In the first quarter alone, “customers” traded $88B of crypto against $11.6B held at 3/31 and $3.5B at year-end 2020. Definitely not a casino, but a platform encouraging the long-term ownership of investments. You think new “customers” learn all about the coffee can approach?

-

Robinhood further discloses that 81% of Q1 revenue came from selling equity and option order flow to 4 market makers, up from 75% of revenue during 2020. Regulatory issue on the horizon? Durability of “moat” issue? It’s in the Risk section, but so is lots of boilerplate.

-

Reasons for concern? In the first quarter, the company lost 5% of account value to transfers out, versus a quarterly average of 1.2% in 2020. Hopefully not a trend, particularly since customers cannot transfer crypto in and out. That said, crypto transactions = revenue! So…

-

The two company founders will own 135 million shares, 16% of those outstanding after the IPO with a value of $5.4 billion. If viewed as a percent of cumulative capital raised, including the IPO, that’s 68% of capital on virtually nothing invested. Ambitions on space travel?

-

Voting control through super-voting B shares give the lads 65% of the vote. Lockups for insiders and newly converted shareholders are benign. A flood is coming, but only after the share price reaches certain thresholds triggering the vesting of additional performance shares.

-

The CFO and Chief Legal Officer were each paid more compensation in 2020, mostly in shares, than Berkshire Hathaway’s two operating Vice Chairmen, Greg Abel and Ajit Jain are paid, all in cash, each year to operate the largest company in the world by fixed tangible assets.

-

The CFO & CLO, non-founders, were each given shares that at a $40 IPO will be valued at almost $100 million each. The CFO signed on in Dec 2018. The CLO joined up in May 2020, so just over a year in. The good news is he was CLO at Mylan, so knows his way around a courtroom.

-

The valuation seems insane, but will be “justified” because the company is a FinTech player. By comparison, Schwab’s market cap is $128 billion on $58 billion of book value and $5 billion of profit. Profit at Schwab is more than twice Robinhood’s total revenues.

-

Schwab’s assets under custody (larger retail & institutional clients) total $7.5 trillion on only 31.5 million active customer accounts. Fewer than 2x the accounts but nearly 100x the assets under custody with a valuation only 3x as great as the expected valuation of $HOOD.

-

Bully for those investing $5.6 billion in Robinhood prior to the IPO. Their investment plus shares given to founders/insiders will own 93% of the company post-IPO, which at a $33.6B valuation represents a $31.3B position & a gain of 650%, mostly earned over the past 2 years

-

Brokers have capital requirements, of which Robinhood has been short of at times. Schwab earns a roughly 10% ROE over time. The IPO will remedy capital need, for now. But a firm highly levered to selling customer order flow, rebates on crypto transactions and margin interest?

-

Equity, option & crypto trading are advertised in the prospectus as, “commission-free.” Um hum. Costless to the unwitting “customer.” The business wins only if the “customer” transacts or borrows. This is good for society? Know that Robinhood’s shave is only part of the cost.

-

Citadel doesn’t pay for flow for grins. The platform is not encouraging the long-term investment of patient capital. What I do know is that on a successful IPO, there will be corks a-popping in Menlo Park. This is massive dilution and delusion about valuing a retail broker.

-

Rob the unsuspecting and keep the gold, or the crypto, is sadly the new Robin Hood. In a week where famously introduced himself to Twitter, perhaps he has room on his plate for this one. The IPO is what it is. The way the company makes money, on the other hand…

-

On the IPO, it’s all there in black & white in the S-1. None of it is illegal. Moral? Surely contemptible. If you like investing in IPOs, where sellers are selling for a reason, and if you like being diluted by people who are in the business of taking, get your subscription in.

But unless one has a portfolio of at least $25,000 you’re generally limited to no more than 3 day trades in a 5 trading day period.

And it locked out customers at a critical time from trading GameStop and AMC. It had to because it was undercapitalized and could not hedge its risks. It still faces multiple lawsuits over the outages.