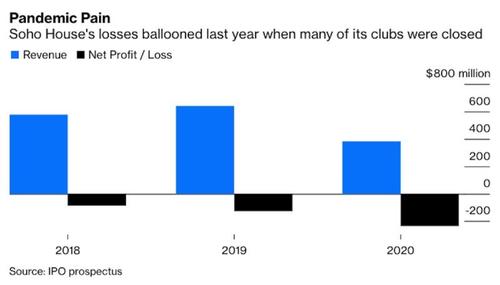

In what its underwriters will likely market as the pure-play bet on the post-COVID urban recovery, Soho House, the social club popular with urbane wannabe influencers and social climbers, revealed Tuesday morning that it’s planning on raising as much as $480MM in an IPO that will target a valuation of $3 billion, pricing the shares at between $14 and $16.

Evoking a less-than-flattering comparison to the botched WeWork IPO, the company revealed in its S-1 that its Class B shares (which will be restricted to investors and company insiders) would have 10 votes per share, while its Class A shares, which will be offered to the public, will only carry one vote. A similar arrangement helped sink WeWork’s planned IPO as investors balked at handing over so much power to then-CEO Adam Neumann and his family. The company plans to set aside 3.5% of the Class A shares being offered and reserving them for employees and members, allowing them to get in at the offering price.

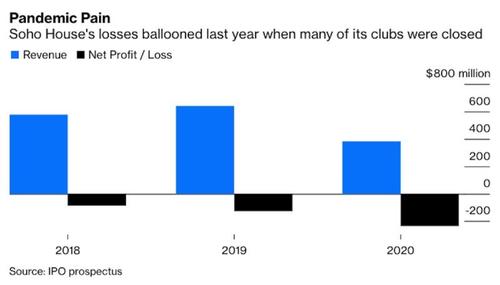

One of the most amusing sections of the prospectus is the part where management details all the different membership packages it offers. Management also repeatedly mentions the company’s “growing” wait list, including in a letter from CEO-founder Nick Jones. At the same time, the firm’s revenues have cratered since the start of the pandemic, with Soho House’s parent company booking just $72MM in revenue during Q1 2021, amounting to a net loss of $72MM.

But the company’s losses didn’t start with the pandemic. One year earlier, during Q12020 (which included the start of the COVID pandemic) the firm’s financial situation wasn’t that much better: For Q12020, the firm had total revenues of $142MM, a net loss of $45MM and Adjusted EBITDA of ($9MM).

Source: Bloomberg

Beginning with one location in London, the company has since opened eight additional ‘houses’ in London, New York and LA over the last two years and as of April 4, 2021, it had more than 1K members. Costs can vary, but even the cheapest membership plans will cost a few hundred dollars a month. For Soho House members, a US Soho Works membership ranges from $250 to $600 per month, depending on membership type.

Despite reporting consistent losses and with the shift away from urban living presenting a long-term tailwind for the firm (though the IPO will be fortuitously timed to coincide with the UK’s post-COVID reopening), Soho is seeking a lofty $3 billion valuation that would be more appropriate for a tech firm. If that sounds familiar, it may be because it’s essentially the same playbook used by WeWork.

Here’s a breakdown of the different membership types and businesses outlined above (text taken from the prospectus):

CITIES WITHOUT HOUSES

In 2017, we introduced a new type of Soho House membership known as Cities Without Houses (‘CWH’), which opens up the Soho House membership to people who live in cities where we do not yet have a physical House. This membership allows us to welcome members to our global community in new geographies, generates additional revenues on our existing base of Houses and provides intelligence for future growth, which we have employed to open new Houses in certain locations, including in Austin, Texas and Paris, both of which are expected to open in 2021. We currently have more than 5,000 CWH members across 45 cities, paying an annual US membership price of $2,630.

SOHO HOUSE DIGITAL MEMBERSHIP

The ambition for Soho House has always been to create a truly global membership that brings creative people together, from all over the world. We believe that we will be able to achieve this through the introduction of Soho House Digital Membership—a new, paid digital-only membership that we plan to launch in late 2021. Not limited by our physical footprint, Soho House Digital Membership will expand our global reach, allowing us to move further into Asia, Africa and South America, adding fascinating creatives from dynamic cities to our membership.

Soho House Digital Membership will be subject to the same application and approval process as Soho House membership, allowing like-minded individuals to connect, communicate and collaborate with each other, in a purely digital space through the SH.APP. It will make our membership truly diverse, and will enable the best creatives from all over the world to make meaningful connections with each other. In the same way that we’ve grown Cities Without Houses membership in 45 cities around the world, we will use our connections and liaisons on the ground in new cities to build awareness of digital membership, growing it organically through existing creative communities.

By leveraging our digital platforms in this way, and removing the reliance on physical spaces to experience the benefits of our membership, we have created a gateway to previously untapped growth opportunities. We believe this new membership type will be attractive to potential members who are already used to socializing, networking and working digitally. Existing Soho House members will also receive the full functionalities of the Soho House Digital Membership, and therefore, the introduction of the Soho House Digital Membership only serves to improve the richness of their membership experience, making it more valuable – with new opportunities to connect with and consume content from a truly global and diverse membership base.

SOHO FRIENDS

There are a significant number of people who enjoy the Soho House way of living and who have already visited our Houses as guests, stayed in our bedrooms, or visited our public restaurants and spas, but do not currently have a Soho House membership. To respond to this audience, we launched Soho Friends in November 2020 for an annual subscription cost of £100. We offer access to physical spaces, including Soho House bedrooms, and Soho Studios (our new social spaces for Soho Friends and Soho House members) that host curated programs of events and screenings, with additional benefits from our restaurants, spas and online retail brands, although Soho Friends do not have full access to our Houses. Between November 2020 and April 2021, we have received almost 6,000 applications, the majority of which originated from a recommendation of a Soho House member or a MCG employee, and accepted over 4,000 Soho Friends members. We intend to grow this membership brand in a measured way so that our Soho House members continue to account for the majority of visitors to our Houses and restaurants.

SOHO HOME

Soho Home was created as a result of the constant requests from our members to recreate the look and feel of the Houses in their own homes. Soho Home is an interiors and lifestyle retail brand that offers handcrafted furniture, lighting, textiles, tableware and accessories through e-commerce. Over the past year, we have transformed Soho Home into a high growth retail business, and in October 2020, we launched SOHO HOME+, which is a subscription-based membership platform with over 2,600 members as of April 4, 2021, that offers price discounts, free delivery, and expert design advice plus early access to new collections and seasonal sales for an annual price of £60.

SOHO WORKS

First launched in 2015, Soho Works provides its members with the space and resources to work alongside other like-minded individuals and businesses — facilitating connections and providing the tools to flourish. Aimed at existing Soho House and Soho Friends members, Soho Works draws on the same design principles and membership ethos as Soho House, but is a space purposed entirely for work and creative collaboration.

Beginning with one location in London, we have since opened eight additional sites in London, New York and Los Angeles over the last two years and as of April 4, 2021, we had over 1,000 members. Soho Works membership rates vary by location and Soho House membership status. For Soho House members, a US Soho Works membership ranges from $250—$600 per month, depending on membership type.

SCORPIOS BEACH CLUB

Set in a cove on the southern tip of Mykonos, Scorpios offers a one of a kind beach experience with a well- established globally recognized brand. With a restaurant, terraces and daybeds, and a distinctive wellness offering, Scorpios enriches the lives of its guests who are looking to escape from their daily lives. We believe the Scorpios concept has significant potential to expand into additional locations as a key part of our platform and we expect to open our second site in Tulum, Mexico at the end of 2022. While we do not currently offer a standalone membership, there is significant interest from our customers to do so and we therefore plan to launch a unique Scorpios membership in 2022.

THE NED

The Ned has created a new space in the heart of the City of London for its members to meet, eat, drink and socialize. The Ned brand seeks to embody a “city within a city” full-service destination, by playing host to multiple restaurants, bedrooms, a range of grooming services, spa, gym and a full service members’ club. The membership offered by The Ned (‘Ned’s Club’) is aimed at a broader group of professional people. As of April 4, 2021, Ned’s Club had over 3,000 members paying an annual subscription price of £3,150, and intends to expand into additional cities beyond London, as well as launch Ned Friends – a more accessible membership similar to Soho Friends, for frequent visitors and customers of The Ned. We receive management fees under our hotel management contract for the operation of The Ned.

As Bloomberg’s Chris Bryant points out, even Soho House’s bankers are approaching the firm and its finances with trepidation. Just look at this loan from Goldman.

A March refinancing replaced a big debt facility provided by Permira Credit with another one funded by Goldman Sachs Group Inc. (Goldman is among a slate of top-tier banks underwriting the offering.)

The $440 million Goldman facility pays 2% cash interest with another 6% on top that’s paid in kind, according to the prospectus, meaning the debt gets bigger over time. Those fairly onerous terms say something about Soho House’s riskiness

Bryant also objected to the voting rights issue that we noted above.

Asking for money from new shareholders without granting equal voting rights takes particular gumption. The co-owners — billionaire Ron Burkle’s Yucaipa Companies LLC, entrepreneur Richard Caring and founder and Chief Executive Officer Nick Jones — plan to receive Class B stock that grants them ten votes per share, according to a prospectus published on Monday. This will allow them to continue to exercise majority voting power after the New York listing, meaning they retain a veto over key decisions and control board appointments.

In summary: Like WeWork before it, Soho House is also launching myriad new businesses including coworking spaces that the firm hopes will benefit from the post-COVID “revenge spending” by wealthy consumers desperate for connection. The company intends to use part of the IPO proceeds to pay down debt and strengthen its financial position. At the time of the filing, the company had only $70MM on its balance sheet.

With WeWork going public via SPAC, we can’t help but notice the similarities between the two businesses.