Is The Retail Investor Rampage Over?

Authored by Lance Roberts via RealInvestmentAdvice.com,

Since the crash in March 2020, the “retail investor army” marched propelled by chat rooms and social media channels. As discussed previously in “Blind Leading The Blind:”

-

In all, 46% have used social media for investing information in the past month.

-

22% of Gen Z investors say they were younger than 18 when they started investing, versus 8% of millennial investors.

-

Only 36% of young investors plan to use that money for retirement. 35% will make additional investments, while 19% will use the funds to pay for a major purchase.

“Considering that many of these individuals have never seen an actual ‘bear market,’ such is the very definition of the ‘blind leading the blind.’”

Of course, with fresh stimulus checks in hand, and sports betting shut down along with the economy, the stock market became the “casino of choice.”

However, something seems to be changing.

A Loss Of Interest

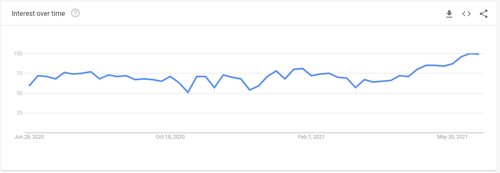

With sports betting back in action and stimulus checks running out, there seems to be a waning interest in the market. Recent google trend searches show some interesting trends.

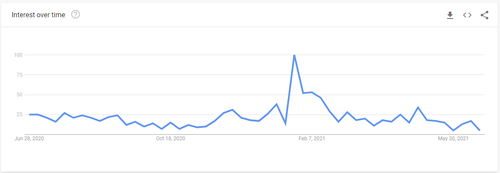

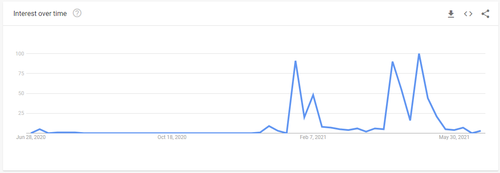

Learn How To Trade Stocks

For beginner investors with a fresh stimulus check in their hands, a search for learning how to trade or invest stocks faded along with the money.

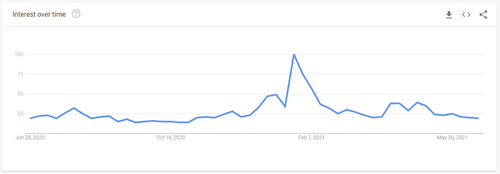

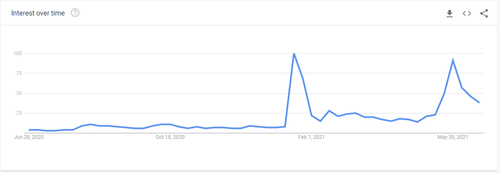

Invest In Stocks

Even the more speculative traders looking to leverage their returns seem to have lost interest.

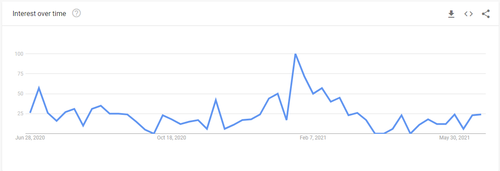

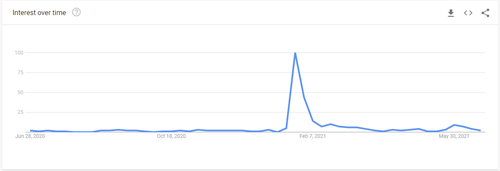

How To Trade Options On Robinhood

That loss of interest also shows up in the areas where retail investors were most focused.

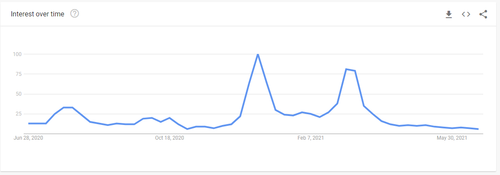

How To Invest In Dogecoin

AMC Theatres (AMC)

The Reddit website of the “Wall Street Bets” army has gone quiet in recent weeks as the stimulus support faded from the markets.

WallStreet Bets

It all reminds me of what Yogi Berra once quipped:

“Nobody ever goes there anymore – it’s too crowded.”

The Death Of WallStreet Bets

When I was growing up, my brother and I regularly had “BB gun” wars. Of course, there was no such thing as safety equipment, helmets, or goggles. It was him, me, and a bunch of kids armed with brass BB’s and pump-action guns going after it. Of course, I can still hear my mother’s warnings:

“It’s all fun and games until someone gets an eye put out.”

Fortunately, we all survived. That in itself is quite a feat considering we rode in cars without seatbelts, drank from garden hoses, rode bikes without helmets, and regularly settled our differences behind the school. And, it all had to happen before the street lights came on.

Today, everyone is looking for someone else to blame. That is the story of Wall Street Bets.

“But since January, the success of WallStreetBets has become an albatross, with the board’s moderators coming under fire for what many of the board’s 10.6 million users saw as inconsistent enforcement of the rules and a growing sense that the moderators were playing it too safe in fear of angering Wall Street and regulators.

There is also rampant speculation that the size and popularity of WallStreetBets made it susceptible to bad actors trying to create pump and dump schemes by spamming old conversation threads with ticker-specific posts that give the appearance of new social media interest in that stock.” – MarketWatch

Interestingly, it was Wall Street Bets which led to an exodus of users from the Robinhood trading app. Now the tables have turned as investors lost money, the excitement died, and having to go back to work for a paycheck crashed the party.

Stimulus

Remote Jobs

Retail Investors Are All In

As Sam Stovall once quipped:

“If everybody’s optimistic, who is left to buy?”

Such is currently the problem for the markets in the near term. Investors are exceedingly optimistic about future market returns as we noted last week:

Wealthy Americans are pretty optimistic about their long-term investment returns, expecting to earn average annual returns of 17.5% above inflation from their portfolios. That’s according to a new survey from Natixis that surveyed households that have over $100,000 in investable assets in March and April of 2021.”

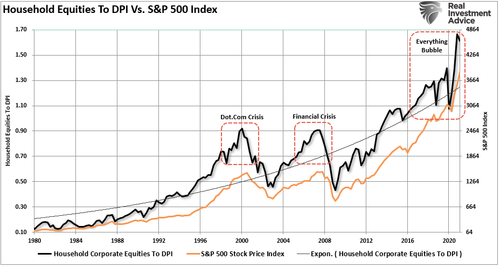

With allocations to equities as a ratio to the disposable income at a record peak, such suggests there is little buying power left.

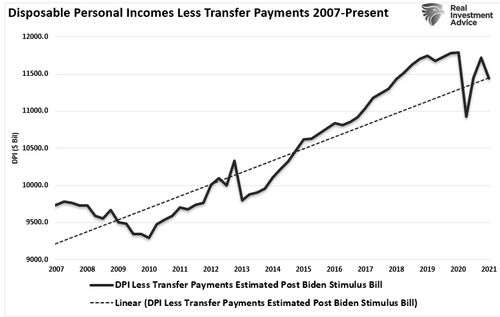

Such becomes more problematic as real disposable incomes return to more normal levels.

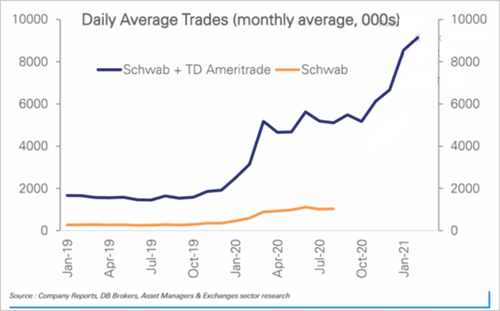

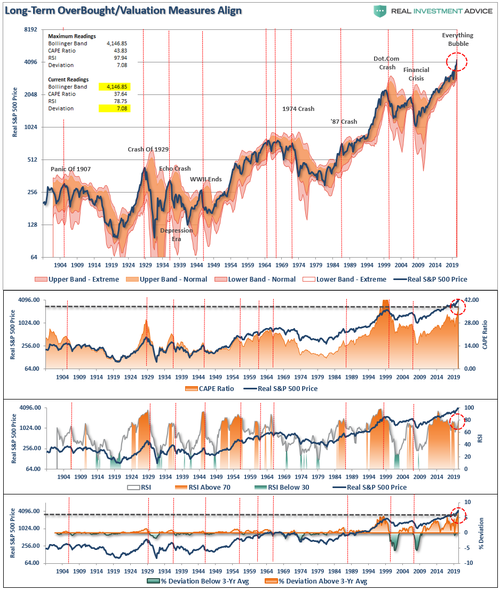

Of course, as liquidity dries up, the demand from retail investors which has made up nearly 20% of trading volumes this year also evaporates. The problem of “liquidity” becomes an important concern when markets are historically elevated from long-term means.

The chart below shows the deviation from the 3-year moving average, CAPE valuations, and RSI. These are levels never seen historically.

In other words, it’s all fun and games until someone gets their eye put out.

Looking For Someone To Blame

Some things don’t seem to change.

Currently, there seems to be no end to the rally. However, such is always the case just before it ends. In February of 2020 sentiment was much the same before a hair raising 35% plunge. Furthermore, those that chased the markets took on excess risk, and leveraged up to do it, will look for someone to blame for their losses.

“History repeats itself all the time on Wall Street” – Edwin Lefevre

Unfortunately, investors are faced with a terrible choice. Invest in extremely overvalued, extended, and bullish markets and hope they can navigate the eventual turn. Or, they can sit on the sidelines waiting for the eventual correction to take on equity risk.

In both cases, investors will wrong. The ones that pile in now will fail to navigate the turn as the “Fear Of Missing Out” keeps them allocated all the way down to the next bottom. Those that wait to get in will see the crash, and then stay out expecting stocks to continue to go lower. In the end, those that stayed in will eventually see their portfolio value recover, and those hoping to get in will still be on the sidelines.

Such is the psychology of investing, and eventually, individuals wind up looking for someone to blame.

Is the retail investing rampage over yet? Maybe. Maybe Not.

However, when the eventual unwinding occurs a new generation of investors will learn the brutal lessons of excess risk, speculation, leverage, and greed.

It is the oldest story on Wall Street.

Tyler Durden

Tue, 07/06/2021 – 09:20

via ZeroHedge News https://ift.tt/3ytSVwo Tyler Durden