World markets resumed their climb on Thursday after the Fed signaled it was in no rush to taper stimulus and reassurances from Beijing saw beaten-up Chinese stocks soar. U.S. equity-index futures gained slightly recovering earlier losses, except for Nasdaq 100 contracts, after mostly positive earnings, China’s efforts to soothe market nerves and the Federal Reserve’s reassurance that there’s some way to go before curbing stimulus. At 715 am Emini S&P futures were up 3.5 points ot 0.08% to 4,397.50, Dow futures rose 149 points or 0.422% while Nasdaq futures were down 23 points or 0.16%.

“Investors cheered positive news from both the U.S. and China after the Fed delayed tapering talks and reiterated the transitory effect of inflation while Beijing took reassuring measures to stop the market rout and ease concerns toward big Chinese companies,” said Pierre Veyret, technical analyst at ActivTrades.

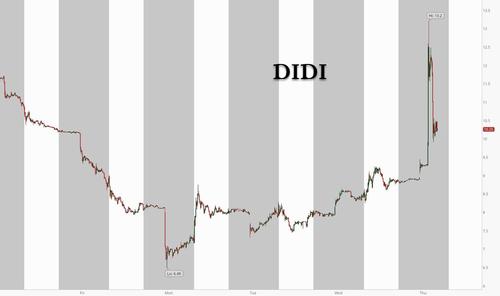

In notable premarket moves, the highlight was the rollercoaster in Didi shares which surged as much as 49% on a WSJ report the company was seeking to go private, only to slide right back down after Reuters reported that the company denied the report. Elsewhere, Facebook shares fell 3.5% in premarket trading after the social-media giant struck a cautious tone in its outlook, warning of headwinds resulting from new ad-targeting rules from Apple. Uber dropped 4.4% after a report that SoftBank, the biggest investor in the ride-haling service, is selling $2.1 billion of its holdings in a block trade through Goldman Sachs.

Other premarket movers include:

- Chinese large- cap stocks listed in the U.S. jump after Beijing stepped in to calm China’s volatile financial markets. Alibaba (BABA) jumps 2.9% in New York, JD.com (JD) rises 3.6%, Baidu (BIDU) gains 3.5%, Pinduoduo (PDD) up 5.8%, NetEase (NTES) is 2.9% higher

- Ford (F) gains 4.4% after the automaker posted a surprise profit in the second quarter. Analysts say 2022 is likely to be better given the improved FY21 guidance and positive structural changes to profitability.

- LendingClub (LC) yesterday boosted its net revenue forecast for the full year to above the highest of three analyst estimates. The show of confidence after the company notched its first full quarter operating a digital bank drove shares up 43% in premarket trading.

- PayPal slid after its quarterly revenue missed estimates.

“Buying the dip mentality in general does make sense because we do have policy settings which are really going a long way to reducing the tail risk for investors,” Peter Oppenheimer, chief global equity strategist at Goldman Sachs Group Inc., said in a Bloomberg TV interview. “The combination of extremely loose monetary policy and forward guidance, together with fiscal support, suggests that deflationary risks that dominated the post-financial crisis era are moderating.”

Meanwhile, the U.S. Senate voted to move ahead with a broad infrastructure package, after a bipartisan group of senators and the White House reached an agreement on a $550 billion plan.

In Europe, the Stoxx 600 Index gained 0.4%, rising to a new all time high of 464.01, as strong earnings from Total and Shell, Airbus and others offset a near 5% drop by Swiss bank Credit Suisse, which reported a near 80% profit plunge in the wake of Archegos and Greensill calamities. Gains led by basic resources and energy companies outweighed losses among travel stocks. Airbus gained 3.6% after raising its profit target, while miner Anglo American jumped 4.8% after saying it will return $4.1 billion to shareholders in dividends and buybacks. By contrast, Anheuser-Busch InBev slumped 6.2%, the most in 5 months, after missing profit estimates. Here are some of the biggest European movers today:

- Shell shares rise as much as 4.2%, the most intraday in more than five months, after reporting second-quarter results described as “strong” by RBC Capital Markets.

- Nokia shares gain as much as 8.7% to the highest price since March 2019 after reporting results above expectations and upgrading guidance.

- Danone shares climb as much as 6.8% after the world’s biggest yogurt maker reported 2Q organic sales growth that was 150 basis points above consensus, with a return to growth across all segments, according to Bernstein (underperform). Unlike its peers, it didn’t give a warning on inflation.

- STMicro’s shares jump as much as 5.3% in Milan after earnings. Oddo says the chipmaker’s second-quarter results and third-quarter guidance are “very good.”

- BT shares slump as much as 8.5% following a trading update for its first quarter, with analysts flagging weakness in the telecom company’s Global business as customers delayed spending on projects and equipment.

- Smith & Nephew shares drop as much as 9%, the most since March 2020, after the company reported 2Q results. Bernstein says investors may be disappointed by the orthopedics results while Shore Capital notes uncertainty ahead.

- Orange shares drop as much as 4.8%, hitting the lowest since Oct. 2020, after the company posted earnings. Attention may be on its anticipated decline in wholesale revenue which looks a “modest negative,” Goldman Sachs (neutral) writes in a note.

Earlier in the session, the MSCI Asia Pacific Index jumped 1.7% with Chinese internet giants Tencent, Alibaba Group and Meituan providing the biggest boost while Japan’s Topix index gained 0.4%. Asian stocks climbed as a rally in China’s equities and the Federal Reserve’s reassurance of gradual tapering helped boost sentiment after the selloff seen earlier this week. The Hang Seng Tech Index surged as much as 8%, extending gains after a CNBC report said China will continue to allow its companies to go public in the U.S. as long as they meet listing requirements.

Thursday’s gain helped Asia’s equity benchmark pare its losses for the week. Stocks in Hong Kong and the mainland rallied from the open as authorities intensified efforts to calm fears about the crackdown on the private education industry, with China’s securities regulator conveying to executives of major investment banks that education policies were not intended to hurt companies in other industries.

The rebound in China’s markets included a near 10% bounce in tech giant Tencent – its second biggest in nearly a decade – after reports that regulators had called banks overnight to ease concerns about the recent crackdown on sectors like tech and education, and on overseas listings. “Beijing is working hard to stem the growing concerns surrounding its regulatory crackdown,” said RBC’s head of Asia FX strategy, Alvin Tan. Equity benchmarks from Japan to Vietnam rose Thursday, with sentiment also buoyed as Fed Chair Jerome Powell said there was still some way to go to meet the conditions for tapering.

Shares in India also climbed, halting a three-day slide and tracking global equity markets after the U.S. Federal Reserve reassured that its proposed tapering of stimulus will be closely linked to economic progress. The dovish Fed should continue “to support risk assets this year by still only gradually moving towards reducing its monthly pace of asset purchases,” Mansoor Mohi-uddin, chief economist at Bank of Singapore Ltd., wrote in a note. The S&P BSE Sensex gained 0.4% to 52,653.07 in Mumbai, its first gain this week. The NSE Nifty 50 Index advanced by a similar magnitude. Twelve of the 19 sector sub-indexes compiled by BSE Ltd. climbed, led by a gauge of metal companies. The Fed’s continued soft monetary policy stance augurs well for emerging markets including India, Binod Modi, head of strategy at Reliance Securities, said in a note. Indian shares had declined for the previous three sessions amid a mostly unimpressive June quarter earnings performance. Of the 25 Nifty companies that have reported to date, 18 have missed the consensus while six managed to beat analysts’ estimates. Kotak Mahindra Bank is the only one to report earnings in line with Street expectations.

Japanese equities climbed, rebounding from Wednesday’s selloff, as investors turned their attention to positive corporate earnings and supportive central bank policies. Electronics makers were the biggest boost to the Topix, which rose 0.4%. SoftBank was the largest contributor to a 0.7% gain in the Nikkei 225 followed by Advantest, which climbed 7% after it raising its profit forecast. Nissan closed nearly 6% higher after it posted a surprise profit and lifted its outlook for the year. “With the local corporate earnings season starting in earnest, the market will be focused on pricing in the results,” said Takashi Ito, an equity market strategist at Nomura Securities. “A huge spike in local virus cases has pushed the number up to a fresh record, but reaction in the stock market is likely to be limited — share prices aren’t likely to keep falling on the same reason over and over again.” Tokyo’s daily virus infections surged to a second straight record on Wednesday, and national figures were also set to reach a new high.

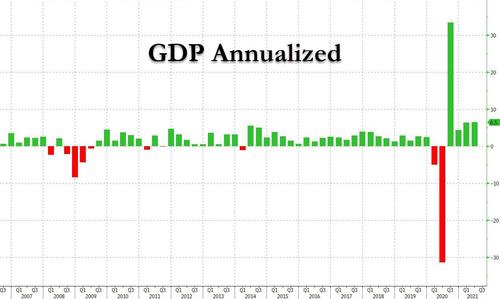

Markets had see-sawed overnight when the Federal Reserve policy statement said progress had been made toward its economic goals, seeming to bring nearer the day when it might start tapering its massive asset-buying campaign. Peak growth was also a nagging theme. Data due later on Thursday is expected to show the U.S. economy likely grew at the fastest pace in 38 years in the last quarter as government aid and vaccinations fuelled spending. However, Fed Chair Jerome Powell took a dovish turn by emphasizing that they were “some ways away” from substantial progress on jobs that is needed to start tapering.

JPMorgan economist Michael Feroli said: “there are three more (U.S.) job reports before the November meeting, and two more between the November and December meetings. We continue to expect a December announcement, though we see a risk it could occur in November.”

In rates, the 10-year Treasury yield rose as high as 1.27% before easing. Treasuries remain under pressure after unwinding Wednesday’s late-day advance that followed FOMC policy decision, with long-end yields cheaper by ~2.5bp. Repricing began during Asia session as stocks rose, and accelerated during European morning. U.S. session features 7-year note auction and 2Q advance GDP. 10Y yields were at ~1.26% cheaper by 2.3bp on the day, underperforming bunds, gilts by 1.2bp and 0.7bp; long-end-led losses steepen 2s10s, 5s30s spreads by 1.6bp and 0.5bp.

“My view is that the Fed policy rate will have a 1% handle” longer term, said PineBridge’s Global Head of Credit and Fixed Income, Steven Oh. “I don’t see an outcome where we see runaway inflation by any stretch of the imagination”.

In FX, the dollar faded to 109.75 yen, from a top of 110.58 early in the week. All of which saw the dollar index dip to 92.032, off its recent peak of 93.194. The New Zealand dollar and Norwegian krone led G-10 gains with the dollar and yen trailing. Sentiment was bolstered by a report that China will continue to allow its firms to go public in the U.S. as long as they meet listing requirements. China’s securities regulator convened executives of major investment banks on Wednesday night, attempting to ease market fears about Beijing’s crackdown on the private education industry. “Markets will seize on any sign that Chinese authorities will allow their private corporations some space,” said Sean Callow, senior currency strategist at Westpac Banking Corp. “It does seem to have knocked the dollar a little lower, supported by a sea of green in equities”

In commodity markets, China-sensitive copper rose 1.25% and gold nudged up to $1,817 an ounce but remains in the $30 range of the past 17 sessions. Oil prices also firmed after data showed U.S. crude inventories fell to pre-pandemic levels, bringing the market’s focus back to tight supplies rather than rising COVID-19 infections. Brent was last up 73 cents at $75.47 a barrel, while U.S. crude added 80 cents to $73.21.

Bitcoin traded around $40,000, holding this week’s gains.

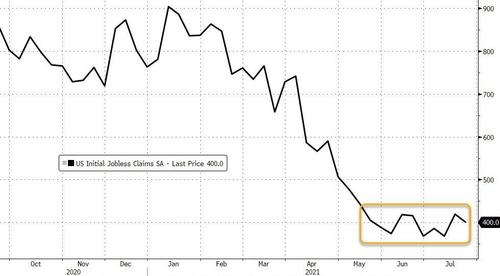

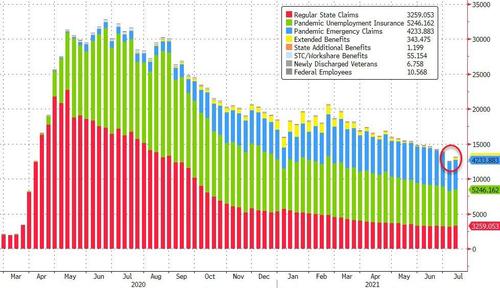

Looking at the day ahead now, and we have an array of data releases, including initial jobless claims and GDP figures at 8:30 a.m. ET, with the latter expected to show the economy grew at a rapid pace during the second quarter, fueled by vaccinations, stimulus and business reopenings. Another barrage of earnings is on deck with results expected from Amazon.com Inc., Mastercard Inc., Comcast Corp. and Merck & Co. among many others.

Market Snapshot

- S&P 500 futures little changed at 4,397.75

- STOXX Europe 600 up 0.3% to 463.23

- German 10Y yield fell 0.4 bps to -0.454%

- Euro up 0.2% to $1.1874

- Brent Futures up 0.9% to $75.38/bbl

- Gold spot up 0.6% to $1,817.69

- U.S. Dollar Index down 0.32% to 92.03

- MXAP up 1.7% to 199.76

- MXAPJ up 2.1% to 660.47

- Nikkei up 0.7% to 27,782.42

- Topix up 0.4% to 1,927.43

- Hang Seng Index up 3.3% to 26,315.32

- Shanghai Composite up 1.5% to 3,411.72

- Sensex up 0.5% to 52,729.09

- Australia S&P/ASX 200 up 0.5% to 7,417.39

- Kospi up 0.2% to 3,242.65

Top Overnight News from Bloomberg

- China will raise tariffs on the exports of some steel materials from next month

- Federal Reserve officials are moving closer to when they can start reducing massive support for the U.S. economy, though Chair Jerome Powell said there was still some way to go.

- Confidence in the euro-area economy climbed to a record in July as business resurges following the end of coronavirus lockdowns.

- U.K. mortgage approvals fell to their lowest level in almost a year in June as house hunters ran out of time to take full advantage of a tax cut on purchases

- U.S. equities advanced and Treasury yields fell after the Federal Reserve held interest rates near zero and Chairman Jerome Powell said that despite the economy’s progress he was still “a ways away” from raising them.

A more detailed look of global markets courtesy of Newsquawk

Asia-Pac stock markets traded positively as focus in the region centred on a deluge of earnings results and with Chinese stocks rebounding after the nation’s securities regulator convened a meeting with banks and brokerages in a bid to restore market calm after the recent stock rout. Conversely, US equity futures were lacklustre amid ongoing Delta variant fears and following on from the FOMC which resulted in an indecisive mood for stocks after the Fed maintained its policy settings as expected and although it kept future tapering in play, as well as stated that the economy has made progress towards goals, it didn’t offer any clues on the timing for a taper and noted that sectors most adversely affected by the pandemic have not fully recovered. ASX 200 (+0.5%) was led higher by tech and mining names with software company IRESS rallying following a takeover approach and with participants digesting earnings and results from the likes of Rio Tinto and Regis Resources. Nikkei 225 (+0.7%) was also kept afloat with Nissan and Advantest the biggest gainers following their earnings including the return to profit by the automaker although upside for the index was initially limited by currency headwinds and anticipation of state of emergency declarations for Tokyo’s neighbouring prefectures, while the KOSPI (+0.2%) was contained by increasing virus infections and with index top-constituent Samsung Electronics sluggish despite beating on its Q2 earnings. Hang Seng (+3.3%) and Shanghai Comp. (+1.5%) outperformed after the recent meeting involving China’s securities regulator to soothe market fears and where the regulator said it will continue to allow Chinese companies to go public in US as long as they satisfy listing requirements. In addition, the PBoC mildly upped its liquidity efforts, while the gains were amplified in Hong Kong amid notable strength in tech and digital health stocks. Finally, 10yr JGBs were relatively unchanged with demand subdued by the rebound in riskier assets, the indecisive post-FOMC mood in T-notes and mixed results at the 2yr JGB auction.

Top Asian News

- Citi Sees $15 Billion Asia Wealth Inflow as Hundreds Hired

- Top Green Energy Banker Sees $150 Billion in India Deals by 2030

- WM Tech’s $1 Billion Hong Kong IPO Is Said to Stall on Vettin

- India Set for Record Steel Demand as Construction to Revive

Major bourses in Europe trade with modest gains (Stoxx 600 +0.4%) with the upbeat sentiment in APAC seeping into Europe on an earnings-abundant day. The mild risk appetite comes amid the aftermath of the Fed policy decision, and with China jitters somewhat stabilising for now after the recent meeting involving China’s securities regulator to soothe market fears. Regulators said Chinese companies will continue to be allowed to go public in the US as long as they satisfy listing requirements. This news was received well across large-cap Chinese stocks, with Alibaba rising over 7.5%, Tencent surging 10% and JD.com gaining almost 13%. In related news, WSJ sources reported that Didi (+36% pre-market) is reportedly mulling going private and compensating investors. This comes amid Beijing’s crackdown on Didi following its US IPO, suggesting it poses national security risks to China. Now with two risks out of the way, markets will likely be focusing on earnings alongside US GDP and PCE data. Back to Europe, the DAX (+0.2%) remains slightly sluggish vs peers as Volkswagen (-0.4%) fail to gain traction due to the ongoing chip shortage prompting a cut in delivery guidance, whilst Chinese demand lagged. The bellwether Euro Stoxx 50 index (+0.2%) is meanwhile capped by post-earnings losses in AB InBev (-6%), Safran (-2.4%) and Air Liquide (-2%). Sectors are mostly firmer and portray a mild cyclical bias, although Travel & Leisure bucks the trend as COVID cases across APAC and with the UK set to review its travel list one week from today. To touch on some highlights from the morning’s earnings, aside from those already mentioned, Shell (+3.3%) topped forecasts across all metrics, declared a dividend of USD 0.24/shr (+38% QQ) and launched a USD 2bln share buyback programme. Airbus (+3.4%) topped analyst forecasts and upgraded its guidance. Nokia (+6%) currently resides as the top performer after raising its FY operating margin forecast to 10-12% vs prev. 7-10%. On the flip side, Credit Suisse (-3.2%) is hampered by its dealings with Archegos, with earnings missing forecasts and as the probe regarding Archegos found a failure to effectively manage risks by both first and second lines of defence as well as a lack of risk escalation.

Top European News

- Sliding German Borrowing Costs Show New ECB Guidance Is Working

- AstraZeneca Says It Supplied Extra Vaccine Doses EU Sought

- U.K. Mortgage Approvals Fall to 81,338 in June Vs. Est. 84,500

- Trendyol Valuation Set to Hit $16.5 Billion in Fundraising Round

In FX, the Dollar has unwound all and more of its knee-jerk gains in wake of the FOMC flagging more progress towards its policy targets, but nowhere near enough in terms of reaching maximum employment to light the QE taper. Moreover, Fed chair Powell stuck to the transitory line on inflation during his press conference, albeit conceding that it could turn out to be higher and more persistent than expected. However, the jury remains out over the prospect of Jackson Hole being the venue to signal ‘substantial’ or the September meeting itself that comes with a new SEP, while another potentially key NFP update looms before either next Friday. Looking at the DXY as a proxy, the index is hovering towards the lower end of a 91.979-92.289 range having breached the last ‘support’ before 92.000 and prior July low of 92.003 from the 6th of the month. Ahead, US jobless claims and advance Q2 GDP are likely to be more influential than pending home sales, while the Usd 62 bn 7 year auction could impact via any big reaction in Treasury yields and/or the curve along with month end rebalancing that is mildly negative for the Buck according to Citi’s portfolio hedging model.

- NZD/CAD/GBP/AUD – The major beneficiaries of their US adversary’s downfall, and to the extent that the Kiwi has probed 0.7000 regardless of declines in NBNZ’s business outlook and own activity readings, while the Loonie continues to glean traction from crude prices and has tested offers/resistance into 1.2450 as WTI tops Usd 73/brl. Elsewhere, Sterling has shrugged off somewhat mixed BoE consumer credit, mortgage approvals and lending data to establish a foothold above 1.3950 and take another close look at 0.8500 vs the Euro in similar vein to the Aussie amidst more calls for the RBA to reverse QE tapering on downward revisions to GDP forecasts prompted by the extended lockdown in NSW and virus restrictions in other areas. In fact, Aud/Usd has been over 0.7400 and Aud/Nzd beyond 1.0600 even though hefty 1.5 bn option expiry interest sits between 0.7385 and the round number in the headline pair.

- EUR/CHF/JPY – Also firmer against the Greenback, albeit to varying degrees with the Euro extending through 1.1850, option expiries from the half round number up to 1.1870 and a Fib retracement on the way to circa 1.1879, while the Franc has scaled 0.9100 and Yen is holding 110.00+ status within a 109.95-68 range irrespective of buoyant risk sentiment.

- SCANDI/EM – The Sek is hovering above 10.2000 vs the Eur following conflicting Swedish macro releases, but the Nok, Rub and Mxn are all deriving impetus from oil and the Try via an improvement in Turkish economic confidence rather than comments from the CBRT Governor or upward revisions to year-end CPI forecasts for this year and 2022 – see 8.42BST post on the Headline Feed for more. Meanwhile, EM currencies in general are taking advantage of broad Usd weakness, including the Cnh and Cny after a recovery in Chinese stock markets overnight, in part on the back of assurances by the securities regulator at a meeting with brokerages that it will allow Chinese companies to go public in the US as long as they satisfy listing requirements, according to sources. The Zar is also eyeing firmer than expected SA PPI alongside Gold around Usd 1820/oz following its ratings reprieve.

In commodities, WTI and Brent front month futures remain on the upward trajectory seen during APAC trade, with the former north of USD 73/bbl (vs low USD 72.26/bbl) and the latter on either side of USD 75.50/bbl (vs low USD 74.63/bbl). News flow for the crude complex has remained light but prices have been underpinned by this week’s larger-than-expected inventory drawdowns, the post-Fed Dollar, alongside the general risk appetite. Participants will also be cognizant of a Magnitude 8 earthquake near oil state Alaska, although the event was not geographically close to any known oil infrastructure. Elsewhere, spot gold and silver have been driving higher in tandem with the decline in the Buck. Spot gold sees its 200 DMA around USD 1,821/oz and the 50 DMA at 1,829/oz. Spot silver remains around USD 25.50/oz ahead of its 200/50/100 DMAs at USD 25.88/26.54/26.31oz respectively. Base metals have been supported across the board by the broader sentiment after China attempted to smooth some recent woes. LME copper resides around session highs just above USD 9,800/t (vs low USD 9,665/t) with comfortable gains also seen across nickel, tin, lead and zinc. It’s also worth noting that China is to raise export duty of some iron products in a bid to promote high-quality development of the steel industry, according to the Chinese Commerce Ministry.

US Event Calendar

- 8:30am: July Initial Jobless Claims, est. 385,000, prior 419,000; July Continuing Claims, est. 3.18m, prior 3.24m

- 8:30am: 2Q GDP Annualized QoQ, est. 8.5%, prior 6.4%

- 2Q Personal Consumption, est. 10.5%, prior 11.4%

- 2Q GDP Price Index, est. 5.4%, prior 4.3%

- 2Q PCE Core QoQ, est. 6.1%, prior 2.5%

- 10am: June Pending Home Sales YoY, est. -3.3%, prior 13.9%; Pending Home Sales MoM, est. 0.1%, prior 8.0%

DB’s Jim Reid concludes the overnight wrap

In spite of being the most anticipated event of the week, the Federal Reserve’s latest policy decision proved to be a much tamer event than the last meeting as far as markets were concerned, with Treasury yields only seeing a modest decline and equities remaining unchanged for the most part. As expected, the FOMC voted unanimously to keep interest rates unchanged and maintained their asset purchases at $120bn a month. However, we did see the beginning of an initial nod towards a tapering of asset purchases at some point, with the statement after the meeting saying that “the economy has made progress” toward the Fed’s goals of maximum employment and price stability, and that “the Committee will continue to assess progress in coming meetings.”

Even with that nod however, the market reaction was fairly subdued and investor expectations of future rate hikes remained in line with where they’d been the previous day. In his press conference, Chair Powell affirmed this shift in language, saying that the committee had taken a “first deep dive” into how to go about tapering asset purchases, but also that no decisions had yet been made. Powell further indicated that there had been a discussion on tapering MBS purchases more quickly than Treasuries, but that there was little support to taper one asset earlier than the other. Meanwhile on inflation, the usual refrain of prices “largely reflecting transitory factors” continued, with Powell noting that for each component causing high inflation there was a reopening story tied to it. Finally, the Fed announced the permanent creation of domestic and foreign standing repo facilities, which seek to smooth money markets and avoid a repeat of the turmoil seen in September 2019. Our US economists viewed the overall messaging from the meeting as consistent with their baseline view for an official tapering announcement at the November FOMC meeting, albeit with risks that it slips to December. You can read their note here for their full views.

As mentioned at the top, financial markets were little changed shortly after the announcement, with a slightly risk-off posture immediately after the statement came through, before equities ended the session largely unchanged. Elsewhere, the USD softened a bit to finish -0.12% lower as the meeting was a touch more dovish than expected, whilst 10yr Treasury yields (which had been trading up +1.1bps prior to the FOMC), fully reversed their earlier moves to end the day -0.8bps lower at 1.233%. That drop in yields could be attributed to yet another large decline in real yields (-4.7bps) as inflation expectations rose +3.9bps, with that move in real yields seeing them continue to plumb new lows with the 10yr TIPS rate down to -1.177% yesterday, having now fallen 9 of the last 11 sessions. Jim actually looked at this issue in his chart of the day yesterday (link here), looking at a historic time series of real yields using different measures.

In terms of the specific moves, technology companies outperformed on the back of some strong earnings after the previous session’s close, with the FANG+ index up +1.75% and the NASDAQ up +0.70%, beating the S&P 500 as it posted a marginal loss (-0.02%). The outperformance among tech stocks was due to particularly strong returns from semiconductors (+1.66%), biotech (+1.01%) and media companies (0.95%). Media in particular was boosted by the Alphabet’s earnings results from the previous night, though the Facebook earnings that came in after last night’s close were much less strong, as the company forecasted that a new rule from Apple could hurt data collection on mobile devices that will ultimately hurt Facebook’s ad revenues. The company’s share price was down -3.5% in after-hours trading, which came in spite of them beating on both sales and profits. Yesterday’s other releases also included Boeing (+4.11%), who announced a profit for the first time in two years with an EPS of $0.40 (vs. -$0.81 expected) as the company’s cash burn was far lower than expected – $705mn compared to the $2.76bn figure expected. The company has halted job cuts and forecasted increased production over the next few years. The raft of earnings releases continues today, with Amazon among the highlights after the US close.

Whilst the Fed were dominating the headlines, we also had some major developments on US fiscal policy after the bipartisan infrastructure talks finally moved forward after a long period of further negotiations. Last night, the Senate voted 67-32 to begin floor consideration of the plan that includes $550bn of new spending over the next 8 years, and although that isn’t a final vote on the package, lawmakers are expecting to discuss and vote on amendments through the weekend with the hopes of finishing the legislation before the August 9 recess. News of the deal saw industrials stocks such as Caterpillar (+0.79%) and Vulcan Materials (+3.58%) rise, especially in the wake of President Biden reaffirming that he would strongly enforce a “buy American” policy for federal agencies.

Overnight in Asia, markets have advanced strongly with the Hang Seng (+2.67%) and Shanghai Comp (+1.04%) posting robust gains, thanks to easing fears about China’s recent regulatory crackdown supporting the move. In terms of the developments, Bloomberg reported on Wednesday night that the country’s securities regulator held a meeting with executives from major investment banks, with some leaving with the message that the crackdown on the private education industry wasn’t intended to hurt companies elsewhere. Otherwise, the People’s Bank of China also added 30 billion yuan of liquidity in a seven-day reverse repurchase agreements, up from 10 billion yuan for the first time since June 30, whilst technology stocks have been performing strongly following a CNBC report that China would continue to allow Chinese firms to go public in the US, so long as they met listing requirements. That’s helped the Hang Seng tech index to rise +6.68% this morning after yesterday’s +3.10% gain, while the onshore yuan is up +0.25% to 6.4748. The Nikkei (+0.65%) and Kospi (+0.06%) are also trading higher this morning, although outside of Asia, futures on the S&P 500 are down -0.14%.

Ahead of the Fed’s announcement, European markets had a strong day on the whole, with the STOXX 600 (+0.66%) recovering from the previous day’s losses to close at a new all-time high. As in the US, technology stocks bounced back sharply to lead the broader index higher, whilst France’s CAC 40 (+1.18%) saw a strong outperformance as well, whereas the DAX (+0.33%) lagged behind. Sovereign bond markets also put in a relatively decent performance as well for the most part, with yields on 10yr bunds down -0.9bps to a new 5-month low, although those on 10yr OATs (+0.1bps) held steady and gilts (+1.7bps) underperformed.

In other market developments, bitcoin gained a further +5.10% yesterday as it achieved its eighth straight daily rise – the longest run this calendar year. The cryptocurrency is now up +34.2% since the run started and closed above $40,000 for the first time since 20 May, as recent positive comments from people like Elon Musk and speculation of Amazon.com’s involvement in the broader crypto sector led to a turnaround over the last week. Crypto-assets more broadly shared in the rally as well, with yesterday featuring large gains in Ethereum (+2.32%), XRP (+10.89%), and Litecoin (+3.86%).

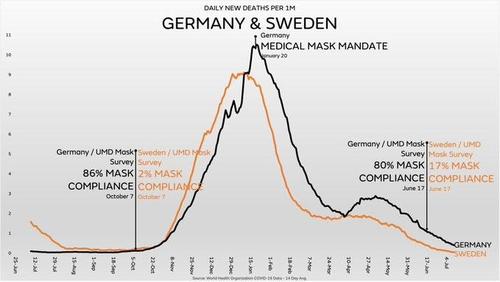

Turning to the pandemic, the issue of vaccination mandates continued to rise up the agenda, as President Biden is set to deliver a speech today, in which multiple outlets including CNN have reported he’ll announce a requirement that federal workers must either be vaccinated or undergo regular testing. Meanwhile, it was announced in New York City that residents who got their first vaccine would get a $100 cash incentive, as they look to improve their vaccination rates. New York State overall announced plans to mandate all state employees either be vaccinated or get tested regularly and the vaccine will be mandatory for health care workers, with Governor Cuomo calling on local governments and unions to do the same. And on the earnings front, Pfizer reported Q2 revenues of $19.0bn, and raised their raised their full-year 2021 revenue guidance to $78.0bn-$80.0bn, and anticipated 2021 revenue for their Covid vaccine of approximately $33.5bn. Meanwhile, given the new mask mandate from the CDC, Walt Disney has said they’ll again require masks at its theme parks in Florida and California, and Apple has also reinstated a mask mandate at most of its US stores.

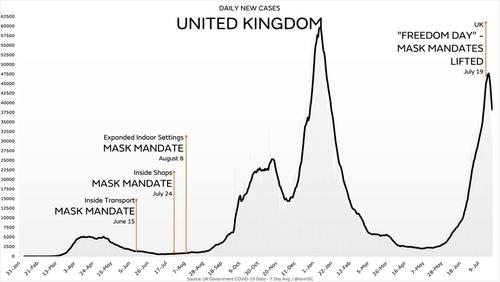

Here in the UK, there was further good news on case numbers, as the number reported yesterday (27,734) was down by -37% on the previous Wednesday’s figure. Furthermore, looking at the last 7 days as a whole relative to the previous week, cases are also down -36%, which is the fastest reduction over a full week that we’ve seen since early April. The continued fall in cases came as it was announced yesterday that arrivals into England from Europe or the USA who are fully vaccinated with an EMA or FDA-authorised vaccine would no longer have to quarantine from August 2. However, in less positive news, 24 new cases were detected at the Tokyo Olympics to bring the total number of infections reported by the organising committee to 193, and Sydney has also decided to add further restrictions on travel and increased penalties for non-compliance to control the spread of the infection.

There wasn’t a massive amount of data yesterday, though the US advance goods trade deficit widened to $91.2bn in June (vs. $88.0bn expected), which is its second-largest on record. Elsewhere, French consumer confidence fell to 101 in July (vs. 102 expected), which is just above its long-term average of 100, whereas Italian consumer confidence rose to a 2-year high of 116.6 in July (vs. 115.5 expected).

To the day ahead now, and we have an array of data releases, including the advance reading of Q2 GDP for the US, along with the weekly initial jobless claims and June’s pending home sales. Over in Europe, we’ll get the preliminary reading for German CPI in July, UK mortgage approvals for June and the final Euro Area consumer confidence reading for July. Otherwise, central bank speakers include the Fed’s Bullard, and earnings releases include Amazon, Mastercard, Comcast, Merck & Co., T-Mobile US and Credit Suisse.