Futures On Edge At All Time High As Oil Surges To Highest Since 2014

Stock futures were steady, if drifting lower from overnight highs in muted trading as traders were watching whether Monday’s surge in oil which pushed WTI to the highest price since the November 2014 OPEC Thanksgiving massacre would depress stock sentiment after yesterday’s breakdown in OPEC+ talks. As of 730am, Emini S&P futures were down 2 points ot -0.05%, Dow jones futs were down 28 points ot -0.08% and Nasdaq minis were up 16.75 or +0.12%.

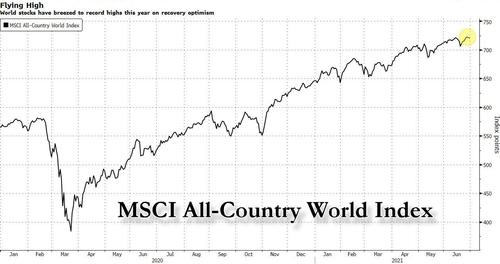

Wall Street was facing a groggy restart after its July 4 holiday, with the S&P near-record streak of 7 consecutive all time highs looking shaky. Europe’s equity markets were spluttering at the prospect of higher inflation and China spooked its tech sector again with another high-profile clampdown. Chinese ride-hailing giant Didi plunged 22% in premarket trading after a Chinese regulator ordered the removal of its platform from app stores, days after its U.S. listing. Full Truck Alliance (YMM) and Kanzhun (BZ), which were also part of the crackdown, sinks 15% and 10% respectively Here are some of the other notable U.S. movers today:

- Odonate Therapeutics (ODT) climbs 37% in premarket trading after a filing showed Ikarian Capital boosted its stake in the pharmaceutical company.

- Oil-linked stocks gain after WTI crude rose to the highest level in more than six years in New York as OPEC+ failed to agree on a production increase. Transocean (RIG) climbs 7.3% and Occidental Petroleum (OXY) rises 2.5%, while Schlumberger (SLB) gains 2.1%.

- Retail trader favorites advance after a long weekend with Marin Software (MRIN) rising 20% and Ocugen (OCGN) gaining 17%.

The biggest mover, however, was oil which hit a six-year high this morning after the breakdown in talks among OPEC and its allies left the market without the production hike it was expecting. A barrel of West Texas Intermediate for August delivery traded as high as $76.98 – the highest price in almost 7 years – with no talks scheduled for today. Some OPEC+ sources said there would be no oil output increase in August, while others said a new meeting would take place in the coming days and they believed there would be a boost in August. Crude traders were not hanging around to find out. They pushed Brent up as far as $77.66 – the highest level since October 2018. Oil is up roughly 50% this year and over 385% since last year’s COVID-driven slump.

The move higher in crude risks heightening inflation fears among investors and forcing the Fed to taper just as the US economy loses the tailwinds from the Biden stimulus. The US is asking for a compromise solution to be found, with a White House official saying President Joe Biden wants Americans to have access to affordable and reliable energy as the economy reopens.

“Slowing growth, rising inflation and less expansive monetary policy could act as a dampener on equity markets and riskier corporate bonds,” Pictet Asset Management’s chief strategist Luca Paolini said.

“Without an injection of some extra barrels of oil in the coming weeks, given the tightness of the market, Brent might cross the USD 80/bbl threshold,” UniCredit’s analysts said.

In Europe, gains in travel shares offset a decline in carmakers. The oil sector made the early running, rising as much as 0.5% as the region’s STOXX 600 sagged 0.2%. Here are some of the biggest European movers today:

- Ocado shares rise as much as 4% after the U.K. online grocer reported 1H Ebitda that beat the average analyst estimate and announced the signing of an agreement with Auchan Retail to develop Alcampo’s online business in Spain.

- Carrefour climbs as much as 2.4%, a fifth session of gains, after Jefferies (buy) said the grocer’s first-half results should confirm strong progress in France on the back of “healthy” market-share wins.

- AngloGold jumps as much as 5.8% after the company named former BHP Group executive Alberto Calderon as its chief executive officer.

- Shop Apotheke plunges as much as 13%, the most since November, after reporting preliminary earnings, with peer Zur Rose also falling. The online pharmacy has lost market share to its biggest competitor at the worst time, Jefferies said in a note.

- Alstom slumps as much as 8.2%. The company’s new targets for FY 2024/2025 should be well received by the market, yet guidance for 1H cash drain is a negative surprise, Morgan Stanley said in a note.

- Asos drops as much as 3.5% after Bank of America downgraded the online retailer to neutral from buy, saying the market may wrongly see its Flexible Fulfillment plans as an equivalent to Zalando’s partner program.

- Wm Morrison falls as much as 0.5% after the company was downgraded to neutral from outperform at Credit Suisse, which sees limited upside potential for the shares as well as uncertainties related to a takeover deal being finalized.

In a notable move, Germany’s ZEW survey saw current conditions surge from -9.1 to 21.9, beating expectations of a 5.0 print, and well above pre-pandemic levels while expectations continued to sour, with the forward lookign component sinking again, adn sliding to 63.3 from 79.8, missing the 66.3 expectation.

Asian stocks also rose, headed for their second (small) gain in two days, as advances in financials and energy firms helped offset concerns over China’s crackdown on the technology industry. Financials were the biggest boost to MSCI Asia Pacific Index as U.S. Treasury yields rose. A gauge of energy stocks climbed the most as crude jumped after OPEC+ failed to reach a deal to bring back more halted output.

Hong Kong shares dipped as investors continued to digest the Chinese government’s move to expand its crackdown on the tech industry beyond Didi to include two other companies that recently listed in New York. The MSCI China Health Care Index fell by as much as 7.5%, its biggest drop since March 2020, on concerns that new government draft guidelines would make it more difficult to develop oncology drugs in China.

Elsewhere, while inflation worries have kept stock gains in check overall recently, energy shares have been the best performers in Asia this year. “I don’t think the OPEC+ disagreement ultimately matters very much for the overall trajectory of crude oil prices,” said Ilya Spivak, head of Asia Pacific strategist at DailyFX. “Supply chain disruptions from uneven economic reopenings and a flood of policy stimulus -– especially on the fiscal side -– are likely to keep prices elevated and feeding the broader reflation narrative that has pushed the Fed to consider tightening sooner than previously expected.” Singapore led gains around the region on Tuesday, with its key stock gauge rising more than 1%. Australian stocks declined after the nation’s central bank indicated it would buy bonds at a slower pace.

Japanese equities rose in thin trading, with trading houses and machinery makers driving a 0.3% gain in the Topix. Energy stocks also advanced, following crude prices higher after OPEC+ failed to reach a deal on output. Daikin and SoftBank Group were the biggest contributors to the 0.2% rise in the Nikkei 225. Nintendo gained 2.5% after Nikkei Inc. announced new rules that may enable it to be added to the blue-chip gauge. Just under 1.7 trillion yen worth of shares traded hands on the first section of the Tokyo Stock Exchange, the lowest daily turnover so far this year. U.S. markets were closed for a holiday Monday.

“Local stocks are likely to show solid performance in the near term,” said Shogo Maekawa, a strategist at JP Morgan Asset Management in Tokyo. “Taking a look globally, business conditions are solid and if U.S. long-term yields rise amid potential tapering by the U.S. Federal Reserve, investors will once again focus on Japan, which is a market heavy with cyclical, value stocks.”

In Australia, the S&P/ASX 200 index fell 0.7% to close at 7,261.80, its lowest since June 21. Health and banking shares dragged the most on the index. The benchmark extended declines after Australia’s central bank indicated it would buy bonds at a slower pace. The Reserve Bank of Australia also said it expects to keep interest rates at a record low for at least another 2-1/2 years. Oil Search was the top performer, advancing alongside other Asian oil explorers as Brent oil extended gains. Ramelius was among the biggest laggards after reporting its 4Q production. In New Zealand, the S&P/NZX 50 index fell 0.4% to 12,758.93.

In rates, treasuries were little changed after erasing declines during European morning, following bunds higher; 10-year note futures briefly eclipsed last week’s high. Treasury yields are near flat on the day after Asia-session losses were erased amid a bund-led rally in Europe; 10-year is around 1.42%, with German 10-year outperforming by ~1bp. S&P 500 futures are little changed while Euro Stoxx 50 slightly lower, despite gains in energy names based on oil rally. With few U.S. economic data releases or Fed speakers slated this week, and no Treasury coupon supply, FOMC minutes release is the main event.

In FX, the Bloomberg Dollar Spot Index was little changed after recovering from a day low when trading entered the European session; the greenback traded mixed versus its Group-of-10 peers, with Antipodean currencies leading gains while the euro fell after earlier nearing the $1.19 handle. New Zealand’s dollar rose to an almost three-week high against the greenback, and the nation’s short-dated bond yields surged after an upbeat business survey drove traders to bring forward rate-hike expectations; markets are now pricing a total unwind of pandemic-fueled rate cuts by the end of 2022. The Australian dollar extended an intraday gain after the RBA said the economy is in a much better position than expected; Aussie 3-year bond yields surged after RBA’s Governor Lowe stressed that the policy rate outlook is dependent on economic factors rather than the central bank’s own forecasts. The U.S. dollar enjoyed a strong performance in both the spot and options market in June, yet options trades versus the Australian dollar came the other way. Norway’s krone swung to a loss as the greenback rebounded; the krone earlier touched a one-week high amid rising oil prices. Brent oil rose to a six-year high after OPEC+ ended days of talks without a deal to bring back more halted output next month.

In commodities, as noted above, it’s all about crude which has surged to fresh multi-year highs this morning, though off best levels, after the breakdown in OPEC+ negotiations and with no clear time for a resumption in the talks; currently, WTI and Brent benchmarks post gains of USD 1.20/bbl and USD 0.20/bbl respectively for the August/September’21 contracts. To recap, Saudi Arabia and Russia are saying the meeting has been cancelled and as such production will now continue at current levels for August; however, the UAE has briefed that the meeting has just been postponed while their proposal is considered. The likes of Iraq believe the situation is ‘normal’ and expects a solution to arise soon while widely followed journalist Reza Zandi writes that the discussions could be reactivated at any moment. However, thus far there has been no fresh update on the status of talks or any timeline for another meeting. A number of desks have given their views on the situation including ING who believes that if output levels are maintained then this will be bullish for prices; however, they do not have a high conviction in members keeping output steady. UBS looks for Brent to hit USD 80/bbl in September.

Away from the oil benchmarks, Credit Suisse equity research cautions that the upside in equities may be comparably more muted given the conflicting leads from increased earnings-upside in H2 and concerns around a lessening of OPEC+’s solidarity. Crude aside, spot gold and silver are firmer this morning in-spite of the increasing upside the USD is experiencing as the metals perhaps take support from the marginally lower yield environment given subdued equity trade; taking the former above USD 1800/oz (vs. low of USD 1791.04/oz). Separately, base metals continue to make ground after strong APAC trade in-spite of the broader indecisive overnight tone.

Looking at the day ahead now, and data releases include German factory orders for May, the ZEW survey for July, the German and UK construction PMIs for June, Euro Area retail sales for May, and the final June US services and composite PMIs, along with June’s ISM services index. Meanwhile central bank speakers include the ECB’s Vice President de Guindos and the ECB’s Hernandez de Cos.

Market Snapshot

- S&P 500 futures little changed at 4,339.25

- STOXX Europe 600 little changed at 457.94

- MXAP up 0.1% to 206.51

- MXAPJ little changed at 691.48

- Nikkei up 0.2% to 28,643.21

- Topix up 0.3% to 1,954.50

- Hang Seng Index down 0.3% to 28,072.86

- Shanghai Composite down 0.1% to 3,530.26

- Sensex up 0.4% to 53,099.15

- Australia S&P/ASX 200 down 0.7% to 7,261.78

- Kospi up 0.4% to 3,305.21

- Brent Futures up 0.4% to $77.44/bbl

- Gold spot up 0.6% to $1,803.36

- U.S. Dollar Index little changed at 92.30

- German 10Y yield fell -0.015 bps to -0.225%

- Euro down 0.1% to $1.1848

Top Overnight News from Bloomberg

- The European Central Bank is entering the final stretch of its biggest strategy review in almost two decades, with officials looking to hammer out key differences over future monetary policy

- The Bank of Japan will likely consider raising its inflation forecast when it updates its quarterly economic outlook next week, according to people familiar with the matter

- German manufacturers unexpectedly saw demand decline in May, suggesting an uneven start to the country’s economic recovery. Orders fell 3.7%, worse than all estimates in a Bloomberg survey. The Economy Ministry said the slump was driven by weak export demand for cars following a steep rise the previous month. Domestic orders rose 0.9%

Quick look at global markets courtesy of Newsquawk

Asian equity markets traded indecisively as the region lacked conviction ahead of this week’s looming central bank events and in the absence of a lead from Wall St where markets were closed for the Independence Day weekend. ASX 200 (-0.7%) was initially kept afloat by strength in energy as oil prices rose to fresh cyclical highs after the cancellation of the OPEC+ meeting with no new date set and which means that the current quota levels will stand, although gains were later reversed amid cautiousness heading into the RBA policy decision where the central bank kept rates unchanged and extended bond purchases at a lower rate through to mid-November when it will then conduct a further review. Nikkei 225 (+0.2%) eked marginal gains after better-than-expected Household Spending data and with Labour Cash Earnings at its largest gain in three years, but with upside restricted by a mixed currency, as well as COVID-19 concerns which threaten an extension of the quasi-restrictions in Tokyo and with the opening ceremony of the Olympics reportedly to be held without spectators. Hang Seng (-0.3%) and Shanghai Comp. (-0.1%) were subdued as concerns regarding China’s fresh tech crackdown persisted and with calls by the PBoC for banks to provide additional credit supply for SMEs doing little to spur risk appetite, although there were some success stories with oil names mostly helped by the gains in underlying energy prices and with Suning.com surging by the daily limit after it received a bailout from a consortium including a state fund and Alibaba. Finally, 10yr JGBs traded lower amid a similar lacklustre picture in T-note futures and after a slip beneath the psychologically key 152.00 level, while support from the firmer results at the 30yr JGB auction was only brief with price action not helped by increased corporate supply as Nomura, Mizuho and Xiaomi plan USD-denominated bond offerings.

Top Asian News

- Hong Kong Court Jails U.S. Lawyer Over Scuffle With Policeman

- Hong Kong to Speed Up IPO Deals to Cut Down on Risks

- Japan, U.S. Must Defend Taiwan Together, Deputy Premier Aso Says

- Carrie Lam Dismisses Fears Over Hong Kong Bill Spooking Big Tech

European equities (Eurostoxx 50 -0.3%) trade predominantly lower with prices having drifted south since the cash open amid a lack of noteworthy fundamental catalysts and a mixed German ZEW release. US participants will be returning to the fray today after the extended weekend with futures stateside hovering near the unchanged mark and exerting no real bias. Upcoming risk events including the ISM Services print due later today and FOMC minutes from the June meeting tomorrow, however, it is unclear how much traction in the market these will garner with the latter somewhat mitigated by the recent flurry of Fed-speak. In a recent note, analysts at Citi suggest that one-side positioning in equity markets, particularly the Nasdaq 100, could see limited scope for further rallies with the index potential vulnerable to profit-taking. Back to Europe, sectors are relatively mixed with Travel & Leisure names top of the pile as investors are taking some comfort from news that Germany is to lift its ban on travellers from the UK, Portugal, Russia, India and Nepal. Oil & Gas names have also been supported throughout the session amid the ongoing advances in the crude complex amid the OPEC+ breakdown yesterday. To the downside, Auto names lag with softness seen in some of the German names with some observers highlight disappointing domestic Industrial Orders for the month of May. In terms of stock specifics, Ocado (+2.6%) sits near the top of the Stoxx 600 after reporting a 21.4% increase in H1 revenues and 41.2% rise in H1 EBITDA. Also of note for the UK supermarket sector, Sainsbury’s (+0.8%) reported a 1.6% increase in Q1 LFL sales which was ahead of Co. expectations. Elsewhere, Sartorious (+5.1%) is the best performer in the Stoxx 600 after upgrading FY21 forecasts. To the downside, Alstom (-4.0%) is a standout laggard after flagging that it expects negative free cash flow for the fiscal year as it looks to integrate Bombardier’s rail unit.

Top European News

- ECB Officials Zero In on Final Compromises of Policy Overhaul

- Hexagon in $2.75 Billion Deal to Buy Infor’s Software Unit

- U.K. to Change Self-Isolation Rules for Those With Double Jabs

- U.K. Homebuilding Drives Construction Growth to 24-Year High

In FX, a flurry of activity in the currency markets even before US participants return from their extended July 4th celebrations as the Buck succumbed to more broad selling pressure that tipped the index to the brink of 92.000. The Greenback remains heavy on the back of last Friday’s mixed NFP release, but also felt the heat from another spike in oil prices as the OPEC+ stalemate continues, while several major rivals are rebounding in their own right for independent reasons. However, the DXY clung on and just carved out a new high at 92.424 after the Dollar defended incursions and/or approaches towards several psychological levels following the loss of some technical supports in the run up to final Markit services and composite PMIs, the non-manufacturing ISM and employment trends.

- NZD/AUD – The Kiwi and Aussie are clearly outperforming, albeit off best levels circa 0.7105 and 0.7599 respectively vs their US peer in wake of an upbeat NZIER Q2 survey overnight and relatively hawkish RBNZ rate calls from ASB Bank and BNZ that are both touting hikes in November. Meanwhile, Aud/Usd dipped initially as the RBA extended its QE remit until mid-November at least and reaffirmed guidance for unchanged rates through to 2024 at the earliest, but then bounced firmly on the improved economic assessment and taper for the third round of bond buying to a Aud 4 bn/week pace from Aud 5 bn. Nevertheless, the Aud/Nzd cross remains anchored around 1.0700 after Governor Lowe re-emphasised a data rather than date dependent timeline for tightening and reiterated that the Bank is not thinking about lifting the cash rate in 2023.

- GBP/JPY – No additional boost for the Pound via a much stronger than expected UK construction PMI, so 1.4000 in Cable looks elusive after a very near miss, but Sterling is having another look at 0.8550 against the Euro after PM Johnson confirmed that almost all remaining virus restrictions will be removed on July 19. Elsewhere, the Yen is holding firmly above 111.00 where hefty option interest resides (1.8 bn) and may have drawn some encouragement from not as weak as anticipated Japanese household spending data.

- CHF/EUR/CAD/NOK – The G10 laggards, or handing back more ground to the recovering Buck than others to be more precise as the Franc retreats through 0.9200, Euro reverses from just shy of 1.1900 and a probe beyond the 10 DMA (1.1893 today), Loonie retraces from even closer to 1.2300 and Norwegian Crown trades nearer 10.1850 vs the Euro than peaks a tad over 10.1400. Note, Eur/Usd is now sub-1.1850 and digesting a mixed ZEW survey that may hamper the headline pair along with option expiries between 1.1865-70 (1.1 bn) and straddling the big figure above at 1.1895-1.1905 (1.7 bn). Back to Usd/Cad and Eur/Nok, correlations with crude appear to be decoupling even though WTI and Brent remain bid and not too far from nigh on Usd 77/brl and Usd 77.84/brl pinnacles.

- SEK/EM – Although the Swedish Krona has not been unduly ruffled by the political void, Eur/Sek is eyeing 10.1300 to the downside within a circa 10.1526-10.1249 following the return of PM Lofven in relief over continuity more than anything else perhaps. However, recovery gains in Bitcoin and other cryptos are fading on the back of another warning from the PBoC over risks attached in contrast to Gold scaling the 100 DMA on the way to reclaiming Usd 1800/oz+ status.

In commodities, crude remains underpinned this morning, though off best levels, after the breakdown in OPEC+ negotiations and with no clear time for a resumption in the talks; currently, WTI and Brent benchmarks post gains of USD 1.20/bbl and USD 0.20/bbl respectively for the August/September’21 contracts. To recap, Saudi Arabia and Russia are saying the meeting has been cancelled and as such production will now continue at current levels for August; however, the UAE has briefed that the meeting has just been postponed while their proposal is considered. The likes of Iraq believe the situation is ‘normal’ and expects a solution to arise soon while widely followed journalist Reza Zandi writes that the discussions could be reactivated at any moment. However, thus far there has been no fresh update on the status of talks or any timeline for another meeting. A number of desks have given their views on the situation including ING who believes that if output levels are maintained then this will be bullish for prices; however, they do not have a high conviction in members keeping output steady. UBS looks for Brent to hit USD 80/bbl in September. Away from the oil benchmarks, Credit Suisse equity research cautions that the upside in equities may be comparably more muted given the conflicting leads from increased earnings-upside in H2 and concerns around a lessening of OPEC+’s solidarity. Crude aside, spot gold and silver are firmer this morning in-spite of the increasing upside the USD is experiencing as the metals perhaps take support from the marginally lower yield environment given subdued equity trade; taking the former above USD 1800/oz (vs. low of USD 1791.04/oz). Separately, base metals continue to make ground after strong APAC trade in-spite of the broader indecisive overnight tone.

US Event Calendar

- 9:45am: June Markit US Services PMI, est. 64.8, prior 64.8

- 9:45am: June Markit US Composite PMI, prior 63.9

- 10am: June ISM Services Index, est. 63.5, prior 64.0

DB’s Jim Reid concludes the overnight wrap

It was a fairly subdued session for markets yesterday with the US out on holiday, though risk assets generally performed strongly as investors reacted positively to the latest services and composite PMI readings from Europe. By the end of the session, the STOXX 600 (+0.34%) had closed less than half a percent away from its all-time high last month, with cyclical sectors leading the advance, whilst the risk-on tone saw a selloff among sovereign bonds and fresh gains for a number of key commodities including oil on the OPEC+ meeting breakdown.

Indeed the most consequential story of the day was probably that around oil where the failure to reach a deal at the latest OPEC+ talks sent prices up to fresh 2-year highs. As we touched on in yesterday’s edition, some members of the group including Saudi Arabia had been hoping to increase production over the coming months, but the UAE had refused to agree and sought better terms that would change how its quota is calculated and allow it to produce more. Then the news came through towards the end of the European session that the meeting planned for yesterday had been called off, and that the group would continue with quotas at their current levels, which sent prices surging, with Brent Crude (+1.30%) and WTI (+2.10%) up to new post-pandemic highs of $77.16/bbl and $76.74/bbl respectively. Clearly there is two way risk here as at first glance a failure to agree supplies is bullish for prices. However too big a disagreement could eventually lead to unilateralism amongst OPEC+ members and maybe notably higher supply as they break ranks. The middle ground may still be paved with compromise. So in helpful research added value, the price of oil might go up, down or sideways!! On a serious note DB’s Michael Hsueh has recently suggested that oil will likely go above $80 in Q3. See here for more. The latest gains yesterday already leave WTI up by over +58% on a YTD basis, which if sustained could have broader consequences for inflation at a time when price pressures are already widespread across the economy. The moves higher for commodities were seen more broadly across the asset class yesterday, with copper (+1.63%), iron (+3.10%) and coal (+2.98%) all climbing as well.

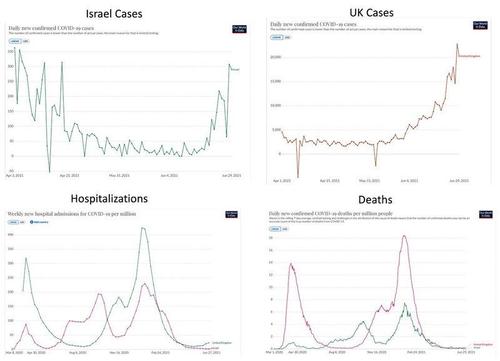

Asian markets are again trading mixed this morning with the Nikkei (+0.33%) and Kospi (+0.39%) up while the Hang Seng (-0.58%), Shanghai Comp (-0.53%) and Asx (-0.13%) are down. It is worth noting that the performance of Asian markets have started to decouple from their US and European peers recently as a number of countries in the region are struggling to check the spread of the delta variant whilst also continuing to lag on vaccinations. Futures on the S&P 500 and Stoxx 50 are both trading broadly flat while yields on 10y USTs are up +2.0 bps to 1.444%. In FX, the New Zealand dollar is up c. +0.80% as the market is starting to price in a rate hike form the RBNZ this year. This has also led to New Zealand’s 10yr yields being up by +4.5bps. Elsewhere, the Reserve Bank of Australia left the key rate unchanged at +0.10% at today’s meeting while indicating that it will do a mild taper of its QE programme after September. However they are indicating that they don’t expect to hike rates until 2024 which is more dovish. The Australian dollar is up c. +0.40% after the decision with yields on 10y sovereign bonds up +4.0bps. In terms of overnight data releases, Japan’s May household spending came in at +11.6% yoy (vs. 11.0% yoy expected) while real cash earnings came in at +2.0% yoy (vs. +2.4% yoy expected) with the previous month’s reading revised down to +1.9% yoy from +2.1% yoy.

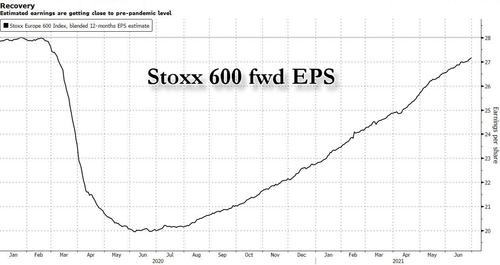

Back to the rest of yesterday’s session now and the morning got off to a decent start after the final PMI readings were generally a little stronger than the flash signal, and the Euro Area Composite PMI hit a 15-year high of 59.5 (vs. flash 59.2), so no sign yet that growth momentum is slowing down. Furthermore, the country-by-country readings were also incredibly strong, with Spain’s composite PMI of 63.4 at its highest level since February 2000, whilst France’s was revised up to a 3-year high of 57.4 (vs. flash 57.1). Even in Germany, where the revision was slightly downwards to 60.1 (vs. flash 60.4), that still marked the highest level for the composite PMI in a decade.

In light of the strong data, which itself came on the back of Friday’s “golidlocks” US jobs report, all the main European bourses moved higher, including the FTSE 100 (+0.58%), the CAC 40 (+0.22%) and the DAX (+0.08%). Sovereign bonds yields also rose in line with the risk-on tone elsewhere, with a bear-steepening that saw yields on 10yr bunds (+2.4bps), OATs (+2.8bps) and BTPs (+3.3bps) all rise on the day.

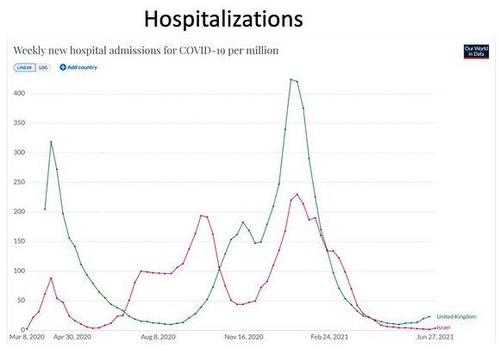

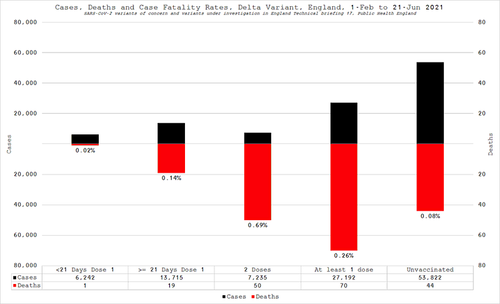

In terms of the latest on the pandemic, we heard from UK Prime Minister Johnson that he was planning to end legal limits on social contact in England on July 19, with a shift in emphasis away from legal restrictions towards personal choices. Furthermore, he said that the legal obligation to wear a face covering would be taken away, and it would no longer be necessary for the government to instruct people to work from home. Assuming this does go ahead as planned (with the full confirmation not taking place until Monday July 12 after they review the latest data), then this would mean the UK becomes a fascinating case study for others on whether it’s possible to live with the delta variant once most of the population have been vaccinated, and what this would mean for hospitalisations and deaths. In terms of the numbers, cases are continuing to rise in the UK, with the total over the last week up +53% on the week before, but the age distribution of cases is much lower this time relative to previous waves, and there are some indications that the rate of growth may have peaked for the time being, with the week-on-week growth rate down from +74% on Friday. Meanwhile, in Japan, PM Suga will meet with relevant ministers today to discuss whether enhanced virus restrictions in Tokyo and other areas will need to be extended. Boradcaster TBS added that given cases are rising in Tokyo and other areas, ending the virus measures as scheduled on July 11 isn’t an option. A formal decision is likely to come on Thursday.

On the vaccine front there was some more negative data out from Israel, where the Health Ministry there said the Pfizer vaccine was just 64% effective against infection amidst the continued spread of the delta variant. Fortunately, the effectiveness numbers for hospitalisations and severe illness were at a higher 93%, but continued reports like these will only raise fears about what a more vaccine-resistant strain could mean in terms of containing the pandemic.

Finally, there really wasn’t much in the way of economic data yesterday apart from the PMI releases, though French industrial production unexpectedly contracted by -0.3% in May (vs. +0.8% expected).

To the day ahead now, and data releases include German factory orders for May, the ZEW survey for July, the German and UK construction PMIs for June, Euro Area retail sales for May, and the final June US services and composite PMIs, along with June’s ISM services index. Meanwhile central bank speakers include the ECB’s Vice President de Guindos and the ECB’s Hernandez de Cos.

Tyler Durden

Tue, 07/06/2021 – 07:54

via ZeroHedge News https://ift.tt/36fWCtn Tyler Durden