Authored by Mike Shedlock via MishTalk.com,

Do we promote solar panels or not? At what price? Do we think long-term or short term?

Tariffs Set to Expire

Trump imposed tariffs on solar panels from China. The result was less demand for solar panels.

Do we want to promote more clean energy or not? If, so, at what cost? Those are the question as Two U.S. Companies Seek Continued Tariffs on Imported Solar Panels

Auxin Solar Inc., a San Jose, Calif., solar panel manufacturer, and Suniva Inc., which owns an idled solar cell factory in Norcross, Ga., plan to ask the U.S. International Trade Commission on Monday to extend the solar tariffs for four years, said Mamun Rashid, Auxin’s chief executive officer.

The 18% tariffs were imposed in 2018, and are set to expire next year. They largely affect imports from Chinese-owned companies. China is the world’s largest producer of solar cells and panels used to generate electricity, although it has moved some of its production to elsewhere in Asia to avoid U.S. tariffs.

Filing the petition triggers a monthslong review by the ITC, a quasi-judicial federal agency that will seek to determine whether the industry has made a “positive adjustment” to import competition.

The ITC can recommend extending the tariffs, but only the president has the power to do so—creating a potential dilemma for the Biden White House, which wants to encourage domestic manufacturing and wants to speed up the adoption of solar technology.

Hooray for Tariffs?!

US production of solar panels tripled under Trump tariffs.

Q: OK, But from what to what?

A: Imports still make up 85% of U.S. sales, according to the research firm Wood Mackenzie.

The imports shifted from China to other places. But these shifts come at a cost and consumers pay.

Team Biden Sounds Like Team Trump

In April, U.S. Trade Representative Katherine Tai indicated sympathy for the tariffs.

“The issue of the solar tariffs are very much on my mind,” she said at a Senate hearing.

“We are struggling with the application of these tariffs that are meant to save maybe the last producer that we have here in the United States.”

What’s the Goal?

Biden will seek more “tax incentives” of course. That means more taxes or higher deficits or both.

Fair Trade

At the head of the flag waving line are those demanding fair trade.

The term of course translates to more tariffs and subsidies to companies that cannot compete.

If we assume the trade is “not fair” what it really means is that Chinese taxpayers are subsidizing US citizens.

We should cheer such an event, if that is indeed what’s happening. Instead, we blast “It’s Not Fair!” in protest of China giving us free stuff.

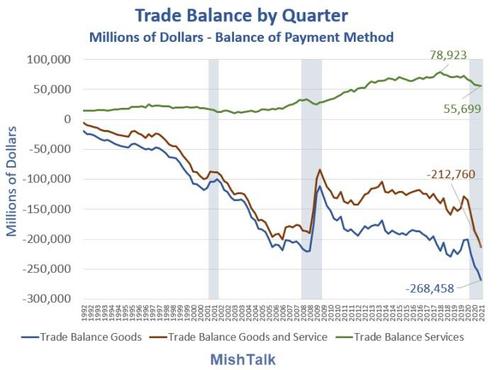

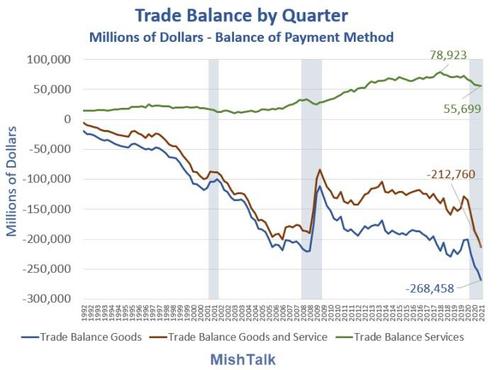

Trade Deficits

To protect a single US manufacturer Trump essentially stated “We insist on paying more.”

Short-Term Dirty Secret

Also in the news is this line of short-term thinking: Those cheap Chinese solar panels have a dirty little secret.

“It takes a lot of energy to extract and process solar-grade silicon, and in China, that energy tends to come from dirtier and less efficient energy sources than it does in Europe,” said Argonne scientist and co-author Seth Darling.

OK, but once the panels are in, they last decades. There is a one-time energy cost of producing the panels vs a long-term benefit.

This discussion assumes there is really any net savings ever. If it’s that marginal, perhaps we should not be promoting solar panels at all.

But if there is a long-term benefit, then faster adoption will happen much faster with cheaper prices.

Tariff Job Killers

“It is time to end the job-killing Section 201 solar tariffs,” said John Smirnow, general counsel for Solar Energy Industries Association, a trade group whose membership includes importers and installers. “They are a multibillion-dollar drag on industry growth.”

I agree wholeheartedly.

Flashback March 1, 2018

Fair Trade = Free Trade = Smart Trade

The link above is broken but please consider these articles.

In Praise of Cheap Labor

Some of us stand in Praise of Cheap Labor.

This is what I wrote:

Moral outrage is common among the opponents of globalization–of the transfer of technology and capital from high-wage to low-wage countries and the resulting growth of labor-intensive Third World exports.

The lofty moral tone of the opponents of globalization is possible only because they have chosen not to think their position through. While fat-cat capitalists might benefit from globalization, the biggest beneficiaries are, yes, Third World workers.

The benefits of export-led economic growth to the mass of people in the newly industrializing economies are not a matter of conjecture.

It is not an edifying spectacle; but no matter how base the motives of those involved, the result has been to move hundreds of millions of people from abject poverty to something still awful but nonetheless significantly better.

If Economists Ruled the World

Also consider my post What Should Trade Negotiators Negotiate?

If economists ruled the world, there would be no need for a World Trade Organization. The economist’s case for free trade is essentially a unilateral case – that is, it says that a country serves its own interests by pursuing free trade regardless of what other countries may do. Or as Frederic Bastiat put it, it makes no more sense to be protectionist because other countries have tariffs than it would to block up our harbors because other countries have rocky coasts.

This suggests an alternative version of the “race to the bottom” story. An environmentalist or defender of workers’ rights might also make a related argument. ….

The true purpose of international negotiations is arguably not to protect us from unfair foreign competition, but to protect us from ourselves. (When the United States recently imposed utterly indefensible restrictions on Mexican tomato exports, an Administration official remarked off the record that Florida has a lot of electoral votes while Mexico has none. The economically correct rebuttal to this sort of thing is to point out that the other 49 states contain a lot of pizza lovers; the politically effective answer is to subject US-Mexican trade to a set of rules and arbitration procedures in which the Mexicans do too have a vote).

Oops, wait a second, “I” Did Not Write Either Article.

I purposely misspoke to make a point.

Click on the links. The person who wrote those articles might surprise you.

That bastion of liberal mainstream media, Paul Krugman, wrote both before his mind morphed into political mush.

Bear in mind, Paul Krugman won a Nobel Prize in science regarding trade.

Ka-Blam

What I Did Write

Here We Go Again

And so here we are again. If we force prices up to save a single US manufacture, the whole industry suffers.

That industry includes importers, installers, truckers, merchants, etc.

Uh-oh, I just mentioned trucks.

Wait a second, I’ve got it.

Let’s just turn off all the lights, all the cars, all the trucks, the internet, games, and air conditioning.

We also need to milk cows by hand while equipping their rear ends with devices to capture methane.

That would fix everything.

Disputing Trump’s NAFTA “Catastrophe” with Pictures

Sarcasm aside, it’s important to understand the true nature of trade imbalances.

Please consider Disputing Trump’s NAFTA “Catastrophe” with Pictures: What’s the True Source of Trade Imbalances?

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.