JPMorgan Spooks Market With $3 Billion Crash Hedge

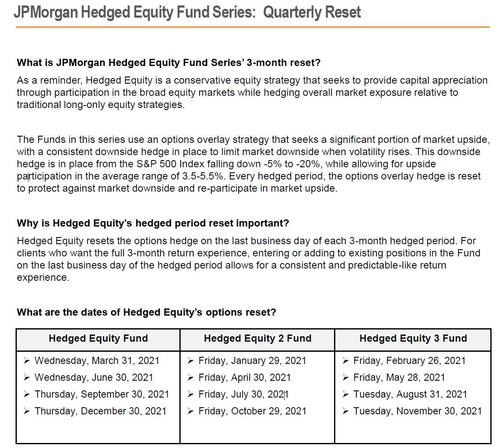

Anyone who has been following Nomura’s Charlie McElligott or the analysis from our friends over at SpotGamma, knows that as part of the quarter-end hedging fireworks, one of the most notable trades to keep an eye on is quarterly reset of the JPMorgan Collar Trade which the JPMorgan Hedge Equity Fund puts on every quarter to protect against a 5% up to 20% crash in stocks.

Just this morning we quoted Nomura’s McElligott who warned of “potential fireworks” in the Equities space will as a result of the “absolutely mongo-sized qtrly SPX Put Spread Collar that is being rolled, where paper needs to buy 44,600 SPX SepQ 4430 Call (on the cover) to buy the DecQ 3490 / 4140 Put Spread while selling the DecQ 4515 Call x 44,600.” As the Nomura quant calculates, the trade will lift the Street on ~$3.1B in Gamma and SELL 14.5mm in Vega.

The details of the trade were also discussed by SpotGamma which dedicated an entire discussion on the JPMorgan Collar Trade which conists of the following:

- Sell 45,000 contracts of the Dec 31st 4505 calls at a delta of 34

- Buy 45,000 of the Dec 31st 4135 puts at a delta of 30

- Sell 45,000 of the Dec 31st 3480 puts at a delta of 7.

According to SpotGamma, the net of this trade is a negative delta of ~57 (34+30-7), and the impact of this trade is shown in the image below, where the top chart is the ES futures, and the bottom blue line is the rolling sum of deltas traded on the day. The sharp move in the deltas is when the trade is put on.

And while option traders are intimately familiar with the quarterly roll of the JPM Collar, it appears that Bloomberg is not, and in a bombastic sounding article, “Giant S&P 500 Options Trade Placed to Guard Against 20% Swoon” the media giant writes that “a trader just established a massive hedging position via options to protect a portfolio of stocks in the event that the S&P 500’s losses snowball toward 20% during the fourth quarter. The trader Thursday morning bought 45,300 put-spread collars — options cocktails that combine various strike prices in a single strategy — on the S&P 500 for $94 million. The order involved selling calls with a strike price at 4,505 while buying puts exercising at 4,135 and selling puts at 3,480.”

Of course, our readers know that JPM is behind this trade which incidentally hardly as exciting as Bloomberg would like to make it sound, even if it is a bit embbarassing for those Wall Street “experts” quoted by the Bloomberg writer, such as Alon Rosin, Oppenheimer’s head of institutional equity derivatives. who was quoted as saying “It’s a portfolio protection trade. It was a notably sized bearish trade.”

Well yes it is: although since the largest bank in the US is behind and regularly rolls it, one would think Oppenheimer would be on top of these things.

Susquehanna’s co-head of derivatives, Chris Murphy, was also quoted: “The top strike of this put spread kicks in if we do actually break the 200dma, and hedges a lot of room on downside if there is an air pocket below. Meanwhile, the upside call is well below the highs from earlier this month and appears to be closer to spot than usual, so this hedger may believe upside will remain muted into the end of the year.”

Actually no, Chris, this is just a quarterly rolled position that JPM puts on – every quarter – to hedge against a crash.

Bloomberg’s ominous conclusion is alarming…

Angst is growing in the market as the S&P 500 has fallen almost 4% in September for the worst month in a year. Stocks tumbled as surging bond yields transpired with the government debt ceiling and China’s real estate woes.

… even if completely misses the point, namely that with JPM now having a $3 billion hedge on, it is far less likely to sell into a crash thus assuring that angst is merely a buying opportunity.

So for all the quoted experts above and the Bloomberg article author, here again is a video from SpotGamma that explains what happened.

Tyler Durden

Thu, 09/30/2021 – 15:21

via ZeroHedge News https://ift.tt/3orWS2Z Tyler Durden