By Michael Every of Rabobank

If only we could eat rhetoric

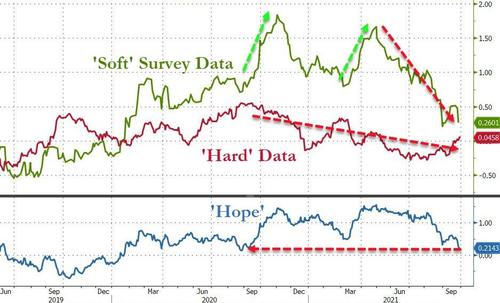

The usual talking heads were out in force yesterday underlining that inflation is transitory: Powell, Lagarde, Bailey, Kuroda (who has a new boss, PM “Continuity” Kishida). Yes, inflation is higher than they thought; yes, it’s lasted longer than they had expected; but, yes, it’s still just going to resolve itself when supply-chain bottlenecks do.

Logically, that is true. Mathematically, that is true – prices can’t keep going up at this rate forever. Politically, it is also “true” in that it is what everyone in power wants to hear.

Practically, it means nothing, however. How are these supply-chain bottlenecks to be resolved, exactly? Yes, you can send the army to deliver fuel, as in the UK, and stop the worst of the short-term panic on the forecourts. But are the army also going to be delivering food? Or, better, *growing* food, picking it, shipping it in via their own port network, to their own port network, and then delivering it? And garden sheds? And Xmas toys? There used to be a name for that kind of economy. Wall Street used to pretend it didn’t like it.

Meanwhile, China is to allow soaring coal prices to be passed on to factories in electricity prices. Now they won’t have to work 3-4 days weeks. But prepare for a surge in PPI, which will likely not be allowed to be passed on to CPI due to ‘common prosperity’. Which logically means margin collapse, and shutting down – so even more structural shortages. Unless we get state subsidies of some sort, or differential pricing for the foreign and domestic market. There used to be a name for that kind of economy. Wall Street used to pretend it didn’t like it.

Likewise, it now appears that top global supplier China is perhaps to stop exporting energy-intensive nitrogen, phosphate, glyphosate, and urea, key agri chemicals needed to *grow food*. If you hadn’t stocked up, you now potentially face a shortfall alongside a global shipping backdrop that means delivery may be delayed. In a worst case, this might mean less crops, so higher prices: and if used as animal feed, less meat – and higher prices. This is not any kind of a forecast – but it underlines how complex global supply-chains are, in the same way the current gas price surge hitting a CO2 factory in the UK briefly threatened to take out both its beer and meat production.

But don’t worry, our central bankers are on it. I am waiting to see their detailed solutions to a global shipping network in a state of “endemic congestion”, to quote my supply-chain-expert colleague Matteo Iagetti? (A topic we shall be publishing on very shortly.) They have one, right?

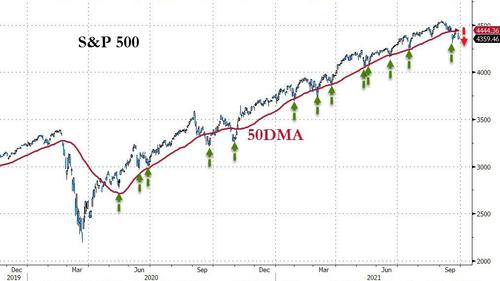

In DC, the Democrats are failing to move any of their bills through Congress. The progressives are digging their heels in over infrastructure, so no vote, and Senator Manchin is doing likewise, saying: “At some point, all of us, regardless of party must ask the simple question – how much is enough?… Spending trillions more on new and expanded government programs, when we can’t even pay for the essential social programs, like Social Security and Medicare, is the definition of fiscal insanity…ignoring the fact we are not in a recession and that millions of jobs remain open will only feed a dysfunction that could weaken our economic recovery.” By next week perhaps opinion will have shifted if the stock market has gone down another few percent. It’s not like there is an urgent need for infrastructure spending.

At a tangent, the Banque de France released a paper yesterday, The Meaning of MMT, which was remarkable for grasping that Stephanie Kelton’s ‘The Deficit Myth’ channels Knapp’s ‘The State Theory of Money’, which sits on my desktop as I type, and Abba Lerner (who, like Abba, is trying to make a comeback). It’s a rarity for a central banque to have read anything like that. However, the paper was equally notable for: 1) not having known the debate over money goes all the way back to the ancient Greeks, not just Yanis Varoufakis; and 2) how it dismissed MMT as nonsense when we have just lived through a physical experiment in it, and the ECB is neck-deep even if it pretends not to be. I would suggest the authors have a word with Steve Keen when he is finished running for office in Australia: but I know whose model of our current system is better. To bring this back to today, the main obstacle to MMT is control of supply chains. Control physical production, and keep a hefty trade surplus, and your currency is sound, and inflation largely controllable. There is a name for that kind of economy. Wall Street keeps showing it likes it. Or be the global reserve currency – but that involves controlling supply chains once again now.

Relatedly, yesterday’s inaugural meeting of the US-EU Trade & Technology Council Meeting “made high-level commitments” to tackle burgeoning economic and security challenges, including regulating artificial intelligence, easing the semiconductor shortage and combating human rights abuses, says Politico. This was despite French insistence on every other sentence in the official communiques say “strategic autonomy”, and seems to suggest Europe is willing to work with the US after all. Indeed, Lithuania has announced a gas pipeline between the Baltics, Finland, and Poland – and it presumably won’t be Russian, but US gas flowing through it. So strategic autonomy inside the EU – but is it really a surprise Finland understands the meaning of “Finlandisation”?

Meanwhile, China has announced the Beijing Olympics will only be attended by its nationals. So the Tokyo Olympics had no spectators, and now we only get one nationality. Isn’t that ironically indicative of the binary geopolitical game being echoed along supply chains?

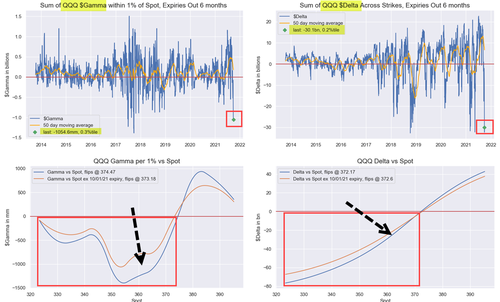

Back in markets, Evergrande still isn’t paying foreign creditors, but the usual bottom-fishers are bidding up all its bonds anyway – because central banks always bail everyone out, right? There is a name for that kind of economy. Wall Street clearly *loves* it.

However, the fact that the US dollar is doing well still points to an underlying nervousness – and not without good measure. Risk-on-ers will be in better cheer from China’s PMI data, where services bounced from 47.5 to 53.2 despite the total absence of retail sales and the Evergrande backdrop: presumably everyone is scrambling to buy Winter Olympics tickets. Manufacturing dipped from 50.1 to 49.6, but if that is what 3-day weeks and now soaring electricity prices look like in the data then I am a Winter Olympic champion.

Aussie building approvals also jumped 6.8% vs. a projected 5% slump. What else does one do when locked down or being pepper-sprayed than plan and approve blueprints? Apply for mortgages, as private sector credit for houses rose 3.5%, against just 0.6% for the whole economy. Oh, how I would love to see the RBA debate the finer points of Knapp and Lerner. Perhaps Steve Keen can learn ‘em.