Crypto Breaks Above Key Technicals, Extends Friday’s Surge

After Friday’s surge in cryptos lifted the entire space green for the week (following an ugly start to the week), Saturday saw markets flatline, but early after trading today (Sunday) has seen a renewed bid across all assets.

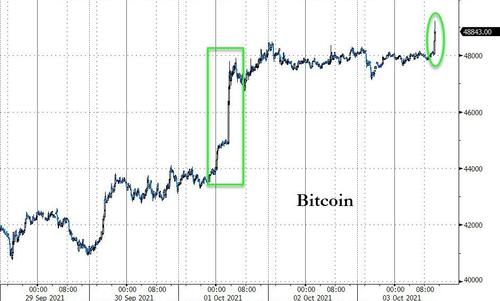

Bitcoin just topped $49,000…

Source:Bloomberg

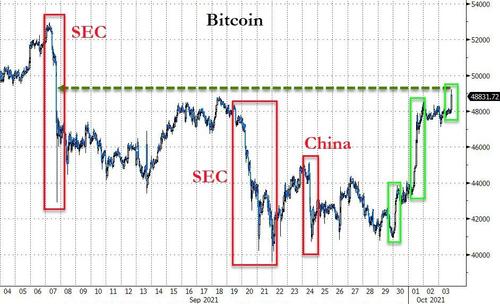

This moves comes just over a week after China ‘banned’ crypto (for the 25th time) and erases losses due to SEC’s Gensler’s comments on DeFi regulation…

Source:Bloomberg

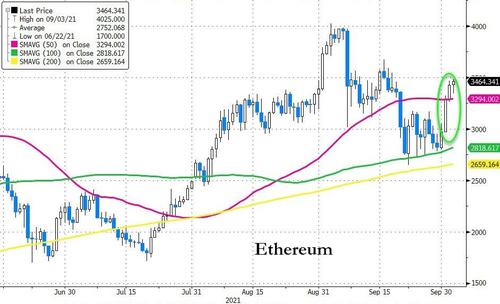

Ethereum is nearing $3500…

Source:Bloomberg

Bloomberg reports that The quick jump may have been fueled by a short squeeze in parts of the market, according to JST Capital co-founder Todd Morakis and Jonathan Cheesman, head of over-the-counter and institutional sales at crypto-derivatives exchange FTX. Market watchers pinned it on everything from the end of the historically tough month of September to lack of interference from the Federal Reserve. As is usually the case when Bitcoin takes a step higher, bulls cheered the move.

The breakout “looks important technically,” strategists at Fundstrat, the firm co-founded by Tom Lee, wrote in a report.

“Prices have eclipsed weekly highs as well as one-month downtrends,” they said.

While trends had turned negative a month ago, “Friday’s move is a big positive in helping to resolve this consolidation.”

“The rally has also preserved positive intermediate-term momentum” via a technical measure known as the moving average convergence/divergence indicator, Fairlead Strategies LLC’s Katie Stocktonsaid in a note — but she sees a counter-trend signal coming from another technical framework, DeMark indicators, that could prevent follow-through on the move.

“We would feel more comfortable moving to a bullish short-term bias once this signal is invalidated – which in our work would require two closes above $48,800,” she said.

“The first upside target lies at September highs at $52,956, then $64,895,” the strategists said, the latter being right around Bitcoin’s record high from mid-April.

Bitcoin also took out its 50- and 200-DMA after finding support at the 100DMA for over a week…

Source:Bloomberg

Ethereum has surged above its 50DMA after finding support at its 100DMA for over a week…

Source:Bloomberg

The overall crypto market went from a market value of about $1.9 trillion on Wednesday to $2.2 trillion on Sunday, according to CoinGecko.

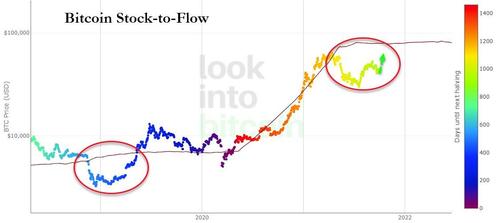

Finally, some traders are looking to the stock-to-flow model – and the similar relationship seen in Q4 2018 to Q1 2019 – as a framework for positioning here.

This model suggests bitcoin will be trading around $80,000 by year-end.

Tyler Durden

Sun, 10/03/2021 – 14:25

via ZeroHedge News https://ift.tt/3A6p8tW Tyler Durden