Wells Fargo Tumbles After Another Ugly Quarter: Loans Shrink Again As Home Lending Tumbles

In a day when the big banks reported generally stellar earnings (especially Bank of America and Morgan Stanley on the back of record advisory fees), easing the bitter aftertaste from yesterday’s disappointing report from JPMorgan, even perennial Wall Street disappointment Wells Fargo managed to beat expectations with net Interest margin posting a much awaited bounce, although there was the usual “but” of higher expenses and failure to post an increase in loan growth..

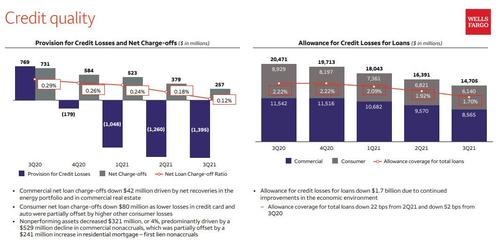

Wells Fargo reported EPS of $1.17, beating expectations of $0.99, thanks to revenue of $18.83BN, also stronger than the $18.37Bn expected. This translated into income of $5.1 billion, which however was padded by a $1.7 billion reserve release “due to continued

improvements in the economic environment”, resulting in an allowance coverage for total loans down 22 bps from 2Q21 and down 52 bps from 3Q20.

The firm also took a $250 million charge related to its latest regulatory order, which drove costs higher than analysts expected.

The company’s earnings summarized:

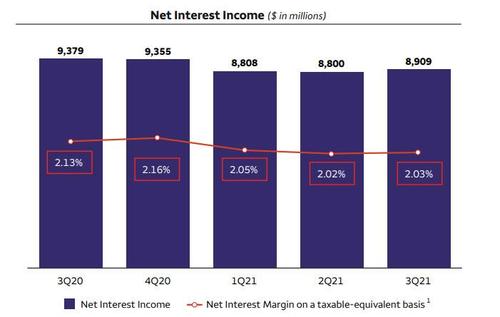

There was some much awaited good news on the Net Interest front, where both net interest income and margin posted a modest sequential improvement, rising $109MM or 1% from Q1, due to rising yields in Q3. Still, on a Y/Y basis, net interest income decreased $470 million or 5%, “reflecting the impact of lower loan balances due to soft demand and elevated prepayments, and the impact of lower yields on earning assets, partially offset by a decline in long-term debt and lower mortgage-backed securities (MBS) premium amortization.” In any case, since Wells Fargo is the most net interest income-reliant bank in the US, the reversal in NIM was certainly good news.

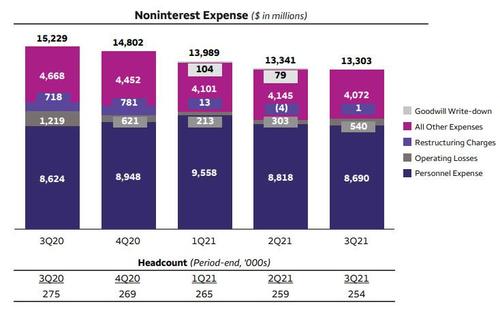

With NIM down Y/Y, expenses followed and the bank reported that noninterest expense (which consists mostly of personnel expenses) was flat sequentially and down 12.6% from a year ago, though analysts had expected a 14% drop. And even though headcount fell to 253,871, from 259,196 at the end of June, personnel expenses actually rose 1% from a year ago “as lower salaries expense driven by reduced headcount reflecting efficiency initiatives was more than offset by higher incentive and revenue-related compensation.”

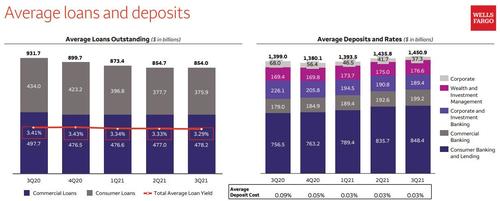

But perhaps the most important, and disappointing aspect of Wells’ results was that total average loans shrank again, and while commercial loans posted a small increase sequentially of $1.2BN to $478.2BN, Consumer Loans dropped by almost $2BN from $377.7BN to $375.9BN in Q3, and down a whopping $58.1BN from a year ago.

The total average loan yield of 3.29%, was down 4 bps from 2Q21 and down 12 bps YoY reflecting the repricing impacts of lower interest rates, as well as lower consumer real estate loans.

Meanwhile, as we have been discussing for the past 5 quarters, average deposits – a proxy for the Fed’s QE – were up $51.9 billion, or 4%, YoY “as growth across most businesses was partially offset by targeted actions to manage to the asset cap, primarily in Corporate Treasury and Corporate and Investment Banking.” The good news it that this remains the cheapest funding possible for Wells – at an average deposit cost of 3 bps, it was stable with 2Q21 and down 6 bps YoY reflecting the lower interest rate environment.

The biggest U.S. banks have been struggling with weak loan growth as consumers and businesses, bolstered by massive government stimulus programs during the pandemic, refrained from borrowing. The rise of the delta variant has also delayed a return to normal and slowed economic activity. Average loans fell 8%, Wells Fargo said.

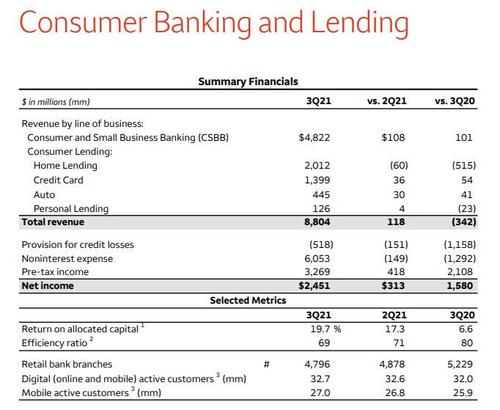

There was more bad news in the bank’s consumer banking and lending group, where total revenue was down 4% YoY. Some more details:

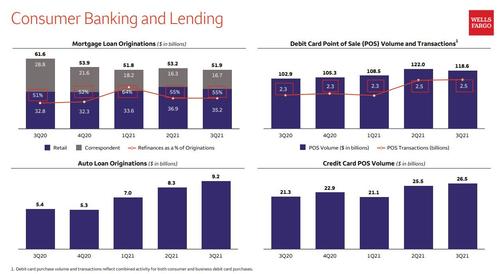

- CSBB up 2% YoY primarily due to an increase in consumer activity, including higher debit card transactions, and lower COVID-19-related fee waivers; up 2% from 2Q21 primarily driven by higher deposit-related fees and higher net interest income on higher deposits

- Credit Card up 4% YoY on higher point-of-sale volume and lower customer accommodations and fee waivers provided in response to COVID-19

- Auto up 10% YoY and up 7% from 2Q21 on higher loan balances

What was most disappointing was that Home Lending – where Wells Fargo once dominated the market – was down 20% YoY primarily due to lower mortgage banking income on lower gain on sale margins, origination volumes, and servicing fees, as well as lower net interest income on lower loans outstanding. In short, it is the biggest housing bubble in US history – bigger even that 2007- and Wells still can’t capitalize on it!

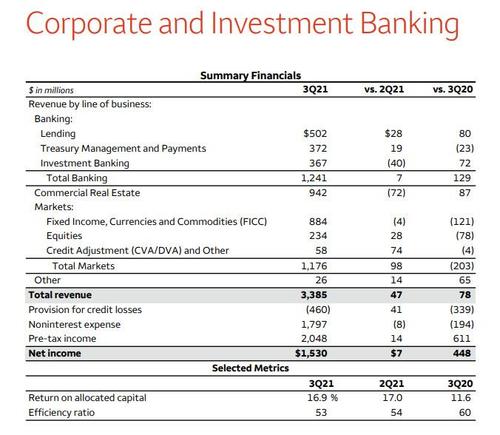

Finally, while for Wells, Banking and Sales and Trading are mostly an afterthought – after all, who would pick the trading desk at Wells over, well, anyone else – and the bank is not even close in the same ballpark as its bigger peers, it did post a modest, 2% increase in corporate and ibanking revenue to $3.385 billion, which was also up 1%, or $47MM, from last quarter.

- Banking revenue was up 12% YoY “on higher advisory and equity origination fees, and higher loan balances, partially offset by lower deposit balances predominantly due to actions taken to manage under the asset cap”

- Commercial Real Estate revenue up 10% YoY reflecting higher commercial servicing income, loan balances, and capital markets results on stronger commercial mortgage gain on sale volumes and margins and higher underwriting fees; down 7% from 2Q21 on lower capital markets volumes and commercial mortgage servicing income

Yet here too there was a disappointment, as markets revenue dropped 15% YoY to just $1.176BN on “lower trading activity across most asset classes primarily due to market conditions”

As Bloomberg notes, the mixed results were a reminder that challenges remain for Scharf, who took the helm of Wells Fargo in 2019. The bank has been cutting jobs and slashing costs as Scharf seeks to boost the firm’s profitability after years of scandals, which have continued this year as the bank has seen several settlements with regulators, a sordid legacy of its ugly past.

“The significant deficiencies that existed when I arrived must remain our top priority,” Scharf said in the statement. “We are a different company today and the operational and cultural changes we’ve made are enabling us to execute with significantly greater discipline than we have in the past.”

Or not: during the quarter, Wells Fargo was hit with a new regulatory action and a $250 million fine over its lack of progress addressing long-standing problems — a topic that is sure to come up on the bank’s analyst call. The firm is also still under a Federal Reserve-imposed asset cap, which limits its balance sheet.

Bottom line: another swing and another miss, with Wells shares the worst performing of all banks this morning.

Tyler Durden

Thu, 10/14/2021 – 10:19

via ZeroHedge News https://ift.tt/3mUOs1C Tyler Durden