US index futures climbed on Friday, paring this week’s losses fractionally as investors braced for jobs data that should provide clues about the pace of Fed tightening and which is expected to come in strong (whisper number at 502k, above 447k estimate, up from 210K last month; Wednesday’s ADP print was 807k, well above 410k estimate, our full preview is here) but not too strong – remember we now live in a “good news is bad news” world – or else the market will freak out that the Fed will hike even faster than is currently expected. Nasdaq futures also showed signs of recovery after a three-day selloff even as cryptocurrencies crashed again during the Asian session. As of 730am, emini S&P futures were up 4 points or 0.1%, Nasdaq futures were 0.24% higher, or 37 points and Dow futures were unchanged.Treasuries were steady, with the two-year yield heading for the biggest weekly spike since October 2019. Crude oil headed for the longest streak of weekly gains since October on tightening supplies.

U.S. hiring likely more than doubled in December from the previous month to 447,000 new jobs, according to consensus projections for nonfarm payrolls. “A low figure, around 100,000-200,000, wouldn’t change the direction the Fed is preparing to take,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note. “However, a strong NFP print, and a beat on unemployment rate, have the power of boosting the Fed hawks, on the idea that the jobs market no longer needs the Fed’s support.” That “could wreak havoc in risk markets.”

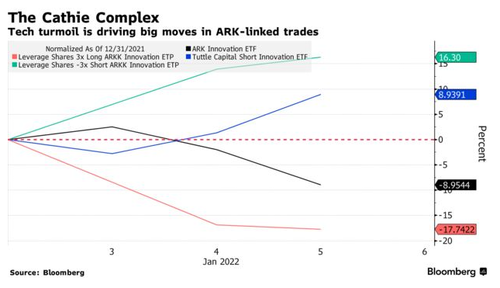

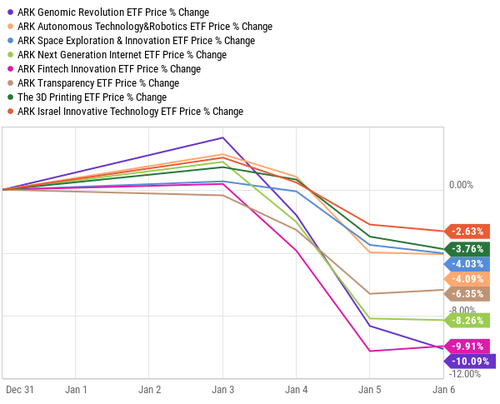

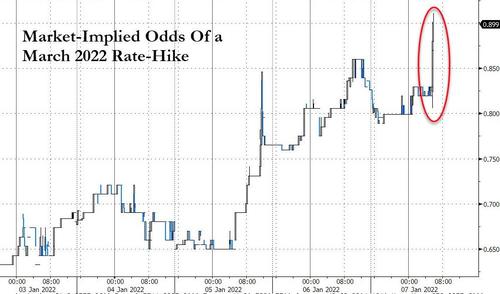

A surprisingly hawkish stance from the Fed revealed in the latest Minutes roiled financial markets at the start of a new year, with investors reassessing how to price assets in an environment of rising interest rates. The removal of crisis-era accommodation marks a shift not seen in at least three years, a time that also saw a spike in volatility.

“We knew coming into 2022 that the Fed was going to be a creator of volatility within the market and we’re seeing that right out of the gate at the start of the year,” said Lindsey Bell, chief markets and money strategist at Ally. “The good news is that today things seem to be stabilizing a little bit after yesterday’s knee-jerk reaction.”

Comments by regional Fed presidents provided some additional insight Thursday as traders attempted to predict a possible schedule for tightening. St. Louis Fed President James Bullard, a more hawkish policy maker, said in a speech the central bank could raise its target interest rate as soon as March. Meanwhile, San Francisco Fed President Mary Daly said at a virtual event that trimming the Fed balance sheet would come after normalizing the Fed funds rate.

Back to markets, Among meme stocks, GameStop jumped 18% in premarket trading after a report that the gaming retailer plans to launch a marketplace for non-fungible tokens this year. AMC Entertainment gained 6.5%. Discovery Inc. rose in New York premarket trading after BofA Global Research recommended the stock. Cryptocurrency-exposed stocks slip as Bitcoin extended its decline, falling below $42,000, before recovering slightly; the largest token declined as much as 4.9% to $41,008, marking a tumble of about 40% from its record near $69,000 reached Nov. 10. Marathon Digital dropped 1.6% in U.S. premarket, Riot Blockchain -1.3%, MicroStrategy -0.4% In Europe, Safello -4%, Arcane Crypto -5.7%, Northern Data -3.1%. Other notable premarket movers:

- GameStop (GME US) shares surge 19% in U.S. premarket trading after the gaming retailer was said to be planning to launch an NFT marketplace.

- Kohl’s (KSS US) falls 3.8% in premarket trading after UBS downgrades it to sell and slashes price target to a Wall Street-low on the “challenging” outlook for the stock in 2022 on inflationary pressures.

- Cryptocurrency-exposed stocks slip as Bitcoin extends its decline, falling below $42,000, before recovering slightly. Marathon Digital (MARA US) drops 1.6% in U.S. premarket, Riot Blockchain -1.3% (RIOT US), MicroStrategy -0.4% (MSTR US).

- Thursday’s court ruling was a “clear win” for Sonos (SONO US), and provides further proof that the firm has industry-leading intellectual property that it can successfully defend, Morgan Stanley (overweight) says. Shares rose 5.7% post-market.

- Marin Software (MRIN US) soars 36% in U.S. premarket trading after the marketing software firm announced an integration with Amazon Ads’ demand-side platform. Marin’s market capitalization was about $53m at Thursday’s close.

- Duck Creek Technologies’ (DCT US) net new annual recurring revenue is “back to beating,” Barclays (overweight) says. The shares rose 7.7% in postmarket trading after co. boosted its full-year revenue forecast.

- Quidel (QDEL US) rose 3% postmarket after the maker of Covid tests reported 4Q preliminary revenue that sailed past expectations.

- Armada Hoffler Properties (AHH US) fell 4.7% in premarket after launching a share sale to help pay the cash cost of its previously announced deal for the Exelon Building in Baltimore.

- Absci Corp. jumped 48% after announcing a research agreement with Merck & Co.

European equities had a choppy morning, settling flat to small lower as losses for travel and real-estate stocks outweighed gains in the mining industry, pulling the Stoxx Europe 600 Index down 0.3%. The gauge has had a bumpy first week of the year, pulling back from three consecutive record highs. In Milan, STMicroelectronics rose as much as 6.5%, the most since October, after the chipmaker reported higher-than-expected revenue. DAX lagged peers, dropping as much as 0.75%. Most indexes trade around lows for the week. Travel and real estate are the weakest sectors; miners, tech and oil & gas stocks lead to the upside. Here are some of the biggest European movers today:

- STMicroelectronics shares rise as much as 6.5% in Milan, the most since Oct. 28, after the chipmaker reported 4Q21 revenue that exceeded projections.

- Banca Carige soars as much as 13% amid reports that Cerberus submitted a non-binding offer for the troubled lender.

- Lanxess jumps as much as 3.3% to the highest since Nov. 3 after the stock is upgraded to overweight from equal-weight at Barclays, which sees “an attractive set-up” for share outperformance this year.

- Aston Martin gains as much as 3.8% after an update from the luxury car-maker that Jefferies (hold) called a “reassuring profit warning.”

- Inpost falls as much as 8.6%, reversing early gains, after the firm posted a 4Q and FY operational update. Growth in 4Q parcel volumes was 1% below Jefferies’ estimates, writes analyst David Kerstens (buy).

- Evolution drops as much as 6.2% after Berenberg says the market is “overly optimistic” about the Swedish online gambling giant’s top-line growth prospects, initiating with a hold rating on the stock.

- M&C Saatchi falls as much as 12%, the most intraday since July 2020, erasing some of the gains since the Jan. 5 announcement that AdvancedAdvT acquired a stake. The drop came after AdvancedAdvT said it’s interested in exploring a share- exchange merger.

- C&C falls as much as 5.8% after the Irish cider maker said performance was behind expectations in December due to the latest U.K. and Ireland measures to control the spread of Covid-19.

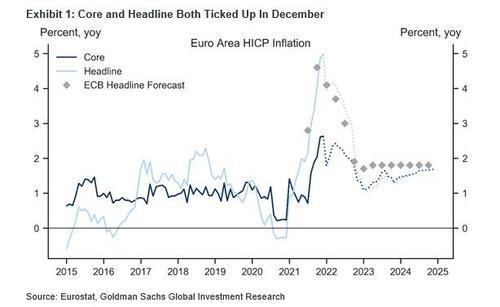

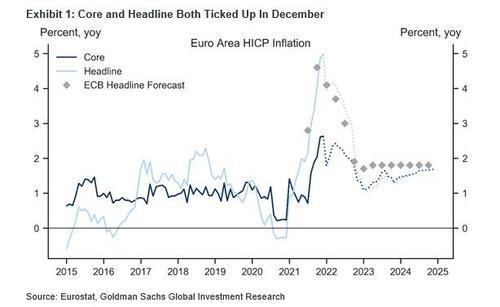

Consumer prices in the euro area jumped a record 5% from a year earlier in December, adding pressure on the ECB to join a growing legion of central banks from the Fed to the Bank of England in tightening monetary conditions.

Earlier in the session, Asian stocks rose, rebounding after a two-day drop, as financials gained amid the outlook for higher U.S. interest rates while traders remained wary of risks from the end of easy-money policies and coronavirus flare-ups. The MSCI Asia Pacific Index pared gains after rising by as much as 0.7%. South Korean chipmakers and Chinese internet giants were among stocks supporting the advance, helping offset drops in Taiwanese and Japanese tech stocks. The regional stock benchmark was poised for a weekly loss of 0.8%, sparked by a more hawkish than expected tone in the Federal Reserve’s December meeting minutes. The prospects of faster-than-expected monetary tightening spooked global investors, triggering a selloff of growth stocks.

“Value stocks continue to be strong, with higher yields pushing up banking stocks,” said Shogo Maekawa, a strategist at JP Morgan Asset Management in Tokyo. But, “for value and cyclicals to continue to be strong, the reasoning over monetary tightening needs to be backed by robust economic fundamentals and corporate earnings.”

Key gauges in Hong Kong, South Korea and Australia rose more than 1%. Japan’s Topix swung from a gain of as much as 1% to a loss of 0.8% at one point as investors reacted to news of spiking Covid-19 cases in some areas and possible restrictions to counter them. For Japan, the “risk of going into a state of emergency again seems to be weighing on the minds of investors,” said Serdar Armutcu, head of electronic trading at Mita Securities Co. in Tokyo.

Japanese stocks finished a volatile day slightly down amid concerns on interest rates and virus measures. Electronics makers and service providers were the biggest drags on the Topix, which closed 0.1% lower after swinging from a gain of 1% to a loss of 0.8%. Banks outperformed amid a rally in global lenders on an outlook for higher U.S. rates. The Nikkei 225 was little changed, with SoftBank Group gaining while Omron and Daikin dropped. “I guess it’s the continuation of yesterday’s market weakness, concerns over the FOMC,” said Serdar Armutcu, head of electronic trading at Mita Securities Co. in Tokyo. Plus, the “risk of going into a state of emergency again seems to be weighing on the minds of investors.” Okinawa was set to record over 1,400 new Covid cases, FNN reported. Kyodo reported earlier that Japan will delay resumption of its “Go To” travel subsidy program until after February and that Tokyo may tighten guidelines on group dining.

Indian stocks rose on optimism that state governments will opt for specific restrictions, instead of broad-based lockdowns, to curb a surge in coronavirus cases. The S&P BSE Sensex climbed 0.2% to 59,744.65, in Mumbai, taking its advance this week to 2.6%, the biggest five-day advance since early September. The NSE Nifty 50 Index gained 0.4%. Reliance Industries Ltd. climbed 0.8% and was the biggest boost for both gauges. Thirteen of 19 sector indexes compiled by BSE Ltd. advanced, led by a gauge of basic materials companies. Of 30 shares in the Sensex index, 16 rose and 14 fell. Mumbai, India’s financial capital, has no plans to shut down even as daily Covid-19 cases increase, the city’s municipal commissioner said. Separately, India will release its official estimate of the economy’s expansion for the fiscal year ending in March later today

In Australia, the S&P/ASX 200 index rose 1.3% to close at 7,453.30, regaining ground after Thursday’s 2.7% slump. All sectors advanced, led by energy shares and banks. Overall, the benchmark added 0.1% in the shortened first trading week of the year. Medibank was the top performer on Friday, gaining the most since March 2020. Magellan was among the worst performers after reporting net outflows of about A$1.55 billion for the December quarter. In New Zealand, the S&P/NZX 50 index fell 0.1% to 12,970.65

In FX, Bloomberg dollar spot drifts 0.2% lower. The euro was marginally higher against the greenback. Scandies top the G-10, AUD lags although ranges are relatively narrow.

In rates, price action was subdued with cash USTs and eurodollars quiet ahead of today’s payrolls report, with yields marginally cheaper across the curve but within Thursday session range. Treasury yields were cheaper by up to 1bp across long-end of the curve with spreads marginally steeper; 10-year yields around 1.725%, remain near top of weekly range. Long-end bunds and gilts richen ~1.5bps, peripheral spreads widen to core.

In commodities, oil was on course for a third weekly increase amid supply constraints; crude futures tagged on another percentage point of gains. WTI regains a $80-handle, Brent stalls near $83 in early London trade. Gains in commodities and emerging-market stocks further underscored the Friday rebound in risk sentiment. Spot gold drifts either side of $1,790/oz. Base metals are set to end the week strongly with LME nickel leading. Cryptos crashed during the Asian session, as usual.

Looking at the day ahead now, and the main highlight will be the aforementioned US jobs report for December. Otherwise, data releases from the Euro Area include the flash CPI reading for December, the final consumer confidence reading for December, and retail sales for November. Elsewhere, there’s also industrial production in November for France and Germany. Central bank speakers include the Fed’s Daly and Bostic, and the BoE’s Mann.

Top Overnight News from Bloomberg

- Federal Reserve policy makers could start to raise their target interest rate as soon as March and shrink the central bank’s balance sheet as a next step in response to surging inflation, Federal Reserve Bank of St. Louis President James Bullard said

- China’s delta variant-fueled Covid-19 outbreak isn’t showing signs of easing, with cases now cropping up elsewhere and technology hub Shenzhen on high alert, despite a dropoff in the latest epicenter Xi’an

- Local governments in China have started mapping out their economic blueprints for 2022, setting moderate to ambitious growth targets that give a signal of national goals

- President Kassym-Jomart Tokayev declared that order had largely been restored in Kazakhstan, after efforts to suppress mass protests that erupted over fuel price increases

- Oil was poised for a third weekly gain as the market tightened due to supply constraints across OPEC+ members following civil unrest.

- Peru hiked for a sixth straight month as inflationary pressure mounts amid the economy’s strong rebound from the pandemic. Argentina also raised its benchmark interest rate for the first time in over a year as it faces calls from the International Monetary Fund to tighten its monetary policy

- Japanese Finance Minister Shunichi Suzuki says he’s closely watching moves in foreign exchange markets and the impact of currencies on the economy

Market Snapshot

- S&P 500 futures up 0.18% to 4,696.00

- STOXX Europe 600 down 0.3% to 486.86

- MXAP up 0.5% to 191.98

- MXAPJ up 0.8% to 625.21

- Nikkei little changed at 28,478.56

- Topix little changed at 1,995.68

- Hang Seng Index up 1.8% to 23,493.38

- Shanghai Composite down 0.2% to 3,579.54

- Sensex up 0.1% to 59,687.14

- Australia S&P/ASX 200 up 1.3% to 7,453.35

- Kospi up 1.2% to 2,954.89

- Brent Futures up 0.9% to $82.71/bbl

- Gold spot little changed at $1,790.39

- U.S. Dollar Index down 0.21% to 96.12

- German 10Y yield little changed at -0.05%

- Euro up 0.2% to $1.1316

A more detailed look at global markets, courtesy of Newsquawk

Asia-Pac equities traded mostly higher but off best levels following a choppy Wall Street session – which saw the Russell 2000 close in the green whilst mild losses were seen across the Dow Jones, Nasdaq and S&P 500. US equity futures resumed trade with modest gains but the upside momentum faded, with the ES Mar’22 on either side of 4,700 in the run-up to the US jobs data. European equity futures traded flat with an upside bias for most of the overnight session. In APAC, the ASX 200 (+1.3%) was supported by its Financials, Energy, and Consumer Discretionary sectors. The Nikkei 225 (unch) was choppy but ultimately negative, with the index subdued by reports the Japanese government is seeking approval to declare COVID “quasi-emergencies” in three prefectures. The KOSPI (+1.2%) saw its Tech sector among the top performers after Samsung Electronic rose over 1.5% following its prelim earnings. The Hang Seng (+1.8%) and Shanghai Comp (-0.2%) held onto the mild gains seen at the cash open, although the property sector felt no reprieve as Shimao – thought to be one of the safer property firms – reportedly defaulted on a trust loan, thus triggering freefalls across its stock and bonds. In fixed income, US 10yr cash yield trimmed some of the prior session’s gains.

Top Asian News

- Hong Kong to Send All Partygoers to Government Quarantine

- Hong Kong’s Growth Forecasts at Risk as Omicron Spreads in City

- Property Stocks Rally, Shimao Pares Losses: Evergrande Update

- China Says It Supports Kazakhstan’s Efforts to End ‘Chaos’

European equities trade mixed/flat (Stoxx 600 -0.1%) with the Stoxx 600 on course to end the week in minor positive territory as markets await the December US NFP report. The handover from Asia was a mixed bag with upside seen for the ASX 200 (+1.3%) and Hang Seng (+1.8%) whilst the Nikkei (unch) was unable to gain much traction to the upside amid reports the Japanese government is seeking approval to declare COVID “quasi-emergencies” in three prefectures. Stateside, after yesterday’s session which saw the Russell 2000 close in the green and modest losses for the Nasdaq and S&P 500, futures are indicative of a relatively flat open with the ES +0.2%. In a recent note, Morgan Stanley suggested that this year’s equity set-up is “is best in Europe and Japan, where estimates look low while valuations are undemanding.” Sectors in Europe are mixed with Basic Resources the clear outperformer amid price action in underlying commodity prices whilst Rio Tinto (+2.0%) has also garnered support from a broker upgrade at Berenberg. Banking names are taking a breather today after gains of 4.4% for the Stoxx 600 Banking Index this week amid the more favourable yield environment seen since the beginning of the year. To the downside, Travel & Leisure names lag peers with no obvious catalyst behind the move whilst Real Estate and Food & Beverage names are also seen lower. In terms of individual movers, STMicroelectronics (+5.5%) is the best performer in the Stoxx 600 after Q4 prelim. revenue exceeded expectations, citing better than anticipated operations in an ongoing dynamic market; gains in the Co. have provided support for the likes of Infineon (+2.8%) and ASML (+2.1%). Shell (+0.2%) has seen marginal, but waning, support after announcing that the remaining USD 5.5bln of proceeds from the Permian divestment are to be distributed in the form of share buybacks at pace. To the downside, Airbus (-1.2%) is a laggard in the CAC after reports that Qatar Airways is seeking compensation regarding surface flaws on the A350.

Top European News

- Sanofi Forms Potential $5.2 Billion AI Deal With Exscientia

- Aston Martin Assures Valkyrie Is On Track After Ramp-Up Issues

- Polish Inflation Hits 21-Year-High With More Rate Hikes Expected

- ABG Hires Partners for Equity Sales From Nordea and Arctic

In FX, not much deviation and perhaps inclination for the Dollar to venture too far before the latest BLS report that may be key in terms of determining whether the Fed pulls the rate hike trigger in March and sets the ball rolling for QT at the next or a nearby FOMC meeting. The index remains finely poised between 96.086-299 parameters amidst fractionally softer US Treasury yields and another downturn in broad risk sentiment, albeit relatively mild compared to previous episodes of aversion this week. Moreover, several Greenback/G10 pairings could be preoccupied with option expiries in the run up to the jobs data (and after pending the outcome) given hefty interest rolling off at today’s NY cut.

- EUR/GBP – The Euro and Pound are marginally outperforming, with the former reclaiming 1.1300+ status vs the Buck and latter retesting resistance around 1.3550 that includes the 100 DMA. However, Eur/Usd has faded multiple times above the round number and needs to breach 1.1350 convincingly to turn the corner, so 1.5 bn option expiry interest from 1.1290 to 1.1300 may still prove to be an impediment. Conversely, Eur/Gbp continues to hold above the 0.8333 mark that equates to the psychological 1.2000 level in the inverse cross to offer the Euro support and cap Sterling regardless of another encouraging UK PMI (construction this time) or flash Eurozone inflation flash ‘surprising’ to the upside (in line with Germany’s preliminary CPI outcome yesterday).

- NZD/CAD – Aud/Nzd dynamics rather than NZ specifics might be propping up the Kiwi as well, while the Loonie is deriving traction from ongoing strength in crude oil (WTI pivoting Usd 80/brl and Brent basically bid within a Usd 82-83 range) before Canada’s LFS. Nzd/Usd is hovering around 0.6750, as the aforementioned Antipodean cross probes 1.0600 and Usd/Cad is inching towards 1.2700.

- CHF/AUD/JPY – The Franc is treading water sub-0.9200 against its US counterpart with little reaction to an unexpected dip in Swiss sa unemployment or an acceleration in retail sales, while the Aussie and Yen both look trapped by option expiries very close or not far outside intraday extremes. Note, Aud/Usd has been up to 0.7178 and down to 0.7143 and Usd/Jpy topped and tailed at 116.05 and 115.75, so well within striking distance of 2.6 bn at 0.7160, 2.2 bn at 0.7200, 1.1 bn between 115.45-50 and 2.7 bn at 116.00.

In commodities, crude benchmarks are firmer in European trade with action directionally following, but eclipsing in magnitude, broader equity/risk performance. Currently, posting gains of around USD 1.0/bbl featuring WTI back above USD 80.00/bbl and Brent probing USD 83.00/bbl. Specific newsflow has been limited. Focus remains on geopolitics with increasingly punchy rhetoric emanating from Kazakhstan leaders regarding fuel-protests, though updates to output there remain limited after the sparse developments yesterday, highlighted by the Tengiz facility making a temporary adjustment. Elsewhere, adding to the positive tones from earlier in the week, the French Foreign Minister says there has been progress in Iranian nuclear discussions, but caveated that time is running out. Moving to metals, spot gold and silver are essentially unchanged at present despite some modest gyrations around the APAC/Europe crossover with newsflow sparse and broader sentiment cagey pre-NFP. Note, the weekly BofA Flow Show highlights the first inflow in a five-week period for precious metals, amounting to USD 0.3bln. Elsewhere, particularly for the copper watchers, a magnitude 5.2 earthquake occurred in Ricardo Palma, Peru – does not appear to be in direct proximity to a copper mine though, no commentary/guidance on any potential impacts yet.

US Event Calendar

- 8:30am: Dec. Change in Nonfarm Payrolls, est. 447,000, prior 210,000

- Dec. Change in Private Payrolls, est. 405,000, prior 235,000

- Dec. Change in Manufact. Payrolls, est. 35,000, prior 31,000

- Dec. Unemployment Rate, est. 4.1%, prior 4.2%

- Dec. Underemployment Rate, prior 7.8%

- Dec. Labor Force Participation Rate, est. 61.9%, prior 61.8%

- Dec. Average Hourly Earnings YoY, est. 4.2%, prior 4.8%

- Dec. Average Hourly Earnings MoM, est. 0.4%, prior 0.3%

- Dec. Average Weekly Hours All Emplo, est. 34.8, prior 34.8

- 3pm: Nov. Consumer Credit, est. $20b, prior $16.9b

DB’s Jim Reid concludes the overnight wrap

My wife dropped a bombshell last night over dinner. She says she is going to start life drawing classes as of next week. I felt slightly better once I had it confirmed that she would be going as an artist rather than the subject. My offer to allow her to draw me at home was swiftly rebuked. She used to do a lot of this when she was at art college but ultimately now the children are at school she wants to get back into art in some form or another. Her long-term goal is to write and illustrate children’s books. So in couple of years time it will be buy one EMR and get a children’s book for free. Or indeed the other way round.

Talking of new jobs, today is another important payrolls report as the Fed is rapidly catching up to the tightness in the labour market that has been clear in most of the data for many months now outside of the actual headline payroll data. We’ll review what our economists are expecting below but for now the consequences of Wednesday’s FOMC minutes continue to reverberate in markets, as Fed officials across the dove-hawk spectrum emphasised support for starting QT shortly after rate hikes. See my CoTD from yesterday here for what happened to assets the last time we saw QT.

Sovereign bond yields saw another leg higher yesterday even as there were some initial signs that equities might be beginning to stabilise. The moves came as investors dialled up their hawkish bets on the Fed’s policy trajectory for this year, with Fed funds futures now pricing in an 84% chance of an initial rate hike as soon as the March meeting, which is the highest probability to date and up from just 33% only a month earlier.

These growing expectations of future rate hikes meant that yields on 10yr Treasuries rose +1.6bps to 1.72%. That’s just below the 2021 highs of 1.74% reached on March quarter-end last year. If I ran a poll asking when yields will move above that level back in March last year, I’m not sure many people would’ve said January 2022. However it was only just before Xmas that we closed at 1.34%. Indeed this marks the 5th consecutive move higher in yields, which is their longest run of increases since October. If we get a 6th today, it would then become the longest sustained run since February. The moves were driven by higher real rates once again, with the 10yr real yield up +5.5bps to -0.80%, its highest level since June. The latest rise also means that real yields have surged by an astonishing +30.2bps since their close on New Year’s Eve, and so are entirely responsible for the increase in nominal yields, with inflation breakevens having continued to fall back as investors grow in confidence that the Fed’s hikes will be able to keep a handle on inflation.

It wasn’t just the US that was affected though, with sovereign bond yields moving higher throughout the world. Yields on 10-year bunds continued to edge closer to the zero mark (not seen since May 2019), after rising another +2.3bps yesterday to -0.07%, and those on gilts (+6.9bps), OATs (+3.1bps) and BTPs (+3.7bps) followed likewise. That said, it was evident how markets are increasingly pricing in a policy divergence between the Fed and the BoE relative to the ECB, with the gap between yields on 2yr Treasuries and 2yr bunds hitting a post-pandemic high, whilst the gap between yields on 2yr gilts and 2yr bunds hit its widest since August 2019.

For US equities, there were some initial signs that the selloff was beginning to stabilise yesterday, with the S&P 500 down just -0.1% and the NASDAQ (-0.13%) mire becalmed, though remaining in negative territory on a YTD basis, albeit after four business days of 2022. Traditional cyclicals led the way, with energy (+2.29%) benefitting from climbing commodity prices and financial shares (+1.55%) enjoying this yield run. Big tech shares were notably mixed today after a rocky start to the year, evidenced by the aforementioned flat Nasdaq, with 4 of 6 FANG (+0.58%) stocks advancing, and 6 declining on the day.

Europe was weaker, having closed the previous day before the release of the minutes, and that saw the STOXX 600 (-1.25%) lose ground for the first time so far this year. The main exception to the broader trend lower in European equities were banks, with the STOXX Banks Index (+0.95%) continuing its run of having advanced in every session so far this year, in turn taking the index to a 3-year high.

Overnight in Asia, most major indices are trading in positive territory, rebounding from its previous session losses. The Shanghai Composite (+0.35%) and CSI (+0.36%) are both edging up. Elsewhere, the Kospi (+1.02%) is outperforming after the index heavyweight Samsung Electronics Q4 operating profit jumped to its highest in four years, while the Hang Seng (+1.15%) is also seeing a decent move higher. However, the Nikkei slipped (-0.33%), giving up its early gains following a -3% drop yesterday.

Staying on Japan, data released earlier this morning showed that household spending eased more than anticipated by -1.3% y/y in November and -1.2% m/m. Separately, real wages fell -1.6% y/y for the third straight month in November reinvigorating concerns about the nation’s economic recovery. Meanwhile, core consumer prices for Tokyo advanced +0.5% y/y, notching its fastest pace in nearly two years in December.

Moving ahead, Futures market in the US are pointing towards a stronger start with the S&P (+0.22%), Nasdaq (+0.21%) and Dow Jones (+0.16%) contracts all in positive territory. US Treasury yields have edged slightly lower with 10yrs back below 1.72%.

Looking forward now, the main highlight today will be the US jobs report for December, which will be an important one as markets look to assess the potential implications for monetary policy. In terms of our what to expect, DB’s US economists are looking for nonfarm payrolls to grow by +600k in December, its fastest pace since July, with the unemployment rate ticking down a tenth to a post-pandemic low of 4.1%. And although their view is that Omicron-related disruptions present some downside risk, that’s more likely to be seen in the January report. You can see their full preview here

Ahead of that, there was somewhat underwhelming data out of the US yesterday, with the ISM services index falling by more than expected to 62.0 in December (vs. 67.0 expected), which was beneath every economist’s estimate on Bloomberg and down from 69.1 the previous month. In fact, that fall of -7.1pts in the space of a month marks the biggest monthly decline since April 2020 at the height of the initial phase of the pandemic, although to be fair it still remains firmly in expansionary territory and is down from a record high the previous month. In addition the prices paid measure rose to 82.5, so not echoing the decline in the prices paid reading that we saw in the ISM manufacturing a couple of days earlier. Meanwhile the weekly initial jobless claims ticked up to 207k in the week through January 1 (vs. 195k expected), and November’s factory orders grew by +1.6% (vs. +1.5% expected).

Alongside the persistent rise in Treasury yields, another familiar pattern of 2022 so far has been the gains in oil prices, which are continuing to cement their place as one of the top 2022 performers, having risen by at least +1% every day so far this year. In fact there was a particular milestone yesterday as WTI (+2.47%) and Brent Crude (+1.88%) both closed above their pre-Omicron level for the first time yesterday, which just shows you how markets have brushed off the risks of the new variant having a significant impact on growth.

Speaking of Omicron, there were some further positive signs yesterday as the total number of Covid-19 hospitalisations in London actually fell for the first time in over 3 weeks. Of course this is only one day, but as one of the first places among the developed economies to be seriously affected by the new variant, London is an important leading indicator for how other places may fare. One caveat to note however is that the UK has one of the most advanced booster programmes in the world, with a majority of the country’s population having now had a booster dose.

The other main data release yesterday came from Germany, where inflation fell to +5.7% in December on the EU-harmonised measure (vs. +5.6% expected). Separately, factory orders in the country rose by a stronger-than-expected +3.7% in November (vs. +2.3% expected).

To the day ahead now, and the main highlight will be the aforementioned US jobs report for December. Otherwise, data releases from the Euro Area include the flash CPI reading for December, the final consumer confidence reading for December, and retail sales for November. Elsewhere, there’s also industrial production in November for France and Germany. Central bank speakers include the Fed’s Daly and Bostic, and the BoE’s Mann.