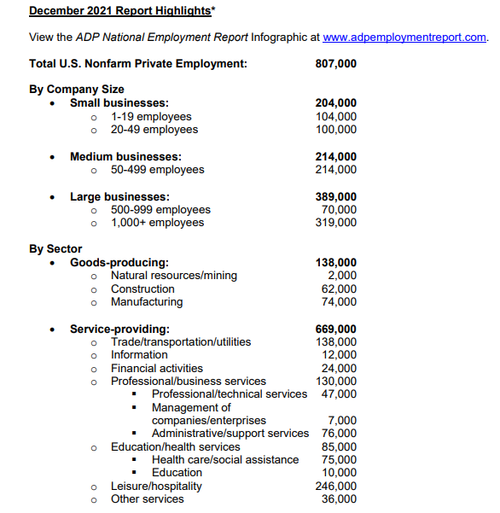

After futures rose to a new all time high during the Tuesday overnight session, the mood has been decided more muted after yesterday’s sharp rates-driven tech selloff, and on Wednesday U.S. futures were mixed and Nasdaq contracts slumped as investors once again contemplated the effect of expected rate hikes on tech stocks with lofty valuations while waiting for the release of Federal Reserve minutes at 2pm today. At 730am, Nasdaq 100 futures traded 0.3% lower amid caution over the impact of higher yields on equity valuations, S&P 500 Index futures were down 0.1%, while Europe’s Stoxx 600 gauge traded near a record high. The dollar weakened, as did bitcoin, while Brent crude rose back over $80.

“The sharp rise in U.S. yields this week has sparked a move from growth to value,” said Jeffrey Halley, senior market analyst at Oanda Asia Pacific. “Wall Street went looking for the winners in an inflationary environment and as a result, loaded up on the Dow Jones at the expense of the Nasdaq.”

Concerns related to the pandemic deepened as Hong Kong restricted dining-in, closed bars and gyms and banned flights from eight countries including the U.S. and the U.K. to slow the spread of the omicron variant. Meanwhile, a selloff in technology stocks extended to Asia, where the Hang Seng Tech Index tumbled as much as 4.2%, sending the gauge toward a six-year low. Traders are now caught in a quandary over deepening fears on global growth combined with a faster tightening by the Federal Reserve.

“Earlier we thought that rate hikes wouldn’t be on the table until mid-2022 but the Fed seems to have worked up a consensus to taper faster and hike sooner rather than later,” Steve Englander, head of global G-10 FX research at Standard Chartered, said in a note. “But we don’t think inflation dynamics will support continued hiking. We suspect the biggest driver of asset markets will be when inflation and Covid fears begin to ebb.”

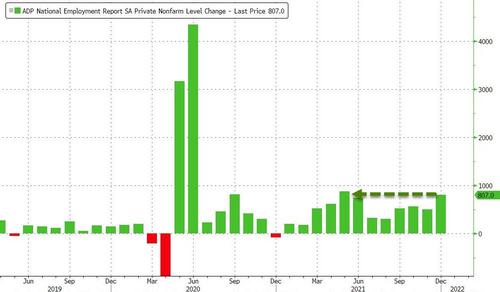

Data on Tuesday showed mixed signs on U.S. inflation. Prices paid by manufacturers in December came in sharply lower than expected. However, figures showing a faster U.S. job quit rate added to concerns over wage inflation. With 4.5 million Americans leaving their jobs in November, compared with 10.6 million available positions, the odds increased the Fed will struggle to influence the employment numbers increasingly dictated by social reasons. The data came before Friday’s monthly report from the Labor Department, currently forecast to show 420,000 job additions in December.

In premarket trading, tech giants Tesla, Nvidia and Advanced Micro Devices were among the worst performers. Pfizer advanced in New York premarket trading after BofA Global Research recommended the stock. Shares of Chinese companies listed in the U.S. extended their decline after Tencent cut its stake in gaming and e-commerce company Sea, triggering concerns of similar actions at other firms amid Beijing’s regulatory crackdown on the technology sector. Alibaba (BABA US) falls 1.2%, Didi (DIDI US) -1.8%. Here are the other notable premarket movers:

- Shares in electric vehicle makers fall in U.S. premarket trading, set to extend Tuesday’s losses, amid signs of deepening competition in the sector. Tesla (TSLA US) slips 1.1%, Rivian (RIVN US) -0.6%.

- Beyond Meat (BYND US) shares jump 8.9% premarket following a CNBC report that Yum! Brands’ KFC will launch fried chicken made with the company’s meat substitute.

- Recent selloff in Pinterest (PINS US) shares presents an attractive risk/reward, with opportunities for the social media company largely unchanged, Piper Sandler writes in note as it upgrades to overweight. Stock gains 2.3% in premarket trading.

- Senseonics Holdings (SENS US) shares rise 15% premarket after the medical technology company said it expects a U.S. Food and Drug Administration decision in weeks on an updated diabetes- monitoring system.

- MillerKnoll (MLKN US) shares were down 3.1% in postmarket trading Tuesday after reporting fiscal 2Q top and bottom line results that missed analysts’ estimates.

- Annexon (ANNX US) was down 23% postmarket Tuesday after results were released from an experimental therapy for a fatal movement disorder called Huntington’s disease. Three patients in the 28- person trial discontinued treatment due to drug-related side- effects.

- Wejo Group (WEJO US) shares are up 34% premarket after the company said it’s developing the Wejo Neural Edge platform to enable intelligent handling of data from vehicles at scale.

- Smart Global (SGH US) falls 6% postmarket Tuesday after the computing memory maker forecast earnings per share for the second quarter. The low end of that forecast missed the average analyst estimate.

- Beyond Meat (BYND) shares surge premarket after CNBC KFC launch report

- UBS cut the recommendation on Adobe Inc. (ADBE US) to neutral from buy, citing concerns over the software company’s 2022 growth prospects. Shares down 2% in premarket trading.

- Oncternal Therapeutics (ONCT US) shares climb 5.1% premarket after saying it reached consensus with the FDA on the design and major details of the phase 3 superiority study ZILO-301 to treat mantle cell lymphoma.

In Europe, the energy, chemicals and car industries led the Stoxx Europe 600 Index up 0.2% to near an all-time high set on Tuesday. The Euro Stoxx 50 rises as much as 0.6%, DAX outperforms. FTSE 100 lags but rises off the lows to trade up 0.2%. Nestle dropped 2.4%, slipping from a record, after Jefferies cut the Swiss food giant to underperform. Utilities were the worst-performing sector in Europe on Wednesday as cyclical areas of the market are favored over defensives, while Uniper and Fortum fall following news of a loan agreement. Other decliners include RWE (-2.4%), Endesa (2.1%), Verbund (-1.3%), NatGrid (-1.2%), Centrica (-1.2%).

Earlier in the session, technology shares led a decline in Asian equity markets, with investors concerned about the prospects of higher interest rates and Tencent’s continued sale of assets. The MSCI Asia Pacific Index fell as much as 0.6%, the most in two weeks, dragged down by Tencent and Meituan. The rout in U.S. tech spilled over to Asia, where the Hang Seng Tech Index plunged 4.6%, the most since July, following Tencent’s stake cut in Singapore’s Sea. Declines in tech and other sectors in Hong Kong widened after the city tightened rules to curb the spread of the omicron variant. Most Asian indexes fell on Wednesday, with Japan an exception among major markets as automakers offered support. The outlook for tighter monetary policy in the U.S. and higher Treasury yields weighed on the region’s technology shares, prompting a rotation from growth to value stocks. Read: China Tech Selloff Deepens as Tencent Sale Spooks Traders Asian equities have underperformed U.S. and European peers amid slower recoveries and vaccination rates in the past year. With omicron rapidly gaining a foothold in Asia, there is a risk of “any further restriction measures, which could cloud the services sector outlook, along with disruption to supply chains,” said Jun Rong Yeap, a strategist at IG Asia Pte. Philippine stocks gained as trading resumed following a one-day halt due to a systems glitch.

North Korea appeared to have launched its first ballistic missile in about two months, just days after leader Kim Jong Un indicated that returning to stalled nuclear talks with the U.S. was a low priority for him in the coming year.

India’s key equity gauges posted their longest run of advances in more than two moths, driven by a rally in financial stocks on hopes of revival in lending on the back of capex spending in the country. The S&P BSE Sensex rose 0.6% to 60,223.15 in Mumbai, its highest since Nov. 16, while the NSE Nifty 50 Index advanced 0.7%. Both benchmarks stretched their winning run to a fourth day, the longest since Oct. 18. All but six of the 19 sector sub-indexes compiled by BSE Ltd. climbed, led by a gauge of banking firms. “I believe from an uncertain, volatile environment, the Nifty is now headed for a directional move,” Sahaj Agrawal, a head of derivative research at Kotak Securities, writes in a note. The Nifty 50 crossed a significant barrier of the 17,800 level and is now expected to trade at 19,000-19,500 level in the medium term, Agrawal added. HDFC Bank contributed the most to the Sensex’s gain, increasing 2.4%. Out of 30 shares in the Sensex, 18 rose, while 12 fell

In FX, Bloomberg Dollar Spot index slpped 0.2% back toward Tuesday’s lows, falling as the greenback was weaker against most of its Group-of-10 peers, SEK and JPY are the best performers in G-10, CAD underperforms. Scandinavian currencies and the yen led gains, though most G-10 currencies were trading in narrow ranges. Australia’s dollar reversed an Asia-session loss in European trading. The yen rebounded from a five-year low as investors trimmed short positions on the haven currency and amid a decline in Asian stock markets.

Treasuries were generally flat in overnight trading, with the curve flatter into early U.S. session as long-end outperforms, partially unwinding a two-day selloff to start the year with Tuesday witnessing a late block sale in ultra-bond futures. 10-year yields traded as high as 1.650% ahead of the US open after being mostly flat around 1.645%; yields were richer by up to 2bp across long-end of the curve while little change from front-end out to belly, flattening 2s10s, 5s30s spreads by 0.5bp and 1.8bp; gilts outperformed in the sector by half basis point. Focus expected to continue on IG issuance, which has impacted the market in the past couple of days, and in U.S. afternoon session FOMC minutes will be released. IG dollar issuance slate includes EIB $5B 5-year SOFR and Reliance Ind. 10Y/30Y/40Y; thirteen borrowers priced $23.1b across 30 tranches Tuesday, making it the largest single day volume for U.S. high-grade corporate bonds since first week of September. European peripheral spreads widen to core. 30y Italy lags peers, widening ~2bps to Germany with order books above EU43b at the long 30y syndication. Ten-year yields shot up 8bps in New Zealand as its markets reopened following the New Year holiday. Aussie yields advanced 4bps. A 10-year sale in Japan drew a bid-cover ratio of 3.46.

In commodities, crude futures were range-bound with WTI near just below $77, Brent nearer $80 after OPEC+ agreed to revive more halted production as the outlook for global oil markets improved, with demand largely withstanding the new coronavirus variant. Spot gold puts in a small upside move out of Asia’s tight range to trade near $1,820/oz. Base metals are mixed. LME nickel lags, dropping over 2%; LME aluminum and lead are up ~0.8%.

Looking at the day ahead, data releases include the December services and composite PMIs from the Euro Area, Italy, France, Germany and the US. On top of that, there’s the ADP’s December report of private payrolls from the US, the preliminary December CPI report from Italy, and December’s consumer confidence reading from France. Separately from the Federal Reserve, we’ll get the minutes of the December FOMC meeting.

Market Snapshot

- S&P 500 futures little changed at 4,783.25

- MXAP down 0.4% to 193.71

- MXAPJ down 0.9% to 626.67

- Nikkei up 0.1% to 29,332.16

- Topix up 0.4% to 2,039.27

- Hang Seng Index down 1.6% to 22,907.25

- Shanghai Composite down 1.0% to 3,595.18

- Sensex up 0.7% to 60,300.47

- Australia S&P/ASX 200 down 0.3% to 7,565.85

- Kospi down 1.2% to 2,953.97

- STOXX Europe 600 up 0.1% to 494.52

- German 10Y yield little changed at -0.09%

- Euro up 0.2% to $1.1304

- Brent Futures down 0.4% to $79.72/bbl

- Gold spot up 0.3% to $1,819.73

- U.S. Dollar Index down 0.13% to 96.13

Top Overnight News from Bloomberg

- The U.S. yield curve’s most dramatic steepening in more than three months has little to do with traders turning more optimistic on the economy or betting on a more aggressive timetable for raising interest rates

- The surge in euro-area inflation that surprised policy makers in recent months is close to its peak, according to European Central Bank Governing Council member Francois Villeroy de Galhau

- Some Bank of Japan officials say it’s likely the central bank will discuss the possible ditching of a long-held view that price risks are mainly on the downward side at a policy meeting this month, according to people familiar with the matter

- Turkish authorities are keeping tabs on investors who are buying large amounts of foreign currency and asked banks to deter their clients from using the spot market for hedging-related trades as they struggle to contain the lira’s slide

- Italy is trying to lock in historically low financing costs at the start of a year where inflationary and political pressures could spell an end to super easy borrowing conditions

- North Korea appears to have launched its first ballistic missile in about two months, after leader Kim Jong Un indicated he was more interested in bolstering his arsenal than returning to stalled nuclear talks with the U.S.

A More detailed breakdown of overnight news from Newsquawk

Asia-Pac equities traded mostly in the red following the mixed handover from Wall Street, where the US majors maintained a cyclical bias and the NDX bore the brunt of another sizeable Treasury curve bear-steepener. Overnight, US equity futures resumed trade with mild losses and have since been subdued, with participants now gearing up for the FOMC minutes (full Newsquawk preview available in the Research Suite) ahead of Friday’s US jobs report and several scheduled Fed speakers. In APAC, the ASX 200 (-0.3%) was pressured by its tech sector, although the upside in financials cushioned some losses. The Nikkei 225 (+0.1%) was kept afloat by the recent JPY weakness, whilst Sony Group rose some 4% after its chairman announced EV ambitions. The KOSPI (-1.2%) was dealt a blow as North Korea fired a projectile that appeared to be a ballistic missile, but this landed outside of Japan’s Exclusive Economic Zone (EEZ). The Hang Seng (-1.6%) saw its losses accelerate with the Hang Seng Tech Index tumbling over 4% as the sector tackled headwinds from Wall Street alongside domestic crackdowns. China Huarong Asset Management slumped over 50% as it resumed trade following a nine-month halt after its financial failure. The Shanghai Comp. (-1.0%) conformed to the mostly negative tone after again seeing a hefty liquidity drain by the PBoC. In the debt complex, the US T-note futures held a mild upside bias since the resumption of trade, and the US curve was somewhat steady. Participants also highlighted large short-covering heading into yesterday’s US close ahead of the FOMC minutes.

Top Asian News

- Asian Stocks Slide as Surging Yields Squeeze Technology Sector

- China’s Growth Forecast Cut by CICC Amid Covid Outbreaks

- BOJ Is Said to Discuss Changing Long-Held View on Price Risks

- Gold Holds Gain With Fed Rate Hikes and Treasury Yields in Focus

European equities (Stoxx 600 +0.1%) trade mixed in what has been a relatively quiet session thus far with the final readings of Eurozone services and composite PMIs providing little in the way of fresh impetus for prices. The handover from the APAC region was predominantly a soft one with Chinese bourses lagging once again with the Hang Seng Tech Index tumbling over 4% as the sector tackled headwinds from Wall Street alongside domestic crackdowns. Meanwhile, the Shanghai Comp. (-1%) conformed to the mostly negative tone after again seeing a hefty liquidity drain by the PBoC. Stateside, the ES and RTY are flat whilst the NQ lags once again after yesterday bearing the brunt of another sizeable treasury curve bear-steepener. In terms of house views, analysts at Barclays expect “2022 to be a more normal yet positive year for equities, looking for high single-digit upside and a broader leadership”. Barclays adds that it remains “pro-cyclical (Industrials, Autos, Leisure, reopening plays and Energy OW), and prefer Value to Growth”. Elsewhere, analysts at Citi stated that “monetary tightening may push up longer-dated nominal/real bond yields, threatening highly rated sectors such as IT or Luxury Goods. Alternatively, higher yields could help traditional value trades such as UK equities and Pan-European Financials”. Sectors in Europe are mostly higher, with auto names leading as Renault (+3.4%) sits at the top of the CAC, whilst Stellantis (+0.6%) has seen some support following the announcement that it is planning for a full battery-electric portfolio by 2028. Elsewhere, support has also been seen for Chemicals, Oil & Gas and Banking names with the latter continuing to be supported by the current favourable yield environment. To the downside, Food and Beverage is the clear laggard amid losses in Nestle (-2.6%) following a broker downgrade at Jefferies. Ocado (+5.5%) sits at the top of the Stoxx 600 after being upgraded to buy at Berenberg with analysts expecting the Co. to sign further deals with new and existing grocery e-commerce partners this year. Finally, Uniper (-2.4%) sits near the bottom of the Stoxx 600 after securing credit facilities totalling EUR 10bln from Fortum and KfW.

Top European News

- U.K. Weighs Dropping Covid Test Mandate for Arriving Travelers

- German Energy Giant Uniper Gets $11 Billion for Margin Calls

- European Gas Extends Rally as Russian Shipments Remain Curbed

- Italian Inflation Hits Highest in More Than a Decade on Energy

In FX, notwithstanding Tuesday’s somewhat mixed US manufacturing ISM survey and relatively hawkish remarks from Fed’s Kashkari, the week (and year) in terms of data and events really begins today with the release of ADP as a guide for NFP and minutes of the December FOMC that confirmed a faster pace of tapering and more hawkish dot plots. As such, it may not be surprising to see the Buck meandering broadly and index settling into a range inside yesterday’s parameters with less impetus from Treasuries that have flipped from a severe if not extreme bear-steepening incline. Looking at DXY price action in more detail, 96.337 marks the top and 96.053 the bottom at present, and from a purely technical perspective, 96.098 remains significant as a key Fib retracement level.

- JPY/EUR/AUD/GBP/NZD – All taking advantage of the aforementioned Greenback fade, and with the Yen more eager than others to claw back lost ground given recent underperformance. Hence, Usd/Jpy has retreated further from multi-year highs and through 116.00 to expose more downside potential irrespective of latest reports via newswire sources suggesting the BoJ is expected to slightly revise higher its inflation forecast for the next fiscal year and downgrade the GDP outlook for the year ending in March. Similarly, the Euro is having another look above 1.1300 even though EZ services and composite PMIs were mostly below consensus or preliminary readings and German new car registrations fell sharply, while the Aussie is retesting resistance around 0.7250 and its 50 DMA with some assistance from firm copper prices, Cable remains underpinned near 1.3550 and the 100 DMA and the Kiwi is holding mainly above 0.6800 in the face of stronger Aud/Nzd headwinds. Indeed, the cross is approaching 1.0650 in contrast to Eur/Gbp that is showing signs of changing course following several bounces off circa 0.8333 that equates to 1.2000 as a reciprocal.

- CHF/CAD – The Franc and Loonie appear a bit less eager to pounce on their US peer’s retrenchment, as the former pivots 0.9150 and latter straddles 1.2700 amidst a downturn in crude pre-Canadian building permits and new house prices.

- SCANDI/EM – Little sign of any fallout from a slowdown in Sweden’s services PMI as overall risk sentiment remains supportive for the Sek either side of 10.2600 vs the Eur, but the Nok is veering back down towards 10.0000 in line with slippage in Brent from Usd 80+/brl peaks reached on Tuesday. Elsewhere, the Zar is shrugging off a sub-50 SA PMI as Gold strengthens its grip on the Usd 1800/oz handle and the Cnh/Cny are still underpinned after another PBoC liquidity drain and firmer than previous midpoint fix on hopes that cash injections might be forthcoming through open market operations into the banking system from the second half of January to meet rising demand for cash, according to China’s Securities Journal. Conversely, the Try has not derived any real comfort from comments by Turkey’s Finance Minister underscoring its shift away from orthodox policies, or insistence that budget discipline will not be compromised.

In commodities, crude benchmarks are currently little changed but have been somewhat choppy within a range shy of USD 1/bbl in European hours, in-spite of limited fresh newsflow occurring. For reference, WTI and Brent reside within USD 77.26-76.53/bbl and USD 80.25-79.56/bbl parameters respectively. Updates for the complex so far include Cascade data reporting that gas flows via the Russian Yamal-Europe pipeline in an eastward direction have reduced. As a reminder, the pipeline drew scrutiny in the run up to the holiday period given reverse mode action, an undertaking the Kremlin described as ‘operational’ and due to a lack of requests being placed. Separately, last nights private inventories were a larger than expected draw, however, the internals all printed builds which surpassed expectations. Today’s EIA release is similar expected to show a headline draw and builds amongst the internals. Elsewhere, and more broadly, geopolitics remain in focus with Reuters sources reporting that a rocket attack has hit a military base in proximity to the Baghdad airport which hosts US forces. Moving to metals, spot gold and silver are once again fairly contained though the yellow metal retains the upside it derived around this point yesterday, hovering just below the USD 1820/oz mark.

US Event Calendar

- 7am: Dec. MBA Mortgage Applications -5.6%, prior -0.6%

- 8:15am: Dec. ADP Employment Change, est. 410,000, prior 534,000

- 9:45am: Dec. Markit US Composite PMI, prior 56.9

- 9:45am: Dec. Markit US Services PMI, est. 57.5, prior 57.5

- 2pm: Dec. FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

As you may have seen from my CoTD yesterday all I got for Xmas this year was Omicron, alongside my wife and two of our three kids (we didn’t test Bronte). On Xmas Day I was cooking a late Xmas dinner and I suddenly started to have a slightly lumpy throat and felt a bit tired. Given I’d had a couple of glasses of red wine I thought it might be a case of Bordeaux-2015. However a LFT and PCR test the next day confirmed Covid-19. I had a couple of days of being a bit tired, sneezing and being sniffly. After that I was 100% physically (outside a of bad back, knee and shoulder but I can’t blame that on covid) but am still sniffly today. I’m also still testing positive on a LFT even if I’m out of isolation which tells me testing to get out of isolation early only likely works if you’re completely asymptomatic. My wife was similar to me symptom wise. Maybe slightly worse but she gets flu badly when it arrives and this was nothing like that. The two kids had no real symptoms unless being extremely annoying is one. Indeed spending 10 days cooped up with them in very wet conditions (ie garden activity limited) was very challenging. Although I came out of isolation straight to my home office that was still a very welcome change of scenery yesterday.

The covid numbers are absolutely incredible and beyond my wildest imagination a month ago. Yesterday the UK reported c.219k new cases, France c.272k and the US 1.08 million. While these are alarming numbers it’s equally impressive that where the data is available, patients on mechanical ventilation have hardly budged and hospitalisations, while rising, are so far a decent level below precious peaks. Omicron has seen big enough case numbers now for long enough that even though we’ve had another big boost in cases these past few days, there’s nothing to suggest that the central thesis shouldn’t be anything other than a major decoupling between cases and fatalities. See the chart immediately below of global cases for the exponential recent rise but the still subdued levels of deaths. Clearly there is a lag but enough time has passed that suggests the decoupling will continue to be sizeable.

It seems the main problem over the next few weeks is the huge number of people self isolating as the variant rips through populations. This will massively burden health services and likely various other industries.

However hopefully this latest wave can accelerate the end game for the pandemic and move us towards endemicity faster. Famous last words perhaps but this variant is likely milder, is outcompeting all the others, and our defences are much, much better than they have been (vaccines, immunity, boosters, other therapeutic treatments). Indeed, President Biden directed his team to double the amount of Pfizer’s anti-covid pill Paxlovid they order; he called the pill a game changer. So a difficult few weeks ahead undoubtedly but hopefully light at the end of the tunnel for many countries. Prime Minister Boris Johnson noted yesterday that Britain can ride out the current Omicron wave without implementing any stricter measures, suggesting that learning to live with the virus is becoming the official policy stance in the UK. The head scratcher is what countries with zero-covid strategies will do faced with the current set up. If we’ve learnt anything from the last two years of covid it is that there is almost no way of avoiding it. Will a milder variant change such a stance?

Markets seem to have started the year with covid concerns on the back burner as day 2 of 2022 was a lighter version of the buoyant day 1 even if US equities dipped a little led by a big under-performance from the NASDAQ (-1.33%), as tech stocks got hit by higher discount rates with the long end continuing to sell off to start the year.

Elsewhere the Dow Jones (+0.59%) and Europe’s STOXX 600 (+0.82%) both climbed to new records, with cyclical sectors generally outperforming once again. Interestingly the STOXX Travel & Leisure index rose a further +3.11% yesterday, having already surpassed its pre-Omicron level.

As discussed the notable exception to yesterday’s rally were tech stocks, with a number of megacap tech stocks significantly underperforming amidst a continued rise in Treasury yields, and the rotation towards cyclical stocks as investors take the message we’ll be living with rather than attempting to defeat Covid. The weakness among that group meant that the FANG+ index fell -1.68% yesterday, with every one of the 10 companies in the index moving lower, and that weakness in turn meant that the S&P 500 (-0.06%) came slightly off its record high from the previous session. Showing the tech imbalance though was the fact that the equal weight S&P 500 was +0.82% and 335 of the index rose on the day. So it was a reflation day overall.

Staying with the theme, the significant rise in treasury yields we saw on Monday extended further yesterday, with the 10yr yield up another +1.9bps to 1.65%. That means the 10yr yield is up by +13.7bps over the last 2 sessions, marking its biggest increase over 2 consecutive sessions since last September. Those moves have also coincided with a notable steepening in the yield curve, which is good news if you value it as a recessionary indicator, with the 2s10s curve +11.3bps to +88.7bps over the last 2 sessions, again marking its biggest 2-day steepening since last September

Those moves higher for Treasury yields were entirely driven by a rise in real yields, with the 10yr real yield moving back above the -1% mark. Conversely, inflation breakevens fell back across the board, with the 10yr breakeven declining more than -7.0bps from an intraday peak of 2.67%, the highest level in more than six weeks, which tempered some of the increase in nominal yields. The decline in breakevens was aided by the release of the ISM manufacturing reading for December, since the prices paid reading fell to 68.2, some way beneath the 79.3 reading that the consensus had been expecting. In fact, that’s the biggest monthly drop in the prices paid measure in over a decade, and leaves it at its lowest level since November 2020. Otherwise, the headline reading did disappoint relative to the consensus at 58.7 (vs. 60.0 expected), but the employment component was above expectations at 54.2 (vs. 53.6 expected), which is its highest level in 8 months and some promising news ahead of this Friday’s jobs report.

Staying with US employment, the number of US job openings fell to 10.562m in November (vs. 11.079m expected), but the number of people quitting their job hit a record high of 4.5m. That pushed the quits rate back to its record of 3.0% and just shows that the labour market continues to remain very tight with employees struggling to hire the staff needed. This has been our favourite indicator of the labour market over the last few quarters and it continues to keep to the same trend.

Back to bonds and Europe saw a much more subdued movement in sovereign bond yields, although gilts were the exception as the 10yr yield surged +11.7bps as it caught up following the previous day’s public holiday in the UK. Elsewhere however, yields on bunds (-0.2bps), OATs (-1.1bps) and BTPs (+0.9bps) all saw fairly modest moves.

Also of interest ahead of tonight’s Fed minutes, there was a story from the Wall Street Journal late yesterday that said Fed officials are considering whether to reduce their bond holdings, and thus beginning QT, in short order. Last cycle, the Fed kept the size of its balance sheet flat for three years after the end of QE by reinvesting maturing proceeds before starting QT. This iteration of QE is set to end in March, so any move towards balance sheet rolloff would be a much quicker tightening than last cycle, which the article suggested was a real possibility. As this cycle has taught us time and again, it is moving much faster than historical precedent, so don’t rely on prior timelines. Balance sheet policy and the timing of any QT will be a major focus in tonight’s minutes, along with any signals for the timing of liftoff and path of subsequent rate hikes.

Overnight in Asia markets are trading mostly lower with the KOSPI (-1.45%), Hang Seng (-0.85%), Shanghai Composite (-0.81%) and CSI (-0.67%) dragged down largely by IT stocks while the Nikkei (+0.07%) is holding up better. In China, Tencent cut its stake in a Singapore based company yesterday by selling $ 4 billion worth shares amidst China’s regulatory crackdown with investors concerned they will do more. This has helped push the Hang Seng Tech Index towards its lowest close since its inception in July 2020 with Tencent and companies it invested in losing heavily. Moving on, Japan is bringing forward booster doses for the elderly while maintaining border controls in an effort to contain Omicron.

Futures are indicating a weaker start in DM markets with the S&P 500 (-0.25%) and DAX (-0.11%) both tracking their Asian peers.

Oil prices continued their ascent yesterday, with Brent Crude (+1.20%) hitting its highest level since the Omicron variant first emerged on the scene. Those moves came as the OPEC+ group agreed that they would go ahead with the increase in output in February of 400k barrels per day. And the strength we saw in commodities more broadly last year has also continued to persist into 2022, with copper prices (+1.12%) hitting a 2-month high, whilst soybean prices (+2.49%) hit a 4-month high.

Looking at yesterday’s other data, German unemployment fell by -23k in December (vs. -15k expected), leaving the level of unemployment at a post-pandemic low of 2.405m in December. Finally, the preliminary French CPI reading for December came in slightly beneath expectations on the EU-harmomised measure, at 3.4% (vs. 3.5% expected).

To the day ahead now, and data releases include the December services and composite PMIs from the Euro Area, Italy, France, Germany and the US. On top of that, there’s the ADP’s December report of private payrolls from the US, the preliminary December CPI report from Italy, and December’s consumer confidence reading from France. Separately from the Federal Reserve, we’ll get the minutes of the December FOMC meeting.