Apple Soars After Smashing Expectations In Record Revenue Quarter

Two days day after Microsoft barely avoided a collapse into the hawkish Powell abyss, and one day after Tesla reported earnings that sent its stock crashing, investors held on to hope that at least the world’s largest company and one of the very few gigacaps generals still standing, Apple, would somehow pull a rabbit out of its magic hat of tricks and report solid earnings pulling the Nasdaq out of what appears to be an almost certain bear market.

It won’t be easy: while the holiday quarter is always Apple’s largest, this time it’s also expected to be Apple’s largest in its history. On the Q4 earnings call, CEO Tim Cook said Q1 2022 revenue would top Q1 2021 revenue of $111.4 billion. So, at the very least, Apple needs to hit that mark to appease investors (any miss here and welcome Nasdaq bear market). But that may not be enough, since Wall Street consensus is even more aggressively, calling for Apple to report revenue of $119.05 billion, clearly an all-time record (Cook said in Q4 that Q1 earnings will have been even $6 billion stronger if not for the ongoing impact of the global chip shortage).

The bullish case is that if Apple beats Wall Street expectations on the iPhone, Services Mac, and Wearables/Home/Accessories, it would be reporting new all-time highs in terms of revenue for those categories. Surely that would be something Apple will tout heavily in its remarks. On the other hand, even the smallest weakness will be hammered by a market that so far has shown zero forgiveness now that the Fed is in hike it till you break it mode.

So with that in mind, was Apple able to save the Nasdaq from freefalling after hours and potentially starting the next bear market?

It appears that – at least at first glance – the answer is a resounding yes as Apple has done it again, and after reporting not only a record quarter that was up 11% Y/Y, but also a big beat on the top and bottom line, its stock is rising sharply after hours and pulling the Nasdaq along with it.

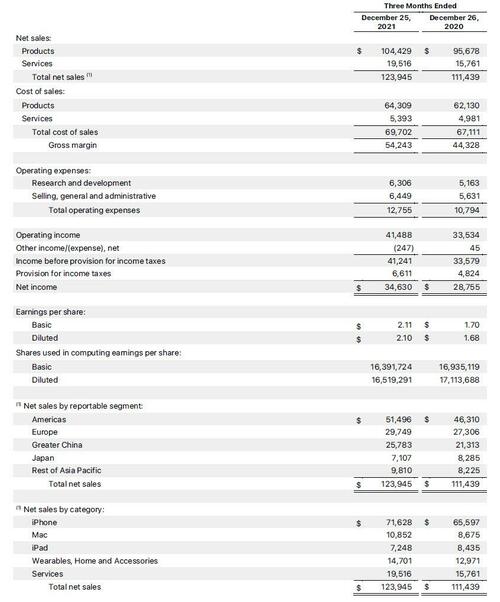

Here are the details from the just concluded holiday quarter:

- Revenue $123.95 billion, beating estimates of $119.05 billion, and up +11% y/y

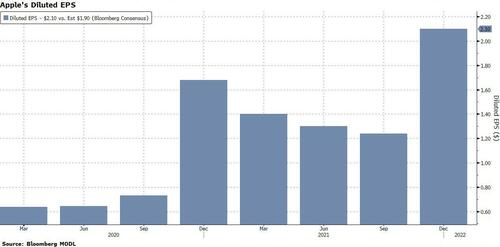

- EPS $2.10 beating estimates $1.90, and up from $1.68.

Some more headlines:

- IPhone revenue $71.63 billion, +9.2% y/y, and beating estimates $67.74 billion

- Mac revenue $10.85 billion, +25% y/y, and beating estimate $9.53 billion

- IPad revenue $7.25 billion, -14% y/y, and missing estimate $8.11 billion

- Wearables, home and accessories $14.70 billion, +13% y/y, beating estimate $14.16 billion

- Service revenue $19.52 billion, +24% y/y, estimate $18.64 billion

- Greater China rev. $25.78 billion, +21% y/y

- Gross margin $54.24 billion, +22% y/y

Earnings snapshot:

Commenting on the quarter, CFO Luca Maestri said that “the very strong customer response to our recent launch of new products and services drove double-digit growth in revenue and earnings, and helped set an all-time high for our installed base of active devices,” said Luca Maestri, Apple’s CFO.

Maestri also said that the company was returning even more cash to shareholders: “These record operating results allowed us to return nearly $27 billion to our shareholders during the quarter, as we maintain our target of reaching a net cash neutral position over time.” This is up from $24 billion last quarter.

Tim Cook was just as happy: “This quarter’s record results were made possible by our most innovative lineup of products and services ever. We are gratified to see the response from customers around the world at a time when staying connected has never been more important. We are doing all we can to help build a better world — making progress toward our goal of becoming carbon neutral across our supply chain and products by 2030, and pushing forward with our work in education and racial equity and justice.”

The stock initially couldn’t believe just how good the results were but has since regrouped and is surging higher, up over 4% in after hours trading and helping boost the Nasdaq.

Developing

Tyler Durden

Thu, 01/27/2022 – 16:44

via ZeroHedge News https://ift.tt/3rQ1Hms Tyler Durden