After a rollercoaster overnight session, which saw S&P futures tumble as much as 2%, dropping as low as 4,260 following Powell’s hawkish comments, futures have recovered and briefly traded in the green while European stocks are still red though trading near session highs as traders spooked by the Fed’s comments started digging for bargains. At 7:20am ET (incredibly illiquid) emini S&P futures were flat at 4,341, Dow futures were up 0.1% or 36 points and Nasdaq futures swung the most and after dropping as much as 2.2% turned green some 0.5% higher or 75 points after Bill Ackman revealed late on Wednesday he had purchased 3.1 million Netflix shares.

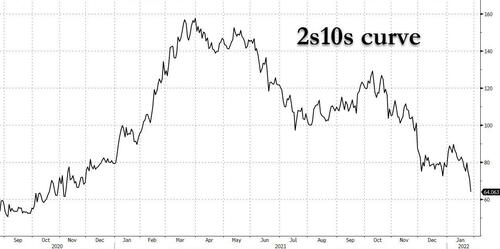

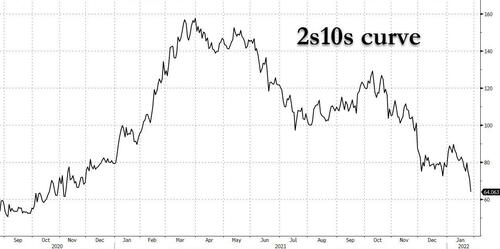

The yield curve shrank to the flattest since 2020 after the meeting. Two-year Treasuries extended declines, though longer-dated ones rebounded. The dollar extended gains. Oil fluctuated as calm reigned for crypto. Expectations of Fed tightening sent the policy-sensitive U.S. two-year yield to 1.208%, levels last reached in February 2020. The benchmark 10-year yield slipped slightly to 1.835% having hit a high of 1.88% on Wednesday. The spread between the 10 and two-year bond yields fell to its narrowest since late 2020 as investors priced in a faster pace of rate rises in the medium-term. This in turn helped the dollar to its highest since June 2020 and sent the euro to its lowest in 19-months. The single currency dropped 0.5% to $1.1182 .

In U.S. premarket trading, Tesla fell after signaling supply chain troubles, while Intel slid as it warned on profit margins. Qualtrics International on the other hand, jumped after posting a better-than-expected revenue forecast. Netflix gained as much as 4.8% after hedge fund founder Bill Ackman said he has acquired more than 3.1 million shares in the online video streaming giant. Meanwhile, Teradyne plunged 18% in premarket after the chip-testing firm’s first-quarter earnings forecast fell short of estimates due to to supply constraints and a drop in demand stemming from a slow transition at one of its customers. Other notable premarket movers:

- DouYu (DOYU US) shares jump 10% in U.S. premarket trading after Reuters reports that Tencent plans to take the live game streaming company private, citing people with knowledge of the matter.

- Teradyne (TER US) shares plunge 18% in U.S. premarket trading after the chip-testing firm’s 1Q earnings forecast fell short of estimates due to to supply constraints and a drop in demand stemming from a slow transition at one of its customers.

- Levi Strauss (LEVI US) shares surge 8.3% in premarket trading after the jeans maker gave an outlook for full-year net revenue that exceeded estimates. Analysts say momentum appears to have carried through to the start of 2022.

- Qualtrics (XM US) shares gain 11% in U.S. premarket trading after the software company gave a revenue forecast for 1Q that beat estimates. Analysts were positive on the company’s organic billings growth and said guidance is strong.

U.S. stocks have swung violently this week as investors worried about the fallout from an increasingly hawkish Federal Reserve on a broader economic recovery and company earnings. Overvalued technology-related stocks have been hit particularly hard since higher interest rates mean a bigger discount for the present value of their future profits, hurting growth stocks with the highest valuations and boosting cheap or so-called value shares.

“The hawkish tone last night from the Fed has led to a renewed rotation into value names but given the magnitude of some of the moves we have now seen in growth stocks year-to-date, we believe the opportunity set is again getting more exciting for growth investors,” said Marcus Morris-Eyton, portfolio manager at Allianz Global Investors. “We expect the market to gradually return to fundamentals now the Fed meeting has passed, and the earnings season moves into full swing.”

Investors expect the speed at which the Fed tightens policy to be the major determinant of risk sentiment in the coming months, although the U.S. central bank has said how quickly it hikes will depend on economic data and especially inflation.

“Powell (is) not committing to the size or the frequency of rate hikes and also the timing of the balance sheet reduction. I think that buys him a bit of wiggle room as to how quickly and with what velocity he wants to normalise monetary policy in the U.S.” said David Chao, global market strategist, Asia Pacific (ex-Japan) at Invesco.

European equities slump at the open but most indexes gradually fade losses. Euro Stoxx 50 is only down 0.6%, having traded off as much as 1.8%. Spain’s IBEX outperforms, turning an initial 1.5% drop into a gain of as much as 0.8%. Banks and autos are the best performers.

Weeks of fretting over the Fed’s plan to combat inflation with higher interest rates is coming to fruition as Asian stock markets tumble into bear markets and technical corrections: Bear Markets Show Pain Across AsiaEquities as Fed Hikes Near; China Stocks Enter Bear Market as Yuan Tumbles Most in 7 Months. Bonds tumbled across Asia after Fed Chair Jerome Powell’s latest hawkish pivot, with Australian and New Zealand benchmark yields spiking to fresh highs: Fed Fallout Sends Sovereign Yields Soaring to Highs Across Asia

China high-yield dollar bonds fell 1-3 cents on the dollar , according to credit traders, after the market notched its longest winning streak since July: China Junk Dollar Bonds Set for First Drop in More Than a Week. Chinese authorities are considering a proposal to dismantle China Evergrande Group by selling the bulk of its assets: China Weighs Dismantling Evergrande to Contain Debt Crisis. The People’s Bank of China’s newfound autonomy may prove to be an unlikely source of support for the recovery: China Rushes to Deliver Stimulus as Fed Pulls Back in New Era.

Investors globally have dumped riskier assets in 2022 and sought safety as they brace for the end of nearly two years of exceptionally cheap and plentiful cash.

“What cheap money has done is provide a safety blanket from bad news,” said Jane Foley, an analyst at Rabobank. “But as this comfort blanket is pulled away, investors will be more exposed and I suspect this will create a more volatile environment for asset prices.”

In rates, after extending post-FOMC drop late Wednesday, Treasuries began clawing their way back during Asia session and European morning led by long-end tenors, further flattening the curve. Ten-year Treasury yields slipped three basis points to 1.83% after surging to near a two-year high in the previous session, while the 2-year yield rose by 4bps to 1.19%. Yields are richer by ~5bp across 30-year sector, flattening 5s30s spread by ~3bp to tightest since March 2020; 2s10s spread is flatter by ~6bp and lowest since November 2020; the 10-year yield ~1.83% has retraced about half Wednesday’s surge to 1.876%. The ED market has boosted rate hike expectations to nearly 5 by December.

Treasury auction cycle concludes with $53b 7-year note sale at 1pm ET, following strong demand for 2- and 5-year sales earlier this week. Fed- dated OIS price in ~30bp of rate hikes for March meeting and 117bp by December after Wednesday’s post-FOMC front-end selloff. The hawkish central-bank pricing spills over into Europe: ECB-dated OIS briefly factor in a 20bps move and BOE OIS ~120bps of tightening by year end. Bunds and gilts drop, curves bear-flattening playing catch up to USTs, which bull-flatten away from their post-FOMC extremes. FOMC-dated OIS rates briefly factor in a full five hikes this year. Peripheral spreads tighten, short-end Italy and Spain outperform.

In FX, Bloomberg dollar spot trades close to session highs, adding 0.3%. The Bloomberg Dollar Spot Index rose for a fourth consecutive day as the greenback strengthened against all of its Group-of-10 peers. Hedging costs in major currencies remain relatively low, even as realized steepens and key risk events are captured by the front- end. The euro fell below $1.12 for the first time since November as traders increase bets on higher borrowing costs, with money markets now expecting five Federal Reserve interest-rate increases this year. Bunds extended a decline, sending the German 10-year yield to a one-week high as money markets bet on a faster pace of ECB policy tightening. The Canadian dollar and Norwegian krone held up best against the greenback as oil prices consolidated near a seven-year high and the pound was also among the better-performing G-10 currencies as markets rushed to price in another four interest-rate rises from the Bank of England. Other risk sensitive currencies, led by the New Zealand dollar, were the worst performers. Government bonds dropped in Australia and New Zealand, while the Australian dollar fell to a seven-week low and the New Zealand dollar slid for a sixth consecutive day to touch $0.6596, the lowest since November 2020. New Zealand’s debt auctions drew strong demand even after local data showed inflation quickened to the highest in more than three decades.

In commodities, crude futures drift back into the green. WTI adds 0.2%, rising back above $87; Brent reclaims $90. U.S. officials say they are in talks with major energy-producing countries and companies worldwide over a possible diversion of supplies to Europe if Russia invades Ukraine, although the White House said it faces challenges finding alternative sources of energy supplies. Spot gold trades off worst levels after finding support near $1,810/oz. Most base metals are in the green with LME tin up over 1%. Crypto markets declined amid broad weakness in risk assets during APAC hours; in-fitting with broader performance, crypto has staged a modest recovery during the European session. Bitcoin was last trading at $36,500.

Looking at the day ahead now, data releases include the US GDP reading for Q4, along with the weekly initial jobless claims, December’s pending home sales, durable goods orders, core capital goods orders, and January’s Kansas City Fed manufacturing index. Central bank speakers include the ECB’s Scicluna, whilst earnings releases include Apple, Visa, Mastercard, Comcast, Danaher and McDonald’s.

Market Snapshot

- S&P 500 futures up 0.2% to 4,351.25

- STOXX Europe 600 down 0.4% to 465.34

- MXAP down 2.4% to 182.01

- MXAPJ down 2.1% to 598.93

- Nikkei down 3.1% to 26,170.30

- Topix down 2.6% to 1,842.44

- Hang Seng Index down 2.0% to 23,807.00

- Shanghai Composite down 1.8% to 3,394.25

- Sensex down 1.2% to 57,180.21

- Australia S&P/ASX 200 down 1.8% to 6,838.28

- Kospi down 3.5% to 2,614.49

- German 10Y yield little changed at -0.03%

- Euro down 0.4% to $1.1198

- Brent Futures down 0.3% to $89.72/bbl

- Gold spot down 0.3% to $1,814.46

- U.S. Dollar Index up 0.35% to 96.81

Top Overnight News from Bloomberg

- Spain’s labor market continued to improve in the fourth quarter, with the unemployment rate falling to the lowest since 2008, according to figures released by the nation’s statistics office, INE

- Norway’s $1.3 trillion sovereign wealth fund, the world’s biggest, returned 14.5% in 2021, equivalent to about $176 billion, after stocks rose.

- Turkey’s central bank raised its inflation projections after a collapse in the currency pushed consumer price growth to its highest in President Recep Tayyip Erdogan’s 19-year rule

A more detailed look at global markets courtesy of Newsquawk

In Asia, APAC markets sold off with risk appetite hit as the region digested the hawkish FOMC meeting. Nikkei 225 (-3.1%) suffered losses of more than 3% and with the index down more than 10% from January highs. KOSPI (-3.5%) was mired by another North Korean launch and with Samsung Electronics dwindling post- earnings. Hang Seng (-1.9%) and declined amid a slowdown in Chinese Industrial Profits andShanghai Comp. (-1.7%) with the CSI 300 Index slipping into bear market territory after falling 20% from its February 2021 peak, while developers are hit including Evergrande as investors will have to wait six months for an initial restructuring plan.

Top Asian News

- China Fintech PingPong Is Said to Weigh $1 Billion Hong Kong IPO

- Tencent Plans to Take U.S.-Listed DouYu Private: Reuters

- China Stocks Enter Bear Market as Yuan Tumbles Most in 7 Months

- Japan’s 10-Year Bond Yield Closes at Highest Level Since 2018

In Europe, major bourses in Europe are nursing the post-Fed pressure with the complex now mixed, Stoxx 600 -0.1%. In Europe, with lagging post-Intel (-3.1% pre-market) in-spite of strong numbers givensectors are mixed Tech soft guidance, with European comparables pressured post respective earnings this morning. While Financials outperform post-Fed.

Top European News

- Deutsche Bank Plans to Boost Dividend After Three-Year Drought

- Dutch Government Said to Resume Sale of Majority ABN Amro Stake

- European Gas Fluctuates With Ukraine Tensions and Mild Weather

- U.S., Other ‘Populist’ Nations Mishandled Pandemic, Study Says

In FX, hawkish Fed Powell overshadows official FOMC policy message to give a fresh boost.Greenback Franc, and underperform as Fed gets set to widen the gap between policy stances of SNB, BoJ andYen Euro ECB. Kiwi fails to benefit much from hot NZ CPI and Aussie via a poll predicting RBA tightening in November amidst the Buck’s latest bill run. Rand stands firm awaiting a SARB hike and regains some poise on technical grounds rather than anyRouble real improvement in Russian relations with the US or western nations. CBRT Minutes: the policy stance will be set taking into account the source/permanence of risks, expects the disinflation process to start on the back of measures taken. Will develop tools to support the increase of TRY assets.

In commodities, crude benchmarks have trimmed post-Fed downside in tandem with the equity recovery, as focus remains as Russia receives the US’ written response.very much on geopolitics WTI and have recaptured USD 87.00/bbl and USD 90.00/bbl respectively, and are now holding nearBrent session highs. Spot gold lies near the post-Fed trough and as such the 200- & 50-DMAs are back in view at USD 1805/oz and USD 1803/oz respectively. China Gold Association said 2021 gold consumption increased 36.5% Y/Y to 1,220.9 tons and gold output rose 10.0% Y/Y to 329.0 tons, according to Bloomberg

US Event Calendar

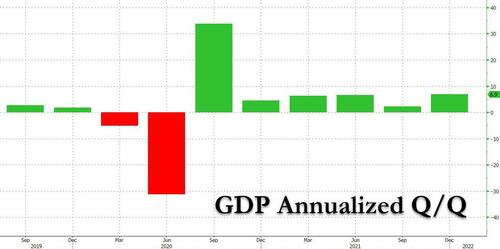

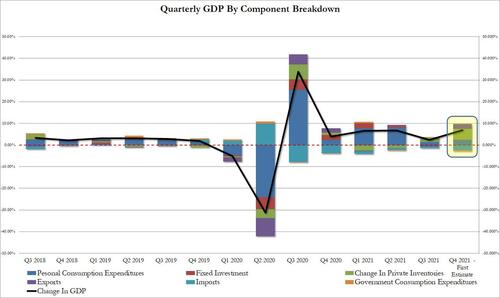

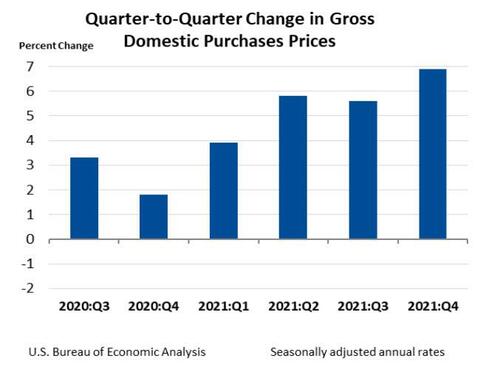

- 8:30am: 4Q GDP Annualized QoQ, est. 5.5%, prior 2.3%

- 8:30am: 4Q GDP Price Index, est. 6.0%, prior 6.0%

- 8:30am: 4Q Personal Consumption, est. 3.4%, prior 2.0%

- 8:30am: 4Q PCE Core QoQ, est. 4.9%, prior 4.6%

- 8:30am: Dec. Durable Goods Orders, est. -0.6%, prior 2.6%

- 8:30am: Dec. -Less Transportation, est. 0.3%, prior 0.9%

- 8:30am: Dec. Cap Goods Ship Nondef Ex Air, est. 0.5%, prior 0.3%

- 8:30am: Dec. Cap Goods Orders Nondef Ex Air, est. 0.4%, prior 0%

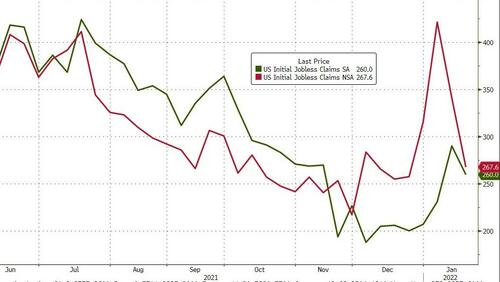

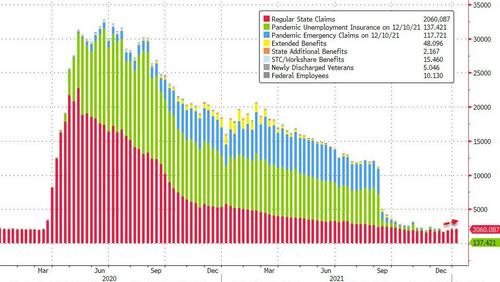

- 8:30am: Jan. Initial Jobless Claims, est. 265,000, prior 286,000

- 8:30am: Jan. Continuing Claims, est. 1.65m, prior 1.64m

- 10am: Dec. Pending Home Sales YoY, est. -4.0%, prior 0.2%; MoM est. -0.4%, prior -2.2%

- 11am: Jan. Kansas City Fed Manf. Activity, est. 20, prior 24

DB’s Jim Reid concludes the overnight wrap

I will be doing a Zoom webinar tomorrow at 14:00 London time on my latest chartbook, called “The Road to the next recession”. The link to register to get details of the webinar is here and the link to the chartbook is here.

The chart book also reiterates two big themes we’ve been discussing over the last year. Firstly that the Fed is hugely behind the curve and secondly that this is a totally different cycle to the last one and therefore the trends, especially on inflation, should be totally different. These themes came to a head last night after a hawkish Powell press conference that saw a major negative turnaround in equities and rates.

Upon the statement release, yields were little changed and the NASDAQ rallied around +1.0% bringing it +3.38% higher on the day, as some equity investors were enthused that asset sales appeared to be off the table. However the rhetoric towards tighter rate policy during the press conference undid equity gains immediately. The fact that the NASDAQ then dipped into negative territory before closing just +0.02% higher told the story of the presser. The NASDAQ had a 4.36% intraday range, compared with a 2.75% range Tuesday and a 5.96% range Monday. The S&P 500 closed -0.15% lower, erasing a +2.2% gain, led by real estate (-1.66%), materials (-1.02%), and industrials (-0.82%). The VIX increased for the seventh straight day for the first time since October 2020, climbing +0.8pts to 31.96, its highest level since January 2021.

Treasury yields sold off across the curve, with most of the price action taking place during the press conference: 2yr, 5yr, and 10yr yields increased +13.3bps, +13.0bps, and +9.5bps, respectively. With 2yrs seeing the biggest sell-off since the whipsaw market of March 2020. Real yields did most of the work, with real 5yr and 10yr yields increasing +14.7bps and +10.4bps, respectively. As big as the move in real yields was, there were bigger one-day increases earlier this month, which does a lot to explain how the market has evolved this year. When all was said and done, the market prices a +117% chance of a 25bp March rate hike, so a meaningful probability of a 50bp move, and 4.6 25bp hikes through 2022. In Asia 2-year US Treasury yields are +3.3bps higher with 10yr notes dipping around -1.4bps meaning a notable flattening of the yield curve to c.+65.7bp. See the first few pages of the chartbook for how the historical playbook would suggest inversion by early next year.

So what did the FOMC actually say? Well they did leave policy unchanged as expected, while the statement signalled it would soon be appropriate to raise the federal funds rate, in line with market expectations. The FOMC also released principles for reducing the balance sheet, which were more or less identical to the last round of QT. That is, the Fed will gradually decrease the size of its balance sheet by letting securities mature uninvested, not through sales, in line with our house view.

The press conference proved much more interesting though. Our US econ team has their full review here, where they have added a hike for 2022, with the base case now five. The biggest takeaway was the Chair’s emphasis that this cycle was different from the last round of tightening, in that inflation is well-above target, the labour market is historically tight, and growth projections remain above long-run potential. While the Chair demurred when asked what that specially meant for parameters of monetary policy, he did not rule out a faster pace of rate hikes or larger increments, adding that the Fed had plenty of room to tighten given the state of the labour market. This was the catalyst that sent shorter-dated yields higher, driven by real yields, as markets priced in a higher probability of an earlier and steeper policy path. Underscoring the shift towards tighter policy, he noted the Committee still viewed the balance of risk tilted towards higher inflation, and that the inflation picture had probably gotten worse since the Committee last submitted projections for the dot plot, which only contained three hikes this year. Presumably more hikes will be incorporated in the March dots.

Speaking of March, the Chair confirmed liftoff was likely to take place at the March FOMC, flagging the risks that would prevent that from happening including a worse-than-expected impact from Omicron (which he noted should not be persistent), and intimated geopolitical risks could pose an issue. So March, and every subsequent meeting should be treated as live with a 50bp hike at some point an increasing possibility.

On balance sheet policy, the Chair noted no decisions were made, and that conversations would continue at upcoming meetings (plural), implicitly matching our US econ team’s timeline that QT will begin after multiple rate hikes. He re-emphasized the message laid out in the balance sheet principles document that the Fed will set caps and let securities mature at a predictable pace, adjusting parameters as needed, but the Committee would rely on rate policy to control monetary policy.

Away from the Fed, one of yesterday’s biggest headlines was another surge in oil prices, with Brent crude finishing a shade below $90/bbl in trading for the first time since 2014. That came as the benchmark rose +1.77% in yesterday’s session, whilst WTI was also up +2.04% to its own post-2014 high of $87.35/bbl. In addition to hopes of a return to more normal levels of mobility this year following the pandemic, growing geopolitical tensions have also supported prices lately, not least given Russia is one of the world’s biggest exporters of oil. Bear in mind it was only back in October that Brent crude closed above $80/bbl for the first time since 2018, which in turn led to growing questions that we could be heading back into a period of 1970s-style stagflation. So the $90/bbl milestone won’t be welcomed by central banks looking to get inflation back to target, nor by politicians who face growing public concern about rising petrol prices and the cost of living. This time last year it was around $55 so its going to be tough for YoY CPI around the world to normalise very quickly.

European equities rallied sharply ahead of the Fed, with the STOXX 600 (+1.68%) seeing its strongest performance of 2022 so far as the more cyclical sectors and energy led the advance. The risk-on tone meant that sovereign bonds lost ground too, with yields on 10yr bunds (+0.6bps), OATs (+0.5bps) and BTPs (+3.8bps) all rising on the day. Interestingly, the latest movements also saw another widening in peripheral spreads, with the gap between Italian and German 10yr yields widening to 140.2bps, which is their biggest gap in over a year.

Staying with fixed income, credit continues to hold in ok relative to the year’s equity moves. We did a big note yesterday looking at how in the US the relative concentrations of the S&P 500 and US IG credit indices are at extremes (link here). Indeed the top 6 equity names make up 23.4% of the index. The same names make up 2.6% of the US IG index. Indeed JPM and BoA alone make up around 4.1% so if tech leads any US sell-off, credit will be relatively (if not absolutely) insulated. The note also has all the equivalent European numbers. We covered it also in my CoTD where we showed that the last time the US equity market was this concentrated was during the hubris of the “nifty fifty” bluechip valuation bubble of the late 1960s/early 1970s. Please email jim-reid.thematicresearch@db.com if you want to be added to the CoTD.

Tesla was the latest mega-cap to report earnings, beating analyst revenue and earnings expectations, and reporting annual profits two-years running for the first time in the company’s history. The shares initially dropped -6.45% in after-hours trading on fears that production would remain constrained by continued supply chain issues in 2022, but share prices gradually rebounded traded around +0.3% in extended after-hours.

Asian stock markets are sharply lower this morning post the Fed. The losses are being led by the Kospi (-3.14%) as the index heavyweight Samsung electronics (-2.46%) Q4 operating profit (13.87 trillion won) fell short of average analyst estimates (14.85 trillion won). Further, reports of North Korea firing an “unidentified projectile” in the early hours have also weighed. Separately, the Nikkei (-3.02%) and Hang Seng (-2.57%) are lower. Elsewhere, the Shanghai Composite (-0.88%) and CSI (-0.99%) are going the same way after profits at China’s industrial firms grew at a slower pace in December (+4.2% y/y) from +9.0% in November.

Looking forward, equity futures in the DM world are indicating a weak start with the contracts on the S&P 500 (-1.47%) and DAX (-2.47%) trading lower again.

Staying with Asia, Michael Spencer will today host a Zoom webinar on the Economic Outlook for the region in 2022. The call is at 08:30 EST / 13:30 UK Time / 21:30 Hong Kong Time. Please Register Here to get the joining details.

For those wanting something to listen to, DB Research have released their latest podcast (link here) on Industrials, a sector often said to be an economic bellwether, featuring lead analyst for US multi-industry and machinery research, Nicole DeBlase and Luke Templeman from my team. They discuss how the sector will fair this year as the Fed begins to raise interest rates, as well as how companies are dealing with the rampant input cost inflation they are experiencing. They also discuss how infrastructure bills can influence the sector.

On the Ukraine front, the buzz of headlines continues. Yesterday, the US embassy in Kyiv encouraged its citizens to leave the country, while the State Department responded to Russia’s security demands through a written statement that was not made available to the public, but apparently set out a serious diplomatic path forward.

The other central bank decision yesterday came from the Bank of Canada, who kept rates on hold at 0.25%. That said, they signalled that rate hikes could soon begin, with their statement saying that the Governing Council thought that “overall slack in the economy is absorbed”, and thus they ended their commitment to keeping policy rates at the effective lower bound, saying that they expect “interest rates will need to increase.” Investors are pricing a decent chance of that happening at the next meeting in March, with overnight index swaps pointing to a 94% probability of a hike.

There wasn’t much data of note yesterday, though US new home sales rose to an annualised rate of 811k in December (vs. 760k expected), which is their highest level in 9 months.

To the day ahead now, and data releases include the US GDP reading for Q4, along with the weekly initial jobless claims, December’s pending home sales, durable goods orders, core capital goods orders, and January’s Kansas City Fed manufacturing index. Central bank speakers include the ECB’s Scicluna, whilst earnings releases include Apple, Visa, Mastercard, Comcast, Danaher and McDonald’s.