1/27/1955: Chief Justice John Roberts’s birthday.

The post Today in Supreme Court History: January 27, 1955 appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/3rTEOP5

via IFTTT

another site

1/27/1955: Chief Justice John Roberts’s birthday.

The post Today in Supreme Court History: January 27, 1955 appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/3rTEOP5

via IFTTT

1/27/1955: Chief Justice John Roberts’s birthday.

The post Today in Supreme Court History: January 27, 1955 appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/3rTEOP5

via IFTTT

Wall Street Banks Award Billions More In Bonuses To Top Earners

Regular Americans struggling to make ends meet as inflationary pressures drive prices higher on everything from fast food to cars to rent are seeing wages rising thanks to a labor crunch that we have discussed in more detail here. Unfortunately for many, rising wages still aren’t enough.

But bankers aren’t having that problem. From Wall Street to Europe and beyond, bankers have been lavished with massive bonuses following the dealmaking bonanza of the last two years. And over the last day or so, we have seen a flurry of headlines in the financial press touting new bonus packages at BofA, Deutsche Bank and Goldman.

Bloomberg reported yesterday that Bank of America had decided to take a $1 billion pool of company shares and use it to distribute bonuses to nearly all of the bank’s employees. 97% of the bank’s workforce is eligible:

The incentive, to come on top of regular compensation, goes to staff who earn as much as $500,000 a year, according to a memo from Chief Executive Officer Brian Moynihan. About 97% of the global workforce is eligible. This is the fifth year the firm has paid the compensation awards, which now total $3.3 billion, spokesman John Yiannacopoulos said.

“Our Sharing Success awards are one of many ways we invest in our teammates,” Moynihan wrote.

Each eligible employee will receive between 65 and 600 restricted stock units, based on compensation, according to the memo. Employees will be awarded the full value in March, and shares will vest in equal payments over four years starting in 2023. CNN previously reported the stock payment.

Meanwhile, a separate BBG report claimed Deutsche Bank was weighing a 15% hike in bonus payments as a “global talent war” continues. Unlike BofA, which is trying to spread the wealth across the bank’s vast workforce, DB’s boosted bonuses will likely be reserved for front-office investment bank staff. Those stuck in the back office might even see their pay drop.

DB’s generous bonuses are coming amid a a broader turnaround that has produced some of the bank’s first profitable quarters in years. However, it wasn’t that long ago that the ECB chided the bank to keep bonuses in check.

High bonuses for the investment bank, led by Mark Fedorcik, come as the division generated a pretax profit of 3.4 billion euros ($3.8 billion) in the first nine months of 2021 — almost double the amount achieved by the lender’s three other operating divisions combined. The unit is likely to continue playing an outsized role for Chief Executive Officer Christian Sewing even as trading activity is set to recede.

Sewing has said he wants to pay top performers “competitively” amid demand for investment banking talent that Fedorcik recently described in a Bloomberg interview as “the highest I’ve ever seen.”

That competition has led Wall Street rivals including Goldman Sachs Group Inc. and JPMorgan Chase & Co. to ratchet up bonuses and incur some of the highest expenses in years.

Goldman’s latest wave of bonuses will accrue to an even more rarefied group of bankers. BBG said that the Vampire Squid is preparing to reward 30 of its most senior leaders with generous equity packages designed to lock them in at the bank with vesting schedules and performance targets. Despite the relative perofrmance of its shares in recent months, GS has been doling out bonuses at the most generous pace in a decade.

It’s all about stemming “defections”.

The new equity awards will be doled out to members of Goldman’s management committee, its top decision-making body, according to people with knowledge of the plan. The packages are designed to cajole executives to stick around longer by putting them in line to unlock millions of dollars if the bank stock hits certain targets, the people said.

A spokesman for Goldman Sachs declined to comment on the new rewards. The new grants would be offered in place of the one-time, guaranteed stock award that’s been presented to other partners, one of the people said. It would be structured similar to the incentive awards announced in October for Chief Executive Officer David Solomon and his deputy, John Waldron, who aren’t included in this latest round of grants.

The measures are one way for the firm to try and stem defections from its leadership as Goldman mines record profits from its core Wall Street operations. But rising compensation costs are starting to give shareholders pause. Since the company posted annual results early this week, the stock has dropped almost 9%, with investors focused on a 33% jump in personnel expenses.

While Wall Street bankers enjoy the spoils of the M&A boom, employees at the world’s retail banks must settle for whatever overtime they can get. Although, in Ireland, a union of retail bankers has decided that it wants more from management. Instead of having to constantly squabble for raises, the Irish bankers are pushing for a deal that would grant them “inflation-proof” pay packages for the foreseeable future.

Union President John O’Connell said in a statement that this would be an appropriate reward following retail bankers’ courageous work during the pandemic.

Tyler Durden

Thu, 01/27/2022 – 07:00

via ZeroHedge News https://ift.tt/3u55Upa Tyler Durden

Can You Sidestep The U.S. Stock Collapse By Abandoning The Dollar And Looking Overseas

Submitted by QTR’s Fringe Finance

I’ve been guiding my personal investing over the last few months by whether or not I think the U.S. is entering a longer term market wreck or another 3 month bump in the road like we saw in early 2020.

After all, if we are at a spot where we can shake it off and “buy the dip” were to work again, why wouldn’t you be keen to adopt the strategy of “if you can’t beat the lobotomized automaton active manager buying the dip, join ‘em.”

But my readers already know that I don’t feel this way. In fact, I believe the Fed to be in a true catch 22 – stuck between not being able to raise rates, which would very likely crash markets further, and the inability to maintain accommodative monetary policy, which could fan the flames of inflation (or at least appear to fan the flames of inflation from a psychological and political spin perspective).

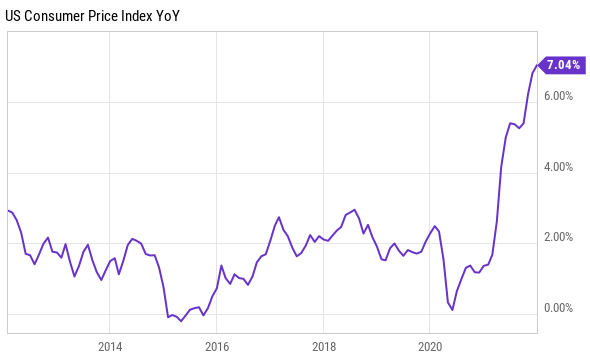

You see, the inflation is the key here. In years past, the Fed never had to face the consequences of its QE. In fact, it was able to parade around suggesting QE was this perfect mechanism for getting the markets to do whatever the Central Banks wanted specifically because it didn’t cause any inflation.

Well now, the inflation has showed up and the Fed’s gravy train is officially over.

As a result, while U.S. markets continue to be brutally volatile, swinging from getting absolutely spanked to ripping 5% higher for no reason, I have dabbled in a couple U.S. names – namely value stocks and a couple of tech stocks that I think have gotten far too cheap.

But I’m also starting to look outside the U.S. – and why wouldn’t you? Overseas and emerging markets are worlds cheaper than U.S. markets and, if you think the dollar’s dominance is at risk, foreign currencies (and the businesses who transact in foreign currencies) are where you want to be. How am I doing this?

I’ve recently been starting to accumulate exposure to the the iShares MSCI Hong Kong ETF (EWH) and the iShares MSCI Japan ETF (EWJ). I had already owned the iShares MSCI Emerging Markets ETF (EEM) and will likely continue to add.

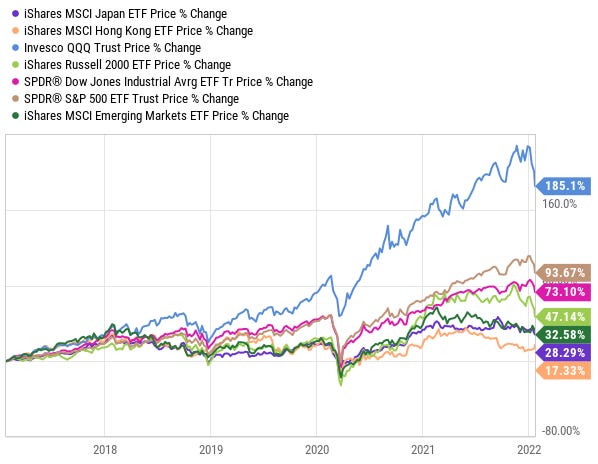

All three have underperformed U.S. index ETFs wildly over the last 5 years. While the NASDAQ ETF is up 185.1%, the S&P ETF is up 93.7% and the Dow Jones ETF is up 73.1%, emerging markets have only risen 32.6%, while the Hong Kong and Japan ETFs have only risen 17.3% and 28.3%, respectively.

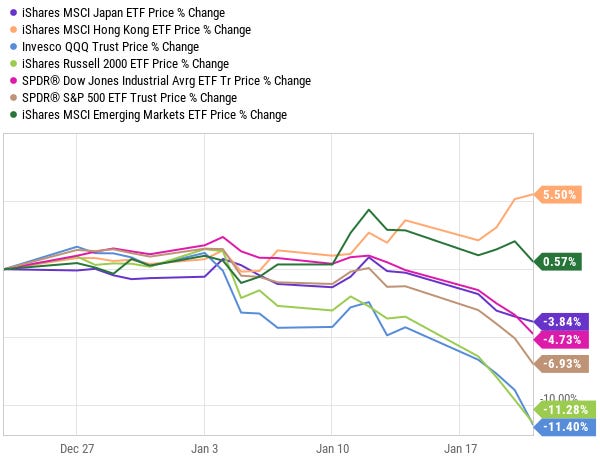

But…all three have also sidestepped the carnage in the U.S. to a degree over the last month, as one-time growth investors start to look for exactly the type of value and dollar safe haven these ETFs provide.

While the same U.S. ETFs crashed as much as 11% over the last month, geographical ETFs like the EWH were up 5.5%. The EEM returned 0.57% in the last month, outperforming the NASDAQ ETF by almost 12%.

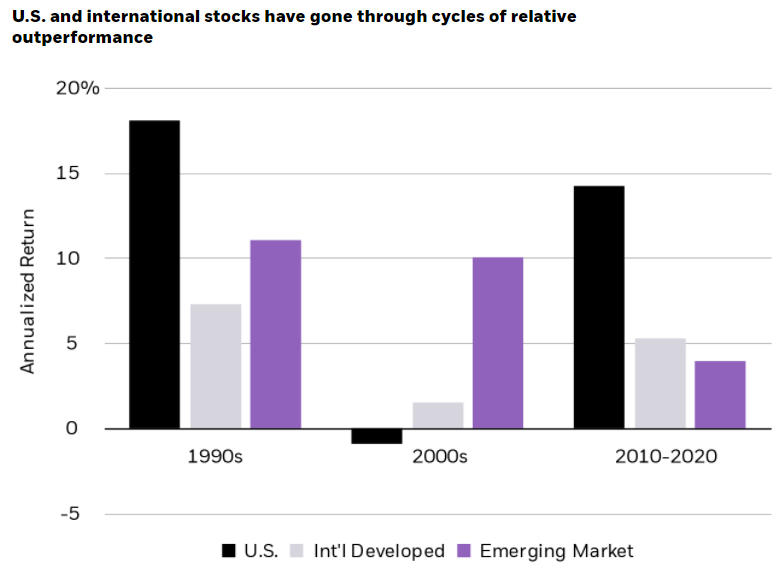

Emerging markets have already underperformed relative to U.S. stocks and other developed countries over the last decade. As market volatility makes it an easy decision to sidestep the U.S., I’m expecting reversion to the mean, which has happened in the past (i.e. emerging markets move higher, U.S. stocks move lower).

The iShares MSCI Emerging Markets ETF (EEM) gets me immediate exposure to a basket of emerging market names, including Taiwan, South Korea, India, Brazil, China, Saudi Arabia and South Africa.

This is a decent enough basket of geographies, while excluding heavy weightings to inordinately risky ones (like Argentina, in my opinion), to gain exposure to the next rotation, hopefully.

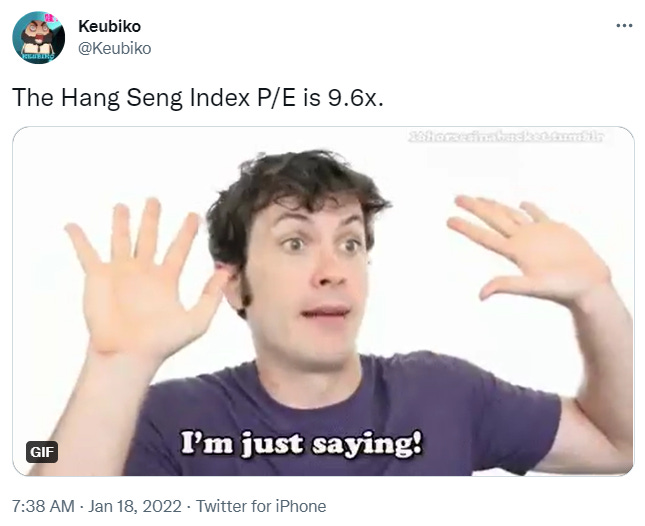

Markets like Hong Kong’s Hang Seng are just outright cheap when compared to U.S. markets, as my friend @Keubiko pointed out the other day on his Twitter.

Here’s a chart of the Hang Seng Index’s ttm P/E dating back to 2015. Since then, it has expanded to as high as 16x earnings and has fallen to as low as 8.97x earnings.

At today’s 9.6x P/E, it is nearly the cheapest it has been over the last 6 years. And it doesn’t have to get to extremely expensive like U.S. exchanges. If you buy the exchange at a 10x multiple and sell it at a 15x multiple, that’s a 50% ride up.

To quote @Keubiko:

“Buy them really cheap, sell them when just cheap.”

The main risk to owning stocks in Hong Kong is that they could very easily get caught in the middle of any escalating U.S./China tensions. Additional risks, pointed out by Global Edge, include:

Lack of innovation and diversification of the economy

Exposure to slowdown in mainland China

Mismatch between business cycles in the United States and China, as the HKD is pegged to the USD

Real estate sector risks and housing affordability

Rising income inequality and social discontent

Industry has fully relocated to mainland China

You can view the full EWH fact sheet, which includes the fund’s components and historical performance here.

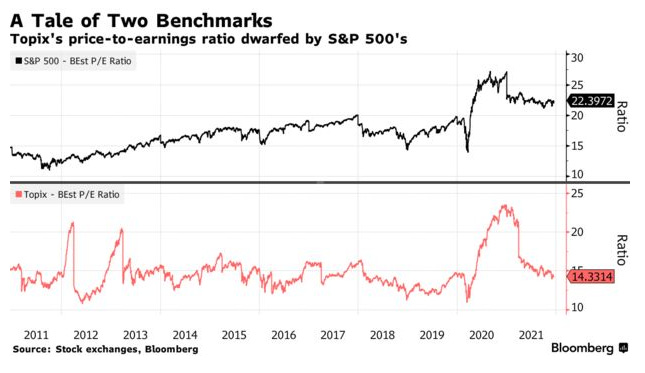

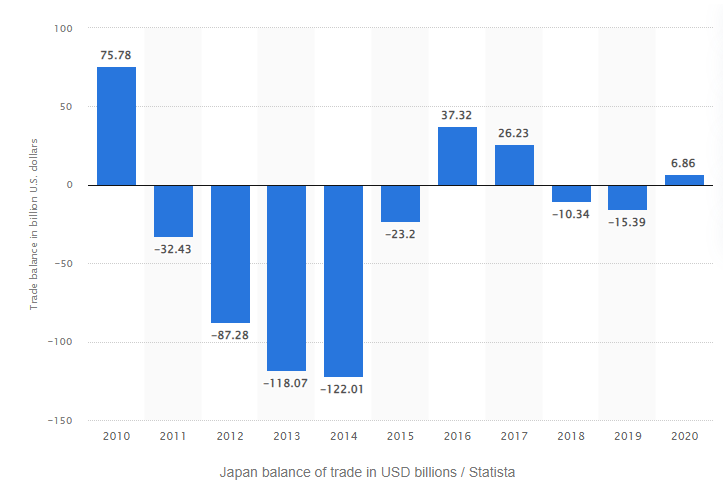

Japanese stocks are also cheap when compared to the U.S., and Japan is a developed country with far healthier trade balance than the U.S.

The Japanese Topix trades at about 14x earnings while the S&P 500 currently sits well over 20x.

Bloomberg notes that Goldman Sachs and Morgan Stanley were out last December advocating for a move into Japanese stocks. Both banks are expecting about 12% gains for the Topix index from December 2021 to December 2022. If U.S. markets continue to sputter, that should be a major outperformance.

For comparison, the NASDAQ has started 2022 off down -11.4% and the Dow has started 2022 off down -5.62%. The EWJ is lower, but only by -3.63% so far this year.

“Japanese equities are primed to close the gap to global peers in 2022,” Bloomberg wrote last month.

Goldman strategist Kazunori Tatebe added: “Cheap valuations and foreigners’ low exposure will all work to the benefit of Japanese stocks.”

Additionally, exports should get a boost as the yen weakens slightly against the U.S. dollar in the short term, as FX markets continue to price a taper and rate hikes in to U.S. monetary policy. This is all, of course, pending short term swings that will occur due to FOMC disclosures set for Wednesday of this week.

Finally, the Nikkei is on the verge of what could be a massive breakout, once it reaches all time highs that it hasn’t come near since the late 1980s! (Yes, as in more than 40 years ago).

The EWJ gives you access to well known worldwide Japanese names like Toyota, Sony and Nintendo.

Jeremy Grantham also added to the chorus of investors recommending Japan last week, Yahoo! Finance reported:

Under these conditions, the traditional 60/40 portfolio of stocks offset by bonds offers so little protection it’s “absolutely useless,” Grantham said. He advises selling U.S. equities in favor of stocks trading at cheaper valuations in Japan and emerging markets, owning resources for inflation protection, holding some gold and silver, and raising cash to deploy when prices are once again attractive.

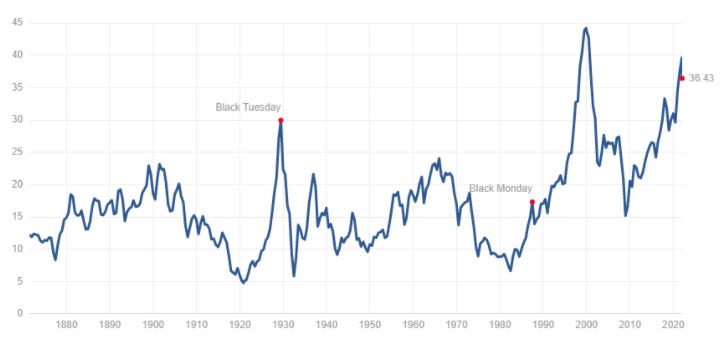

The fact is that even though valuations have come down in the US slightly due to the ugly nature of the last 2 months, the current Shiller PE (as of morning, 1/25/2022), still stands at an astronomical 36.43x.

If we really are headed for a tough year and a broad re-valuation of stocks, things look as though they can sure get a lot worse.

A lot is going to depend on whether or not the Fed pivots or postures heading into the end of January. If the market catches wind that Powell could lay off the gas, stocks will rip. If the Fed holds its hawkish stance, it’s look out below.

But either way – even if U.S. stocks rally, they should take global markets with them and these ETFs may also appreciate in such a case. On the downside, they may couch the blow a little if U.S. stocks continue to plunge.

—

Now read:

When The Global Monetary Reset Happens, Don’t You Dare Forget Why

The Fed Is Fucked And So Are The Lobotomized “Genius” Fund Managers It Has Created

Inflation Is The Kryptonite That Will End The Fed’s Ponzi Scheme

If you don’t already subscribe to Fringe Finance and would like access, I’d be happy to offer you 20% off. This coupon expires in 48 hours: Get 20% off forever

—

Disclaimer: I own and have owned and will continue to own EWJ, EWH and EEM. This is not a recommendation to buy or sell any securities, it is merely a look into my own personal portfolio. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. Consult your financial adviser before making any investing decisions, always. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Thu, 01/27/2022 – 06:30

via ZeroHedge News https://ift.tt/3ILQPNB Tyler Durden

February 2007

“Reality TV has many lessons to teach us, but there is one it reiterates with a frequency even parrots can’t match: If you want people to behave badly, stick a camera in their faces….Still, the symbolic utility of surveillance cameras is unimpeachable. Install hundreds of deliberately conspicuous cameras—many of Chicago’s are topped with flashing blue lights—and you have a highly visible, all-purpose metaphor that you can apply to the War on Drugs, the War on Terror, and the never-ending struggle against public nose picking. So get ready for your close-up. New York is installing surveillance cameras on 450 buses. Houston’s police chief believes apartment complexes should be required to install cameras. Mayor [Richard] Daley believes the same thing about Chicago’s bars.”

Greg Beato

“Smile, You’re on the Telescreen”

February 2002

“[Charter schools’] pitch is simple: If we succeed in running good schools, we’ll attract students and make a profit. If we fail, take back the school and try something else. That’s not the way things are usually done in the public school system. Traditionally, nothing succeeds like failure. Failure is rewarded with more money for more programs, more specialists, and, of course, more failure. Success, on the other hand, is a risky business. It destroys excuses. It raises expectations.”

Joanne Jacobs

“Threatened by Success”

February 1997

“One of the most frequently overlooked dimensions of assimilation is the extent to which it depends more on the behavior of natives than of immigrants. Most conventional definitions and analyses of the subject assume that assimilation involves affirmative acts or choices that immigrants alone must make. But the real secret of American assimilation is that the native-born Americans—not the immigrants—have made it work. Since independence, a majority of Americans, all of whom once were immigrants themselves or the descendants of immigrants, have been instilled with the assimilationist ethos and have, in turn, instilled it in each new generation of immigrants.

Americans have accorded immigrants (and their children) their legitimacy. They have done so by letting them come, letting them quickly become citizens, according them a full complement of American civil rights, and treating them in myriad ways, both large and small, as equals. Americans, through their faith in individual achievement, have given immigrants the chance to prove themselves.”

Peter Salins

“Assimilation, American Style”

February 1982

“The creation of the welfare state coincided with a most extraordinary phenomenon: the longest period of sustained economic growth in history, the one we have had since the last world war. And that enabled the welfare state to live up to its political image. People felt that, despite the increasing pressure of taxation, they still got more out of the welfare state than they put into it.

Also, at this point cause and effect became muddled. Many welfare politicians actually believed that the welfare state should be credited with the economic growth. They saw the welfare state as the cause of economic prosperity, while in actual fact, it is economic prosperity that is the indispensable condition for being able to afford welfare services. It was like Robin Hood telling the poor that, not only did they benefit from his robbing the rich, but his robberies actually produced wealth, with a net benefit for people as a whole.”

Ole-Jacob Hoff

“Which Way Norway?”

February 1972

“One of the more sacred of Washington’s sacred bovines has long been the Food and Drug Administration. Only in recent years, with the rise of health-food advocates and of the NAS-NRC drug efficacy studies, has there begun to be direct challenge of the agency’s right to dictate what substances shall or shall not be on the market. [The drug] DMSO has been tested and found effective both as a pain-killer and as a transfer agent for other medicines. It has been used safely in Europe for years but, because of political hyper-caution, the FDA refuses to license it here. This situation has so incensed the medical profession and Congress that Representative [Joseph] Wyatt and Senator [Mark] Hatfield have introduced a bill to remove drug testing completely from the FDA, transferring it to a ‘nonpolitical, scientific body,’ so as to ‘protect the public from its protector,’ according to Senator Hatfield.”

Reason Staff

“Do We Really Need the FDA?”

The post Archives: February 2022 appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/3HbFPbN

via IFTTT

February 2007

“Reality TV has many lessons to teach us, but there is one it reiterates with a frequency even parrots can’t match: If you want people to behave badly, stick a camera in their faces….Still, the symbolic utility of surveillance cameras is unimpeachable. Install hundreds of deliberately conspicuous cameras—many of Chicago’s are topped with flashing blue lights—and you have a highly visible, all-purpose metaphor that you can apply to the War on Drugs, the War on Terror, and the never-ending struggle against public nose picking. So get ready for your close-up. New York is installing surveillance cameras on 450 buses. Houston’s police chief believes apartment complexes should be required to install cameras. Mayor [Richard] Daley believes the same thing about Chicago’s bars.”

Greg Beato

“Smile, You’re on the Telescreen”

February 2002

“[Charter schools’] pitch is simple: If we succeed in running good schools, we’ll attract students and make a profit. If we fail, take back the school and try something else. That’s not the way things are usually done in the public school system. Traditionally, nothing succeeds like failure. Failure is rewarded with more money for more programs, more specialists, and, of course, more failure. Success, on the other hand, is a risky business. It destroys excuses. It raises expectations.”

Joanne Jacobs

“Threatened by Success”

February 1997

“One of the most frequently overlooked dimensions of assimilation is the extent to which it depends more on the behavior of natives than of immigrants. Most conventional definitions and analyses of the subject assume that assimilation involves affirmative acts or choices that immigrants alone must make. But the real secret of American assimilation is that the native-born Americans—not the immigrants—have made it work. Since independence, a majority of Americans, all of whom once were immigrants themselves or the descendants of immigrants, have been instilled with the assimilationist ethos and have, in turn, instilled it in each new generation of immigrants.

Americans have accorded immigrants (and their children) their legitimacy. They have done so by letting them come, letting them quickly become citizens, according them a full complement of American civil rights, and treating them in myriad ways, both large and small, as equals. Americans, through their faith in individual achievement, have given immigrants the chance to prove themselves.”

Peter Salins

“Assimilation, American Style”

February 1982

“The creation of the welfare state coincided with a most extraordinary phenomenon: the longest period of sustained economic growth in history, the one we have had since the last world war. And that enabled the welfare state to live up to its political image. People felt that, despite the increasing pressure of taxation, they still got more out of the welfare state than they put into it.

Also, at this point cause and effect became muddled. Many welfare politicians actually believed that the welfare state should be credited with the economic growth. They saw the welfare state as the cause of economic prosperity, while in actual fact, it is economic prosperity that is the indispensable condition for being able to afford welfare services. It was like Robin Hood telling the poor that, not only did they benefit from his robbing the rich, but his robberies actually produced wealth, with a net benefit for people as a whole.”

Ole-Jacob Hoff

“Which Way Norway?”

February 1972

“One of the more sacred of Washington’s sacred bovines has long been the Food and Drug Administration. Only in recent years, with the rise of health-food advocates and of the NAS-NRC drug efficacy studies, has there begun to be direct challenge of the agency’s right to dictate what substances shall or shall not be on the market. [The drug] DMSO has been tested and found effective both as a pain-killer and as a transfer agent for other medicines. It has been used safely in Europe for years but, because of political hyper-caution, the FDA refuses to license it here. This situation has so incensed the medical profession and Congress that Representative [Joseph] Wyatt and Senator [Mark] Hatfield have introduced a bill to remove drug testing completely from the FDA, transferring it to a ‘nonpolitical, scientific body,’ so as to ‘protect the public from its protector,’ according to Senator Hatfield.”

Reason Staff

“Do We Really Need the FDA?”

The post Archives: February 2022 appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/3HbFPbN

via IFTTT

Consumers Are “Going Everywhere…Except The Office”, AmEx CEO Says This Week

According to American Express, spending is still almost “everywhere you want to be”. Except in the office and for business travel, that is…

The company’s Chief Executive Officer Stephen Squeri said this week that “corporate travel will never be the same” after the pandemic, Bloomberg reported. This is despite the fact that U.S. consumers “staged a robust comeback” in the last quarter of 2021, he said.

In fact, spending on travel and entertainment has actually passed pre-Covid levels. But business spending is still about 33% of what it once was, the report says.

On Tuesday, the AmEx chief said: “People are skeptical about business travel because of all the remote workforce.”

He continued: “Business travel is going to be completely different. And, I think, as you have more people in more remote locations, they may need to get together three, four, maybe five times a year to come to headquarters.”

Squeri, talking about how the climate for work has changed since employees abandoned their offices in 2020, concluded about Covid: “Consumers are learning to live with it — we’re over it. They’re going everywhere right now except the office.”

Tyler Durden

Thu, 01/27/2022 – 05:45

via ZeroHedge News https://ift.tt/3G9rlb0 Tyler Durden

US Intervened With Patriot Missiles During Houthi Attack On UAE

Authored by Jason Ditz via AntiWar.com,

US Air Force spokesman Lt. Col. Philip Ventura reported on Monday that US planes intervened during a missile alert in the United Arab Emirates (UAE), and helped them repel two ballistic missiles.

“U.S. military forces successfully reacted to multiple inbound threats during an attack near Abu Dhabi,” the U.S. Air Force said in a Monday statement. The New York Times confirmed the rare intervention with US Patriots: “The U.S. Air Force said that it had intervened on Monday to repel an attack on the United Arab Emirates amid an escalation of tensions between the Gulf nation and the Iran-backed Houthi rebels in Yemen.”

The Houthis said they had targeted Al Dhafra Air Base in Abu Dhabi, which hosts the U.S. Air Force’s 380th Air Expeditionary Wing.

American forces were on a heightened state of alert and spent about an hour in security bunkers after the missile alert sounded, said Lt. Col. Phillip Ventura, a spokesman for the U.S. Air Forces in the Middle East.

The missiles were fired by Yemen’s Houthis, and this was the second attack on UAE soil in the past week. The first attack hit Abu Dhabi, damaging the oil storage facility. That was the first such strike on UAE, causing a panic.

It was the US military that fired at least some of the Patriots that intercepted ballistic missiles over Abu Dhabi last night. The Houthis claimed they were targeting the US airbase. A new twist in an alarming escalation that puts UAE on the front line pic.twitter.com/TPsgGd0y1R

— Liz Sly (@LizSly) January 24, 2022

These new missiles were also intercepted over Abu Dhabi. It isn’t clear what was targeted but the oil seems a good bet for doing inordinate economic damage. A Houthi statement acknowledged the intent to disrupt the economy and external investment:

Mr. Sarea warned foreign companies and investors in the Emirates to leave “since it has become an unsafe country that will be targeted regularly as long as it continues its aggression and siege of the Yemeni people.”

Unverified video of Patriot systems being activated during the assault…

#BREAKING: Iran backed #Houthi rebels just conducted another attack at #AbuDhabi. You can see here the Patriot PAC-3 SAM battery stationed next to the city fired multiple MIM-104F missiles at the drones #Yemen pic.twitter.com/Kj621WUCT7

— Baba Banaras™ (@RealBababanaras) January 24, 2022

The Houthi spokesman urged investors to leave the UAE “since it has become an unsafe country.” He added that the UAE would remain targeted so long as the war continues.

Tyler Durden

Thu, 01/27/2022 – 05:00

via ZeroHedge News https://ift.tt/3fZ5KHI Tyler Durden

The Sunrise, Florida, police department has placed Sgt. Christopher Pullease on paid administrative leave after he was caught on video grabbing another officer by the throat and shoving her against a patrol car. Several officers had just arrested a man for aggravated assault and were placing him in a patrol car when Pullease arrived and spoke to the suspect. The audio on the video released by the police department had been turned off, but Chief Anthony Rosa said the sergeant’s words made the situation worse. Pullease leaned into the patrol car with pepper spray in his hand. That’s when one of the officers grabbed him by his work belt and pulled him away. Pullease turned around and grabbed her by the throat and shoved her against a a patrol car. Pullease walked back to the suspect, said something to him then pointed to the officer and said something to her.

The post Brickbat: Get a Grip appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/33QiJcu

via IFTTT

Putin Holds Economic-Development Meeting With Italian Executives Amid Rising Tensions With West

President Biden’s laughable attempt to create a strong deterrent to Russian “aggression” in Ukraine was further undermined early this week by a video meeting between Russian President Vladimir Putin and a group of Italy’s most important executives from 25 top companies to discuss new business opportunities.

Following the end of the meeting Wednesday, Putin hailed the effort to warm economic ties between Moscow and Rome as a great success, further cementing Russia’s ties to Continental Europe while Washington threatens economic sanctions – but not much else – as more than 100,000 Russian troops are poised on the border between Russia and eastern Ukraine.

According to the Moscow Times, Putin praised Italy as “one of Russia’s leading economic partners”.

“I would like to emphasize that we consider Italy to be one of Russia’s leading economic partners…and we see serious prospects for expanding the Russian-Italian business partnership,” Putin said, according to a transcript of opening remarks published by the Kremlin.

This isn’t the first time Italy has bucked its western allies in the name of commerce. Italy’s decision to become the first EU nation to join China’s BRI initiative was also harshly criticized by Washington, even if leaders in Rome insisted that any economic development would be worth it.

The FT reported that the video event was organized by the Italy-Russia chamber of commerce and the Italo-Russian business committee. It received the government’s OK in November with the knowledge of Italy’s foreign ministry. The meeting included top executives from some of Italy’s largest companies, including Pirelli, Generali and UniCredit.

Before the Wednesday meeting, the Kremlin said would cover “the potential for further expanding ties between the two countries’ businessmen”. However, pressure from the Italian government managed to convince some of those who had RSVP’d to cancel.

Here’s a breakdown of senior executives who were on the list of attendees. Although whether they ultimately attended is unclear. There were some last-minute cancellations due to government pressure:

Some 500 Italian businesses have operations in Russia, Putin said, and the two nations enjoy $8 billion in bilateral investments, Putin said. “During the first 11 months of last year, bilateral trade grew by 54% to $27.5 billion. At the final count for the year, it will probably pass $30 billion,” he added. Those involved with the event defended it as a routine event to bolster bilateral ties.

Italian officials and businessmen defended the event, which they said was part of a regular cycle of meetings between Putin and companies with big investments in Russia. “Everyone’s objective is dialogue, not escalation, in this context there is no political stance on the part of businesses,” said one business leader who is planning to attend. Lucio Caracciolo, analyst and editor-in-chief of geopolitical magazine Limes, said: “There is the risk of economic sanctions that would negatively impact the Italian economy and the Italian businesses that trade with Russia, therefore the meeting is a way to keep dialogue channels open.”

Meetings like these are important to Putin because he believes “big business can weaken the west’s Russia policy,” said Alexander Gabuev, a senior fellow at the Carnegie Moscow Center. Of course, Germany’s new government has already shown that it’s not just special interest groups who are reluctant to anger the Kremlin.

Trade ties between the two countries have been improving ever since the famous friendship in the 2000s between Putin and longtime Italian PM Silvio Berlusconi. And even long before that, as Politico points out.

Even from the days of the Cold War, Italy has had unusually tight links with Russia. In the 1960s Fiat produced cars in the Russian town of Tolyatti, named after Italian communist leader Palmiro Togliatti. Eni has also been operating there since the 1960s, while a Pirelli factory received the Soviet Union’s Order of Lenin award in the same decade. “Among European countries, Italy is probably the closest to Russia for economic and cultural ties,” noted Aldo Ferrari, a Russia expert at think tank ISPI and professor at Ca’ Foscari University in Venice.

Meanwhile, the Italians have been somewhat preoccupied lately as the third round of voting to elect Italy’s next president has also failed to yield a suitable result, opening the door for round four on Thursday, as many disagree about whether PM Mario Draghi should be elevated to replace President Sergio Mattarella. Whatever happens, the idea is to show that Draghi will do “whatever it takes” to ensure his reform policies persist past the end of his term as PM in 2023.

Tyler Durden

Thu, 01/27/2022 – 04:15

via ZeroHedge News https://ift.tt/3KPYgF0 Tyler Durden