Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

baller (ˈbɔːlə)

n

slang someone, usually a man, who lives in an extravagant and materialistic manner, tending to be something of a socialite

My wife and I got sucked into watching the Dwayne Johnson series Ballers on HBOMax over the weekend. Aside from being hilarious, it struck me how much of a microcosm of our world this seemingly alien world of twentysomething millionaires and rapacious billionaires really is.

When you drill into the details, the world of Ballers really isn’t that far from ours.

For those that don’t know the setup, broke former NFL bad boy Johnson is trying to turn a new leaf “monetizing his friendships” to help NFL players hold onto all that money they are making at an age when they have zero ability to contemplate their own mortality.

One storyline from the first season is especially relevant. A kid with a good heart, Vernon, banking on his next big contract, is out of money having spent it all on being ‘loyal’ to his friends and family, throwing parties, inviting 40 people to a business lunch, etc.

His loyalty is so out of control he has to borrow money from Johnson (who’s broke mind you) to bridge him until the contract comes through. Of course there are complications and hilarity ensues. The typical Hollywood fantasy fare. Nothing groundbreaking, eventually things work out (mostly).

Johnson has to endure a lot to get Vernon to see the truth, put limits on the situation and get Vernon to properly save his money. The pitch is the right one: put it to work and pay everyone for the long term, not just for tomorrow.

Sound familiar?

No, because that’s exactly what we don’t preach in this world of central bank issued easy money. This shouldn’t be a central conflict, it should be a given.

Because this background for this story is playing out at every level of our society, all a consequence of too much money flowing around finding ways to corrupt everything it touches.

Ballers is all about the corruption money brings to those few thousand people in the NFL and their organizations because of the millions of people who spend too much money on a passing fancy, entertainment.

The NFL, like all pro sports, is nothing but a money funnel with a Federal Reserve sized Hoover attached to it. It’s the ultimate corruption of e pluribus unum. From many to one.

Take a little bit from all of us, time and again to help us relieve the stress of the shitty world they’ve built. Give some of it to the rubes who play the game, who blow it on hookers, high end cars, and drugs, while the lion’s share gets sucked right back up into the same oligarch class that created it in the first place.

But it’s no different than you or me, buying shit we don’t need on credit, self-medicating with pro sports, alcohol, video games, day-trading cryptos on Robinhood, yelling at racists on Twitter or my personal favorite, a ridiculous board game collection.

We’re all ballers to one degree or another, spending easy money on distractions rather than facing the reality that the most unsustainable thing about our society is the money which makes it all happen.

And before anyone revokes my libertarian creds, I pass no judgment on this. It’s all voluntary exchange, mostly. At the very least it has the appearance of being voluntary.

That said, here we are waiting to hear from the philosopher kings at the FOMC and the markets are melting down around our ears.

The tantrums that have begun are no different than those pitched by Vernon’s friends over having the barest amount of fiscal discipline imposed on them.

Everywhere I look everyone is saying some version of the same thing, “Hey man, Don’t take the punch bowl away.” They’d say it a lot more colorfully on Ballers, but being white I’m not allowed to use that language.

From Chairman Xi leading off this year’s virtual Davos with a plea not to hike rates to the howls from the Financial press including some Austrians, pleading that he can’t possibly raise rates because it would cause a market meltdown and blow out the Federal budget, Powell is now off everyone’s invite list to party on the yacht.

I get the feeling that some folks would rather be right about their hyperinflation theories rather than actually figuring out what’s really going on.

But the reality is that something has changed and the markets are finally coming to that conclusion.

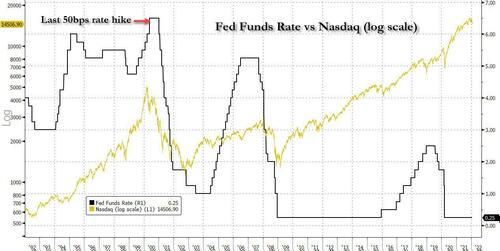

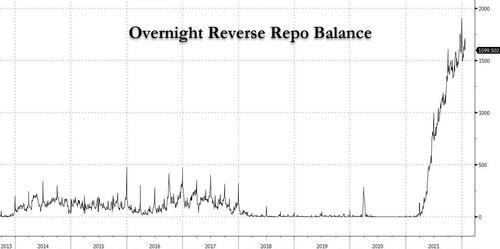

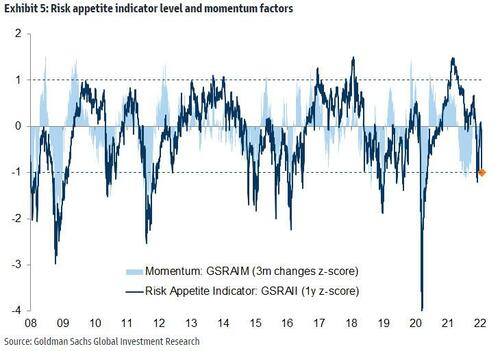

For months I’ve been arguing that Jerome Powell ignited a firestorm when he raised the Reverse Repo Rate by 0.05%, pulling trillions in base liquidity from overseas markets while handing U.S. banks all the collateral they needed.

It’s created a political firestorm on Capitol Hill who tried to oust him from the Chair and failed. They got three of his fellow hawks, but not the king. He was able to run out the political clock on both Build Back Better and opposition to his reappointment.

But it doesn’t happen if Powell doesn’t have the backing of the people behind him.

And who backs Powell? The New York Fed, that’s who.

That leads you to the conclusion that all is not hunky dory in Oligarchville. That, shock of shocks, narcissists only like each other when they are sucking our lives and souls away. But when they start taking from each other, that’s when the knives come out.

It seems incredible to me that many people won’t consider this idea, that these people don’t like each other, and aren’t willing to hand over their business and their wealth without a fight?

Because that’s what’s implied when everyone jumps up and down and screams at Powell to “Save them!” from deflationary forces.

And he looks down from the Marriner-Eccles building and says, “No.”

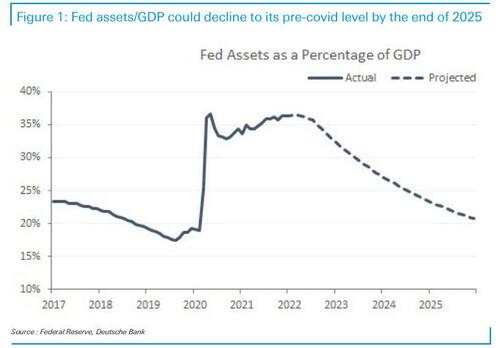

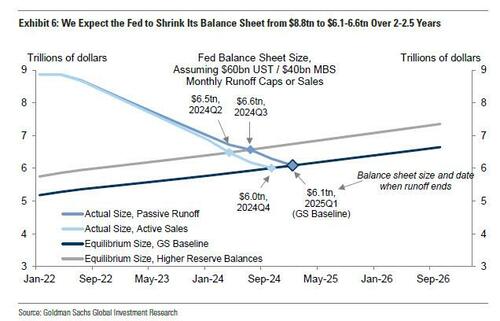

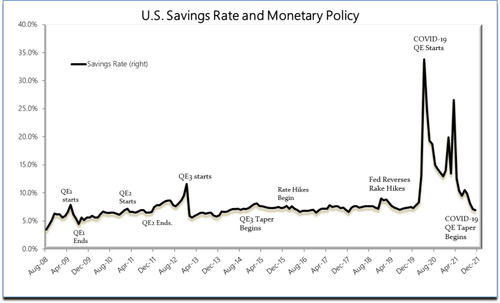

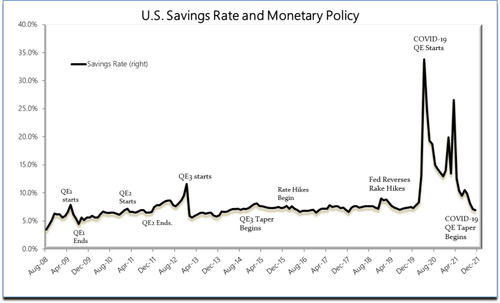

It’s time to put it all in order. With ‘Build Back Better’ dead there is no more insane new spending to monetize. There is no reason for the Fed to keep up QE or rates at the zero-bound. Savings is down, money is circulating again. Inflation isn’t transitory.

People want to work. COVID-9/11 is behind us. The anger over losing two years is just getting started but that’s a different wrinkle to this story for another day.

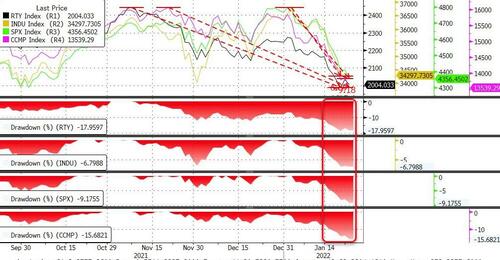

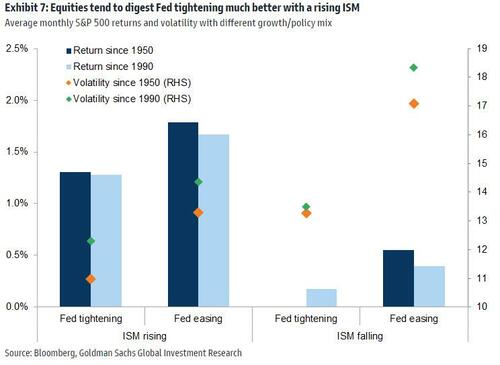

If the Fed isn’t intimidated by the recent weakness in stocks, in truth a healthy correction after a massive run, and raises rates on Wednesday we have our answer as to what Powell and friends are willing to do. Whatever your opinion of it is, it will not be a ‘policy error’ but a clear-eyed understanding that it’s time to rein it in, change the direction of the big boat, and begin living within our means.

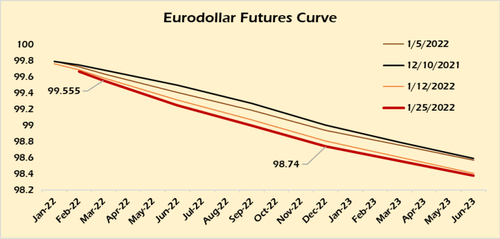

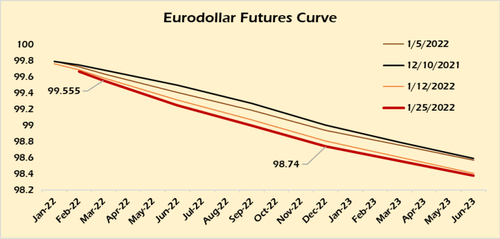

If he doesn’t it won’t be the opposite signal. It will simply mean that they’ll take another couple of months to nail down the particulars, namely getting proper control over the O’Biden administration, and begin hiking on schedule per the current expectations in the Eurodollar futures market.

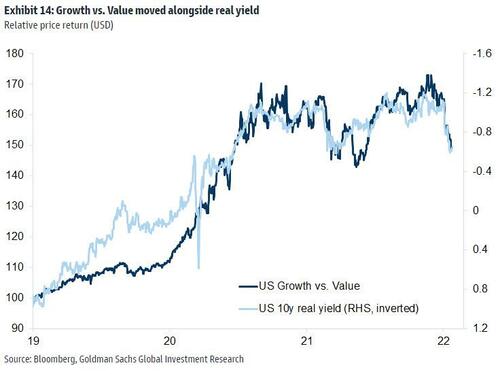

Has anyone looked at the ratings for pro sports? Old media? Hollywood box office receipts? All down. Netflix is getting killed because it’s growth cannot sustain its valuation, much like a lot of the NASDAQ. This is something that should have happened two or three years ago, just like Tesla.

But didn’t because of COVID-19 and the massive wealth transfer the stimulus provided to them during the absence of sanity oceans of money always produces.

That said, these are all unsustainable Ponzi scheme masquerading as viable industries based on cheap money and malinvestment in politically-motivated production.

Now I’m not suggesting for a second that Powell is some kind of saint or anything. He’s no savior sent down to redeem us sinful ballers from our excesses. No sir. He represents the very people that helped create this mess.

But at the same time, they want to remain where they are. They are not willing to hand their power and their money over to another group within the cartel.

They didn’t get where they were putting their money on the table to bail out anyone else.

And they won’t this time.

All I’m doing here is assessing what everyone’s real motivations are and who they answer to. To quote another, far more classic television show, “The universe is run by the interweaving of three elements: Energy, matter, and enlightened self-interest.”

And, to me, where’s the enlightened self-interest angle for the NY Boys, represented by Powell, for turning over their business to a bunch of European and Chinese commies?

When you step back and really look at what’s happening, they have already told Europe, China and all those emerging markets currently whining, the post-COVID world you created is your mess now.

This is why I’m convinced the Fed will hike and hike aggressively this year, maybe starting on Wednesday.

There is no deal possible between Wall St., City of London and Europe. In that game, Europe loses. If China wants to play hardball and default on foreign-held property debt, fine. Have fun attracting any capital in the future.

All the fiscal projections of the U.S.’s insolvency are great (and accurate) but I hate to burst anyone’s bubble, literally, but you CAN taper a Ponzi scheme if you’re 1) the biggest Ponzi and 2) control the flow of funds into them.

And if you don’t think Powell and his backers at the NY Fed aren’t willing to sacrifice a few thousand points on the Dow or even a few points of GDP, to restructure the US’s finances for the long term while the Fed hands them all the collateral and liquidity they need to keep playing while everyone else craps out, I do believe you are terminally naïve.

It’s what they call playing hard ball.

There are two ways to reset the monetary system. The first option is printer go brrr and default by switching out the old currency for a new one. The other is collapse the old system by returning risk and rebuilding it after the malinvestment is gone.

Paul Volcker chose the latter to finally establish the Dollar Reserve Standard as the only game in town. Nixon set the process in motion, Volcker closed the deal. It’s what established today’s game.

We are at an inflection point in history, both monetary and geopolitical.

I discussed this in my latest podcast with Alex Krainer and believe the rules of the game have fundamentally changed. The next game will look a lot different than the baller one we’ve been playing.

Those who won’t adjust to that or admit it should be very afraid of what Jerome Powell does next.

* * *

Join my Patreon if you hate the game, not the playa.

BTC: 3GSkAe8PhENyMWQb7orjtnJK9VX8mMf7Zf

BCH: qq9pvwq26d8fjfk0f6k5mmnn09vzkmeh3sffxd6ryt

DCR: DsV2x4kJ4gWCPSpHmS4czbLz2fJNqms78oE

LTC: MWWdCHbMmn1yuyMSZX55ENJnQo8DXCFg5k

DASH: XjWQKXJuxYzaNV6WMC4zhuQ43uBw8mN4Va

WAVES: 3PF58yzAghxPJad5rM44ZpH5fUZJug4kBSa

ETH: 0x1dd2e6cddb02e3839700b33e9dd45859344c9edc

DGB: SXygreEdaAWESbgW6mG15dgfH6qVUE5FSE