Authored by Bill Blain via MorningPorridge.com,

“Fair fa’ yer honest sonsie face, great chieftain o’ the puddin race .”

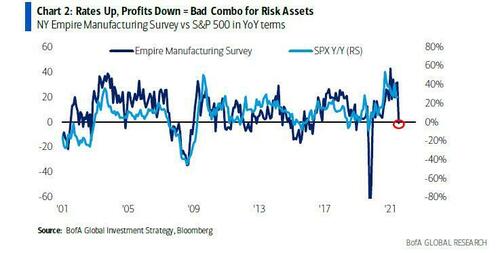

After yesterday’s dramatic market roller-coaster, traders are wondering if it’s a buy-the-dip moment. They probably will. But the narrative has reversed. The improbable tech stocks into substantial correction territory have a considerable way still to fall if history is any guide.

Yesterday, was an extraordinary day…. which we will all-to-soon forget.

As European markets closed last night it looked like markets had surrendered, down some 5%. More than a few chums were wondering if “this is it”. Apparently, the massive volumes in the morning were driven by retail investors who, after fretting about their loss-making positions for the whole weekend, decided to dump stock. In the afternoon, the selling reversed as brave buyers reckoned they were smarter, reckoned stocks looked cheap, and for all the usual reasons the market recovered – one of the biggest upside reversals in recent history…

Volatility is back with a vengeance. Yay! We love it… Don’t trust it.

This morning.. Lot’s of noise, but I am not hearing that many fact-based calls of a “buying window” or that stocks look suddenly cheap. The early morning vibe is its still “speculative” out there – and that markets will go up because that’s what they’d done on every dip since 2009.

I am definitely not about to pull on my size 12 Buying Boots. I am going to wait a while longer to see how this plays out. I have cash in the account – waiting, waiting, confident the right moment to pile-in is coming… but I am utterly unconvinced it has arrived… And when I do re-enter the market, it will be very selective.

Instead… this morning I confidently expect some market dither in earnest discussion of the Dead Cat Bounce theory of markets – a magnificent simile from crashing markets back in 1987 based upon the observation that if you throw a deceased feline from a high enough point it will bounce, but not a lot. Exactly who had time to do that experiment we shall never know, but it is scientific method and observation that moves us forward….

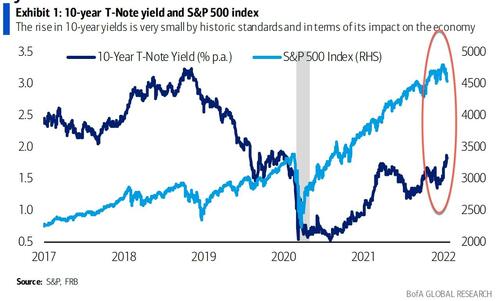

The problem is: the market has not really moved on. It is still thinking like it’s a random year between 2008-2021 when central banks were playing the “juice the markets” game. Wake up. Welcome to reality – its 2022.

This morning you are going to open your newspapers, scan through analyst reports and commentary like the Morning Porridge, and read earnest debates about where the market goes in the next hours, days, weeks and maybe months. Teenage scribblers and learned market sages will be variously telling you it’s the worst of times because:

-

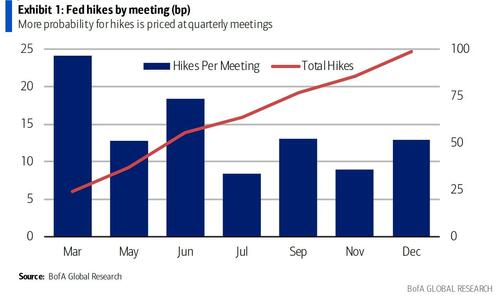

Tightening monetary policy, rising interest rates, the expected rise in bond yields, rising inflation, geopolitical tension, supply chain weakness, and looming recession spell further sell-offs to come,

Or, they might be raving about how positive the coming best of times look on;

-

Post pandemic recovery, repressed demand, that stocks look better than bonds during inflationary growth phases, and long-term growth prospects are rising as the last 10-years of productivity inventiveness is innovated (phew, what a phrase!) will lead to long-term market upside.

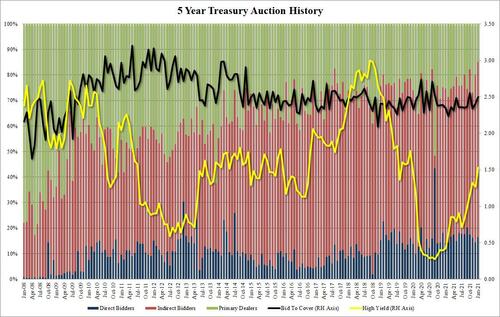

The immediate tone will be set by this week’s Fed meeting, which will be gleaned for clues on rate timing, but is unlikely to do anything for the market in terms of convincing players the Fed stands ready to accommodate a market sell off.

Take yer pick… I shall stick with things are “never as bad as you fear, but seldom as good as you hope”, and hang back from the market waiting for real bargains.

CNBC’s populist Jim Cramer reckons the market is approaching an “investible bottom”, on the basis its negative headlines currently leading the narrative. These can quickly turnaround. He noted:

-

There is “a sickening level of negativity” and a bear outlook indicator of surveyed investors climbed from 38% to 47% over a week.

-

That’s reinforced by an increasing number of analyst downgrades.

-

The divergence between strong and weak earnings highlights swimmers and sinkers.

Market’s always overreact on the downside… which is why they create opportunity! Positive signals in a tumbling market often attract speculative buy-the-dip bids. Occasionally, they look strong enough to generate a following, attracting the hot money element, and the algo buy programmes. That may be what happened on Monday afternoon when the signals suddenly flipped positive after the midday bottom.

But all these analysts and market talking heads arguing about when to pile in or out of the market are missing a FUNDAMENTAL POINT. Things have changed.

I am not a uber-bear. The outlook for the global economy will be long-term rosy. History tells us that.

To get there on the constantly rising wave of human wealth, the market has periodic phases of Euphoric Madness. These moments tend to auto-correct. The last 14 years since 2008 have seen one of the longest, most Eurphoric markets in history – with all financial assets (bonds and stocks) inflated and fuelled by easy money, cheap capital and monetary experimentation by central banks. The building head of speculation was led by a pied-piper promising unlimited market riches, spawning cryptos, memes, Spacs and whatever other unlikely get-rich schemes could be shown.

I would reckon at least 60% of current market participants have never seen any other kind of market.

Now we have entered a correction phase. The stage when speculation is itself swallowed…

What is clear is the market is not crashing as a single wave – there is significant divergence between Good, Bad, Ugly and Fugly stocks. Over a quarter of the S&P 500 are down more than 20% – the worst being Moderna (down 43%) and Netflix (down 40%). There is now clear differentiation between fundamentally strongly positioned, high margin dividend stocks and those with little to show except profitless scale in a market evolving past them. It’s happened before, and it will happen again.

We are maybe wrong to talk about stock market bubbles? The real issue is that they comprise lots of tiny little bubbles – the individual stocks that speculation and over-fervid belief has whipped up to frenzied levels. The sound of these mini-bubbles popping, leaving the market champagne flat, is what’s now occurring. There are plenty of stocks still to pop.

I’ve referenced this many times, looking back to how it took considerable time for prices to settle after the Dot.com crash in March 2000. The correction won’t be done overnight – it might take years for us to properly value the over-priced inflated expectations the last few years has attached to so many improbable tech stocks. If you buy-the-dip today in a long-term correction stock you will be holding a ticking bomb.

We will know it’s begun when the improbable tech stocks correct 20-30% – which has pretty much happened. And the next stage is not a buy-the-dip opportunity, but long-term decline down to fair value, which for many of these stocks will be default and bankruptcy. If you haven’t already dumped ARK, then get on the phone….

Meanwhile, how long does anyone give the relatively new President of El Salvador – Nayib buy-the-dip Bukele? He was on the wires saying Bitcoin is really cheap, and spent another $15 mm of his nation’s precious dollar reserves scooping up the “cheap” but tumbling cryptocon.