Biden continues to scapegoat American businesses for government-created problems. On Monday, President Joe Biden gave a public address during a meeting with his Competition Council, discussing an executive order he issued last July. Why now? Because inflation keeps getting worse, and the Biden administration needs somewhere to lay the blame.

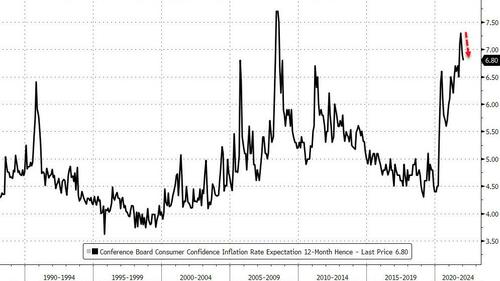

Inflation has been hitting its highest levels in decades. In late December, for instance, gas prices were up 51 percent, beef prices up 20 percent, and furniture prices up 11 percent. Food prices are up. Clothing prices are up. Energy prices are up. Used car prices are up. Booze prices are up. And the list goes on.

Part of this can be blamed on the pandemic, which has contracted the labor force, increased demand for certain sorts of goods, and caused disruptions in supply chains.

But government policies have made things much worse. There’s been absolutely massive amounts of new government spending—and printing more money to pay for it. (The “supply of dollars has increased by nearly 40 percent over the past 2 years, which is an off-the-charts record,” Reason‘s Nick Gillespie noted in December.) Meanwhile, Biden and Democrats just keep trying to spend more.

While raising interest rates is traditionally a way to try and keep inflation in check, “America’s high levels of debt make the maneuver more fraught because higher interest rates will reverberate through the government’s own debt,” Eric Boehm points out.

Biden energy policies and the Trump tariffs he’s continued may also be worsening inflationary woes.

With Americans feeling the pinch of rising prices all around, Democrats have been looking for somewhere to lay the blame that doesn’t implicate their own policies. They’ve coalesced around blaming big businesses—a sort of “killing two birds with one stone” strategy.

Passing “antitrust” laws that give government regulators more control over tech companies and U.S. markets at large has been big on Democrats’ recent agenda. Blaming big businesses for inflation lends give a good cover to this push.

Rather than come across as control freaks who want a say in how all U.S. companies run, they feign concern for consumer welfare, asserting that lack of competition is what’s causing rising prices. “Lack of competition costs the median American family household… $5,000 a year,” claimed Biden on Monday.

Don’t buy it.

These type of claims are based more in politics than economic realities.

“As the president’s economic approval ratings slipped, his aides fielded increasingly alarmed messages from Democratic operatives urging the White House to adopt a new message on inflation,” The Washington Post reported earlier this month:

In November and December, at least four Democratic polling experts told senior White House officials that they needed to find a new approach as public frustration over price hikes became widespread and highly damaging to Biden’s popularity, according to three people with knowledge of the private conversations.

“What we said is, ‘You need a villain or an explanation for this. If you don’t provide one, voters will fill one in. The right is providing an explanation, which is that you’re spending too much,'” one Democratic pollster who, like the others, spoke on the condition of anonymity to reflect private conversations, told The Washington Post. “That point finally became convincing to people in the White House.”

Corporate consolidation and corporate greed has become that villain. But economists across the spectrum are skeptical, including “some liberal economists in the administration’s orbit,” as the Post pointed out:

They point out that corporate consolidation is a phenomenon going back decades, so it is unlikely to explain this year’s sudden burst of inflation. …

“I don’t think corporate consolidation explains the jump in prices,” said Dean Baker, a liberal economist who endorsed Warren’s presidential candidacy in 2020. Baker said he had relayed this skepticism to the White House. “I don’t see a good story here in blaming inflation on concentration.”

Claudia Sahm, a liberal economist who worked at the Federal Reserve, added, “I don’t understand the strategy. It must have something to do with politics, but you’re not going to get many economists to back up the argument that it’s going to address inflation right now.”

The criticisms are even more pointed from less liberal economists. Larry Summers and Jason Furman, who both served in the Obama administration, have been dismissive of the notion that corporate consolidation explains the price hikes. But they said it makes sense for the administration to use price pressures to push their antitrust agenda.

This push was made clear by Biden’s meeting remarks yesterday. In addition to blaming businesses for rising prices, he touted his administration’s efforts to crack down on business mergers.

“Capitalism without competition is not capitalism. It’s exploitation,” he said.

Biden and his allies would like us to believe that only his preferred massive spending initiatives and economic policies can save Americans from rising prices. It may be good political messaging, but like so many American goods right now, the price of believing this is way too high.

FREE MINDS

Florida universities can’t bar professors from testifying in lawsuits against the state. A federal judge ruled against the University of Florida in a case brought by six professors at the school. “The stinging ruling, by Judge Mark E. Walker of U.S. District Court for the Northern District of Florida, accused the university of trying to silence the professors for fear that their testimony would anger state officials and legislators who control the school’s funding,” The New York Times reports.

“Judge Walker likened that to the decision last month by Hong Kong University to remove a 25-foot sculpture marking the 1989 massacre of student protesters in Beijing’s Tiananmen Square by the Chinese military, apparently for fear of riling the authoritarian Chinese government. If the comparison distressed university officials, he wrote, ‘the solution is simple. Stop acting like your contemporaries in Hong Kong.'”

FREE MARKETS

Businesses in the Netherlands find a way around COVID-19 restrictions? Dutch museums and theaters—which are ordered to remain closed—”are temporarily turning themselves into hair salons and gyms to protest against what they say are unfair coronavirus measures,” Bloomberg reports. “The Van Gogh Museum in Amsterdam is open to get a hair cut, and the Frans Hals Museum in Haarlem is being used for gym classes.”

QUICK HITS

• The Supreme Court will take on race in college admissions in cases concerning Harvard and the University of North Carolina. “The case against Harvard accused it of discriminating against Asian American students by using a subjective standard to gauge traits like likability, courage and kindness and by effectively creating a ceiling for them in admissions,” notes The New York Times. “In the North Carolina case, the plaintiffs [say] the university discriminated against white and Asian applicants by giving preference to Black, Hispanic and Native American ones.”

• Prosecutors in Kansas are using a stand-your-ground law to shield juvenile detention center employees from prosecution in a case involving the death of a 17-year-old in their custody, Cedric Lofton. A lawyer for the boy’s family said the self-defense rationale makes no sense since the boy was unarmed and 135 pounds.

• President Joe Biden’s competition remarks yesterday weren’t all bad. For instance, he touted regulatory changes that allow hearing aids to be sold over the counter:

• Biden was overheard on a hot mic calling a reporter a “stupid son of a bitch.”

• An interesting new study looks at how declining U.S. mobility affects American culture in other ways:

• Fight Club gets a new ending:

• In Baldwin County, Alabama, people “are routinely forced to wear ankle monitors while out on bail even though they haven’t been convicted of crimes,” and pay $10 per day for these monitors, AL.com reports.

• New York’s statewide mask mandate has been struck down.

• A new bill in California would require all schoolchildren to be vaccinated against COVID-19.

• “A Wisconsin appeals court has temporarily blocked a judge’s order that would have banned the use of absentee ballot drop boxes in the swing state,” reports NPR.

• “We talk a lot in my business about how younger, more diverse generations are changing politics and culture. But we often forget to think about the corollary: Older, Whiter generations disproportionately make up our workforce, and our customers,” writes The Washington Post‘s Megan McArdle. “If we don’t account for those generational effects when designing diversity initiatives, we’re setting ourselves up for frustration, or worse.”

The post Biden Blames Government's Economic Failures on Big Business appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/3tYzmgs

via IFTTT