Following one of the greatest intraday market reversals in history, US index futures resumed their decline led by the Nasdaq, signaling more pain for richly valued technology shares as investors braced for the highly anticipated Fed meeting and a flurry of earnings as geopolitical tensions between Russia and Ukraine persisted. Companies including GE, J&J, Verizon and Microsoft report earnings on Tuesday, as the Fed starts a two-day meeting. As of 7:30am ET, emini S&P futures were down 60 points or 1.36% to 4,343, Nasdaq futures were down 1.88% or 272 points and Dow futures were down 236 points or 0.68%. The VIX was at 33, after swinging between 29 and 39 on Monday; 10Y Treasury yields were unchanged at 1.77% and the dollar gained.

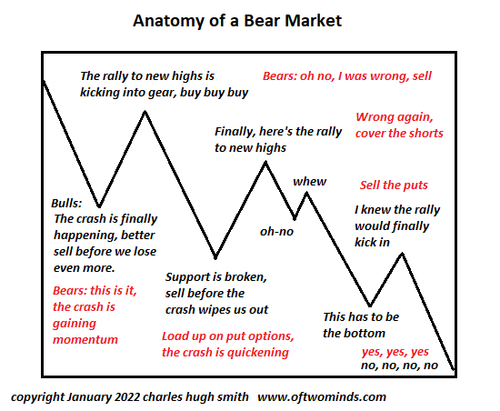

US equities swung in a rollercoaster of volatility on Monday as both underlying gauges had erased intraday losses to end the session slightly higher as dip-buyers came in. According to JPM’s trading desk, yesterday’s 5% reversal in the Nasdaq is an uncommon occurrence: “If you exclude March 2020, yesterday was the 7th 5%+ NDX reversal since GFC. The following day, markets were down 4 of the previous 6 times, with an average return of -1.6%. In 2000 – 2002 and in 2008, there are many more observations of 5% reversals, occurring 194 times during those time periods. Overall, intraday reversals of this magnitude seems to suggest more volatility rather than a directional change.” In other words, expect much more volatility. That said, the market has sent the Fed a message: an overly hawkish message tomorrow and stocks get it.

“The recent market turmoil will certainly soften the Fed’s tone, or at least prevent the Fed from sounding too hawkish,” said Ipek Ozkardeskaya, senior analyst at Swissquote. “The Fed can’t afford to trigger a financial crisis.”

She is right, but things are not looking too good for Powell right now as the VIX, rose for a sixth session on Tuesday, after briefly jumping intraday to the highest since October 2020 on Monday. Global equities at one point wiped almost $3 trillion on Monday, with the S&P 500 down more than 10% from a record high, before a dramatic reversal saw major U.S. benchmarks end in the green.

“Volatility is back,” Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, said on Bloomberg Television. “We’re having a sea-change in terms of Fed policy. Equity investors frankly have been behind the curve in anticipating what’s coming, so there’s a lot of catch-up to do.”

In premarket trading, General Electric dropped after missing sales expectations, while International Business Machines Corp. and American Express Co. gained after posting revenue that beat forecasts. Big tech and growth stocks declined amid a slide in Nasdaq 100 Index futures, as worries linger over the prospect of Fed rate hikes and rising bond yields. Apple (AAPL US) -1.4%, Microsoft (MSFT US) -0.7%, chipmaker Nvidia (NVDA US) -2.1%, Amazon.com (AMZN US) -1.8%. IBM shares gained 3.2% after the technology company reported revenue for the fourth quarter that beat the average analyst estimate. Other notable premarket movers:

- General Electric (GE) shares are down 5.9% in premarket trading on Tuesday, after the industrial conglomerate reported revenue for the fourth quarter that missed the average analyst estimate

- Retail-trader favorites GameStop (GME US) and AMC (AMC US) declined in U.S. premarket trading, suggesting losses for so-called meme stocks may continue in Tuesday’s session.

- Nvidia Corp. (NVDA US) shares are lower in premarket trading after Bloomberg News reported it is quietly preparing to abandon its purchase of Arm Ltd. from SoftBank Group Corp. after making little to no progress in winning approval for the $40 billion chip deal, according to people familiar with the matter.

- SmileDirectClub (SDC US) shares rise 8% in premarket trading after it announced plans to cut jobs and suspend operations in some countries.

- Robinhood (HOOD) shares slump 3.7% in premarket trading after Mizuho analyst Dan Dolev slashed his price target on the stock to $20 from $55 previously.

- Inter Parfums (IPAR US) gained in postmarket trading Monday after boosting its net sales guidance for 2022, which beat the average analyst estimate.

In Europe, equities recovered from yesterday’s selloff, grinding back to best levels after a choppy start; banks, telecoms and energy are the strongest Stoxx 600 sectors, gaining over 2%. The Stoxx Europe 600 Index up 0.6%, after being up more than 1% earlier; CAC is the marginal outperformer. Logitech jumped 11%, the most since October 2020, after the Swiss-based producer of computer accessories reported better-than-expected earnings and raised its 2022 profit outlook.

Earlier in the session, Asian stocks slumped to their lowest since November 2020 amid investor concerns over upcoming monetary-policy tightening by the Federal Reserve and rising tension between Russia and Ukraine. The MSCI AsiaPacific Index slid as much as 1.7%, driven by losses in the information-technology and financial sectors. Key benchmarks tumbled more than 2% in Japan, Australia and South Korea. China’s CSI 300 Index falls as much as 2.2%, the most since Aug. 20, driven by losses in energy and telecom shares. The gauge drops to its lowest intraday level in nearly six months. The biggest decliners include Jafron Biomedical, Lepu Medical Technology and Huaneng Power, all down more than 7%. Shanghai Composite -2.4%, Shenzhen Composite -3.2%, ChiNext -2.4%.

Ukraine-related market risk “has become a bit more real now, so investors are confused about what to do,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management. “It will be a shock if Russia does make a move, so some are feeling the need to run from stocks for now.” The Asian stock benchmark is down more than 15% from its peak last February. Japan’s Topix and New Zealand’s S&P/NZX 50 have touched correction levels, down 10% from recent highs, while key measures for in mainland China and South Korea inched closer to the 20% drop that indicates a bear market

India’s key equity gauges snapped their five-day decline to outperform Asian peers, helped by robust earnings performances of local companies ahead of the announcement of the federal budget next week. The S&P BSE Sensex rose 0.6% to 57,858.15 in Mumbai while the NSE Nifty 50 Index gained 0.8%, the biggest single-day surges of both since Jan. 12. The indexes erased losses of as much as 1.9% and 1.8%, respectively, earlier in the session. All but two of the 19 sector sub-indexes compiled by BSE Ltd. closed high, led by a gauge of telecom companies. The rally in Indian equities were in contrast to most cohorts in the region, with the MSCI Asia Pacific Index slumping to its lowest since November 2020 amid concerns over monetary-policy tightening and rising tension between Russia and Ukraine. “The earnings season has gathered pace with revenue largely in-line with estimates, however higher commodity prices taking toll on margin and profitability to some extent,” Mitul Shah, head of research at Reliance Securities, wrote in a note.

In rates, Treasury and gilt curves all bear steepen as Monday’s haven bid fades. Treasuries are steady with yields cheaper by at least 1bp across long-end, slightly steepening the curve. 10-year TSY yields hover around 1.77%, with gilts trading almost 4bp cheaper on the sector as dealers prepare for a new 50-year bond syndication next month; spreads slightly wider with long-end marginally underperforming. A $55b 5-year note auction at 1pm ET, second of three this week, follows strong 2-year sale that drew a yield 1.2bp lower than the WI at the bidding deadline; cycle concludes with $53b 7-year notes Thursday. WI 5-year yield at ~1.568% is above auction stops since December 2019 and ~30.5bp cheaper than last month’s result. IG dollar issuance slate remains moribund, though desks expected around $20b this week. Gilts underperforming at the back end after the DMO announces a new 50y syndication due in early February. Peripheral spreads tighten, with 10y Italy narrowing 3.5bps to core as day 2 of presidential voting resumes.

In FX, Bloomberg Dollar Spot drifts back up through Monday’s best levels extending yesterday’s gains as it climbed against most of its Group-of-10 peers. The Australian dollar outperformed and was bought against the kiwi after a strong 4Q inflation report boosted yields across the curve and reinforced RBA tightening bets. Australian three-year yield jumped as much as 9bps to highest since April 2019 and all but one of 17 analysts polled by Bloomberg expect the RBA will end quantitative easing at its Feb. 1 meeting. The euro extended an overnight loss to trade below $1.13; the currency was sold for the dollar and yen after NATO said it would boost its deployments in eastern Europe to deter a new Russian invasion in Ukraine. The euro’s volatility skew shifts lower compared to a week ago as the options space tracks the spot market, where the common currency is under pressure. The pound advanced versus the euro, rebounding after it reached the weakest level against the common currency this year on Monday. The yen eased from a five-week high and Japanese government bonds traded in narrow ranges after a solid auction. BOJ Governor Haruhiko Kuroda said the Bank of Japan must continue with monetary easing because its 2% inflation target remains distant. RUB outperforms in EMFX, fading part of Monday’s weakness.

In commodities, crude futures tick higher. WTI adds ~$1, regaining a $84-handle, Brent pushes back above $87. Spot gold drops to about $1,838/oz. Most base metals are in the red, with LME tin down over 2.5%.

Looking at the day ahead, data releases include the Ifo’s business climate indicator from Germany for January, along with the US Conference Board’s consumer confidence indicator for January. Earnings releases include Microsoft, Johnson & Johnson, Verizon Communications, NextEra Energy, Texas Instruments, American Express, General Electric and Moderna. And on top of that, the IMF will be releasing their World Economic Outlook Update.

Market Snapshot

- S&P 500 futures down 0.9% to 4,363.50

- STOXX Europe 600 up 1.0% to 460.80

- MXAP down 1.5% to 187.12

- MXAPJ down 1.4% to 612.92

- Nikkei down 1.7% to 27,131.34

- Topix down 1.7% to 1,896.62

- Hang Seng Index down 1.7% to 24,243.61

- Shanghai Composite down 2.6% to 3,433.06

- Sensex up 0.6% to 57,862.85

- Australia S&P/ASX 200 down 2.5% to 6,961.63

- Kospi down 2.6% to 2,720.39

- Brent Futures up 1.3% to $87.36/bbl

- German 10Y yield little changed at -0.07%

- Euro down 0.3% to $1.1297

- Gold spot down 0.3% to $1,838.19

- U.S. Dollar Index up 0.14% to 96.05

Top Overnight News from Bloomberg

- Global traders already on tenterhooks over this week’s key Federal Reserve meeting were jolted further Tuesday by Australian inflation data that smashed expectations, a surprise monetary tightening in Singapore and further swings in U.S. equity futures

- Western allies are pushing ahead with diplomatic efforts to avert war between Russia and Ukraine, after U.S. President Joe Biden held what he described as a “great” call with European leaders on Monday

- German Ifo Institute’s business expectations gauge rose to 95.2 in January, more than economists predicted. Manufacturers saw supply bottlenecks easing at the start of the year, and even services providers were optimistic about the future — despite current curbs on activity

- U.K. Prime Minister Boris Johnson’s office has confirmed that staff gathered to celebrate his birthday during the 2020 lockdown, adding to existing allegations of rule-breaking parties

- While positive turnarounds are often viewed as a good sign, that might not be the case this time. According to calculations by Bespoke Investment Group, Monday was the sixth time since 1988 that the Nasdaq erased a 4%-plus intraday decline to close higher on the day. On previous occasions the tech-heavy gauge saw a median decline of 5.5% one month later and a drop of 7.9% three months down the line

- Deutsche Bank AG turned the blame on its ex-client Palladium Group for crippling losses it suffered investing in risky foreign exchange derivatives the German lender sold

A more detailed breakdown of global markets courtesy of Newsquawk

In Asia, markets were heavily pressured after yesterday’s whirlwind session in the US. ASX 200 (-2.5%) slumped with losses exacerbated as firm CPI supports RBA tightening calls. Nikkei 225 (-1.7%) briefly fell beneath 27,000 for the first time since August last year. KOSPI (-2.6%) ignored strong GDP as South Korea reported record daily COVID-19 cases and North Korea fired cruise missiles.

Hang Seng (-1.7%) and Shanghai Comp. (-2.5%) conformed to the downbeat mood with Hong Kong dragged by notable losses in its tech sector and with Chinese property names also subdued amid ongoing Evergrande woes

Top Asian News

- Asian Stocks Slump to 14-Month Low on Concerns Over Fed, Ukraine

- Bear Markets, Corrections Loom for Many Asian Stock Gauges

- Shimao Dollar Bonds Jump on Asset Sale Report: Evergrande Update

- Korea Considering Fully Resuming Short-Selling in 1H: Yonhap

European bourses are firmer taking the lead from the resurgence in Wall St. trade that they failed to benefit from yesterday, Euro Stoxx 50 +0.7. Sectors are all in the green in Europe though defensives are the relative laggards. Stateside, US futures are pressured with the NQ (-1.4%) the current underperformer after yesterday’s turnaround and as yields climb Volkswagen (VOW3 GY) is to collaborate with Bosch on automated driving software, could be sold to other autos in the future. Level 2 ‘hands free’ technology to be deployed in the Volkswagen fleet in 2023. Nvidia (NVDA) is said to be preparing to ditch its takeover of Arm, according to reports; subsequently, a spokesperson states that they continue to hold views expressed in detail in the latest regulatory filing.

Top European News

- Deutsche Bank Blames Client in $565 Million FX Mis-Selling Suit

- Oil Buyers Snap Up Diesel-Rich Crude as Omicron Fears Abate

- Swedish Sex-Toy Retailer Purefun Seeks SEK250m Valuation in IPO

- Kuwait Refers Army Officers for Prosecution in Eurofighter Deal

In FX, the DXY nudges further over 96.000 as hawkish FOMC expectations overshadow less supportive risk dynamics, but the Franc loses safe haven appeal across the board in what appears to be an orchestrated effort to curb demand. Euro fails to benefit from a better than expected German Ifo survey on balance, as technical impulses and yield differentials weigh. Pound relatively resilient as policy probe PM Johnson and Tory party for potential lockdown breaching events. Loonie holds off lows awaiting BoC amidst forecasts for an early hike. Aussie also underpinned by further predictions for the RBA to bring forward tightening after stronger than anticipated Q4 inflation data. CBRT opens a gold swap auction via the traditional method for 20/T of gold, three-month maturity.

In commodities, WTI and Brent March contracts have continued to nurse yesterday’s losses, with the benchmarks picking up further with geopolitics around Ukraine, China and North Korea dominating newsflow. WTI March is back on a USD 84/bbl handle (vs USD 83.43 intraday low) while its Brent counterpart reclaims USD 87/bbl from a USD 86.50/bbl daily low. Spot gold and silver are subdued amid USD upside, and as such remain comfortable above a number of DMAs that have drawn recent focus; while LME Copper is modestly softer in familiar ranges

DB’s Jim Reid concludes the overnight wrap

At one point yesterday it felt like we were in a full blown crisis let alone a recession. At Europe closed their laptops down the S&P was as much as -3.98% lower, which would have been the worst daily return since June 2020. The NASDAQ was -4.90% lower, the worst potential close since September 2020. However at that point Manic Monday turned and remarkably the S&P 500 (+0.28%) and NASDAQ (+0.63%) closed higher. The volatility continues this morning though with S&P 500 futures down -1.1% and Nasdaq futures -1.4%. Note that earning season starts to get going with some momentum today. The highlights of those reporting are in the day ahead at the end but Microsoft is probably the biggest and most important.

This morning Asian markets are trying to come to terms with the sharp down, sharp up and then down move and are trading lower. The Kospi (-2.86%), Nikkei (-2.14%), Hang Seng (-1.59%), Shanghai Composite (-1.12%) and CSI (-0.80%) are all around the lows for the session as we type. It could be all change by the time you read this though.

Reviewing the US session in more detail now and cyclical sectors staged an impressive rebound, led by discretionary (+1.21%), energy (+0.55%), and industrials (+0.53%) stocks while defensives lagged, with the three worst performing sectors being utilities (-1.03%), health care (-0.37%), and consumer staples (-0.35%). Itwas interesting that the reversal was so broad-based. With a market this concentrated among mega-cap stocks, it’s usually safe to assume a few big names drove the changes in the headline index, but the FANG+ index was actually lower by -0.91%. Amazon was emblematic of the broader move, however, declining more than -5% intraday before finishing +1.33% in the green, but it looks like its fortunes were tied with the broader recovery in discretionary stocks than its status as a mega-cap. At the end of the day, 320 stock prices advanced. Much like the turns-for-the-worse last week, the reversal in fortunes came absent a clear catalyst, which is much more common when volatility is this high. Speaking of this the Vix index of volatility also took an intraday round trip, increasing +10.08pts before ending the day just +1.27pts higher at a still-elevated 30.12pts, right around levels seen during the initial Omicron outbreak.

This late rally left European bourses behind, with the STOXX 600’s decline (-3.81%) marking it the worst daily performance since June 2020, with indices slumping across the continent including the DAX (-3.80%), the CAC 40 (-3.97%) and the FTSE MIB (-4.02%). After the US rebound but the Asian falls Stoxx futures are only +0.7%.

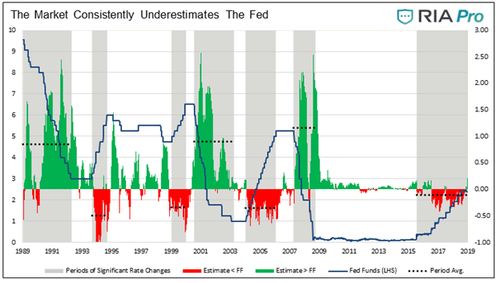

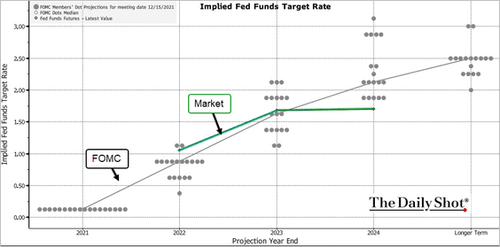

The current high volatility in markets comes as the FOMC are set to begin their two-day policy deliberations today.

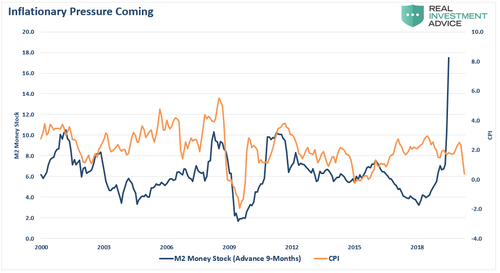

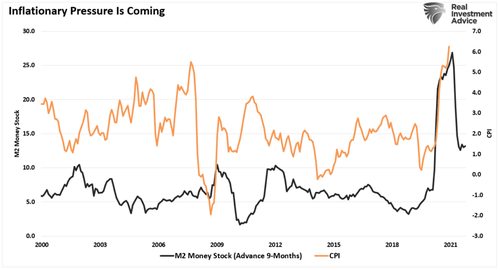

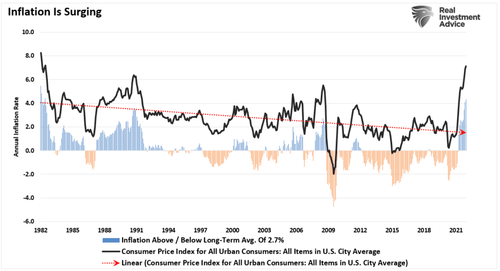

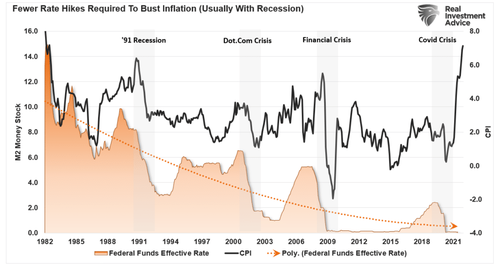

The year-to-date selloff in risk assets was sparked by the release of the December FOMC minutes in the first week of January, when investors took fright at the possibility of a more hawkish Fed over the coming months. So will Powell change the mood tomorrow night? With inflation at 7% that’s tough but we might get an idea of how much financial conditions tightening will frighten the Fed and how much they are actually comfortable with.

While markets are certainly concerned about the Fed and other central banks right now, the market also has to contend with the backdrop of an increasingly hostile geopolitical environment, with tensions ratcheting up continuously between Russia and the West. Reports note both sides are increasing their troop presence and putting current troops on higher alert within the region, while western leaders including Presidents Biden and Macron, Chancellor Scholz, and Prime Minister Johnson reportedly had a productive call on western cooperation on Ukraine issues. Separately, there was a meeting of EU foreign ministers that was joined by US Secretary of State Blinken, and the EU reiterated its warning that “any further military aggression by Russia against Ukraine will have massive consequences and severe costs”. The latest developments saw Russian assets lose further ground yesterday, with the Ruble down -1.68% against the US Dollar, whilst Russian equities underperformed globally, with the MOEX Russia index down -5.93% by the close but before the US bounce. Meanwhile European natural gas futures surged again given the higher perceived risk of conflict, with the benchmark future up by +17.75%. For those wanting further info, our colleagues in CEEMEA research put out a note on this last week (link here).

Back to yesterday, and there were few places in markets immune to yesterday’s volatility, with oil prices giving up a decent chunk of their recent gains from the European afternoon. By the close, Brent Crude was down -1.84% and WTI had shed -2.15%, marking the worst day of 2022 so far for both of them. Indeed, commodities more broadly lost ground, with copper down -2.14%, which is often taken to be a key industrial bellwether. Oil is back up around +0.5% this morning.

Amidst the woes for markets more broadly, sovereign bonds were fairly subdued, with the long-end of the Treasury curve selling off from intraday lows in line with the turn in risk. Yields on 10yr Treasuries increased +1.3bps to 1.77% (1.755% in Asian), with real yields declining -3.8bps but breakevens cancelled out the decline by rebounding alongside equities late in the afternoon, ending the day +4.9bps higher. Breakevens moved with risk assets on the day, so the price action seemed to reflect the broader growth outlook rather than incremental updates to the Fed’s inflation-fighting bona fides, having already declined -22.9bps from the start of the year’s hawkish pivot.

In line with the turn in risk, the 2s10s US yield curve bounced from intraday lows of 70.3 bps to increase +4.5bps to 79.5bps at the close. However it’s back down to 74.5bps in Asia but 2-3bps of this is a 2yr benchmark change. The rally in the front end of the curve left the market pricing 3.83 Fed hikes this year, the lowest level in more than a week. Faith in the Fed put is alive and well. The probability of March liftoff dipped as well, with the market pricing 98.5% chance of a rate hike. As I wrote in my latest chartbook, the 2s10s is one of the best recessionary indicators and a classic late-cycle signal, and it’s lost around half its steepness in less than a year, having peaked at 157.6bps at the end of Q1 2021. However don’t let’s get too ahead of ourselves. It hasn’t inverted yet so recession is likely someway off yet even if we’re moving in that direction. Over in Europe, sovereign bond yields wound up the day a little lower, having missed the late selloff, with those on 10yr bunds (-4.2bps to -0.11%), OATs (-2.8bps) and gilts (-4.5bps) seeing declines, thus coming off their recent highs last week that saw 10yr bund yields back in positive territory at one point in trading.

Staying on Europe, our economists updated their ECB call yesterday (link here), and are now expecting liftoff to begin in December 2022 with a 25bp hike. Given the latest upgrading of their inflation forecasts, this means that the ECB’s “triple lock” criteria for liftoff will be met earlier, potentially as soon as the end of this year, with the ECB set to act at the start of this window. And as well as bringing forward the timing of liftoff, they’ve also accelerated the pace of tightening, and now see 25bp hikes in the deposit rate each quarter until rates hit +0.5% in September 2023, followed by less frequent hikes.

Earlier this morning, South Korea’s Q4 GDP expanded +1.1% q/q, in line with market expectations, up from a +0.3% rise in the third quarter. For the full year, the economy grew +4.0%, recording the fastest pace of growth since 2010 buoyed by a jump in exports and corporate investments and rebounded from the previous year’s -0.9%.

Given the array of other events yesterday, the flash PMIs for January took a bit of a backseat relative to normal. They showed a fairly divergent picture across the global economy, with surprises to the upside and downside depending on the country. For the Euro Area as a whole, the composite PMI fell to an 11-month low of 52.4 (vs. 52.6 expected). However, that came as the manufacturing PMI rose unexpectedly to 59.0 (vs. 57.5 expected), whereas the services PMI fell to 51.2 (vs. 53.1 expected). In Germany, there was a significant upside surprise as the composite PMI rose to 54.3 (vs. 49.4 expected), but France’s fell back to 52.7 (vs. 54.7 expected), as did the UK’s to 53.4 (vs. 54.0 expected). Over in the US, there were downside surprises there too, with the services PMI down to an 18-month low of 50.9 (vs. 55.4 expected).

To the day ahead now, and data releases include the Ifo’s business climate indicator from Germany for January, along with the US Conference Board’s consumer confidence indicator for January. Earnings releases include Microsoft, Johnson & Johnson, Verizon Communications, NextEra Energy, Texas Instruments, American Express, General Electric and Moderna. And on top of that, the IMF will be releasing their World Economic Outlook Update.