Authored by Bill Blain via MorningPorridge.com,

“Without Energy-Security, no nation is sovereign.”

It’s easy to say no to an investment likely to generate hostile news. It’s simple to go along with increasingly Militant ESG rhetoric on gas to avoid negative headlines. But – we will fail to reach Carbon Net-Zero unless gas remains part of the transition equation and governments get a grip on energy strategies.

Yet again I’m going to highlight how blinkered ESG (Environment, Social and Governance) thinking could be driving us all towards climate and economic disaster..

Let me share a few snippets from what’s been a fascinating week for Energy, climate change and energy transition.

-

Oil headed for $100.

-

Chinese coal production has hit a record high.. up 7.2% yoy to 390 million tonnes in Dec 2021. It will use over 4 billion tons this year. It used less than 50 million tons per month in 2000.

-

France, Germany and the UK all fired up coal stations due to a January blocking high shutting down the wind.

-

1/5th of France’s nuclear power stations are currently “under repair”. Germany’s are closed. The UK’s new ones look stalled in cost overrun.

-

UK consumers face a brutal cost of living crisis on the back of soaring energy bills.

-

The Scots’ government is celebrating a windfall £700mm from selling a clutch of offshore wind licences.

-

The EU may withdraw low Co2 Natural Gas and Nuclear power from its green energy taxonomy.

-

A La Nina cooling event meant 2021 was only the 7th warmest year on record – but the last 7 years have been the warmest series on record..

And, Larry Fink (the brains behind the biggest investor on the planet; Blackrock) was lambasted by ESG and environmental zealots for the heinous thot-crime of suggesting Gas might be part of ongoing energy transition.

Shock. Horror… Burn the Heretic!

I genuinely fear the tail is wagging the dog when it comes to climate change and energy transition.

There is a distinct lack of joined-up planning to solve the complex issues of a) weaning the global economy off fossil fuels while b) maintaining economic growth. Governments are failing to direct energy transition strategies necessary for part a. They have effectively surrendered the narrative to populists and environmentalists, who completely ignore the economic growth (part b) of transition.

The populists now own the climate change agenda – and I congratulate them for raising awareness. They are well-intentioned, but have set a Militant ESG tone oblivious to the reality that a chaotic mass shutdown of energy sources they object to, (primarily fossil fuels but also nuclear), could leave the global economy shuttered and in an even worse state than rising global temperatures. They have seized the agenda because no one was willing to object.

There are solutions, and net-zero can be achieved.

Recently I covered how we can get to Carbon Net-Zero in the Morning Porridge. We can innovate a mix of the downright obvious and relatively cheap schemes to save us from climate change chaos. We can become more efficient, reforest vast swathes of land, improve soils, build more renewables, while saving costs, time, effort and resources by defocusing the expectations being placed on expensive unproven technologies. My note was written based on research from the top energy analysts; Thunder Said Energy. You can read the article here: “Energy Transition and Why We Should Not Panic.”

One of the key points for an affordable and effective Net-Zero Carbon by 2050 plan would be to swiftly replace the worst carbon polluter, Coal, with cleaner Natural Gas, and over the coming decades gradually replace Gas with new more efficient and diverse renewable power. To speed up the process we could invest more and more thoughtfully in Nuclear.

Unfortunately, as we saw at the COP26 conference, Militant ESG is close to achieving a stranglehold on investment decisions. Gas is Fossil therefore Gas is Evil. Nuclear is not much better.

In every single discussion I have with fund management professionals – my day job – the subject of ESG comes up. Chief investment officers and senior fund managers all tell me the same things. Their investors insist on knowing how their money is being invested in a green and sustainable manner – because their investors apparently want to be green. Their investment committees block anything with a whiff of ESG difficulty. ESG is now the single most important investment parameter when making investments. And no Asset Management or Corporate CEO wants to risk facing down angry environmental protesters because he/she has proposed or funded gas or nuclear investments.

It’s easier to say no than it is to say yes when it comes to “challenging investments” – which leads to underinvestment.

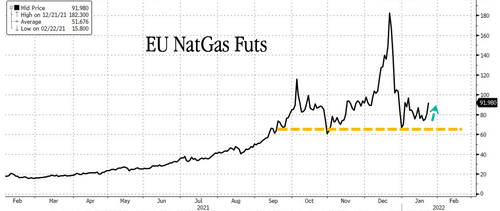

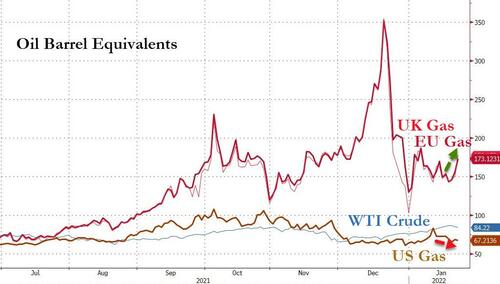

Which is broadly the reason why Gas prices in Europe spiked 800% at one point last year, and are likely to spike again in the next freeze. (It’s also why the price of oil-major stocks have soared.) Lack of investment leaves Europe vulnerable to energy insecurity, facing ruinous energy bills and potential stagflation following what is clearly an energy-price-shock.

It was one remarkable line in a recent Morningstar sustainability report that set me off yesterday afternoon. I read Morningstar’s Head of Sustainability saying: “I was disappointed Fink saw fit to tout the ongoing importance of natural gas as a transition fuel..” It shows how firmly established the anti-Gas lobby within finance has established itself. The Morningstar guy then whittered on about the importance of stopping all fossil fuel finance to get to net-zero faster. It’s all utter Bollchocks!

Fink has done much to reset the way we think about investment. He appeals to wishy-washy champagne socialists (like myself), allowing us to gloss over the evils of capitalism by embracing it in the guise of Stakeholder Capitalism: the belief if everyone in any venture gets consideration; communities, employees, and shareholders then we all win. The gist is shareholders will benefit most when all stakeholders benefit by ensuring effective and efficient allocation of capital and sustainable returns and profits for the long run. Simple stuff – everybody benefits – and I subscribe to it.

But, I draw the line at Militant ESG.

Fink made the unforgivable mistake of daring to suggest it’s in interest of companies to think about gas as part of their energy transition plans. A campaign manager from the Sierra Club is quoted in the article: “Fink is insisting on continuing to prop up dirty fuels like fracked gas and peddling the dangerous and outdated view gas has a place in energy transition, despite the scientific consensus we need to stop expanding fossil fuels immediately.”

What was Fink supposed to say? Did the truth hurt? Should he support Morningstar’s false narrative and self-appointed role of being ESG’s fanatical Sustainability Inquisition? Play along with the falsehood that we can only save the planet by dropping hydrocarbons to invest quintillions in more wind farms, hydrogen, and anything else that might work, while dooming us all to negative growth by switching off every fossil fuel power plant yesterday?

Sadly, ESG has become a straightjacket rather an enabler of energy transition.

We are now in danger of investing our climate “eggs” into either a very limited number of unreliable, but easy to achieve baskets delivering short-term happiness, and a host of medium term improbables, which will not solve the long-term need for sustainable new power security to keep the wheels of the global economy rolling.

Militant ESG has stifled debate on how to reach carbon neutrality while keeping global growth, literally, fuelled!

Increasingly it feels like we’re making the mistake of thinking we can replace fossil fuels overnight by placing our climate bets on attractive sounding, but very expensive, unproven and improbable climate solutions because they sound exciting, look sexy, and offer apparently unlimited economic upside. Lots of climate change projects are getting bandwidth because the world has become a very credulous place, believing whatever a well-constructed social media/marketing campaign tells them.

Take the Scottish licences this week. They will create jobs and result in very expensive floating wind platforms – delivered at far greater price, but no more reliable or even maintainable as current fixed wind farms. They will no doubt they will provide nice clean energy… when the wind blows – but a massive cost.

On the other hand, the failure to move on Nuclear power makes zero sense. Large power stations are proving too complex and unreliable (see France and China) or too expensive (the UK). Yet, plans from Rolls Royce to develop smaller, cheaper, safe mini-nukes seem to be going nowhere. Is it because Govt isn’t willing to address the nuclear issue for fear of protests?

Meanwhile, we seem intent on rolling down a whole series of distracting tech paths to carbon neutrality – like steel without coal, CO2 air extraction and ecofuels. But not all tech works or is economic. Look at the discard pile in any patent office. The number of industrial solutions that become long-term is very limited. There is no such thing as a perpetual motion machine, and when it comes to gambling on our environment – we need better.

Some of the potential failure points are becoming obvious. In Tesla’s case, Elon Musk has become the world’s richest man convincing us EVs are a critical part of greening the global economy, but lithium batteries are old tech (basically torch batteries linked up in series), and an evolutionary and recycling dead end. Lithium is scarce and its price is shooting up – meaning EVs will likely price themselves out the market – unless we find something else.

Everyone thinks Hydrogen will be the next big thing – but the costs of building hydrogen infrastructure to charge fuel cells will be huge! (Even more expensive than the complete rebuild of national grids 50% EV adoption will require.) Hydrogen engines are going to be massively over-built because the hydrogen atom is so tiny it can seep out of any containment structure. As I said earlier this week – forget Hydrogen powered aircraft.

I do appreciate that writing about the failures of climate change and energy transition and how ESG threatens to derail the process will probably get me cancelled. My views on the subject means much of the media is now closed to me. I have been dismissed as crank by the emerging ESG industry that’s sprung up to service the multitude of ESG roles that have sprung up across the financial industry.

Before you cancel me as a climate sceptic – I absolutely accept the science of climate change. It’s critical we address the world heating up because of the industrial age spike in carbon emissions and greenhouse gasses has triggered a chaotic rise in temperatures. I’m also happy to accept the clear evidence the Earth also has natural warming and cooling cycles, but on the basis real climate scientists think the consequences of 200 years of “Anthropocene” activity are not normal – I’m prepared to take it very seriously.

Addressing the damage being done by pumping greenhouse gases into our perilously thin atmosphere gets my vote – every time. But we need to address it pragmatically – not emotionally as ESG is now doing.