In a remarkable show of force and unity, western powers cast aside all their previous concerns about Russian energy supplies and uniliaterally announced the nuclear option of imposing sanctions on the Russian central bank coupled with targeted exclusions from SWIFT of key Russian banks.

- *EU APPROVES BANNING ALL TRANSACTIONS WITH RUSSIAN CENTRAL BANK

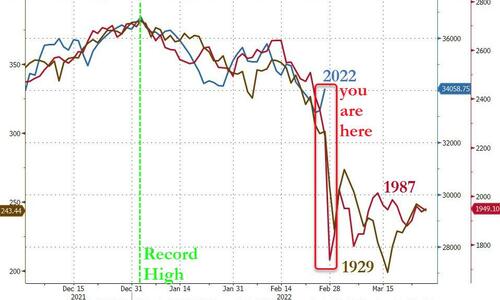

The move has sparked a bank run in Russia, as locals scramble to pull out whatever hard currency they can get their hands on before it runs out, and is certain to trigger chaotic moves in FX and commodities when markets reopen in a few hours. Already some Russian banks are offering to exchange rubles for dollars at a rate of 171 rubles per dollar on Sunday, compared to the official closing price of 83 on Friday before the European/US announcement about targeting the Russian central bank. In other words we are looking at a 50%+ devaluation of the Ruble. Additionally, widespread announcements of divestments in Russian equities by the likes of BP pls and the Norwegian sovereign wealth fund mean that the Russian market will be a bloodbath on Monday.

As Bloomberg notes, commodities are heading for a manic start to the week as investors scramble to assess how the West’s latest sanctions on Russia will affect flows of energy, metals and crops.

The coming days are fraught with event risk for crude, even aside from the sanctions fallout. There’s a midweek meeting of OPEC+ on output; the Biden administration may tap stockpiles; and Iranian nuclear talks look to be nearing a conclusion. On top of that, American crude inventories at the key Cushing hubcould sink to the lowest since 2014 if there’s another modest draw.

Meanwhile, Goldman Sachs said that despite the rally in prices, it’s unlikely OPEC+ will choose to quicken the pace at which the alliance has been restoring supplies, citing Russia’s “essential role” in the grouping.

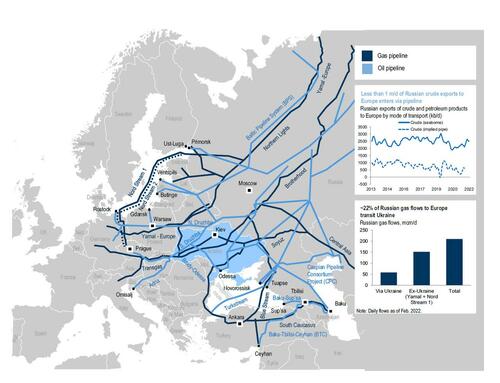

And while Europe’s moment of unity is certainly inspiting, it doesn’t answer the question just how the continent will replace the massive amount of energy that flow every single day via the countless Russian pipelines into Europe, which are now for most intents and purposes shut.

But a bigger question – and one which has so far not been pursued – is what happens to the western financial system as a result of the sudden expulsion of Russia – and its billions of dollars – from the global monetary system.

One somewhat dire take comes from Bear Traps report author Larry McDonald who writes overnight that we need urgently to know what is actually sanctioned here: “They – Olaf – Macron – Biden – will try and dance around risk with a targeted swift but they’re probably not qualified to do so” adding that “It’s like a Lehman weekend with clueless politicians trying to find risk in the dark.“

“If they sanctioned the central bank and the transfer agents for Eurobonds then Russia will default on all foreign debt immediately. And if Russia tries to find a back door through China we will fine or sanction Chinese banks. Another thing, Germany can play swift tough guy but Macron has to protect most vulnerable Soc Gen and Draghi is probably trying to protect vulnerable Italian banks like intesa.”

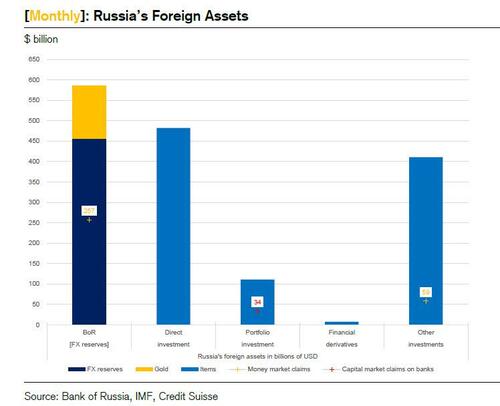

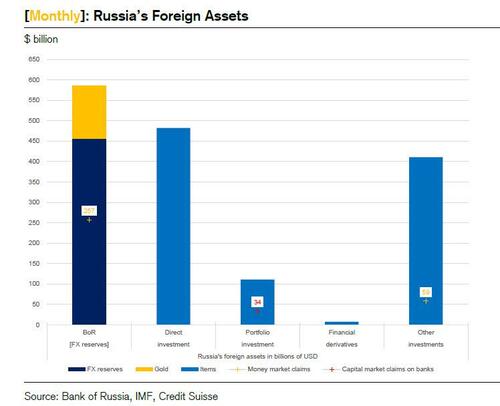

While that take may be a bit extreme as it presupposes Europe has rushed into the wholesale sanctions without any backup plans, a more nuanced take comes from Credit Suisse repo guru and monetary plumbing expert, Zoltan Pozsar, who took a detour from his extensive narrative of how the Fed’s QT will impact the market and instead focuses on what could be a “Lehman weekend” for funding markets as a result of Western sanctions on Russia which as Zoltan notes is a “surplus agent” – i.e., an entity which typically lends a lot of funds in the Eurodollar market. The Bank of Russia has over $450 billion in non-gold FX reserves, and the private sector has over $500 billion of liquid investments as shown below

First, some background on where Russian central bank assets are located

As shown in the chart below, of Russia’s close to $1 trillion of liquid wealth, just over $300 billion is in short-term money market instruments, and Pozsar estimates that about $200 billion of this represents the lending of US dollars in the FX swap market.

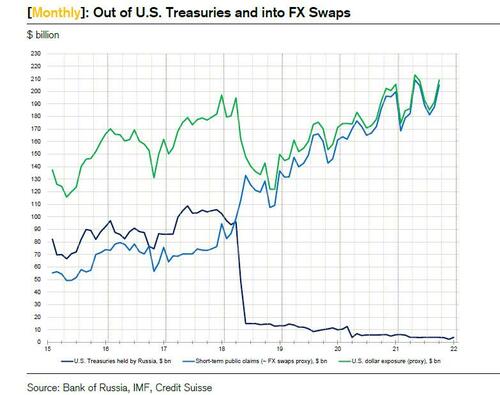

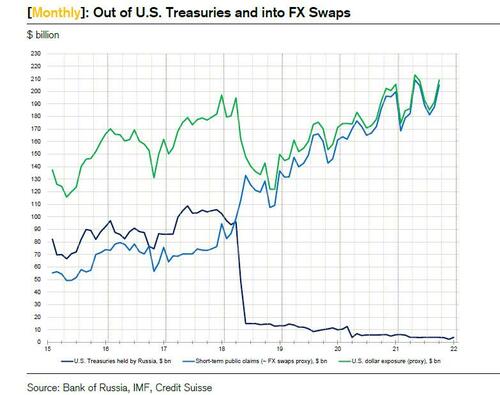

This, however, is not immediately obvious from the Bank of Russia’s reports, which as the Credit Suisse strategist notes don’t mention FX swaps and list only about $100 billion in US dollar exposures. As such, Pozsar cautions that the published numbers require careful interpretation: Thus, according to the Bank of Russia’s latest Foreign Exchange and Gold Asset Management report, U.S. dollar assets made up about 20% of Russia’s non-gold FX reserves at the end of June 2021, which is way down from 50% at the end of March 2018

As a reminder, in April 2018, Russia sold all its cash Treasury securities – both the central bank and the private sector – but as Zoltan notes, there are tell-tale signs in the data that the proceeds from these sales went into the FX swap market. In other words, “FX reserves are still in U.S. dollars, but not onshore. They are offshore in the Eurodollar market.”

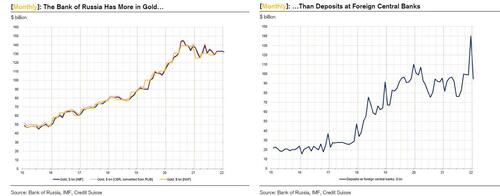

As further proof that Russian reserves have entered the swap market, Pozsar notes a substantial increase in Russia’s claims on foreign central banks after it sold U.S. Treasuries (see chart belowe), adding that on-balance sheet manifestations of FX swaps (the spot sale and forward purchase of U.S. dollars for other currencies) are non-U.S. dollar assets that the lender of U.S. dollars buys with the local currency collateral received against U.S. dollars: “For central banks, these are typically deposits at other central banks.”

Chasing the trail of where Russian central bank reserves can be found, Figure 3 shows the big increase in the Bank of Russia’s claims on foreign central banks and the typical year-end spikes that come as lenders in the FX swap market lend more to harvest year-end funding premia: “In recent years – because QE during the pandemic compressed dollar premia – the data also shows a shift in the reinvestment strategy toward short-term debt issued by supranationals.” The chart above shows Zoltan’s estimate of the Bank of Russia’s U.S. dollar exposure with adjustments for dollars lent through FX swaps. The share hasn’t much changed since 2018 – it’s still about 50%, which is more reasonable than the reported 20% for a country that is a big exporter of commodities priced in U.S. dollars.

Assuming that Russia has roughly $200 billion in FX swaps, the Hungarian repo expert then points the Bank of Russia and the private sector have claims on foreign banks in the form of deposits in the amount of about $50 billion each – likely a mix of euro- and U.S. dollar- denominated deposits, which is how Zoltan arrived at the $300 billion total above.

Market Impact of Sanctions

If Russian short-term money market instruments are roughly 30% of its total liquid wealth of $1 trillion, as the above calculations suggest, Zoltan then warns that “$300 billion deployed in the money markets is a lot. $300 billion is enough to push spreads around in funding markets.” He then goes on to note that “$300 billion – in the extreme – can either be potentially trapped by sanctions, or moved somehow from West to East to avoid being trapped by sanctions. Each would be a market event.“

What happens if the funds get frozen through sanctions – an event which the CS analyst says “would turn a surplus agent into a deficit agent, which in turn would lead to missed payments, much like the onset of Covid-19 led to missed payments and turned surplus agents into deficit agents.”

The downside case if indeed this is similar to the start of Covid when overnight trillions in short-term funding markets were frozen, is something the market should discount according to Pozsar. Alternatively, as he explains it more simply, “consider the notion that if you owe the bank $1 million, that’s your problem, but if you owe the bank $1 billion, that’s the bank’s problem.“

One potential loophole Russia has is that as surplus agent, it can move surplus funds from Western financial centers and institutions to financial centers, financial institutions, and central banks elsewhere (i.e., in the east, such as China) that would then re-cycle surpluses back into the financial system.

However, that would mean the partial “tear-up” of matched FX swap books and outflows of operating deposits (as public and private surpluses are moved, respectively) from Western banks. But that would be their funding problem – as deficit agents, these institutions may then have to tap the dollar swap lines.

And here things start getting ugly, because as Pozsar puts it, “when flows change, spreads can gap.”

Escalation and central bank response

Conceding ahead of the weekend’s escalation that he is no expert on geopolitics, nor does he know which way events will unfold either on the ground or in the domain of sanctions, Pozsar cautions that “if things escalate, it’s hard not to see a direct impact on FX swaps and U.S. dollar Libor fixings given Russia’s vast financial surpluses and where those surpluses are deployed.” Or as he put it “

Whoever moves first, there is a funding impact either way…”

Which brings us to Pozsar’s latest must read note (available to professional subs), which was published after we learned that the Russian central bank will be sanctioned effectively triggering the worst case scenario for funding markets, and in which Pozsar writes that “I’ll never forget the late-night briefing on Friday before Lehman’s bankruptcy where according to one line of argument Lehman’s problems were so widely understood that the system had enough time to hedge itself so that the actual default would be manageable.” Well, as he sarcastically notes, “It didn’t turn out like that” adding that “if a bank closes a $200 billion balance sheet on Friday and doesn’t open on Monday, someone’s $200 billion wasn’t hedged by definition.”

The same applies with exclusions from SWIFT. According to Pozsar, exclusions from SWIFT “will lead to missed payments and giant overdrafts similar to the missed payments and giant overdrafts that we saw in March 2020.”

As a reminder, back then Zoltan was perhaps the first to warn – loudly – that “supply chains are payment chains in reverse” and that lockdowns would lead to missed payments everywhere. Today, all global payments go through SWIFT (including payments for commodities) and so the Credit Suisse strategist notes that “exclusions from SWIFT will lead to missed payments everywhere again” or as he puts it, “Just as covid virus froze the flow of goods and services that led to missed payments, war has led to exclusions from SWIFT that will lead to missed payments again…. But by design, and not without a risk of retaliation: if a freeze in activity can lead to missed payments, an inability to receive payments through SWIFT can freeze the flow of goods, services, and commodities like gas or neon in kind.

Being a monetary plumbing expert, Pozsar is in his prime to warn that “we are dealing with pipelines here – financial and real. In the present context, they are two sides of the same coin. Inability to receive may mean unwillingness to send. Commodity flows aside, one would assume that central banks would re-activate daily swap line operations now that the SWIFT option got invoked.

In other words, central banks should stand ready to make markets on Monday again.

As an aside, the Russia central bank appears to have anticipated at least a part of the current escalation, because as noted above, “the Bank of Russia (BoR) has neither Treasuries to repo with the new FIMA repo facility, nor dollar swap lines with the Fed, and if its assets are frozen, it can’t raise dollars to provide for its domestic banks.” It does, however, have swap lines where the rehypothecation pathway can be severed… and it also has lots of gold.

Why does that matter? Well, as Pozsar explains in a quick crash course on “moneyness”, central bank deposits, bank deposits, and securities are all “inside money” – that is, money and money-like claims that are someone else’s liability – and it’s situations like this when “outside money” – money claims like gold bullion that are no one’s liability – is king, especially if stored in vaults domestically. Unlike balances at the Deutsche Bundesbank, western G-SIBs, or Euroclear, you control what you have.

The best example of course is Gold, which is a sovereign’s money under the mattress, and as Pozsar notes, “the Bank of Russia has more of it than deposits at foreign central banks!”

The silver, or rather golden lining for Russia, is that gold can be pledged under repo operations to cover one’s dollar needs (something which both Venezuela and Turkey have done) with a willing, collateral-rich central bank that has enough Treasuries to repo (such as China), or perhaps even the BIS (which owes its origin to reparation payments), and one can accumulate dollar surpluses anew through ongoing commodity exports away from financial centers in the West by seeding financial centers in the East.

Indeed, As Pozsar puts it, “the options appear limitless”, as long as there is a willing counterparty to transact with Russia:

- U.S. dollars from Treasuries via repos.

- U.S. dollars from local currency via FX swaps.

- U.S. dollars from gold via whatever we’ll end up calling that…

But this is where the repo plumbing guru warns again that such “transitions are never smooth” especially since “banking is about double entry bookkeeping: My assets are your liabilities like the blue and red veins in a body in one’s elementary biology book.”

Lehman weekend 2.0

Which brings us to the punchline of Pozsar’s warning: “there is no difference between Lehman unable to pay back money funds because its tri-party clearing agent is unwilling to unwind o/n repo trades, and banks unable to receive and make payments because they are out of SWIFT.” He then adds that the Herstatt risk – or settlement risk – owes its name to a mishap at a single bank, but “the risk in the current scenario involves an entire country’s banking system.”

And here comes Pozsar with another Lehman analogy:

Banks’ inability to make payments due to their exclusion from SWIFT is the same as Lehman’s inability to make payments due to its clearing bank’s unwillingness to send payments on its behalf. History does not repeat itself, but it rhymes…

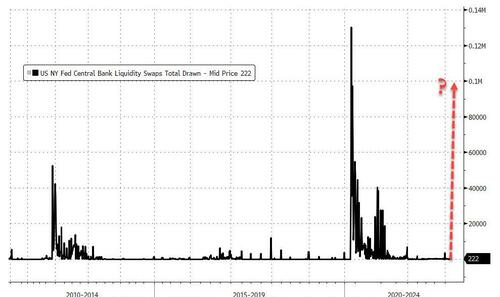

The bottom line from Pozsar, and one which western leaders appears to have ignored in their pursuit of a unified statement against Russia, is that “the consequence of excluding banks from SWIFT is real, and so is the need for central banks to re-activate daily U.S. dollar funds supplying operations.”

And just to underscore the point of how serious it will get in the coming hours (not days), the Hungarian warns that “excess reserves and o/n RRP balances won’t be enough.” Instead, we will see the Fed’s most powerful stabilizing intervention in play: a spike in liquidity swaps, which are currently at zero.

As Pozsar concludes, it appears that the Ukraine war has translated into yet another Fed balance sheet-boosting crisis just like covid, and “so the Fed’s balance sheet might expand again before it contracts via QT – and not just because of the swap lines. The FIMA repo facility is also there to turn collateral into dollars – anonymously, away from the prying eye of dealers, if a central bank becomes a friendly correspondent for a sanctioned central bank turning gold into cash.”

That, or an unforeseen call on unwanted reserves in the o/n RRP facility as the correspondents flood the repo market with collateral before QT even began.

And just like that we are back to square one: keep an eye on press releases from the Fed ahead of Monday’s open announcing the central bank’s readiness to keep the world flush with dollars as the Ukraine worst-case scenario is now reality.

The full Pozsar notes are available to professional subs in the usual place.