Three weeks ago, roughly around the time we would point out that equity market liquidity was at all time lows…

… a much more ominous liquidity problem was gripping the $23 trillion world of US Treasury debt.

As BofA’s resident bond plumbing expert and former NY Fed staffer Mark Cabana wrote on March 8 in a report whose title couldn’t be clearer (and which is available to pro subs in the usual place)…

… the recent elevated market volatility driven by the Russian invasion and ongoing conflict in Ukraine caused many to de-risk simultaneously, prompting a surge in market fragility in not only equities but also bonds. As a result, traders observed a wash out of popular rates trades: short front-end duration, flatteners, richer TU-OIS, and short belly TIPS.

This de-risking behavior – which comes just as the Fed ends its QE and is set to announce the launch of even more liquidity draining balance sheet reduction in just a few weeks – “leaves behind a market highly susceptible to liquidity issues” according to Cabana who warns that without a ceasefire or sharp moderation in tensions we expect UST illiquidity will persist, and more problematically, “Fed or Treasury actions may be needed to sustain UST market functioning.”

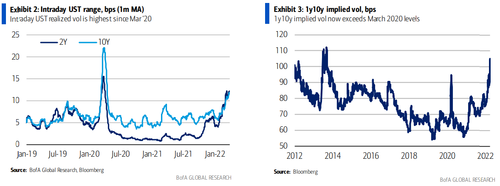

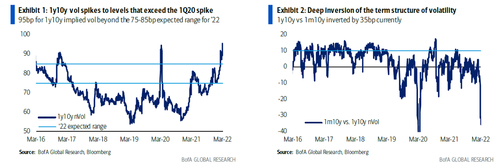

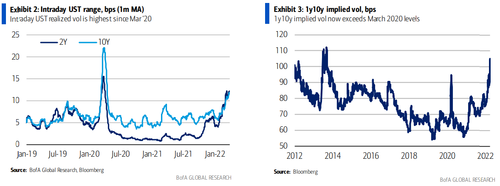

While most traders have already experienced it on their own, the degree of near-term uncertainty is clearly reflected in rates volatility by higher implied vols, exceeding levels reached at the peak of the covid uncertainty in 1Q20 and a deep inversion of the term structure of volatility.

The latter is particularly significant as fading these inversions (selling rich gamma vs buying intermediate vol) is quite attractive from a carry perspective (short theta), and indeed the right chart above shows that these inversions generally dissipate relatively quickly. The magnitude of the current inversion (35bp currently between 1m10y and 1y10y) as well as its length (the inversion has persisted and exacerbated since 10 Feb) expresses a significant degree of uncertainty in the market, of a similar degree to that seen over 1Q20.

It’s not just chaos over the Ukraine war however: the dynamic of TSYs in the recent risk-off context also reflects uncertainty around the utility of Treasuries for portfolios (a recent Bloomberg article was titled “Strategy With Crypto Beats 60/40 Portfolio During Russian War“). As a risk-off asset, USTs generally tend to overweight the tail scenarios relative to other assets, but recently we have seen some stickiness in the recent risk-off dynamic.

One of the likely drivers for this increased uncertainty relates to the current inflation context. The risk off dynamic has led to the pricing out of more aggressive 50bp hike scenarios for the Fed, but liftoff is likely to stay on track near-term. The first 100bp are justified & almost mechanical in the current inflation context but beyond that, the policy path may be more contingent on geopolitical scenarios, reflecting a Fed reaction function that may start to show concern for slower growth scenarios versus an inflation backdrop that is expected to ease over the year. It’s also why the rates market is now pricing in 3 rate cuts in 2023 and 2024 following the burst of rate hikes this year and next.

The Fed, however, is hell bent on raising rates until the low/mid 3’s, which creates scope for higher structural inflation and constrains the potential response of the nominal UST curve in a risk-off dynamic.

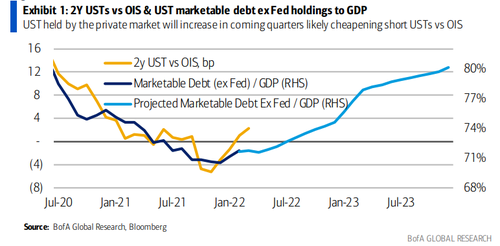

One would expect this change in Treasury utility (driven by a higher inflation context) to be more significant at the backend of the UST curve (which also matters more for tail-risk hedging). However, it does extend also to the front-end of the curve, likely compounded by liquidity concerns. Contrary to the historical pattern, we have seen a collapse of 2y spreads (2yT cheapening) as Libor/OIS spreads spiked wider in the geopolitical crisis.

Whatever the reason behind the shrinking liquidity, evidence of poor market functioning can be observed everywhere across the treasury curve, and is most thorny in sectors that typically demonstrate a liquidity discount.

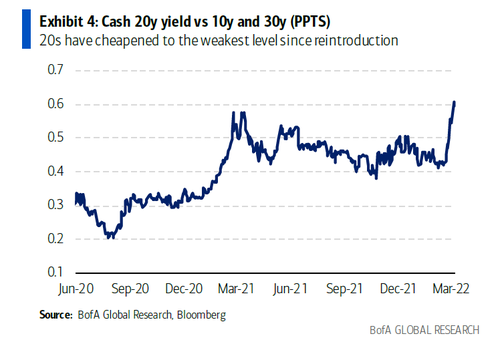

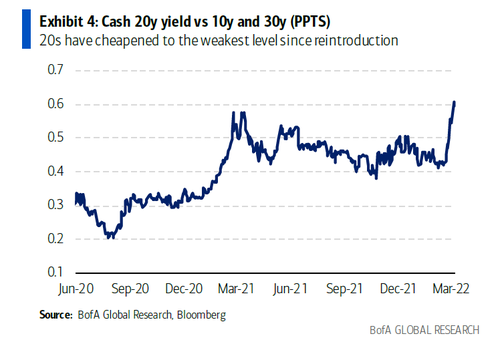

Twenty-year notes have cheapened on the fly to some of their weakest levels since their reintroduction in May 2020.

TIPS have seen some of the largest intraday swings over the last 5-years and off-the-run issues have cheapened versus on-the runs.

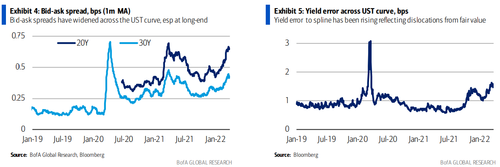

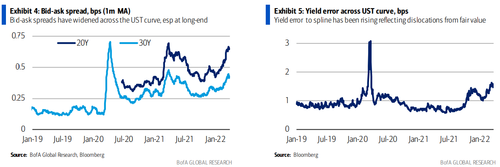

At the same time, elevated volatility has also led to a decline in liquidity measures, including through wider bid-ask spreads & spline error. There are also signs of thinning market depth as seen through the CME Liquidity Tool, which now shows some of the thinnest book depth (i.e., number of buy & sell orders at each price level) since 2020 across Treasury futures contracts

bid ask spreads have widened out and spline pricing error is also elevated.

Realized & implied UST vol have both spiked. The UST intraday range is the highest since Mar ’20 & registers at the 90th+ percentile for realized volatility over the past 5Y. Implied vol has also spiked as 1y10y now exceeds March 2020 levels and are at levels last seen in 2013. The surface is also deeply inverted with 1m10y vs 1y10y implied vols seeing the deepest inversion since March 2020.

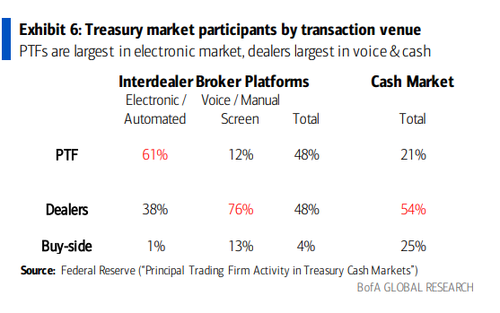

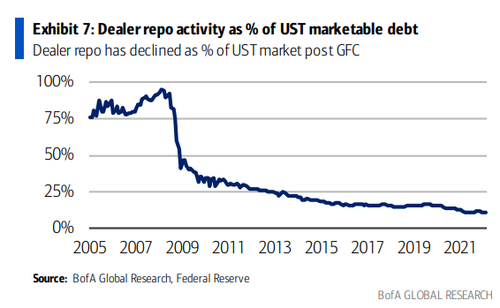

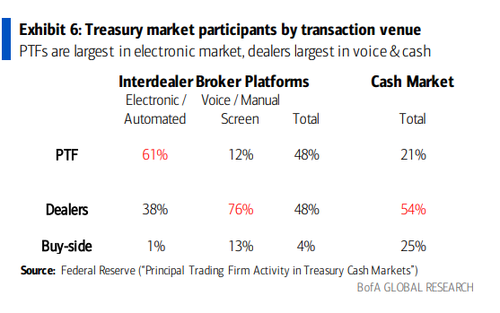

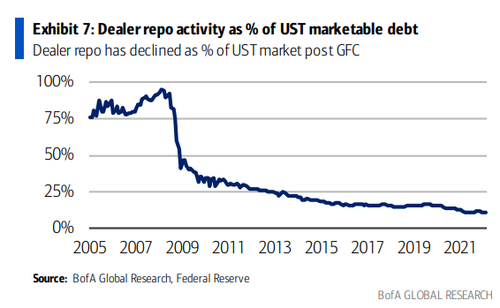

Besides growing fears of a secular shift in inflation, the very shifts in UST market structure are now amplifying volatility and illiquiduity. In a near and dear topic to this website which first cracked the scam that is High Frequency Trading back in 2009 long before Michael Lewis wrote FlashBoys, over recent years, high-frequency trading firms (aka principal trading firms or PTFs) have become larger not only in equities but also in the Treasury market while dealer activity has not grown with the UST market. The official sector defines PTFs as principals who trade for their own account, almost exclusively use automated trading strategies, and end each day with little to no directional exposure thus making them thinly capitalized. Dealers, by contrast, have historically been able to buy and sell from customers in large amounts, hold a portion of these positions across days, and maintain a large balance sheet to support positions.

Over recent years, PTF activity has increased in the Treasury market while dealer balances sheets & trading volume have been relatively stable. PTFs comprise the majority of electronic activity on interdealer broker platforms while dealers are still most active in voice & cash market activity.

Dealer trading volume & UST holdings have remained relatively stable but dealer balance sheets have materially declined as a percentage of total Treasury market size.

The increased role of HFTs and smaller relative dealer role vs UST market size can and will result in more limited UST liquidity during times of elevated volatility or stress. The official sector Interagency Working Group (UST, Fed, SEC, CFTC) has noted the risk of market making can be particularly relevant for PTFs “whose lower capitalization relative to dealers may leave them with less capacity to absorb adverse shocks.” This was true in March 2020 and we suspect it may be a factor with increased volatility today. The SEC has also recently announced greater PTF oversight by requiring them to become dealers.

Meanwhile, in another feedback loop, elevated UST volatility and thin market liquidity have likely caused a number of end investors to de-risk or reduce risk appetite, exacerbating current moves.

* * *

So what does all this mean going forward? Well, all else equal, treasury market functioning is expected to return as realized volatility declines… but all else is not equal, and a huge problem facing the Fed is that according to Cabana – who along with Pozsar was in charge of the Fed’s POMO/QE implementation – treasury functioning will be increasingly challenged by an accumulation of Treasury supply held in private hands, i.e., Quantitative Tightening.

To wit, BofA projects that Treasury supply will increase around US$3 trillion in the next 2Y due to large government deficits and aggressive Fed balance-sheet reduction. UST supply normalized for GDP is projected to increase back to mid ’20 levels by end ’23.

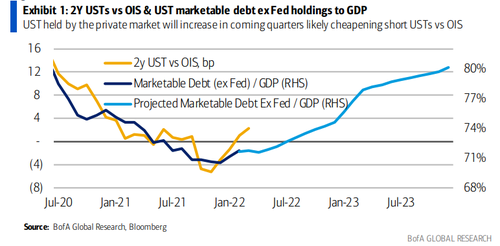

This means that already fragile TSY liquidity today may be exacerbated by the supply shift in coming months, especially after the Fed starts quantitative tightening (QT). And although short-dated USTs are rich today, Cabana thinks that investors should position for a cheapening starting mid-year with the supply shift and potential challenging liquidity: “Cheapening USTs are likely to

support tighter financial conditions that may ultimately require official action to contain.”

* * *

Putting it all together, in case it was not obvious yet, Cabana warns that Treasury liquidity is a concern ahead of supply shift”, i.e., the upcoming $3 trillion in Quantitative Tightening.

Some math: BofA projects that Treasury supply will increase around US$3tn in the next 2Y due to government deficits & aggressive Fed balance-sheet reduction. At the same time, Fed QT is expected to add nearly US$550-700BN to UST debt outstanding in each of next thee years. UST supply normalized for GDP is projected to increase back to mid ’20 levels by end ’23. Even assuming lower deficits in coming years as modeled by the CBO – which we truly doubt – these will at best limit coupon financing need but total UST supply growth vs GDP will still accumulate in private hands.

The bottom line: the already Fragile Treasury market functioning will only exacerbate the coming UST supply shift, especially given concerns about end-user demand. According to Cabana, bank buying has slowed with uncertainty around deposit & balance sheet growth, pension / insurance demand has been moderate despite their strong funded status, and hedged pickup of USTs to foreign

equivalents is set to decline.

To be sure, modest Japanese demand may pick up in April with the new fiscal year and that asset managers will find USTs increasingly attractive as a risk-off hedge (at some point). However, end-user demand is needed.

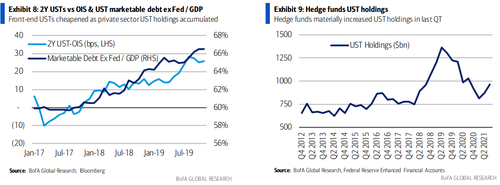

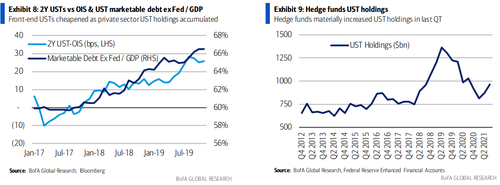

During the last QT episode, a similar supply accumulation increased cheapening pressure on USTs, especially at the front-end, leading to increased UST-leveraged demand. BofA’s measure of marketable debt ex Fed-to-GDP increased 6ppt during the prior QT episode, while 2Y USTs to FF OIS cheapened around 30bp. Treasury cheapening incentivized hedge funds to materially increase their UST holdings by US$585bn from QT start (4Q ’17) to finish (3Q ’19).

Cabana expects hedge funds to provide a similar source of demand but only if USTs are sufficiently cheap (read – yields are high enough) to encourage their leveraged participation.

The BofA strategist also expects a similar cheapening of Treasuries at the front-end during this QT episode, which could be exacerbated by thin UST liquidity. In other words, the official launch of QT in less than two month, could lead to a rapid bond market liquidity vacuum and subsequent crash, forcing the Fed to quickly find a justification to reverse its balance sheet shrinkage as the alternative is a complete lockup in the world’s most important market.

While this could be viewed as an exaggerated take, Cabana himself concedes that cheapening TSYs would support a broader tightening of financial conditions that could require official action to contain, and “The Fed, Treasury, and regulators could all act to support UST liquidity but debt managers are likely best positioned to act today.” Detail below:

Fed action: UST market functioning support over recent years has largely been done by the Fed. The Fed now has limited flexibility due to its inflation problem. “The Fed could delay QT in hopes of limiting UST market functioning challenges” Cabana writes, adding that “Powell said the Fed will be mindful of financial stability & the Fed wants to avoid adding uncertainty to an already very uncertain geopolitical backdrop.” However, the Fed likely wants to get moving on QT to tightening financial conditions & restrain inflation. And worst case, the Fed can just halt QT early on if it sees that the lock up across the bond market is too severe.

UST debt management: Treasury can play a more meaningful role in the support of market functioning after years of abdicating this responsibility to the Fed. There are a number of actions Treasury could take:

- (1) Large & decisive cuts at troubled parts of the UST curve. This would signal help to improve market functioning, especially in the troubled 20Y. Large cuts will not fix oversupplied parts of the market but it would support deeper liquidity in current issues.

- (2) Buybacks for liquidity management purposes. UST could start liquidity providing buyback operations across the curve, which would help unclog dealer balance sheets & limit RV dislocations. Treasury could fund buybacks by issuing in the most liquid (2, 5, 10, 30Y) points or target the richest points (bills) if willing to tolerate WAM reduction.

- (3) Improved communication. Treasury only sporadically communicates with the market via the quarterly refunding meetings. Improved communication could help guide expectations on key areas of market concern such as oversupply & challenging liquidity.

The bottom line, according to Cabana is that Treasury market functioning has deteriorated with elevated realized volatility stemming from Fed re-pricing & geopolitical tensions. Decreased liquidity has likely been exacerbated by market structure shifts and regulatory changes that have reduced UST resilience: the BofA strategist is “concerned about the accumulation of increased Treasury supply into a fragile market place, which will likely support a cheapening of USTs & tightening of financial conditions. The official sector can still act to smooth this process though the US Treasury may need to take a more active role to promote Treasury market resilience.”

TL/DR: QT will lead to unintended bond market freezes/lockdowns and only “official sector” intervention will prevent QT from leading to a bond market crash. So far, neither the Fed nor the Treasury are even contemplating this possibility. Meanwhile the clock until the launch of Quantitative Tightening is ticking…

There is much more in the full notes, available to pro subscribers.