Mass Incarceration: A Weaponized Myth

By Matt Rosenberg of Wirepoints

The term “mass incarceration” has been weaponized in Illinois, Cook County, Chicago, and nationwide. It is used as a cudgel to try to beat down opposition to meaningful punishment for violent crime. It is meant to support an ongoing – and increasingly successful – push in major metro regions for “decarceration” and rehabilitation. Even for repeat gun law offenders and violent criminals. “Mass incarceration” is also meant to evoke the notion of a criminal justice system imprisoning Americans indiscriminately, in service to a “prison-industrial” complex.

There’s just one problem.

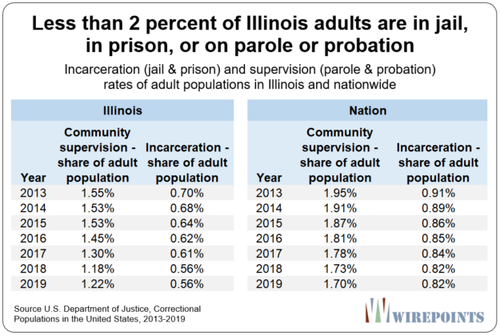

In Illinois the incarcerated are less than six-tenths of one percent of the adult population. Nationally in 2019, eight-tenths of one percent of the adult population was incarcerated. That includes all major venues: local, state, and federal jails or prisons.

There’s more.

When the “community supervision” population of those on parole or probation is added in, “mass incarceration” grows to still less than 2 percent in Illinois.

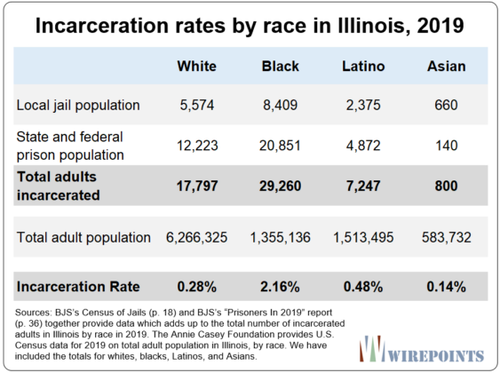

Finally, there are attempts to claim blacks are incarcerated “disparately.” But this is based on a flimsy construct that unequal outcomes by race suggest a racist hand on the scales. And notably, 98 percent of adult blacks in Illinois were not incarcerated in 2019.

The Illinois and nationwide general incarceration rate data come from an annual series of reports called “Correctional Populations In The United States,” compiled by the Bureau of Justice Statistics (BJS) of The U.S. Department of Justice. In those reports they are expressed as a rate per 100,000 population. We have converted those rates to percentages.

And the numbers have continued to drop over recent years. Over the seven year-span from 2013 through 2019 for which we analyzed the data, incarceration rates have dropped from seven-tenths of one percent to less than six-tenths of one percent in Illinois, and from nine-tenths of one percent to eight-tenths of one percent nationwide.

Comparable federal data covering the entire incarcerated population for 2020 and 2021 are not finalized and issued yet. But preliminary indicators are – in some part due to health concerns raised by the COVID pandemic – that the numbers will be lower still, both in Illinois and for the nation as a whole. The trend was well underway before COVID.

Yet at the same time, many major metro regions are beset with sharp increases in certain types of violent and property crimes. In 2021, Chicago Police Department data showed that versus in 2019, shooting incidents were up 67 percent, and murders 61 percent. Carjackings over the full year of 2021 were up 204 percent in Chicago versus 2019. The insane outlier known as expressway shootings jumped in Cook County from 51 in 2019 to 273 in 2021, according to an Illinois State Police dashboard. Reported violent crimes on Chicago’s transit system were up nearly 40 percent in 2021 versus 2015.

Nonetheless, key Cook County officials have continued to push a social justice transformation of criminal justice.

Cook County Chief Judge Tim Evans in 2017 instituted no-cash or low-cash bail for charged violent and gun offenders and then fudged data on related recidivism. Cook County State’s Attorney Kim Foxx dropped thousands more prosecutions than her predecessor. Now she’s attacking “over incarceration” and seeking to shorten sentences of imprisoned violent criminals. Supporting her initiative are an Illinois criminal justice reform NGO head and a local law professor who attacked “mass incarceration” four times in one op-ed.

We’ve already noted that actual reported incarceration rates in 2019 were less than one percent of the adult population in both Illinois and nationwide. So, again, there is no such thing as ”mass incarceration” or “over incarceration.”

But what if you add in the adult population that’s under “community supervision”? That refers to those on probation or parole. In that case, the numbers grow a little bit. But not to anything approaching “mass” dimensions.

In Illinois in 2019, the “supervised” adult population rate was 1,220 per 100,000, or 1.2 percent. Combined with the incarcerated adult population rate of 560 per 100,000, that means the total adult “correctional population” – as BJS calls it – was 1,780 per 100,000.

Rounded up, that’s 1.8 percent. Not altogether nothing. But hardly mass incarceration.

Nationwide in 2019, the adult correctional population was higher, at two-and-a-half percent, or a rate of 2,520 per 100,000 adults.

Looking at incarceration by race in Illinois

Data on incarceration by race is often used to suggest that related decisions may often be made with intent that is either consciously or unconsciously racist. A key part of this argument is what are called “racial disparities.”

We already know that in 2019 the statewide incarceration rate was almost six-tenths of one percent. Using additional BJS and Census data* for 2019 we calculated adult incarceration rates for Illinois by race. Those 2019 adult incarceration rates for Illinois are 2.16 percent blacks, 0.48 percent for Latinos, 0.28 percent for whites, and 0.13 percent for Asians.

So the incarceration rate for blacks was more than seven times that of whites, more than four times that of Latinos, and almost 17 times that of Asians. Yet, the rate for whites is also double that for Asians. No one would say society favors Asians over whites. All of this is to say that concern about “disparate outcomes” are not inherent proof of malevolence. Disparate humans and distinct population cohorts may make disparate decisions and pursue disparate paths. This accounts for much of what are termed “disparities.”

In Chicago, for instance, although blacks are only 29.2 percent of the population, they were 80 percent of murder victims in 2019, 2018 and 2017, according to annual police reports. And in the 21 years between 1991 through 2011 where murder perpetrators were identified, they were more than 70 percent of perps in each of those years, except one, according to the CPD report “Chicago Murder Analysis” (p. 38).

Meanwhile, the beat goes on. At the end of Week 13 of 2022, Chicago Police Department summary data show that versus the same period in the last pre-Covid year of 2019, shooting incidents were up 53 percent, murders 68 percent, motor vehicle thefts 56 percent and robberies 13 percent, and major crimes 12 percent.

Compared to the same span in 2021, the 2022 year-to-date data were not encouraging, either. Although murders and shooting incidents were down six and 11 percent versus a year ago to this point, but overall major crimes are up 36 percent compared to 2021. Motor vehicle thefts are up 43 percent, thefts 70 percent, and burglary 36 percent.

It’s clear what’s the current purpose in Cook County of the rhetoric of “over incarceration” and “mass incarceration.” It is to weaken – in pursuit of a race-driven agenda of decarceration – a criminal justice system which has little to no deterrent effect against a continuing wave of crime which sprung loose in 2020 and hasn’t stopped yet.

Even allowing for alternative sentencing and second chances where appropriate, it seems entirely plausible the real problem is “under incarceration.”

Tyler Durden

Tue, 03/29/2022 – 18:05

via ZeroHedge News https://ift.tt/fqjyEKc Tyler Durden

passage from Hurd’s book is his evisceration of Adam Schiff

passage from Hurd’s book is his evisceration of Adam Schiff