By Macro Ops

The “greatest money making machine in history”, a man with “Jim Roger’s analytical ability, George Soros’ trading ability, and the stomach of a riverboat gambler” is how fund manager Scott Bessent describes Stanley Druckenmiller. That’s high praise, but if you look at Druckenmiller’s track record, you’ll find it’s well deserved.

Druck averaged over 30% returns the last three decades — impressive. But what’s even more astonishing is the lack of volatility… the guy almost never loses.

He never had a single down year and only had five losing quarters out of 120 altogether! That’s absolutely unheard of. And he did all of this in size. At his peak, Druck was running more than $20 billion and he was still managing to knock it out the park.

When you study Druckenmiller you get the sense that he was built in a laboratory, deep in a jungle somewhere, where he was put together piece by piece to create the perfect trader. Every character trait that makes up a good speculator, Druck possesses in spades… things like:

-

Mental flexibility

-

Independent thinking

-

Extreme competitiveness

-

Tireless inquisitiveness

-

Deep self-awareness

Maybe he’s a freak of nature or perhaps a secret Jesse Livermore / George Soros lovechild… or maybe he’s just a relentlessly determined trader who’s been on a lifelong path of mastery. Either way, it behooves us to study the thoughts and actions of one of the game’s greatest. And with that, let’s begin.

On what moves stocks

In Jack Schwager’s book The New Market Wizards, Druckenmiller said this in response to the question of how he evaluates stocks (emphasis is mine):

When I first started out, I did very thorough papers covering every aspect of a stock or industry. Before I could make the presentation to the stock selection committee, I first had to submit the paper to the research director. I particularly remember the time I gave him my paper on the banking industry. I felt very proud of my work. However, he read through it and said, “This is useless. What makes the stock go up and down?” That comment acted as a spur. Thereafter, I focused my analysis on seeking to identify the factors that were strongly correlated to a stock’s price movement as opposed to looking at all the fundamentals. Frankly, even today, many analysts still don’t know what makes their particular stocks go up and down.

The financial world is chock full of noise and nonsense. It’s filled with smart people who don’t know a damn thing about how the world really works. The financial system’s incentive structure is set up so that as long as analysts sound smart and pretend like they know why stock xyz is going up, they get rewarded. This holds true for all the talking heads and “experts” except for those who actually trade real money. They either learn the game or get competed out.

Being one of those who compete in the arena, Druckenmiller was forced to learn early on what actually drives prices. This is what he found:

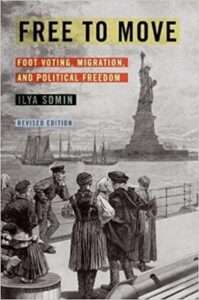

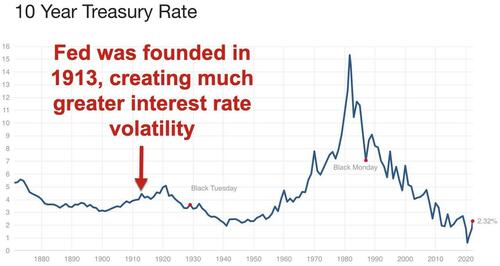

Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.

Liquidity is the expansion and contraction of money, specifically credit. It’s the biggest variable that drives demand in an economy. It’s something our team at Macro Ops follows closely.

The federal reserve has the biggest lever on liquidity. This is why a trader needs to keep a constant eye on what the Fed is doing.

This is not to say that things like sales and earning don’t matter. They are still very important at the singular stock level. Here’s Druckenmiller again (emphasis mine):

Very often the key factor is related to earnings. This is particularly true of the bank stocks. Chemical stocks, however, behave quite differently. In this industry, the key factor seems to be capacity. The ideal time to buy the chemical stocks is after a lot of capacity has left the industry and there’s a catalyst that you believe will trigger an increase in demand. Conversely, the ideal time to sell these stocks is when there are lots of announcements for new plants, not when the earnings turn down. The reason for this behavioral pattern is that expansion plans mean that earnings will go down in two to three years, and the stock market tends to anticipate such developments.

The market is a future discounting machine; meaning earnings matter for a stock, but more so in the future than in the past.

Most market participants take recent earnings and just extrapolate them into the future. They fail to really look at the mechanism that drives the bottom line for a particular company or sector. The key to being a good trader is to identify the factor(s) that will drive earnings going forward, not what drove them in the past.

Druckenmiller said in a recent interview that his “job for 30 years was to anticipate changes in the economic trends that were not expected by others, and, therefore not yet reflected in security prices.” Focus on the future, not the past.

Another thing that sets Druck apart is his willingness to use anything that works; as in any style or tool to find good trades and manage them.

Another discipline I learned that helped me determine whether a stock would go up or down is technical analysis. Drelles was very technically oriented, and I was probably more receptive to technical analysis than anyone else in the department. Even though Drelles was the boss, a lot of people thought he was a kook because of all the chart books he kept. However, I found that technical analysis could be very effective.

I never use valuation to time the market. I use liquidity considerations and technical analysis for timing. Valuation only tells me how far the market can go once a catalyst enters the picture to change the market direction.

Druckenmiller employs a confluence of approaches (fundamental, macro, technical and sentiment) to broaden his view of the battlefield. This is a practice we follow at Macro Ops. It doesn’t make sense to pigeonhole yourself into a single rigid scope of analysis… simply use what works and discard what doesn’t.

How to make outsized returns

Druckenmiller throws conventional wisdom out the window. Instead of placing a lot of small diversified bets, he practices what we call the “Big Bet” philosophy, which consists of deploying a few large concentrated bets.

Here’s Druckenmiller on using the big bet philosophy (emphasis mine):

The first thing I heard when I got in the business, not from my mentor, was bulls make money, bears make money, and pigs get slaughtered. I’m here to tell you I was a pig. And I strongly believe the only way to make long-term returns in our business that are superior is by being a pig. I think diversification and all the stuff they’re teaching at business school today is probably the most misguided concept everywhere. And if you look at all the great investors that are as different as Warren Buffett, Carl Icahn, Ken Langone, they tend to be very, very concentrated bets. They see something, they bet it, and they bet the ranch on it. And that’s kind of the way my philosophy evolved, which was if you see – only maybe one or two times a year do you see something that really, really excites you… The mistake I’d say 98% of money managers and individuals make is they feel like they got to be playing in a bunch of stuff. And if you really see it, put all your eggs in one basket and then watch the basket very carefully.

A lot of wisdom in that paragraph. To earn superior long-term returns you have to be willing to bet big when your conviction is high. And the corollary is that you need to protect your capital by not wasting it on a “bunch of stuff” you don’t have much conviction on.

This reminds me of what Seth Klarman wrote in his book Margin of Safety:

Avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather “don’t lose money” means that over several years an investment portfolio should not be exposed to appreciable loss of capital. While no one wishes to incur losses, you couldn’t prove it from an examination of the behavior of most investors and speculators. The speculative urge that lies within most of us is strong; the prospect of free lunch can be compelling, especially when others have already seemingly partaken. It can be hard to concentrate on losses when others are greedily reaching for gains and your broker is on the phone offering shares in the latest “hot” initial public offering. Yet the avoidance of loss is the surest way to ensure a profitable outcome.

You need to keep your powder dry so that when the stars align you can go for the jugular and turkey neck that son of a gun.

The importance of striking when the iron is hot is something Druckenmiller learned while trading for George Soros.

I’ve learned many things from [George Soros], but perhaps the most significant is that it’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong. The few times that Soros has ever criticized me was when I was really right on a market and didn’t maximize the opportunity.

An intense focus on capital preservation coupled with a big bet approach is the barbell philosophy used by many of the greats.

Keeping your losses small and pushing your winners hard is the name of the game in profitable speculation.

The fund washout we’re seeing today is not just because of the glut of mediocrity in the money management space, but also because even decent managers are scared to take the necessary risks to have big return years. They manage too much to the benchmark and are too short-term focused. That’s a recipe for average performance. Here’s Druck on how it should be done:

Many managers, once they’re up 30 or 40 percent, will book their year [i.e., trade very cautiously for the remainder of the year so as not to jeopardize the very good return that has already been realized]. The way to attain truly superior long-term returns is to grind it out until you’re up 30 or 40 percent, and then if you have the conviction, go for a 100 percent year. If you can put together a few near-100 percent years and avoid down years, then you can achieve really outstanding long-term returns.

Once you’ve earned the right to be aggressive and can bet with the house’s money (profits), you should plunge hard when that high conviction trade arises and push for outsized returns.

The trader’s mindset and handling losses

According to Druck, to be a winning trader you need to be “decisive, open-minded, flexible and competitive”.

The day before the crash in 1987, Druckenmiller switched from net short to 130% long because he thought the selloff was done. He saw the market bumping up against significant support. But through the course of the day he realized that he made a terrible mistake. The next day he flipped his book and got short the market and actually made money. You see this type of mental flexibility in all the greatest traders. And Druckenmiller is one trader that epitomizes it perhaps better than anybody else.

The practice of having “strong opinions, weakly held” is difficult but paramount to success.

In order to attain that level of mental flexibility, you need to learn to detach ego from your immediate trade outcomes. If you allow losses to affect your judgement, you’ll inevitably make bigger mistakes. Druckenmiller learned this lesson early on from Soros.

Soros is the best loss taker I’ve ever seen. He doesn’t care whether he wins or loses on a trade. If a trade doesn’t work, he’s confident enough about his ability to win on other trades that he can easily walk away from the position. There are a lot of shoes on the shelf; wear only the ones that fit. If you’re extremely confident, taking a loss doesn’t bother you.

One of the best parts about this game is that as long as you stay alive (protect your capital) you can always make another trade. Druckenmiller said the “wonderful thing about our business is that it’s liquid, and you can wipe the slate clean on any day. As long as I’m in control of the situation — that is, as long as I can cover my positions — there’s no reason to be nervous.”

I remember watching Charlie Rose interview Druckenmiller a few years ago. Charlie asked him why, after all these years, and with all the money he’s made, does he still put in 60-hour weeks trading? Druck responded (and I’m paraphrasing here) “because I have to… I love the game and I love winning, the money isn’t even important.”

To get to Druck’s level, you have to trade because that’s just what you do. It’s what you live for.