By Michael Every of Rabobank

Yesterday I argued US President Biden’s inflation-fighting plan boils down to “rates or nothing.” It seems both he and Treasury Secretary Yellen agree, as following a White House meeting with Fed Chair Powell, the president made clear he fully backs the Fed’s independence and wants to give it “space” to act on high inflation. And little else on the topic.

You can tell just how seriously the White House is taking its role in the inflation crisis because the Powell meeting started at 13:15EST, and by 15:00EST the president was meeting South Korean boyband BTS. I presume they all know their inflation rate is 4.8% y-o-y, and the price of ‘Butter’?

Is that White House hospital pass intended to allow the Fed to pause in September, and then start to cut again? Yellen, talking to CNN, offered a mea culpa in saying, “I was mistaken about inflation’s trajectory,” but again stressed, “The Fed is taking necessary actions,” adding, “I think it’s impossible to rule out more inflationary surprises,” to give them a push towards the incoming bone-crunching tackle. (That is as Bloomberg says ‘China Plans for Years of Covid Zero With Tests on Every Corner’. Sorry, global supply chains.)

The Fed’s Bostic also clarified his comments last week about a “September pause” should not be construed as a “Fed put”. He predicts a significant drop in inflation as we will see a fall in the “willingness to spend freely among certain segments of the population”, with the key PCE deflator measure of price pressures expected to drop back from 6.3% y-o-y to 4.0% by year end – but still twice the level it should be.

Then again, there is a more cynical interpretation of yesterday’s meeting (with Powell, not BTS). Could the White House –which those in the know say was leaning on the Fed last year, as is the US tradition– have publicly stressed the Fed is independent *and* told them to pivot in September, to ensure all the blame falls on Powell?

From here Powell either Volckers or Burns. Either way we see hospitalization-inducing volatility.

After yesterday’s shock Eurozone 8.1% y-o-y CPI print –and with lots more food inflation in the pipeline yet to come– we got more ECB chatter of whether a 50bps step might be needed, and whether the neutral rate is 1.00%, which once looked impossible, or 2.00%, which to many still does. Again it looks to be rates or nothing – although with acronymtastic action to try to keep the Eurozone periphery out of danger.

Ironically, yesterday also saw drops in key commodities. In grains and oilseeds, this was due to thoughts of Russian exports from the Black Sea. Nothing can be ruled in or ruled out, but the removal of Western sanctions on Russia, Moscow’s core demand for letting food flow again, is something that is almost certainly not going to happen. In which case, that agri sell-off is not going to last.

On oil, the impact of the EU’s oil embargo was minor, as was French insistence the next step should be on gas (given it is nuclear-powered, naturellement). What moved markets was the Wall Street Journal reporting some OPEC+ members “are considering the idea of suspending Russia in an oil production deal as Western sanctions hurt the nation’s ability to produce more.” That would open the doors for Saudi Arabia to pump – and so oil prices fell. Yet the Saudis insist that there is already enough oil around and the problem is a lack of refineries.

At time of writing, the market did not appear to have fully digested the other big energy news: Europe, the US, and UK are to stop insuring any vessels carrying Russian oil. That could have a serious impact given the lack of alternatives, and a likely Western backlash if other insurance actors step in to provide insurance. That’s also a hospital pass for central banks.

As an aside, there is lots happening regarding Saudi. They have, pointlessly, flirted with selling some oil in CNY, and Russia’s Lavrov arrives in Riyadh soon. However, they are also reportedly close to a gradual move towards joining the US-initiated Abraham Accords with Israel: the US looking serious about backing off from the Iran nuclear deal was key. They are also talking about soon having the world’s largest horizontal buildings – because with oil where it is, it seems we are back to ‘gold toilets’ cliches.

Meanwhile, New Zealand is clearly moving towards the US. PM Ardern and President Biden just released a joint statement on a ‘21st-Century Partnership’ that makes it 100% clear the Kiwis stand with the West, not as a tongue-in-cheek ‘New Xi-Land’. The key highlights are that:

“Our countries will expand our work in the Pacific on infrastructure, including transportation and information-communications technology; cyber security; maritime security, including combatting illegal, unreported, and unregulated fishing; education and skills training; COVID-19 pandemic assistance and global health security; and economic recovery. At the same time, we will promote democratic governance, free and fair elections, media freedom, and transparency; we will increase respect for human rights and the rule of law.”

All of this with deep US coordination.

“We oppose unlawful maritime claims and activities in the South China Sea that run counter to the rules-based international order, particularly UNCLOS. We reiterate our grave concerns regarding the human-rights violations in Xinjiang, and the erosion of rights and freedoms in Hong Kong… We underscore the importance of peace and stability across the Taiwan Strait and encourage the peaceful resolution of cross-Strait issues.”

All the hot-button US issues are now hot for NZ too.

“We acknowledge that security and defence will become an ever-more-important focus of our strategic partnership. We look to increase the interoperability of our forces, including through personnel exchanges, co-deployments, and defence trade. Achieving this vision will require robust and sustained commitment to defence in the Pacific. As New Zealand takes delivery of new capabilities, we will look for opportunities for combined operations and to expand our cooperation in other ways. As the security environment in the Indo-Pacific evolves, so must our defence cooperation.”

It’s not joining The Quad – but given the US is aiming for military interoperability with Japan, India, and the UK, it’s not far off. It also means more Kiwi defence spending.

“We intend…to explore how we can expand bilateral trade and investment in order to strengthen the security of our supply chains and economic resilience. To that end, the US and New Zealand will resume annual Trade and Investment Framework Agreement (TIFA) discussions.”

Wellington of course fully backs the new US-initiated IPEF trade structure.

Will the above move Kiwi markets today? No. Will it if we see a bifurcated Indo-Pacific region, and/or China importing much less from New Zealand to push-back against its shift towards the US? Yes – and the risks of that just increased markedly. As such, some might see this statement as a hospital pass: yet not acting geopolitically in the present environment would have been one too.

Likewise, the South China Morning Post says, ‘Europe beefs up trade armory for long-term fight with China’. Europe doesn’t fight physically, but boy can it do so in committees, and paper cuts can hurt. The EU is going to address everything ‘China’, from state subsidies to market access, economic coercion to carbon emissions, and forced labor to tech transfer. Europe reportedly sees itself as able to leave the US for dust in these technical areas, doing its bit for the ‘liberal world order’. (As the US oddly once again flirts with the inflation-irrelevant issue of removing China tariffs: but this internal debate may yet end the same way as the Iran deal did.)

That is as Jörg Wuttke, the president of the EU Chamber of Commerce in China, says the “allure of China” is waning, as foreign businesses consider their options for new investments. Moreover, the EU just upgraded Thursday’s bilateral trade summit with Taiwan to ministerial level.

Will the above move Eurozone markets today? No. Will it if the end-point is a bifurcated world, and/or China importing much less from Europe to push-back? Or if China exports less to it, when supply-side inflation is already an issue? Yes – and the risks of that just increased markedly. As such, some might see this EU statement as a hospital pass: yet not acting geopolitically in the present environment would have been one too.

Today saw the new Aussie government faced with its first immediate crisis: CoreLogic house prices dropped 0.3% m-o-m. I would have expected a housing stimulus package by lunchtime if it was the last lot, but the new ones need to get their email up and running first. Q1 GDP, for which they are not responsible, meanwhile came in at 0.8% q-o-q vs. 0.7% expected and 3.3% y-o-y vs. 3.0%, with upward revisions to back data. So, Aussie rates are going to rise (after everyone else led them there). And Aussie house prices are going to…. [fill in the blank, RBA]. What a hospital pass for PM Albanese(?)

China’s Caixin manufacturing PMI was out today too and was 48.1 vs. 49.0 expected and 46.0 last month. It’s ‘interesting’ to see that it only half echoed the more upbeat official measures, which picked up more in May despite lockdowns.

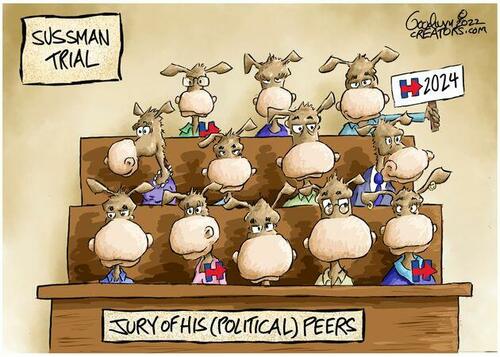

Not directly linked to any of the above, but also a hospital pass of sorts, an Israeli tech firm has estimated that up to 12% of Twitter users are ‘bots’. Moreover, Pew research says the top 10% of tweeters account for 92% of all tweets, of which 69% are Democrats and only 26% Republicans. Expect to see more from Elon Musk ‘on Twitter’.