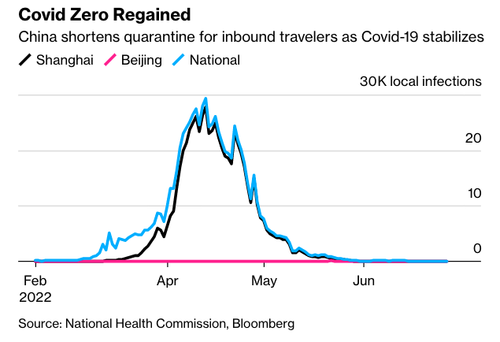

US stock futures rebounded from Monday’s modest losses and traded near session highs after China reduced quarantine times for inbound travelers by half – to seven days of centralized quarantine and three days of health monitoring at home – the biggest shift yet in a Covid-19 policy that has left the world’s second-largest economy isolated as it continues to try and eliminate the virus. The move, which fueled optimism about stronger economic growth and boosted appetite for both commodities and risk assets, sent S&P 500 futures and Nasdaq 100 contracts higher by 0.6% each at 7:15 a.m. in New York, setting up heavyweight technology stocks for a rebound. Mining and energy shares led gains in Europe’s Stoxx 600 and an Asian equity index erased losses to climb for a fourth session. 10Y TSY yields extended their move higher rising to 3.25% or about +5bps on the session, while the dollar and bitcoin were flat, and oil and commodity-linked currencies strengthened.

In premarket trading, the biggest mover was Kezar Life Sciences which soared 85% after reporting positive results for its lupus drug. On the other end, Robinhood shares fell 3.2%, paring a rally yesterday sparked by news that FTX is exploring whether to buy the company. In a statement, FTX head Sam Bankman-Fried said he is excited about the firm’s business prospects, but “there are no active M&A conversations with Robinhood.” Here are some of the other most notable premarket movers”

- Playtika (PLTK US) shares rallied 11% in premarket trading after a report that private equity firm Joffre Capital agreed to acquire a majority stake in the gaming company from a Chinese investment group for $21 a share.

- Nike (NKE US) shares fell 2.3% in US premarket trading, with analysts reducing their price targets after the company gave a downbeat forecast for gross margin and said it was being cautious in its outlook for the China market.

- Spirit Airlines (SAVE US) shares rise as much as 5% in US premarket trading after JetBlue boosted its all-cash bid in response to an increased offer by rival suitor Frontier in the days before a crucial shareholder vote.

- Snowflake (SNOW US) rises 3.3% in US premarket trading after Jefferies upgraded the stock to buy from hold, saying its valuation is now “back to reality” and offers a good entry point given the software firm’s long-term targets.

- Sutro Biopharma (STRO US) shares rise 34% in US premarket trading after the company and Astellas said they will collaborate to advance development of immunostimulatory antibody-drug conjugates, which are a modality for treating tumors and designed to boost anti-cancer activity.

- State Street (STT US) shares could be in focus after Deutsche Bank downgraded the stock to hold, while lowering EPS estimates and price targets across interest rate sensitive coverage of trust banks and online brokers.

- US bank stocks may be volatile during Tuesday’s trading session after the lenders announced a wave of dividend increases following last week’s successful stress test results.

Stock rallies have proved fleeting this year as higher borrowing costs to fight inflation restrain economic activity in a range of nations. European Central Bank President Christine Lagarde affirmed plans for an initial quarter-point increase in interest rates in July, but said policy makers are ready to step up action to tackle record inflation if warranted. Some analysts also argue still-bullish earnings estimates are too optimistic. Earnings revisions are a risk with the US economy set to slow next year, though China emerging from Covid strictures could act as a global buffer, according to Lorraine Tan, Morningstar director of equity research.

“You got a US slowdown in 2023 in terms of growth, but you have China hopefully coming out of its lockdowns,” Tan said on Bloomberg Radio.

In Europe, stocks are well bid with most European indexes up over 1%. Euro Stoxx 50 rose as much as 1.2% before drifting off the highs. Miners, energy and auto names outperform. The Stoxx 600 Basic Resources sub-index rises as much as 3.5% led by heavyweights Rio Tinto and Anglo American, as well as Polish copper producer KGHM and Finnish forestry companies Stora Enso and UPM- Kymmene. Iron ore and copper reversed losses after China eased its quarantine rules for new arrivals, while oil gained for a third session amid risks of supply disruptions. Iron ore in Singapore rose more than 4% after being firmly lower earlier in the session, while copper and other base metals also turned higher. Here are the biggest European movers:

- Luxury stocks climb boosted by an easing of Covid-19 quarantine rules in the key market of China. LVMH shares rise as much as 2.5%, Richemont +3.1%, Kering +3%, Moncler +3%

- Energy and mining stocks are the best-performing groups in the rising Stoxx Europe 600 index amid commodity gains. Shell shares rise as much as 3.8%, TotalEnergies +2.7%, BP +3.4%, Rio Tinto +4.6%, Glencore +3.9%

- Banco Santander shares rise as much as 1.8% after a report that the Spanish bank has hired Credit Suisse and Goldman Sachs for its bid to buy Mexico’s Banamex.

- GN Store Nord shares gain as much as 4.2% after Nordea resumes coverage on the hearing devices company with a buy rating.

- Swedish Match shares rise as much as 4% as Philip Morris International’s offer document regarding its bid for the company has been approved and registered by the Swedish FSA.

- Wise shares decline as much as 15%, erasing earlier gains after the fintech firm reported full- year earnings. Citi said the results were “mixed,” with strong revenue growth being offset by lower profitability.

- UK water stocks decline as JPMorgan says it is turning cautious on the sector on the view that future regulated returns could surprise to the downside, in a note cutting Severn Trent to underweight. Severn Trent shares fall as much as 6%, Pennon -7.7%, United Utilities -2.3%

- Akzo Nobel falls as much as 4.5% in Amsterdam trading after the paint maker announced the appointment of former Sulzer leader Greg Poux-Guillaumeas chief executive officer, succeeding Thierry Vanlancker.

- Danske Bank shares fall as much as 4%, as JPMorgan cut its rating on the stock to underweight, saying in a note that risks related to Swedish property will likely create some “speed bumps” for Nordic banks though should be manageable.

In the Bavarian Alps, limiting Russia’s profits from rising energy prices that fuel its war in Ukraine have been among the main topics of discussion at a Group of Seven summit. G-7 leaders agreed that they want ministers to urgently discuss and evaluate how the prices of Russian oil and gas can be curbed.

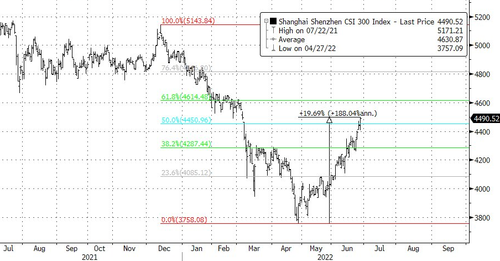

Earlier in the session, Asian stocks erased earlier losses as China’s move to ease quarantine rules for inbound travelers bolstered sentiment. The MSCI Asia Pacific Index rose as much as 0.6% after falling by a similar magnitude. The benchmark is set for a fourth day of gains, led by the energy and utilities sectors. BHP and Toyota contributed the most to the gauge’s advance, while China’s technology firms were among the biggest losers as a plan by Tencent’s major backer to further cut its stake fueled concern of more profit-taking following a strong rally. A move by Beijing to cut quarantine times for inbound travelers by half is helping cement gains which have made Chinese shares the world’s best-performing major equity market this month. The nation’s stocks are approaching a bull market even as their recent rise pushes them to overbought levels.

Still, the threat of a sharp slowdown in the world’s largest economy may pose a threat to the outlook. “US recession risk is still there and I think that’ll obviously have impact on global sectors,” Lorraine Tan, director of equity research at Morningstar, said on Bloomberg TV. “Even if we do get some China recovery in 2023, which could be a buffer for this region, it’s not going to offset the US or global recession.” Most stock benchmarks in the region finished higher following China’s move to ease its travel rules. Main equity measures in Japan, Hong Kong, South Korea and Australia rose while those in Taiwan and India fell. Overall, Asian stocks are on course to complete a monthly decline of about 4%.

Meanwhile, the People’s Bank of China pledged to keep monetary policy supportive to help the nation’s economy. It signaled that stimulus would likely focus on boosting credit rather than lowering interest rates.

Japanese stocks gained as investors adjusted positions heading into the end of the quarter. The Topix Index rose 1.1% to 1,907.38 as of the market close in Tokyo, while the Nikkei 225 advanced 0.7% to 27,049.47. Toyota Motor contributed most to the Topix’s gain, increasing 2.2%. Out of 2,170 shares in the index, 1,736 rose and 374 fell, while 60 were unchanged. “As the end of the April-June quarter approaches, there is a tendency for institutional investors to rebalance,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley. “It will be easier to buy into cheap stocks, which is a factor that will support the market in terms of supply and demand.”

India’s benchmark stock gauge ended flat after trading lower for most of the session as investors booked some profits after a three-day rally. The S&P BSE Sensex closed little changed at 53,177.45 in Mumbai, while the NSE Nifty 50 Index gained 0.1%. Six of the the 19 sector sub-gauges compiled by BSE Ltd. dropped, led by consumer durables companies, while oil & gas firms were top performers. ICICI Bank was among the prominent decliners on the Sensex, falling 1%. Out of 30 shares in the Sensex index, 17 rose and 13 fell.

In rates, fixed income sold off as treasuries remained under pressure with the 10Y yield rising as high as 3.26%, following steeper declines for euro-zone and UK bond markets for second straight day and after two ugly US auctions on Monday. Yields across the curve are higher by 2bp-5bp led by the 7-year ahead of the $40 billion auction. In Europe, several 10-year yields are 10bp higher on the day after comments by an ECB official spurred money markets to price in more policy tightening. WI 7Y yield at around 3.32% exceeds 7-year auction stops since March 2010 and compares with 2.777% last month. Monday’s 5-year auction drew a yield more than 3bp higher than its yield in pre-auction trading just before the bidding deadline, a sign dealers underestimated demand. Traders attributed the poor results to factors including short base eroded by last week’s rally, recently elevated market volatility discouraging market-making, and sub-par participation during what is a popular vacation week in the US. Focal points for US session include 7-year note auction at 1pm ET; a 5-year auction Monday produced notably weak demand metrics.

The belly of the German curve underperformed as markets focus on hawkish comments from ECB officials: 5y bobl yields rose 10 bps near 1.46%, red pack euribors dropped 10-13 ticks and ECB-dated OIS rates priced in 163 basis points of tightening by year end.

In FX, Bloomberg dollar spot index is near flat as the greenback reversed earlier losses versus all of its Group-of-10 peers apart from the yen while commodity currencies were the best performers. The euro rose above $1.06 before paring gains after ECB Governing Council member Martins Kazaks said the central bank should consider a first rate hike of more than a quarter-point if there are signs that high inflation readings are feeding expectations. Money markets ECB raised tightening wagers after his remarks. ECB President Lagarde later affirmed plans for an initial quarter-point increase in interest rates in July but said policy makers are ready to step up action to tackle record inflation if warranted. The ECB is likely to drain cash from the banking system to offset any bond purchases made to restrain borrowing costs for indebted euro-area members, Reuters reported, citing two sources it didn’t identify.

Elsewhere, the pound drifted against the dollar and euro after underperforming Monday, with focus on quarter-end flows, lingering Brexit risks and the UK economic outlook. Scottish First Minister Nicola Sturgeon due to speak later on how she plans to hold a second referendum on Scottish independence by the end of next year. The yen gave up an Asia session gain versus the dollar as US equity futures reversed losses. The Australian dollar rose after China cut its mandatory quarantine period to 10 days from three weeks for inbound visitors in its latest Covid-19 guidance. JPY was the weakest in G-10, drifting below 136 to the USD.

In commodities, oil rose for a third day with global output threats compounding already red-hot markets for physical supplies and as broader financial sentiment improved. Brent crude breached $117 a barrel on Tuesday, but some of the most notable moves in recent days have been in more specialist market gauges. A contract known as the Dated-to-Frontline swap — an indicator of the strength in the key North Sea market underpinning much of the world’s crude pricing — hit a record of more than $5 a barrel. The rally comes amid growing supply outages in Libya and Ecuador, exacerbating ongoing market tightness.

Oil prices also rose Tuesday as broader sentiment was boosted by China’s move to cut in half the time new arrivals must spend in isolation, the biggest shift yet in its pandemic policy. Meanwhile, the G-7 tasked ministers to urgently discuss an oil price cap on Russia.

Finally, the prospect of additional supply from two of OPEC’s key producers also looks limited. On Monday Reuters reported that French President Emmanuel Macron told his US counterpart Joe Biden that the United Arab Emirates and Saudi Arabia are already pumping almost as much as they can.

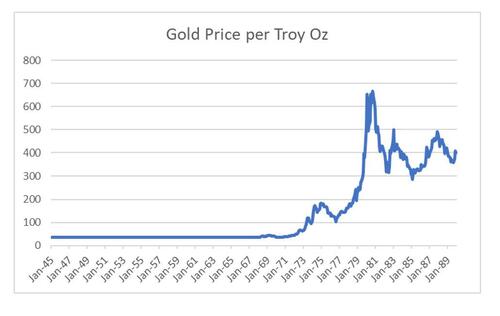

In the battered metals space, LME nickel rose 2.7%, outperforming peers and leading broad-based gains in the base-metals complex. Spot gold rises roughly $3 to trade near $1,826/oz

Looking to the day ahead now, data releases include the FHFA house price index for April, the advance goods trade balance and preliminary wholesale inventories for May, as well as the Conference Board’s consumer confidence for June and the Richmond Fed’s manufacturing index. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Lane, Elderson and Panetta, the Fed’s Daly, and BoE Deputy Governor Cunliffe. Finally, NATO leaders will be meeting in Madrid.

Market Snapshot

- S&P 500 futures up 0.5% to 3,922.50

- STOXX Europe 600 up 0.6% to 417.65

- MXAP up 0.4% to 162.36

- MXAPJ up 0.4% to 539.85

- Nikkei up 0.7% to 27,049.47

- Topix up 1.1% to 1,907.38

- Hang Seng Index up 0.9% to 22,418.97

- Shanghai Composite up 0.9% to 3,409.21

- Sensex down 0.3% to 52,990.39

- Australia S&P/ASX 200 up 0.9% to 6,763.64

- Kospi up 0.8% to 2,422.09

- German 10Y yield little changed at 1.62%

- Euro little changed at $1.0587

- Brent Futures up 1.4% to $116.65/bbl

- Gold spot up 0.3% to $1,828.78

- U.S. Dollar Index little changed at 103.89

Top Overnight News from Bloomberg

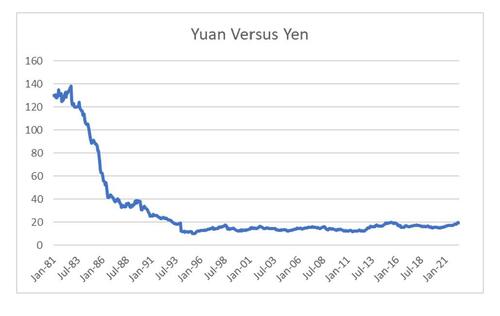

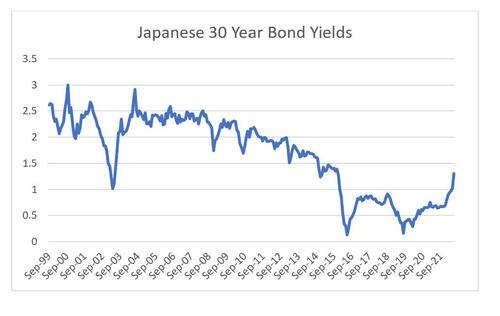

- In Tokyo’s financial circles, the trade is known as the widow- maker. The bet is simple: that the Bank of Japan, under growing pressure to stabilize the yen as it sinks to a 24-year low, will have to abandon its 0.25% cap on benchmark bond yields and let them soar, just as they already have in the US, Canada, Europe and across much of the developing world

- Bank of Italy Governor Ignazio Visco may leave his post in October, paving the way for the appointment of a high profile executive close to Premier Mario Draghi, daily Il Foglio reported

- NATO is set to label China a “systemic challenge” when it outlines its new policy guidelines this week, while also highlighting Beijing’s deepening partnership with Russia, according to people familiar with the matter

- The PBOC pledged to keep monetary policy supportive to aid the economy’s recovery, while signaling that stimulus would likely focus on boosting credit rather than lowering interest rates

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mixed with the region partially shrugging off the lacklustre handover from the US. ASX 200 was kept afloat with energy leading the gains amongst the commodity-related sectors. Nikkei 225 swung between gains and losses with upside capped by resistance above the 27K level. Hang Seng and Shanghai Comp. were pressured amid weakness in tech and lingering default concerns as Sunac plans discussions on extending a CNY bond and with Evergrande facing a wind-up petition.

Top Asian News

- China is to cut quarantine time for international travellers, according to state media cited by Reuters.

- Shanghai Disneyland (DIS) will reopen on June 30th, according to Reuters.

- PBoC injected CNY 110bln via 7-day reverse repos with the rate at 2.10% for a CNY 100bln net daily injection.

- China’s state planner official said China faces new challenges in stabilising jobs and prices due to COVID and risks from the Ukraine crisis, while the NDRC added they will not resort to flood-like stimulus but will roll out tools in its policy reserve in a timely way to cope with challenges, according to Reuters.

- China’s state planner NDRC says China is to cut gasoline and diesel retail prices by CNY 320/tonne and CNY 310/tonne respectively from June 29th.

- BoJ may have been saddled with as much as JPY 600bln in unrealised losses on its JGB holdings earlier this month, as a widening gap between domestic and overseas monetary policy pushed yields higher and prices lower, according to Nikkei.

European bourses are firmer as sentiment picked up heading into the cash open amid encouraging Chinese COVID headlines. Sectors are mostly in the green with no clear theme. Base metals and Energy reside as the current winners and commodities feel a boost from China’s COVID updates. Stateside, US equity futures saw a leg higher in tandem with global counterparts, with the RTY narrowly outperforming. Twitter (TWTR) in recent weeks provided Tesla (TSLA) CEO Musk with historical tweet data and access to its so-called fire hose of tweets, according to WSJ sources.

Top European News

- UK lawmakers voted 295-221 to support the Northern Ireland Protocol bill in the first of many parliamentary tests it will face during the months ahead, according to Reuters.

- Scotland’s First Minister Sturgeon will set out a plan today for holding a second Scottish Independence Referendum, according to BBC News.

- ECB’s Kazaks Says Worth Looking at Larger Rate Hike in July

- G-7 Latest: Leaders Want Urgent Evaluation of Energy Price Caps

- Ex- UBS Staffer Wants Payout for Exposing $10 Billion Swiss Stash

- SocGen Blames Clifford Chance in $483 Million Gold Suit

- GSK’s £40 Billion Consumer Arm Picks Citi, UBS as Brokers

- Russian Industry Faces Code Crisis as Critical Software Pulled

ECB

- ECB’s Lagarde said inflation in the euro area is undesirably high and it is projected to stay that way for some time to comeFragmentation tool, via the ECB.

- ECB’s Kazaks said 25bps in July and 50bps in September is the base case, via Bloomberg TV. Kazaks said it is worth looking at a 50bps hike in July and front-loading hikes might be reasonable. Fragmentation risks should not stand in the way of monetary policy normalisation. If necessary, the ECB will come up with tools to address fragmentation.

- ECB’s Wunsch said he is comfortable with a 50bps hike in September; adds that 200bps of hikes are needed relatively fast, and anti-fragmentation tool should have no limits if market moves are unwarranted, via Reuters.

- Bank of Italy said Governor Visco’s resignation is not on the table, according to a spokesperson cited by Reuters.

Fixed Income

- Bond reversal continues amidst buoyant risk sentiment, hawkish ECB commentary and supply.

- Bunds lose two more big figures between 146.80 peak and 144.85 trough, Gilts down to 112.06 from 112.86 at best and 10 year T-note retreats within 117-01/116-14 range

FX

- DXY regroups on spot month end as yields rally and rebalancing factors offer support – index within 103.750-104.020 range vs Monday’s 103.660 low.

- Euro continues to encounter resistance above 1.0600 via 55 DMA (1.0614 today); Yen undermined by latest bond retreat and renewed risk appetite – Usd/Jpy eyes 136.00 from low 135.00 area and close to 134.50 yesterday.

- Aussie breaches technical and psychological resistance with encouragement from China lifting or easing more Covid restrictions – Aud/Usd through 10 DMA at 0.6954.

- Loonie and Norwegian Krona boosted by firm rebound in oil as France fans supply concerns due to limited Saudi and UAE production capacity – Usd/Cad sub-1.2850 and Eur/Nok under 10.3500.

- Yuan receives another PBoC liquidity boost to compliment positive developments on the pandemic front, but Rand hampered by latest power cut warning issued by SA’s Eskom

Commodities

- WTI and Brent futures were bolstered in early European hours amid encouragement seen from China’s loosening of COVID restrictions.

- Spot gold is uneventful, around USD 1,825/oz in what has been a sideways session for the bullion since the reopening overnight.

- Base metals are posting broad gains across the complex – with LME copper back above USD 8,500/t amid China-related optimism.

US Event Calendar

- 08:30: May Advance Goods Trade Balance, est. -$105b, prior -$105.9b, revised -$106.7b

- 08:30: May Wholesale Inventories MoM, est. 2.1%, prior 2.2%

- May Retail Inventories MoM, est. 1.6%, prior 0.7%

- 09:00: April S&P CS Composite-20 YoY, est. 21.15%, prior 21.17%

- 09:00: April S&P/CS 20 City MoM SA, est. 1.95%, prior 2.42%

- 09:00: April FHFA House Price Index MoM, est. 1.4%, prior 1.5%

- 10:00: June Conf. Board Consumer Confidenc, est. 100.0, prior 106.4

- Conf. Board Expectations, prior 77.5; Present Situation, prior 149.6

- 10:00: June Richmond Fed Index, est. -5, prior -9

DB’s Jim Reid concludes the overnight wrap

It’s been a landmark night in our household as last night was the first time the 4-year-old twins slept without night nappies. So my task this morning after I send this to the publishers is to leave for the office before they all wake up so that any accidents are not my responsibility. Its hopefully the end of a near 7-year stretch of nappies being constantly around in their many different guises and states of unpleasantness. Maybe give it another 30-40 years and they’ll be back.

Talking of unpleasantness, as we near the end of what’s generally been an awful H1 for markets, yesterday saw the relief rally from last week stall out, with another bond selloff and an equity performance that fluctuated between gains and losses before the S&P 500 (-0.30%) ended in negative territory.

In terms of the specific moves, sovereign bonds lost ground on both sides of the Atlantic, with yields on 10yr Treasuries up by +7.0bps following their -9.6bps decline from the previous week. That advance was led by real rates (+9.6bps), which look to have been supported by some decent second-tier data releases from the US during May yesterday. The preliminary reading for US durable goods orders surprised on the upside with a +0.7% gain (vs. +0.1% expected). Core capital goods orders also surprised on the upside with a +0.8% advance (vs. +0.2% expected). And pending home sales were unexpectedly up by +0.7% (vs. -4.0% expected). Collectively that gave investors a bit more confidence that growth was still in decent shape last month, which is something that will also offer the Fed more space to continue their campaign of rate hikes into H2. This morning 10yr USTs yields have eased -2.45 bps to 3.17% while 2yr yields (-4 bps) have also moved lower to 3.08%, as we go to press.

Staying at the front end, when it comes to those rate hikes, if you look at Fed funds futures they show that investors are still only expecting them to continue for another 9 months, with the peak rate in March or April 2023 before markets are pricing in at least a full 25bps rate cut by end-2023 from that point. I pointed out in my chart of the day yesterday (link here) that the median time historically from the last hike of the cycle to the first cut was only 4 months, and last time it was only 7 months between the final hike in December 2018 and the next cut in July 2019. So it wouldn’t be historically unusual if Fed funds did follow that pattern whether that fits my view or not.

Over in Europe yesterday there was an even more aggressive rise in yields, with those on 10yr bunds (+10.9bps), OATs (+11.0bps) and BTPs (+9.1bps) all rising on the day as they bounced back from their even larger declines over the previous week. That came as investors pared back their bets on a more dovish ECB that they’d made following the more negative tone last week, and the rate priced in by the December ECB meeting rose by +8.5bps on the day.

For equities, the major indices generally fluctuated between gains and losses through the day. The S&P 500 followed that pattern and ultimately fell -0.30%, which follows its best daily performance in over 2 years on Friday Quarter-end rebalancing flows seem set to drive markets back-and-forth price this week. Even with the decline yesterday, the index is +6.36% higher since its closing low less than a couple of weeks ago. And over in Europe, the STOXX 600 (+0.52%) posted a decent advance, although that masked regional divergences, including losses for the CAC 40 (-0.43%) and the FTSE MIB (-0.86%).

Energy stocks strongly outperformed in the index, supported by a further rise in oil prices that left both Brent crude (+1.74%) and WTI (+1.81%) higher on the day. G7 ministers reportedly agreed to explore a cap on Russian gas and oil exports, with the official mandate expected to be announced today, but it would take time for any mechanism to be developed. The impact on global oil supply is not clear: if Russia retaliates supply could go down, if this enables other third parties to import more Russian oil supply could go up. Elsewhere, political unrest in Libya and Ecuador could simultaneously hit oil supply. In early Asian trading, oil prices continue to move higher, with Brent futures up +1.13% at $116.39/bbl and WTI futures gaining +1% to just above the $110/bbl level.

Asian equity markets are struggling a bit this morning. The Hang Seng (-1.00%) is the largest underperformer amid a weakening in Chinese tech stocks whilst the Nikkei (-0.15%), Shanghai Composite (-0.15%) and CSI (-0.19%) are trading in negative territory in early trade. Elsewhere, the Kospi (-0.05%) is just below the flatline. US stock futures are slipping with contracts on the S&P 500 (-0.12%) and NASDAQ 100 (-0.18%) both slightly lower.

In central bank news, the People’s Bank of China (PBOC) Governor Yi Gang pledged to provide additional monetary support to the economy to recover from Covid outbreaks and lockdowns and other stresses. In a rare interview conducted in English, the central bank chief did caution though that the real interest rate is low thereby indicating limited room for large-scale monetary easing.

Turning to geopolitical developments, the G7 summit continued in Germany yesterday, and in a statement it said they would “further intensify our economic measures against Russia”. Separately, NATO announced that it will increase the number of high readiness forces to over 300,000, with the alliance’s leaders set to gather in Madrid from today. And we’re also expecting a new round of nuclear talks with Iran to take place at some point this week, something Henry mentioned in his latest Mapping Markets out yesterday (link here), which if successful could in time pave the way for Iranian oil to return to the global market.

Finally, whilst there were some decent May data releases from the US, the Dallas Fed’s manufacturing activity index for June fell to a 2-year low of -17.7 (vs. -6.5 expected).

To the day ahead now, and data releases include Germany’s GfK consumer confidence for July, French consumer confidence for June, whilst in the US there’s the FHFA house price index for April, the advance goods trade balance and preliminary wholesale inventories for May, as well as the Conference Board’s consumer confidence for June and the Richmond Fed’s manufacturing index. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Lane, Elderson and Panetta, the Fed’s Daly, and BoE Deputy Governor Cunliffe. Finally, NATO leaders will be meeting in Madrid.