After yesterday’s remarkable U-turn in US stocks which tumbled at the open only to recover all losses by EOD (except the energy sector which suffered a furious rout), overnight futures traded subdued, fluctuating between gains and losses ahead of today’s FOMC minutes as traders debate whether the coming recession is good news (more stimulus from the Fed) or bad news (stagflationary, tying the Fed’s hands). S&P futures were down 0.1% last, having traded on both sides of the unchanged line for much of the past 12 hours while Europe’s Stoxx 600 was much more excited and climbed the most since June 24. The two- and 10-year US yield curve remained inverted as investors awaited the minutes of the Federal Reserve’s last meeting; the 10-year Treasury yield held steady around 2.81%. The dollar rose for a fourth day as the Euro tumbled while bitcoin traded at $20,000.

In China, Shanghai launched mass testing for Covid in nine districts after detecting cases the past two days, fueling concerns that the financial hub may once again find itself locked down in pursuit of Covid Zero. The Shanghai Composite Index slid the most since May 24.

In thin premarket trading, bank stocks were lower as investors await the release of the Federal Reserve’s meeting minutes. In corporate news, crypto broker Voyager Digital filed for Chapter 11 bankruptcy protection. Meanwhile, HSBC is in talks to sell its Russia unit to local lender Expobank, according to people familiar with the matter. Stocks related to cryptocurrencies fell in US premarket trading as Bitcoin fell amid mounting concerns of a global recession. Here are some of the most notable premarket movers:

- Kornit (KRNT US) shares plunged 23% in US premarket trading after the inkjet printer manufacturer issued disappointing preliminary second-quarter results. Stifel cut its recommendation to hold from buy.

- Chip and chip equipment stocks could be active on Wednesday after Bloomberg reported that the US is pushing the Netherlands to ban ASML from selling some chipmaking tools to China. Watch shares including Applied Materials (AMAT US), Lam Research (LRCX US) and KLA (KLAC US), as well as Nvidia (NVDA US), Qualcomm (QCOM US), Intel (INTC US), Advanced Micro Devices (AMD US)

- Stocks related to cryptocurrencies decline as Bitcoin drop amid mounting concerns of a global recession. Riot Blockchain (RIOT US) -4.2%, Coinbase (COIN US) -3.3%, Ebang (EBON US) -5.5%, Marathon Digital (MARA US) -1.8%, BitNile -5.2% (NILE US)

- Shopify (SHOP US) shares slide 0.9% as The Globe and Mail reports, citing people familiar, that the company is delaying a compensation overhaul that would give its employees flexibility on how their salary is paid in stock and cash.

- Cazoo (CZOO US) and Carvana (CVNA US) fall as Davy cuts earnings estimates and price targets for online auto stocks, citing inflation, higher interest rates and weakening consumer sentiment as threats to operational execution.

- RADA Electronic Industries (RADA US) sinks 11%, after the Israeli defense firm said that it’s withdrawing its full-year 2022 revenue guidance in light of its pending merger with Leonardo DRS.

- Watch cybersecurity companies like Palo Alto Networks (PANW US), CrowdStrike Holdings (CRWD US) and Okta (OKTA US) as Morgan Stanley analysts said they expect durable security spending environment in the second half of 2022 against an uncertain macro backdrop.

With energy names plunging on expectations of a recession, bargain hunters chased technology stocks boosting US equity indexes on Tuesday, helping mask a deepening slump in stocks linked to economic activity, such as energy, commodity and industrial names. A renewed spike in China’s Covid cases and a worsening gas crisis in Europe signaled that a worldwide slowdown is coming even as central banks tighten monetary policy to contain consumer prices.

“Markets are caught between two opposing forces and that’s the place we are going to be in for the next few months,” Diana Amoa, chief investment officer for long-biased strategies at Kirkoswald Asset Management, said on Bloomberg Television. “We go from trading lower growth to trading high inflation.”

European equities pared opening gains, with the Euro Stoxx 50 up 1.5% having risen as much as 2.3% in early trade, clawing back roughly half of Tuesday’s sharp losses. CAC 40 and FTSE 100 outperform. Retail, tech and media names are the best performers among broad-based sectoral gains within the Stoxx 600. European semiconductor stocks bounced back on Wednesday, following heavy selling in the past three sessions spurred by concerns over cooling chip demand. ASML shares rise 3.2% as of 9:39am CET, halting a seven-day losing streak, despite news that the US is pushing the Netherlands to stop the chip tool maker from selling deep ultraviolet lithography systems to China. Banks remain the only European industry group in the red on Wednesday, with the Stoxx 600 Bank Index. Here are the most notable European movers:

- Just Eat Takeaway shares surge over 20% after the meal delivery firm struck a deal with Amazon for the e-commerce giant to take up to a 15% stake in its US unit Grubhub.

- Abrdn shares jump as much as 8.8% after the UK asset management firm said it will commence a return of £300m through the repurchase of its shares, with a first phase of up to £150m being undertaken by Goldman Sachs, according to a filing.

- Atos shares climb as much as 8.1% after a filing shows Bank of America holding a 7.77% stake in the French tech services company. Meanwhile, governance remains in focus amid a fresh news report of shareholder unrest.

- Airlines rise on Wednesday amid a rebound in the broader European market. Ryanair shares rally as much as 5.1%, EasyJet +4.2%, Wizz Air +4.5%.

- Shop Apotheke shares gain as much as 13% after jumping 12% yesterday when the online pharmacy reported preliminary 2Q results. Baader notes that e-scripts will be mandatory in all German states by January 2023, further pushing the company’s sales prospects in the country.

- Trainline stock surges as much as 24% as its new FY23 guidance implies a 27% upgrade to consensus, Morgan Stanley writes in note following trading update.

- Fresnillo stocks fall as much as 4.2%, while Endeavour rises as much as 4% after Credit Suisse starts coverage of the former with an underperform recommendation and initiates UK-listed shares of the latter at outperform.

- TotalEnergies and Engie fall in Paris, underperforming peers, as President Emmanuel Macron comes under increasing pressure to introduce a windfall tax on energy and transport giants to fund his bill aimed at protecting consumer purchasing power.

- Adidas shares fall as much as 5.4% after Hauck & Aufhaeuser double downgrades to sell from buy, also setting a Street low price target for the sports-apparel maker, whose FY22 targets are likely at risk due to a 2Q margin squeeze.

Earlier in the session, Asian stocks slipped as fears of a global economic recession and fresh Covid-19 outbreaks in China weighed on sentiment. The MSCI Asia Pacific Index fell as much as 1.3%, led by energy-related shares as oil traded below $100 per barrel, while investors snapped up defensive shares. Stocks in China declined as Shanghai ramped up mass testing in nine districts after detecting cases the past two days, fueling concerns that the financial hub may once again find itself locked down in pursuit of Covid Zero. The Shanghai Composite Index slid the most since May 24. Benchmarks in the tech-heavy markets of Taiwan and South Korea also dropped. In China, Shanghai launched mass testing for Covid

The fall in Asia shares came despite US stocks recouping most of their losses in a volatile session overnight. Traders are turning their attention to the minutes of the most-recent Federal Reserve meeting, which will be released later today, for a sense of policy makers’ debate about the near-term path for interest rates. Asian equities have been stuck in range-bound trading in recent months as investors weigh higher interest rates and the prospect of an economic downturn driven by elevated inflation. Still, narratives of peak inflation are building up as the Fed ramps up its policy-tightening campaign. It’s “much too early, in our view, to think that inflation trades are over,” Frank Benzimra, head of Asia equity strategy at Societe Generale, said in a Bloomberg TV interview. For emerging-market assets, “you also have some valuation buffer, some levels of yields which are becoming interesting. So this is where we are seeing that we may be close to the peak of pain.” Equity measures in the Philippines and New Zealand bucked the regional trend to each rise more than 1.6%.

Japanese stocks declined as oil tumbled and concerns of a global economic downturn damped sentiment. The Topix Index fell 1.2% to 1,855.97 at the market close in Tokyo, while the Nikkei 225 declined 1.2% to 26,107.65. Toyota Motor Corp. contributed the most to the Topix’s loss, decreasing 2.8%. Out of 2,170 shares in the index, 572 rose and 1,520 fell, while 78 were unchanged. “Japanese stocks are seen as representative of the global cyclical economy, so when concerns about recession appear, not only in the US but globally as well, stocks overall are likely to be sold off,” said Yasuhiko Hirakawa, head of an investment department at Rakuten Investment Management. Oil Steadies Above $100 After Plunging on Recession Concerns

Key equity gauges in India rallied as commodity prices eased while a recovery in monsoon rainfall buoyed sentiment. The S&P BSE Sensex Index rose 1.2% to 53,750.97 in Mumbai, while the NSE Nifty 50 Index advanced 1.1%. Hindustan Unilever was the biggest boost to the Sensex, increasing 4%. Out of 30 shares in the index, 25 rose and five fell. Seventeen of the 19 sectoral indexes compiled by BSE Ltd. gained, led by automobile and consumer goods companies. Asia’s biggest software exporter Tata Consultancy Services will kickoff the April-June earnings season for companies on Friday.

Australia’s S&P/ASX 200 index fell 0.5% to close at 6,594.50, as fears of a global economic recession as well as tumbling commodity prices hit market sentiment. The benchmark was dragged by a group of mining shares that fell to the lowest level since Nov. 2, and energy stocks that fell the most in over two years. In New Zealand, the S&P/NZX 50 index rose 1.6% to 11,141.07

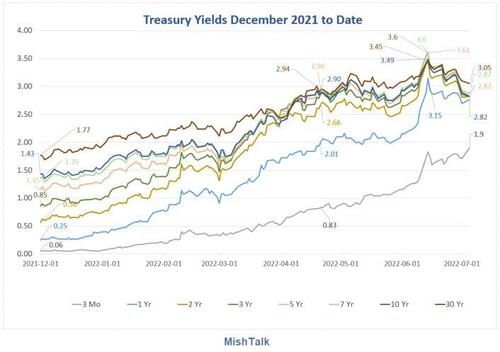

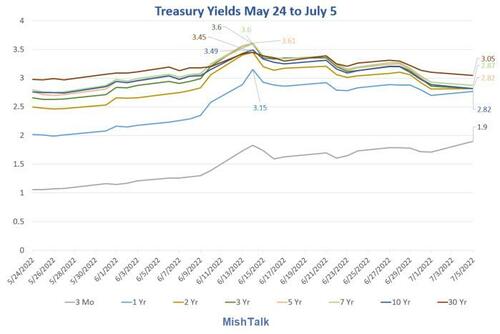

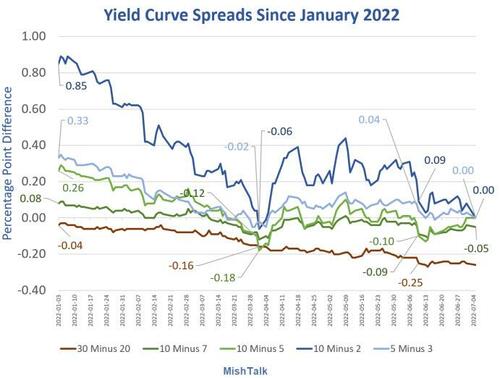

Fixed income was comparatively quiet. Bunds and USTs bear-steepened as 2y Bunds outperformed. Treasuries are flat in early US trading Wednesday with front end underperforming, pushing 2s10s yield curve into deeper inversion. Yields are mostly lower led by 2-year, at 2.82%; the 10Y yield was trading just south of 2.80% last; 5- to 30-year yields hold increases of less than 2bp after touching lowest levels since late May on Tuesday amid a slump in commodity prices led by oil. 2s10s curve inverted as much as 3.6bp; maximum inversion this year was 9.5bp on April 4, reached as futures markets began to price in bigger Fed rate increases in response to persistently high inflation readings, pushing 2- year yields higher. Latest inversion, by contrast, occurred as 10- year yield declined more than 2-year, with expectations for Fed rate path in broad decline on economic-slowdown concerns. UK Gilts bear-flattened, erasing an initial decline after comments from BOE’s Pill. Peripheral spreads are marginally wider to Germany.

In FX, Bloomberg dollar spot index rises 0.2%. JPY is the strongest in G-10, trading near 135.30/USD. EUR sits at the bottom of the scoreboard with EUR/USD trading through Tuesday’s lows.

In commodities, crude futures drift off Asia’s best levels. WTI slips below $100, Brent trades on a $104 handle, with Goldman Sachs arguing that a plunge driven by fears a recession will hurt demand was overdone. Today’s gains were small compared to Brent’s decline of more than $10 on Tuesday, its third largest ever in dollar terms. Investors have been pricing in the consequences of a slowdown even as physical crude markets continue to show signs of vigor and the war in Ukraine drags on. Copper dropped as fears of a global economic slowdown piled pressure on industrial metals.. Spot gold holds a narrow range near $1,765/oz. Base metals are mixed; LME tin falls 1.5% while LME lead gains 1.7%.

Looking to the day ahead now, data releases from Europe include German factory orders for May, the German and UK construction PMIs for June, and Euro Area retail sales for May. Over in the US, there’s also the final services and composite PMIs for June, the ISM services index for June, and the JOLTS job openings for May. Otherwise from central banks, we’ll get the minutes from the June FOMC meeting, and also hear from the Fed’s Williams, the ECB’s Rehn and the BoE’s Cunliffe and Pill.

Market Snapshot

- S&P 500 futures down 0.2% to 3,825.75

- MXAP down 0.8% to 156.29

- MXAPJ down 0.9% to 516.65

- Nikkei down 1.2% to 26,107.65

- Topix down 1.2% to 1,855.97

- Hang Seng Index down 1.2% to 21,586.66

- Shanghai Composite down 1.4% to 3,355.35

- Sensex up 0.8% to 53,570.29

- Australia S&P/ASX 200 down 0.5% to 6,594.48

- Kospi down 2.1% to 2,292.01

- STOXX Europe 600 up 1.4% to 406.26

- German 10Y yield little changed at 1.24%

- Euro little changed at $1.0259

- Brent Futures up 1.3% to $104.15/bbl

- Gold spot up 0.2% to $1,769.16

- U.S. Dollar Index little changed at 106.46

Top Overnight News from Bloomberg

- With the European economy lurching toward a recession, traders are growing more convinced that the euro breaking parity with the dollar is imminent

- “If the fragmentation in bond markets is unwarranted then we should be as unlimited as possible,” European Central Bank Governing Council member Pierre Wunsch tells the Financial Times. “The case to act is strong when faced with unwarranted fragmentation”

- German factory orders unexpectedly rose in May, even as global momentum was affected by rampant inflation and uncertainty stoked by Russia’s war in Ukraine. Demand increased 0.1% compared to the previous month, compared to an economist estimate of -0.5%

- Britain’s new Chancellor of the Exchequer, Nadhim Zahawi, signaled he wants to cut taxes faster than his predecessor Rishi Sunak, as he set out plans to boost the UK’s struggling economy

- British Prime Minister Boris Johnson is on red alert for signs of a coordinated plot from his ministers to bring him down, according to a senior government official

- China’s central bank looks set to withdraw cash from its financial system in a sign that it’s moving toward normalizing monetary policy as major global peers are forcefully raising interest rates

- A combination of the recent bond rebound and the spiraling cost to hedge the volatile yen has wiped out the yield premium a Japanese investor once enjoyed from US debt. The yen-hedged yield on 10-year Treasuries collapsed to 0.24% Tuesday from almost 1.7% in April, just above the 0.22% yield on comparable Japanese debt

- Emerging-market currencies are tumbling as the twin threats of rising US interest rates and a global recession send traders scurrying to the safety of the dollar. The MSCI Emerging Markets Currency Index dropped for a second day, extending this year’s slide to 4.4%, heading for the steepest annual drop since 2015

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly negative with risk appetite sapped by headwinds from the global growth concerns and US recession fears. ASX 200 was marginally lower with energy leading the descent in the commodity-related sectors, although the downside in the index was stemmed by tech strength following the duration-sensitive bias stateside and lower yield environment. Nikkei 225 weakened alongside a firmer currency and with Japan said to delay the call on the start of the nationwide travel support.Hang Seng and Shanghai Comp. conformed to the downbeat mood after the PBoC continued to drain liquidity and with reports noting that US President Biden could lift tariffs on just USD 10bln of Chinese goods, while the US was also said to pressure ASML to stop selling key chipmaking equipment to China. In addition, COVID-19 concerns persisted after China’s Xi’an city entered a 7-day period of ‘temporary control measures’ and with Macau officials locking down the Grand Lisboa hotel and casino due to a cluster of infections.

Top Asian News

- PBoC injected CNY 3bln via 7-day reverse repos with the rate at 2.10% for a CNY 97bln net drain.

- Shanghai suspended the operation of KTV venues due to COVID-19 but other entertainment venues can remain open, while the gradual reopening of cinemas and concert venues will go ahead from July 8th, according to Reuters.

- US top diplomat for East Asia Kritenbrink said the top priority for US Secretary of State Blinken’s meeting with Chinese Foreign Minister Wang is to underscore US commitment to diplomacy and maintaining open lines of communication, while he expects Blinken to raise human rights in the meeting with China’s Foreign Minister, according to Reuters.

- Two US senators called for the FTC to investigate TikTok after the disclosure about Chinese access to US data, according to Reuters.

- Chinese Capital Beijing will resume direct international flights in an orderly way, via Reuters.

- ‘Bad for EM’: Why Funds Are Furiously Selling Risky Currencies

- SenseTime Plunge Raises Stakes for Slew of China Lockups Lifts

- Goldman Sachs Sees Kotak Mahindra Bank to Double Market Value

- Singapore’s Price for Right to Buy a Car Hits All- Time High

European bourses are firmer across the board, Euro Stoxx 50 +1.3%, continuing to take impetus from the NDX-led rebound in US hours on Tuesday and shrugging off negative APAC trade. Stateside, futures are mixed/flat at present, but like their European peers have been choppy in overnight ranges awaiting US data and Fed speak; ES -0.1%. Back to Europe, sectors exhibit a pro-cyclical bias that features Tech as the clear outperformer. China’s CPCA says prelim figures show China sold 1.926mln cars in June, +22% Y/Y. Prelim. figures indicate Tesla (TSLA) sold 78k (prev. 32.1k MM) China-made vehicles in June, via Reuters.

Top European News

- Latest British Political Drama Proves ‘Sideshow’ for Investors

- French Rail Strike Adds to European Summer Travel Havoc

- Russia Slams Macron for Breaching Diplomatic Confidentiality

- Bulgaria’s Gerb Holds Narrow Lead Over Ruling PP Party: Poll

- BOE Chief Economist Says Fighting UK Inflation Is Priority

- Italy Five Star Party is leaning on keeping support for PM Draghi, according to ANSA.

Central Banks

- ECB’s Wunsch said If the fragmentation in bond markets is unwarranted then we should be as unlimited as possible, via the FT.

- BoE’s Cunliffe said we will act to ensure the inflation shock does not become imbedded.

- BoE’s Pill says the (BoE) statement re. acting forcefully if necessary reflects both my willingness to adopt a faster pace of tightening than implemented thus far in this tightening cycle & emphasis conditionality on data; Pill will be data-dependant. Much remains to be resolved before we vote on our August policy decision. Adds, that there is a case of steady-handed approach; one-off bold moves can be disturbing to markets.

FX

- Dollar dips, but retains firm underlying bid ahead of FOMC minutes, Fed’s Williams and services ISM, DXY holds around 106.500 within 106.760-340 range.

- Yen outperforms on technical grounds and with JPY crosses maintaining downward momentum; USD/JPY closer to 135.00 than 136.00, but faces stiff support if breached via recent lows .

- Euro remains pressured after largely weak Eurozone construction PMIs and no real compensation from mixed retail sales data, EUR/USD slips to new 20 year low nearer 1.0200.

- Pound precarious as more UK Tory Party MPs quit to pile pressure on PM Johnson, Cable back under 1.1950 after brief rebound from low 1.1900 area.

- Yuan bucks downbeat mood in EM currencies even though China suffers more outbreaks of Covid-19 as it adopts regional safe haven status; USD/CNH and USD/CNY straddle 6.7100.

- Lira lurches again and Forint falls to fresh all time low; USD/TRY tops 17.2550 and EUR/HUF touches 410.50.

Fixed Income

- Bulls keep debt afloat after retreat from Tuesday peaks.

- Bunds subsequently breach prior session best by a lone tick, at 151.66 before running into supply issues, as new 10 year German benchmark technically uncovered.

- Gilts back on 116.00 handle from 115.47 Liffe low and T-note hovers nearer top end of 120-03/119-21 overnight range ahead of Fed’s Williams, US services ISM and FOMC minutes.

- UK debt unruffled by more UK Government resignations and BoE rhetoric awaiting PMQs that will put spotlight on under fire Conservative Party leader Johnson.

Commodities

- Crude benchmarks are firmer and having been moving with the equity space after yesterday’s significant crude selloff; however, the ‘recovery’ is limited with WTI pivoting USD 100/bbl.

- Goldman Sachs said oil has overshot as the global deficit is unresolved and it is premature for oil to drop on recession concerns

- OPEC Secretary General Barkindo has passed away, according to Arab News. Note, from an OPEC personnel perspective, Barkindo’s term as the OPEC SecGen was due to end on July 31st, after which the Kuwaiti oil executive Haitham Al Ghais was due to replace him as the new secretary-general

- Tengiz field in Kazakhstan continues operations following a blast, according to a source cited by Reuters.

- Spot gold is lacklustre after Tuesday’s USD-driven downside; notably, the yellow metal has been fairly resilient to fresh advances in the DXY. While base metals continue to falter, LME copper below 7.5k/T at worst.

US Event Calendar

- 07:00: July MBA Mortgage Applications -5.4%, prior 0.7%

- 09:45: June S&P Global US Services PMI, est. 51.6, prior 51.6

- 10:00: May JOLTs Job Openings, est. 10.9m, prior 11.4m

- 10:00: June ISM Services Index, est. 54.0, prior 55.9

- 14:00: June FOMC Meeting Minutes

Central Banks

- 09:00: Fed’s Williams Makes Remarks at Event on Bank Culture

- 14:00: June FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

It’s sports day at school today and I’m going to pop in for an hour to watch. However given that my 4yr old twins are the youngest in their year and my daughter is still in a wheelchair I suspect I won’t be building a new trophy cabinet. For those that have asked about Maisie (thanks by the way) she continues to be in great spirits and is exceptional at swimming for her age (6) so she would likely win that if there was such an event. Fingers crossed she’ll be able to get out of the wheelchair in a few months after 8 months so far. The next scan is in 3 weeks and we’ll know if the hip ball has finished collapsing and if it is showing any early sign of regrowing.

As my kids are unlikely to win a prize they’ve asked me to ensure I win some for them to make their tears go away. So if you value our research I would appreciate it if you would vote in the Global Institutional Investor FI survey that opened yesterday. You can see the categories I am up for in this (link here) pdf. There are a number but I’ve listed the priorities. If you could let us know if you voted that would be appreciated unless it is to tell me you voted for one of our competitors!

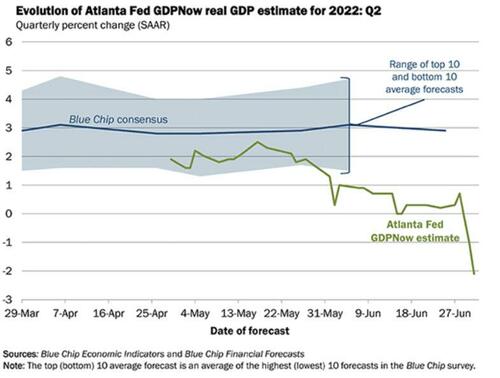

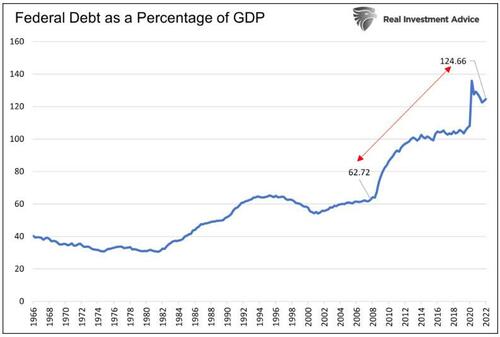

It’s been another tumultuous 24 hours in markets, with a massive risk-off move reversing late in the US session as the S&P (+0.16%) climbed over 2% after Europe closed. We’ll run through the various headlines in a moment, but there was so much going on here’s a quick highlights reel. We’ve seen the euro decline to a 20-year low against the US Dollar, another round of inversions across the Treasury curve, a mammoth rally in bonds, the tightest financial conditions since the initial wave of the Covid pandemic, a market now pricing in at least two full rate cuts by the Fed in 2023, the German government starting work on bailing out the gas sector, near double-digit percentage drops in oil, and a UK Prime Minister who is getting hit with very high profile cabinet resignations.

Running through the day, investor fears were evident from the get-go, with European markets swiftly giving up their gains after the open to move progressively lower through the day. An important catalyst for that was the latest bad news on the energy side, where an escalation in the Norwegian gas strike we mentioned yesterday means that nearly 60% of the country’s gas exports could have been affected from Saturday according to the Norwegian Oil and Gas Association. However, there were some optimistic signs overnight, as it appears the Norway labour minister intervened to put an end to the strike by summoning both sides to the table, saying “When the conflict can have such great social consequences for the whole of Europe, I have no choice but to intervene in the conflict”.

It goes without saying that this strike would have been coming at a particularly bad time for the European economy, not least with the scheduled maintenance on Nord Stream that’s occurring from July 11-21 and the uncertainty over what happens next. Germany yesterday accelerated legislation that will allow it to rescue energy companies if the need arises with Uniper looking set to be the first to receive state support. Economy Minister Habeck has talked about gas as potentially being a Lehman Brothers moment so the stakes are high.

Indeed this is a heavy cloud hanging over European assets at the moment and they were among the worst global performers yesterday as the prospect of a chaotic gas situation and recession came closer into view. Indeed, the euro itself weakened by a massive -1.50% against the US Dollar yesterday, which was its largest daily decline since March 2020, and left the single currency at its lowest level against the dollar since 2002, closing at just $1.0266. It’s dipped another -0.2% overnight.

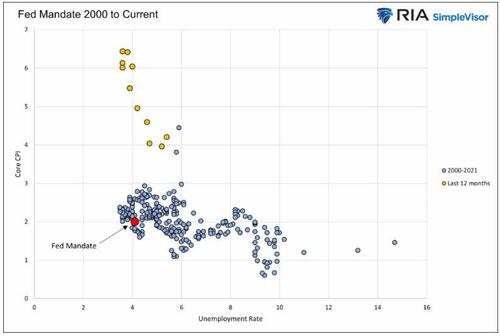

Another factor behind the euro’s weakness were growing doubts that the ECB could embark on as aggressive a hiking cycle as initially thought. That expectation of more dovish central banks was present across the world yesterday in light of the recession fears, but it was particularly prevalent in Europe, where the rate priced in by the June 2023 meeting came down by -11.4bps by the close of trade. It was a similar story in the US where the rate priced in by June 2023 came down by -11.4bps, but what’s becoming increasingly apparent is that investors are now expecting that the Fed will shift towards easing policy by mid-2023, with at least a full 25bp cut now priced in between the February and July meetings in 2023, as well as a further one by year-end.

Those fears of a recession were manifesting themselves in other asset classes too, with commodities more broadly (European natural gas excepted) having an awful day as the resiliency of global demand was brought into question. For instance, Brent crude oil prices (-9.45%) witnessed their largest daily move lower since March, taking prices down to their lowest level since early May at $102.77/bbl while WTI (-8.24%) broke beneath $100/bbl for the first time since April. The traditional industrial bellwether of copper was another victim of this trend, plummeting by another -5.36% yesterday to a 19-month low of its own, whilst wheat futures (-4.61%) are now trading beneath their levels prior to Russia’s invasion of Ukraine. In Asia, oil futures have pared bigger bounce back gains but are still trading slightly higher with Brent futures +1.05% and WTI futures (+0.72%) just above the $100/bbl level again.

Given the rising doubts about future rate hikes and the weakening inflationary pressures from key commodities, sovereign bonds put in a strong performance as they also benefited from their usual appeal as a haven asset. Yields on 10yr Treasuries came down by -7.5bps to 2.81%, and the 10yr breakeven fell -6.2bps to 2.30%, which takes it to a level unseen since September 2021, back before the Fed had even begun to taper their asset purchases. The declines in yields were concentrated at longer maturities, with the 2s10s curve flattening by -6.2bps to -1.9bps, closing inverted for the first time in nearly a month. And speaking of inversions, another milestone was reached yesterday as the 2s5s curve inverted for the first time this cycle in trading, closing -5.0bps lower at -0.9bps. That picture was echoed over in Europe as well, where yields on 10yr bunds (-15.6bps), OATs (-13.8bps) and BTPs (-9.1bps) all moved lower on the day. This morning yields on 10yr USTs (+2.37 bps) are edging higher as I type.

For equities, the layer upon layer of bad news resulted in another significant selloff until the Euro close, with the STOXX 600 shedding -2.11%. However the rate rally supported a steady tech-led march higher in the US after opening very weak and trading more than -2% lower. The S&P 500 finished +0.16% higher and the NASDAQ was up +1.75% on the day. Energy stocks led the moves lower on both sides of the Atlantic, and the index-level gains in the US were supported by a narrow subset of large cap stocks sensitive to lower rates, with only 3 S&P sectors – tech, discretionary, communications – in the green, and a massive 667bps differential between the best performing sector (communications +2.66%) and worst (energy -4.01%). Indeed, the even more concentrated mega-cap FANG+ outperformed the rest of the complex, gaining +3.01%. In line with the late US divergence, it was a tale of two credit markets, with HY credit spreads widening in Europe with the iTraxx crossover +27.4bps to 616bps, a level not seen since early April 2020 at the height of the initial lockdowns, while US HY CDX spreads tightened -11.8bps to 565bps after trading as high as 592bps intra-day.

On the UK political scene, Prime Minister Johnson’s position is under significant pressure at the minute with two high profile resignations in his cabinet after yet more conduct issues were raised about the PM’s leadership. Johnson has indicated he plans to stay on and has appointed replacements for the outgoing ministers, but his position looks increasingly perilous given the lack of party support. The pound was -1.41% lower versus the US dollar, but most of the decline took place before the news of the resignations and the pound was actually in the middle of the pack for G10 currency performance on the day, with the broader risk environment proving more perilous. If the PM can stay on he will likely pivot towards easier fiscal policy now the Chancellor has resigned. However it’s tough to price that in as it’s not clear whether the PM can survive this episode.

Asian equity markets are lagging this morning even with the late US rally. Across the region, the Hang Seng (-1.56%) is the largest underperformer followed by the Kospi (-1.33%) and the Nikkei (-1.26%) in early trade. Markets in mainland China are also sliding with the Shanghai Composite (-1.20%) and CSI (-1.23%) trading in negative territory dragged down by worries about new COVID-19 cases in Shanghai risking fresh restrictions.

Moving ahead, stock futures in the DMs indicate a mixed start with contracts on the S&P 500 (-0.12%) and NASDAQ 100 (-0.10%) edging lower albeit with DAX futures bouncing +1.35% after that late US rally.

Moving to Covid news, Shanghai reported 24 infections yesterday, its most in three weeks although the overall case load remains small by global standards. To avert a wider spread and huge disruptions, Shanghai’s municipal government said in a statement that there’d be mass PCR testing in 9 districts and partial areas in another 3 districts, with residents required to take 2 tests within 3 days. The measures follow a reported outbreak, which has driven anxiety that the financial capital will be closed back down after just emerging from a two-month long lockdown.

On the data side, US factory orders expanded by a stronger-than-expected +1.6% in May (vs. +0.5% expected), whilst the previous month’s growth was revised up four-tenths to +0.7%. Over in Europe, the final composite PMI for the Euro Area in June was revised up from the flash reading to 52 (vs. flash 51.9).

To the day ahead now, and data releases from Europe include German factory orders for May, the German and UK construction PMIs for June, and Euro Area retail sales for May. Over in the US, there’s also the final services and composite PMIs for June, the ISM services index for June, and the JOLTS job openings for May. Otherwise from central banks, we’ll get the minutes from the June FOMC meeting, and also hear from the Fed’s Williams, the ECB’s Rehn and the BoE’s Cunliffe and Pill.