Payment-For-Order-Flow & The SEC’s Plan To End It

Authored by Lance Roberts via RealInvestmentAdvice.com,

“Payment For Order Flow” remains a contention between retail investors and Wall Street. On the one hand, it creates the ability to have “free trading” for retail investors. However, it also creates an opportunity for Wall Street to “front-run” individuals for profit.

In financial markets, “Payment For Order Flow,” or “PFOF,” refers to a broker’s compensation from third parties to influence how the broker routes client orders for fulfillment.

Read that again.

For years, paying for order flows allowed firms to centralize customers’ orders for another firm to execute. Such allowed smaller firms to use economies of scale of larger firms. Such enables small firms to combine orders with larger firms, providing better execution quality.

Over the years, the decimalization of the trading securities diminished the profitability of trade execution. Such pushed Wall Street toward payment for order flow as a way to generate revenue and subsidize the move to zero commissions.

Technological advances and data analysis increased the speed with which information gets sent and received. Over the last decade, Wall Street spent billions to figure out ways to take advantage of the data and “game the system.”

Today, Robinhood and others generate the bulk of their revenues from payment for order flow by selling orders to the highest bidder.

Think about this carefully. If a firm is selling order flow to the highest bidder, even though you are paying “zero commissions,” you are not necessarily getting the best execution.

In other words, “free” isn’t necessarily “free.”

The Fleecing Of Retail Investors

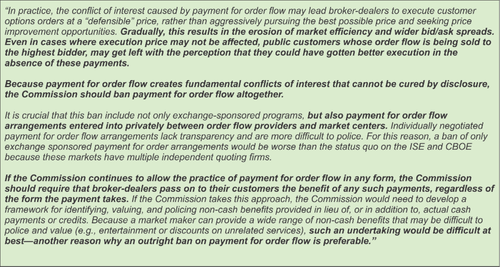

The issue of payment for order flow is not a new thing. In 2004, Citadel’s attorney Jonathan G. Katz wrote a letter to the SEC making a definitive argument the practice of selling order flow should be illegal.

Source: https://www.sec.gov/rules/concept/s70704/citadel04132004.pdf

Think about that for a moment.

-

In 2004, Citadel argued that payment for order flow should be illegal to the SEC.

-

In 2020, Citadel is the largest firm in the payment for order flow business.

Citadel decided that “if you can’t beat ’em, join ’em” was the best game plan.

What happened between 2004 and 2020?

During the waning days of fractional pricing, the smallest spread was ⅛ of a dollar, or $0.125. Spreads for options orders were considerably wider. Traders discovered “free” trades cost them quite a bit since they didn’t get the best transaction price.

At that point, the SEC did step in to conduct a study. The result was a near ban on payment for order flow. The study found, among other things, that the proliferation of options exchanges narrowed spreads due to the additional competition for order execution.

In the end, under pressure from Wall Street, the SEC acquiesced and allowed the practice to continue stating:

“While the fierce competition by increased multiple-listing produces immediate economic benefits to investors in the form of narrower quotes and effective spreads. By some measures these improvements get muted with the spread of payment for order flow and internalization.”

That decision opened “Pandora’s box.”

No Such Thing As Free Trading

Better Markets previously wrote:

“As is clear from the billions paid for, and made from, order flows, there is no such thing as ‘free trading.’

Thus, the claim of ‘commission-free trading’ is no more than a rhetorical ruse to attract new investors. Such distracts them from the billions of dollars in PFOF and other hidden costs that come out of retail investors’ pockets.

These intermediaries are often merely transferring the investors’ visible upfront commissions into invisible after-the-fact de facto commissions.

Such enables the complexity of the fragmented order processing system that one could argue is designed primarily to hide those payments.” – Better Markets

Such is why Wall Street lobbies the SEC heavily to look the other way. They also continue to obfuscate the “racket” under the guise of “creating market liquidity.” However, liquidity would remain in a world without payment for order flow. Wall Street would merely shift focus back to market-making.

But, if you don’t think this is a “big deal,” you are sorely misinformed.

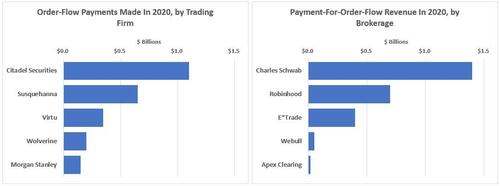

“Brokerages such as Charles Schwab Corp., TD Ameritrade, Robinhood Markets Inc., and E*Trade collected nearly $2.6 billion in payments for stock and option orders. The biggest sources of the payments were electronic trading firms such as Citadel Securities, Susquehanna International Group LLP and Virtu Financial Inc.” – WSJ

“Such firms make money by selling shares for slightly more than they are willing to buy them, and pocketing the price difference.”

So, exactly why would firms pay for order flow?

They are willing to pay for order flow from online brokerages because they are less likely to lose money trading against individual investors than on an exchange, where traders tend to be larger and more sophisticated.” – WSJ

The SEC’s Plan To Fix It?

Once again, the SEC is looking at fixing the payment for order flow practice.

“Right now, there isn’t a level playing field among different parts of the market: wholesalers, dark pools, and lit exchanges. It’s not clear, given the current market segmentation, concentration, and lack of a level playing field, that our current national market system is as fair and competitive as possible for investors.” – SEC Chairman, Gary Gensler

The Wall Street Journal went into more detail about what was currently getting considered:

“Chairman Gary Gensler directed SEC staff last year to explore ways to make the stock market more efficient for small investors and public companies. While aspects of the effort are in varying stages of development, one idea that has gained traction is to require brokerages to send most individual investors’ orders to be routed into auctions where trading firms compete to execute them.

The most consequential change being discussed would affect the way trades are handled after an investor places a so-called market order with a broker to buy or sell a stock. Market orders, which account for the majority of individual investors’ trades, don’t specify a minimum or maximum price the investor is willing to pay.

Mr. Gensler has said he wants to ensure that brokers execute orders at the best possible price for investors—the highest price for when an investor is selling, or the lowest price if they are buying.” – WSJ

The SEC is considering an “auction market” that would force firms to compete with each other to fill an individual investor’s trade. That change would impact how firms like Citadel Securities and Robinhood Markets process retail trade orders.

Now you can understand that “free trades” weren’t that “free” after all.

The Other Problem Of “Free Trades”

The other “free trading” problem is that it also leads to poor investor outcomes. As noted recently by the CEO of the investment app “Stash:”

“The entire way that trading is happening right now in the market and how payment for order flow is working. It is driving a casino effect where everyday Americans who don’t know how to trade and don’t have financial education supplied to them at school and from their parents are actively trading. And I want to understand how market structure will change to make it about the retail customer. The institutional customers and the hedge funds, they’ll be OK, but I want to make sure that we’re protecting retail investors.

Payment order flow has had a spiral effect where it just made it really, really easy to trade and actively trade. I think that it does benefit the market makers and the high frequency trading firms. Whereas, what I want to see is more retail customers thinking about the long term and investing slowly.”

As we noted previously, numerous studies prove more frequent trading leads to worse performance over time. Such is due to the emotional mistakes investors make, primarily of buying high and selling low, but also tax issues and trading costs associated with frequent trading.

The problem with free trading is that humans tend to overreact to good or bad news. This emotional reaction causes illogical investment decisions. This tendency to overreact can become even more significant during personal uncertainty or when the economy is terrible.

An entire field of study researches this tendency to make illogical financial decisions. It documents and labels our money-losing mind tricks like “recency bias” and “overconfidence.”

While the reasons for underperformance are many, commission-free trading exacerbates that trend by removing the “brake pedal” from the speeding car.

The Return Of Commissions

As Better Markets concluded:

“There is no reason for the markets today to be so fragmented other than to serve as a wealth extraction mechanism that moves money from buy-side pockets to sell-side firms, intermediaries, and their affiliates.

However, it isn’t just Robinhood and a couple of hedge funds but a collaboration of every Wall Street player.

I am a firm believer in “free markets.”

However, for “free markets” to work effectively, they must also be “fair markets.”

Our current capital market system may be “free,” but it is not “fair” in many ways. Banning payment for order flow is a good start.

Yes, such would mean that firms providing transaction services would have to charge a commission for execution. But such would potentially have the knock-off effect of “slowing things down” and providing better investor outcomes.

However, while this was an exercise in understanding payment for order flow and that “free trading isn’t free,” nothing will likely change. As is always the case, there is too much money, power, and political pressure from Wall Street on the SEC.

We aren’t holding our breath that anything will change for the better anytime soon.

But maybe it’s worth realizing that paying a small commission for “fair execution” wasn’t so bad.

Tyler Durden

Tue, 07/05/2022 – 13:45

via ZeroHedge News https://ift.tt/z07IxA1 Tyler Durden