The confused and muddled messaging of The G Word, a six-part Netflix documentary miniseries about federal government bureaucracies hosted by Adam Conover and produced by former President Barack Obama, is well illustrated toward the end of the very first episode.

Conover has spent much of the episode explaining how the U.S. Department of Agriculture (USDA) works and its role in monitoring our food supply. He takes viewers to a meat processing plant for an explanation of the relationship between USDA inspectors and domestic meat suppliers, heavily weighted toward the importance of having the federal government overseeing the process.

When Conover visits a supermarket, though, the episode shifts and explains the less savory side of the USDA. Conover notes how federal crop subsidies distort the natural food marketplace, line the pockets of wealthy agricultural corporations, and contribute to a flood of cheap but unhealthy junk food.

“It sure feels like the government’s mission to help farmers is getting in the way of its mission to help eaters,” he says. “Especially since the same USDA that keeps agriculture afloat is also responsible for crafting the dietary guidelines that advise us what to eat. I wonder if that’s a little bit of a conflict of interest.” It is, of course.

Conover knows that junk food is junk, even if it’s delicious, regardless of whatever food pyramids the government may shove in front of us. And he says so, but as he’s opining in the checkout line, he complains, “Every article and ad tells us that the key to healthy eating is to make better choices. But why is it all on us? Maybe instead of worrying so much about what we choose off the shelves, we should pay more attention to what the government chooses to put on them. Because only it has the power to determine if our food is safe and fit to eat.”

Wait, what? Only the U.S. government has the power to determine if our food is safe and fit to eat? He just noted that he has the ability to independently evaluate the quality of the food he’s consuming and yet consumes food that he knows is unhealthy because he likes the taste. He knows full well that we have experts completely outside the realm of government who can adequately advise us on healthy eating. And he even just noted that part of the corruption of the USDA’s dietary guidance was the result of the government ignoring these experts for the benefit of agriculture interests.

This is the weirdness of The G Word in a nutshell. Across the six 30-minute episodes, released in late May, Conover details what various federal agencies do and notes how they frequently fail to do what we need them to do. Nevertheless, the purpose of The G Word is to sell to viewers that a large and powerful federal government is good and that citizens need it for protection. Essentially, Conover’s flipped his typical script and is trying to unruin the government.

Obama appears in just the first and last episode, but his fingerprints are all over the show’s sense of technocratic optimism, a consistent belief that government is supposed to be big and broad and deployed to serve our best interests, whatever those might be. There’s an emphasis on what I call the imaginary “we,” a familiar refrain of Obama’s presidency: the insistent and utterly mistaken belief that “we” all largely want similar things from our government. We do not.

To the extent that the federal government fails or struggles, the show largely lays the blame on two factors—outside corporate manipulation and reductions in funding and staffing. In the second episode, the show calls out AccuWeather’s attempts to restrict public access to National Weather Service data so that it can profit off providing them, a very specific claim of meddling. But when talking about the many, many failures of the Federal Emergency Management Agency (FEMA), it’s somewhat vaguely attributed to differing goals and agendas of the various organizations under the agency’s umbrella and funding being unfairly distributed based on the political power of differing states (also known as democracy in action).

The funniest moment in the series comes not from the various attempts at humorous sketches. The segment that presents the Defense Advanced Research Projects Agency (DARPA) as a parody of Willy Wonka & the Chocolate Factory is cringe-inducing to the very edge of unwatchability. The only time I laughed out loud was purely unintentional. At one point, when explaining FEMA’s failures to adequately respond to the needs of Puerto Ricans in the wake of Hurricane Maria in 2017, Conover blames “red tape,” which he then describes as “the archnemesis” of government. If I had been drinking, I would have done a spit-take here.

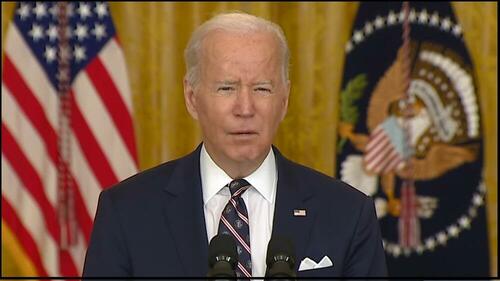

While the show is happy to get specific about corporate malfeasance in attempts to capture and control government, it treats the excesses of government bureaucracy as things that just come up out of nowhere and uninvited, like mold growing on bread. The G Word does not in any way approach bureaucracy as itself a form of internal corruption designed to make government more expensive and more powerful in the service of various interested parties that fiscally benefit with contracts and jobs when government is bigger and more intrusive. At no point when the show mentions FEMA’s failures in Puerto Rico does anybody mention anything like the federal Jones Act, a deliberately protectionist law that benefits the maritime industry (and its unionized employees) and at the same time makes it extremely expensive to ship anything to the island. It’s an example of bureaucracy that is not just some magical evil force showing up out of nowhere. It’s there deliberately, and it made it exorbitantly expensive for Puerto Ricans to recover from the disaster caused by the hurricane. Yet, President Joe Biden’s administration continues to support it because the maritime unions support it.

Later in the series, Conover expresses confusion that his mother—a public school teacher—was one of those types of people who believed that government is big and wasteful. Rather than tackling any of the many, many, many examples of government being wasteful, The G Word essentially insults the intelligence of the audience by suggesting that the push to shrink the size of government is a modern movement pushed by certain types of people (including think tanks, so presumably Reason falls into this category) as a reaction to the civil rights movement. The G Word says the call for smaller government only really began to build under President Ronald Reagan, shown as an actor performing comically inept surgery on a hunky Uncle Sam.

And while it’s true that Reagan did run on the promise of reducing the scope and size of government, federal employment numbers actually increased during his eight years of office, from 2.9 million to 3.1 million. Today’s numbers are back down to 2.8 million. Most of the job cuts actually took place under President Bill Clinton (and the show does note that both he and Obama agreed to cutting the size of government), but the data just simply doesn’t support the claim that the federal government has actually been reduced in size and scope. If Conover wanted to make the claim that the money going to government isn’t being used how it’s needed, the problem then lies in the show’s unwillingness to explore the reality of the “red tape” or the waste. When the show vaguely references the lack of affordable housing in our cities, it doesn’t properly blame it on NIMBYs abusing environmental protection procedures to halt construction or labor unions suing to block projects unless they get a cut of the money but on “anti-housing capitalists,” because capitalism apparently somehow hates providing goods in exchange for money?

To its credit, the show is, in a limited sense, willing to explore how federal and local government power is used to cause harm. The DARPA segment discusses the positive private use of drones (to film a wedding) contrasted with our government’s deadly deployment of them to assassinate targets in countries we aren’t even officially at war with. The G Word even rejects the Obama administration’s lackluster undercounting of civilian victims and instead uses independent observer numbers to show how our drone strikes have killed hundreds of unintended targets. (The show, however, stops short of pointing out that the federal government has imprisoned Daniel Hale, the whistleblower who helped reveal how poorly the drone program operated.)

Toward the end, the final 15 minutes of the final episode, The G Word turns its sights toward local government in an attempt to optimistically encourage local election engagement. Here the show notes that this is where, in particular, criminal justice reform needs to take place because most who are serving prison time are in state custody, not in federal prisons. But even here the show is strangely vague, turning to some activists in Philadelphia who were involved in getting District Attorney Larry Krasner elected. But the show apparently no longer has any time to elaborate on why Krasner’s election was important or even really explain much of his platform other than a vague reference to reducing cash bail. Krasner doesn’t even appear on the show. It doesn’t engage with the backlash against progressive district attorneys and their proposed reforms. It doesn’t discuss the awkward public safety balancing act that comes from trying to make sure citizens feel safe while also not unnecessarily imprisoning people who would be better served by other systems.

After attributing attempts to reduce the size of government to people with bad intentions, it completely ignores the “Defund the Police” part of the criminal justice reform movement. It doesn’t engage with it or attempt to even push the conversation in the direction of getting more mental health and social service experts to respond to certain emergency needs. It just completely ignores it.

On this Independence Day weekend, it’s worth noting this series because of the tendency of some people to worship at the altar of big and powerful government as a solution to all our ills even when they absolutely know how frequently it fails, how frequently it hurts people, and how frequently it serves only itself and its friends. There’s nothing unusual about Conover (and Obama) thinking that government is failing because it’s just somehow not powerful enough or effective enough. It’s very American, in fact. But The G Word shows that holding onto this belief that our government isn’t funded enough requires completely ignoring huge chunks of what the government does with its money and authority.

The post <em>The G Word</em> Begs Americans To Fall Back in Love with Uncle Sam appeared first on Reason.com.

from Latest https://ift.tt/Qgf7wGP

via IFTTT