Authored by Bill Blain via MorningPorridge.com,

“Cheer up my lads ‘tis to glory we steer, to add something new to this wonderful year…”

Stocks tumbled 20% in H1, but Central Banks are fixated on Inflation as the No 1 priority with higher interest rates nailed on. Supply chain issues remain difficult, meaning corporate earnings will remain under pressure. The market is setting up for further weakness through H2.

It’s the last day of June, the end of the 2nd Quarter of this inglorious year, and the headlines sum up the mood: Banks are warning of recession, Tesla is laying off staff from its Autodrive division (really? I thought that was what justified it’s 100 times P/E?), petrol prices at the pump are putting on a new high. Or how about Morgan Stanley warning the price of Carnival Cruise could tumble to zero if recession triggers a major demand shock.. High probability then…

Will things get any better in the second half of the year?

Probably not.

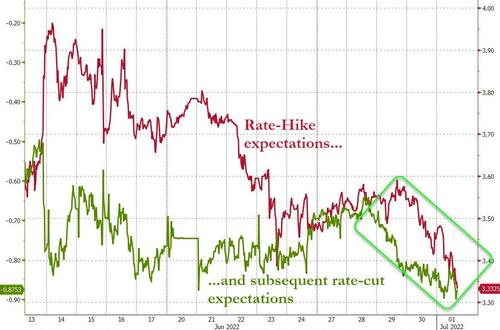

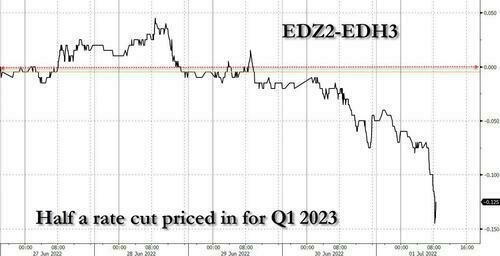

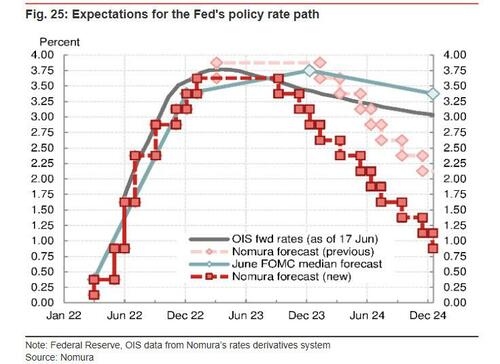

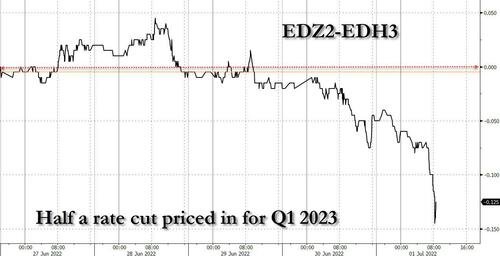

Jay Powel said it all: The process is highly likely to involve some pain, but the worst pain would be from failing to address this high inflation and allowing it to become persistent” Inflation is Central Banks number one concern – not addressing the market declines we’ve seen in the first half. We’re expecting a series of large hikes in interest rates through the summer – even the ECB!

Yet, Markets are still in denial/fool-themselves mode. Markets tend to accentuate the positive and, in doing so remain largely unaware of reality. But at some point reality and inflated hopes tend to collide. Usually painfully.

I’m guessing, but I have a gut-feeling the coming July earnings season could be the straw that triggers the next leg down. The results news-flow will be subtle, and its unlikely to be a succession of disastrous results – just a stream of not-quite-as-good-as-expected numbers. Cumulatively, the news trend will confirm companies are struggling more than anticipated with the consequences of high staffing costs and low availability, high inventories and the need to discount, falling demand on the back of the inflation shock, and ongoing supply chain issues.

Listen very closely to what CEO’s are really saying, and strip out what they want you to hear. Get past the corporate blandishments and it could reverse years of blithe expectations. It’s going to highlight just how badly the real world is still misfiring. (There is a developing sub-text to the corporate outlook – the increasing untenability of highly levered Zombies.. the first, like Revlon have already stumbled.)

Think back to the Pandemic. When it began in March 2020 the stock market took a massive dip. And then it went steadily higher and higher – fuelled by expectations of swift recovery once Covid was beaten. Positive news – like vaccine tests, airports reopening or falling infections were each greeted by rallies. Traders and professional investors talked about how the wall of pandemic savings would create a post-pandemic boom.

The real question to ponder is… why were markets so wrong? Now we look headed for recession. It’s not just the Ukraine energy and food inflation stocks. Much of it boils down to still broken global supply chains.

One of the surprising things I’ve learnt over nearly 40 years about the business of finance is how little investment bankers actually know about the real world. They experience little real “friction” in the business of moving assets around an electronic balance sheet, or calculating returns on a laptop. This morning I have experienced friction because my Laptop had a hissy fit. I was about to punch it before our IT guy bravely stepped in….

In the real world there is tremendous friction in every single part of all transactions – loading a ship, putting cargo on a plane, getting goods shifted from A to B, waiting for parts, waiting for payments, dealing with customers, building products and selling them. It’s difficult. Yet, friction played little part in the markets analysis of the pandemic. Analysts straight out of Investment Management school have diddly-squat idea about the real world.

Even now I don’t think the “market” understands the real economy. It’s still poised for a buying opportunity – looking for signals the bottom has passed and it’s time to buy. I read loads of research about why markets may go up, and look at pages of overweight recommendations and just a few lines of underweight. The market remains highly biased to the upside.

That’s the real divergence in the economy – what the market thinks is happening, and what actual people on the ground actually see… Let me digress for a moment and try to explain the divergence:

For the first 20 years of my inglorious career in finance I spent 99% of my time speaking to fellow finance professionals – traders, salesmen, economists all pushing whatever the investment banking line was. I then relayed these perspectives to my clients in the debt capital markets; Bank Treasurers, CEOs, Investment Firm Economists and Strategists, Portfolio Managers and funding bosses. I existed in a groupthink bubble comprising entirely financial market participants. I thought, acted and behaved like a financial professional clone.

It took me years to realise just how conditioned I had become.

I was lucky. Writing the Morning Porridge since 2007 – and being a natural cynic – has helped. I was lucky to retain just enough disbelief to realise how fundamentally broken financial markets were by the Global Financial Crisis in 2008. My blinkers over investment banking were lifted after the bank I’d led from zero to top 3 in the Financial Institutions business sacked me for “not fitting in.” I perceived just how distorted markets became as a result of regulation, monetary experimentation and QE.

I broke out the bubble. As financial markets became more and more distorted, I started to look for opportunities in real assets rather than financial assets. It’s been fascinating.

Since 2009 I’ve been fortunate to spend an increasing amount of my time talking to real people with real jobs in the real economy. I chat to real entrepreneurs and businesses looking for finance and meeting a whole range of executives, engineers, marketing managers, retail leaders, designers and guys who actually make stuff. A brush with illness brought me to Earth, meeting doctors able to explain not only why I wasn’t working, but the issues with heath provision. Talking to real nurses, brickies, chippies, and artisans has been extraordinary.

I now find it’s difficult to take all finance professionals seriously. It’s been a learning curve about friction.

Pandemic reality slows and there still aren’t enough ships, lorry drivers, pilots, baggage handlers… As shortages bite, inflation rises, we get further exogenous shocks, and a cost-of-living crisis develops. Firms suddenly find themselves with over-ambitious inventories, and suddenly there is talk of companies dumping stock, meaning they miss margins. As interest rates soar to address inflation, zombie companies that leveraged themselves up to buy back their own stock suddenly find themselves busting. (There just is not enough worry about how the junk sector is likely to fare.)

And supply chains are not fixed.

Speak to real economy professionals and they will tell you rising labour costs, rising energy costs, rising logistical costs, rising transport costs, ongoing shortages of key parts, longer lead times for parts, ongoing supply disruptions, rising inventory levels, rising tariffs and barriers to trade, increasing red-tape, geopolitical uncertainty, right down to their simply not being enough space to store components in what was once a just-in-time based factory… and it’s all a recipe for a broken economy.

Compare and contrast to what the market expected and believed would happen – a frictionless reopening of the post-pandemic economy, and what we actually have: ongoing supply chain disruption and friction. All it takes is a few missing containers, a delayed ship (because it slowed down because fuel costs soared), or a container pork blocked because there aren’t enough lorry drivers. One pebble quickly becomes a landslide.

Real businesses are addressing it – they are solving problems ranging from storage space, using smart data, communications, planning and new supply chain approaches. If a particular chip is unavailable and irreplaceable, they find a work around – even it means delaying deliveries. Its tough. They know it may take years because it’s not just supply chains that are changing – its terms of trade, trade routes and costs. Markets assume it will just happen – probably tomorrow or the day after. No it won’t.

And ongoing supply chain crisis is just one aspect of what markets aren’t grasping in terms of the economic reality out there… The inflation shocks from Energy, Food and now Wages. These are real and long-term. They were never transitory.

One of the aspects of the coming Carnival Lines dunking will be its coming liquidity crisis on the back of rising interest rates and crashing customer demand. Morgan Stanley point out it has $30 bln of debt and “unsustainably” high leverage. As its’ stock prices continues on a downwards spire, then raising new equity will be dilutive and costly. You can bet its not the only firm in trouble!