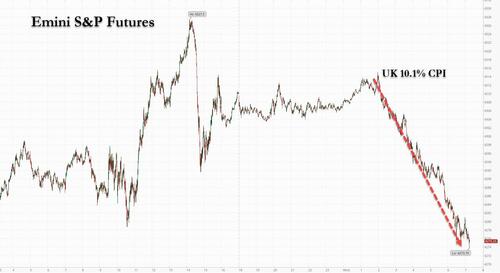

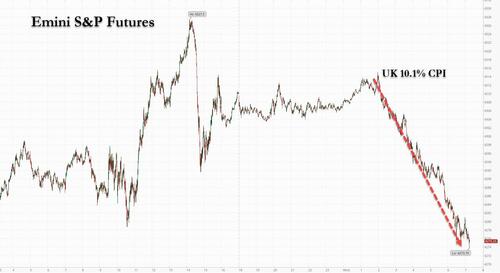

Futures were grinding gingerly higher, perhaps celebrating the end of the Cheney family’s presence in Congress, and looked set to re-test Michael Hartnett bearish target of 4,328 on the S&P (which marked the peak of yesterday’s meltup before a waterfall slide lower when spoos got to within half a point of the bogey), when algos and the few remaining carbon-based traders got a stark reminder that central banks will keep hammering risk assets after the UK reported a blistering CPI print, which at a double digit 10.1% was not only higher than the highest forecast, but was the highest in 40 years.

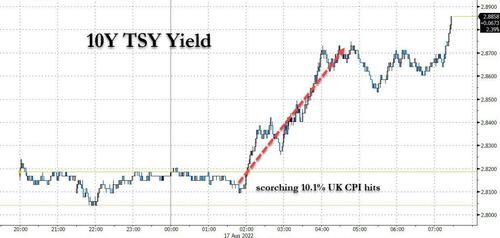

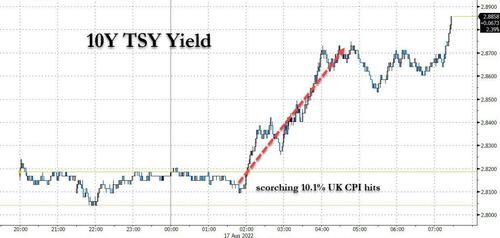

The print appeared to shock markets out of their month-long levitating complacency, and yields – both in the UK and the US – spiked…

… and with yields surging, futures had no choice but to notice and after trading at session highs just before the UK CPI print, they have since tumbled more than 40 points and were last down 0.85% or 37 points to 4,271.

Nasdaq 100 futures retreated 0.9% signaling a selloff in technology names will continue. The dollar rose as investors awaited the minutes of the Fed’s last policy meeting for clues on policy makers’ sensitivity to weaker economic data.

In US premarket trading, retail giant Target slumped 4% after reporting earnings that missed expectations despite still predicting a rebound. Applied Materials and PayPal dropped at least 1.3%. Tech stocks are the forefront of the growing pessimism over equity valuations on the back of Fed rate increases. The S&P 500 had posted a small gain on Tuesday, aided by earnings reports from retailers Walmart Inc. and Home Depot. Here are some of the other biggest U.S. movers today:

- Manchester United (MANU US) rises as much as 17% in US premarket trading before trimming most of the gains, after Tesla CEO Elon Musk said he was buying the English football club but later added that he was joking.

- Hill International (HIL US) shares rise 61% in premarket trading hours after it announced Global Infrastructure Solutions will commence an all-cash tender offer for $2.85/share in cash, representing a premium of 63% to the last closing price.

- BioNTech (BNTX US) was initiated with a market perform recommendation at Cowen, which expects demand for Covid-19 vaccines to mirror annual flu trends as the pandemic enters its endemic phase.

- Bed Bath & Beyond (BBBY US) shares surge 20% in premarket trading, putting the stock on track for its sixth day of gains. The home-goods company has helped reinvigorate a wave of meme stock buying

- Agilent (A US) saw its price target boosted at brokers as analysts say the scientific testing equipment maker’s results were strong thanks to growth in biopharma and a recovery in China, while the company’s guidance was on the conservative side. Shares rose .

- Jefferies initiated coverage of Waldencast Plc (WALD US) class A with a buy recommendation as analyst Stephanie Wissink sees 29% upside potential.

- Sea Ltd. (SE US) ADRs slipped as much as 2.1% in US premarket trading, extending Tuesday’s declines, as Morgan Stanley cut its PT on expectations of slowing growth at the Shopee owner’s e-commerce business in the third quarter.

- Weber (WEBR US) downgraded to sell from neutral at Citi, which says there are too many concerns to remain on the sidelines, including a decline in point-of-sale traffic and macro factors like inflation weighing on consumer demand

In the past two months, US stocks rallied on signs of peaking inflation and an earnings-reporting season that saw four out of five companies meeting or beating estimates. Boosted by relentless systematic (CTA) buying and retail-driven short squeezes, as well as a surge in buybacks, stocks recovered more than 50% of the bear market retracement. Yet, continuing rate hikes and the likelihood of a recession in the world’s largest economy are weighing on sentiment. Meanwhile, concern is growing that Fed rate setters will remain focused on the fight against inflation rather than supporting growth.

“We expect the FOMC minutes to have a hawkish tilt,” Carol Kong, strategist at Commonwealth Bank of Australia Ltd., wrote in a note. “We would not be surprised if the minutes show the FOMC considered a 100 basis-point increase in July.”

In Europe, the Stoxx 600 fell after a strong start amid signs the continent’s energy crisis is worsening. Benchmark natural-gas futures jumped as much as 5.1% on expectations the hot weather will boost demand for cooling. In the UK, consumer-price growth jumped to 10.1%, sending gilts tumbling. Real estate, retailers and miners are the worst performing sectors. The Stoxx 600 Real Estate Index declined 2%, making it the worst-performing sector in the wider European market, as focus turned to UK inflation that soared to double digits for the first time in four decades and also to today’s FOMC minutes. German and Swedish names almost exclusively account for the 10 biggest decliners. TAG Immobilien drops 5.4%, Wallenstam is down 4.7%, Castellum falls 4% and LEG Immobilien declines 3.3%. The sector tumbles on rising bond yields, with 10y Bund yield up 11bps, and dwindling demand for Swedish real estate amid rising rates.

Earlier on Wednesday, stocks rose in Asia amid speculation that China may deploy more stimulus to shore up its ailing economy while Japanese exporters were boosted by a weaker yen. After a string of weak data driven by a property-sector slump and Covid curbs, China’s Premier Li Keqiang asked local officials from six key provinces that account for 40% of the economy to bolster pro-growth measures. The MSCI Asia Pacific Index advanced as much as 0.8%, with consumer-discretionary and industrial stocks such as Japanese automakers Toyota and Honda among the leaders on Wednesday. The benchmark Topix erased its year-to-date loss. Chinese food-delivery platform Meituan also rebounded after dropping more than 9% in the previous session on a Reuters report that Tencent may divest its stake in the firm. Chinese stocks erased declines early in the day, as investors hoped for more economic stimulus after a surprise rate cut on Monday failed to excite the market. Premier Li Keqiang has asked local officials from six key provinces that account for about 40% of the country’s economy to bolster pro-growth measures.

“I believe policymakers have the tools to prevent a hard landing if needed,” Kristina Hooper, chief global market strategist at Invesco, said in a note. “I find investors are overly pessimistic about Chinese stocks — which means there is the potential for positive surprise.” Asia’s stock benchmark is trading at mid-June levels as traders attempt to determine the trajectory of interest-rate hikes and economic growth globally — as well as the impact of China’s property crisis and Covid policies. Meanwhile, minutes of the US Federal Reserve’s July policy meeting, out later Wednesday, will be carefully parsed. New Zealand stocks closed little changed as the country’s central bank raised interest rates by a half percentage point for a fourth-straight meeting. Australia’s S&P/ASX 200 index rose 0.3% to close at 7,127.70, supported by materials and consumer discretionary stocks. South Korea’s benchmark missed out on the rally across Asian equities, as losses by large-cap exporters weighed on the measure

In FX, the Bloomberg Dollar Spot Index rose as the dollar gained versus most of its Group-of-10 peers. The pound was the best G-10 performer while gilts slumped, led by the short end and sending 2-year yields to their highest level since 2008, after UK inflation accelerated more than expected in July. The yield curve inverted the most since the financial crisis as traders ratcheted up bets on BOE rate hikes in money markets, wagering on 200 more basis points of hikes by May. The euro traded in a narrow range against the dollar while the region’s bonds slumped, led by the front end. Scandinavian currencies recovered some early European session losses while the aussie, kiwi and yen extended their slide in thin trading. EUR/NOK one-day volatility touched a 15.12% high before paring ahead of Norges Bank’s meeting Thursday where it may have to raise rates by a bigger margin than indicated in June given Norway’s inflation exceeded forecasts for a fourth straight month, hitting a new 34-year high. Consumer sentiment in Norway fell to the lowest level since data began in 1992, according to Finance Norway. New Zealand’s dollar and bond yields both rose in response to the Reserve Bank hiking rates by 50bps, while flagging concern about labor market pressures and consequent wage inflation; the currency subsequently gave up gains in early European trading. The Aussie slumped after data showing the nation’s wages advanced at less than half the pace of inflation in the three months through June, backing the Reserve Bank’s move to give itself more flexibility on interest rates.

In rates, treasuries held losses incurred during European morning as gilt yields climbed after UK inflation rose more than forecast. US 10-year around 2.87% is 6.5bp cheaper on the day vs ~13bp for UK 10-year; UK curve aggressively bear-flattened following inflation data, with long-end yields rising about 10bp. Front-end UK yields remain cheaper by ~20bp, off session highs, leading a global government bond selloff. US yields are higher on the day by by 4bp-7bp; focal points of US session are 20-year bond auction and FOMC minutes release an hour later. Treasury auctions resume with $15b 20-year bond sale at 1pm ET; WI 20-year yield at around 3.35% is ~7bp richer than July’s sale, which stopped 2.7bp through the WI level.

In commodities, oil fluctuated between gains and losses, and was in sight of a more than six-month low — reflecting lingering worries about a tough economic outlook amid high inflation and tightening monetary policy. Spot gold is little changed at $1,774/oz

Looking at the day ahead, the FOMC minutes from July will be the main highlight, and the other central bank speaker will be Fed Governor Bowman. Otherwise, earnings releases include Target, Lowe’s and Cisco Systems, and data releases include US retail sales and UK CPI for July.

Market Snapshot

- S&P 500 futures down 0.3% to 4,293.00

- STOXX Europe 600 little changed at 443.30

- MXAP up 0.5% to 163.48

- MXAPJ up 0.2% to 530.38

- Nikkei up 1.2% to 29,222.77

- Topix up 1.3% to 2,006.99

- Hang Seng Index up 0.5% to 19,922.45

- Shanghai Composite up 0.4% to 3,292.53

- Sensex up 0.5% to 60,168.83

- Australia S&P/ASX 200 up 0.3% to 7,127.68

- Kospi down 0.7% to 2,516.47

- German 10Y yield little changed at 1.06%

- Euro little changed at $1.0178

- Gold spot down 0.0% to $1,775.21

- U.S. Dollar Index little changed at 106.50

Top Overnight News from Bloomberg

- More market prognosticators are alighting on the idea of benchmark Treasury yields sliding to 2% if the US succumbs to a recession. That’s an out-of-consensus call, compared with Bloomberg estimates of about a 3% level by the end of this year and similar levels through 2023. But it’s a sign of how growth worries are forcing a rethink in some quarters

- The euro-area economy grew slightly less than initially estimated in the second quarter as signs continue to emerge that momentum is unraveling. Output rose 0.6% from the previous three months between April and June, compared with a preliminary reading of 0.7%, Eurostat said Wednesday

- Egypt became a prime destination for hot money by tethering its currency and boasting the world’s highest interest rates when adjusted for inflation

- Norway’s $1.3 trillion sovereign wealth fund, the world’s largest, posted its biggest loss since the pandemic as rate hikes, surging inflation and Russia’s invasion of Ukraine spurred volatility. It lost an equivalent of $174 billion in the six months through June, or 14.4%

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks just about shrugged off the choppy lead from the US where markets were tentative amid mixed data signals and strong retailer earnings, but with gains capped overnight ahead of the FOMC Minutes and as participants digested another 50bps rate hike by the RBNZ. ASX 200 swung between gains and losses with the index indecisive amid a slew of earnings and with strength in the consumer sectors offset by underperformance in tech, energy and healthcare. Nikkei 225 climbed above the 29,000 level with the index unfazed by mixed data releases in which Machinery Orders disappointed although both Exports and Imports topped forecasts. Hang Seng and Shanghai Comp were somewhat varied with Hong Kong led higher by tech amid plenty of attention on Meituan after reports its largest shareholder Tencent could reduce all or the bulk of its shares in the Co. which a Tencent executive later refuted, while the mainland was less decisive amid headwinds from the ongoing COVID situation and with power restrictions disrupting activity in Sichuan, although reports also noted that Chinese Premier Li told top provincial officials that they must have a sense of urgency to consolidate the economic recovery and reiterated to step up macro policies.

Top Asian News

- RBNZ hiked the OCR by 50bps to 3.00%, as expected, while it stated that conditions need to continue to tighten and they agreed that maintaining the current pace of tightening remains the best means. RBNZ also agreed that further increases in the OCR were required to meet the remit objective and that domestic inflationary pressures had increased since May. Furthermore, the RBNZ raised its projections for the OCR and inflation with the OCR seen at 3.69% in Dec. 2022 (prev. 3.41%) and at 4.1% for both Sept. 2023 and Dec. 2023 (prev. 3.95%), while it sees annual CPI at 4.1% by Sept. 2023 (prev. 3.0%).

- RBNZ Governor Orr stated at the press conference that they are not forecasting a recession but expected below-potential growth amid subdued consumer spending. Governor Orr also stated that they did not discuss a 75bps rate hike today and that 50bps moves have been orderly and sufficient, while he added that getting rates to 4% would buy comfort for the policy committee and that a Cash Rate of around 4% is unambiguously above neutral and sufficient to meet the inflation mandate.

- Chongqing, China is to curb power use for eight days for industry.

- China’s Infrastructure Boom Gets Swamped by Property Woes

- Tencent 2Q Revenue Misses Estimates

- Hong Kong Denies Democracy Advocates Security Law Jury Trial

- UN Expert Says Xinjiang Forced Labor Claims ‘Reasonable’

- Singapore’s COE Category B Bidding Hits New Record

- Delayed Deals Add to Floundering Singapore IPO Market: ECM Watch

European bourses have dipped from initial mixed/flat performance and are modestly into negative territory, Euro Stoxx 50 -0.5%. Stateside, futures are under similar pressure awaiting fresh corporate updates and the July FOMC Minutes, ES -0.6%. Fresh drivers relatively limited throughout the session with known themes in play and focus on upcoming risk events; stocks also suffering on further hawkish yield action. Lowe’s Companies Inc (LOW) Q1 2023 (USD): EPS 4.68 (exp. 4.58), Revenue 27.47 (exp. 28.12bln); expect FY22 total & comp. sales at bottom-end of outlook range, Operating Income and Diluted EPS at top-end. Target Corp (TGT) Q1 2023 (USD): EPS 0.39 (exp. 0.72), Revenue 26.0bln (exp. 26.04bln); current trends support prior guidance.

Top European News

- German Gas to Last Less Than 3 Months if Russia Cuts Supply

- European Gas Surges Again as Higher Demand Compounds Supply Pain

- Entain Falls; Citi Views Fine Negatively but Notes Steps by Firm

- UK Inflation Hits Double Digits for the First Time in 40 Years

- Crypto.com Receives Registration as UK Cryptoasset Provider

FX

- Greenback underpinned ahead of US retail sales data and FOMC minutes, DXY holds tight around 106.500.

- Pound pegged back after spike in wake of stronger than expected UK inflation metrics, Cable hovers circa 1.2100 after fade into 1.2150.

- Kiwi retreats following knee jerk rise on the back of hawkish RBNZ hike, NZD/USD near 0.6300 from 0.6380+ overnight peak.

- Aussie undermined by marginally softer than anticipated wage prices and lower RBA tightening bets in response, AUD/USD well under 0.7000 vs 0.7026 at one stage.

- Yen weaker as yield differentials widen again, but Euro cushioned by more pronounced EGB reversal vs USTs, USD/JPY probes 21 DMA just below 135.00, EUR/USD bounces from around 1.0150 towards 1.0200.

- Loonie and Nokkie soft amidst latest slippage in oil, USD/CAD closer to 1.2900 than 1.2800, EUR/NOK nudging 9.8600 within 9.8215-9.8740 range.

Fixed Income

- Debt retracement ongoing and gathering pace ahead of Wednesday’s key risk events.

- Bunds now closer to 154.00 than 156.00 and 157.00 only yesterday, Gilts not far from 114.50 vs almost 116.00 and 117.00+ earlier this week and T-note sub-119-00 vs 119-31 at best on Monday.

- Sonia strip hit hardest as markets price in aggressive BoE hikes in response to UK inflation data toppy already elevated expectations.

Commodities

- Crude benchmarks are currently little changed overall, having recovered from a bout of initial pressure; newsflow thin awaiting fresh JCPOA developments

- Spot gold is little changed overall but with a slight negative bias as the USD remains resilient and outpaces the yellow metal as the haven of choice.

- Aluminium is the clear outperformer amid updates from Norsk Hydro that they are shutting production at their Slovalco site (175k/T year) by end-September, due to elevated energy prices.

- OPEC Sec Gen says he sees a likelihood of an oil-supply squeeze this year, open for dialogue with the US. Still bullish on oil demand for 2022. Too soon to call the outcome of the September 5th gathering. Spare capacity at around the 2-3mln BPD mark, “running on thin ice”.

- US Private Inventory Data (bbls): Crude -0.4mln (exp. -0.3mln), Cushing +0.3mln, Gasoline -4.5mln (exp. -1.1mln), Distillates -0.8mln (exp. +0.4mln).

- Shell (SHEL LN) announced it is to shut its Gulf of Mexico Odyssey and Delta crude pipelines for two weeks in September for maintenance, according to Reuters.

- Uniper (UN01 GY) says the energy supply situation in Europe is far from easing and gas supply in winter remains “extremely challenging”.

- China sets the second batch of the 2022 rare earth mining output quota at 109.2k/T, via Industry Ministry; smelting/separation quota 104.8k/T.

Geopolitics

- China’s military is to partake in a military exercise in Russia, their participation has nothing to do with the international situation.

- Taiwan’s Defence Ministry says they have detected 21 Chinese aircraft and five ships around Taiwan on Wednesday, via Reuters.

- Iran is calling on the US to free jailed Iranian’s, says they are prepared for prisoner swaps, via Fars.

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications, prior 0.2%

- 08:30: July Retail Sales Advance MoM, est. 0.1%, prior 1.0%

- 08:30: July Retail Sales Ex Auto MoM, est. -0.1%, prior 1.0%

- 08:30: July Retail Sales Control Group, est. 0.6%, prior 0.8%

- 10:00: June Business Inventories, est. 1.4%, prior 1.4%

- 14:00: July FOMC Meeting Minutes

DB’s Tim Wessel concludes the overnight wrap

Starting in Europe, where the looming energy crisis remains at the forefront. An update from our team, who just published the fourth edition of their indispensable gas monitor (link here), where they note the surprisingly fast rebuild of German gas storage, driven by reductions in industrial activity, reduces the risk that rationing may become reality this winter. Many more insights within, so do read the full piece for analysis spanning scenarios. Keep in mind, that while gas may be available, it is set to come at a higher clearing price, which manifest itself in markets yesterday where European natural gas futures rose a further +2.64% to €226 per megawatt-hour, just shy of their closing record at €227 in March. But, that’s still well beneath their intraday high from March, where at one point they traded at €345. Further, one-year German power futures increased +6.30%, breaching €500 for the first time, closing at €507. Germany is weighing consumer relief measures in light of climbing consumer prices and also announced that planned nuclear facility closures would be “temporarily” postponed.

The upward energy price pressure and attenuated (albeit, not eliminated) risk of rationing pushed European sovereign yields higher. 10yr German bunds climbed +7.1bps to 0.97%, while 10yr OATs kept the pace, increasing +7.4bps. 10yr BTPs increased +15.9bps, widening sovereign spreads, while high yield crossover spreads widened +10.2bps in the credit space.

Equities were resilient, however, with the STOXX 600 posting a +0.16% gain after flitting around a narrow range all day. Regional indices were also robust to climbing energy prices, with the DAX up +0.68% and the CAC +0.34% higher. In the States the S&P 500 registered a modest +0.19% gain, with the NASDAQ mirroring the index, falling -0.19%. Retail shares drove the S&P on the day, with the two consumer sectors both gaining more than +1%, following strong earnings reports from Wal Mart and Home Depot.

Treasury yields also climbed, but the story was the further flattening in the curve. 2yr yields were +7.5bps higher while 10yr yields managed to increase just +1.6bps, leaving 2s10s at its second most negative close of the cycle at -46bps. 10yr yields are another basis point higher this morning. A hodgepodge of data painted a mixed picture. Housing permits beat expectations (+1674k vs. +1640k) while starts (+1446k vs. +1527k) fell to their slowest pace since February 2021. However, under the hood, even permits weren’t necessarily as strong as first glance, as single family permits fell -4.3% with gains in multifamily pushing the aggregate higher. Indeed, year-over-year, single family permits have now fallen -11.7% while multifamily permits are +23.5% higher. So the single family housing market continues to feel the impact of Fed tightening. Meanwhile, industrial production climbed +0.6% month-over-month (vs. +0.3%), with capacity utilization hitting its highest level since 2008 at 80.3%.

Drifting north of the border, Canadian inflation slowed to 7.6% YoY in July in line with estimates, while the average of core measures climbed to a record 5.3%. Bank of Canada Governor Macklem penned an opinion piece saying that while it looks like inflation may have peaked, “the bad news is that inflation will likely remain too high for some time.” In turn, Canadian OIS rates by December climbed +16.2bps.

In other data, the expectations component of the German ZEW survey fell to -55.3, its lowest level since October 2008 at the depths of the GFC. In the UK, regular pay (excluding bonuses) fell by -3.0% in real terms over the year to April-June 2022, its fastest decline on record.

On the Iranian nuclear deal, EU negotiators reportedly found Iran’s response constructive, though Iran still had some concerns. Notably, Iran is looking for guarantees that if a future US administration withdraws from the JCPOA the US will “have to pay a price”, seeking insulation from the vagaries of representative democracy.

Asian equity markets are trading higher after Wall Street’s solid performance overnight. The Nikkei (+0.76%) is leading gains across the region with the Hang Seng (+0.57%), the Shanghai Composite (+0.23%) and the CSI (+0.51%) all rebounding from its opening losses this morning. US futures are struggling to gain traction this morning with the S&P 500 (-0.02%) and NASDAQ 100 (-0.09%) trading just below flat.

The Reserve Bank of New Zealand lifted its official cash rate (OCR) for the fourth consecutive time by an expected +50bps to 3%, a seven-year high, while bringing forward the estimate of future rate increases. The central bank expects the OCR will reach 3.69% at the end of this year and expects it to peak at 4.1% in March 2023, higher and sooner than previously forecast.

Early morning data coming out from Japan showed that exports rose +19.0% y/y in July (v/s +17.6% expected) posting 17 straight months of gains while imports advanced +47.2% (v/s +45.5% expected) driven by global fuel inflation and a weakening yen. With the imports outweighing exports, the nation reported trade deficit for the 14th consecutive month, swelling to -2.13 trillion yen in July (v/s -1.91 trillion yen expected) compared to a revised deficit of -1.95 trillion yen in June.

In terms of the day ahead, the FOMC minutes from July will be the main highlight, and the other central bank speaker will be Fed Governor Bowman. Otherwise, earnings releases include Target, Lowe’s and Cisco Systems, and data releases include US retail sales and UK CPI for July.