Georgia police did not close a squad car door after placing a handcuffed woman in the backseat and then driving off. The woman—28-year-old Brianna Grier, who was in the midst of a mental health crisis—later rolled out of the moving car and suffered injuries that led to her death.

“Agents have concluded that the rear passenger side door of the patrol car, near where Grier was sitting, was never closed,” according to the Georgia Bureau of Investigation (GBI). “GBI agents concluded that Grier was placed in the backseat of the patrol car, handcuffed in the front of her body with no seatbelt.”

“To put Grier in the patrol car, one of the deputies walked around and opened the rear passenger side door,” said the GBI. “The deputy quickly returned to the rear driver’s side door. Both deputies put Grier in the backseat of the patrol car. The deputies closed the rear driver’s side door. The investigation shows that the deputy thought he closed the rear passenger side door. The deputies left the scene and drove a short distance.”

On Friday, the GBI released bodycam video footage of the July 15 encounter. It shows Hancock County deputies approaching Grier, who tells them repeatedly she is not drunk and they can give her a breathalyzer test. They carry a handcuffed Grier to the car as she shouts: “Get off me! I ain’t broke no law!” Grier also threatened to harm herself if they took her in.

We see one of the officers get int his squad car and then drive for a while before stopping, getting out, and running to the side of the road, where Grier is lying motionless. The officer who was driving is joined by another officer, who had been in a car behind him. They check that Grier is still breathing (she is) and keep yelling at her to sit up as she lays there, seeming unresponsive.

At several points, the video footage flashes back to the cop car she had been in and shows that the back door is wide open. The cop who had been driving closes it, then comes back to the other cop, who is cradling Grier in his lap.

“How did she jump out?” asks the cop holding Grier, commenting that the back door of the car isn’t supposed to be unlocked. “How’d your back door open?” He tells the other cop that when he writes his report, he should “just say, you know, you got out, and the back door was open.”

“She’s fine, she’s fine,” the cop holding Grier keeps saying throughout this. Neither of them attempts to perform any resuscitating measures on her, though they do take off her handcuffs.

Grier fell into a coma. She died in an Atlanta hospital six days later, having sustained severe head injuries.

Her death is the latest to show how police responses to psychological episodes can have tragic results.

The Hancock County deputies had arrested Grier after her family called for help. “Marvin Grier said his wife called authorities on the night of July 14 because their daughter, who was diagnosed with schizophrenia nearly a decade ago and was medicated for the condition but used illegal drugs to cope, was having a mental health crisis,” reports NBC:

During previous similar episodes, he said ambulances were dispatched to the family’s home and she was cared for in a medical setting. Last week, two deputies came in a patrol car instead, Marvin Grier said.

His daughter told the deputies that she’d been drinking, Marvin Grier recalled, so one of the deputies said they would detain her for intoxication until the morning, when she could get medical attention.

Police told the Grier family that their daughter had “kicked the door open and jumped out of the car.”

FREE MINDS

National Review says libertarian-conservative fusionism still matters. Dan McLaughlin writes:

When fusionism is discussed today, especially by its critics, the focus is typically on fusionism as an ideological project. That project, often identified with William F. Buckley Jr. and Reaganism, was largely the intellectual handiwork of Frank Meyer and M. Stanton Evans. For a flavor of the debate at the time, read Meyer and L. Brent Bozell Jr. in these pages 60 years ago debating the relative merits of fusionism as opposed to Bozell’s case for the primacy of virtue over liberty as the central organizing principle of conservatism….

Meyer wanted conservatives of varying stripes and factions to see one another not merely as uneasy coalition partners, but as common adherents to a single, coherent creed. His success in this was not complete, but the endeavor was nonetheless remarkably effective for over half a century.

McLaughlin says that “the philosophical fusion that Meyer and his successors forged is still vital to what National Review does. It remains crucial to how conservatives should think about the principles of our movement and how we call ourselves and our allies to fidelity to those principles—even as the Meyer–Bozell debate is still with us.”

This sounds nice, but the conservative movement as a whole these days seems less and less keen on the liberty end of this equation. Read Reason‘s Stephanie Slade on how “conservatives have lost sight of the relationship between liberty and personal responsibility” in the years since the Cold War.

FREE MARKETS

There’s always another drug war (sigh). But as states move to ban hemp-based Delta 8, hemp businesses are fighting back. NPR reports:

State regulators in Texas, Kentucky and Kansas are facing lawsuits from the hemp industry over new restrictions. In Virginia, regulators were met with occasional jeers and angry outbursts at a meeting earlier this month after they announced new restrictions on edible delta-8 products.

Some of the hemp entrepreneurs at that meeting said regulators were using bad actors to villainize an entire industry. Many argued for regulation rather than prohibition, which they argued would just hurt Virginia’s competitiveness in relation to other states with friendlier laws.

“I’m about 45 minutes from the Tennessee border,” hemp processor Kerry McCormick told Virginia’s hemp commission. “About 15 of my jobs are about to get outsourced to Tennessee. That’s going to be on this committee.”

Earlier this year, a federal appeals court said Delta 8 was legal under the parameters of the 2018 farm bill.

QUICK HITS

• President Joe Biden has a case of rebound COVID after taking Paxlovid.

• “The ripple effects of the Covid-19 pandemic’s influence on nearly every aspect of health in America are becoming clear,” writes Brianna Abbott at The Wall Street Journal. “Overall deaths and the death rates from heart disease and stroke rose sharply during the pandemic,” and overdose deaths and reports of excessive drinking were also up.

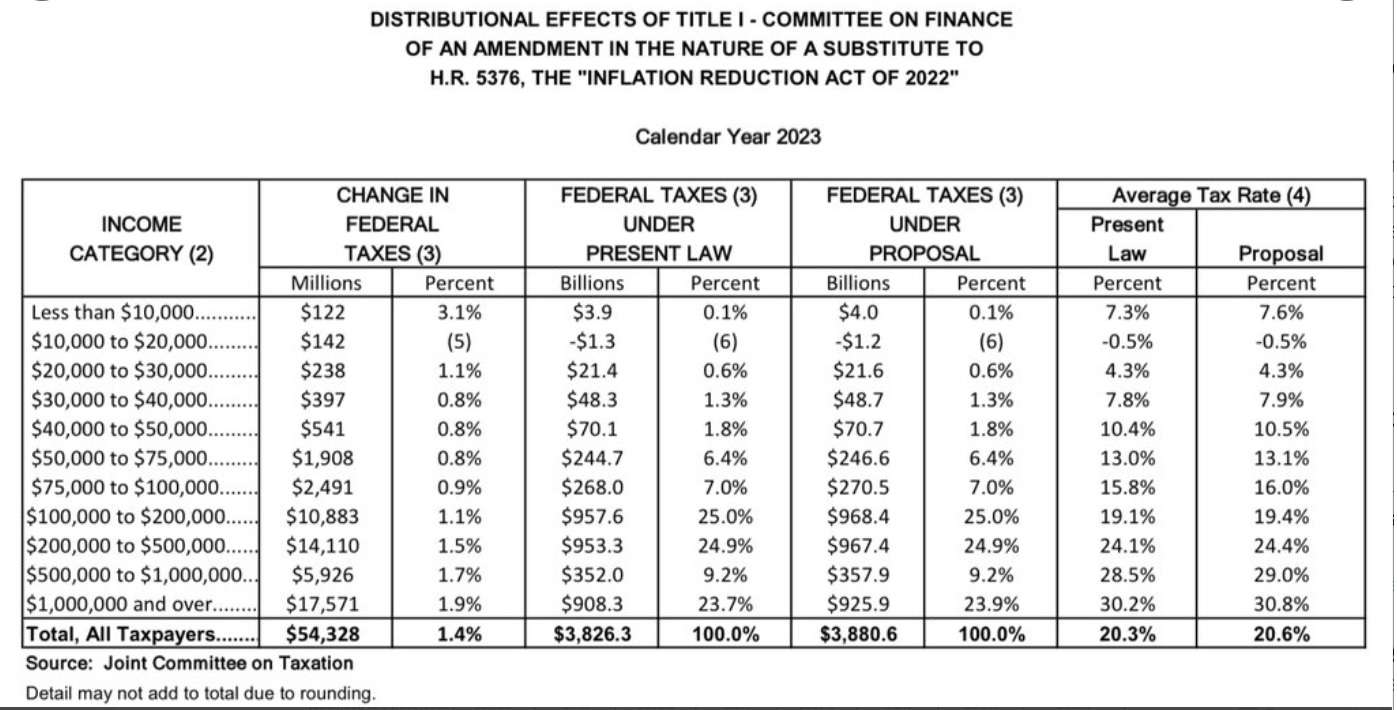

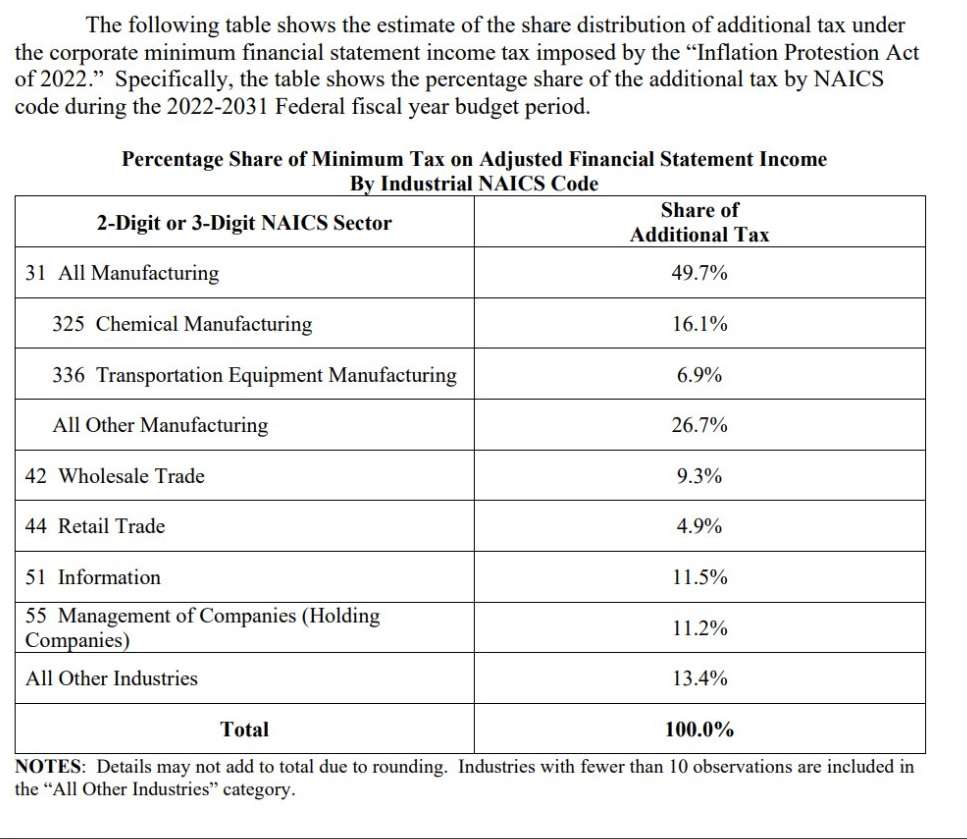

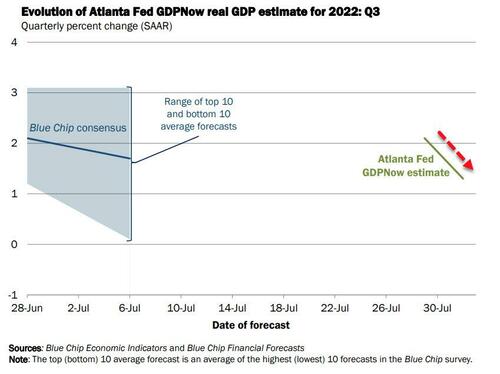

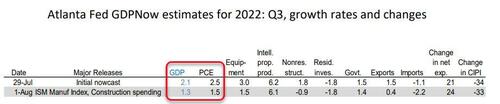

• The new spending bill will raise taxes on middle-class earners, according to the Congressional Joint Committee on Taxation.

• Remember sex bracelet hysteria? “In 2003, a media frenzy led schools across the country to ban colorful jelly bracelets out of concern they were being used for a teen sex game,” Claire McNear reminds us. “The origins of that frenzy—and the speed with which it spread—offer enduring insight into the machinations behind moral panic.”

• New York City has declared monkeypox a public health emergency. “The declaration will allow officials to issue emergency orders under the city health code and amend code provisions to implement measures to help slow the spread,” reports NPR.

• Kansans tomorrow will vote on whether the state constitution should protect abortion.

• “Andrew Yang’s rebooted Forward Party glosses over Americans’ conflicting values and preferences,” argues J.D. Tuccille.

• “The pediatric neurosurgeon who first popularized shaken-baby syndrome has doubts about how it is used in courtrooms today,” reports C.J. Ciaramella.

• Biden wants “to turn the U.S. into a hub of microchip manufacturing,” says Politico. But this can’t happen without immigration reform.

• Indiana’s Senate has passed a near-total ban on abortion; the measure will now be considered by the state’s House of Representatives.

The post Cops Forget To Close Patrol Car Door, Handcuffed Woman Rolls Out and Dies appeared first on Reason.com.

from Latest https://ift.tt/Iy36B4z

via IFTTT