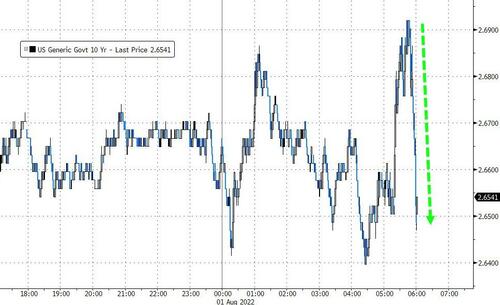

While European and Asian stocks have extended the blistering July rally to start August, US futures remain have traded in the red in the overnight session, if only modestly, which is to be expected after the best month for US markets since November 2020. Contracts on both the Nasdaq 100 and S&P 500 were lower by about 0.1%, alongside a drop in oil, the dollar and crypto, as investors assessed recession risks against the latest remarks from Neel Kashkari over the weekend and Bill Dudley this morning that higher interest rates are needed to bring inflation under control. The Stoxx 600 Index rose 0.2%, led by banks, as HSBC Holdings Plc posted better-than-estimated profits. 10Y yields dipped to 2.64%.

Oil declined after poor Chinese economic data added to concerns that a global slowdown may sap demand. West Texas Intermediate dropped below $97 a barrel after sinking almost 7% in July in the first back-to-back monthly loss since late 2020.

In thin premarket trading, bank stocks were lower as investors remain on edge over recession risks. In corporate news, Global Payments agreed to buy Evo Payments for $34 per share in cash. Meanwhile, HSBC delivered better-than-estimated profits and pledged to return to paying quarterly dividends next year as it seeks to head off a call by its largest shareholder to split up. Here are some of the biggest U.S. movers today:

- Siga Technologies (SIGA US) shares are set to rebound on Monday after the stock sank in the previous session following an FDA update on monkeypox. Shares of other companies making vaccines and antiviral products tied to the disease were also higher in premarket trading.

- Mobile Global Esports (MGAM US) shares surge as much as 76%, set for another day of gains, following the esports platform’s initial public offering on Friday when it jumped 180%.

- Cryptocurrency-linked stocks fall as Bitcoin slips following its best month since October 2021, with traders assessing the strength of a recovery from the market’s worst levels. Coinbase (COIN US) down 2%, Marathon Digital (MARA US) falls 4.2%.

- Comcast (CMCSA US) and Charter Communications (CHTR US) both downgraded at Barclays which said it sees the cable companies as “likely past peak growth.” Comcast shares down 0.1%.

- Bumble (BMBL US) is cut to hold at Jefferies, with the broker citing incremental FX headwinds and a valuation that is not “compelling.”

- PubMatic (PUBM US) and Taboola (TBLA US) both cut to sector weight at KeyBanc as the broker anticipates “disparate” 2Q results from the adtech sector. Prefers overweight-rated TradeDesk (TTD US).

Traders have been speculating the Federal Reserve will tone down its anti-inflation campaign and opt for a slower path of rate hikes after data showed the US economy shrank a second quarter. While that sentiment drove July’s market turnaround after historic first-half losses, over the weekend some Fed officials – such as Kashkari and Dudley – sought to reinforce the message that higher rates are needed to stamp out price pressures and downplayed recession risks.

“The fact that a very weak run of data is seen as equity bullish just purely on the basis of lower rates speaks to just how utterly dominant Fed policy has become in driving investor behavior,” said James Athey, investment director at abrdn. “Unless the Fed pulls off a miracle I am afraid the bear market is absolutely not over.”

Investors are also monitoring US House Speaker Nancy Pelosi’s trip to Asia. A statement from her office skipped any mention of a possible stopover in Taiwan. A visit may stoke US-China tension over the island. Here are a handful of related headlines:

- US House Speaker Pelosi’s official itinerary for her trip to Asia was released which did not mention Taiwan, while Radio France Internationale’s Chinese website quoted sources that stated Pelosi will fly to Taiwan via Clark Air Base in the Philippines on August 4th, according to Dimsum Daily HK.

- China held live-fire drills off the coast opposite Taiwan and its air force said it will resolutely safeguard national sovereignty and territorial integrity regarding Taiwan, according to Associated Press and Chinese state media.

- A senior official in Beijing said the atmosphere of last week’s Biden-Xi telephone conversation was the worst among the five talks between the leaders and President Xi was said to have showed the toughest attitude he has ever shown to any world leader, while the most important topic in the conversation was China-US relations especially the ‘Taiwan Question’. Furthermore, the official believes the probability of US House Speaker Pelosi’s visit to Taiwan is low, as President Xi’s tough position on Taiwan will push President Biden to put more pressure on Pelosi to bypass Taiwan on this trip and the official warned that an accidental military conflict around the island of Taiwan cannot be ruled out if Pelosi insists on visiting Taiwan, according to SGH Macro Advisors.

European stocks climb as earnings continue to buoy risk sentiment, while US futures slide, with S&P 500 and Nasdaq 100 down 0.4%. Euro Stoxx 50 rises 0.3%. FTSE MIB outperforms peers, adding 0.9%, Stoxx 600 lags, adding 0.2%. Banks, telecoms and autos are the strongest-performing sectors. Here are the other notable European movers:

- HSBC jumps as much as 7%, the most since January 2021, after the lender reported interim results. Analysts were impressed with second-quarter pretax profit coming in ahead of consensus.

- Pearson shares rise as much as 10% after first-half sales beat analyst estimates, with weakness in the higher education segment more than offset by strong growth in other divisions.

- EssilorLuxottica shares climb as much as 4.2% after CEO Francesco Milleri told Les Echos he’s bullish about the eyewear giant’s outlook. Analysts also are positive about its prospects.

- Deutsche Telekom shares rise after Kepler Cheuvreux re-initiated coverage with buy, saying its free cash flow yield is set to rise to over 13% by 2024 from about 8% in 2022.

- Air- France KLM shares gain as much as 6.1% after being upgraded to buy at HSBC and to outperform at Oddo BHF, with the latter noting that the effects of the airline’s restructuring seem to be underestimated.

- Quilter shares gain as much as 18% amid a report that NatWest is considering a bid for the wealth management firm. The article said several other private equity firms are also considering an offer.

- Spectris drops as much as 8.2%, the most since Feb. 28, after the precision instrumentation and controls supplier reported half-year results. Jefferies said the interims were a “touch light.”

- Heineken shares fall as much as 3.5% after the company reported strong 1H results, with investors focusing on the cautious outlook and tweaked 2023 guidance.

- Samhallsbyggnadsbolaget i Norden shares plunged after a fresh sell rating by Goldman Sachs, which downgraded the landlord, saying it’s overleveraged as financing costs continue to surge.

- Varta fell the most since November 2021 after the German battery maker cut its full-year forecast for sales and earnings over headwinds including rising raw materials and energy costs.

- CEZ shares fell the most in a month as investors in the Czech power utility digested mounting signals that the government was ready to impose a windfall tax on the most profitable companies.

Earlier in the session, Asian stocks rose as investors bet corporate earnings will support market valuations and as weak economic data from China spurred hopes for more stimulus. The MSCI Asia Pacific Index gained as much as 0.8% with Toyota boosting the measure the most ahead of its earnings release later this week. Industrials led gains among the sectoral gauges as Mitsubishi jumped ahead of its quarterly report. Benchmarks in Japan, Singapore, Vietnam and Thailand outperformed. Hong Kong and mainland China indexes reversed their earlier losses, buoyed by prospects that weak factory data increases the likelihood of fresh policy support from Beijing.

China’s factory activity unexpectedly contracted in July while property sales continued to shrink, data over the weekend showed. Some investors said the weak figures have already been priced into last month’s losses in Chinese markets. “Expecting more stimulus is reasonable, although the market feels the GDP target is no longer a hard target,” said Steven Leung, an executive director at UOB Kay Hian in Hong Kong. “Weak economy means more policies needed to achieve their target, or get closer to their target.” Asian stocks have been on a downtrend despite Monday’s pending gain, with the regional benchmark down almost 30% from its February 2021 high. The gauge has underperformed US peers so far this year as Covid woes continue in China, along with the nation’s property crisis, while ongoing earnings reports in the region are being closely watched.

Japanese equities erased earlier losses to end higher as better-than-expected domestic corporate earnings boosted sentiment. The Topix Index rose 1% to 1,960.11 as of the close in Tokyo, while the Nikkei advanced 0.7% to 27,993.35. Toyota Motor Corp. contributed the most to the Topix Index’s gain, increasing 3.5%. Out of 2,170 shares in the index, 1,706 rose and 395 fell, while 69 were unchanged. Earnings are “fairly good,” said Hiroshi Namioka, chief strategist and fund manager at T&D Asset Management. “The numbers coming out are clearly positive compared to the previous quarter especially in terms of profit growth.”

In Australia, the S&P/ASX 200 index rose 0.7% to close at 6,993.00, the highest since June 9, boosted by gains across mining, healthcare and energy shares. A subgauge of miners climbed for a third session, closing the highest since June 29. Investors await the Reserve Bank of Australia’s interest rate decision due Tuesday, with it expected to lift the key interest rate by 50 basis points to 1.85%. In New Zealand, the S&P/NZX 50 index rose 0.3% to 11,525.87

In FX, the Bloomberg Dollar Spot Index is down about 0.4%; NOK and CAD are the weakest performers in G-10 FX, NZD and JPY outperform. Yen trades at 132.33/USD. The yen climbed as much as 1% against the greenback to 131.89, rising a fourth day in its longest-winning streak since February. While the gains were initially spurred by signs the Federal Reserve will rein back rate hikes, an Asia-based FX trader said Monday that the yen is increasingly seen as a haven play. The euro edged up 0.4%, bolstered by dollar weakness; Goldman Sachs strategists have revised down their three- and six-month forecasts for EUR/USD to 0.99 and 1.02 (from 1.05 and 1.10 previously), citing the shifting European growth outlook.

In rates, Treasuries bear-flatten, with the 10-year rate at 2.64%, well down from June’s peak near 3.50%, after hawkish comments from Kashkari and Bostic. Bund 10-year yields rose about 5 bps, after German and Euro Area PMIs were revised higher, while the yield on 10-year gilts climbs about 4 bps to 1.91%. Italian bonds rallied, sending the 10-year yield below 3% for the first time since May, as investors bet that a new government will stick to commitments needed to unlock about 200 billion euros ($205 billion) of European Union funds.

In commodities, WTI drifted 2.2% lower to trade at around $96. Base metals are mixed; LME aluminum falls 1.8% while LME nickel gains 4.4%. Spot gold is little changed at $1,766/oz. Bitcoin declined after reaching the highest levels since mid-June on Saturday amid optimism that the market may have recovered from its worst levels.

Looking at today’s calendar, we get the July ISM index and June Construction Spending data, Japan July vehicle sales, Eurozone June unemployment rate, Italy July PMI, budget balance, new car registrations, June unemployment rate. We also get earnings from Devon Energy, Activision Blizzard.

Market Snapshot

- S&P 500 futures down 0.3% to 4,123.00

- STOXX Europe 600 up 0.2% to 439.12

- MXAP up 0.7% to 161.54

- MXAPJ up 0.2% to 523.50

- Nikkei up 0.7% to 27,993.35

- Topix up 1.0% to 1,960.11

- Hang Seng Index little changed at 20,165.84

- Shanghai Composite up 0.2% to 3,259.96

- Sensex up 0.8% to 58,043.18

- Australia S&P/ASX 200 up 0.7% to 6,992.97

- Kospi little changed at 2,452.25

- Gold spot up 0.0% to $1,766.44

- U.S. Dollar Index down 0.26% to 105.63

- German 10Y yield little changed at 0.87%

- Euro up 0.2% to $1.0241

- Brent Futures down 1.2% to $102.77/bbl

Top Overnight News from Bloomberg

- European stocks climb as earnings continue to buoy risk sentiment, while US futures slide, with S&P 500 and Nasdaq 100 down 0.3%. Stoxx 600 rises 0.1% with banks, telecoms and autos the strongest-performing sectors. In fixed income, Bund 10-year yield rises about 5 bps, after German and Euro Area PMIs were revised higher, while the yield on 10-year gilts climbs about 4 bps to 1.91%. Italian bonds hold gains, with the 10-year yield falling below 3% for the first time since May.

- European factory activity plunged and Asian manufacturing output continued to weaken in July amid lingering supply-chain complications and a slowing global economy.

- Natural gas prices in Europe rose, after posting the biggest weekly gain in more than a month, as Russia’s tightening grip over supply rips through the economy and heightens concerns about shortages in the winter.

- The US Treasury is expected to make its fourth straight reduction in a quarterly sale of longer-term debt this month, with most dealers predicting extra cutbacks for the 20-year bond.

- China’s massive trade surplus helped to offset capital outflows in the first half of the year, anchoring its balance of payments even as the Federal Reserve’s aggressive interest rate hikes fuel outflows from developed and emerging markets alike.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were choppy as momentum from last week’s earnings-inspired euphoria on Wall St was partially offset by disappointing Chinese PMI data and cautiousness ahead of upcoming risk events including central bank rate decisions, NFP jobs data and US House Speaker Pelosi’s trip to Asia. ASX 200 was kept afloat by strength in energy and utilities after the competition regulator’s interim gas report forecast Australia’s east coast could face a shortfall of 56PJ in 2023, while the latest domestic manufacturing PMI data remained in expansion territory. Nikkei 225 was also positive with the biggest movers driven by recent earnings releases and reports also noted that Japan’s panel is expected to seek a record increase of at least JPY 30 to minimum wages. Hang Seng and Shanghai Comp were initially pressured after Chinese PMI data missed expectations in which the official manufacturing reading printed at a surprise contraction, with sentiment also not helped by US-China tensions as the world second-guesses whether or not US House Speaker Pelosi will defy China’s warnings regarding visiting Taiwan during her Asia trip. However, the mood in Chinese stocks gradually improved and retraced the majority of losses.

Top Asian News

- US House Speaker Pelosi’s official itinerary for her trip to Asia was released which did not mention Taiwan, while Radio France Internationale’s Chinese website quoted sources that stated Pelosi will fly to Taiwan via Clark Air Base in the Philippines on August 4th, according to Dimsum Daily HK.

- China held live-fire drills off the coast opposite Taiwan and its air force said it will resolutely safeguard national sovereignty and territorial integrity regarding Taiwan, according to Associated Press and Chinese state media.

- A senior official in Beijing said the atmosphere of last week’s Biden-Xi telephone conversation was the worst among the five talks between the leaders and President Xi was said to have showed the toughest attitude he has ever shown to any world leader, while the most important topic in the conversation was China-US relations especially the ‘Taiwan Question’. Furthermore, the official believes the probability of US House Speaker Pelosi’s visit to Taiwan is low, as President Xi’s tough position on Taiwan will push President Biden to put more pressure on Pelosi to bypass Taiwan on this trip and the official warned that an accidental military conflict around the island of Taiwan cannot be ruled out if Pelosi insists on visiting Taiwan, according to SGH Macro Advisors.

- Macau is to permit dine-in services and will reopen gyms, bars and beauty parlours beginning this Tuesday, according to Bloomberg.

- US, South Korea and Japan will begin joint ballistic missile defence exercises in waters off Hawaii this week, according to Yonhap.

- “China is willing to boost China-New Zealand comprehensive strategic partnership to yield more results based on the principle of mutual respect and mutual benefit while appropriately handling differences,” according to the Chinese Foreign Minister via Global Times.

European bourses remain firmer across the board, Euro Stoxx 50 +0.4%, as the region shrugs-off Final Manufacturing PMIs and a mixed APAC handover given Friday’s strong Wall St. performance. However, US futures are underpressure in a continuation of downbeat APAC trade amid poor Chinese PMIs and with multiple key risk events looming for the week, ES -0.2%. In Europe, sectors are mixed with the breadth of performance narrow ex-banks given pronounced upside in HSBC, +6.0%, post-earnings; note, HSBC accounts for 18% of the Europe Stoxx 600 Banking sector.

Top European News

- HSBC Shares Jump After Profit Rise and Vow to Restore Dividends

- Ukraine Latest: First Grain Ship Since Start of War Leaves Odesa

- Marex Agrees to Buy ED&F Man Brokerage in Global Expansion

- Italy 10-Year Yield Falls Below 3% for the First Time Since May

- Quilter Gains; Potential NatWest Deal Has Clear Logic: Investec

- Vinci Agrees Deal for 30% Stake in Mexico Airport Operator OMA

FX

- DXY down to deeper cycle low sub-105.500 as Yen revival continues and activity currencies climb, USD/JPY retesting underlying bids and support into 132.00 including next layer of Japanese importer buying interest.

- Aussie up in anticipation of RBA and Kiwi ahead of NZ jobs data, AUD/NZD and NZD/USD firmly back above 0.7000 and 0.6300 respectively.

- Euro eyes recent peaks and Sterling probes stops around last Friday’s high, EUR/USD touches 1.0270 and Cable tops 1.2250 .

- Yuan softer in wake of weaker than expected Chinese PMIs, but Rand remains bid irrespective of inflation contractionary SA PMI as Gold underpins, USD/CNH and USD/CNY 6.7600+ and 6.7500+, USD/ZAR under 16.5000.

Fixed Income

- Debt continues to consolidate and retrace from new corrective peaks, but curves remain steeper.

- Bunds and Gilts sub-par within 157.74-156.74 and 118.22-117.72 respective ranges, T-notes flattish between 121-07+/120-28 parameters.

- BTPs bid and sharply outperform ahead of Italy’s snap elections and into month bereft of issuance.

- 10 year bond tops 127.50 from 126.40 low just 7 ticks above prior close.

Commodities

- Crude benchmarks are pressured in a resumption of Friday’s action after modest overnight consolidation as the complex looks towards OPEC+.

- Currently, benchmarks are firmer by over USD 1.50/bbl; while Dutch TTF remains around the EUR 200/MWh mark as Russia put the onus on others re. Nord Stream 1.

- Spot gold is firmer, deriving upside from the pressure seen in the USD though the magnitude of the yellow metal’s move perhaps capped by the generally constructive European tone.

- OPEC Secretary General Al-Ghais said OPEC is not in competition with Russia and that Russia is a big main player in the world energy map with its membership in OPEC+ vital for the success of the agreement. Al-Ghais added OPEC doesn’t control oil prices but practices tuning markets in terms of supply and demand, while he added that the recent rise in prices is not just related to the Ukraine crisis but is also due to lack of spare production capacity. Furthermore, he said the current state of the global oil market is very volatile and that the most important factor to affect oil prices by year-end is the lack of investments in the sector, according to an interview with Al Rai newspaper cited by Reuters.

- Libya’s Unity government oil minister said oil production is at 1.2mln bpd, according to Reuters.

- Gazprom said it is halting gas supplies to Latvia and accused it of violating conditions, while Latvia said that it doesn’t expect Gazprom’s decision to have any major impact, according to Reuters.

- European governments have eased back on efforts to curb trade in Russian oil in which they are delaying a plan to shut Moscow out of the vital Lloyd’s of London maritime insurance market and will permit some international shipments amid fears of rising crude prices and tighter global energy supplies, according to FT.

- The first ship with grain left the port of Odessa, according to CNN Türk; subsequently, Ukrainian Infrastructure minister says if the grain deal works in full, they will start consultations to open the port of Mykolaiv, via Reuters.

- Part of the damaged Beirut port silos collapsed following a weeks-long fire, according to Al Jazeera

US Event Calendar

- 10:00: June Construction Spending MoM, est. 0.2%, prior -0.1%

- 10:00: July ISM Manufacturing, est. 52.0, prior 53.0

- Employment, est. 48.2, prior 47.3

- New Orders, est. 49.0, prior 49.2

- Prices Paid, est. 73.5, prior 78.5

DB’s Jim Reid concludes the overnight wrap

The 2023 global II survey opens in 11 months’ time. If you are likely to value our work in the next year please …… ah ok, I did promise not to mention it again. Thanks for all the support and we’ll see how we do in October or November when the results drop. Talking of results, congratulations to the England women’s football team for winning the Euros. After years of watching the men’s team lose time and time again in important moments it was strange watching them win, especially against Germany. First second place in the Eurovision Song Contest and now this. The world order is being turned upside down!

Anyway, welcome to August and a spectacular start to H2 for markets with the S&P 500 in July (+9.1%) seeing its best month since November 2020 and 10yr US Treasuries (-37bps and +1.7%) seeing their best performance since March 2020. This follows the worst H1 since 1962 and 1788 respectively. A stunning comeback for 60/40, 50/50 or whatever ratio you chose to allocate. See our monthly performance review, out soon after this mail, for all the details.

It’s a complicated outlook at the moment as we don’t think the US is in a typical recession yet but will almost certainly be within a few quarters. That delay is supportive for markets relative to what was priced a few weeks ago but it’s hard to say the outlook is positive. However the market has more rallied on lower expected terminal rates and the move to price rate cut probabilities within 6 months. We don’t think either will come to pass but my rates colleague Francis Yared always tells me not to fight bullish fixed income markets in the summer. Indeed the CoTD on Friday (link here) showed that August is by far and away the best month of the year for bonds.

Interestingly Larry Summers had some harsh words over the weekend suggesting the Fed is engaging in “wishful thinking” in what it will take to tame inflation and that “Jay Powell said things that, to be blunt, were analytically indefensible ….” and that “…there is no conceivable way that a 2.5% interest rate, in an economy inflating like this, is anywhere near neutral.” So this debate will rage on but the winner in August may not be the winner by year end.

Markets haven’t had a chance to wind down for summer yet and maybe they won’t get the chance with US payrolls on Friday, followed by CPI on Wednesday 10th. If nothing out of the ordinary occurs in these two prints though maybe we can have a quiet two or three weeks. However if payrolls are far from consensus and/or CPI is strong then we may have some fun and games in August. It’s a month of low liquidity and if something big happens it can be multiplied in such thin trading.

Outside of payrolls, the other most important events this week include the manufacturing PMIs and ISM today, the RBA decision and US JOLTS tomorrow, services PMIs and ISM Wednesday, and the likely biggest hike from the BoE for 27 years alongside the increasingly important US jobless claims data on Thursday. Apart from that, earnings are still coming from all directions, but we are past halfway in the US with over 260 companies having reported. It’s 232 in the Stoxx 600. It might be hard to eclipse the big US tech week last week though. The other thing to look out for is whether US House Speaker Pelosi visits Taiwan this week on her Asian trip. It could set off a major geopolitical incident if she does and domestic accusations of backing down to China if she doesn’t given she’d previously said she would visit.

The full day by day week ahead is at the end as usual on a Monday but let’s preview the main highlights in detail with the big one being payrolls of course.

Our US economists expect a 250k reading for nonfarm payrolls (down from 372k in June with consensus also at 250k) and for the unemployment rate to slightly decline to 3.5% from 3.6% (consensus 3.6%). Our economists think the gradual increase in continuing claims since last month is enough to slow the pace of job growth. Remember we did a CoTD on payrolls day last month showing that the first month of a recession on average has a negative payroll print whereas the months leading up to it don’t (including R-1). See here for a reminder. This is one of the main reasons we don’t think we’re there yet in terms of a recession.

Our favoured measure of the strength of the labour market has been the JOLTS data which next comes out tomorrow for June. The problem is that it is always one month behind other data. However it gives us a decent if slightly rear-view mirror look at job openings and labour market tightness.

Moving on, the BoE’s decision on Thursday will be a big event with our UK economists and consensus expecting a +50bps move, which will take the Bank Rate to 1.75% and become the largest single increase since 1995. It will likely also be accompanied by somewhat hawkish economic forecasts from the Bank. The team’s full preview, including expectations on forward guidance and QT, can be found here.

Before the BoE, our economists expect the RBA to also hike +50bps tomorrow. Regarding policy guidance, they expect the central bank to reiterate the need for higher interest rates, which would implicitly keep another +50bps hike in September among the options.

Turning to corporate earnings, this week’s line-up will feature a number of important commodities companies, including BP, Occidental Petroleum (tomorrow), ConocoPhillips and Glencore (Thursday). Travel & leisure firms like Marriott, Airbnb (tomorrow) and Booking (Wednesday) will be in the spotlight as well to assess trends in consumer spending on services. Notable carmakers reporting results will include Toyota (Thursday), BMW (Wednesday) and Ferrari (tomorrow). In healthcare, investors will be focused on Regeneron, Moderna (Wednesday), Eli Lilly, Novo Nordisk and Bayer (Thursday). Other notable reporters will include Advanced Micro Devices, PayPal (tomorrow), Maersk (Wednesday) and Alibaba (Thursday).

Asian equities are quiet at the start of the week but with China’s disappointing economic data pointing to further weakness in the world’s second biggest economy (more below). As I type, the Nikkei (+0.47%), Shanghai Composite (+0.15%), the CSI and the Kospi (+0.10%) are holding on to their gains helped by a strong US session on Friday. Elsewhere, the Hang Seng (-0.25%) is lower. Outside of Asia, DM stock futures are weaker with contracts on the S&P 500 (-0.50%), NASDAQ 100 (-0.45%) and DAX (-0.25%) edging lower.

Oil prices are around -1.5% lower post China data and uncertainty over the OPEC+ meeting this week. Separately, yields on 10yr USTs (-2.0bps) have moved lower, trading at 2.67%, as we go to press.

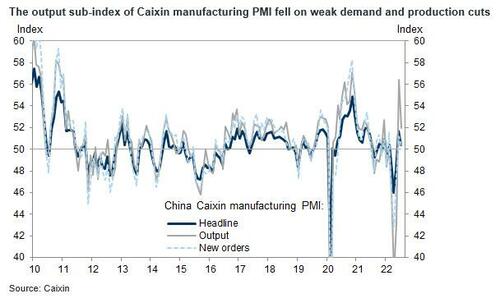

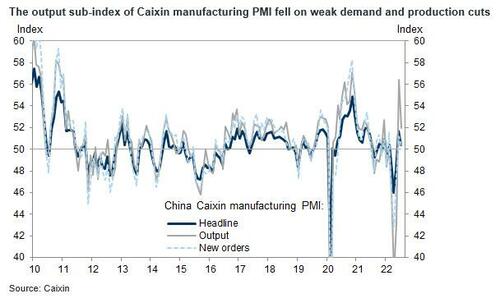

Onto that China data, and factory activity expanded at a slower pace with the Caixin/Markit manufacturing PMI for July easing to 50.4 from 51.7 in June, below analysts’ expectations for a slight dip to 51.5 as growth momentum softened in output, new orders and employment. Over the weekend, China’s factory activity contracted unexpectedly in July with the official reading falling to 49.0 (50.3 expected) from 50.2 in June, underscoring the extent of the uncertainty around growth stemming from fresh virus flare-ups, declining global demand and property market risks.

Onto last week now, the FOMC raised rates a super-charged 75bps for the second consecutive meeting, yet financial conditions eased as the market latched onto comments that the hiking cycle would slow at some point and that the Committee was paying heed to slowing activity data. On that news, the splashiest data of the week was the Q2 US GDP which showed the second consecutive quarter of contraction, spurring endless debates as to what constitutes a recession. In Europe, lower Nord Stream capacity continues to ratchet energy pressure higher.

The perceived pivot in Fed communications along with slowing activity data drove a shallower pricing of global monetary policy, and thus a rally in global sovereign yields. 10yr Treasuries were -10.2bps lower (-2.7bps Friday), led by a -30.8bp decline in real yields, while 2yr Treasuries were -8.6bps lower on the week (+2.2bps Friday). Not to be outdone, 10yr bunds fell even more, declining -21.4bps (-0.9bp Friday), as the continent looks exposed to even larger potential external shocks. With less aggressive tightening expected, 10yr BTPs tightened -8.1bps versus bunds, -14.3bps of which came on Friday as the main populist far-right party Brothers of Italy, who are polling very strongly, were reported to be likely to adhere to EU budget rules if elected.

The easing of expected tightening was a boon to equity markets, which staged big gains across the Atlantic. The S&P 500 was +4.26% higher (+1.42% on Friday) while the NASDAQ picked up +4.70% (+1.88%). Many of the mega cap tech companies reported this week in the US to mixed results. Advertising revenue was sluggish, but supply chain pressures seemed to ease which helped those facing retail customers. Across the board, it seemed like hiring was either slowing or plans were in place to start reducing hiring. European equities also enjoyed some respite from global policy tightening, with the STOXX 600 picking up +2.96% (+1.28% Friday), the DAX +1.74% (+1.52% Friday), and the CAC higher by +3.73% (+1.72% Friday).

Despite slowing activity data, oil prices showed no signs of a demand slowdown, with Brent futures climbing +6.60% over the week (+2.68% Friday).

On Friday’s data, the US Employment Cost Index increased +1.3%, above 1.2% expectations but a marginal deceleration from 1Q’s 1.4%. The final University of Michigan Sentiment reading was 51.5, versus 51.1 expectations, while year-ahead inflation expectations stayed at 5.2% even if longer term ones edged back up a tenth to 2.9%.