Authored by Lance Roberts via The Epoch Times,

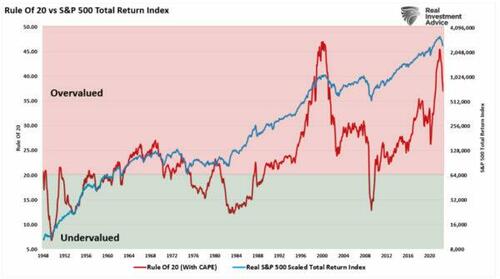

The “Rule Of 20” says the “bear market” may just be resting despite much commentary to the contrary. In a recent Investing.com article, Bank of America strategist Savita Subramanian warned clients that stocks are still expensive despite this year’s drawdown.

“Our analysis of the ERP indicates a 20% likelihood of a recession is now priced in vs. 36% in June. In March, stocks priced in a 75% probability of recession. Even on Enterprise Value to Sales, where sales should be elevated by the tailwind of 9% CPI, the market multiple is excessively elevated (+40%) relative to history – possibly because real sales growth ex-Energy is essentially flat.”

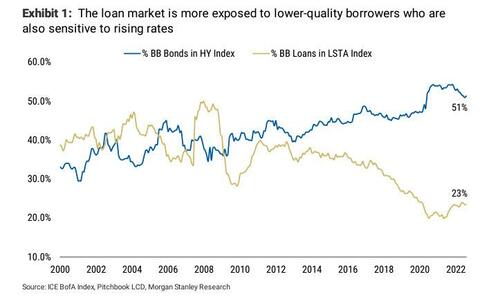

Such is a critically important point due to the massive influx of capital in recent years.

“There’s a global glut of liquidity, minimal interest in traditional investments, little apparent concern about risk, and skimpy prospective returns everywhere. Thus, investors are readily accepting significant risk in the form of heightened leverage, untested derivatives and weak deal structures. The current cycle isn’t unusual in its form, only its extent.”

– Howard Marks, Oaktree Capital Management

With the Federal Reserve reversing that monetary accommodation, such poses a very significant, and likely unrealized, risk to investors. Such brings us to the Rule Of 20, which suggests the stock market is substantially overvalued, as BofA noted.

“Outside of inflation falling to 0%, or the S&P 500 falling to 2500, an earnings surprise of 50% would be required to satisfy the Rule of 20, while consensus is forecasting an aggressive and we think unachievable 8% growth rate in 2023 already.”

– BofA

Unfortunately, the last time the Rule Of 20 was overvalued was in 2007. That was when Howard Marks wrote that passage above. In other words, while things always seem different, they are almost always the same.

What Is The Rule Of 20?

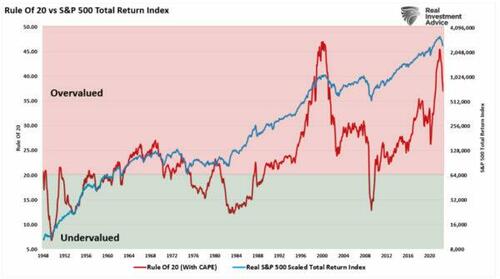

The Rule of 20 helps us think about valuations and bull and bear markets. To calculate the Rule Of 20 we combine the P/E ratio and inflation rate. Over the years, markets have shown a distinct tendency to revert to a sum of 20 for these two metrics.

The value of the markets is fair when the sum of the P/E ratio and the inflation rate equals 20.

P/E + Inflation = 20

The stock market is undervalued when the sum is below 20 and overvalued when the sum is above 20.

This seemingly simplified insight is nonetheless surprisingly effective, as noted by Evercore ISI for the Rule of 20.

-

Markets rarely trade at equilibrium, so it’s no surprise that the Rule of 20 is seldom precise.

-

The combined P/E ratio and inflation rate have ranged from a low of 14 to a high of 34.

-

Over the last 50 years, the average P/E is just below 16, the average inflation rate is 4 percent, and the average sum of P/E and inflation, as expected, is close to 20.

The rule peaked at the 2nd highest level in history earlier this year. Such levels suggest the market is more than “fully priced.” Regardless of what definition you choose to use.

Source: St. Louis Federal Reserve, Refinitive Chart: RealInvestmentAdvice.com

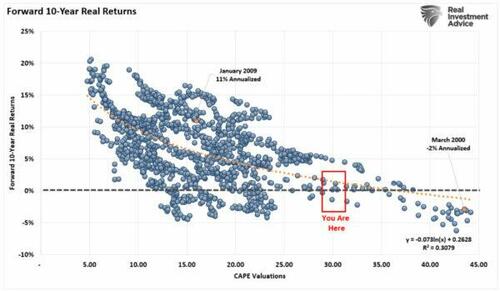

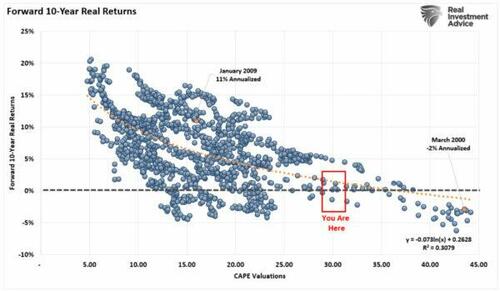

As Howard Marks noted, the math suggests forward 10-year returns will be substantially lower than the last.

Source: St. Louis Federal Reserve Chart: RealInvestmentAdvice.com

In a market where momentum drives an ever smaller group of participants, fundamentals become displaced by emotional biases.

If This Is A Bear Market, We Have More To Go

As I noted in “Don’t Fight The Fed,” David Einhorn once discussed the problem with valuations concerning the market in 2008.

“The bulls explain that traditional valuation metrics no longer apply to certain stocks. The longs are confident that everyone else who holds these stocks understands the dynamic and won’t sell either. With holders reluctant to sell, the stocks can only go up – seemingly to infinity and beyond. We have seen this before.”

Such is the problem that investors face today.

With the Rule Of 20 very elevated, the Fed reversing monetary accommodation, and inflation and wages impacting earnings and margins, the risk of a further bear market decline is not entirely unreasonable.

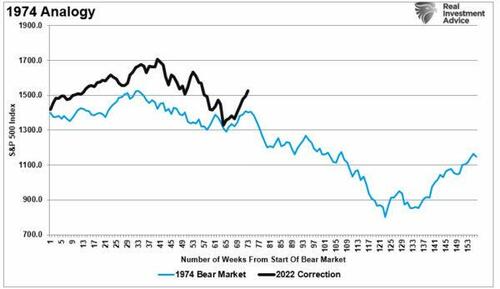

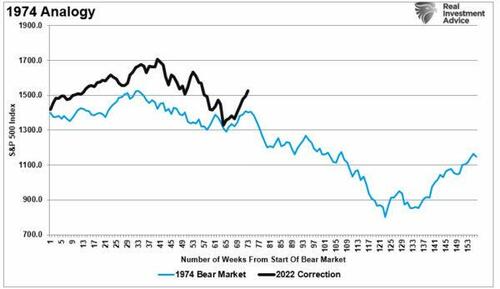

As monetary policy becomes more restrictive and high inflation erodes economic growth, the market will have to reprice for lower sales, margins, and earnings. As such, if we are indeed in a bear market and not just a correction, then we have more work to do.

Source: St. Louis Federal Reserve, Refinitive Chart: RealInvestmentAdvice.com

Even the 1974 Bear Market, where the Fed was hiking rates to fight high inflation, suggests the same.

Source: St. Louis Federal Reserve, Refinitive Chart: RealInvestmentAdvice.com

Currently, with investor complacency surging and equity allocations still near record levels, no one sees a severe market retracement as a possibility. But maybe that should be warning enough.

With the Rule Of 20 elevated, the risk of lower returns is significant. Such is particularly evident due to the “pull forward” of returns over the last decade due to repeated global Central Bank interventions.

Source: Refinitiv Chart by: RealInvestmentAdvice.com

The outsized returns, above the rate of economic growth, are unsustainable. Therefore, unless the Federal Reverse remains committed to a never-ending program of zero interest rates and quantitative easing, the eventual reversion of returns to their long-term means is inevitable.

Such will result in profit margins and earnings returning to levels that align with actual economic activity.

“Profit margins are probably the most mean-reverting series in finance. And if profit margins do not mean-revert, then something has gone badly wrong with capitalism.”

– Jeremy Grantham

The only question is when the markets begin to realize it.